Parkour Training Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438617 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Parkour Training Equipment Market Size

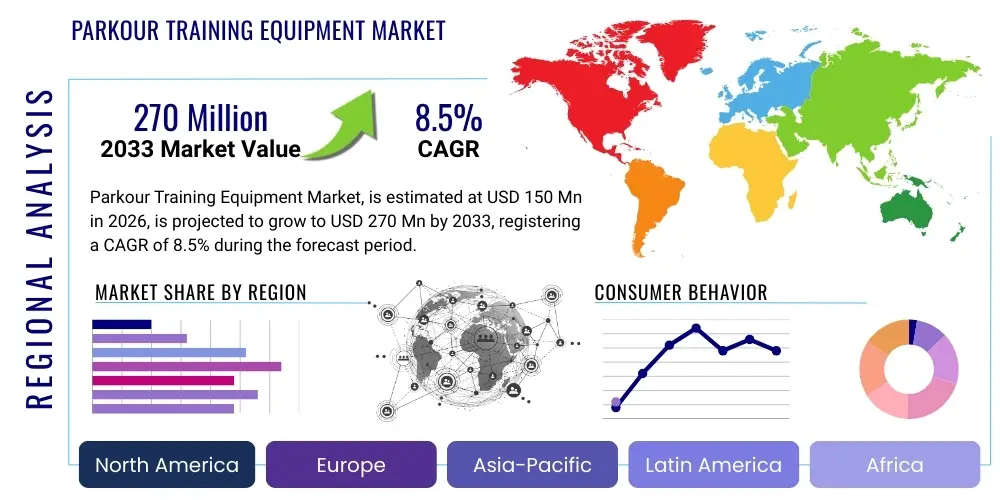

The Parkour Training Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 270 Million by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the increasing globalization and mainstream acceptance of parkour, freerunning, and ninja warrior training, moving these disciplines from niche urban subcultures into recognized competitive sports and recreational fitness activities. The heightened emphasis on functional fitness, agility, and core strength training among consumers globally further strengthens the demand for specialized, safety-compliant equipment designed for dynamic movement training.

Parkour Training Equipment Market introduction

The Parkour Training Equipment Market encompasses specialized gear, modular structures, and safety systems designed to facilitate safe, progressive practice of parkour, which involves traversing obstacles efficiently using movements such as running, climbing, swinging, vaulting, and jumping. The product descriptions range from high-density impact landing mats and precision obstacle blocks to complex modular steel scaffolding systems and customized climbing features. Major applications span specialized parkour academies, commercial fitness centers integrating functional training zones, educational institutions utilizing equipment for physical education curricula, and residential consumers seeking dedicated home training setups. The core benefits include enhanced safety through standardized construction and protective materials, versatility allowing for diverse movement sequences, and scalability to accommodate various skill levels from beginner to advanced traceur.

Driving factors for this market include the formalization of parkour competitions, increasing media coverage of related sports like World Chase Tag and Ninja Warrior, and the growing recognition by urban planners of the need for dedicated, safe training environments rather than relying solely on non-purpose-built urban architecture. Furthermore, the development of lightweight, portable, and durable materials, such as advanced composite plastics and high-impact foam cores, is broadening the accessibility of quality training tools to a wider consumer base. These factors collectively establish a robust foundation for sustained market growth, particularly in regions with high disposable income and established fitness cultures.

Parkour Training Equipment Market Executive Summary

The global Parkour Training Equipment Market is characterized by robust business trends focusing on modularity, safety certification (e.g., ASTM standards for playground equipment), and integration with digital training platforms. Key regional trends show significant acceleration in North America and Europe, driven by established professional parkour organizations and high commercial investment in functional fitness gyms. Asia Pacific, particularly China and Japan, is emerging rapidly due to expanding urban populations adopting Western fitness trends and government initiatives promoting physical activity. Segment trends indicate a strong shift towards Specialized Parkour Academies as the primary revenue generator within the Application segment, demanding high-durability, custom-designed steel and composite structures. Simultaneously, the Safety Gear segment, particularly landing mats and protective padding, exhibits resilient growth due to stringent safety standards and heightened awareness of injury prevention among amateur practitioners.

A central theme emerging from the market analysis is the convergence of professional training needs with consumer demand for aesthetically pleasing and space-efficient home training solutions. Manufacturers are increasingly prioritizing quick assembly/disassembly features and multi-functional designs to cater to both commercial fitness landlords optimizing floor space and residential users with limited training areas. Furthermore, the executive outlook anticipates increased merger and acquisition activity among niche equipment providers and larger sports goods manufacturers seeking to consolidate market share and leverage specialized intellectual property related to modular construction and impact absorption technologies. The market remains competitive, necessitating continuous product innovation and strategic partnerships with professional athletes and training organizations to maintain brand relevance and credibility within the community.

AI Impact Analysis on Parkour Training Equipment Market

Common user questions regarding AI’s influence on the Parkour Training Equipment Market frequently revolve around personalized training optimization, predictive safety analytics, and the future of smart equipment design. Users are keenly interested in whether AI can interpret biometric data collected from wearable sensors to dynamically adjust training parameters or suggest specific equipment setups tailored to an individual's movement efficiency and fatigue levels. Concerns often focus on the privacy implications of collecting movement data and the reliability of AI algorithms in complex, real-world parkour scenarios. Expectations are high for AI-driven maintenance scheduling for large-scale modular installations, ensuring structural integrity is proactively managed. Overall, the consensus theme is that AI will transition equipment from static training tools to intelligent, integrated components of a comprehensive digital training ecosystem.

- AI-driven personalized training regimens based on real-time biometric and performance data, optimizing equipment configuration and usage.

- Predictive maintenance analytics for modular structures and high-wear components, reducing equipment failure risk and ensuring longevity.

- Integration of computer vision and machine learning for automated form analysis, providing instant feedback on vault technique or landing mechanics.

- Enhanced safety systems utilizing AI for real-time fall detection, alerting trainers or automatically deploying auxiliary safety measures within designated training zones.

- Optimization of manufacturing processes through AI simulations, leading to the design of lighter, stronger, and more ergonomically effective parkour apparatus.

DRO & Impact Forces Of Parkour Training Equipment Market

The dynamics of the Parkour Training Equipment Market are shaped by powerful Drivers promoting growth, Restraints limiting widespread adoption, clear Opportunities for future development, and various Impact Forces governing market structure. Key Drivers include the rising global interest in functional fitness, the professionalization and competitive structuring of urban sports, and heightened consumer awareness regarding training safety, which necessitates high-quality, certified equipment. Restraints primarily involve the high initial capital investment required for comprehensive modular setups, significant space requirements for installation, and, in some regions, the lack of standardized regulatory frameworks governing equipment specifications for specialized sports training outside traditional gymnastics or playgrounds. Opportunities reside in developing integrated digital solutions (e.g., AR/VR training coupled with physical equipment), expanding into emerging Asian and Latin American markets, and innovating lightweight, portable gear for individual consumers.

The primary Impact Forces at play are rooted in consumer perception and safety regulation. Porter’s Five Forces analysis suggests a moderate level of competitive rivalry due to a fragmented market structure with both large sports manufacturers and specialized niche fabricators. The bargaining power of buyers (large parkour academies or fitness chains) is moderate, as customized solutions are often required, limiting substitution. However, the threat of substitutes is present; many practitioners still rely on non-purpose-built urban environments, underscoring the necessity for equipment manufacturers to emphasize safety, repeatability, and specific technical benefits. Regulatory impact, particularly increasing adoption of international safety standards (like ISO/ASTM) for impact absorption and structural stability, is forcing manufacturers to invest heavily in R&D, thereby raising barriers to entry for new, smaller competitors.

Furthermore, the societal perception of parkour has transitioned from a fringe activity to a legitimate athletic endeavor, which is fundamentally driving municipal and private investment in dedicated training facilities. This positive shift is a significant external force. However, economic downturns can act as a powerful constraint, as specialized equipment purchases are often considered discretionary, especially in the consumer segment. Manufacturers must strategically position their products not merely as recreational items but as essential investments for injury prevention and performance optimization, ensuring resilience against economic volatility. This positioning requires robust data and certification demonstrating superior safety performance compared to improvised or non-certified alternatives.

Segmentation Analysis

The Parkour Training Equipment Market segmentation provides a detailed view of key revenue streams and operational niches, primarily categorizing products based on Type (material and function), Application (end-user setting), and Material. The comprehensive analysis reveals that the Type segment focusing on Modular Structures holds the highest revenue share globally, reflecting the preference of commercial clients for scalable and reconfigurable training environments. The Application segment highlights the crucial role of Specialized Parkour Academies as early adopters and high-volume purchasers of premium, robust equipment, setting industry trends for quality and design. Geographically, the market displays strong segmentation, with highly regulated markets like North America and Western Europe prioritizing certified safety equipment, influencing the Material segment towards high-grade steel and rigorously tested composite foams.

The market’s structure is further defined by the increasing sophistication of safety regulations, which mandates that manufacturers differentiate their products based on impact attenuation capabilities and structural durability under repeated stress. This regulatory pressure heavily influences the Material segmentation, promoting the use of advanced, durable, and often more expensive materials. Within the Type segment, the distinction between permanent fixtures (used in parks or dedicated centers) and portable, quick-assembly kits (favored by travelling teams or smaller gyms) is crucial for market targeting. Understanding these segmentation nuances allows stakeholders to develop targeted marketing strategies, align R&D efforts with high-growth product categories, and accurately forecast demand across different end-user verticals, ensuring optimized resource allocation for inventory and distribution.

- By Type:

- Modular Steel and Aluminum Structures (Scaffolding, Rails, Bars)

- Precision Blocks and Plyometric Boxes (Wood/Foam Core)

- High-Density Impact Landing Mats and Padding Systems

- Climbing Walls and Grips (Indoor/Outdoor rated)

- Portable Obstacles and Training Aids (e.g., Vault Boxes, Balance Beams)

- Safety and Protective Gear (Gloves, Joint Supports)

- By Application:

- Specialized Parkour Academies and Training Centers

- Commercial Fitness Gyms (Functional Training Zones)

- Residential and Personal Use

- Public Parks and Urban Recreation Spaces (Permanent Installations)

- Educational Institutions (Schools and Universities)

- By Material:

- Steel and Metal Alloys (High Load Bearing Structures)

- Wood (Plywood, Treated Lumber for Blocks)

- High-Density Composite Foam and Vinyl (Mats and Padding)

- Composite Plastics and Fiberglass (Climbing Grips and Modular Components)

- By Distribution Channel:

- Direct Sales (B2B projects, Custom Fabrications)

- Retail Stores (Specialty Sporting Goods)

- E-commerce Platforms and Online Retailers

Value Chain Analysis For Parkour Training Equipment Market

The value chain for the Parkour Training Equipment Market begins with upstream activities involving the sourcing of raw materials, primarily high-grade steel alloys, durable woods, specialized composite plastics, and high-resilience foam cores. This stage is critical as the safety and longevity of the final product depend heavily on material quality and certification. Key upstream suppliers include specialized metallurgy firms, industrial foam manufacturers, and composite material producers. Differentiation at this stage often relates to proprietary impact absorption technologies and the use of sustainable or recycled materials, responding to growing consumer and regulatory demand for environmentally conscious products. Effective inventory management and securing reliable supply of certified materials are essential for maintaining production quality and cost stability in a market where safety compliance is non-negotiable.

Midstream activities involve design, fabrication, assembly, and quality testing. Design houses specialize in modular, customizable, and often proprietary geometries that maximize training utility while minimizing footprint and ensuring compliance with structural and safety standards. Fabrication involves precision welding, CNC cutting, and specialized coating applications (e.g., weather-resistant powder coats). Assembly processes often leverage standardized components to enable rapid scaling and easier installation by end-users. Rigorous quality assurance, particularly stress testing and impact attenuation validation, is a crucial value-add step, contributing directly to brand reputation and liability mitigation. Companies that integrate advanced technologies like robotics in fabrication tend to achieve cost efficiencies and higher product consistency.

Downstream activities center on distribution, sales, installation, and after-sales support. The distribution channel is bifurcated between Direct Sales (B2B model) for large, customized facility projects (academies, municipal parks) and indirect sales through e-commerce or specialized sports retailers for standard products and safety gear. Direct sales often include mandatory installation and comprehensive consulting services, offering higher margins but requiring specialized technical staff. After-sales support, including maintenance contracts and replacement part services for modular systems, forms a crucial part of the downstream value proposition, ensuring long-term customer satisfaction and facility safety compliance. The transition towards digital commerce allows smaller fabricators to reach a global audience, bypassing traditional retail intermediaries.

Parkour Training Equipment Market Potential Customers

The Parkour Training Equipment Market targets a diverse set of end-users, collectively comprising institutions and individuals committed to specialized physical training and fitness versatility. The primary and highest-value customer segment consists of Specialized Parkour Academies and Functional Fitness Gyms. These entities require large-scale, durable, and highly configurable modular systems to accommodate multiple skill levels and diverse classes. Their purchasing decisions are driven by safety certifications, modularity, floor space efficiency, and long-term durability, necessitating high initial capital outlay. These customers typically engage in direct B2B transactions with manufacturers, often requiring custom design and professional installation services to maximize their training utility and meet specific architectural requirements of their facilities.

A rapidly expanding customer base includes municipal governments and urban planning departments seeking to integrate designated training spaces into public parks and recreation areas. This segment prioritizes tamper-proof, weather-resistant, and permanently installed equipment that complies with local public safety codes and often requires transparent procurement processes and competitive tendering. The focus here is on maximizing accessibility and community engagement, necessitating equipment that is intuitively safe and requires minimal supervision. Finally, the individual consumer segment, composed of independent traceurs and home fitness enthusiasts, forms the largest volume segment, primarily purchasing portable landing mats, balance equipment, and small, versatile plyometric boxes via e-commerce platforms. For these buyers, price, ease of storage, and instructional integration (e.g., compatibility with online training videos) are key purchasing motivators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 270 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parkour Generations, MoveStrong, American Ninja Warrior Training, Monkeybar Storage, World Chase Tag, Ramplite, Urban Freeflow, EZ-Climb Walls, Escape Climbing, Atomik Climbing Holds, Tuffstuff, Gravity Fitness, Functional Fitness Systems, Freerun Systems, Dyno Equipment, Playworld, True Movement, X-Movement, Parkour Project, Synergy Parkour. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Parkour Training Equipment Market Key Technology Landscape

The technological landscape of the Parkour Training Equipment Market is primarily driven by advancements in materials science, modular engineering, and integrated sensor technology aimed at enhancing safety, versatility, and user engagement. Material innovation focuses heavily on developing composite foam cores with superior impact absorption characteristics while maintaining high rebound efficiency, crucial for safe landings and continuous movement flow. Manufacturers are leveraging advanced computational fluid dynamics and structural analysis software to design modular steel structures that are lighter yet possess higher structural integrity, minimizing material waste and installation complexity. Powder coating technologies are also evolving to provide extreme durability and weather resistance for outdoor installations, significantly extending product lifecycle and reducing maintenance costs.

Furthermore, technology is increasingly focused on the "smart" integration of equipment into digital training environments. This includes embedding passive or active sensor technology (e.g., RFID tags or pressure sensors) into obstacles and mats to track user interaction, measure jump height or distance, and provide quantifiable performance metrics. These sensors are vital for professional academies seeking objective assessment of athlete progress. The rapid uptake of 3D printing is also playing a role, particularly in prototyping custom climbing grips and connectors for modular systems, allowing for faster product iteration and highly specialized, low-volume components. This technological integration is shifting the perception of parkour equipment from simple physical structures to connected fitness tools, maximizing training effectiveness.

A major focus remains on modular and rapid assembly technologies. Proprietary locking mechanisms, often utilizing specialized industrial fasteners and connectors, enable facility owners to reconfigure their entire training layout quickly and safely without specialized tools, offering unparalleled flexibility in class instruction and competition setup. This engineering emphasis addresses the commercial restraint concerning floor space utilization and the need for dynamic training environments. The ongoing refinement of simulation software also allows manufacturers to accurately model how equipment will perform under extreme, dynamic loads before physical prototyping, significantly reducing development time and ensuring compliance with the increasingly strict international safety standards governing load-bearing fitness structures.

Regional Highlights

The global Parkour Training Equipment Market demonstrates distinct patterns of growth and maturity across key regions, heavily influenced by local fitness culture, regulatory environments, and economic development.

- North America: Represents the largest market share, characterized by high consumer spending on specialized fitness and the immense popularity of televised urban obstacle course competitions (like American Ninja Warrior). The region possesses stringent safety and liability standards (often based on ASTM), driving demand for premium, certified landing mats and highly engineered modular systems. Market growth is robust, fueled by commercial gym investment and the proliferation of dedicated parkour facilities, particularly in metropolitan areas.

- Europe: A mature and highly influential market, particularly in Western and Central Europe (France, UK, Germany). This region, often considered the birthplace of parkour/freerunning, focuses on authenticity and community development. Demand is high for high-quality, durable outdoor installations funded by municipalities and specialized training academies. Emphasis is placed on aesthetic integration into urban landscapes and adherence to EU safety directives for play and sports equipment.

- Asia Pacific (APAC): Exhibits the highest projected CAGR. Growth is driven by rapid urbanization, increasing youth engagement in extreme sports, and rising disposable incomes in countries like China, South Korea, and Australia. While safety standards are currently variable, there is a strong emerging trend towards Western-style, professionally managed fitness centers, accelerating the demand for imported or locally manufactured high-specification equipment. Residential demand for smaller, portable gear is also significant in densely populated urban centers.

- Latin America (LATAM): Currently a nascent market but showing strong potential, particularly in Brazil and Mexico. Economic volatility presents a restraint, often leading to a preference for locally fabricated, lower-cost solutions. However, increasing global media exposure of the sport is gradually driving demand for internationally certified, higher-quality modular structures, primarily concentrated in private sector academies focused on professional development.

- Middle East and Africa (MEA): This region is characterized by fragmented demand, with major procurement driven by high-income Gulf Cooperation Council (GCC) countries investing in large-scale recreational facilities, sports complexes, and expatriate-focused fitness centers. Demand in these areas focuses exclusively on premium, durable, and often custom-designed equipment suitable for extreme climate conditions (heat and sand resistance).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Parkour Training Equipment Market.- Parkour Generations

- MoveStrong

- American Ninja Warrior Training

- Monkeybar Storage

- World Chase Tag

- Ramplite

- Urban Freeflow

- EZ-Climb Walls

- Escape Climbing

- Atomik Climbing Holds

- Tuffstuff

- Gravity Fitness

- Functional Fitness Systems

- Freerun Systems

- Dyno Equipment

- Playworld

- True Movement

- X-Movement

- Parkour Project

- Synergy Parkour

Frequently Asked Questions

Analyze common user questions about the Parkour Training Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Parkour Training Equipment Market?

The primary driver is the increasing mainstream professionalization and commercialization of parkour and related urban obstacle sports, alongside the global trend towards functional fitness. This professional acceptance necessitates certified, high-safety equipment for formal training and competition venues.

Which segment holds the largest market share by application?

The Specialized Parkour Academies and Training Centers segment typically holds the largest market share by application. These professional institutions require extensive, high-durability modular structures and large volumes of certified landing mats, driving high-value B2B transactions.

How significant is the impact of safety standards on equipment design?

Safety standards, particularly those relating to impact attenuation (like ASTM or EN standards), are critically significant. Compliance mandates the use of specialized, high-density foam and rigorously tested structural components, fundamentally influencing material selection, R&D costs, and product differentiation within the market.

Which region is expected to show the fastest market growth through 2033?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid urbanization, increasing adoption of Western fitness trends, and rising investments in dedicated recreational and training facilities across major economies like China and Southeast Asia.

What role does technology play in modern parkour equipment?

Technology plays a critical role through the integration of sensors for performance tracking, advanced material science for lighter and stronger structures, and AI-driven design optimization. This integration transforms physical structures into 'smart' training tools, providing measurable data for users and predictive maintenance alerts for operators.

Is residential use a viable market segment for equipment manufacturers?

Yes, residential use is a highly viable segment, specifically targeting portable, space-efficient, and easy-to-store equipment such as small plyometric boxes, balance beams, and personal landing pads. This segment is crucial for volume sales, often driven by e-commerce platforms and individual practitioners.

What are the main restraints affecting market expansion?

The main restraints include the high initial capital investment required for comprehensive, certified modular systems, which can deter smaller commercial entities, and the significant space requirements needed for effective installation, particularly in high-rent urban areas globally.

How do modular systems benefit commercial customers?

Modular systems benefit commercial customers by offering unparalleled flexibility. They allow facility owners to quickly reconfigure layouts for different training classes, skill levels, or competition formats, maximizing the utility of floor space and adapting to evolving training demands without extensive construction.

What materials are prioritized for structural components in the market?

High-grade steel alloys and aluminum are prioritized for structural components due to their superior load-bearing capacity, durability, and resilience under dynamic stress. These materials are often treated with weather-resistant powder coatings, especially for permanent outdoor installations.

In the value chain, which activity adds the most specialized value?

The midstream activity of design, custom fabrication, and specialized quality assurance adds the most specialized value. This involves proprietary modular engineering, precision welding, and rigorous stress testing to meet safety certifications, differentiating high-quality manufacturers from general fabricators.

How does the threat of substitutes influence pricing strategies?

The threat of substitutes (i.e., practitioners using non-purpose-built urban architecture) forces manufacturers to strategically emphasize the superior safety, standardization, and repeatability offered by certified equipment. This justifies premium pricing by positioning the product as an essential investment in injury prevention and specific performance training, rather than a mere recreational item.

Are municipalities increasing investment in parkour facilities?

Yes, municipalities, particularly in Europe and North America, are increasingly investing in dedicated, permanent parkour training facilities in public parks. This trend is driven by recognizing parkour as a legitimate form of physical recreation and a tool for youth engagement, requiring durable, tamper-proof, and safe outdoor structures.

What is the expected CAGR for the forecast period (2026-2033)?

The market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, reflecting accelerating global adoption and commercial investment in specialized urban fitness infrastructure.

How are environmental concerns influencing equipment manufacturing?

Environmental concerns are increasingly influencing manufacturing through a shift toward using recycled materials, particularly in high-density foam production and metal sourcing. Furthermore, manufacturers are optimizing supply chains and production methods to reduce material waste and energy consumption, appealing to environmentally conscious consumers and regulators.

What is the role of e-commerce in the distribution channel?

E-commerce plays a vital role, especially in the indirect sales channel, making specialized equipment accessible globally to individual consumers, small gym owners, and residential users who primarily purchase portable or smaller training aids. Online platforms facilitate direct-to-consumer relationships and rapid inventory turnover for standard products.

What are 'Precision Blocks' and why are they essential?

Precision Blocks are specialized training aids, often made from wood or high-density foam with non-slip surfaces, designed to teach accurate foot placements, vaulting techniques, and precision landings. They are essential for foundational training, allowing traceurs to practice complex movements incrementally in a controlled, adjustable environment.

How is the AI impact analyzed in terms of safety?

The AI impact on safety is analyzed through the potential for predictive maintenance (using machine learning to flag structural weaknesses before failure) and real-time safety monitoring (integrating computer vision to assess movement risk and detect falls, thereby enhancing immediate responsiveness in training environments).

Which sub-segment within Materials is gaining traction?

The high-density composite foam and specialized vinyl segment is rapidly gaining traction. Continuous R&D into foam technology yields lighter, more durable landing mats with optimized impact attenuation, which is vital for meeting evolving safety regulations and improving user confidence.

What is the primary differentiation strategy used by key market players?

The primary differentiation strategy involves proprietary modular design systems and obtaining highly recognized safety certifications (e.g., specific ASTM ratings). Companies focus on offering unique configurability, superior durability, and comprehensive warranty/support packages that justify a premium price point over generic alternatives.

How do manufacturers address the challenge of space limitations for installation?

Manufacturers address space limitations by designing highly modular, vertical training systems and apparatus with quick-fold or quick-disassembly mechanisms. This allows commercial gyms to utilize multifunctional zones, maximizing training capacity during peak hours and minimizing footprint when the area is needed for other activities.

What is meant by the "professionalization of urban sports" in this context?

The "professionalization of urban sports" refers to the shift where activities like parkour and freerunning are transitioning into organized competitive sports with established governing bodies, standardized rules, and professional athlete circuits (e.g., World Chase Tag). This creates a direct commercial need for professional-grade, standardized, and high-performance training equipment.

How does the market in the Middle East and Africa differ from North America?

The MEA market, particularly the GCC countries, primarily focuses on premium, custom-designed, large-scale projects, often requiring equipment specialized for extreme outdoor climate resilience. Conversely, North America's market is broader, characterized by high volume sales to existing commercial gyms and a greater diversity of consumer-level products.

What is the significance of the "Base Year 2025" in this market analysis?

The Base Year 2025 signifies the reference point for calculating current market estimates and projecting future growth rates (CAGR). It represents the most recent period for which comprehensive, validated market data is fully compiled and analyzed, serving as the foundational figure for the subsequent forecast period (2026-2033).

Do educational institutions represent a significant growth opportunity?

Yes, educational institutions (high schools and universities) represent a significant latent growth opportunity, driven by curriculum integration of functional and alternative fitness programs. Their procurement decisions are heavily influenced by durability, safety compliance (often aligning with playground standards), and multi-functionality to serve diverse athletic programs.

What key material challenges do manufacturers face today?

Key material challenges include maintaining cost-effectiveness while sourcing high-specification materials necessary for safety compliance (e.g., proprietary foam compounds for impact mats). Furthermore, achieving optimal strength-to-weight ratios in modular structures, essential for both portability and structural integrity, remains a continuous engineering challenge.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager