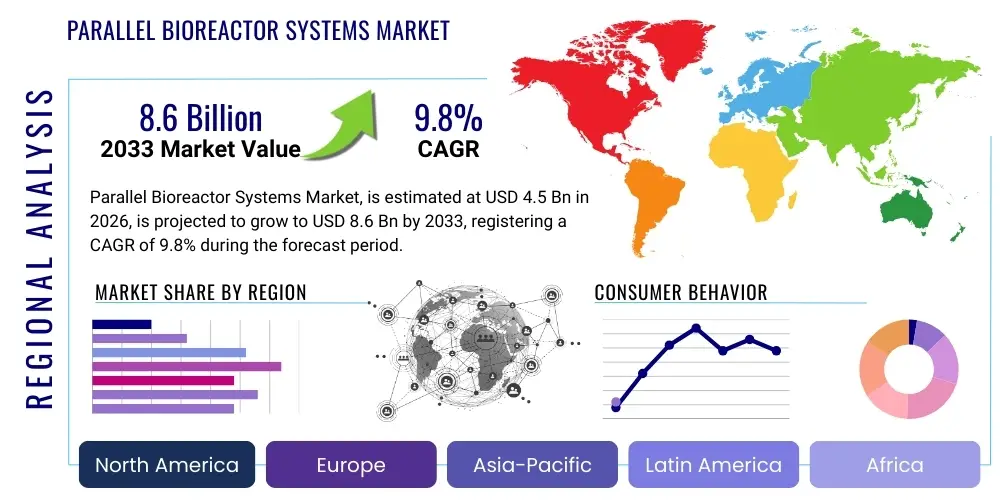

Parallel Bioreactor Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438524 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Parallel Bioreactor Systems Market Size

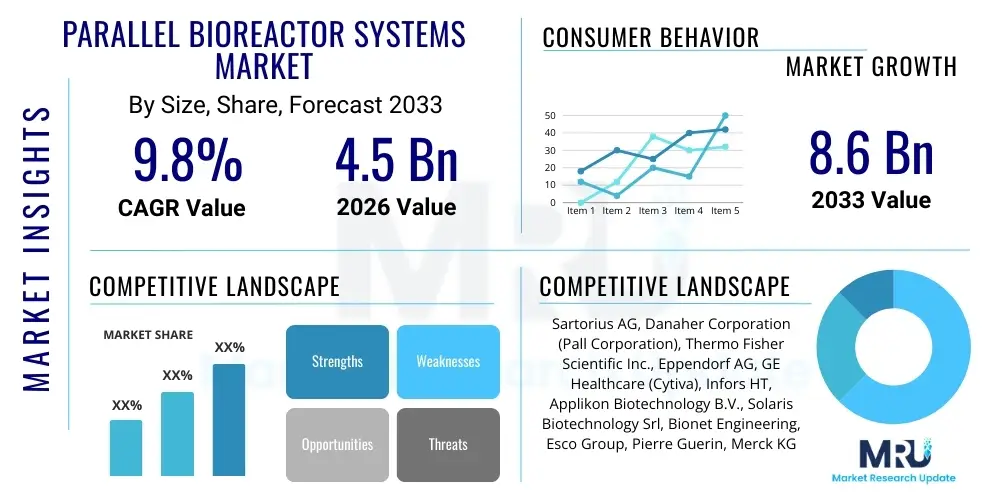

The Parallel Bioreactor Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Parallel Bioreactor Systems Market introduction

Parallel Bioreactor Systems represent a foundational technology in modern bioprocessing, enabling researchers and manufacturers to conduct multiple bioprocess experiments simultaneously under highly controlled conditions. These systems are essential tools for accelerating upstream process development, optimizing media formulations, and conducting high-throughput screening of microbial, mammalian, and plant cell cultures. The core advantage of parallel systems lies in their ability to maintain identical or systematically varied environmental parameters—such as pH, dissolved oxygen (DO), temperature, and stirring speed—across several small-scale reactors, thereby maximizing experimental efficiency and statistical robustness. This simultaneous execution dramatically shortens the timeline required for process characterization and scale-up studies, which is critical in the fast-paced development cycles of biopharmaceuticals and novel therapeutics.

The primary applications of Parallel Bioreactor Systems span across various life science sectors, including drug discovery, vaccine production, biomanufacturing of recombinant proteins, and the burgeoning field of cell and gene therapy. These systems are indispensable in academic research institutions and contract manufacturing organizations (CMOs) seeking to streamline process optimization before transitioning to large-scale production. The systems typically incorporate advanced automation and data logging capabilities, ensuring high reproducibility and traceability of results. Key benefits derived from adopting parallel systems include significant reduction in reagent and resource consumption, expedited time-to-market for new bioproducts, and enhanced capacity for Design of Experiments (DoE) studies, leading to a deeper understanding of critical process parameters (CPPs).

The market growth is fundamentally driven by the escalating global demand for complex biologic drugs, including monoclonal antibodies (mAbs) and biosimilars, which necessitate rigorous and efficient process development. Furthermore, increasing investments in R&D by pharmaceutical and biotechnology companies, coupled with technological advancements in sensor integration, miniaturization, and software analytics, are fueling the adoption of these sophisticated systems. The trend toward personalized medicine and the rapid expansion of advanced therapy medicinal products (ATMPs) further cement the critical role of high-throughput, parallel bioprocessing solutions in meeting future manufacturing challenges. These factors collectively establish parallel bioreactor technology as a cornerstone of next-generation biomanufacturing infrastructure.

Parallel Bioreactor Systems Market Executive Summary

The Parallel Bioreactor Systems Market is experiencing robust expansion, largely driven by fundamental shifts in the biopharmaceutical landscape toward high-efficiency, data-intensive process development. Business trends highlight a strong emphasis on automation and software integration, where leading vendors are focusing on developing turnkey solutions that offer seamless connectivity with advanced analytical tools and machine learning platforms for predictive modeling. The ongoing consolidation and strategic partnerships among system providers and consumables manufacturers are aimed at creating integrated ecosystems that simplify complex upstream workflows for end-users, particularly Contract Development and Manufacturing Organizations (CDMOs) and large biopharma firms accelerating their biosimilar portfolios. This push toward high throughput capabilities and miniaturization, epitomized by the rising popularity of benchtop and single-use parallel systems, defines the current commercial trajectory of the market.

Regionally, North America maintains market dominance, propelled by substantial governmental and private funding for biomedical research, the presence of numerous major biotechnology hubs, and early adoption of cutting-edge bioprocessing technologies. Europe follows closely, driven by rigorous regulatory standards promoting quality-by-design (QbD) principles and strong academic research output, particularly in fermentation and cell culture optimization. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive foreign direct investment in biomanufacturing infrastructure, the emergence of local pharmaceutical giants in countries like China and India, and increasing awareness regarding efficient bioproduction methods necessary to serve rapidly expanding patient populations. These regional dynamics underscore a global commitment to modernizing bioprocess capabilities.

In terms of segmentation trends, the market exhibits a clear preference for Single-Use (Disposable) Parallel Bioreactor Systems, which offer significant advantages in terms of reduced cleaning validation time, minimized risk of cross-contamination, and accelerated turnaround times compared to traditional stainless steel systems. Among end-users, Pharmaceutical and Biotechnology Companies remain the largest consumers, utilizing these systems heavily for early-stage clone screening and process optimization. Furthermore, microbial cultures, owing to their use in vaccine and enzyme production, represent a dominant application segment, though mammalian cell culture applications are rapidly gaining market share due to the increasing complexity and volume of monoclonal antibody production requiring precise environmental control provided by these parallel platforms. The technological focus remains on enhancing sensor accuracy and incorporating real-time monitoring features across all reactor scales.

AI Impact Analysis on Parallel Bioreactor Systems Market

Common user questions regarding AI's influence on Parallel Bioreactor Systems frequently center on how machine learning algorithms can enhance predictive capabilities, optimize complex DoE studies, and facilitate autonomous operation. Users are particularly interested in understanding how AI can analyze the enormous volumes of process data generated by parallel systems—including physiological parameters, metabolite profiles, and gene expression data—to identify non-linear correlations and Critical Process Parameters (CPPs) that human analysis might overlook. Key concerns revolve around data quality standards, the necessity for robust interoperability between bioreactor control software and analytical AI platforms, and the potential for AI-driven optimization to significantly reduce experimental cycles and failure rates in scale-up. The consensus expectation is that AI integration will transform parallel bioreactors from sophisticated experimental tools into smart, self-optimizing bioproduction units, thereby accelerating bioprocess knowledge generation and ensuring Quality by Design (QbD) principles are met more efficiently.

- AI enables real-time predictive modeling of cell growth kinetics and product yield using high-dimensional parallel data sets.

- Machine learning algorithms optimize experimental design (DoE) by suggesting optimal parameter combinations, dramatically reducing the number of physical runs required.

- Integration facilitates autonomous control loops, allowing the system to adjust feeding strategies, temperature, and pH automatically based on instantaneous predictions.

- AI enhances anomaly detection and fault prediction, minimizing costly batch failures in parallel screening campaigns.

- Supports advanced process analytical technology (PAT) by correlating spectral data from inline sensors with complex physiological states.

- Accelerates process scale-up by deriving robust scaling rules from small-volume parallel experiments, improving technology transfer success.

- Enables deep phenotyping of various cell lines simultaneously under different conditions, critical for clone selection and cell line development.

- Improves data management and visualization, transforming raw parallel data streams into actionable bioprocess insights for regulatory submissions.

DRO & Impact Forces Of Parallel Bioreactor Systems Market

The market dynamics of Parallel Bioreactor Systems are shaped by a complex interplay of structural drivers, cost-related restraints, and technological opportunities, all mediated by significant impact forces from regulatory and commercial environments. The primary driver is the exponentially increasing R&D investment in biologics and advanced therapeutics, demanding scalable and high-throughput bioprocess optimization tools. Simultaneously, the industry-wide shift toward Quality by Design (QbD) mandates the use of controlled, multivariable experimentation, which is perfectly facilitated by parallel systems, making them indispensable for demonstrating process robustness. However, the high initial capital expenditure associated with purchasing and installing sophisticated parallel systems, alongside the specialized training required for operation and maintenance, acts as a significant restraint, particularly for smaller academic labs or emerging biotechs with limited budgets. This financial hurdle necessitates careful consideration of Return on Investment (ROI) and encourages the adoption of more affordable, benchtop models.

Opportunities for market expansion are substantial, particularly in emerging applications such as continuous bioprocessing and the manufacturing of cell and gene therapies (CGTs), which require highly flexible and tightly controlled small-scale systems for process fine-tuning before clinical scale-up. Geographical expansion into rapidly developing biomanufacturing hubs in the Asia Pacific region presents a critical avenue for market growth, supported by governmental initiatives aiming to establish local pharmaceutical self-sufficiency. Furthermore, continuous technological advancements, especially the integration of advanced sensors (e.g., non-invasive pH, dissolved oxygen), microfluidics, and digital twins powered by Artificial Intelligence, are creating new market segments and enhancing the value proposition of parallel systems by improving data resolution and operational autonomy.

The core impact forces shaping the market include strict regulatory guidelines, particularly those enforced by the FDA and EMA, which compel pharmaceutical companies to adopt sophisticated systems that provide comprehensive data packages supporting process validation. Competition among key vendors drives innovation in system scalability and automation features, pushing down the unit cost of consumables over the long term. The availability of skilled personnel trained in bioprocess engineering and data analytics significantly influences market penetration, while the shift toward sustainability is driving demand for systems that minimize energy consumption and waste generation. These forces collectively propel the market forward while prioritizing efficiency, regulatory compliance, and technological superiority in bioproduction.

Segmentation Analysis

The Parallel Bioreactor Systems market is segmented based on several critical factors, including the type of reactor used, the volume capacity, the specific cell culture application, and the end-user profile. Analyzing these segments provides a clear map of market demand dynamics and technological preferences across different sectors of the biopharma industry. The segmentation highlights a strong technological dichotomy between traditional reusable (stainless steel/glass) systems, which offer long-term robustness, and modern single-use (disposable) systems, which provide operational flexibility and contamination control. Furthermore, the market is differentiated by the organisms cultured—microbial (fast-growing bacteria, yeasts) versus mammalian (sensitive animal cells)—as each requires distinct environmental control tolerances and system configurations. Understanding these segments is crucial for manufacturers to tailor their product offerings and marketing strategies to specific bioprocess needs, ranging from high-throughput screening to large-scale process optimization.

- By Type:

- Reusable/Glass Bioreactors

- Single-Use/Disposable Bioreactors

- By Volume:

- Benchtop Systems (Under 250 ml)

- Small-Scale Systems (250 ml to 5 L)

- Pilot-Scale Systems (5 L to 20 L)

- By Culture Type:

- Microbial Cell Culture

- Mammalian Cell Culture

- Others (Algae, Insect Cells, etc.)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

Value Chain Analysis For Parallel Bioreactor Systems Market

The value chain for the Parallel Bioreactor Systems market begins with upstream activities, focusing heavily on the specialized sourcing of high-quality components and raw materials. This includes high-precision sensors (e.g., optical or electrochemical probes for pH, DO), advanced pumps, motor drives, sophisticated controller hardware, and, critically for single-use systems, pharmaceutical-grade plastics and specialized polymer bags (bioreactor vessels). Suppliers in this initial stage require rigorous quality control to ensure compatibility and reliability within the complex bioprocessing environment. Key upstream factors determining system quality and cost are the reliability of automated fluid handling components and the integration of highly accurate, real-time Process Analytical Technology (PAT) tools. Managing the supply chain for single-use plastics, which are currently subject to complex logistics and potential vulnerability to global supply disruptions, is a major strategic imperative for system manufacturers.

The midstream segment involves the core manufacturing, system integration, and software development performed by the key market players. This stage encompasses the engineering and assembly of parallel reactor units, including the design of intuitive control software, the development of robust data acquisition platforms, and the necessary validation and calibration services. Direct distribution channels are often preferred for large, customized, or capital-intensive parallel systems, enabling direct interaction between the manufacturer’s specialized technical support team and the end-user's bioprocess engineers. This direct engagement ensures optimal system configuration, installation, and immediate troubleshooting. Indirect distribution, involving specialized scientific distributors or regional agents, is more commonly used for consumables, reagents, and smaller, standardized benchtop systems, allowing for broader geographical reach and faster delivery of non-capital goods.

The downstream activities center on the end-users—biopharmaceutical companies, academic institutions, and CMOs—who utilize these systems for critical applications like clone selection, media optimization, and scale-down model development. Success at this stage relies heavily on comprehensive after-sales support, including system maintenance, software upgrades, and application-specific training, which often dictates long-term customer loyalty and repeat purchases of consumables. The effectiveness of the overall value chain is maximized when there is strong feedback integration between end-users and manufacturers, allowing for continuous product improvement, especially in areas such as minimizing system footprint, enhancing sensor lifetime, and ensuring compliance with evolving regulatory standards related to data integrity (e.g., 21 CFR Part 11). The high-touch nature of this specialized equipment necessitates strong technical expertise throughout the sales and support lifecycle.

Parallel Bioreactor Systems Market Potential Customers

The primary customers for Parallel Bioreactor Systems are deeply embedded within the life sciences and biomanufacturing ecosystem, requiring tools that bridge the gap between small-scale research and commercial production. Pharmaceutical and Biotechnology Companies represent the largest and most strategically important customer segment. These organizations rely on parallel systems for the high-throughput screening of numerous cell lines or microbial strains under varied conditions early in the drug development pipeline. The critical need for rapid optimization of culture media, determination of optimal feeding strategies, and development of robust scale-up procedures for biologics, vaccines, and advanced therapies drives their substantial investment in these platforms. Their procurement decisions are heavily influenced by automation capabilities, regulatory compliance features, and the system's capacity to integrate with existing laboratory information management systems (LIMS) and Process Analytical Technology (PAT) tools.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs/CDMOs) form the second most crucial customer segment. As outsourcing in bioprocessing increases, these entities require highly flexible, multi-purpose parallel bioreactor systems to service diverse client needs, ranging from small-scale feasibility studies to full-scale process characterization. The appeal of single-use parallel systems is particularly strong in this segment, as disposability minimizes changeover time between client batches, effectively maximizing facility utilization and throughput. CMOs prioritize systems that offer rapid deployment, high data fidelity, and proven scalability, ensuring successful technology transfer to larger production volumes for their clients.

Academic Research Institutes and Government Laboratories constitute the third major customer group. While their purchasing volumes may be lower than corporate customers, they are critical for early-stage innovation and training the next generation of bioprocess engineers. These institutions utilize parallel systems primarily for fundamental research in metabolic engineering, synthetic biology, and novel cultivation techniques. Their buying decisions are often influenced by budget constraints, leading to a focus on robust, versatile benchtop systems, though access to grant funding increasingly supports the acquisition of advanced, highly automated models for large collaborative research projects focusing on maximizing research efficiency and publication output.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartorius AG, Danaher Corporation (Pall Corporation), Thermo Fisher Scientific Inc., Eppendorf AG, GE Healthcare (Cytiva), Infors HT, Applikon Biotechnology B.V., Solaris Biotechnology Srl, Bionet Engineering, Esco Group, Pierre Guerin, Merck KGaA, CerCell, Distek, Inc., Broadley-James Corporation, Solaris Biotechnology Srl, Shanghai Bao-xing Biological Equipment Co., Ltd., ZETA Biopharma, Praj Industries, and Bio-Rad Laboratories. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Parallel Bioreactor Systems Market Key Technology Landscape

The technological landscape of the Parallel Bioreactor Systems market is characterized by rapid advancements focused on increasing throughput, enhancing data quality, and improving ease of use through automation and disposability. A fundamental shift has occurred with the dominance of single-use technology (SUT), replacing traditional glass and stainless steel reactors, particularly in smaller volume parallel systems. SUT minimizes sterilization and cleaning validation, significantly accelerating experimental turnaround time, which is paramount in high-throughput screening environments. Key innovations in SUT focus on designing biocompatible materials that reduce leachables and extractables and developing advanced single-use sensors (SUS) that provide highly accurate, calibrated measurements of critical parameters such as pH, dissolved oxygen, and biomass density directly within the disposable vessel. These technological improvements are crucial for maintaining consistency across multiple parallel units and ensuring the integrity of scale-down models.

Another major technological pillar is the pervasive integration of advanced automation and software capabilities. Modern parallel systems are equipped with sophisticated automation platforms controlling precise liquid handling, media feeding, and gas mixing across dozens of reactors simultaneously, often with minimal human intervention. The software component has evolved from simple data logging to complex supervisory control and data acquisition (SCADA) systems that incorporate Design of Experiments (DoE) software, enabling users to automatically set up and analyze complex factorial studies. The integration of Process Analytical Technology (PAT) tools, such as in-line spectroscopy (e.g., Raman or NIR) and advanced off-gas analysis systems, provides real-time, non-invasive monitoring of cell culture metabolic states. This rich data stream is fundamental for implementing Quality by Design (QbD) and developing process understanding required for regulatory submissions.

The convergence of biotechnology with data science is defining the next generation of parallel systems. Systems are now being designed with enhanced connectivity, facilitating seamless data export and integration with third-party analytical platforms, including Machine Learning and Artificial Intelligence tools. The concept of "digital twins"—virtual representations of the bioprocess running in parallel—is gaining traction, allowing researchers to simulate conditions and predict outcomes before running physical experiments. Furthermore, miniaturization is driving market innovation, particularly with the emergence of micro-bioreactors and microfluidic platforms that allow for hundreds of parallel experiments to be conducted at the milliliter or microliter scale, pushing throughput capabilities to unprecedented levels. These technological advancements collectively reduce development costs, accelerate timelines, and improve the predictability of large-scale biomanufacturing outcomes.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the robust presence of leading biopharmaceutical companies, substantial federal and private funding allocated to life sciences research, and rapid adoption of cutting-edge bioprocessing technologies. The US is the epicenter for novel drug discovery and advanced therapeutic manufacturing (Cell & Gene Therapy), creating consistent high demand for high-throughput, automated parallel systems for optimization and regulatory compliance.

- Europe: Europe represents a mature market characterized by stringent regulatory oversight (EMA) and strong government support for academic and industrial biotechnology initiatives, particularly in Germany, the UK, and Switzerland. The focus here is often on high-quality, reusable systems for established bioprocesses and significant adoption of single-use parallel technology for streamlined vaccine and biosimilar production across the region.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive investment in biomanufacturing infrastructure, the expansion of local CDMOs, and favorable government policies in China, India, and South Korea aimed at improving drug self-sufficiency. This region is witnessing a rapid installation base of both small-scale research systems and larger, pilot-scale parallel units as facilities rapidly scale up their biologics production capabilities.

- Latin America (LATAM): The LATAM market is nascent but growing, primarily driven by increasing healthcare expenditure, expanding local pharmaceutical production capabilities in Brazil and Mexico, and rising academic engagement in biotechnology. Market growth is heavily concentrated in capital cities and is currently focused on standardized, cost-effective parallel benchtop systems.

- Middle East and Africa (MEA): This region exhibits slow but steady growth, largely concentrated in technologically advanced nations like Israel, Saudi Arabia, and the UAE. Demand is driven by government initiatives to diversify economies through localized pharmaceutical production and research collaborations, focusing primarily on acquiring reliable, internationally certified parallel bioreactor technology for quality assurance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Parallel Bioreactor Systems Market.- Sartorius AG

- Danaher Corporation (Pall Corporation)

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- GE Healthcare (Cytiva)

- Infors HT

- Applikon Biotechnology B.V.

- Solaris Biotechnology Srl

- Bionet Engineering

- Esco Group

- Pierre Guerin

- Merck KGaA

- CerCell

- Distek, Inc.

- Broadley-James Corporation

- Shanghai Bao-xing Biological Equipment Co., Ltd.

- ZETA Biopharma

- Praj Industries

- Bio-Rad Laboratories

- Fuji Film Diosynth Biotechnologies

Frequently Asked Questions

Analyze common user questions about the Parallel Bioreactor Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using parallel bioreactor systems over traditional systems?

The primary benefit is the dramatic increase in throughput and efficiency. Parallel systems allow researchers to execute multiple, highly controlled experiments simultaneously, accelerating process optimization, clone selection, and Design of Experiments (DoE) studies necessary for biopharmaceutical development, saving time and resources.

Are Single-Use (Disposable) Parallel Bioreactor Systems dominating the market?

Yes, single-use systems are the dominant and fastest-growing segment due to their significant advantages in minimizing cross-contamination risks, reducing cleaning and sterilization validation time, and offering superior operational flexibility, particularly for CMOs handling diverse client projects.

How does Artificial Intelligence (AI) enhance the functionality of parallel bioreactors?

AI integration enables advanced process analytical technology (PAT), real-time data interpretation, predictive modeling of cell behavior, and automated optimization of culture parameters, effectively allowing the parallel system to become a self-optimizing unit that accelerates QbD implementation.

Which end-user segment drives the highest demand for parallel bioreactor technology?

Pharmaceutical and Biotechnology Companies are the largest consumers, utilizing these systems extensively in upstream process development, clone screening, and optimization of complex bioprocesses for monoclonal antibodies and recombinant proteins.

What is the main challenge limiting the wider adoption of these systems?

The main challenge is the high initial capital investment required for purchasing and installing fully automated parallel bioreactor systems, along with the complexity of integrating advanced sensors and software platforms, particularly for smaller laboratories or startups.

The Parallel Bioreactor Systems Market is positioned at the intersection of advanced engineering and bioprocessing science, serving as a critical infrastructure component for the future of drug development and biomanufacturing. The market's robust growth trajectory, reflected by the projected 9.8% CAGR through 2033, underscores the global biopharma industry's increasing reliance on high-throughput, data-rich optimization tools. Continuous technological innovation, driven by the demand for enhanced automation, single-use scalability, and AI integration, ensures that these systems will remain central to achieving Quality by Design (QbD) and accelerating time-to-market for complex biologics. Market leaders are competing fiercely on system flexibility, sensor accuracy, and software capabilities, aiming to provide comprehensive solutions that address the specific needs of mammalian cell culture, microbial fermentation, and the rapidly emerging field of cell and gene therapy manufacturing. Regional expansion, particularly in the Asia Pacific, coupled with regulatory pressure to improve process robustness, guarantees sustained investment and innovation within this specialized and vital sector of the life sciences instrumentation market. The strategic importance of parallel experimentation in de-risking scale-up processes solidifies the market's long-term value proposition across the entire biopharmaceutical value chain. The move towards fully integrated, autonomous bioprocessing labs highlights the technological maturity and critical role of parallel systems in modern R&D environments globally.

Future growth will be significantly shaped by advancements in miniaturization (micro-bioreactors) and the development of cost-effective, high-density sensing arrays. As the cost barrier for single-use consumables continues to decrease due to improved manufacturing efficiencies, the adoption rate is expected to accelerate across academic and smaller industrial settings. Furthermore, addressing the restraints related to the required specialized skill set through improved user interfaces and AI-assisted data interpretation platforms will be crucial for broader market penetration. The inherent efficiency and reliability offered by parallel platforms make them irreplaceable tools, guaranteeing their centrality in achieving the next wave of productivity gains in global biomanufacturing operations. The ability to generate robust, predictive scale-down models using these systems is a key differentiator, supporting streamlined regulatory approval processes and ensuring consistent product quality from bench to commercial scale production.

The global shift toward biopharmaceuticals as the primary class of next-generation medicines dictates a sustained requirement for systems capable of rapidly and reliably optimizing complex biological processes. Parallel bioreactors are uniquely positioned to meet this need by providing the controlled environment and high data resolution necessary for multivariate experimentation. The integration of advanced computational tools, moving beyond simple data logging to true process intelligence, is transforming these systems into strategic assets. Consequently, pharmaceutical companies view these systems not merely as laboratory equipment but as fundamental platforms for reducing clinical risk and improving manufacturing economics. This strategic alignment between technological capability and industrial necessity ensures that the Parallel Bioreactor Systems Market will continue its aggressive growth trajectory, supported by constant innovation in material science, sensor technology, and digital integration capabilities, driving efficiency across the entire spectrum of bioprocessing activities worldwide.

The growing pipeline of personalized medicines and regenerative therapies further intensifies the need for systems that can handle small, high-value batches with exceptional precision. Parallel bioreactors, especially those adapted for perfusion and continuous processing, offer the flexibility and control essential for handling these sensitive and critical cultures. The market remains competitive, with major players continuously releasing enhanced product lines featuring modularity, increased vessel count capacity, and improved software analytics to maintain market leadership. The focus on system interoperability is key, ensuring seamless integration into existing biopharma workflows, from cell line development through to pilot-scale runs. This commitment to both high performance and user-friendliness is critical for maintaining robust market expansion in both established and emerging biotechnology economies.

Furthermore, regulatory bodies are increasingly endorsing the use of data generated from advanced parallel systems to support process validation and comparability studies. This regulatory confidence in the data quality produced by modern parallel bioreactors reinforces their position as standard tools in Good Manufacturing Practice (GMP) compliant environments. The ongoing trend of facility modernization and digitalization across the biopharma industry ensures a consistent upgrade cycle, favoring vendors who offer scalable, future-proof platforms capable of integrating with emerging technologies like the Internet of Things (IoT) and centralized cloud data management. The long-term outlook for the Parallel Bioreactor Systems Market is exceptionally positive, characterized by technological convergence, escalating application complexity, and sustained global investment in biological drug development infrastructure.

The market environment also reflects the strategic importance of rapid prototyping and failure analysis, particularly in the context of global health emergencies, where rapid vaccine and therapeutic development is paramount. Parallel systems allow for quick screening of different production strains and media optimization protocols, dramatically shortening the response time. This demonstrated value in crisis scenarios further enhances the perceived necessity and long-term stability of the market. Investment in localized manufacturing capabilities, particularly in regions like APAC and LATAM, necessitates the establishment of modern bioprocess labs equipped with reliable parallel systems, further diversifying the geographical demand base and insulating the market from reliance on any single region's economic volatility. Consequently, the market is structurally resilient and aligned with macro trends in global healthcare technology.

To capitalize on the future opportunities, manufacturers are heavily investing in training and service infrastructure, recognizing that the complexity of the technology requires expert support. The provision of comprehensive service contracts, application specialists, and online technical resources has become a key competitive differentiator. As systems become more automated, the focus shifts from hardware maintenance to software and data management support. This evolution in the service model is crucial for maximizing system uptime and ensuring that end-users can fully leverage the advanced capabilities for high-throughput process development. The combination of cutting-edge hardware, intelligent software, and robust support ensures the sustained adoption and utilization of parallel bioreactor systems across the entire biopharmaceutical production lifecycle.

The evolution towards continuous bioprocessing, which demands steady-state conditions and long-duration runs, is another key technical driver for parallel systems. These small-scale, high-control systems are ideal for modeling and optimizing continuous processes before large-scale implementation. The flexibility inherent in parallel configurations allows researchers to test various continuous strategies (such as perfusion rates and cell retention technologies) simultaneously, dramatically speeding up the transition from traditional batch processing to more cost-effective and efficient continuous manufacturing. This technological synergy positions parallel bioreactors as essential enablers of the next-generation biomanufacturing paradigm, ensuring market relevance for the foreseeable future.

The increasing use of advanced analytical techniques, such as mass spectrometry and comprehensive metabolomics, in conjunction with parallel bioprocess data, necessitates parallel systems with robust sampling capabilities. Vendors are therefore innovating in automated, sterile sampling systems integrated across all vessels, ensuring that high-quality, reproducible samples are collected for complex off-line analysis without interrupting the parallel culture environment. This focus on sample integrity and automation supports the generation of richer datasets, crucial for developing sophisticated mechanistic models of cell culture behavior and further driving the application of AI in bioprocess control. The seamless harmonization of upstream process control and downstream analytical methods defines the current technological competitive advantage in the parallel bioreactor sector.

Market growth is also influenced by environmental, social, and governance (ESG) factors. Single-use systems, while offering operational advantages, generate plastic waste, prompting manufacturers to explore sustainable alternatives, including recyclable materials and smaller footprint systems that reduce resource consumption. Future innovations are expected to include bioreactor vessels made from biodegradable or advanced composite materials, balancing the need for disposability with environmental responsibility. System designers are also optimizing energy consumption profiles for peripheral equipment, recognizing that operational sustainability is becoming an increasingly important purchasing criterion for major pharmaceutical customers globally, adding another layer of complexity and opportunity to the parallel bioreactor market landscape.

The complexity of cell line development for therapeutic proteins requires extensive screening and optimization, making parallel systems indispensable tools in early-stage research. The ability to quickly iterate on genetic constructs and expression conditions significantly reduces the lead time for selecting high-performing clones. Moreover, the capacity of modern parallel systems to handle specialized cultures, such as adherent cells grown on microcarriers or shear-sensitive stem cells used in regenerative medicine, opens up lucrative, high-value market niches. Vendors who can provide specialized parallel configurations optimized for these sensitive cell types, complete with non-invasive monitoring and low-shear mixing capabilities, are gaining a competitive edge in the high-growth advanced therapies market segment. This specialization ensures that parallel systems remain at the forefront of biological innovation.

Regulatory harmonization efforts globally are positively influencing the market by standardizing data requirements and validation protocols, making it easier for biopharma companies to adopt sophisticated parallel systems across their international R&D facilities. The necessity for robust data integrity (compliance with 21 CFR Part 11) embedded within the control software is a non-negotiable feature for systems procured by GMP-compliant manufacturers. Vendors who demonstrate clear, auditable data trails and system validation support are favored, emphasizing the importance of quality assurance in the selection process. This regulatory environment acts as a strong barrier to entry for lower-quality or unvalidated systems, reinforcing the dominance of established market leaders focused on compliance and data security.

Finally, the growing trend of decentralized manufacturing, including the deployment of smaller, modular biomanufacturing facilities, relies heavily on benchtop and small-scale parallel systems for rapid local production optimization. This shift necessitates portable, easy-to-deploy, and standardized parallel units. This trend, particularly relevant for specialized therapies or regional vaccine production, expands the market beyond centralized R&D hubs and creates new opportunities for manufacturers to offer scalable, distributed parallel bioprocessing solutions. The core drivers—efficiency, high throughput, and data fidelity—remain universally relevant across all geographic and application domains, ensuring the sustained market vitality of parallel bioreactor systems.

The market's future vitality is intrinsically linked to advancements in sensor technology. The development of next-generation non-invasive, disposable sensors that can accurately measure cell viability, specific growth rate, and key metabolite concentrations (e.g., glucose, lactate) in real-time is a major R&D focus. Enhanced sensor data resolution directly feeds the power of AI and predictive modeling, creating a virtuous cycle of process improvement. This evolution minimizes the need for manual sampling, reduces contamination risks, and provides unparalleled kinetic data, transforming process development from an empirical exercise into a data-driven science. Companies investing heavily in proprietary sensor technologies integrated into their parallel platforms are expected to gain significant competitive advantage and capture premium market share by offering truly transformative bioprocess capabilities.

In summary, the Parallel Bioreactor Systems Market is experiencing powerful momentum driven by high R&D activity in biologics, technological shifts toward single-use and automation, and strong regional market expansions, particularly in Asia Pacific. While initial costs pose a challenge, the demonstrable return on investment through accelerated drug development timelines and enhanced process robustness ensures sustained long-term demand. The integration of AI and sophisticated data analytics is reshaping the definition of what a parallel bioreactor system can achieve, positioning these tools as critical platforms enabling the efficient, compliant, and data-rich bioprocessing ecosystem of tomorrow.

The continuous innovation within this technology space reflects the necessity of handling increasingly complex and sensitive biological molecules with precision. The move towards specialized parallel platforms dedicated to microalgae cultivation for biofuels or cellular agriculture for alternative proteins also demonstrates the versatility and expanding addressable market beyond traditional pharmaceuticals. This diversification into industrial and environmental biotechnology applications provides additional revenue streams and stabilizes market growth against fluctuations in the pharmaceutical pipeline. The technological robustness and adaptability of parallel bioreactor systems cement their position as foundational equipment necessary for advancing modern biotechnology across multiple high-value sectors.

A crucial factor underpinning market stability is the entrenched relationship between equipment manufacturers and biopharma regulatory bodies. Early engagement in system design to meet future regulatory requirements (e.g., enhanced data integrity standards, cybersecurity protocols for networked systems) is paramount. This proactive approach ensures that systems purchased today remain compliant throughout the long lifecycle of a pharmaceutical product, reducing future validation risks for end-users. This emphasis on regulatory foresight by market leaders reinforces the trust placed in high-end parallel bioreactor systems as reliable tools for generating quality data essential for global market access for biologics.

The overall market ecosystem is characterized by intensive collaboration, particularly between parallel system providers and developers of specialized cell culture media and reagents. Optimized media formulations designed specifically for the unique mixing and mass transfer characteristics of parallel small-scale vessels ensure successful scale-down modeling. These strategic alliances streamline the workflow for biopharma users, offering integrated and pre-validated solutions that minimize the experimental variables and accelerate the transition from discovery to development. This ecosystem approach, where hardware, software, and consumables are designed to function seamlessly together, maximizes the efficiency gains offered by parallel bioprocessing technology, driving the market toward integrated, end-to-end solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager