Paper Folder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431680 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Paper Folder Market Size

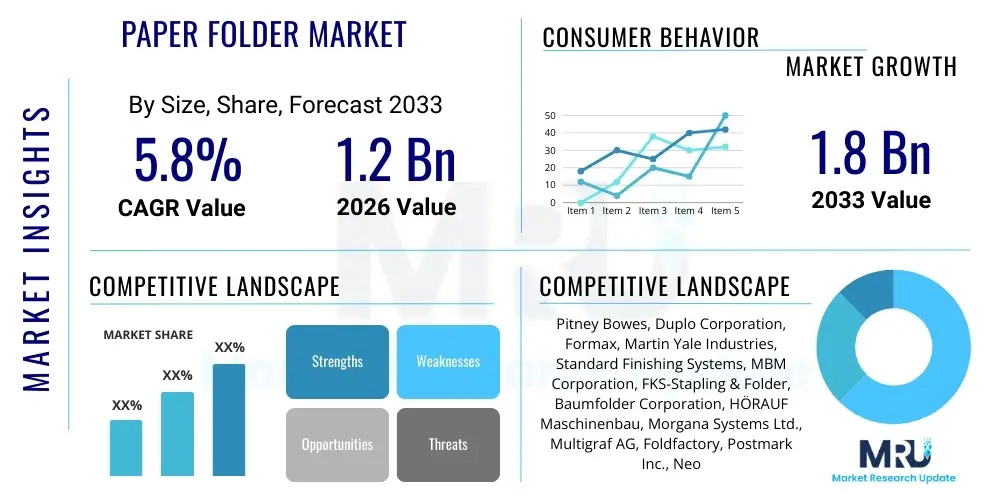

The Paper Folder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Paper Folder Market introduction

The Paper Folder Market encompasses the manufacturing, distribution, and sale of specialized machinery designed for automatically folding sheets of paper, letters, brochures, and documents into various configurations (e.g., C-fold, Z-fold, half-fold). These machines range from compact, low-volume desktop units used in small offices and mailrooms to high-capacity, industrial-grade floor models integrated into print finishing lines or large financial service bureaus. The demand for paper folders is fundamentally driven by the ongoing requirement for efficient, professional document processing, particularly in sectors where mass mailings, transactional printing, and high-volume collateral preparation remain essential business functions, despite trends toward digitalization.

The primary applications for paper folders span diverse operational environments, including banking, insurance, healthcare administration, government agencies, direct marketing firms, and educational institutions. Key benefits associated with utilizing automated paper folding equipment include significant improvements in processing speed, enhanced accuracy and consistency compared to manual folding, and substantial labor cost savings. These factors collectively contribute to a rapid return on investment, particularly for organizations handling daily volumes exceeding several hundred documents. Furthermore, modern paper folders often feature advanced capabilities such as sequential folding, specialized perforation, and compatibility with various paper stocks and weights, thereby broadening their utility in complex marketing and administrative campaigns.

Major driving factors sustaining the market include the persistent need for physical document security and official communications, especially in legal and financial services where regulatory compliance mandates hardcopy retention. Furthermore, the growth in direct mail marketing, which continues to demonstrate high conversion rates in specific demographic segments, necessitates reliable high-speed folding equipment. Technological advancements, though evolutionary rather than revolutionary, focus primarily on increasing throughput speeds, improving sensor technology to minimize jams, and developing user-friendly digital interfaces that simplify job setup and monitoring. These drivers ensure continued, steady demand across established and emerging economies, where infrastructure development often relies heavily on physical documentation.

Paper Folder Market Executive Summary

The global Paper Folder Market is characterized by mature technology but sustained demand driven primarily by compliance requirements and the ongoing viability of direct mail marketing campaigns. Business trends indicate a bifurcation in product offerings: on one hand, manufacturers are focusing on producing highly affordable, entry-level desktop models for small businesses; on the other, they are innovating high-end industrial systems with superior integration capabilities (e.g., connecting directly to high-speed inkjet printers and inserters) to serve transactional document processing centers. A critical challenge remains the overarching trend of corporate digitalization and the reduction of paper consumption, which necessitates manufacturers diversify their offerings or emphasize the utility of folders in environments where hybrid digital-physical workflows are mandatory.

Regionally, North America and Europe currently represent the largest revenue share, characterized by stringent financial and healthcare regulations that mandate extensive hardcopy documentation, alongside sophisticated and large-scale printing infrastructure supporting direct marketing. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate throughout the forecast period. This acceleration is attributed to the rapid expansion of banking and insurance sectors, coupled with increasing governmental bureaucracy and infrastructure projects in countries such as China, India, and Southeast Asian nations, leading to escalating demand for efficient office and mailroom equipment. Standardization of document formats and increased investment in administrative efficiency in these regions are key growth catalysts.

Segment trends highlight the dominance of the high-volume (Industrial) segment in terms of revenue, driven by specialized print finishing companies and large enterprises requiring throughputs exceeding 10,000 sheets per hour. Concurrently, the low-volume (Desktop) segment shows robust growth in unit sales, primarily appealing to small and medium enterprises (SMEs) and localized administrative offices prioritizing affordability and compactness. In terms of product type, friction-feed folders continue to hold a significant market share due to their cost-effectiveness, although air-feed/vacuum-feed systems are increasingly preferred in high-speed, high-precision applications dealing with coated or glossy paper stocks, emphasizing quality and jam reduction as paramount factors.

AI Impact Analysis on Paper Folder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Paper Folder Market typically revolve around whether AI-driven automation will render physical document handling obsolete, or alternatively, how AI can integrate with existing physical workflows to enhance efficiency. Key concerns center on the sustainability of hardcopy equipment investment given rapid digitalization, while expectations often focus on AI’s ability to optimize mailroom logistics, predict equipment failure, and automate complex job setups. Users seek clarification on how intelligent systems might manage variable data printing workflows that still require physical folding, ensuring the correct documents are folded and inserted according to personalized data streams.

The tangible impact of AI, particularly Machine Learning (ML) and computer vision, is less about directly replacing the physical folding process and more about optimizing the upstream and downstream processes. AI integration is manifest in predictive maintenance algorithms that analyze machine usage patterns and environmental factors to anticipate component failures, thereby minimizing downtime—a critical factor for high-volume service bureaus. Furthermore, AI-powered Quality Control (QC) systems, utilizing high-resolution cameras, are being deployed to inspect the precision of folds and detect misfeeds or double feeds in real-time. This level of granular quality assurance significantly reduces waste and labor costs associated with manual inspection, enhancing the overall productivity and reliability of industrial folding operations.

- AI drives predictive maintenance scheduling, reducing machine downtime.

- Machine Learning optimizes workflow management for variable data printing requiring precise folding sequences.

- Computer vision systems enhance quality control by detecting folding inaccuracies and paper flaws in high-speed operations.

- AI integration assists in optimizing complex job setups and calibration based on paper type and environmental conditions.

- Minimal direct impact on the core electro-mechanical folding mechanism; primary influence is on periphery management systems.

DRO & Impact Forces Of Paper Folder Market

The Paper Folder Market is governed by a predictable set of Dynamics, Restraints, and Opportunities. The primary driver stems from the non-discretionary necessity for hardcopy communication in regulated industries such as finance, insurance, and government, where legal and archival requirements mandate physical documentation. Coupled with this is the continued success of targeted direct mail campaigns, which relies heavily on efficient, high-speed document preparation equipment. Opportunities are identified in emerging markets (APAC, MEA) where increasing administrative capacity translates directly into higher equipment installation rates, and through the development of hybrid machines that seamlessly handle both physical folding and digital archiving requirements, thereby aligning with modern integrated communication strategies.

However, the market faces significant restraints. The paramount challenge is the pervasive trend of corporate and governmental digitalization, aimed at reducing paper usage, storage costs, and environmental impact. This secular shift inherently limits the ceiling of market growth in mature economies. Furthermore, paper folder technology is relatively mature, resulting in long replacement cycles; older, well-maintained machines often satisfy operational requirements for many years, limiting the impetus for capital expenditure on new units unless substantial speed or feature improvements are offered. Competition from multifunction office devices, while not directly capable of industrial folding, can absorb some lower-volume administrative tasks, further restraining the low-end segment.

The impact forces influencing the market trajectory are multifaceted. Technological forces, while slow in the core mechanism, exert pressure through adjacent technologies like advanced inserters and specialized cutters, demanding higher precision and better integration from folders. Economic forces, particularly corporate budgetary constraints on office equipment, favor durable, long-lasting machines, intensifying competition based on Total Cost of Ownership (TCO) rather than upfront price. Regulatory forces, such as GDPR or HIPAA, ironically serve as a minor driver, as compliance often necessitates auditable hardcopy trails and secure document handling processes, for which dedicated, reliable folding equipment is crucial. The interaction of these forces ensures stable but modest growth, underpinned by replacement cycles and emerging market expansion.

Segmentation Analysis

The Paper Folder Market is systematically segmented based on product type, technology, application, and operating volume, providing a granular view of demand distribution across various end-user sectors. Product type segmentation primarily differentiates between friction-feed, air-feed (vacuum), and combination folders, each suited for distinct paper types and required throughputs. Technology segmentation focuses on the degree of automation, ranging from manual adjustment machines to fully automatic digital setup models. Application-based segmentation divides the market by end-user industries such as Commercial Printing, Office Administration, Education, and Financial Services, reflecting specialized document requirements across these fields.

Operating volume classification—Desktop (Low Volume), Mid-Volume, and Industrial (High Volume)—is the most crucial differentiator in terms of revenue generation and strategic focus for manufacturers. Desktop folders typically handle up to 5,000 sheets per hour and appeal to small offices prioritizing cost and size. Mid-Volume machines are robust solutions for mailrooms and medium-sized organizations, offering superior reliability and speeds up to 15,000 sheets per hour. The Industrial segment, critical for print shops and service bureaus, encompasses heavy-duty folders exceeding 20,000 sheets per hour, often requiring specialized integration with ancillary equipment like slitters and cutters, emphasizing durability and 24/7 operational capability.

Analysis of these segments reveals that while the Desktop segment drives unit sales volume, the Industrial segment contributes disproportionately to overall market revenue due to the high average selling price (ASP) of complex machinery and associated maintenance contracts. The shift toward higher quality, particularly in direct mail, boosts the demand for air-feed technology, which minimizes marks and improves handling of glossy or heavy stock paper compared to traditional friction feed mechanisms. Understanding these segmented needs allows market participants to tailor their distribution channels, focusing on office supply retailers for desktop units and specialized industrial equipment distributors for high-end systems, thereby optimizing market penetration strategies across diverse procurement landscapes.

- By Product Type:

- Friction Feed Folders

- Air Feed (Vacuum) Folders

- Combination Folders

- By Operating Volume:

- Desktop (Low Volume)

- Mid-Volume

- Industrial (High Volume)

- By Application:

- Commercial Printing and Mail Houses

- Corporate and Office Administration

- Educational Institutions

- Financial Services and Insurance

- Government and Legal Agencies

- By Feeding Mechanism:

- Manual Load

- Automatic Feed

Value Chain Analysis For Paper Folder Market

The value chain for the Paper Folder Market is structured, beginning with upstream raw material suppliers and culminating in downstream end-user deployment and ongoing service. Upstream activities primarily involve sourcing specialized components, including precision mechanical parts (gears, rollers, bearings), high-quality rubber components for friction rollers, and sophisticated electronic control systems, including motors, sensors, and programmable logic controllers (PLCs). Key suppliers include specialized metal fabricators and global electronics manufacturers. The competitive advantage at this stage lies in securing reliable, high-tolerance components that ensure the longevity and precision of the final folding equipment, mitigating risks associated with frequent mechanical failures.

The core manufacturing stage involves design, assembly, and rigorous testing. Midstream activities are dominated by specialized original equipment manufacturers (OEMs) who integrate the sourced components, often customizing frame designs and implementing proprietary folding mechanisms (e.g., patented fold plate designs). Distribution channels vary significantly based on the volume segment. Low-volume desktop folders are typically sold through indirect channels, utilizing office supply superstores, e-commerce platforms, and general business equipment dealers. This approach leverages existing retail infrastructure and broad market reach, prioritizing accessibility and shelf visibility for smaller purchases.

Conversely, high-volume industrial folders necessitate a direct or highly specialized indirect distribution model. Direct sales teams or dedicated industrial equipment distributors, possessing technical expertise for installation, training, and maintenance, handle these complex transactions. Aftermarket services, including component replacements, preventive maintenance, and software updates (for digitally controlled machines), constitute a significant and profitable segment of the downstream value chain. Establishing robust, responsive service networks is crucial for maintaining customer loyalty, especially among high-volume users whose operations are critically dependent on continuous machine uptime. This comprehensive value chain ensures product efficiency from component sourcing to operational deployment.

Paper Folder Market Potential Customers

The primary end-users and buyers of paper folding equipment span various large organizations requiring systematic preparation of mass documentation. Financial institutions, including banks, credit unions, and insurance carriers, are significant consumers, utilizing folders for processing statements, policy documents, personalized correspondence, and regulatory notices. Healthcare providers and administrative networks rely on these machines for preparing patient billing statements, explanation of benefits (EOBs), and internal medical records. These sectors demand high reliability and compatibility with sensitive, often multi-page, documents, prioritizing air-feed technology for precision and security features.

Another major customer segment consists of professional mail houses and commercial print finishing companies (service bureaus). These entities handle massive, outsourced print and mail jobs for multiple clients, focusing on direct marketing collateral, catalogs, and transactional mail. Their purchasing decisions are almost exclusively driven by speed (sheets per hour), durability, and the ability to integrate seamlessly with automated inserting and enveloping systems. For these industrial users, the equipment represents a core production asset, making factors like Total Cost of Ownership, mean time between failures (MTBF), and maintenance contract availability paramount in their procurement criteria.

Furthermore, government agencies, including tax authorities, defense departments, and social service offices, utilize paper folders for large-scale official correspondence, bulk notices, and internal administrative document management. Educational institutions, from large university admissions offices to K-12 district administration centers, also constitute a stable customer base for mid-volume equipment, used for student records, enrollment packages, and donor communications. These organizations typically prioritize user-friendliness, safety features, and durability over absolute top-end speed, often favoring mid-range, automatic-setup models that can be operated by diverse administrative staff.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pitney Bowes, Duplo Corporation, Formax, Martin Yale Industries, Standard Finishing Systems, MBM Corporation, FKS-Stapling & Folder, Baumfolder Corporation, HÖRAUF Maschinenbau, Morgana Systems Ltd., Multigraf AG, Foldfactory, Postmark Inc., Neopost (Quadient), GBR, Uchida Yoko Co. Ltd., Eurofold, Riso Kagaku Corporation, Horizon International, Accu-Fast. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paper Folder Market Key Technology Landscape

The technological landscape of the Paper Folder Market is characterized by incremental improvements focusing on enhanced precision, throughput, and user operability, rather than radical innovation. The fundamental mechanism remains reliant on roller and fold plate technology, but modern machines incorporate sophisticated electronic controls. One key area of advancement is the implementation of fully automated, digital job setup. Instead of requiring manual adjustments to fold plates and paper stops—a process prone to human error and time consumption—newer models allow operators to input document specifications via a touchscreen interface. The machine then automatically calibrates all internal settings using servo motors, significantly reducing changeover time and increasing operational precision, critical for quick-turnaround print jobs.

Another significant technological focus is on superior paper handling mechanisms, particularly in the high-volume segment. Air-feed technology has been refined to handle extremely challenging substrates, including highly coated, glossy, or heavily textured papers, by utilizing sophisticated air separation and vacuum suction to ensure singular sheet feeding without marking or static issues. Furthermore, advancements in sensor technology are pivotal; modern folders use multiple optical and ultrasonic sensors to detect double feeds, measure paper length variances, and dynamically adjust roller pressure in real-time. This sophisticated sensing minimizes machine jams and guarantees compliance with strict transactional mailing standards, where document integrity is paramount.

Integration capabilities also define the competitive technological edge. Current folders are increasingly designed as modules within comprehensive print finishing lines. This includes protocols for direct communication with upstream digital printers (for inline operations) and downstream inserters or stitchers. The integration often involves shared operational data and real-time feedback loops that allow the entire production line to adjust speed and parameters dynamically. Furthermore, connectivity features, allowing remote diagnostics and firmware updates over network connections, are becoming standard, enhancing the longevity and serviceability of the equipment, moving the market toward an Internet of Things (IoT) paradigm for production machinery management.

Regional Highlights

North America commands a substantial portion of the global Paper Folder Market revenue, primarily due to the maturity of its financial, healthcare, and direct marketing sectors. Regulatory environments in the US and Canada, which necessitate meticulous physical record-keeping and secure mail handling, ensure a baseline demand for reliable, high-speed folders. The concentration of major printing and mail house service bureaus, characterized by massive production capacities, drives strong investment in industrial-grade, highly automated folding and inserting systems. While digitalization is widespread, the sheer volume of mandated transactional mail (e.g., tax documents, medical claims, bank statements) sustains steady demand for replacement and upgrade cycles, with a strong preference for brands offering advanced technical support and local servicing capabilities.

Europe represents another critical and stable market, marked by stringent quality standards and a high degree of integration between digital printing and finishing technologies. Countries like Germany, France, and the UK demonstrate persistent demand driven by corporate administration efficiency and a strong institutional need for organized physical archives, particularly within government and the legal sector. The European market often favors folders that offer flexibility in handling diverse international paper sizes (A4, A5) and complex fold types required for specialized marketing inserts and pharmaceutical information leaflets. Emphasis here is placed on energy efficiency, reduced noise output (for office environments), and compliance with various EU technical standards, contributing to a premium pricing structure for advanced, high-precision European-manufactured machinery.

Asia Pacific (APAC) is recognized as the fastest-growing region, offering significant untapped potential. Market expansion is propelled by rapid urbanization, substantial investment in banking and insurance infrastructure, and the massive scale of governmental administrative operations in populous countries like China and India. As these economies mature, there is an increasing shift from manual document handling to mechanized processing to improve efficiency and reduce labor costs. While affordability often drives initial purchases (favoring friction-feed technology), the rapidly developing corporate sector is increasingly adopting mid- to high-volume air-feed folders to handle sophisticated marketing collateral and sensitive financial documents, marking a steady upward trend in technological adoption and market sophistication.

Latin America and Middle East & Africa (MEA) represent nascent but expanding markets. Growth in these regions is less uniform and more concentrated in economic hubs (e.g., UAE, Saudi Arabia, Brazil, Mexico). Demand is highly correlated with foreign direct investment and the establishment of international corporate branches and financial service centers requiring standardized document processing equipment. Challenges include inconsistent distribution infrastructure and reliance on imported machinery, often impacting maintenance and spare parts availability. However, ongoing governmental infrastructure projects and burgeoning financial inclusion initiatives are steadily increasing the demand for efficient mailroom and document production equipment, creating localized opportunities for specialized distributors focusing on robust, easy-to-maintain mid-volume folders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paper Folder Market.- Pitney Bowes

- Duplo Corporation

- Formax

- Martin Yale Industries

- Standard Finishing Systems

- MBM Corporation

- FKS-Stapling & Folder

- Baumfolder Corporation

- HÖRAUF Maschinenbau

- Morgana Systems Ltd.

- Multigraf AG

- Foldfactory

- Postmark Inc.

- Neopost (Quadient)

- GBR

- Uchida Yoko Co. Ltd.

- Eurofold

- Riso Kagaku Corporation

- Horizon International

- Accu-Fast

Frequently Asked Questions

Analyze common user questions about the Paper Folder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving sustained demand in the Paper Folder Market despite digitalization?

The primary driver is the non-discretionary need for hardcopy documentation mandated by regulatory compliance, particularly across the financial, legal, and healthcare sectors. Additionally, the proven effectiveness and high conversion rates of targeted direct mail marketing continue to necessitate high-volume document preparation equipment.

How do friction-feed folders differ from air-feed folders, and for which applications is each mechanism best suited?

Friction-feed folders are cost-effective and suitable for standard office paper (bond paper) and lower volumes. Air-feed (vacuum) folders are higher-precision systems using air blasts to separate sheets, making them ideal for high-volume, continuous operations, or handling delicate, glossy, or heavily coated paper stocks without marking or sticking.

Which geographical region is expected to demonstrate the highest growth rate for paper folder sales?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth. This acceleration is linked to rapid industrialization, expansion of the regional banking and insurance industries, and increasing governmental administrative requirements that require efficient, mechanized document handling solutions.

What key technological features are currently defining the competitive edge in industrial paper folders?

The competitive edge is defined by fully automated digital job setup (reducing manual calibration time), advanced sensor technology for double-feed detection and jam reduction, and seamless integration capabilities with upstream digital printers and downstream automated inserting machines for end-to-end workflow efficiency.

What is the main restraint challenging the market potential, particularly in mature Western economies?

The most significant restraint is the accelerating trend of corporate and governmental digitalization and paper reduction initiatives (paperless office strategies). This secular trend limits the total addressable market size and extends equipment replacement cycles, focusing new demand almost exclusively on high-efficiency, industrial-grade systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager