Passenger Car Flame Retardant Fiber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439312 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Passenger Car Flame Retardant Fiber Market Size

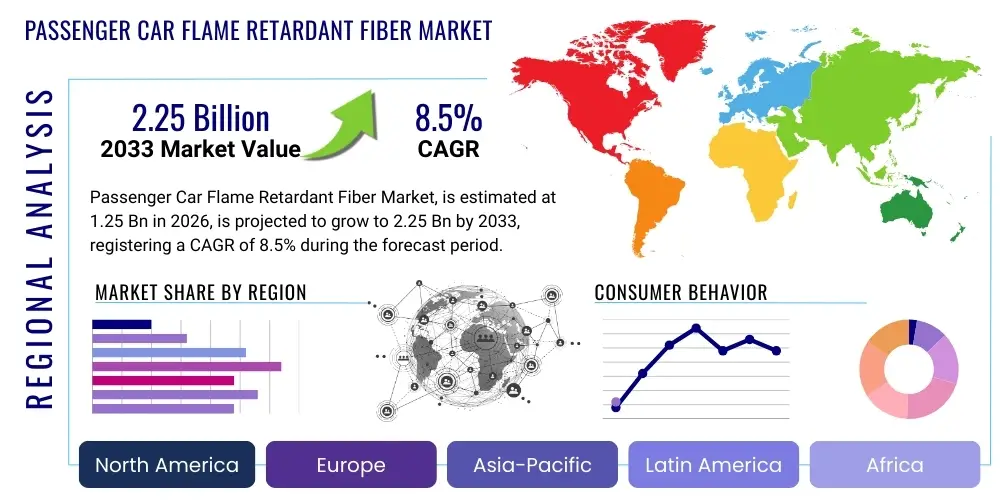

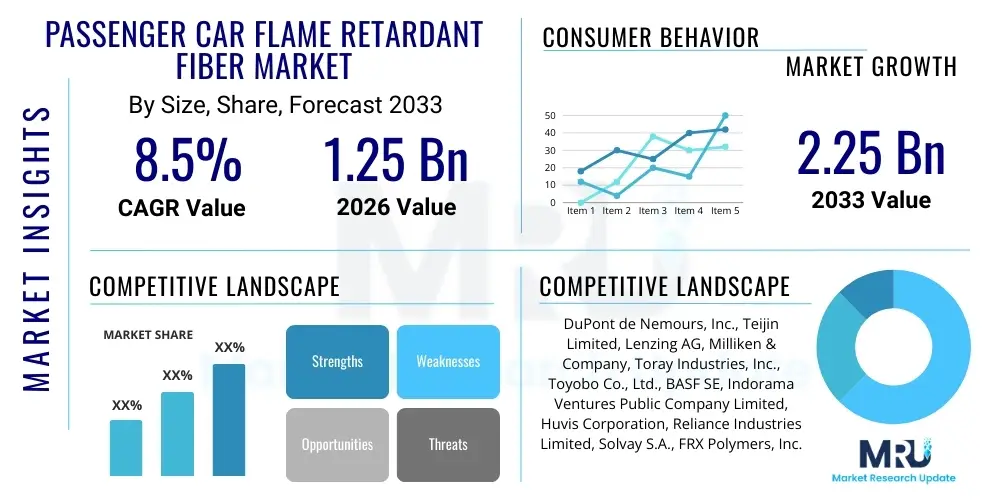

The Passenger Car Flame Retardant Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.25 Billion by the end of the forecast period in 2033.

Passenger Car Flame Retardant Fiber Market introduction

The Passenger Car Flame Retardant Fiber market encompasses a specialized segment within the automotive industry, focusing on materials engineered to inhibit, suppress, or delay the combustion of various components within passenger vehicles. These advanced fibers are critical in enhancing vehicle safety by reducing the risk and severity of fires, a paramount concern for both manufacturers and consumers. The core product offering includes a range of synthetic and natural fibers treated with flame-retardant chemicals or inherently designed with fire-resistant properties. These materials are meticulously integrated into numerous interior parts of a car, forming a crucial barrier against potential ignition sources and rapid flame spread, thereby safeguarding occupants and minimizing property damage in the event of an accident or electrical malfunction. The driving factors behind the market's robust expansion are multifaceted, primarily stemming from increasingly stringent global automotive safety regulations, a heightened consumer awareness regarding passive safety features, and continuous innovation in material science aimed at developing more effective and sustainable flame-retardant solutions.

Major applications of flame retardant fibers in passenger cars span across a wide array of interior components, including upholstery for seats, carpets and floorings, headliners, door panels, pillar trims, sun visors, and trunk linings. These fibers are chosen for their ability to meet rigorous fire safety standards without compromising other critical performance attributes such as durability, aesthetics, comfort, and weight. Beyond their primary function of fire protection, these materials often contribute to the overall acoustic insulation and structural integrity of the vehicle interior. The benefits extend beyond regulatory compliance, offering vehicle occupants a significantly improved safety profile, providing manufacturers with a competitive advantage through enhanced product reliability, and contributing to a safer transportation ecosystem. The demand is further propelled by the rising production of passenger cars globally, especially within emerging economies, coupled with a growing emphasis on premium vehicle segments where advanced safety features are a standard expectation. The evolution towards electric vehicles (EVs) also presents new challenges and opportunities, as high-voltage components and battery systems necessitate even more sophisticated fire safety measures, thereby increasing the demand for high-performance flame retardant fibers tailored for specific EV requirements.

Passenger Car Flame Retardant Fiber Market Executive Summary

The Passenger Car Flame Retardant Fiber market is experiencing dynamic growth, propelled by a confluence of evolving business trends, stringent regulatory landscapes, and consumer-driven demands for enhanced safety. Key business trends include a significant shift towards sustainable and eco-friendly flame retardant solutions, driven by environmental concerns and regulatory pressures to reduce hazardous chemicals. Manufacturers are increasingly investing in research and development to introduce halogen-free and bio-based flame retardant fibers that offer comparable or superior performance while minimizing environmental impact. Strategic collaborations and partnerships between fiber manufacturers, chemical suppliers, and automotive OEMs are becoming more prevalent, aimed at accelerating innovation, optimizing supply chains, and integrating advanced materials seamlessly into vehicle designs. Furthermore, the market is witnessing consolidation among smaller players and strategic acquisitions by larger corporations looking to expand their product portfolios and geographical reach, signaling a maturing yet highly competitive landscape focused on differentiation through performance and sustainability.

Regional trends indicate that Asia Pacific continues to dominate the market in terms of production and consumption, primarily due to the high volume of automotive manufacturing in countries like China, India, Japan, and South Korea. This region is characterized by rapidly expanding middle-class populations, leading to increased passenger car sales and subsequently higher demand for safety components. Europe and North America, while having mature automotive markets, exhibit strong demand for premium and luxury vehicles, which often incorporate a higher concentration of advanced flame retardant fibers due to their stringent safety standards and consumer preferences for sophisticated features. These regions are also at the forefront of implementing stricter environmental regulations, pushing for the adoption of next-generation, environmentally benign flame retardants. Emerging markets in Latin America and the Middle East & Africa are showing significant potential for growth, driven by increasing disposable incomes, urbanization, and the gradual adoption of global safety standards, albeit at a slower pace compared to developed regions.

Segmentation trends highlight the increasing prominence of high-performance fiber types such as aramid and modacrylic, particularly in applications requiring superior heat resistance and durability, often found in luxury and electric vehicles. Polyester and polypropylene fibers, due to their cost-effectiveness and versatility, continue to hold substantial market share in mass-market vehicles, benefiting from continuous advancements in flame-retardant additives that enhance their performance. By application, seating and carpet & flooring segments remain the largest consumers of flame retardant fibers, given their extensive surface area and proximity to potential ignition sources. However, growth is also notable in more specialized areas such as battery enclosures and cable insulation within electric vehicles, where localized fire protection is paramount. The OEM segment accounts for the vast majority of demand, directly driven by new vehicle production, while the aftermarket segment sees steady demand for replacement parts and customization, though it represents a smaller, niche market focusing on specific repair and upgrade needs.

AI Impact Analysis on Passenger Car Flame Retardant Fiber Market

The integration of Artificial Intelligence (AI) and machine learning (ML) is poised to revolutionize various facets of the Passenger Car Flame Retardant Fiber market, addressing key concerns and expectations around material innovation, production efficiency, and safety performance. Users are keenly interested in how AI can accelerate the discovery and development of novel flame-retardant compounds, particularly focusing on sustainable, non-halogenated alternatives that meet evolving environmental regulations without compromising efficacy. There is a strong expectation that AI will optimize material formulations, predicting the performance of new fiber blends and additive combinations through advanced simulations, thereby significantly reducing the time and cost associated with traditional R&D cycles. Furthermore, users anticipate AI's role in streamlining manufacturing processes, from predictive maintenance in fiber production facilities to intelligent quality control systems that ensure consistent flame retardancy across batches. The ability of AI to analyze vast datasets related to material properties, processing conditions, and fire test results offers unprecedented opportunities for fine-tuning production parameters and ensuring superior product quality, directly impacting the market's efficiency and responsiveness to complex safety demands.

Beyond material development and production, AI is expected to influence the application and integration of flame retardant fibers within vehicle design. Users foresee AI-driven design tools that can simulate fire propagation scenarios within a vehicle cabin, allowing engineers to strategically place flame-retardant materials for optimal protection. This advanced simulation capability, coupled with generative design, could lead to more efficient use of materials, reduced vehicle weight, and enhanced overall passenger safety. Another significant area of interest is the potential for AI to aid in post-incident analysis. By integrating sensor data from vehicles (e.g., thermal sensors, smoke detectors) with AI algorithms, manufacturers could gain deeper insights into how materials perform in real-world fire incidents, informing future material improvements and design modifications. This data-driven feedback loop, powered by AI, promises to elevate the continuous improvement cycle for flame retardant fibers, making them more resilient and effective against the dynamic challenges of automotive fires. The market's stakeholders are thus looking to AI as a catalyst for a safer, more efficient, and more sustainable future in automotive fire protection.

- Accelerated discovery of sustainable, non-halogenated flame retardant materials through AI-driven molecular design and computational chemistry.

- Optimization of fiber formulations and additive blends using machine learning algorithms to predict performance and properties, reducing R&D cycles.

- Enhanced manufacturing efficiency through AI-powered process optimization, predictive maintenance, and intelligent quality control systems in fiber production.

- AI-driven simulation tools for fire propagation analysis within vehicle interiors, enabling optimal placement and design of flame retardant components.

- Data-driven insights from real-world fire incident analysis, leveraging AI to inform continuous improvements in material performance and vehicle safety features.

- Development of smart materials with integrated sensors, leveraging AI for real-time monitoring of material integrity and early fire detection capabilities.

- Personalized safety solutions for vehicles, using AI to tailor flame retardant strategies based on vehicle type, usage patterns, and regional safety standards.

- Supply chain optimization and risk management through AI analytics, ensuring stable and efficient sourcing of raw materials for flame retardant fibers.

DRO & Impact Forces Of Passenger Car Flame Retardant Fiber Market

The Passenger Car Flame Retardant Fiber market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and various impact forces that collectively dictate its trajectory. A primary driver is the relentless evolution and enforcement of global automotive safety regulations, such as those mandated by the Federal Motor Vehicle Safety Standards (FMVSS 302) in the US, ECE R118 in Europe, and similar standards in Asia Pacific. These regulations compel manufacturers to integrate materials that meet specific flammability requirements for interior components, thereby creating a foundational demand for flame retardant fibers. Furthermore, the burgeoning global automotive production, particularly in developing economies, significantly contributes to market growth. As more vehicles are manufactured, the absolute volume of flame retardant fibers required for interior applications naturally increases. Consumer demand for enhanced vehicle safety, often influenced by high-profile safety ratings and accident statistics, also plays a crucial role. Modern consumers are increasingly sophisticated and prioritize safety features, including passive fire protection, when making purchasing decisions, pushing OEMs to adopt superior flame-retardant solutions. Lastly, continuous technological advancements in fiber development, leading to the creation of more effective, lightweight, and environmentally friendly flame retardant materials, further fuels market expansion by addressing performance gaps and sustainability concerns.

Despite these strong drivers, the market faces several notable restraints. High production costs associated with specialized flame retardant fibers and the complex chemical treatments involved can pose a significant challenge, especially for mass-market vehicle segments where cost efficiency is paramount. The integration of these advanced materials often requires specific manufacturing processes, which can add to the overall vehicle production expenses. Supply chain disruptions, exacerbated by geopolitical tensions, trade wars, and global events like pandemics, can severely impact the availability and pricing of raw materials, creating volatility in the market. Many flame retardant additives are derived from specialized chemicals, and their consistent supply is crucial. Limited awareness in certain emerging markets regarding the specific benefits and importance of advanced flame retardant fibers can also hinder adoption, as manufacturers in these regions may prioritize cost over maximal safety features in some instances. The inherent complexity of integrating diverse flame retardant materials into various automotive components while ensuring compatibility with other vehicle systems and maintaining aesthetic appeal presents an ongoing engineering challenge.

Opportunities for growth are abundant and diverse. The development of bio-based and halogen-free flame retardants represents a significant avenue for innovation and market expansion, addressing environmental concerns and stricter regulatory mandates against certain chemical compounds. As sustainability becomes a core tenet of automotive manufacturing, companies investing in green flame retardant solutions are likely to gain a competitive edge. The accelerating global adoption of electric vehicles (EVs) presents a unique and substantial opportunity. EVs introduce new fire risks associated with high-voltage battery packs and electrical systems, necessitating specialized, high-performance flame retardant fibers for battery enclosures, cabling, and interior components, creating an entirely new segment of demand. Expansion into high-growth emerging markets, where automotive penetration is still increasing and safety standards are gradually improving, offers untapped potential for market players. Moreover, strategic collaborations among material suppliers, automotive OEMs, and research institutions can foster innovation, accelerate product development, and facilitate market penetration of novel flame retardant solutions, creating synergistic benefits for all stakeholders and driving the market forward.

Segmentation Analysis

The Passenger Car Flame Retardant Fiber market is meticulously segmented to provide a comprehensive understanding of its diverse components and dynamics. This segmentation allows for targeted market analysis, identification of specific growth opportunities, and a clearer view of competitive landscapes across various material types, application areas, vehicle categories, and end-use channels. Understanding these segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and investment decisions, ensuring alignment with specific market needs and regulatory requirements. The broad categories include divisions based on the chemical composition of the fibers, the specific interior component where they are applied, the type of passenger vehicle being manufactured, and whether the fibers are supplied to original equipment manufacturers or the aftermarket.

- By Fiber Type:

- Polyester: Widely used due to cost-effectiveness and versatility, often treated with FR additives.

- Aramid: Known for exceptional heat and flame resistance, common in high-performance and luxury vehicles.

- Modacrylic: Inherently flame retardant, offers good textile properties and a balance of performance and cost.

- Polypropylene: Lightweight and durable, increasingly treated with advanced FR compounds for automotive use.

- Others: Including specialized fibers like Glass Fiber, Basalt Fiber, and novel composite materials.

- By Application:

- Seats: Covers, cushions, and internal structures for passenger seating.

- Carpets & Floorings: Interior floor coverings and mats.

- Headliners: Overhead interior roof lining material.

- Door Panels: Interior trim on vehicle doors.

- Pillars: Interior trim on A, B, and C pillars.

- Trunks: Lining and carpeting in the vehicle's trunk area.

- Others: Sun visors, dashboards, gear shift boots, parcel shelves, and specific EV battery enclosures.

- By Vehicle Type:

- Sedans: Traditional four-door passenger cars.

- SUVs (Sport Utility Vehicles): Versatile vehicles combining elements of passenger cars and off-road vehicles.

- Hatchbacks: Cars with a large rear door that opens upwards, often including compact and subcompact models.

- Luxury Cars: High-end vehicles characterized by premium materials, advanced technology, and superior performance.

- Electric Vehicles (EVs): Battery electric vehicles and plug-in hybrid electric vehicles, requiring specialized fire safety.

- By End-Use:

- OEM (Original Equipment Manufacturer): Fibers supplied directly to automotive manufacturers for new vehicle assembly.

- Aftermarket: Fibers supplied for replacement parts, repairs, and customization in existing vehicles.

Value Chain Analysis For Passenger Car Flame Retardant Fiber Market

The value chain for the Passenger Car Flame Retardant Fiber market is a complex ecosystem involving multiple stages, from raw material sourcing to end-product integration, all crucial for delivering safe and effective automotive components. The upstream analysis begins with the extraction and processing of fundamental raw materials, which include petrochemicals for synthetic fibers (like polyester, polypropylene, and aramid precursors), natural polymers, and various inorganic chemicals and compounds that serve as flame retardant additives (e.g., halogenated compounds, phosphorus-based compounds, metal hydroxides, silicones). Key players at this stage are chemical companies and basic fiber producers who supply these foundational ingredients. The next step involves the manufacturing of flame retardant fibers, where these raw materials are either inherently spun into fire-resistant textiles (e.g., aramid, modacrylic) or existing fibers are chemically treated and compounded with flame retardant additives during the polymerization, spinning, or finishing stages. This critical manufacturing process requires specialized machinery, advanced chemical expertise, and stringent quality control to ensure the fibers meet specific flammability standards.

Moving downstream, the flame retardant fibers are then supplied to textile manufacturers and component fabricators. These entities process the raw fibers into various automotive textiles, such as woven fabrics for seating, non-woven materials for headliners and carpets, and knit fabrics for door panel inserts. This stage often involves dyeing, cutting, sewing, and molding processes to create semi-finished or finished interior components. These components are then delivered to automotive original equipment manufacturers (OEMs). The OEMs integrate these flame-retardant parts into the final assembly of passenger cars, ensuring they comply with all relevant safety regulations and design specifications. This direct distribution channel to OEMs is the predominant route for flame retardant fibers in new vehicle production. The aftermarket segment, while smaller, involves the distribution of replacement parts and specialized materials through automotive parts suppliers, distributors, and repair shops, serving vehicle owners seeking repairs, upgrades, or customizations.

The distribution channel for flame retardant fibers is primarily direct-to-customer for large-volume OEM orders, often involving long-term supply agreements and stringent quality audits. This direct approach fosters close collaboration between fiber manufacturers, textile processors, and OEMs, allowing for co-development and custom solutions. Indirect channels exist predominantly within the aftermarket, where smaller quantities of specialized flame retardant fabrics or components might pass through a network of distributors, wholesalers, and retailers before reaching independent repair shops or individual consumers. The efficiency and reliability of both direct and indirect channels are critical for the market's seamless operation, ensuring that high-quality, compliant flame retardant materials are available where and when needed, contributing significantly to overall vehicle safety and compliance. The entire value chain emphasizes rigorous testing, certification, and traceability to uphold the integrity and performance of flame retardant fibers from raw material to final vehicle integration.

Passenger Car Flame Retardant Fiber Market Potential Customers

The primary potential customers and end-users of Passenger Car Flame Retardant Fiber are multifaceted, spanning various stages of the automotive manufacturing and maintenance lifecycle. Foremost among these are the global automotive Original Equipment Manufacturers (OEMs). These major car manufacturers, including giants like Toyota, Volkswagen, General Motors, Ford, Hyundai, BMW, Mercedes-Benz, Tesla, and numerous others, are the largest purchasers. Their demand is driven by the necessity to comply with stringent national and international fire safety regulations for vehicle interiors, such as FMVSS 302, ECE R118, and various regional standards. OEMs require large volumes of consistent, high-quality flame retardant fibers for integration into the new vehicles they produce annually, covering everything from seat upholstery to headliners and carpets. Their purchasing decisions are influenced not only by regulatory compliance but also by brand reputation, consumer safety expectations, cost-effectiveness, and the desire for lightweight, durable, and aesthetically pleasing interior materials that offer superior fire protection.

Beyond the direct automotive OEMs, the market also serves a critical segment of Tier 1 and Tier 2 suppliers within the automotive ecosystem. These suppliers specialize in manufacturing specific interior components like seats, floor systems, headliner modules, and door panels. Companies such as Lear Corporation, Adient, Forvia (Faurecia and Hella), Continental AG, Magna International, and others, often purchase flame retardant fibers or treated fabrics from specialist textile manufacturers. They then incorporate these materials into their sub-assemblies before supplying them to the OEMs. Their role is pivotal in processing the raw flame retardant fibers into finished or semi-finished components, ensuring that these parts meet the fire safety specifications provided by the car manufacturers. This segment requires a stable supply of diverse fiber types and grades, often engaging in co-development efforts with fiber producers to meet evolving design and performance requirements, highlighting the collaborative nature of the automotive supply chain for safety-critical materials.

Finally, the aftermarket segment constitutes another important, albeit smaller, customer base. This includes independent automotive repair shops, upholstery specialists, custom car builders, and individual vehicle owners. These customers purchase flame retardant fabrics and components for vehicle repairs, interior refurbishment, upgrades, or personalization. While their individual purchase volumes are significantly lower than OEMs or Tier 1 suppliers, their collective demand contributes to a steady revenue stream for specialized distributors and retailers. The aftermarket emphasizes availability, ease of installation, and adherence to replacement standards. With the increasing lifespan of vehicles and the growing trend towards vehicle customization, this segment provides a continuous demand for flame retardant fibers and finished textile products, ensuring that safety standards can be maintained even in older vehicles or those undergoing significant modifications. The growth of the electric vehicle market also creates new customer segments, particularly for specialized flame retardant materials required for battery enclosures and high-voltage cabling systems, expanding the customer landscape beyond traditional interior applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, Inc., Teijin Limited, Lenzing AG, Milliken & Company, Toray Industries, Inc., Toyobo Co., Ltd., BASF SE, Indorama Ventures Public Company Limited, Huvis Corporation, Reliance Industries Limited, Solvay S.A., FRX Polymers, Inc., Kaneka Corporation, Trevira GmbH, SGL Carbon SE, Asahi Kasei Corporation, Kolon Industries, Inc., Rhodia (Solvay Group), Celanese Corporation, Mitsubishi Chemical Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passenger Car Flame Retardant Fiber Market Key Technology Landscape

The Passenger Car Flame Retardant Fiber market is characterized by a rapidly evolving technology landscape, driven by the dual imperatives of enhanced safety performance and environmental sustainability. A core technological thrust involves the development of inherently flame retardant (IFR) fibers, such as aramids (e.g., meta-aramid, para-aramid) and modacrylics. These fibers possess flame resistance built into their molecular structure, offering durable protection that cannot be washed out or worn away. Recent advancements in IFR fiber technology focus on improving their processability, dyeability, and textile aesthetics, making them more versatile for various automotive interior applications without compromising their critical fire safety attributes. Another significant area of innovation is the development and application of advanced flame retardant (FR) additives. This includes phosphorus-based compounds, which are gaining prominence as effective halogen-free alternatives, offering excellent charring capabilities and smoke suppression. Similarly, metal hydroxides (e.g., magnesium hydroxide, aluminum hydroxide) are utilized for their endothermic decomposition properties, releasing water and cooling the burning material, thus acting as a smoke suppressant and flame inhibitor. Nanomaterials, such as nanoclay and carbon nanotubes, are also being explored for their ability to enhance the barrier properties and thermal stability of fibers, often in synergistic combinations with traditional FR additives, creating multi-functional materials that offer superior protection at lower loading levels.

Beyond the intrinsic properties of the fibers and additives, processing technologies play a crucial role in the market. Advanced compounding techniques are used to uniformly disperse FR additives into polymer matrices before spinning, ensuring consistent flame retardancy throughout the fiber. Specialized spinning methods, including melt spinning, wet spinning, and dry spinning, are continuously optimized to produce fibers with desired physical properties and enable the incorporation of various FR chemistries. Furthermore, surface treatment technologies, such as plasma treatment and sol-gel coatings, are being developed to impart or enhance flame retardancy on existing non-FR fibers or fabrics. These surface modifications offer a cost-effective way to upgrade materials and expand their application scope within vehicle interiors. The integration of smart textile technologies is also emerging, with research focused on fibers that can sense heat or smoke and trigger active fire suppression systems, moving beyond passive protection to a more proactive safety approach. This involves embedding micro-sensors or conductive elements within the fiber structure, which can communicate with the vehicle's electronic systems, adding a new dimension to automotive fire safety.

A major technological trend is the rigorous shift towards sustainable and eco-friendly flame retardant solutions. This includes a strong focus on halogen-free flame retardants (HFFRs) to eliminate concerns related to toxic gas emissions during combustion and environmental persistence. Bio-based flame retardants derived from natural sources, such as lignin, starch, and cellulose derivatives, are actively being researched and commercialized, aiming to provide sustainable alternatives that reduce the environmental footprint of automotive materials. Additionally, advancements in recycling technologies for flame retardant fibers are crucial, as end-of-life vehicle dismantling and material recovery gain importance. Technologies that allow for the separation and reuse of flame retardant treated fibers are under development, contributing to a circular economy in the automotive sector. The overall technological landscape is thus characterized by a holistic approach, integrating material science, chemical engineering, textile manufacturing, and environmental considerations to deliver next-generation flame retardant fibers that are not only highly effective in preventing fires but also align with global sustainability mandates and the evolving requirements of electric and autonomous vehicles, pushing the boundaries of what is possible in automotive safety materials.

Regional Highlights

- North America: A mature market driven by stringent safety regulations (FMVSS 302) and a strong demand for high-performance and luxury vehicles. Significant R&D investment in sustainable, halogen-free solutions. The growing EV market further fuels demand for specialized fire protection.

- Europe: Characterized by highly evolved safety standards (ECE R118) and a strong emphasis on environmental regulations, pushing for bio-based and halogen-free flame retardants. Germany, France, and the UK are key contributors, with robust automotive manufacturing and a focus on premium segments and electric mobility.

- Asia Pacific (APAC): The largest and fastest-growing market due to high-volume automotive production in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and improving safety standards are driving demand across all vehicle segments. This region is a major hub for both production and consumption of flame retardant fibers.

- Latin America: An emerging market with increasing automotive production and growing awareness of vehicle safety. Brazil and Mexico are leading countries, attracting investments from global OEMs. Demand for flame retardant fibers is steadily rising as safety standards gradually align with international norms.

- Middle East & Africa (MEA): A developing market with nascent but growing automotive manufacturing capabilities and increasing imports. Demand is influenced by rising disposable incomes and infrastructure development. The adoption of global safety standards is slower but progressing, creating future opportunities for flame retardant fiber suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passenger Car Flame Retardant Fiber Market.- DuPont de Nemours, Inc.

- Teijin Limited

- Lenzing AG

- Milliken & Company

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- BASF SE

- Indorama Ventures Public Company Limited

- Huvis Corporation

- Reliance Industries Limited

- Solvay S.A.

- FRX Polymers, Inc.

- Kaneka Corporation

- Trevira GmbH

- SGL Carbon SE

- Asahi Kasei Corporation

- Kolon Industries, Inc.

- Rhodia (Solvay Group)

- Celanese Corporation

- Mitsubishi Chemical Corporation

Frequently Asked Questions

What are the primary drivers for the Passenger Car Flame Retardant Fiber market's growth?

The market is primarily driven by increasingly stringent global automotive safety regulations, rising passenger car production, continuous technological advancements in fiber and additive development, and a growing consumer demand for enhanced vehicle safety features. The shift towards electric vehicles also creates new specialized demand.

What types of flame retardant fibers are commonly used in passenger cars?

Commonly used flame retardant fiber types include polyester, aramid, modacrylic, and polypropylene. These are either inherently flame retardant or treated with specialized chemical additives, selected based on application requirements, performance needs, and cost considerations for various interior components.

How is the market impacted by the rise of Electric Vehicles (EVs)?

The rise of EVs significantly impacts the market by introducing new fire safety challenges, particularly around high-voltage battery packs and electrical systems. This necessitates the development and adoption of specialized, high-performance flame retardant fibers for battery enclosures, cabling, and enhanced interior protection, creating a substantial new growth opportunity.

What role do regulations like FMVSS 302 play in this market?

Regulations such as FMVSS 302 (Federal Motor Vehicle Safety Standard) in the US and ECE R118 in Europe are foundational. They mandate specific flammability performance for interior materials, compelling automotive manufacturers to integrate compliant flame retardant fibers, thereby directly shaping demand and product development in the market.

What are the key trends in sustainable flame retardant fiber development?

Key sustainable trends include a strong focus on developing halogen-free flame retardants (HFFRs) to mitigate toxic gas emissions and environmental impact. There is also increasing research and commercialization of bio-based flame retardants derived from natural sources, aiming to provide eco-friendly alternatives without compromising fire safety performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager