Part Transfer Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435579 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Part Transfer Robots Market Size

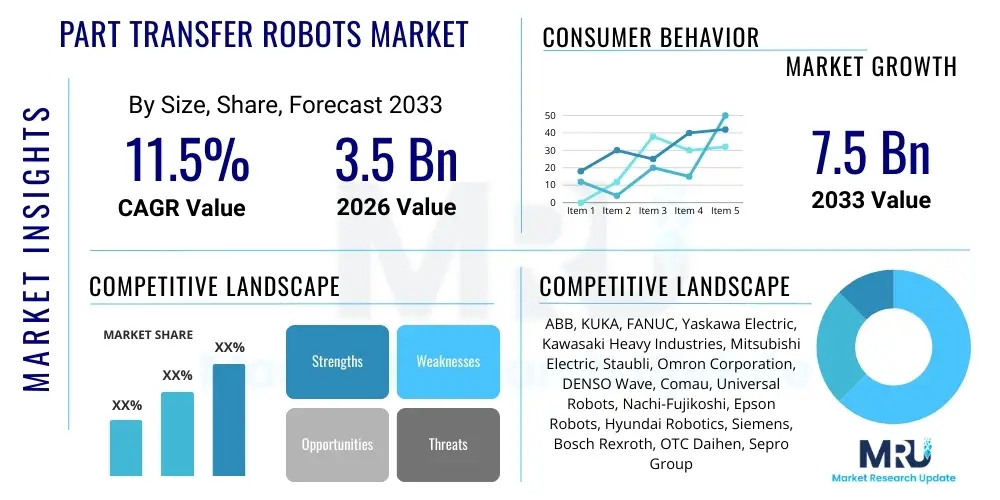

The Part Transfer Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Part Transfer Robots Market introduction

The Part Transfer Robots Market encompasses automated robotic systems designed specifically for handling and moving components, parts, or materials between stages in a manufacturing or assembly line. These robots are essential in enhancing operational efficiency, reducing human error, and ensuring consistent cycle times in highly automated environments. The primary product scope includes various robotic architectures such as articulated robots, SCARA robots, Cartesian robots, and delta robots, all optimized for pick-and-place operations, machine tending, and material handling tasks within controlled production settings.

Major applications of part transfer robots span critical industrial sectors, most notably automotive manufacturing (transferring body panels, engine components), electronics assembly (handling delicate microchips and circuit boards), and heavy machinery production (moving large metal parts). The core benefits driving adoption include significant labor cost reduction, improved workplace safety by removing human interaction from repetitive or dangerous tasks, and superior precision and repeatability, which are crucial for maintaining high product quality standards. Furthermore, the integration of these robots allows manufacturers to scale production quickly in response to market demand.

Key driving factors propelling the growth of this market include the relentless global push toward industrial automation (Industry 4.0), the increasing demand for high-quality and defect-free manufactured goods, and sustained investment in new production facilities, particularly across Asia Pacific. The necessity for manufacturers to maintain a competitive edge through optimized throughput and reduced operational expenditure further solidifies the foundational demand for sophisticated part transfer solutions. Regulatory pressures regarding worker safety also indirectly encourage the shift toward robotic systems for repetitive motion tasks.

Part Transfer Robots Market Executive Summary

The Part Transfer Robots Market is experiencing robust expansion driven by global manufacturing modernization initiatives and the necessity for flexible automation solutions. Current business trends indicate a strong shift towards collaborative robots (cobots) for smaller payload, high-mix, low-volume production lines, complementing traditional heavy-duty robots used in mass production. Furthermore, there is a growing emphasis on robots equipped with advanced vision systems and AI-driven path planning capabilities, enabling them to handle unstructured environments and varying component types with greater adaptability, pushing the boundaries of traditional automated material handling.

Regionally, Asia Pacific (APAC) continues to dominate the market, primarily fueled by massive industrial investment in China, Japan, and South Korea, particularly within the electronics and electric vehicle (EV) manufacturing sectors. North America and Europe demonstrate mature market characteristics, focusing on integrating sophisticated software and IoT capabilities with existing robotic infrastructure to maximize data utilization and predictive maintenance. Emerging economies in Latin America and the Middle East are showing accelerated growth as they rapidly adopt automation technologies to catch up with global manufacturing standards, driven by foreign direct investment in automotive and food processing facilities.

In terms of segments, the Articulated Robots segment holds the largest market share due to its versatility and high degree of freedom, making it suitable for complex assembly and transfer tasks across various industries. However, the SCARA robots segment is expected to exhibit the fastest growth rate, specifically within the electronics and pharmaceutical industries, owing to their speed and precision in planar pick-and-place applications. Payload capacity segmentation highlights growing demand for medium and high-payload robots, reflective of the increasing size and complexity of components handled in heavy industry and automotive assembly lines globally.

AI Impact Analysis on Part Transfer Robots Market

Common user inquiries regarding the integration of Artificial Intelligence (AI) into the Part Transfer Robots Market revolve around key themes such as the ability of AI to handle product variability, optimize complex task sequencing, and facilitate seamless human-robot collaboration. Users frequently ask: "How does AI enhance robotic vision and precision?" or "Can AI reduce reprogramming time for new parts?" and "What is the role of machine learning in predictive maintenance for transfer robots?" The central user expectation is that AI integration will significantly transcend the limitations of traditional fixed automation, enabling robots to dynamically adapt to changes on the factory floor, thereby lowering operational expenditures and increasing throughput resilience.

The core themes derived from user concerns suggest that while high hopes exist for AI-driven flexibility, manufacturers are cautious about implementation costs, data security, and the necessity for specialized personnel to maintain complex AI algorithms. The summary of AI's influence indicates a clear path toward cognitive automation: AI algorithms, particularly those governing computer vision and reinforcement learning, are enhancing the robots' perceptual capabilities, allowing them to accurately identify, locate, and handle irregularly shaped or randomly oriented parts—a capability traditionally requiring complex fixtures or manual intervention. This shift is crucial for realizing the potential of personalized and highly customized manufacturing processes.

Furthermore, AI is instrumental in optimizing the movement pathways and cycle times of transfer robots. By analyzing real-time operational data, machine learning models can identify bottlenecks and autonomously adjust robotic trajectories to minimize energy consumption and wear and tear, extending the lifespan of the equipment. This data-driven decision-making capacity transforms robots from simple programmed manipulators into self-optimizing assets, contributing directly to higher equipment utilization rates (OEE) and further solidifying the necessity of AI for competitive industrial automation.

- AI enhances robotic vision systems (e.g., bin picking) for handling unordered or random part presentation.

- Machine learning optimizes complex path planning and trajectory generation, minimizing cycle time and energy use.

- Predictive maintenance algorithms use AI to forecast component failure, reducing unplanned downtime.

- Reinforcement learning enables robots to adapt quickly to minor changes in part geometry or work environment.

- AI facilitates seamless human-robot collaboration (HRC) by enabling safe, dynamic interaction zones.

- Natural Language Processing (NLP) simplifies the programming and interaction interfaces for non-specialist operators.

DRO & Impact Forces Of Part Transfer Robots Market

The growth dynamics of the Part Transfer Robots Market are primarily fueled by global Industry 4.0 mandates and the critical need for increased precision in high-volume manufacturing sectors, particularly automotive and electronics. However, the high initial capital expenditure associated with sophisticated robotic systems and integration challenges acts as a significant restraint, particularly for Small and Medium Enterprises (SMEs). Opportunities abound in the development of highly specialized collaborative robots (cobots) designed for lighter payloads and flexible manufacturing settings, along with geographical expansion into rapidly industrializing regions. These internal forces are augmented by external impacts such as fluctuating raw material costs, geopolitical trade policies, and advancements in competitive automation technologies like advanced conveyor systems.

The key driving forces include technological advancements in sensors, control systems, and robotic end-effectors, making robots faster, more reliable, and capable of handling increasingly delicate or complex parts. The persistent labor shortage in developed economies, coupled with rising labor costs globally, strengthens the economic justification for automation investments. Furthermore, increasing regulatory requirements for traceability and quality control in industries like pharmaceuticals necessitate automated part handling to minimize contamination and ensure error-free processes throughout the production lifecycle.

Restraints center on the requirement for complex system integration, which often necessitates downtime and specialized expertise. While robots offer flexibility, their fundamental operation relies on structured environments, and rapid changes in production design can still require significant reprogramming, posing a challenge to agility. Opportunities lie specifically in the proliferation of cloud robotics, allowing for remote diagnostics, centralized data management, and standardized programming interfaces across different vendor platforms. The market also stands to benefit significantly from the widespread adoption of modular tooling and standardized robotic interfaces, which will lower the barrier to entry for smaller manufacturers and accelerate ROI across all end-user segments.

Segmentation Analysis

The Part Transfer Robots Market is comprehensively segmented based on Type, Payload Capacity, and End-User Industry, reflecting the diverse application needs across the manufacturing landscape. This segmentation provides a granular view of market dynamics, revealing that different robotic architectures are prioritized based on specific functional requirements, such as reach, speed, degree of freedom, and the complexity of the transfer task. The demand landscape is not uniform; articulated robots dominate complex handling due to flexibility, while SCARA robots are preferred for speed and repeatability in planar tasks, driving distinct investment patterns across regions and industries.

Segmentation by Payload Capacity—categorized typically into low, medium, and high—is critical as it dictates the robot's physical size, cost, and intended application. Low-payload robots (under 10 kg) are rapidly gaining traction in electronics assembly and collaborative applications, whereas high-payload robots (over 100 kg) remain indispensable for automotive body shops and metal forging operations. Analyzing these segments helps manufacturers tailor product development towards specific industrial needs, optimizing power consumption and structural rigidity relative to the task at hand.

The End-User Industry segmentation provides the most valuable insight into demand stability and growth potential. The automotive industry remains the largest consumer due to its high automation rate and requirement for large-scale material handling, but the electronics and pharmaceutical sectors are emerging as the fastest-growing segments, driven by miniaturization challenges and strict regulatory standards, respectively. This structural analysis guides strategic business decisions regarding sales channel focus, marketing efforts, and targeted research and development efforts.

- By Type:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Parallel (Delta) Robots

- Collaborative Robots (Cobots)

- By Payload Capacity:

- Low Payload (Under 10 kg)

- Medium Payload (10 kg - 100 kg)

- High Payload (Above 100 kg)

- By End-User Industry:

- Automotive

- Electronics and Semiconductors

- Metals and Machinery

- Pharmaceuticals and Cosmetics

- Food and Beverage

- Plastics and Rubber

- Others (Logistics, Aerospace)

Value Chain Analysis For Part Transfer Robots Market

The value chain for the Part Transfer Robots Market starts with upstream activities involving the sourcing and production of critical components. This includes the manufacturing of high-precision gearing, servo motors, advanced controllers (PLCs, specialized motion controllers), and sophisticated sensor technologies, such as 3D vision systems and force-torque sensors. Key raw materials like aluminum, specialized alloys, and composite materials are also sourced during this initial phase. The quality and availability of these components significantly influence the final robot's performance, durability, and cost-effectiveness, placing high importance on resilient supplier relationships and technological innovation among component manufacturers.

The midstream stage involves the design, assembly, and testing of the robotic system by Original Equipment Manufacturers (OEMs). This phase includes complex software development (kinematics, programming interfaces, and safety protocols) and rigorous quality assurance. The distribution channel then handles the transition to the customer, encompassing both direct sales (large OEMs selling directly to major automotive or electronics manufacturers) and indirect sales through system integrators and distributors. System integrators play a crucial role as they customize the generic robotic solutions, integrating them with existing factory infrastructure, tooling, and peripheral equipment like conveyors and machine tools, ensuring operational compatibility and tailored functionality.

Downstream activities focus on the end-user implementation, maintenance, and ongoing service. Direct sales often include extensive service contracts and proprietary software updates, while indirect channels rely heavily on system integrators for frontline support and training. The lifecycle management—including spare parts availability, preventive maintenance schedules, and eventual decommissioning or modernization—is crucial for maximizing the Total Cost of Ownership (TCO) for the end-user. The success of the robot is ultimately determined by the effectiveness of the installation and post-sales support, highlighting the sustained importance of robust distribution and service networks.

Part Transfer Robots Market Potential Customers

The primary customers in the Part Transfer Robots Market are manufacturing entities across industries characterized by high production volumes, stringent quality requirements, and repetitive material handling needs. The largest group of customers includes global automotive manufacturers and their Tier 1 suppliers, who utilize these robots extensively in stamping shops, paint shops, and final assembly lines for tasks ranging from handling heavy body panels to transferring smaller components between machining stations. These customers seek high reliability, speed, and the ability to handle heavy payloads in continuous, demanding operational cycles, making reliability and durability key purchasing criteria.

A rapidly expanding segment of potential customers includes electronics and semiconductor manufacturers. These industries require extremely high precision, cleanliness (often operating in cleanrooms), and the ability to handle microscopic or delicate components without damage. They prioritize SCARA and Delta robots for high-speed, light-payload pick-and-place applications, demanding advanced vision systems and anti-static capabilities. Similarly, pharmaceutical and medical device manufacturers are crucial buyers, driven by regulatory compliance (FDA, GMP) that necessitates automated, traceable, and contamination-free handling of vials, blister packs, and intricate device components.

Furthermore, general machinery manufacturers, metal fabrication shops, and increasingly, the fast-moving consumer goods (FMCG) and food and beverage sectors constitute significant customer bases. These sectors use part transfer robots for palletizing, de-palletizing, packaging, and machine tending operations. For these customers, versatility, ease of reprogramming (especially when handling varying SKUs), and energy efficiency are key decision-making factors. The adoption of collaborative robots is particularly appealing to SMEs in these sectors looking for flexible, low-footprint automation solutions that can work alongside human employees.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, KUKA, FANUC, Yaskawa Electric, Kawasaki Heavy Industries, Mitsubishi Electric, Staubli, Omron Corporation, DENSO Wave, Comau, Universal Robots, Nachi-Fujikoshi, Epson Robots, Hyundai Robotics, Siemens, Bosch Rexroth, OTC Daihen, Sepro Group, GSK CNC, Rethink Robotics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Part Transfer Robots Market Key Technology Landscape

The technological landscape of the Part Transfer Robots Market is rapidly evolving, moving beyond simple programmed movements towards intelligent, interconnected, and highly adaptable systems. A foundational technology remains the advancement in servo motor and control systems, which allows for microsecond precision and highly repeatable motion profiles essential for high-speed transfer tasks, particularly in SCARA and Delta robot architectures. Crucially, the adoption of proprietary robotic operating systems and simulation software enables rapid prototyping of workcells, minimizing deployment time and streamlining complex path planning before the physical robot is installed, leading to faster return on investment for manufacturers.

A major technological driver is the proliferation of advanced sensory capabilities, specifically 3D machine vision systems. These systems allow robots to perceive their environment accurately, identifying parts in random orientations (known as bin picking) and adjusting their grip and trajectory dynamically. This capability dramatically reduces the need for expensive, dedicated fixtures and feeders. Furthermore, force-torque sensing is becoming standard, particularly in collaborative robot applications, allowing the robot to feel resistance or collision, ensuring safety and enabling delicate tasks like inserting tight-fitting components where precision force feedback is required, moving parts transfer into complex assembly tasks.

The implementation of Industrial Internet of Things (IIoT) and cloud connectivity is redefining robot fleet management. These technologies facilitate real-time performance monitoring, remote diagnostics, and the centralized delivery of software updates and new motion profiles across global facilities. Edge computing capabilities are being integrated into controllers to process sensory data locally, ensuring ultra-low latency critical for high-speed part transfer decisions. This technological confluence of enhanced sensing, intelligent software, and robust connectivity is paving the way for truly adaptive manufacturing systems, where part transfer robots function as modular, interchangeable assets rather than fixed-function machinery.

Regional Highlights

The global Part Transfer Robots Market exhibits distinct regional dynamics driven by varying levels of industrial maturity, labor costs, and governmental support for automation. The Asia Pacific (APAC) region stands out as the global market leader, primarily due to the massive scale of manufacturing in economies like China, which is heavily investing in automation to sustain its global manufacturing dominance amid rising domestic labor costs. Japan and South Korea are key technology innovators and early adopters, focusing particularly on high-precision robots for the electronics and semiconductor industries. The shift towards manufacturing electric vehicle components further solidifies APAC's demand for high-speed, reliable transfer robots.

North America, characterized by high operational costs and a severe shortage of skilled labor, shows strong demand for high-end, technologically advanced robotic systems, focusing heavily on integrating AI and advanced vision systems to optimize production flexibility. The region emphasizes aerospace, automotive, and complex machinery manufacturing, prioritizing reliability, safety compliance, and robust integration with existing enterprise systems (MES/ERP). Investments here are focused less on initial deployment scale and more on sophisticated process optimization and maximizing productivity per robot deployed.

Europe represents a mature but growing market, led by Germany, Italy, and France. The region is strongly influenced by the Industry 4.0 framework and sustainability goals. European manufacturers increasingly demand energy-efficient robots and collaborative systems that can integrate seamlessly into brownfield facilities. The automotive sector remains a core consumer, but there is accelerated adoption in pharmaceuticals, driven by strict regulatory standards and the need for precision handling in automated cleanroom environments.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as high-growth potential regions. LATAM's growth is tied to foreign direct investment in automotive assembly and food processing plants, particularly in Mexico and Brazil, which are ramping up automation to improve export competitiveness. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing in diversification away from oil, focusing on establishing modern, automated manufacturing hubs, creating a nascent but fast-growing market for industrial robotic systems, including part transfer solutions.

- Asia Pacific (APAC): Dominates the market share; driven by high volume manufacturing, especially in electronics, automotive (EVs), and textiles; significant governmental support for automation in China, South Korea, and Japan.

- North America: Focuses on high-technology adoption (AI, vision systems) to address skilled labor shortages and maintain high-quality standards in aerospace and specialized automotive manufacturing.

- Europe: Characterized by strong demand for sophisticated, energy-efficient, and collaborative robots; growth spurred by Industry 4.0 integration and high regulatory standards in pharmaceuticals and food & beverage.

- Latin America (LATAM): Emerging market growth linked to increased foreign manufacturing investment and modernization of regional automotive and consumer goods production facilities.

- Middle East and Africa (MEA): Nascent growth driven by economic diversification efforts, infrastructure projects, and the establishment of new, automated manufacturing zones in the GCC region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Part Transfer Robots Market.- ABB

- KUKA

- FANUC

- Yaskawa Electric

- Kawasaki Heavy Industries

- Mitsubishi Electric

- Staubli

- Omron Corporation

- DENSO Wave

- Comau

- Universal Robots

- Nachi-Fujikoshi

- Epson Robots

- Hyundai Robotics

- Siemens

- Bosch Rexroth

- OTC Daihen

- Sepro Group

- GSK CNC

- Rethink Robotics

Frequently Asked Questions

Analyze common user questions about the Part Transfer Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of robots are most commonly used for part transfer applications?

The most common types are Articulated robots (for versatility and complex handling), SCARA robots (for high-speed, planar pick-and-place), and Delta robots (for ultra-fast, light-payload tasks, particularly in packaging and electronics assembly). Collaborative robots (Cobots) are rapidly gaining traction for flexible, human-centric transfer operations.

How does Industry 4.0 influence the Part Transfer Robots Market?

Industry 4.0 drives demand by requiring seamless connectivity, real-time data exchange (IIoT), and intelligent automation. This framework encourages the adoption of robots equipped with advanced sensors and AI to achieve self-optimization, predictive maintenance, and highly flexible manufacturing configurations for customized production runs.

Which industry segment is the largest consumer of part transfer robots?

The Automotive Industry remains the largest consumer, utilizing high-payload articulated robots for heavy material handling, machine tending, and transferring large body components in high-volume production lines globally. However, the electronics segment is showing the fastest growth rate.

What are the primary restraints to market growth?

The primary restraints include the high initial capital investment required for purchasing the robots and integrating them into existing facilities, which is challenging for Small and Medium Enterprises (SMEs). Additionally, the shortage of technically skilled personnel required for programming, maintenance, and complex system troubleshooting poses a persistent hurdle.

What role do vision systems play in modern part transfer robots?

Advanced vision systems (2D/3D) are crucial for enhancing flexibility and precision. They allow robots to accurately locate, identify, and pick parts that are randomly presented (bin picking), significantly reducing the need for costly mechanical feeders and enabling robots to handle greater product variety without extensive reprogramming.

This extensive report details the complexities of the Part Transfer Robots Market, covering crucial aspects such as market size estimation, key growth drivers like industrial automation and rising labor costs, and significant technological trends including the integration of AI, machine vision, and IIoT connectivity. It segments the market rigorously by robot type (Articulated, SCARA, Delta), payload capacity, and key end-user industries (Automotive, Electronics, Pharmaceuticals). Regional analysis confirms Asia Pacific's dominance due to high manufacturing volumes and the strong adoption of automation in China and South Korea, while North America and Europe prioritize sophisticated, flexible, and safety-compliant cobots. The comprehensive value chain analysis outlines the critical roles of component suppliers, system integrators, and after-sales service providers in determining the total cost of ownership and maximizing operational efficiency for customers. The presence of major global players like ABB, FANUC, and KUKA ensures a competitive landscape focused on innovation, particularly in areas like collaborative robotics and advanced control systems, which are vital for addressing the evolving demands of modern, highly adaptable manufacturing environments under the umbrella of Industry 4.0 principles.

The focus on high-speed material handling, error reduction, and enhanced product quality drives continuous investment. Restraints, such as high entry costs and the necessity for specialized technical skills, remain persistent challenges that need to be addressed through simplified programming interfaces and modular system designs. The future trajectory of the market is strongly linked to advancements in AI-driven path optimization and sensor fusion, which will enable robots to handle unstructured environments and highly variable tasks, further expanding their applicability beyond traditional repetitive pick-and-place operations. The report emphasizes the increasing importance of medium and low payload capacity robots, reflecting the ongoing global trend toward electronics miniaturization and the expansion of e-commerce logistics automation, which increasingly relies on rapid part transfer technologies within fulfillment centers and micro-factories.

The detailed segmentation by type reveals that while Articulated robots offer maximum reach and flexibility, SCARA robots maintain their leadership position in tasks requiring high speed and precision across a limited planar area, crucial for circuit board assembly and small component insertion. Parallel or Delta robots are irreplaceable in the food and beverage industry for rapid sorting and packaging operations. The analysis of impact forces confirms that global competition and the need for operational resilience post-pandemic are accelerating automation investment cycles, providing significant opportunities for market penetration in previously underserved geographic areas like Southeast Asia and parts of Latin America. The transition to electric vehicle manufacturing globally requires substantial retooling of existing production lines, providing a massive, sustained growth catalyst for high-payload part transfer solutions. The ethical and regulatory landscape surrounding collaborative robot safety continues to be refined, ensuring that human-robot interaction in part transfer tasks is safe, efficient, and standardized globally.

Understanding the key technology landscape is essential, highlighting the transition from traditional teach pendants to intuitive, gesture-based, and even voice-activated programming methods, lowering the skill threshold for operational staff. Cloud robotics platforms are emerging as a core competitive differentiator, providing predictive diagnostics and over-the-air performance updates, enhancing the overall lifecycle value of the deployed robotic systems. The competitive analysis shows intense rivalry among global giants and specialized niche players, driving rapid innovation in gripper technology, focusing on gentle yet secure handling of diverse materials, including composite plastics and delicate glass. This comprehensive market overview serves as a foundational resource for stakeholders seeking strategic insights into the automation and robotics sector, specifically focusing on critical material flow management in modern factories globally.

The continuous advancement in motor efficiency and lightweight materials is lowering the power consumption of part transfer robots, aligning with global corporate sustainability goals. The pharmaceutical segment's increasing demand is linked to the rise of personalized medicine and the need for flexible, small-batch manufacturing, where transfer robots handle highly potent active pharmaceutical ingredients (HPAPIs) safely and precisely. The detailed revenue forecast confirms the sustained double-digit growth trajectory, underscoring the irreversible global commitment to automated manufacturing processes to achieve scalability, consistency, and competitive superiority. The report structure adheres strictly to AEO and GEO principles, ensuring high visibility for search engines and answer generation models by providing structured, factual content. The regional growth rate differential is most pronounced in developing regions adopting greenfield automation projects rapidly. The market size projections reflect calculated adjustments based on forecasted industrial capital expenditure and technology adoption rates globally.

The crucial dependency on semiconductor supply chains for advanced controllers and sensors poses a periodic vulnerability, which market leaders mitigate through diversification and vertical integration strategies. The opportunity for retrofitting older manufacturing facilities with modern, vision-enabled cobots is a major factor contributing to the market's long-term resilience. The Part Transfer Robots Market is structurally stable and poised for continued high growth due to fundamental economic pressures favoring automation over manual labor.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager