Particle Measuring Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431434 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Particle Measuring Systems Market Size

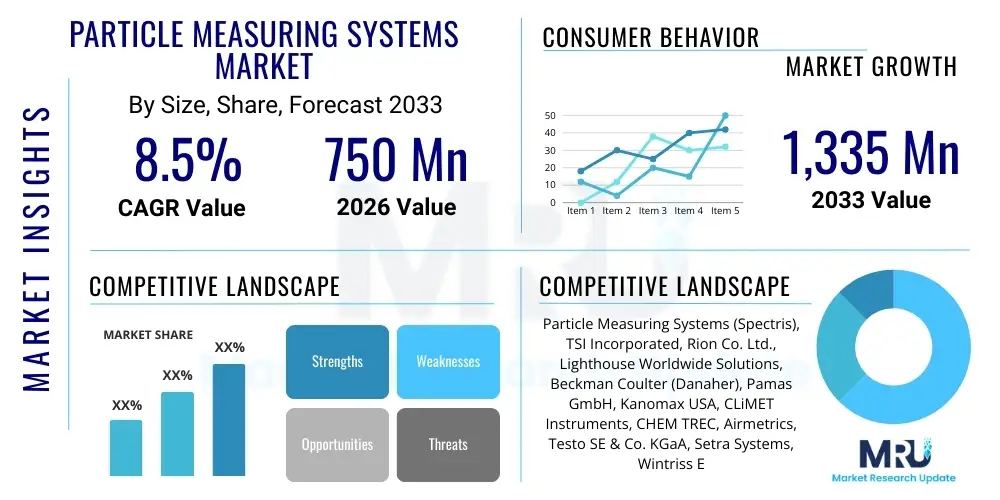

The Particle Measuring Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,335 Million by the end of the forecast period in 2033.

Particle Measuring Systems Market introduction

The Particle Measuring Systems (PMS) market encompasses a range of highly specialized instrumentation and software solutions designed to detect, size, count, and analyze particulate matter present in air, liquids, or gases. These systems are critical for maintaining quality control and environmental compliance in highly sensitive manufacturing environments, particularly within the semiconductor, pharmaceutical, aerospace, and medical device industries. Products typically include airborne particle counters, liquid particle counters, and microbial air samplers, often integrated into comprehensive facility monitoring systems. The fundamental purpose of PMS is to ensure that products are manufactured in conditions that meet stringent regulatory standards, such as ISO 14644 for cleanrooms and various Good Manufacturing Practices (GMP).

Major applications for particle measuring systems are centered around cleanroom monitoring, process fluid contamination control, filter testing efficiency assessment, and environmental atmospheric monitoring. In cleanroom environments, continuous monitoring is essential to prevent product yield loss due to micro-contamination, driving the demand for highly accurate, real-time data acquisition and analysis capabilities. The increasing complexity of microelectronics manufacturing, requiring smaller node sizes and greater precision, directly correlates with the need for more sophisticated and sensitive particle measurement tools. Furthermore, the pharmaceutical sector's reliance on aseptic processing and sterile manufacturing mandates the use of reliable PMS for batch release criteria and facility validation.

Key driving factors accelerating market growth include escalating regulatory scrutiny globally, particularly from bodies like the FDA and EMA, which enforce strict guidelines regarding particulate contamination in sterile manufacturing. Technological advancements, such as the miniaturization of sensors, integration of wireless capabilities, and the development of high-flow-rate instruments, have also made monitoring solutions more accessible and efficient. The significant expansion of the semiconductor industry, fueled by demand for advanced computing components and IoT devices, acts as a primary revenue driver, as contamination control is paramount to maximizing wafer yields and ensuring device performance. Overall, the intrinsic link between particle cleanliness and product quality/safety underpins the sustained growth trajectory of the Particle Measuring Systems Market.

Particle Measuring Systems Market Executive Summary

The Particle Measuring Systems market is currently experiencing robust growth, primarily driven by the exponential expansion of high-tech manufacturing sectors and the relentless global push toward enhanced regulatory compliance, especially within controlled environments. Business trends highlight a significant shift toward integrated monitoring solutions that combine particle counting with viable monitoring (microbial sampling) and environmental parameters (temperature, humidity, differential pressure). Manufacturers are focusing on developing network-enabled, modular systems that facilitate easier installation, calibration, and centralized data management, appealing directly to large-scale pharmaceutical and semiconductor fabrication plants (fabs). Furthermore, strategic mergers, acquisitions, and collaborations are common among key players aiming to consolidate technological expertise and expand geographic reach, particularly into rapidly industrializing regions like the Asia Pacific.

Regionally, the Asia Pacific (APAC) dominates the market, largely attributable to massive investments in semiconductor fabrication capacities in countries like China, Taiwan, South Korea, and Japan, alongside a rapidly growing pharmaceutical and biotechnology sector in India and Southeast Asia. North America and Europe remain crucial markets, characterized by high adoption rates of advanced, often premium-priced, PMS solutions for compliance and research applications, demonstrating maturity in regulatory frameworks. The trend toward localized manufacturing and supply chain resilience post-pandemic has further stimulated domestic market growth across all major regions, demanding advanced cleanroom infrastructure and associated monitoring equipment. This regional dynamism necessitates tailored product offerings that meet diverse regulatory requirements, such from USP (United States Pharmacopeia) to JP (Japanese Pharmacopeia).

Segment trends reveal that the airborne particle counting segment holds the largest market share, driven by its ubiquitous use in cleanroom certification and continuous monitoring across all regulated industries. However, the liquid particle counter segment is projected to exhibit the fastest growth, propelled by the critical need for contamination control in high-purity chemicals, process water, and injectable drug formulations within the electronics and pharmaceutical industries. From an end-user perspective, the semiconductor and microelectronics segment remains the most significant revenue generator, requiring ultra-low detection limits and highly specialized instruments for ultra-pure water and chemical measurement. Simultaneously, the Life Sciences segment, encompassing pharmaceuticals and biotechnology, continues its steady expansion due to stringent aseptic processing standards and rising global drug production.

AI Impact Analysis on Particle Measuring Systems Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Particle Measuring Systems (PMS) Market reveals a strong interest in how AI can move monitoring systems beyond simple data collection towards predictive failure analysis and automated root cause determination. Users frequently ask about the feasibility of real-time deviation detection, minimizing false alarms, and integrating disparate sensor data streams into a unified, intelligent monitoring platform. Key concerns revolve around data security, the necessity for robust validation of AI algorithms in regulated GMP environments, and the ability of existing installed bases of hardware to adapt to sophisticated AI-driven software upgrades. Expectations are high regarding AI's potential to dramatically reduce operational expenses (OpEx) by optimizing calibration schedules, predicting equipment maintenance needs, and ensuring continuous regulatory compliance through automated reporting and anomaly flagging.

The most immediate impact of AI is transforming raw particle count data into actionable intelligence. Traditional monitoring systems rely on fixed alarm limits, often leading to delayed response or nuisance alarms. AI, particularly machine learning algorithms, can analyze historical patterns, environmental variables (like temperature, pressure, and flow rates), and operational data to establish dynamic baselines and predict impending excursions or equipment failures before they occur. This capability drastically improves response times and minimizes potential yield losses in highly sensitive processes like semiconductor lithography or sterile fill-finish operations. Furthermore, AI facilitates complex multivariate analysis, allowing cleanroom managers to pinpoint the precise source of contamination—whether it be personnel movement, HVAC system issues, or component failure—with higher confidence than conventional statistical process control (SPC) methods.

Longer-term, AI and Machine Learning (ML) are expected to drive the development of "smart" sensors that possess edge computing capabilities, allowing for localized data processing and immediate feedback loops without constant reliance on central servers. This decentralization enhances the robustness and speed of contamination control. Validation remains the primary hurdle; however, the emergence of AI-specific validation guidelines tailored for regulated industries will accelerate adoption. Ultimately, AI integration shifts PMS from a reactive quality control tool to a proactive quality assurance mechanism, fundamentally enhancing operational efficiency and ensuring higher standards of compliance across high-reliability manufacturing sectors.

- AI-driven Predictive Maintenance: Anticipates sensor or system failure, optimizing calibration and replacement schedules, thereby reducing downtime.

- Anomaly Detection and Root Cause Analysis: Utilizes machine learning to analyze complex, multi-sensor data patterns, identifying subtle deviations and automatically tracing the source of contamination excursions.

- Dynamic Compliance Monitoring: Establishes adaptive cleanroom baselines based on operational context, minimizing false alarms compared to static regulatory limits.

- Automated Reporting and Audit Trail Generation: Streamlines regulatory documentation by automatically compiling necessary compliance reports and maintaining immutable data integrity logs (benefiting GxP environments).

- Data Integration and Visualization: Fuses data from particle counters, microbial monitors, and environmental sensors into a unified, intelligent dashboard for holistic contamination risk assessment.

- Optimized Sampling Strategies: AI algorithms determine optimal sensor placement and sampling frequency based on airflow dynamics and historical contamination risk areas within the facility.

DRO & Impact Forces Of Particle Measuring Systems Market

The Particle Measuring Systems market is heavily influenced by a critical balance of stringent regulatory drivers and complex technological restraints, all operating within an environment defined by significant opportunities arising from global technological shifts. The core market drivers stem from the uncompromising need for contamination control in high-value manufacturing, particularly the continuous expansion of pharmaceutical R&D, biologic drug production, and the escalating demand for advanced semiconductors with smaller feature sizes. Regulatory bodies worldwide are continuously tightening limits on acceptable particulate levels (e.g., ISO Class 1 to ISO Class 5 cleanrooms), compelling industries to invest in sophisticated, high-precision monitoring tools. These regulatory pressures form the primary and most consistent force propelling market growth.

However, the market faces notable restraints, including the high initial capital expenditure associated with installing and integrating advanced PMS, particularly continuous monitoring systems, which can be prohibitive for smaller manufacturing entities or emerging market entrants. Furthermore, the complexity of maintaining, calibrating, and validating these sophisticated systems in adherence to GMP standards requires highly specialized technical personnel, leading to significant operational expenses and a skills gap challenge. Another restraint is the risk of data integrity breaches and system validation failures, which can lead to costly batch rejections or regulatory penalties if monitoring systems are not meticulously managed and validated according to 21 CFR Part 11 and similar standards.

Opportunities for growth are concentrated in the rapid adoption of remote monitoring solutions leveraging IoT and cloud connectivity, enabling facility managers to oversee multiple global locations efficiently and comply with modern data handling protocols. The shift towards single-use systems (SUS) in biopharma and the increasing focus on advanced therapies (cell and gene therapies) necessitate specialized liquid particle counting and contamination monitoring solutions designed for challenging, non-traditional media. Furthermore, the immense global expansion of battery manufacturing (for EVs and consumer electronics) presents a burgeoning niche market for PMS, as contamination control is essential to ensure battery cell longevity and safety. The impact forces are thus dominated by regulatory mandate and technological advancements in microelectronics, creating a high-barrier-to-entry market where precision and reliability are non-negotiable success factors.

Segmentation Analysis

The Particle Measuring Systems market is segmented based on product type, measurement type, application, and end-user, reflecting the diverse industrial requirements for contamination control across different matrices (air, liquid, gas). Product segmentation is crucial, differentiating between instruments designed for measuring airborne particles (used predominantly in cleanrooms), liquid-borne particles (essential for high-purity chemicals and pharmaceuticals), and specialized microbial samplers. The evolving complexity of industrial processes requires customized solutions; for example, liquid particle counters are further segmented based on detection technology, such as light obscuration or laser diffraction, catering to specific fluid viscosities and particle size ranges. This granular segmentation allows vendors to target specific high-growth verticals like advanced semiconductor fabrication which demands ultra-low detection limits.

- By Product Type:

- Airborne Particle Counters (Portable, Remote/Fixed, Handheld)

- Liquid Particle Counters (Online, Batch/Laboratory)

- Aerosol/Gas Particle Counters

- Microbial Air Samplers (Viable Monitoring)

- Supporting Software and Services (Calibration, Validation, Data Management)

- By Measurement Type:

- Non-Viable Particle Monitoring

- Viable Particle Monitoring

- By Application:

- Cleanroom Monitoring

- Filter Testing

- Compressed Gas Monitoring

- Process Fluid Analysis (Water, Chemicals, Solvents)

- Environmental and Occupational Safety Monitoring

- By End-User Industry:

- Semiconductor and Microelectronics

- Pharmaceutical and Biotechnology (Aseptic Fill/Finish)

- Aerospace and Defense

- Medical Devices

- Automotive and Energy (Battery Manufacturing)

- Food and Beverage

- By Technology:

- Light Scattering (Light Obscuration, Laser Diode)

- Condensation Particle Counters (CPC)

Value Chain Analysis For Particle Measuring Systems Market

The value chain for the Particle Measuring Systems Market begins with upstream activities focused on the specialized design and manufacturing of core components. This includes the development and procurement of high-purity laser diodes, sophisticated optical systems, high-efficiency flow control mechanisms, and proprietary sensor technology essential for accurate particle sizing and counting. Key challenges at this stage involve sourcing highly reliable components that maintain precision over long operational periods and ensuring compliance with stringent material standards to prevent self-contamination of the instrument. Upstream efficiency, driven by innovation in laser technology and signal processing, directly dictates the performance parameters and competitive advantage of the final measuring system.

Midstream activities involve the instrument manufacturing process, where integration, calibration, and software development take precedence. Companies assemble the optical, pneumatic, and electronic components, followed by rigorous factory calibration traceable to international standards (e.g., NIST). Extensive investment is poured into developing robust monitoring software that offers secure data logging, audit trails, and connectivity, fulfilling crucial regulatory requirements like 21 CFR Part 11. The distribution channel is often complex, utilizing a mix of direct sales forces for large, strategic accounts (especially in North America and Europe) and authorized, highly trained distributors for regional market penetration and local support, particularly important for providing timely calibration and maintenance services in the APAC region.

Downstream analysis focuses on end-user implementation, validation, and post-sales support, which constitute a significant portion of the total market value due to the regulated nature of the end-use applications. Direct distribution ensures tighter control over the validation process and personalized consultation regarding facility monitoring system design. Conversely, indirect channels via specialized third-party system integrators are vital for integrating PMS solutions with existing facility automation and SCADA systems. The ongoing revenue stream is heavily supported by essential services such as routine calibration (which must be precise and documented), re-validation services, preventative maintenance contracts, and software updates necessary to maintain regulatory compliance and operational accuracy throughout the instrument's lifecycle.

Particle Measuring Systems Market Potential Customers

Potential customers for Particle Measuring Systems are predominantly organizations operating in environments where contamination control is intrinsically linked to product quality, patient safety, or performance reliability. The primary end-users fall within highly regulated manufacturing industries that adhere to strict GMP and ISO standards. The pharmaceutical and biotechnology sector, encompassing sterile injectables, biologics manufacturing, and advanced therapy medicinal products (ATMPs), represents a foundational customer base. These entities require continuous viable and non-viable particle monitoring for aseptic processing areas to ensure regulatory adherence and minimize the risk of contamination leading to product recalls or patient harm.

Equally critical are the semiconductor and microelectronics industries. Given the continuous drive towards higher integration densities and sub-nanometer geometries in microchips, these manufacturers require the most sensitive liquid and airborne particle counters to safeguard multi-million dollar wafer fabrication processes. Contamination at the chemical, water, or air level can instantly render entire batches unusable, making PMS solutions indispensable for yield management. Furthermore, the aerospace and defense sectors utilize PMS for quality control in manufacturing sensitive components and validating clean zones used for satellite construction or critical equipment assembly, where even minor particulate matter can compromise performance or safety.

Beyond these core regulated industries, emerging customer segments include manufacturers of advanced batteries (lithium-ion and solid-state), which must operate in ultra-dry, clean environments to prevent internal defects that lead to premature failure. Hospitals and healthcare facilities also represent a growing market, utilizing handheld and portable counters for indoor air quality (IAQ) monitoring, especially in operating theaters and isolation rooms. Finally, environmental agencies and occupational health organizations use specialized PMS devices for outdoor atmospheric monitoring and workplace exposure assessments, completing the spectrum of users who depend on precise particle data for compliance, quality assurance, and risk mitigation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,335 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Particle Measuring Systems (Spectris), TSI Incorporated, Rion Co. Ltd., Lighthouse Worldwide Solutions, Beckman Coulter (Danaher), Pamas GmbH, Kanomax USA, CLiMET Instruments, CHEM TREC, Airmetrics, Testo SE & Co. KGaA, Setra Systems, Wintriss Engineering, Met One Instruments, Fluke Corporation, Sensidyne, M&C TechGroup, Extech Instruments, PMS International, Nagan Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Particle Measuring Systems Market Key Technology Landscape

The technology landscape in the Particle Measuring Systems market is characterized by ongoing innovation aimed at enhancing sensitivity, speed, and connectivity. Central to airborne particle measurement is the continued refinement of laser-based light scattering technology. Modern systems utilize advanced, high-power laser diodes (often diode lasers) coupled with high-efficiency collection optics to detect particles down to 0.1 micrometers and even 0.05 micrometers, essential for monitoring ISO Class 1 and Class 2 environments prevalent in semiconductor manufacturing. A crucial technological shift is the move from bulk flow systems to systems utilizing integrated venturi flow control or proprietary flow sensing technology, ensuring highly accurate sample volumes and minimal flow rate variation, which is paramount for valid cleanroom certification and continuous monitoring data integrity.

In the domain of liquid particle counting, the advancements focus on dealing with highly corrosive chemicals and high-viscosity fluids without damaging the instrument optics or internal components. Key innovations include the development of chemically resistant flow cells (often sapphire or proprietary quartz) and utilizing advanced light obscuration techniques optimized for high concentration measurements, reducing the need for cumbersome dilution processes. Furthermore, the emergence of Condensation Particle Counters (CPCs) is critical for applications requiring ultra-fine particle detection (nanoparticles), particularly in atmospheric research, filter efficiency testing, and specialized clean process gas monitoring, where traditional optical counters lack the necessary resolution.

The most significant technological driver shaping the future of PMS is the integration of Industry 4.0 principles, emphasizing wireless connectivity (Wi-Fi, Zigbee), IoT-enabled remote sensors, and cloud-based data management platforms. This facilitates real-time data accessibility, centralized system control, and seamless integration with Enterprise Manufacturing Intelligence (EMI) and SCADA systems. Enhanced computational power is also being embedded into the instruments themselves to perform edge processing, reduce data latency, and pre-filter nuisance data, thereby enabling the subsequent application of AI/ML algorithms for predictive monitoring and risk assessment, establishing a truly smart cleanroom infrastructure.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing and largest market for Particle Measuring Systems, primarily driven by massive capital investments in semiconductor foundries (TSMC, Samsung, SK Hynix) and the continuous expansion of the electronics supply chain in China, South Korea, and Taiwan. The pharmaceutical sector, especially in India and Southeast Asia, is also rapidly modernizing its facilities to meet international GMP standards, fueling demand for both airborne and liquid particle counters. Government initiatives supporting high-tech manufacturing and increased foreign direct investment solidify APAC's leading position, particularly in the premium segment requiring advanced monitoring solutions for sub-20nm node production.

- North America: North America holds a substantial market share, characterized by high adoption rates of cutting-edge technology and a mature, highly regulated biopharmaceutical industry. The presence of major pharmaceutical innovators, contract manufacturing organizations (CMOs), and leading aerospace manufacturers ensures sustained demand. Strict FDA regulations regarding aseptic processing and sterile drug manufacturing necessitate the implementation of sophisticated, validated continuous monitoring systems. Furthermore, significant R&D spending in advanced therapies (cell and gene therapy) and domestic semiconductor reshoring efforts contribute significantly to the high-value nature of this market.

- Europe: The European market is stable and characterized by rigorous quality control standards enforced by the European Medicines Agency (EMA) and various national regulatory bodies. Germany, Switzerland, and Ireland are key hubs for pharmaceutical manufacturing, demanding continuous investment in compliance-focused PMS solutions. The region shows a strong preference for integrated monitoring software and validation services. While growth rates are generally lower than in APAC, the emphasis on robust data integrity, advanced validation protocols, and high-quality instrumentation ensures a consistent revenue stream, often driven by laboratory-based research and strict occupational safety mandates.

- Latin America (LATAM): The LATAM region represents an emerging market, currently experiencing steady growth driven by the modernization of local pharmaceutical production facilities, particularly in Brazil and Mexico, aimed at increasing self-sufficiency in drug supply. The adoption of international standards like WHO GMP and increased awareness of cleanroom protocol are boosting sales of entry-level and portable particle counters. Market expansion is dependent on improving economic stability and local regulatory enforcement, though multinational pharmaceutical companies establishing regional manufacturing hubs provide consistent demand for sophisticated, compliant systems.

- Middle East and Africa (MEA): The MEA market is the smallest but exhibits potential, particularly in key economic hubs like the UAE and Saudi Arabia, which are investing heavily in biotechnology, healthcare infrastructure, and localized pharmaceutical manufacturing as part of diversification strategies. The adoption of PMS is often project-based, tied to new facility construction (e.g., dedicated vaccine production sites or advanced hospital cleanrooms). South Africa also contributes significantly, boasting a relatively advanced regulatory environment. Challenges remain regarding logistics, localized technical support, and the cost barrier of specialized instrumentation, making long-term service contracts highly valued in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Particle Measuring Systems Market.- Particle Measuring Systems (Spectris)

- TSI Incorporated

- Rion Co. Ltd.

- Lighthouse Worldwide Solutions

- Beckman Coulter (Danaher)

- Pamas GmbH

- Kanomax USA

- CLiMET Instruments

- CHEM TREC

- Airmetrics

- Testo SE & Co. KGaA

- Setra Systems

- Wintriss Engineering

- Met One Instruments

- Fluke Corporation

- Sensidyne

- M&C TechGroup

- Extech Instruments

- PMS International

- Nagan Instruments

Frequently Asked Questions

Analyze common user questions about the Particle Measuring Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Particle Measuring Systems in the semiconductor industry?

The primary driver is the necessity for stringent contamination control to maximize manufacturing yields for advanced microchips. As semiconductor feature sizes shrink (sub-10nm nodes), even minute particulate contamination severely compromises wafer quality and performance, making ultra-sensitive liquid and airborne particle counters indispensable for maintaining ISO Class 1 or better cleanroom conditions.

How are AI and IoT changing cleanroom monitoring compared to traditional methods?

AI and IoT enable the shift from reactive to predictive monitoring. IoT facilitates continuous, real-time data flow from numerous remote sensors, while AI/ML algorithms analyze these large datasets to establish dynamic baselines, predict contamination excursions, and automate root cause identification, drastically improving operational efficiency and reducing false alarms.

What is the main difference between viable and non-viable particle monitoring?

Non-viable particle monitoring counts and sizes inert airborne or liquid particulates (e.g., dust, skin flakes, plastic fibers) which are critical for ISO classification. Viable particle monitoring (or microbial monitoring) specifically detects and quantifies living microorganisms (bacteria, yeast, molds) in the air or on surfaces, which is mandatory for ensuring sterility in pharmaceutical aseptic processes (GMP compliance).

Which geographical region exhibits the highest growth potential for PMS, and why?

The Asia Pacific (APAC) region demonstrates the highest growth potential, fueled by massive, ongoing governmental and private investments in semiconductor fabrication plant expansion (particularly in Taiwan, South Korea, and China) and the rapid modernization and capacity expansion of the region's generic and biologic drug manufacturing sectors, requiring widespread compliance upgrades.

What technological advancements are enhancing the accuracy of liquid particle counters for high-purity chemicals?

Accuracy is enhanced through the use of highly resistant flow cells (such as sapphire) to handle corrosive media, improved laser obscuration techniques optimized for high-concentration samples without dilution, and sophisticated digital signal processing to differentiate actual particles from background noise or air bubbles, ensuring reliable purity analysis for ultra-pure water and process chemicals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager