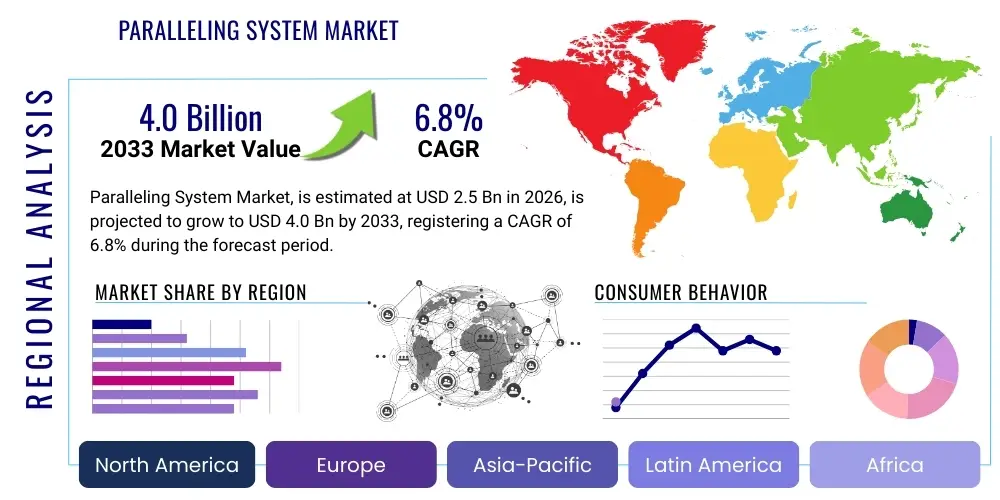

Paralleling System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438883 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Paralleling System Market Size

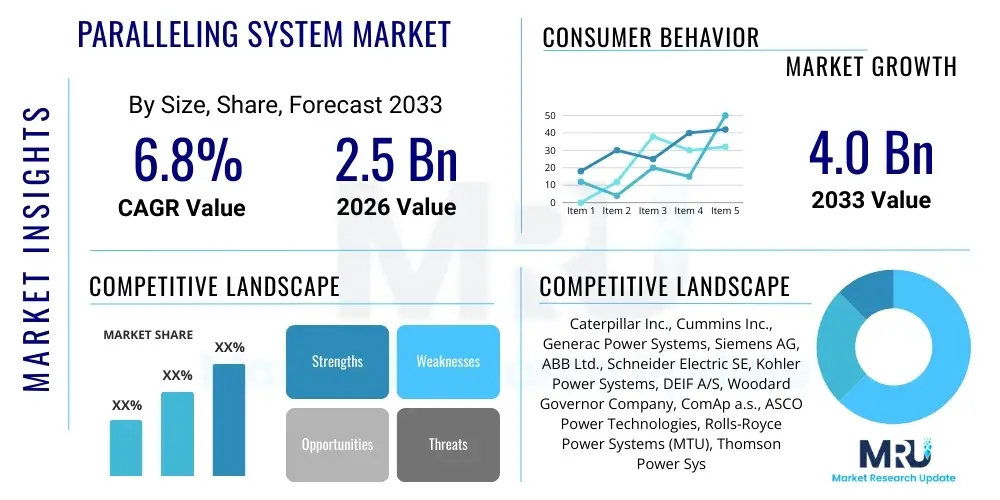

The Paralleling System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Paralleling System Market introduction

The Paralleling System Market encompasses technologies designed to efficiently synchronize and manage multiple power generation units, such as diesel generators, gas turbines, or renewable energy sources, allowing them to operate cohesively to share load and provide redundancy. These systems are essential for mission-critical applications where uninterrupted power supply (UPS) is non-negotiable, including large-scale data centers, hospitals, telecommunication hubs, and heavy industrial facilities. The core functionality involves sophisticated control units, protective relays, and communication protocols that ensure seamless transfer, optimized fuel efficiency through load management, and enhanced system reliability by providing N+1 or 2N redundancy configurations. The increasing complexity of modern power grids, characterized by the integration of distributed energy resources (DERs) and microgrids, is significantly driving the demand for advanced paralleling technology capable of managing bidirectional power flow and maintaining grid stability under varying operational conditions.

Paralleling systems offer substantial economic and operational benefits, primarily through increased system uptime and optimized resource utilization. By enabling multiple generators to share the load, these systems reduce the wear and tear on individual units, allowing for staggered maintenance schedules and extending the operational lifespan of the equipment. Furthermore, during periods of low power demand, paralleling systems facilitate the activation of only the necessary number of units, running them closer to their peak efficiency curve, thus minimizing fuel consumption and reducing overall operating costs. This focus on efficiency and resilience makes paralleling solutions foundational to modern distributed power infrastructure, particularly in regions prone to grid instability or those facing escalating energy demands from rapid urbanization and digitalization.

The principal driving factors propelling market growth include the global surge in data center construction, motivated by cloud computing and artificial intelligence requirements, which demand exceptionally high levels of power reliability. Additionally, stringent regulatory requirements concerning power quality and environmental mandates favoring cleaner energy generation further necessitate the integration of sophisticated control systems. The adoption of microgrids, particularly in remote areas or institutions seeking energy independence, acts as a powerful catalyst for market expansion, as microgrids inherently rely on highly reliable paralleling mechanisms to manage the integration of diverse generation sources like solar, wind, and traditional fossil fuels, ensuring instantaneous response to load fluctuations and maintaining islanded mode operation seamlessly.

Paralleling System Market Executive Summary

The Paralleling System Market is experiencing robust growth fueled by pervasive digitalization and the critical need for power redundancy across various industries. Business trends indicate a shift towards modular and scalable paralleling solutions, driven by the increasing deployment of containerized and modular data centers. Key market players are heavily investing in developing smart paralleling controllers that incorporate advanced predictive diagnostics and Internet of Things (IoT) capabilities, enabling remote monitoring and proactive maintenance, thereby minimizing downtime and optimizing performance. Strategic mergers, acquisitions, and partnerships aimed at integrating proprietary control software with hardware systems are common, reflecting a competitive landscape focused on offering comprehensive, integrated power management ecosystems rather than standalone components. Furthermore, the trend toward decentralization of power generation is spurring innovation in technologies that can handle complex synchronization scenarios involving intermittent renewable sources and energy storage systems.

Regionally, the market is spearheaded by North America, attributed to the presence of a vast and rapidly expanding network of Hyperscale data centers and rigorous regulatory standards mandating high-reliability backup power systems in critical infrastructure such as hospitals and financial institutions. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, large-scale infrastructure development projects in economies like China and India, and significant government initiatives promoting electrification and grid modernization. Emerging economies in the Middle East and Africa (MEA) are also showing strong potential, driven by oil and gas industry demands and investment in energy security measures. European market growth is steady, emphasizing energy efficiency and the integration of microgrids supported by ambitious clean energy targets.

Segment trends highlight the dominance of the digital/microprocessor-based control unit segment, replacing older analog systems due to superior processing power, flexibility, and integration capabilities required for modern power management. Application-wise, the Data Center sector remains the largest consumer, while the Utilities segment, driven by investments in smart grid infrastructure and distributed generation capacity, is anticipated to grow fastest. The trend towards hybridization of power sources—combining conventional generators with battery storage and renewables—is forcing manufacturers to develop paralleling software solutions that prioritize dynamic load adjustment, grid forming capabilities, and protection against harmonic distortion, ensuring stability irrespective of the energy mix deployed.

AI Impact Analysis on Paralleling System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Paralleling Systems commonly revolve around themes such as optimization potential, predictive failure analysis, enhanced grid stability in microgrids, and the future role of human operators. Users frequently ask how AI can improve load-sharing accuracy, minimize fuel consumption across a fleet of generators, and whether AI algorithms can handle the rapid decision-making required for synchronization and fault isolation better than traditional Programmable Logic Controllers (PLCs). The core expectation is that AI will transition paralleling systems from reactive fault response mechanisms to proactive, self-optimizing power management platforms, capable of forecasting demand fluctuations, identifying subtle component degradation before failure, and dynamically adjusting operational parameters in real-time to maximize efficiency and resilience, particularly in highly volatile renewable energy environments.

AI technologies, specifically machine learning and deep learning algorithms, are poised to revolutionize the operation and maintenance of complex paralleling infrastructure. By analyzing historical load profiles, environmental conditions, and generator performance metrics, AI can create highly accurate predictive models for energy demand. This allows the paralleling system to make optimal decisions on when to start or stop specific generating units, ensuring they operate within the most efficient range possible, minimizing suboptimal partial loading, and leading to substantial savings in fuel and maintenance costs. Furthermore, AI facilitates enhanced transient stability management by processing vast amounts of sensor data almost instantaneously, allowing for micro-adjustments to excitation systems and governors, significantly improving the system's ability to recover from sudden load changes or external disturbances, which is crucial for sensitive loads like sophisticated computing equipment.

The integration of AI also fundamentally transforms maintenance strategies from time-based or reactive approaches to true condition-based monitoring. Machine learning models can detect anomalies in vibration data, oil quality metrics, or electrical signatures that are indicative of impending mechanical or electrical failure within the generating units or the paralleling hardware itself. This capability enables predictive maintenance, drastically reducing unplanned downtime and the associated costs. Moreover, in the context of advanced microgrids, AI acts as the central brain, dynamically managing the interplay between traditional generators, intermittent renewables, and Battery Energy Storage Systems (BESS), optimizing charge/discharge cycles and ensuring perfect synchronization between islanded operation and grid connection, thereby maximizing the economic value and reliability of the overall power infrastructure.

- AI enhances operational efficiency by predicting load demand and optimizing generator start/stop sequences.

- Machine learning enables true predictive maintenance by detecting subtle anomalies in system component health.

- AI algorithms improve transient stability through real-time, micro-level adjustments to system controls during disturbances.

- Advanced control systems utilize AI for optimal synchronization and seamless grid integration of intermittent renewable sources.

- Generative AI models assist engineers in simulating complex fault scenarios and designing robust paralleling logic.

- AI-driven optimization reduces fuel consumption and minimizes operational expenditure (OPEX) in generator fleets.

DRO & Impact Forces Of Paralleling System Market

The dynamics of the Paralleling System Market are shaped by powerful Drivers promoting growth, significant Restraints challenging adoption, and diverse Opportunities enabling future expansion, all culminating in measurable Impact Forces across the industry. The primary driver remains the pervasive global increase in demand for uninterrupted and high-quality power, directly linked to the proliferation of data centers, critical healthcare facilities, and automated industrial complexes which cannot tolerate even momentary power interruptions. Restraints largely center around the high initial capital expenditure associated with complex paralleling hardware and specialized installation expertise, alongside the significant challenge of integrating legacy power infrastructure with modern digital paralleling control units. Opportunities reside in the rapid expansion of the microgrid segment, particularly in remote or unstable grid regions, and the continuous innovation in software-defined power management solutions that simplify system configuration and maintenance, making advanced paralleling accessible to a broader range of smaller-scale industrial and commercial applications.

The Impact Forces are substantial, primarily driven by regulatory frameworks emphasizing grid resilience and operational safety, which compel critical infrastructure operators to adopt proven paralleling technologies for redundancy. Technological impact forces include the integration of IoT sensors and advanced communications (like IEC 61850 protocol adoption), leading to systems that offer unprecedented levels of remote diagnostics and performance transparency. Economically, the move towards smart load management through paralleling systems provides a clear return on investment by maximizing fuel efficiency and reducing maintenance frequency, creating a strong economic incentive for deployment. Conversely, the workforce challenge, characterized by a shortage of technicians specialized in complex digital power synchronization and control systems, acts as a decelerating force, requiring manufacturers to invest heavily in user-friendly interfaces and automated commissioning tools to mitigate installation complexity.

The strategic imperative for energy independence is another critical driver, especially following geopolitical instability and natural disasters that expose grid vulnerabilities. Organizations are increasingly adopting islanding capability, facilitated by sophisticated paralleling gear, to ensure business continuity irrespective of external grid status. This desire for energy autonomy is opening new market opportunities in captive power plants and specialized infrastructure, such as military bases and remote mining operations. However, the market must constantly navigate the complexities introduced by varied international power standards and certification requirements, which necessitate extensive customization and engineering efforts, serving as a friction point in global market penetration and standardization efforts across different geographic regions.

Segmentation Analysis

The Paralleling System Market is structurally segmented based on Component, Application, End-Use, and Power Rating, providing a granular view of market dynamics and adoption patterns. The component segment differentiates between the core hardware elements like control units, load sharing modules, circuit breakers, and auxiliary components such as protective relays and sensors. Control units, particularly those employing advanced microprocessors and software capabilities, remain the core of the market due to their central role in synchronization and load distribution. Application segmentation highlights the diverse environments utilizing these systems, ranging from critical infrastructure like hospitals to power-intensive industrial operations and increasingly, utility-scale power plants managing decentralized generation assets. The overall analysis shows a clear shift toward digital, integrated solutions that offer superior flexibility and remote management capabilities across all segment lines.

- By Component:

- Control Units/Controllers (Digital Microprocessor-based)

- Load Sharing Modules (LSMs)

- Protection Relays and Circuit Breakers (Switchgear)

- Sensors and Auxiliary Components

- By Application:

- Data Centers and Telecommunications

- Industrial Manufacturing (Oil & Gas, Mining)

- Healthcare and Pharmaceuticals (Hospitals, Laboratories)

- Utilities and Power Generation (Microgrids, Peaking Plants)

- Commercial (High-rise Buildings, Financial Institutions)

- By End-Use:

- Commercial

- Industrial

- Residential (Large Multi-Dwelling Units)

- Government and Defense

- By Power Rating:

- Low Power (< 1 MW)

- Medium Power (1 MW – 5 MW)

- High Power (> 5 MW)

Value Chain Analysis For Paralleling System Market

The value chain for the Paralleling System Market begins with the upstream component suppliers, which include manufacturers of advanced microprocessors, communication chips, high-reliability sensors, and specialized switchgear components. These foundational suppliers provide the critical technology building blocks, often operating under strict quality control standards given the mission-critical nature of the final product. Key activities at this stage involve substantial R&D expenditure focused on improving signal processing speed, communication security, and component longevity. The market relies heavily on a few specialized suppliers for control unit intellectual property (IP) and robust electrical hardware capable of handling high voltages and currents during synchronization and fault isolation, ensuring the integrity of the power system.

Midstream activities involve the Original Equipment Manufacturers (OEMs) and specialized power solution providers. OEMs (such as generator set manufacturers) integrate the control units and switchgear into their overall power packages, focusing on system integration, software development, and customization tailored to specific generator models and application requirements. Distribution channels are varied, encompassing direct sales for large, complex utility or hyperscale data center projects, and indirect channels through authorized distributors, system integrators, and electrical contractors for smaller industrial or commercial installations. Direct sales emphasize deep technical support and customization, while indirect channels focus on volume and localized installation services. The complexity of installation necessitates highly specialized system integrators who bridge the gap between manufacturer specifications and real-world site conditions.

The downstream segment is defined by installation, commissioning, maintenance, and service delivery. Direct channels, especially for specialized industrial clients, often involve ongoing service contracts managed by the OEM, providing technical support, remote monitoring, and firmware updates. Indirect channels rely on certified third-party service providers. Potential customers, spanning data centers to utilities, demand high reliability and comprehensive after-market support, driving competition in service efficiency and response time. The life cycle of paralleling systems is lengthy, making the recurring revenue from maintenance and software support a significant value component. The continuous need for system upgrades, driven by new communication protocols (e.g., cybersecurity enhancements) and changing grid codes, ensures sustained downstream engagement.

Paralleling System Market Potential Customers

The primary consumers of paralleling systems are sectors where power continuity is intrinsically linked to operational viability and public safety, making system redundancy a capital expenditure necessity rather than an optional safeguard. Data centers, including hyperscale cloud providers and smaller co-location facilities, represent the largest and most rapidly growing customer segment. These entities require robust, highly redundant power systems (typically N+1 or 2N architectures) to ensure the continuous operation of servers, which cannot tolerate even milliseconds of downtime. The massive financial losses associated with data center outages solidify their position as essential buyers of advanced, high-power paralleling solutions capable of managing large fleets of generators and seamless switchovers.

Another significant customer base lies within critical infrastructure, including hospitals, airports, military installations, and financial trading floors. Hospitals, for instance, must maintain power for life support systems and essential clinical operations, driving demand for systems that meet stringent regulatory compliance regarding switchover speed and reliability. Industrial complexes, particularly in sectors such as petrochemicals, mining, and continuous process manufacturing (e.g., steel, paper), are also heavy users. In these environments, power interruptions can lead to catastrophic equipment damage, massive production losses, and lengthy restart procedures, justifying the investment in sophisticated paralleling gear for maintaining stable captive power generation or seamless transfer during utility failures.

Emerging customers include rural communities, educational campuses, and large corporate facilities investing in microgrids or localized distributed energy resources (DERs). As the adoption of solar PV, wind, and battery storage grows, these entities require high-precision paralleling technology to synchronize these disparate sources with each other and with the main utility grid, often needing islanding capabilities. Utility companies themselves are increasingly becoming direct customers, utilizing paralleling control systems for managing grid-connected peaking plants and for integrating utility-scale battery energy storage systems (BESS) into the transmission and distribution network, ensuring power quality and managing peak demands efficiently across regional grids.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Cummins Inc., Generac Power Systems, Siemens AG, ABB Ltd., Schneider Electric SE, Kohler Power Systems, DEIF A/S, Woodard Governor Company, ComAp a.s., ASCO Power Technologies, Rolls-Royce Power Systems (MTU), Thomson Power Systems, Selco A/S, Socomec Group, Mitsubishi Heavy Industries, Wärtsilä Corporation, Kirloskar Oil Engines Ltd., Yanmar Holdings Co. Ltd., Zenith Controls Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paralleling System Market Key Technology Landscape

The technological landscape of the Paralleling System Market is rapidly evolving, moving beyond simple voltage and frequency matching towards highly sophisticated, digitalized power management platforms. The core technology remains the microprocessor-based paralleling controller, which has replaced traditional analog relay logic due to its superior processing speed, programmability, and ability to handle complex control algorithms necessary for managing heterogeneous power sources. Modern controllers feature advanced communication interfaces, supporting protocols like Modbus TCP/IP, Ethernet, and IEC 61850, enabling seamless integration into broader Supervisory Control and Data Acquisition (SCADA) systems and Distributed Control Systems (DCS). A key innovation is the transition to adaptive load sharing algorithms, which utilize real-time feedback loops to distribute load based not only on capacity but also on individual generator efficiency curves and maintenance schedules, optimizing the entire generation fleet's performance.

The integration of advanced sensing technology and IoT is paramount in the current technology environment. High-precision sensors monitor variables such as reactive power flow, harmonic distortion, and mechanical stresses within the generators. This sensor data is transmitted via secure industrial IoT networks to the paralleling controller, facilitating immediate corrective action or predictive maintenance alerts. Furthermore, synchronization processes are increasingly software-driven, utilizing phase-locked loops (PLLs) and digital signal processing (DSP) techniques to achieve synchronization accuracy within milliseconds, which is vital for smooth power transfer without voltage dips or transients that could affect sensitive electronic loads. Cybersecurity protocols are also being embedded directly into the control units to protect against remote tampering, as these systems represent a critical point of potential vulnerability in power infrastructure.

A crucial technological shift is the development of "Grid-Forming" inverters and control systems, particularly relevant for the microgrid segment. Traditional paralleling systems rely on the utility grid or a dedicated generator set to establish voltage and frequency reference (Grid-Following). Grid-Forming technology, however, allows renewable energy sources and battery storage systems, managed by the paralleling controller, to independently establish the grid reference, enabling robust and stable islanded operation. This capability drastically improves resilience and efficiency in environments integrating a high percentage of inverter-based resources. Manufacturers are also focusing on modular and scalable designs, utilizing standardized bus communication systems, which simplify future capacity expansion and enable systems to grow alongside the facility’s power demand without requiring complete replacement of the control infrastructure.

Regional Highlights

The global Paralleling System Market exhibits significant regional variations in growth and maturity, driven primarily by infrastructure spending, regulatory environments, and the pace of microgrid adoption.

- North America (NAM): Dominates the market share due to the highest concentration of Hyperscale data centers globally, strict regulatory requirements (e.g., NFPA standards) mandating reliable backup power for essential services, and extensive infrastructure modernization efforts across the U.S. and Canada. The region benefits from early adoption of advanced digital control technology and substantial investment in distributed generation systems and localized grid resilience initiatives.

- Asia Pacific (APAC): Expected to register the fastest growth rate (CAGR). This acceleration is fueled by massive industrialization, rapid urbanization in countries like China, India, and Southeast Asia, and escalating government focus on developing robust power infrastructure to support new manufacturing bases and expanding urban centers. The high demand for energy security in manufacturing and telecommunications sectors drives large-scale system deployments.

- Europe: Characterized by stable growth, driven largely by regulatory pressures to enhance energy efficiency and grid stability, particularly the mandated integration of vast amounts of renewable energy capacity. European demand is focused on highly integrated microgrid solutions and advanced paralleling systems capable of seamless interaction between decentralized energy sources and the established transmission network, adhering to demanding EU clean energy directives.

- Middle East and Africa (MEA): Shows strong emerging market potential, propelled by major investments in oil and gas infrastructure, which requires highly reliable captive power solutions, and substantial government spending on large-scale construction projects (e.g., smart cities). Market growth in Africa is concentrated around addressing power supply deficits through decentralized power generation and remote infrastructure projects.

- Latin America (LATAM): Growth is steady, primarily concentrated in modernization efforts of existing utility infrastructure and increasing industrial activity in Brazil and Mexico. The market is moderately constrained by economic volatility but supported by persistent needs for robust backup power solutions in mining, processing, and financial sectors to counter unreliable local utility grids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paralleling System Market.- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Kohler Power Systems

- DEIF A/S

- Woodard Governor Company

- ComAp a.s.

- ASCO Power Technologies

- Rolls-Royce Power Systems (MTU)

- Thomson Power Systems

- Selco A/S

- Socomec Group

- Mitsubishi Heavy Industries

- Wärtsilä Corporation

- Kirloskar Oil Engines Ltd.

- Yanmar Holdings Co. Ltd.

- Zenith Controls Inc.

Frequently Asked Questions

Analyze common user questions about the Paralleling System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a generator paralleling system and why is it essential for data centers?

The primary function of a paralleling system is to synchronize the voltage, frequency, and phase angle of multiple power sources (e.g., generators) so they can be interconnected safely, allowing them to share the total electrical load. For data centers, it is essential because it provides redundancy (N+1 or 2N), ensures seamless load transfer during utility outages, optimizes fuel consumption by running generators at peak efficiency, and facilitates modular expansion of power capacity.

How does the integration of renewable energy sources affect the complexity of paralleling systems?

Integrating intermittent renewable energy sources (like solar and wind) significantly increases system complexity. Paralleling systems must be advanced enough to manage bidirectional power flow, handle rapid voltage and frequency fluctuations caused by varying renewable output, and precisely synchronize inverter-based resources with traditional generators, often requiring "Grid-Forming" capabilities for stable microgrid operation.

Which technology segment dominates the Paralleling System Market and why?

The Digital/Microprocessor-based Control Unit segment dominates the market. Digital controllers offer superior computational power, flexibility, and communication capabilities compared to older analog systems. They are necessary for executing complex load-sharing algorithms, integrating IoT data for predictive maintenance, and meeting modern regulatory compliance standards for power quality and grid synchronization accuracy.

What are the key drivers for market growth in the Asia Pacific (APAC) region?

Market growth in APAC is primarily driven by massive infrastructure investments, rapid deployment of telecommunication and hyperscale data center facilities, high rates of industrialization, and government initiatives aimed at modernizing aging electrical grids and improving regional energy access and security, particularly in high-growth economies such as China and India.

What role does predictive maintenance play in optimizing paralleling system performance?

Predictive maintenance, enabled by AI and IoT sensor data, allows the paralleling system to monitor the operational health of its components and connected generators in real-time. This ensures that maintenance tasks are performed only when necessary, preventing unplanned catastrophic failures, minimizing critical downtime, reducing overall maintenance costs, and maximizing the operational lifespan of the entire power generation fleet.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager