Parallel Drive Actuator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432177 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Parallel Drive Actuator Market Size

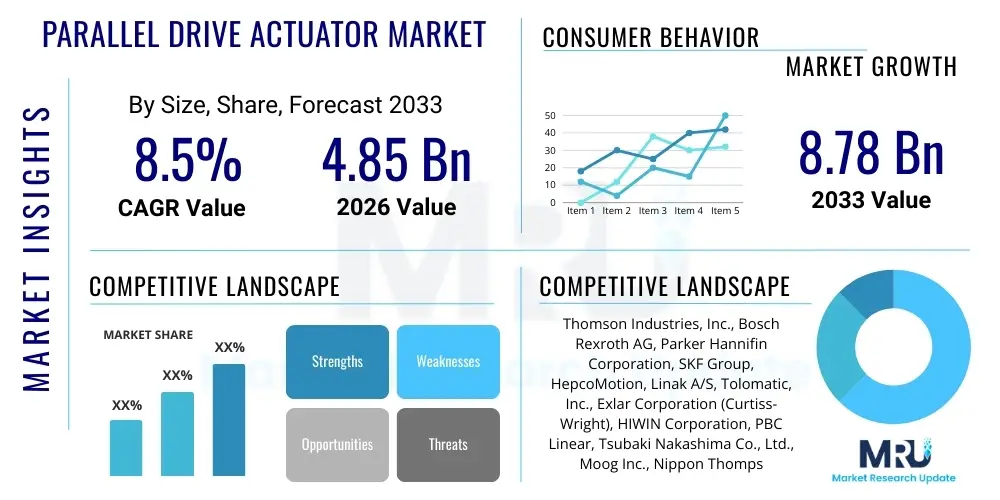

The Parallel Drive Actuator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 8.78 Billion by the end of the forecast period in 2033.

Parallel Drive Actuator Market introduction

The Parallel Drive Actuator Market encompasses advanced motion control systems designed to provide precise, synchronized linear movement, primarily characterized by having the drive mechanism (motor/gearbox) positioned parallel to the main actuation axis. These systems typically utilize robust mechanics such as ball screws, lead screws, or timing belts, coupled with high-efficiency motors (servo or stepper), to handle substantial loads with high accuracy and repeatability. The product description emphasizes high structural rigidity, minimal backlash, and extended lifespan, making them ideal for demanding industrial environments where reliable, continuous operation is paramount. Parallel drive configurations often allow for better space utilization and simplified maintenance compared to standard inline systems, contributing to their growing adoption in integrated manufacturing cells and complex automation setups.

Major applications of Parallel Drive Actuators span across various high-growth sectors, notably advanced manufacturing, automotive production, semiconductor fabrication, and pharmaceutical processing. In manufacturing, they are indispensable for pick-and-place robotics, precision material dispensing, large-format 3D printing, and machine tool loading/unloading. The core benefits driving their market uptake include superior dynamic performance, the ability to handle high moment loads without additional guidance systems, and flexibility in installation configurations, particularly crucial in multi-axis gantries and cleanroom environments. Furthermore, their inherent design allows for easier scalability and customization to specific stroke lengths and speed requirements, providing a compelling solution for complex handling tasks that require synchronized movement over long distances.

Key driving factors propelling the growth of this market include the global surge in industrial automation and the push towards Industry 4.0 standards, which demand higher throughput and operational precision. The increasing integration of robotic systems in non-traditional manufacturing sectors, coupled with significant investments in smart factories, necessitates motion control components that offer enhanced reliability and digital connectivity. Additionally, technological advancements in motor control electronics, such as predictive maintenance features and high-resolution encoders, further amplify the performance envelope of Parallel Drive Actuators, solidifying their position as essential components in the next generation of automated production lines.

Parallel Drive Actuator Market Executive Summary

The Parallel Drive Actuator Market is currently experiencing robust growth, primarily fueled by accelerating global trends toward smart manufacturing and comprehensive digital integration across industrial verticals. Business trends indicate a strong shift among leading manufacturers towards developing modular, highly configurable actuator solutions that integrate seamlessly with sophisticated control systems, often leveraging EtherCAT or Profinet communication protocols to enhance real-time data exchange and diagnostics. Key technological advancements center around optimizing motor efficiency, minimizing thermal expansion effects in high-speed applications, and incorporating lightweight, durable materials to improve power density. Strategic mergers and acquisitions among component suppliers and system integrators are consolidating the market, focusing on offering complete motion subsystems rather than discrete components, thereby simplifying integration for end-users and capturing greater value in the automation stack.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive investments in domestic manufacturing capabilities, particularly in China, South Korea, and Japan, focusing on electric vehicle (EV) production, high-tech electronics, and semiconductor assembly. North America and Europe maintain strong market share, characterized by high adoption rates in advanced aerospace and defense manufacturing, and a strong preference for high-precision, closed-loop actuation systems required in medical device manufacturing and laboratory automation. The trend across all major geographies is a demand for higher reliability and reduced total cost of ownership (TCO), leading to manufacturers emphasizing preventive maintenance features and extended service intervals built into their actuator designs.

Segmentation trends highlight the dominance of the Ball Screw segment due to its exceptional accuracy and load-carrying capacity, though the Belt Driven segment is gaining traction rapidly in applications requiring high speeds and long stroke lengths, such as material transfer and large-scale packaging. The application segment growth is robust across industrial robotics and CNC machinery, reflecting the widespread replacement of conventional hydraulic and pneumatic systems with cleaner, more energy-efficient, and digitally controllable electric actuators. Furthermore, the market for integrated parallel drive units—where the motor, drive, and actuator are sold as a single, optimized assembly—is projected to grow faster than the market for discrete components, aligning with the industry's need for plug-and-play solutions.

AI Impact Analysis on Parallel Drive Actuator Market

User inquiries regarding AI's influence on the Parallel Drive Actuator Market predominantly focus on four core themes: enhancing predictive maintenance capabilities, optimizing motion profiles for energy savings, improving actuator performance under dynamic load conditions, and facilitating seamless integration into fully autonomous manufacturing cells. Users frequently question how AI algorithms can interpret vast datasets generated by actuator sensors (position, temperature, vibration, current draw) to forecast potential failures before they occur, transitioning from reactive to true predictive maintenance paradigms. Furthermore, there is significant interest in utilizing machine learning (ML) to refine the trajectory and speed of actuators in complex, multi-axis systems, minimizing cycle times while adhering strictly to quality tolerance requirements, thereby pushing the limits of current control methodologies. The consensus among technical queries is that AI will transform actuators from passive execution components into intelligent, self-optimizing system elements, driving efficiency gains unattainable through classical control theory alone.

- AI enables highly precise predictive maintenance by analyzing sensor data for anomaly detection and forecasting component wear, significantly reducing unexpected downtime.

- Machine learning algorithms optimize complex motion profiles, resulting in reduced cycle times, improved throughput, and tangible energy savings through smoother deceleration and acceleration ramps.

- AI facilitates self-calibration and self-tuning capabilities in actuators, allowing them to dynamically adapt to changes in load, temperature, and wear conditions without manual intervention.

- Integration of AI-driven control loops enhances synchronization accuracy in multi-axis gantry systems, crucial for large-scale, high-precision applications like aerospace assembly.

- Generative AI tools assist in the design phase, simulating performance under extreme conditions and accelerating the development of lighter, more robust actuator configurations.

- AI powers advanced diagnostics, providing root cause analysis instantaneously, drastically cutting down troubleshooting and repair times in sophisticated automation environments.

DRO & Impact Forces Of Parallel Drive Actuator Market

The market dynamics for Parallel Drive Actuators are governed by a complex interplay of macroeconomic trends, technological maturation, and stringent industrial requirements. The primary Drivers revolve around the relentless global pursuit of automation across all manufacturing sectors, intensified by labor shortages and the necessity for enhanced manufacturing precision (e.g., semiconductor and medical device production). Restraints include the high initial capital investment required for implementing sophisticated electric actuator systems compared to traditional pneumatic alternatives, and the complexity associated with integrating these advanced systems into legacy factory infrastructures, requiring specialized technical expertise. Opportunities are emerging through the adoption of decentralized control architectures and the push toward sustainable manufacturing, where the energy efficiency and clean operation of electric actuators provide a distinct competitive advantage over hydraulic systems. The resulting Impact Forces necessitate that actuator manufacturers continuously innovate on power density, ease of integration, and data connectivity features to remain relevant in the rapidly evolving industrial landscape.

Segmentation Analysis

The Parallel Drive Actuator Market segmentation provides a crucial framework for understanding the diverse applications and technological preferences shaping demand. The market is primarily segmented based on Actuation Mechanism (Ball Screw, Belt Driven, Lead Screw), End-use Industry (Industrial Automation, Robotics, Automotive, Aerospace, Medical), and Actuator Type (Electric, Pneumatic, Hydraulic). The detailed analysis of these segments reveals that Electric Parallel Drive Actuators dominate the market due to their superior precision, energy efficiency, and low maintenance requirements, aligning perfectly with Industry 4.0 objectives. Geographically, segmentation highlights the dominance of the Asia Pacific region in terms of volume consumption, driven by mass production needs, while North America and Europe lead in value consumption due to higher demand for ultra-precision actuators for niche applications like advanced surgical robotics and aerospace tooling. Understanding these segments is key for manufacturers to tailor their product offerings, focusing on high-load ball screw actuators for automotive press lines and high-speed belt-driven actuators for packaging and material transfer systems.

The mechanism segmentation is particularly critical, as the choice between ball screw and belt drive fundamentally determines the application. Ball screw actuators are favored where high stiffness, thrust force, and micron-level repeatability are essential, typically in CNC machines and precision assembly tasks. Conversely, belt-driven actuators offer superior speed and travel length capabilities, making them the standard choice for synchronized transfer lines and large-scale gantry systems, where slight reductions in absolute accuracy are acceptable in exchange for rapid movement. The continuous miniaturization of components within the electronics and medical sectors is further driving the demand for compact, high-performance lead screw actuators that offer cost-effective, precise motion for smaller instruments. The ongoing evolution of materials science and lubrication technologies is also enhancing the operational lifespan and maintenance intervals across all actuation types, reducing the total cost of ownership for end-users across all segmented industries.

The detailed market segmentation is essential for strategic planning, enabling market participants to identify lucrative sub-segments, such as cleanroom-compatible actuators for semiconductor fabrication or corrosion-resistant variants for food and beverage processing. The convergence of hardware and software capabilities is blurring the lines between actuator types, as modern electronic controls can compensate for inherent mechanical limitations, leading to increasing performance overlap. This trend mandates that market research focuses not only on the mechanical segmentation but also on the integration capabilities and software features (e.g., condition monitoring, predictive analytics) offered across different product lines, ensuring a holistic understanding of market demand drivers across various industrial verticals.

- Actuation Mechanism:

- Ball Screw Parallel Drive Actuators

- Belt Driven Parallel Drive Actuators

- Lead Screw Parallel Drive Actuators

- Rack and Pinion Parallel Drive Actuators

- Actuator Type:

- Electric

- Pneumatic

- Hydraulic

- End-Use Industry:

- Industrial Automation and Robotics

- Automotive and Transportation

- Aerospace and Defense

- Medical and Pharmaceutical

- Packaging and Logistics

- Semiconductor and Electronics

- Food and Beverage

- Load Capacity:

- Light Duty (Under 100 kg)

- Medium Duty (100 kg - 500 kg)

- Heavy Duty (Above 500 kg)

Value Chain Analysis For Parallel Drive Actuator Market

The Value Chain for the Parallel Drive Actuator Market is characterized by a high degree of technological integration and dependence on specialized component suppliers. The upstream segment involves the sourcing and production of critical raw materials and components, including high-grade steel alloys for screws and shafts, specialized polymers for belts and guides, precision bearings, and sophisticated electronic components such as servo motors, encoders, and drive controllers. Key challenges in the upstream segment include maintaining supply chain resilience against geopolitical instability and managing the escalating costs of precision components. Manufacturers must maintain robust relationships with specialized suppliers of motion control electronics and raw material providers to ensure consistent quality and timely delivery, especially for customized high-performance actuators required in sectors like aerospace and medical devices.

The midstream phase involves the core manufacturing, assembly, and testing of the actuators. This segment requires significant investment in advanced manufacturing technologies, including precision machining, cleanroom assembly facilities, and rigorous quality control processes to ensure the tight tolerances necessary for linear motion precision. Manufacturers add substantial value by integrating the mechanical components (screws, belts, guides) with the electrical components (motors, brakes, feedback sensors) and developing proprietary firmware and control algorithms that optimize performance metrics such as speed, acceleration, and repeatability. Distribution channels, both direct and indirect, play a pivotal role in market reach. Direct sales are often preferred for highly technical projects or large-scale OEM agreements, where custom engineering support and deep product knowledge are required. This approach ensures technical specifications are met precisely, especially for unique applications.

Downstream activities focus on system integration, installation, maintenance, and aftermarket services provided to the end-users. System integrators, often functioning as indirect channels, are crucial partners as they incorporate the parallel drive actuators into larger automation systems, robotics, and industrial machinery. The value chain concludes with the end-users who deploy the actuators in their manufacturing processes. The importance of aftermarket services, including spare parts, calibration, and predictive maintenance contracts, is growing significantly, offering a high-margin revenue stream. The trend toward digital twins and remote diagnostics further enhances the service portion of the value chain, enabling manufacturers to provide superior uptime and performance support remotely, strengthening customer loyalty and providing critical feedback for future product development cycles.

Parallel Drive Actuator Market Potential Customers

Potential customers for Parallel Drive Actuators are primarily found within industries undergoing rapid automation and requiring high levels of precision and reliability in material handling and processing. The largest end-user segment is the Industrial Automation sector, encompassing machine builders (OEMs) who integrate these actuators into their standard products like CNC machines, packaging equipment, and assembly lines, and large-scale manufacturing enterprises modernizing existing production facilities. These customers prioritize longevity, high throughput, and seamless integration capabilities with existing Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs). The demand from this segment is cyclical, tied directly to capital expenditure trends in global manufacturing.

The Automotive industry represents another critical customer base, particularly with the transition toward Electric Vehicle (EV) manufacturing. Parallel Drive Actuators are heavily used in battery production lines, welding cells, body shop operations, and final assembly lines where heavy loads must be moved rapidly and precisely. These buyers demand robust, high-force actuators that can withstand harsh operating environments and continuous heavy cycling. Furthermore, the Medical and Pharmaceutical sector is a high-value customer group, requiring actuators that meet stringent cleanroom standards, corrosion resistance, and ultra-high precision for applications such as laboratory automation, surgical robotics, and precise fluid dispensing systems. For these customers, certification and material traceability are paramount considerations, often overshadowing cost.

A rapidly growing customer segment includes advanced technology manufacturers, specifically semiconductor and electronics fabricators. These customers require actuation systems capable of nanometer-level precision and minimal particulate generation (vacuum compatibility or cleanroom compliance) for wafer handling, inspection equipment, and micro-assembly tasks. The Aerospace and Defense sector also remains a steady customer, utilizing large-scale parallel actuators in structural testing rigs, aircraft assembly tooling, and simulation platforms where powerful, reliable, and precise movement is mandatory. Understanding the distinct procurement cycles, technical standards, and performance criteria of each customer segment is vital for targeted sales and marketing strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 8.78 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thomson Industries, Inc., Bosch Rexroth AG, Parker Hannifin Corporation, SKF Group, HepcoMotion, Linak A/S, Tolomatic, Inc., Exlar Corporation (Curtiss-Wright), HIWIN Corporation, PBC Linear, Tsubaki Nakashima Co., Ltd., Moog Inc., Nippon Thompson Co., Ltd. (IKO), Rollon S.p.A., Bimba Manufacturing Company, Duff-Norton Company, Ewellix Group, Altra Industrial Motion Corp., Festo SE & Co. KG, Siemens AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Parallel Drive Actuator Market Key Technology Landscape

The technological landscape of the Parallel Drive Actuator Market is characterized by continuous advancements aimed at improving speed, precision, power density, and connectivity. A significant trend is the development and integration of high-resolution absolute encoders and advanced servo motor technology, enabling tighter closed-loop control and eliminating the need for homing procedures after power cycling. Manufacturers are heavily investing in specialized motor windings and magnet technology to maximize torque output within compact footprints, crucial for maintaining high performance while shrinking the actuator envelope for space-constrained applications. Furthermore, sophisticated finite element analysis (FEA) and computational fluid dynamics (CFD) are used extensively during the design phase to optimize structural rigidity, minimize vibration, and manage thermal loads generated during high-duty cycles, ensuring prolonged operational life and consistent performance under stress.

Material science innovation is equally vital, focusing on lighter, stronger aluminum profiles for the main body and utilizing advanced surface treatments or protective coatings to enhance resistance against harsh chemicals, dust, and moisture, thereby expanding the applicability into specialized industrial environments like food processing and offshore facilities. Lubrication technology has also seen marked improvements, with synthetic, long-life greases designed specifically for ball screw and guiding systems, drastically extending maintenance intervals and supporting higher dynamic load ratings. This focus on mechanical refinement is paired with advancements in cable management systems, ensuring that power and feedback cables can handle the rapid, repeated flexing cycles common in gantry systems without premature failure, contributing significantly to system reliability and uptime.

On the electronic and software front, the most impactful technological shift is the robust implementation of Industrial Internet of Things (IIoT) capabilities. Modern parallel drive actuators are increasingly equipped with integrated sensors for vibration, temperature, and current monitoring, feeding operational data directly into edge computing devices or cloud platforms. This seamless digital integration supports real-time performance monitoring and enables AI-driven diagnostics, moving toward fully autonomous operational status adjustment. Furthermore, interoperability is enhanced through compliance with industrial Ethernet standards (e.g., EtherCAT, PROFINET, Ethernet/IP), allowing for deterministic, high-speed synchronization of multiple axes, a fundamental requirement for advanced robotic applications and complex machine tool operation.

Regional Highlights

The global distribution of the Parallel Drive Actuator Market shows significant variation in maturity, adoption drivers, and technological demands across key regions. The Asia Pacific (APAC) region currently holds the largest market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is primarily attributed to the region's massive manufacturing base, particularly in China and Southeast Asian nations, which are rapidly transitioning from manual labor to automated production methods across electronics, automotive, and general manufacturing sectors. Government initiatives, such as China’s Made in China 2025, heavily incentivize factory automation, leading to widespread adoption of high-speed, cost-effective belt-driven and ball screw actuators for mass production lines. Japan and South Korea remain global leaders in high-tech manufacturing, driving demand for ultra-precision actuators used in semiconductor lithography and robotics.

North America and Europe represent mature markets characterized by high value consumption and stringent quality standards. In North America, growth is robust in specialized, high-margin sectors such as aerospace manufacturing, defense applications, and medical technology. Companies here typically prioritize durability, compliance with regulatory standards (e.g., FDA for medical devices), and advanced customization. The European market, particularly Germany and Italy, benefits from strong domestic machine tool and automotive industries. European manufacturers emphasize energy efficiency, system integration ease (with a strong preference for standardized industrial communications), and TCO reduction through long-life components and advanced diagnostics. These regions generally demand premium, technically sophisticated electric actuators with integrated safety features and comprehensive certification.

The Middle East and Africa (MEA) and Latin America (LATAM) markets are emerging, characterized by increasing, albeit slower, adoption rates. Growth in MEA is driven by diversification strategies away from oil dependence, focusing on infrastructural development and localized manufacturing hubs (e.g., automotive in Turkey, logistics in UAE). LATAM’s market growth is supported by investments in packaging, food and beverage processing, and agricultural machinery, necessitating robust, environmentally resilient actuators. While these regions currently adopt less complex, often cost-optimized solutions, the long-term trend indicates a gradual shift towards higher-precision electric actuators as local manufacturing expertise and capital availability improve, paving the way for future advanced automation projects.

- Asia Pacific (APAC): Dominant market share and fastest growth rate; driven by mass industrial automation in China, high-volume electronics manufacturing, and significant investment in EV production lines. Focus on cost-efficiency and high throughput.

- North America: High value market focusing on advanced manufacturing (Aerospace, Defense, Medical Devices). Strong demand for precision, robust design, and integrated smart features (IIoT).

- Europe: Mature market with strong reliance on German machine tool manufacturing and automotive industry. High focus on energy efficiency, precision engineering, and standardized industrial communication protocols (Industry 4.0 implementation).

- Latin America (LATAM): Emerging market growth in packaging, mining, and food & beverage processing. Demand centers on durable actuators for challenging environments and moderate precision requirements.

- Middle East & Africa (MEA): Growth driven by economic diversification efforts, infrastructure projects, and developing localized light manufacturing capabilities. Adoption is increasing but often focuses on foundational automation needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Parallel Drive Actuator Market.- Thomson Industries, Inc.

- Bosch Rexroth AG

- Parker Hannifin Corporation

- SKF Group

- HepcoMotion

- Linak A/S

- Tolomatic, Inc.

- Exlar Corporation (Curtiss-Wright)

- HIWIN Corporation

- PBC Linear

- Tsubaki Nakashima Co., Ltd.

- Moog Inc.

- Nippon Thompson Co., Ltd. (IKO)

- Rollon S.p.A.

- Bimba Manufacturing Company

- Duff-Norton Company

- Ewellix Group

- Altra Industrial Motion Corp.

- Festo SE & Co. KG

- Siemens AG

Frequently Asked Questions

Analyze common user questions about the Parallel Drive Actuator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Parallel Drive Actuator over an inline actuator?

The primary advantage of the parallel configuration is improved structural rigidity, the ability to handle high moment loads without additional external support, and a more compact design profile relative to its load capacity, making it highly effective for cantilever and gantry setups.

Which actuation mechanism (Ball Screw vs. Belt Driven) dominates the market?

Ball Screw Parallel Actuators dominate the market segment requiring maximum precision, high thrust force, and repeatability. However, Belt Driven systems are increasingly dominant in applications prioritizing high speed, long stroke lengths, and high dynamic response, such as automated material transfer and packaging.

How is the Parallel Drive Actuator Market influenced by Industry 4.0?

Industry 4.0 drives demand for Parallel Drive Actuators by mandating features like integrated sensing, digital connectivity (IIoT readiness), and compatibility with industrial Ethernet protocols, allowing for real-time diagnostics, remote monitoring, and complex synchronized motion control within smart factory environments.

What are the key restraint factors limiting market growth?

The primary restraints are the significantly higher initial capital investment required for electric parallel drive systems compared to traditional pneumatic or hydraulic alternatives, and the need for specialized technical expertise for sophisticated installation, programming, and ongoing maintenance.

Which application segment shows the most potential for growth in the next five years?

The Industrial Robotics and Semiconductor/Electronics manufacturing segments are expected to show the strongest growth potential, driven by the increasing complexity of assembly tasks, the push for miniaturization, and the ongoing global expansion of wafer fabrication facilities requiring ultra-clean, high-precision motion systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager