Parylene Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439448 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Parylene Market Size

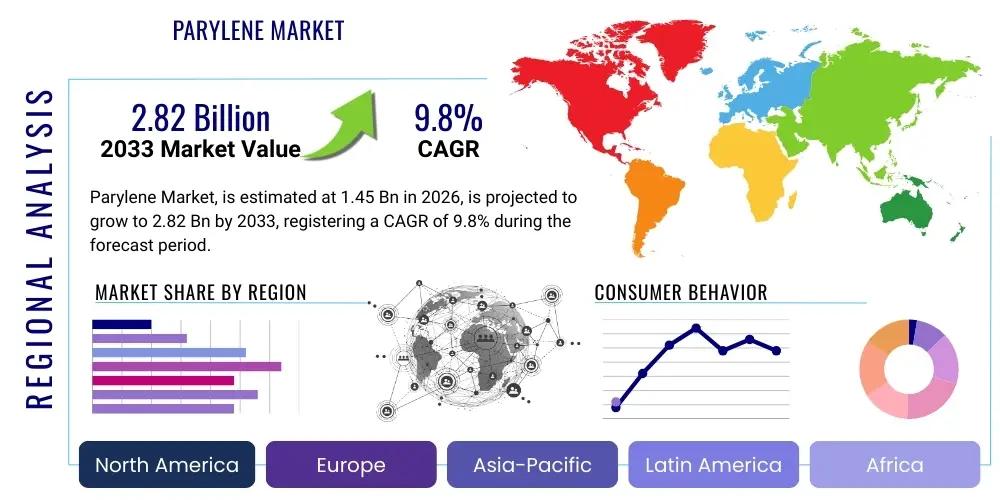

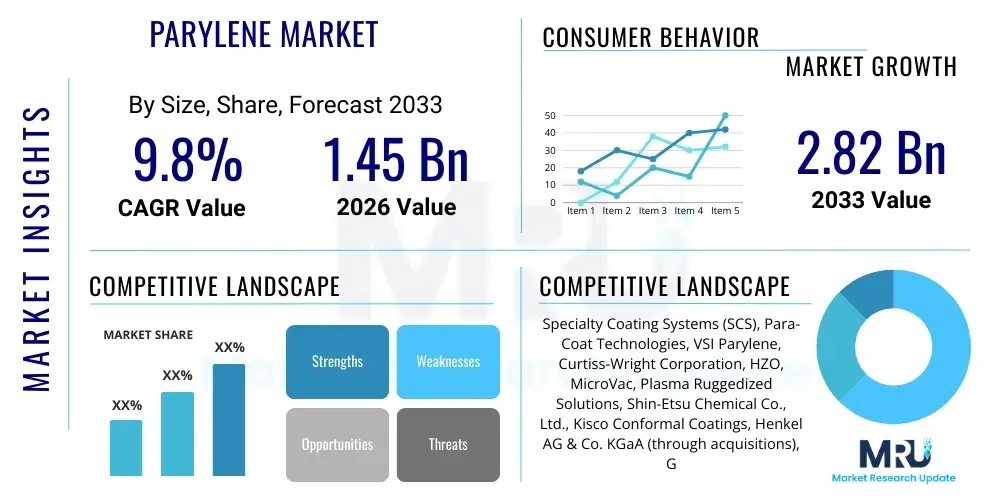

The Parylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.45 Billion in 2026 and is projected to reach USD 2.82 Billion by the end of the forecast period in 2033.

Parylene Market introduction

Parylene, a generic term for a unique series of poly-para-xylylene polymers, represents a critical class of conformal coatings known for their exceptional barrier properties, electrical insulation, and chemical inertness. These ultra-thin, pinhole-free coatings are applied through a specialized vapor deposition polymerization (VDP) process at ambient temperatures, forming a continuous film that fully encapsulates even complex geometries. Unlike liquid coatings, Parylene completely penetrates crevices and forms a uniform layer without pooling, bridging, or curing stresses. This distinctive deposition method ensures unparalleled conformal coverage, making it an indispensable material across various high-reliability applications where traditional coatings fall short.

The primary forms of Parylene include Parylene N, Parylene C, and Parylene D, each offering slightly different properties in terms of barrier performance, dielectric strength, and thermal stability. Parylene N, derived from p-xylylene, provides high dielectric strength and excellent penetration. Parylene C, chlorinated at one aromatic hydrogen, offers superior barrier properties against moisture and chemicals, making it the most commonly utilized variant. Parylene D, with two chlorine atoms, offers enhanced thermal stability. Beyond these, newer variants like Parylene AF-4 (Parylene F) are emerging, designed for extreme temperature applications and improved UV stability. The versatility of these polymers stems from their ability to create a highly protective layer that is both biocompatible and resistant to a wide array of environmental challenges.

Major applications for Parylene coatings span across diverse sectors, predominantly in medical devices, electronics, aerospace, and automotive industries. In medical devices, Parylene's biocompatibility, lubricity, and barrier properties are crucial for implants, catheters, and surgical tools, protecting sensitive components and ensuring patient safety. Within electronics, it safeguards printed circuit boards (PCBs), sensors, and microelectromechanical systems (MEMS) from moisture, dust, chemicals, and electrical leakage, enhancing device longevity and reliability. Its benefits include exceptional corrosion resistance, dielectric insulation, thermal stability, and mechanical reinforcement for delicate components. The driving factors for its market growth include the increasing miniaturization of electronic components, the rising demand for high-performance medical devices, stringent reliability requirements in aerospace, and the growing integration of sophisticated electronics in automotive systems, all necessitating advanced, durable protective coatings.

Parylene Market Executive Summary

The Parylene market is experiencing robust growth driven by the escalating demand for advanced protective coatings in critical applications across diverse industries. Key business trends include the increasing adoption of Parylene in high-reliability segments such as implantable medical devices and mission-critical aerospace electronics, where its unique properties offer unparalleled protection against harsh operating conditions and biological environments. Strategic collaborations between coating service providers and original equipment manufacturers (OEMs) are becoming more prevalent, aimed at developing customized Parylene solutions for specific application requirements. Furthermore, advancements in deposition technology, including improved throughput and process control, are expanding the accessibility and cost-effectiveness of Parylene coatings, facilitating broader market penetration. The market is also witnessing a surge in research and development activities focused on novel Parylene variants with enhanced properties, such as improved UV stability, higher temperature resistance, and tailored surface functionalities, to address evolving industrial needs.

Regional trends indicate that the Asia Pacific (APAC) region continues to dominate the Parylene market, primarily due to its robust manufacturing base for electronics and medical devices, coupled with rapid industrialization and increasing investments in advanced technological infrastructure. Countries like China, Japan, and South Korea are at the forefront of this growth, driven by their thriving semiconductor and consumer electronics industries. North America is also a significant market, characterized by strong innovation in medical technology and aerospace & defense sectors, along with stringent regulatory requirements that favor high-performance materials like Parylene. Europe demonstrates steady growth, particularly in automotive electronics and industrial applications, influenced by strict environmental and performance standards. Emerging economies in Latin America and the Middle East & Africa are showing nascent but promising growth, driven by increasing foreign investments in manufacturing and healthcare infrastructure, indicating potential future expansion opportunities for Parylene manufacturers and service providers.

From a segmentation perspective, Parylene C remains the most widely adopted variant due to its superior moisture and chemical barrier properties, making it ideal for a broad range of applications, especially in electronics and medical implants. However, demand for Parylene N is also substantial, particularly where excellent dielectric strength and minimal mass addition are paramount, such as in ultra-thin microelectronics. The medical device application segment holds a significant share, propelled by the continuous innovation in implantable and wearable health technologies that demand biocompatible and durable protection. The electronics segment, encompassing PCBs, sensors, and MEMS, is another dominant force, consistently expanding with the proliferation of IoT devices, advanced driver-assistance systems (ADAS) in automotive, and sophisticated consumer electronics. Growth in the aerospace & defense segment is steady, driven by the need for lightweight, high-performance coatings that ensure the longevity and reliability of critical components in extreme environments, while the automotive segment is poised for accelerated growth due to the increasing electronic content and the shift towards electric vehicles.

AI Impact Analysis on Parylene Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to significantly impact the Parylene market by revolutionizing material science, optimizing manufacturing processes, and enhancing quality control. Users are increasingly questioning how AI can accelerate the discovery of novel Parylene variants with tailored properties, improve the efficiency and precision of the complex vapor deposition polymerization (VDP) process, and predict coating performance under various environmental stresses. Concerns revolve around the data requirements for training robust AI models, the initial investment in AI infrastructure, and the potential for job displacement, alongside expectations for unprecedented levels of process automation, predictive maintenance, and superior coating quality. The overarching theme is the anticipation that AI will unlock new potentials for Parylene applications by making its production more efficient, cost-effective, and adaptable to specific industrial demands, thereby driving market expansion and innovation.

- AI-driven material discovery can accelerate the development of new Parylene formulations with enhanced properties like improved thermal stability, UV resistance, or specific electrical characteristics, reducing R&D cycles.

- Machine Learning algorithms can optimize the complex Chemical Vapor Deposition (CVD) process parameters, leading to improved coating uniformity, adhesion, and thickness control, minimizing defects and waste.

- Predictive analytics can be employed for real-time monitoring of deposition equipment, anticipating maintenance needs and reducing downtime, thereby increasing operational efficiency and throughput.

- AI-powered automated optical inspection (AOI) systems can drastically improve quality control by rapidly identifying minute coating imperfections that are challenging for human inspectors, ensuring higher product reliability.

- Data analytics can be used to correlate process parameters with end-product performance, enabling manufacturers to refine their processes and deliver coatings that precisely meet stringent application requirements.

- Supply chain optimization through AI can lead to more efficient raw material procurement, inventory management, and logistics, reducing operational costs and improving market responsiveness.

- AI can facilitate advanced simulation and modeling of Parylene coating behavior in various environments, allowing for virtual testing and faster validation of new designs before physical prototyping.

DRO & Impact Forces Of Parylene Market

The Parylene market is profoundly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and defining the competitive landscape. A primary driver is the pervasive trend of miniaturization across electronics and medical devices, where components are becoming smaller and more sensitive, necessitating ultra-thin, highly conformal, and robust protective coatings that only Parylene can reliably provide. The escalating demand for high-performance and reliable electronic systems in harsh environments, from automotive under-the-hood applications to aerospace avionics, further fuels market growth, as Parylene offers unmatched protection against moisture, chemicals, and extreme temperatures. Moreover, the increasing adoption of implantable and wearable medical devices, which require biocompatible, non-toxic, and durable coatings to ensure patient safety and device longevity, significantly contributes to the market's expansion. However, the market faces notable restraints, including the relatively high initial capital expenditure associated with Parylene deposition equipment and the intricate, batch-oriented nature of the vapor deposition process, which can sometimes limit throughput and drive up per-unit costs compared to alternative liquid-based coatings. Additionally, a lack of widespread awareness regarding Parylene's unique advantages among a broader spectrum of potential end-users outside of specialized high-tech industries can hinder market penetration. Despite these challenges, significant opportunities abound, particularly in the burgeoning sectors of flexible electronics, Internet of Things (IoT) devices, and advanced sensor technologies, all of which benefit immensely from Parylene’s protective capabilities. Furthermore, ongoing research into new Parylene variants with enhanced functionalities, such as improved UV stability or higher temperature resistance, alongside the exploration of continuous-flow deposition processes, presents pathways for market diversification and overcoming existing technical limitations. Strategic partnerships and increased educational initiatives to highlight Parylene’s unique value proposition are also key impact forces driving future market expansion by fostering broader adoption and innovative application development.

Segmentation Analysis

The Parylene market is extensively segmented to reflect the diverse chemical compositions of the polymers, their various application areas across industries, and the distinct end-user categories they serve. This detailed segmentation provides critical insights into market dynamics, growth drivers, and demand patterns for specific Parylene types and their deployment in different sectors. Understanding these segments is crucial for manufacturers, service providers, and investors to identify lucrative niches, tailor product offerings, and devise targeted market entry strategies. The distinct properties of each Parylene variant, such as barrier effectiveness, dielectric strength, and thermal resistance, directly influence their suitability for particular applications, leading to specialized market segments. Furthermore, the evolving requirements of end-use industries, driven by technological advancements and regulatory changes, continuously reshape the demand landscape for Parylene coatings.

- By Type

- Parylene N: Known for its highest dielectric strength and excellent crevice penetration, ideal for high-frequency electronics and delicate components where minimal mass addition is critical. Offers good thermal stability and a low dielectric constant.

- Parylene C: The most widely used variant, providing superior moisture and chemical barrier properties due to a chlorine atom on the aromatic ring. Exhibits better adhesion and less permeability, making it suitable for medical devices and harsh-environment electronics.

- Parylene D: Contains two chlorine atoms, offering enhanced thermal stability and hardness compared to Parylene C, making it valuable for applications requiring greater resistance to elevated temperatures.

- Parylene F (AF-4): A newer class of Parylene with fluorine atoms, providing exceptional UV stability, higher thermal resistance, and lower dielectric constant, suited for outdoor applications and specialized high-temperature electronics.

- Other Variants: Includes developmental or niche Parylene types designed for specific properties such as improved adhesion to certain substrates, enhanced flexibility, or anti-microbial characteristics for emerging applications.

- By Application

- Medical Devices: Critical for implantable devices (e.g., pacemakers, neurostimulators), catheters, stents, surgical tools, and hearing aids, providing biocompatibility, lubricity, and protection against bodily fluids and sterilization processes.

- Electronics: Extensive use in Printed Circuit Boards (PCBs), sensors, MEMS, LEDs, semiconductors, micro-display components, and flexible electronics to prevent moisture ingress, corrosion, and electrical leakage, ensuring reliability in consumer, industrial, and specialized electronics.

- Aerospace & Defense: Protects avionics, missile guidance systems, satellite components, drones, and other critical electronic assemblies from extreme temperatures, vacuum, radiation, moisture, and vibration in harsh operational environments.

- Automotive: Applied to Electronic Control Units (ECUs), sensors (e.g., oxygen, pressure, position), infotainment systems, and battery components in electric vehicles to safeguard against moisture, fuels, oils, and temperature fluctuations, enhancing reliability and lifespan.

- Industrial: Used for protective coatings on industrial sensors, control systems, motors, and instrumentation in challenging industrial settings, including chemical processing, manufacturing, and energy sectors, to ensure operational continuity.

- Consumer Goods: Protects wearables (e.g., smartwatches, fitness trackers), smartphones, and other personal electronic devices from sweat, humidity, and accidental spills, extending product durability and performance.

- Others: Includes niche applications in research & development, laboratory equipment, telecommunications infrastructure, and specific optical components requiring inert, pinhole-free coatings.

Value Chain Analysis For Parylene Market

The value chain of the Parylene market is a complex ecosystem beginning with the synthesis of specialized raw materials and extending through sophisticated manufacturing processes to the ultimate end-use applications. At the upstream end, the chain is dominated by a few specialized chemical manufacturers responsible for producing the dimeric raw materials (di-p-xylylene) that serve as the foundational precursors for all Parylene variants. These dimeric compounds require precise synthesis and purification processes to ensure the high quality and purity necessary for subsequent vapor deposition polymerization. The quality and availability of these raw materials directly impact the cost-effectiveness and scalability of Parylene production downstream. Innovation at this stage focuses on developing more efficient synthesis routes and exploring novel dimeric structures to create new Parylene types with enhanced properties, thereby expanding the material's application spectrum and market reach. The limited number of suppliers for these specialized raw materials contributes to a moderately concentrated upstream segment, requiring robust supply chain management by coating service providers.

Moving downstream, the value chain involves two primary stages: the manufacturing of specialized deposition equipment and the provision of Parylene coating services. Equipment manufacturers design and produce the sophisticated vacuum deposition systems required for the Parylene VDP process. These systems are critical for controlling the precise parameters of sublimation, pyrolysis, and deposition that ensure the formation of uniform, pinhole-free films. Technological advancements in equipment focus on increasing chamber sizes for higher throughput, improving process automation for enhanced efficiency, and integrating advanced control systems for greater coating precision and repeatability. Following equipment manufacturing, the next crucial step is the coating service providers, who operate these specialized systems to apply Parylene coatings onto client components. These providers possess the expertise in process optimization, material handling, and quality assurance specific to Parylene, offering tailored solutions to various industries. Their role often involves consultation, masking, cleaning, coating, and post-coating inspection, serving as a vital link between the raw material producers and the diverse end-user industries.

The distribution channels for Parylene predominantly involve a direct-to-customer model for coating services, especially for specialized or high-volume applications where direct technical consultation and precise adherence to specifications are paramount. Coating service providers often engage directly with end-product manufacturers in the medical, electronics, and aerospace sectors to integrate Parylene application into their production lines. For less specialized or smaller volume needs, indirect channels through regional distributors or sales agents may facilitate broader market access, particularly in emerging markets. These distributors might also offer basic masking and de-masking services or connect clients with certified coating centers. The presence of both direct and indirect channels ensures market penetration across different scales of operations and geographical regions. Ultimately, the end-users, such as medical device manufacturers, electronics companies, aerospace contractors, and automotive suppliers, integrate Parylene-coated components into their final products, leveraging the protective benefits to enhance performance, reliability, and longevity. The efficiency and reliability of each stage in this value chain are critical for the overall growth and competitive positioning of the Parylene market, driving continuous collaboration and innovation across all segments.

Parylene Market Potential Customers

The Parylene market caters to a diverse array of end-users and buyers across multiple high-tech industries, each seeking the unique protective and functional attributes that Parylene coatings offer. These customers are typically manufacturers of sensitive or mission-critical components that require robust protection against environmental factors, electrical interference, or biological interaction. A significant segment of potential customers includes medical device manufacturers, ranging from producers of life-sustaining implantable devices like pacemakers, defibrillators, and neurostimulators, to those specializing in minimally invasive surgical tools, catheters, and hearing aids. For these applications, Parylene's biocompatibility, lubricity, and exceptional barrier properties against bodily fluids are indispensable for ensuring patient safety, device longevity, and reliable performance within the human body. The stringent regulatory requirements in the medical field further solidify Parylene's position as a preferred coating solution, making these manufacturers key buyers who often demand highly customized coating services and rigorous quality control.

Another dominant customer base resides within the electronics industry, encompassing manufacturers of a vast array of devices and components. This includes companies producing printed circuit boards (PCBs) for consumer electronics, industrial control systems, telecommunications equipment, and automotive electronics. Additionally, manufacturers of advanced sensors, microelectromechanical systems (MEMS), semiconductors, light-emitting diodes (LEDs), and various micro-display technologies represent crucial buyers. These customers rely on Parylene to provide superior dielectric insulation, prevent moisture ingress, protect against corrosive chemicals, and enhance the overall durability and reliability of their intricate electronic assemblies. As electronic devices become increasingly miniaturized, complex, and are deployed in more challenging environments, the demand for precise, pinhole-free conformal coatings like Parylene continues to surge, positioning electronics manufacturers as high-volume and technologically sophisticated customers who prioritize performance and long-term reliability.

Beyond medical and electronics, significant potential customers exist in the aerospace and defense sector, where manufacturers of avionics, missile guidance systems, satellite components, and military-grade electronic systems require coatings that can withstand extreme temperatures, vacuum conditions, radiation, and harsh mechanical stresses. Parylene's lightweight nature and robust protective capabilities make it an ideal choice for safeguarding critical components in these high-stakes applications. Similarly, the automotive industry presents a growing customer segment, particularly with the proliferation of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and sophisticated in-car electronics. Automotive suppliers and OEMs utilize Parylene to protect electronic control units (ECUs), various sensors (e.g., oxygen, pressure, position), and battery management system components from moisture, road salts, fuels, oils, and vibrations, thereby enhancing vehicle safety and reliability. Furthermore, industrial equipment manufacturers, research laboratories, and specialized optical component producers also represent valuable, albeit sometimes niche, customer segments, all seeking the unparalleled protection and performance characteristics that Parylene coatings consistently deliver across a wide spectrum of demanding applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.45 Billion |

| Market Forecast in 2033 | USD 2.82 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialty Coating Systems (SCS), Para-Coat Technologies, VSI Parylene, Curtiss-Wright Corporation, HZO, MicroVac, Plasma Ruggedized Solutions, Shin-Etsu Chemical Co., Ltd., Kisco Conformal Coatings, Henkel AG & Co. KGaA (through acquisitions), GVD Corporation, Labthink International, Inc., PMP Corporation, Advanced Coating, Inc., Coatings 2000, Inc., Diamond-MT, Inc., Surface Solutions Group, LLC, Vactec, Inc., SciLabs LLC, AST Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Parylene Market Key Technology Landscape

The key technology landscape of the Parylene market is predominantly defined by the specialized process of Chemical Vapor Deposition (CVD), specifically a variant known as vapor deposition polymerization (VDP), which distinguishes Parylene from traditional liquid-based conformal coatings. This proprietary process involves three primary stages within a vacuum chamber: sublimation, pyrolysis, and deposition. First, the solid dimeric raw material (e.g., di-p-xylylene) is heated in a vacuum to sublime into a gaseous form. This gaseous dimer then passes into a high-temperature pyrolysis furnace, where it is cleaved into stable monomeric free radicals (p-xylylene). Finally, these monomeric radicals enter a deposition chamber, maintained at ambient temperature and high vacuum, where they spontaneously polymerize and deposit as a thin, uniform, and pinhole-free polymer film onto all exposed surfaces of the substrate. The elegance of this process lies in its ability to achieve truly conformal coverage, penetrating intricate geometries and sharp edges without bridging or sag, which is often a limitation for other coating technologies. This unique technology enables the application of ultra-thin layers, typically ranging from a few hundred nanometers to tens of micrometers, offering exceptional barrier properties and electrical insulation without adding significant mass or altering component dimensions.

Beyond the core VDP technology, significant advancements in process control and equipment design are continuously shaping the Parylene market. Modern deposition systems incorporate sophisticated control mechanisms to precisely regulate temperature, pressure, and monomer flow rates, ensuring highly repeatable and consistent coating outcomes. Automation features, including robotic material handling and integrated quality assurance sensors, are enhancing efficiency and reducing the labor intensity of the coating process. This focus on automation is crucial for increasing throughput and making Parylene coatings more cost-effective for high-volume manufacturing. Furthermore, research and development efforts are focused on improving the adhesion of Parylene to various challenging substrates through surface pre-treatment techniques, such as plasma activation or primer application, thereby expanding the range of compatible materials and applications. Innovations in masking techniques, essential for protecting specific areas from coating, are also critical, with developments in laser cutting and precision masking tapes improving accuracy and efficiency.

Another crucial area within the technology landscape involves the development of new Parylene variants. While Parylene N, C, and D remain industry standards, ongoing chemical research is exploring new monomeric structures to engineer Parylene films with enhanced functionalities. This includes the synthesis of fluorinated Parylenes (e.g., Parylene F) for superior UV resistance, higher thermal stability, and lower dielectric constants, making them suitable for extreme environmental conditions and advanced high-frequency electronics. Efforts are also being made to develop Parylenes with tailored surface energies, offering properties like hydrophobicity or hydrophilicity, which can be beneficial for specific medical or microfluidic applications. The integration of inline monitoring technologies, such as quartz crystal microbalances (QCMs) or optical interferometry, allows for real-time measurement of coating thickness during deposition, providing immediate feedback for process adjustments and ensuring adherence to tight specifications. These continuous technological innovations in both the deposition process and material science are pivotal for maintaining Parylene's competitive edge and expanding its utility across a growing spectrum of demanding industrial applications.

Regional Highlights

- North America: This region is a powerhouse for innovation in medical devices and aerospace & defense, driving high demand for Parylene. The presence of stringent regulatory frameworks and a strong emphasis on product reliability and miniaturization in electronics further boosts market growth. The United States, in particular, leads in R&D investment and adoption of advanced coating technologies, with a significant concentration of specialized Parylene service providers and equipment manufacturers. Canada and Mexico also contribute, with growing manufacturing sectors and increasing integration into global supply chains.

- Europe: Characterized by stringent quality and environmental regulations, Europe exhibits a steady demand for Parylene, especially in the automotive electronics, industrial, and medical technology sectors. Countries like Germany, France, and the UK are key markets due to their robust manufacturing industries and continuous investment in high-reliability components. The region's focus on precision engineering and long-term product performance makes Parylene an attractive choice for protective coatings, while innovations in renewable energy and smart infrastructure also present niche opportunities.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Parylene, primarily driven by its massive electronics manufacturing base and burgeoning medical device industry. Countries such as China, Japan, South Korea, Taiwan, and India are pivotal, fueled by rapid industrialization, increasing disposable income, and government initiatives promoting local manufacturing and technological advancement. The region's extensive production of consumer electronics, semiconductors, and automotive components creates an immense demand for cost-effective yet high-performance conformal coatings like Parylene, making it a critical hub for market expansion and competitive activity.

- Latin America: This region is an emerging market for Parylene, with growth driven by increasing foreign direct investment in manufacturing, improving healthcare infrastructure, and the expansion of the automotive and electronics sectors, particularly in Brazil and Mexico. While smaller in scale compared to established markets, rising industrialization and the need for enhanced product reliability present significant future growth opportunities for Parylene adoption, especially as local industries mature and global supply chains extend their reach.

- Middle East and Africa (MEA): The MEA region represents a nascent but promising market, with demand primarily stemming from critical infrastructure projects, oil and gas exploration, and a developing healthcare sector in countries like UAE, Saudi Arabia, and South Africa. Investment in diversifying economies away from traditional sectors and towards technology and manufacturing is expected to drive increased adoption of high-performance coatings, including Parylene, for electronics and industrial applications. However, market penetration is currently limited by lower technological adoption rates and reliance on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Parylene Market.- Specialty Coating Systems (SCS)

- Para-Coat Technologies

- VSI Parylene

- Curtiss-Wright Corporation

- HZO

- MicroVac

- Plasma Ruggedized Solutions

- Shin-Etsu Chemical Co., Ltd.

- Kisco Conformal Coatings

- Henkel AG & Co. KGaA

- GVD Corporation

- Labthink International, Inc.

- PMP Corporation

- Advanced Coating, Inc.

- Coatings 2000, Inc.

- Diamond-MT, Inc.

- Surface Solutions Group, LLC

- Vactec, Inc.

- SciLabs LLC

- AST Products, Inc.

Frequently Asked Questions

Analyze common user questions about the Parylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Parylene and what are its primary characteristics?

Parylene is a unique series of poly-para-xylylene polymers applied as ultra-thin, pinhole-free conformal coatings through a specialized vapor deposition process. Its primary characteristics include exceptional barrier properties against moisture and chemicals, excellent dielectric insulation, biocompatibility, chemical inertness, and high thermal and mechanical stability, making it ideal for protecting sensitive components.

Which industries extensively utilize Parylene coatings and why?

Parylene coatings are extensively utilized across medical devices, electronics, aerospace & defense, and automotive industries. Medical device manufacturers rely on its biocompatibility and barrier properties for implants. Electronics manufacturers use it for moisture and corrosion protection of PCBs, sensors, and MEMS. Aerospace & defense applications benefit from its resilience in harsh environments, while automotive utilizes it for protecting critical electronics from severe operating conditions.

How is Parylene applied, and what makes this process unique?

Parylene is applied using a unique Chemical Vapor Deposition (CVD) process at ambient temperatures. This three-stage vacuum deposition polymerization (VDP) involves subliming a solid dimer, pyrolyzing it into a gaseous monomer, and then depositing it onto the substrate as a polymer film. This gas-phase process ensures a truly conformal, uniform, and pinhole-free coating on all exposed surfaces, including complex geometries, which is difficult to achieve with liquid coatings.

What are the key advantages of Parylene over other conformal coatings?

Parylene offers several key advantages including superior barrier protection against moisture, chemicals, and gases, exceptional dielectric strength, true conformality that eliminates bridging or pooling, ultra-thin application without mechanical stress, and biocompatibility. Unlike other coatings, its deposition process does not involve solvents, ensuring high purity and compatibility with delicate components, making it ideal for high-reliability applications.

What are the main types of Parylene and their distinct uses?

The main types include Parylene N, C, and D, with newer variants like Parylene F emerging. Parylene N offers high dielectric strength and crevice penetration for electronics. Parylene C provides superior moisture and chemical barrier properties, widely used in medical and general electronics. Parylene D offers enhanced thermal stability. Parylene F provides exceptional UV stability and higher thermal resistance for extreme conditions, catering to specific high-performance requirements across diverse applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager