Parts Washer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436840 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Parts Washer Market Size

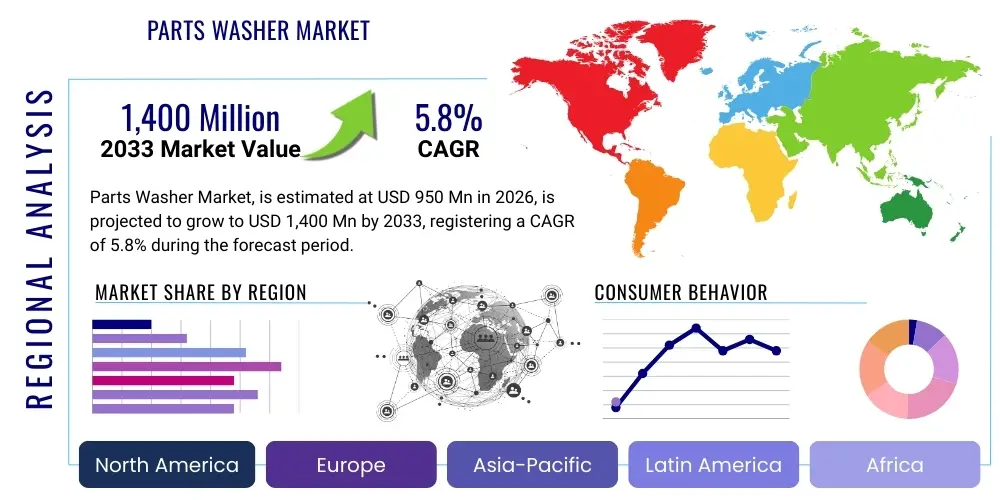

The Parts Washer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,400 million by the end of the forecast period in 2033.

Parts Washer Market introduction

The Parts Washer Market encompasses equipment designed for the cleaning and degreasing of mechanical components, tools, and industrial parts. These systems are crucial in maintenance, repair, and overhaul (MRO) operations across numerous heavy and light industries, ensuring components meet stringent cleanliness standards before assembly, inspection, or reuse. Parts washers utilize various methods, including aqueous solutions, solvents, and bioremediation technology, offering essential functions such as removing oils, greases, chips, coolants, and other contaminants that can impede performance or cause equipment failure. The primary function is to enhance operational efficiency and extend the lifespan of machinery.

Major applications of parts washers are widespread, prominently featuring in the automotive sector (engine overhaul, transmission repair), aerospace (cleaning precision components), heavy equipment manufacturing, and general manufacturing facilities. The rise in complexity of modern machinery necessitates higher levels of particulate cleanliness, pushing the demand for sophisticated, multi-stage washing systems. Furthermore, the push towards eco-friendly manufacturing practices is accelerating the adoption of aqueous and bio-based cleaning agents, shifting market dynamics away from traditional volatile organic compound (VOC) emitting solvents. This transition is a significant factor driving innovation and market growth.

Key driving factors include the stringent regulatory standards governing industrial cleanliness, particularly in sectors like medical devices and aerospace, where zero-tolerance for contamination is enforced. Economic growth, especially in emerging economies, spurs industrial production and MRO activities, directly increasing the demand for efficient parts cleaning solutions. The benefits provided by these systems—such as improved worker safety (due to reduced exposure to hazardous chemicals), increased component quality, and automation potential—further solidify their indispensable role in the modern industrial landscape. Continuous advancements in automation and solvent recovery technologies are also contributing to market expansion by enhancing the cost-effectiveness and environmental profile of parts washing processes.

Parts Washer Market Executive Summary

The global Parts Washer Market is experiencing robust expansion driven primarily by the cyclical nature of maintenance and repair operations across critical industrial sectors, coupled with strict environmental compliance mandates. Business trends indicate a strong move towards automated, closed-loop systems that maximize fluid efficiency and minimize waste generation. Manufacturers are prioritizing solutions offering faster cycle times, lower energy consumption, and superior cleaning efficacy for complex geometries. Strategic collaborations focused on integrating IoT capabilities for predictive maintenance and real-time monitoring of cleaning fluid status are emerging as key differentiators, positioning advanced parts washing technology as essential capital equipment rather than just a utility.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, burgeoning automotive production, and expanding aerospace MRO facilities, especially in countries like China and India. North America and Europe, characterized by mature manufacturing ecosystems, exhibit high adoption rates for advanced, environmentally compliant aqueous systems, focusing on efficiency and specialized applications such as electric vehicle (EV) component cleaning. In these developed regions, market maturity necessitates product differentiation through high customization, specialized chemical compatibility, and superior compliance with demanding European Union (EU) and Environmental Protection Agency (EPA) standards regarding solvent use and disposal.

Segment trends reveal that the aqueous parts washer segment dominates the market due to regulatory pressures favoring sustainability and improved worker health and safety. Within technology types, automated cabinet washers and conveyor systems are showing accelerated growth, driven by the need for high-volume processing in manufacturing lines. Demand for specialized cleaning agents, including biodegradable surfactants and corrosion inhibitors designed for sensitive materials like aluminum and composites, is also escalating. Furthermore, the increasing complexity of components manufactured using additive manufacturing (3D printing) is creating a niche demand for post-processing parts washing tailored to remove unbound powder and support materials effectively.

AI Impact Analysis on Parts Washer Market

Common user questions regarding AI's influence on the Parts Washer Market typically revolve around optimizing operational parameters, predicting maintenance needs for the cleaning equipment itself, and ensuring consistent output quality without manual inspection. Users frequently inquire about how AI can adjust cleaning cycles in real-time based on contaminant load variability, and whether machine learning algorithms can minimize chemical consumption and energy use. The consensus among these queries highlights a clear expectation that AI integration should translate directly into reduced operational expenditure (OPEX), higher throughput, and proactive failure prevention within high-stakes industrial environments. These concerns underscore that AI is viewed not merely as an add-on, but as a crucial tool for achieving industrial precision, regulatory adherence, and sustainability goals in cleaning processes.

- AI-driven optimization of cleaning cycles based on sensor data (e.g., fluid turbidity, temperature, pH levels) to minimize resource usage (water, energy, detergent).

- Predictive maintenance schedules for parts washer components (pumps, filters, heating elements) leveraging machine learning to prevent costly unscheduled downtime.

- Automated quality control systems using computer vision and AI to inspect cleaned parts for residual contamination, ensuring adherence to strict cleanliness specifications.

- Real-time chemical inventory management and automatic dosing adjustments, enhancing process stability and reducing human error in solution preparation.

- Integration of washing data into overall manufacturing execution systems (MES) for holistic process optimization and traceability compliance.

- Enhanced troubleshooting and remote diagnostics facilitated by AI pattern recognition based on operational anomalies.

DRO & Impact Forces Of Parts Washer Market

The market is primarily driven by escalating global manufacturing activity, particularly in high-growth industrial sectors like automotive and aerospace, which necessitate continuous MRO operations and component cleanliness. Regulatory shifts toward sustainable and environmentally friendly cleaning methods, especially the phasing out of traditional solvent-based systems (Restraint), act as a powerful catalyst (Driver) for the adoption of modern aqueous and bioremediation technologies. The rising global focus on worker safety and reducing exposure to Volatile Organic Compounds (VOCs) further supports the transition to safer alternatives. These drivers are fundamentally reshaping product development and strategic investments across the market landscape.

Restraints largely center on the high initial capital expenditure associated with advanced, automated washing systems and the specialized infrastructure required for wastewater treatment and solvent recycling, posing a barrier to entry for smaller enterprises. Furthermore, the performance limitations of aqueous systems in certain heavy-duty degreasing applications, where traditional solvents still offer superior speed and efficacy, temporarily impede full market migration. Market growth is also marginally constrained by the cyclical volatility in industrial capital investment spending, which can delay the purchase of new, high-value cleaning equipment during economic downturns.

Opportunities for expansion are significant, primarily stemming from the rapid electrification of the automotive industry (EV production), which requires highly specific and residue-free cleaning processes for battery components and sensitive electronic parts. The development of advanced nanotechnology-based cleaning fluids and highly efficient ultrasonic cleaning systems presents avenues for superior performance. Additionally, the proliferation of centralized parts washing services (outsourced cleaning solutions) offers a compelling business model, especially for SMEs, minimizing their capital outlay while ensuring high compliance standards. Impact forces predominantly relate to the intense pressure from environmental agencies globally, compelling manufacturers to rapidly innovate and adhere to zero-discharge standards, thus making environmental compliance an absolute prerequisite for market competitiveness.

Segmentation Analysis

The Parts Washer Market is comprehensively segmented based on technology, agent type, product type, operation mode, and application, reflecting the diverse industrial needs for component cleaning. Understanding these segments is crucial for manufacturers tailoring solutions to specific end-user requirements, ranging from high-precision cleaning in medical and aerospace sectors to high-volume degreasing in heavy machinery manufacturing. The most significant differentiation occurs between aqueous and solvent-based systems, which dictates compliance needs, operational costs, and environmental footprints.

- By Technology:

- Aqueous Parts Washers (Hydrocarbon-based, Water-based)

- Solvent Parts Washers (Traditional and Modified Solvents)

- Bioremediation Parts Washers

- By Product Type:

- Cabinet Washers (Rotary/Turntable)

- Immersion Washers (Agitating/Dunking)

- Conveyor Washers (Tunnel Washers)

- Ultrasonic Washers

- Manual/Drum Mount Washers

- Customized/Specialty Systems

- By Operation Mode:

- Manual

- Semi-Automatic

- Automatic

- By Agent Type:

- Chemical Cleaning Agents (Detergents, Degreasers)

- Solvents (Mineral Spirits, Acetone, etc.)

- Bio-based Cleaning Agents

- By Application/End-User:

- Automotive (Repair, Manufacturing, EV)

- Aerospace and Defense

- Heavy Machinery and Off-Road Equipment

- General Manufacturing

- Medical Devices

- Printing/Coating Industries

- Oil and Gas

Value Chain Analysis For Parts Washer Market

The value chain for the Parts Washer Market begins with the upstream suppliers providing essential raw materials and specialized components. Upstream activities involve procuring materials such as stainless steel and industrial plastics for washer fabrication, alongside specialized components like high-efficiency pumps, filtration systems, heating elements, and sophisticated electronic control units (PLCs). Crucially, the supply of cleaning agents—including proprietary aqueous detergents, specialized solvents, and microbial blends for bioremediation systems—forms a vital upstream segment. Strategic partnerships with reliable component manufacturers are essential for ensuring the quality, reliability, and energy efficiency of the final washing equipment.

Midstream activities encompass the core manufacturing, assembly, and testing of the diverse range of parts washing systems, requiring expertise in metallurgy, fluid dynamics, and automated machinery production. Key players engage in research and development to integrate advanced features such as closed-loop recycling, multi-stage cleaning capabilities, and IoT-enabled monitoring. The downstream component focuses on distribution and after-sales service. Distribution channels are typically dual: direct sales are common for large, highly customized industrial systems, allowing direct interaction with major manufacturing clients; conversely, smaller, standardized manual washers often utilize an indirect approach through industrial supply distributors, MRO equipment wholesalers, and specialized chemical distributors who also provide necessary cleaning fluids.

The final stage involves installation, commissioning, training, and ongoing maintenance, which is a critical source of recurring revenue and customer retention. Direct and indirect sales channels must be optimized based on the product's complexity and end-user sophistication. Direct channels ensure technical expertise transfer for complex conveyor or ultrasonic systems, while indirect channels provide broad geographical reach for standard products. The increasing demand for sustainable operations is pushing distributors to provide comprehensive waste management and fluid recycling services alongside the equipment, further embedding them in the customer's operational loop.

Parts Washer Market Potential Customers

Potential customers for parts washing equipment span nearly all industries involved in manufacturing, assembly, or routine maintenance, where component cleanliness is non-negotiable for operational integrity and product quality. The primary segment comprises Maintenance, Repair, and Overhaul (MRO) facilities, particularly in the automotive aftermarket, where engine and transmission components require thorough cleaning before reassembly. Large automotive OEMs constitute a significant customer base, requiring high-volume, automated washers integrated directly into their production lines for continuous part flow and pre-painting preparation.

Another major end-user category includes aerospace manufacturers and MRO centers. Due to the critical nature of aircraft components, these customers demand high-precision cleaning (often utilizing ultrasonic or vacuum degreasing) to remove microscopic particulates from complex geometries without damaging delicate materials. Similarly, medical device manufacturers are heavy users, requiring validated cleaning processes to ensure bio-compatibility and sterility, especially for surgical instruments and implant components, driving demand for specialized, highly regulated aqueous systems.

Furthermore, general manufacturing, heavy machinery, and metalworking shops represent a perpetual demand source, needing robust systems to remove cutting fluids, metal chips, and rust-preventive oils from machined parts. The emerging electric vehicle (EV) sector is also rapidly becoming a prime customer segment, requiring unique washing solutions for battery casings, power electronics, and motor components that cannot tolerate residues from traditional solvents. These customers seek equipment offering high precision, environmental compliance, and seamless integration into modern smart factory environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 1,400 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mactech Parts Washer Systems, JRI Industries, Safety-Kleen Systems Inc., Karcher SE & Co. KG, ChemFree Corporation, Stoelting Cleaning Equipment, Cleaning Technologies Group (CTG), Ransohoff, Goff, Cleaning Equipment Inc. (CEI), PROCECO Ltd., Better Engineering Mfg. Inc., Alliance Manufacturing Inc., BMT Manufacturing, Guyson International Ltd., L&R Manufacturing Co., Firbimatic S.p.A., H2O International Inc., Ecoclean Group, and Mart Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Parts Washer Market Key Technology Landscape

The technology landscape of the Parts Washer Market is characterized by continuous innovation focused on optimizing efficiency, environmental compatibility, and cleaning precision. A significant trend is the proliferation of multi-stage cleaning and rinsing systems, particularly in the aqueous domain, which allow for complex sequences of washing, rust protection, and drying within a single automated unit. Ultrasonic cleaning technology is also gaining traction, especially for components with complex internal geometries or high-precision requirements, utilizing high-frequency sound waves to generate micro-cavitation bubbles that effectively scour surfaces without physical abrasion. The integration of vacuum drying systems post-wash is becoming standard practice to eliminate water spots and ensure rapid processing, crucial for high-throughput manufacturing.

The shift towards sustainable cleaning agents has spurred rapid development in bioremediation technology. These systems utilize naturally occurring microorganisms to degrade oil and grease contaminants, transforming them into harmless water and carbon dioxide, significantly reducing hazardous waste disposal costs and environmental impact. Furthermore, advanced filtration and oil separation techniques, such as membrane filtration, coalescers, and centrifugal separators, are crucial technologies ensuring the longevity and effectiveness of the cleaning solution, enabling closed-loop systems that minimize water consumption and chemical replenishment, thereby maximizing operational sustainability.

Digitalization and connectivity are increasingly defining the modern parts washer. Implementation of Industrial Internet of Things (IIoT) sensors allows for real-time monitoring of critical operational parameters—such as solution concentration, temperature consistency, and pump performance—facilitating proactive maintenance and ensuring adherence to validated cleaning protocols. This level of data integration supports Generative Engine Optimization (GEO) in manufacturing by providing actionable insights into process variability, enabling manufacturers to adjust parameters automatically and ensure consistent component quality, reducing manual intervention and optimizing energy usage, which is a key competitive advantage.

Regional Highlights

- North America: This region holds a significant market share, driven by a mature automotive MRO sector and high adoption rates in aerospace and general heavy machinery manufacturing. Strict environmental regulations, particularly regarding VOC emissions, accelerate the demand for advanced aqueous and solvent recovery systems. The U.S. remains the largest market, focusing on automated and high-capacity industrial cleaning solutions.

- Europe: Characterized by stringent REACH regulations and robust commitments to sustainability, Europe exhibits strong demand for highly energy-efficient and closed-loop parts washing technologies. Germany, as a manufacturing powerhouse, leads in adopting advanced cabinet and conveyor washers integrated into automated production lines. The focus is heavily on green chemistry and biodegradable cleaning agents.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to rapid industrialization, massive investments in automotive manufacturing (including EV production), and expanding MRO activities in China, India, and Southeast Asia. The demand is currently high for both cost-effective manual systems and large-scale automated washers to support high-volume output.

- Latin America (LATAM): Growth is steady, primarily fueled by the local automotive aftermarket and mining sectors. Market adoption is price-sensitive, often favoring robust, lower-automation systems, though regulatory pressure in key industrial hubs is gradually pushing the transition towards more environmentally responsible solutions.

- Middle East and Africa (MEA): Growth is tied to the expansion of oil and gas exploration, heavy infrastructure projects, and developing aerospace centers (e.g., UAE). The demand focuses on heavy-duty washers capable of handling extreme contamination found in oilfield equipment, with increasing interest in sustainable alternatives driven by international operational standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Parts Washer Market.- Safety-Kleen Systems Inc.

- ChemFree Corporation

- JRI Industries

- Karcher SE & Co. KG

- Cleaning Technologies Group (CTG)

- Ransohoff

- Stoelting Cleaning Equipment

- Mactech Parts Washer Systems

- PROCECO Ltd.

- Better Engineering Mfg. Inc.

- Alliance Manufacturing Inc.

- Guyson International Ltd.

- L&R Manufacturing Co.

- Ecoclean Group

- BMT Manufacturing

- Goff

- Firbimatic S.p.A.

- Mart Corporation

- H2O International Inc.

- Cleaning Equipment Inc. (CEI)

Frequently Asked Questions

What is the projected CAGR for the Parts Washer Market?

The Parts Washer Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing industrial MRO activities and strict component cleanliness regulations globally.

What are the primary differences between aqueous and solvent parts washers?

Aqueous parts washers use water-based solutions, often with detergents, focusing on environmental compliance and safety. Solvent washers use hydrocarbon-based chemicals, offering fast and effective degreasing, but they face higher regulatory scrutiny due to VOC emissions and hazardous waste concerns.

Which application sector is driving the highest demand for advanced parts washing systems?

The Automotive sector, particularly the Maintenance, Repair, and Overhaul (MRO) segment, and the rapidly expanding Electric Vehicle (EV) component manufacturing segment, are key drivers demanding high-precision, automated aqueous cleaning solutions.

How does AI technology benefit the operation of industrial parts washers?

AI integration enables predictive maintenance, real-time optimization of cleaning fluid parameters (temperature, concentration), and automated quality inspection using computer vision, significantly improving efficiency, reducing operational costs, and ensuring consistent output quality.

Which geographical region is expected to experience the fastest growth in the Parts Washer Market?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by accelerating industrialization, massive infrastructure development, and substantial expansion in automotive and manufacturing production capacities, particularly in emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Parts Washer Market Size Report By Type (Solvent-based, Water/Aqueous-based), By Application (Automotive, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Parts Washer Market Statistics 2025 Analysis By Application (Automotive, Industrial), By Type (Solvent-based, Water/Aqueous-based), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager