Passenger Elevators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433178 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Passenger Elevators Market Size

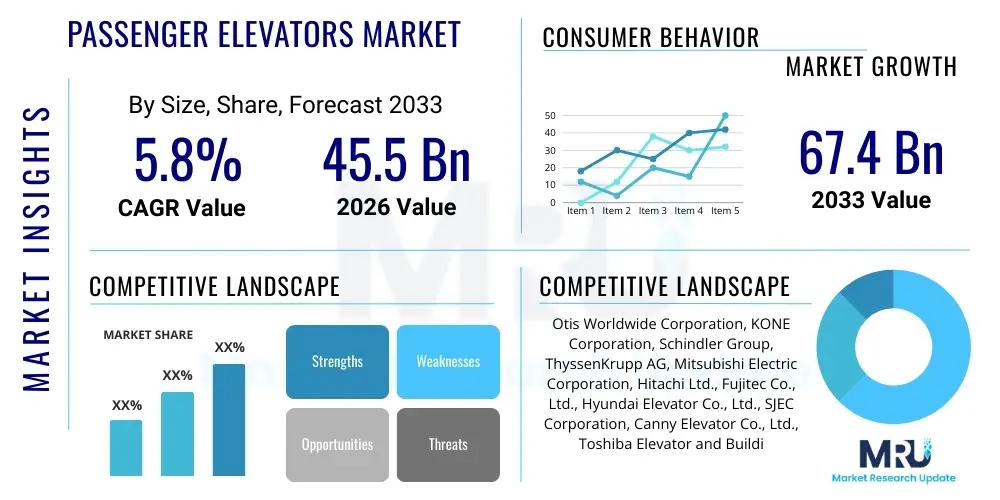

The Passenger Elevators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.4 Billion by the end of the forecast period in 2033.

The expansion is predominantly driven by rapid urbanization across emerging economies, coupled with increased focus on infrastructure development, particularly in high-rise residential and commercial buildings. Sustained global population growth requires efficient vertical transport solutions, making passenger elevators essential components of modern architecture. Furthermore, the stringent safety regulations and the growing demand for smart, energy-efficient lifting solutions contribute significantly to market valuation increases year over year.

A key factor bolstering market size is the large installed base of elevators requiring periodic modernization and maintenance. Developed regions, such as North America and Europe, exhibit high demand for replacing aging elevator systems with technologically advanced, IoT-enabled units that offer enhanced performance and reduced energy consumption. This modernization segment, complementing new installations, ensures robust and stable market growth throughout the forecast period.

Passenger Elevators Market introduction

The Passenger Elevators Market encompasses the design, manufacturing, installation, and maintenance of various vertical transportation systems primarily used for moving people within buildings and structures. Products range from conventional hydraulic and traction elevators to advanced machine-room-less (MRL) systems and high-speed units tailored for skyscrapers. These systems are indispensable in diverse sectors, including residential complexes, commercial offices, healthcare facilities, and retail environments, where they enhance accessibility, optimize space utilization, and improve the overall flow of traffic within multi-story structures.

Major applications of passenger elevators include high-traffic public transit hubs, luxury residential towers requiring bespoke interior finishes, and corporate headquarters demanding high-speed, efficient movement. The core benefit provided by these systems is enabling architects to design vertically expansive buildings, thereby maximizing usable urban real estate. Driving factors for this market include evolving global safety codes, governmental investment in smart city projects, increasing average building height globally, and technological innovations focusing on energy regeneration and predictive maintenance capabilities.

The industry is characterized by fierce competition centered on technological differentiation, especially in areas like sensor integration, destination control systems, and predictive maintenance protocols. Manufacturers are increasingly focused on developing sustainable, resource-efficient elevator systems that align with global green building standards, positioning the market as a crucial enabler of modern, sustainable infrastructure development.

Passenger Elevators Market Executive Summary

The global Passenger Elevators Market demonstrates resilient growth fueled by a confluence of accelerating infrastructure development in Asia Pacific and mandatory modernization cycles in established Western markets. Business trends highlight a pronounced shift towards Machine-Room-Less (MRL) technology due to its space-saving benefits and installation flexibility, particularly in mid-rise construction. Key industry players are aggressively investing in digital services, integrating IoT sensors and cloud-based platforms to offer advanced maintenance contracts, thereby shifting revenue streams from purely hardware sales to comprehensive service provision.

Regionally, Asia Pacific maintains its dominance, driven primarily by massive urban expansion projects in China, India, and Southeast Asian nations. However, North America and Europe show robust growth in the modernization and servicing segments, where compliance with stricter efficiency and safety standards necessitates the upgrade of existing fleets. Political stability and favorable regulatory environments in key developing markets are critical determinants of the pace of new installation growth, while concerns over commodity price volatility impact manufacturing margins across all regions.

Segment-wise, traction elevators continue to hold the largest market share due to their superior efficiency and speed for high-rise applications. However, the commercial segment (office spaces, hotels) is expected to exhibit the fastest growth, primarily due to the global return to office mandates and sustained investment in commercial real estate refurbishment. The maintenance and repair services segment is emerging as the most stable and profitable component of the value chain, ensuring long-term recurring revenue for major original equipment manufacturers (OEMs).

AI Impact Analysis on Passenger Elevators Market

Common user questions regarding AI's impact on the Passenger Elevators Market often revolve around predictive maintenance efficacy, optimization of traffic flow, and job displacement among technicians. Users are primarily concerned with how Artificial Intelligence can transform the traditionally reactive maintenance model into a proactive one, seeking evidence of tangible operational cost reductions and enhanced safety records. They frequently ask about the role of machine learning algorithms in analyzing elevator usage patterns to dynamically adjust scheduling, minimizing wait times during peak hours. Furthermore, significant interest exists regarding the integration of AI-powered security features, such as facial recognition for access control, and the deployment of AI in destination control systems to handle complex multi-car scenarios efficiently.

AI integration is fundamentally redefining the operational efficiency and safety profile of vertical transportation systems. Machine learning algorithms process continuous data streams from embedded IoT sensors—monitoring components like ropes, brakes, and motors—to accurately predict potential failures before they occur. This shift from calendar-based maintenance to condition-based predictive maintenance significantly reduces system downtime and extends the operational lifespan of the equipment. Consequently, building owners benefit from optimized resource allocation and minimized disruption, addressing a primary pain point in facility management.

Beyond diagnostics, AI is crucial for optimizing the user experience. AI-driven destination control systems use sophisticated algorithms to group passengers traveling to the same floors and assign them the most suitable elevator, drastically improving handling capacity and decreasing energy expenditure associated with unnecessary stops. This intelligent traffic management is particularly vital in large commercial and institutional buildings where optimizing vertical throughput is essential for operational performance and tenant satisfaction.

- AI-Powered Predictive Maintenance: Reduces unplanned downtime by forecasting component failures.

- Intelligent Destination Control: Optimizes passenger grouping and car assignments, reducing wait times by up to 30%.

- Real-time Performance Monitoring: Analyzes sensor data (vibration, temperature, current draw) for immediate anomaly detection.

- Energy Optimization: Machine learning algorithms adjust lift operation speeds and standby modes based on forecasted building traffic.

- Enhanced Security and Access Control: Integration of facial recognition and anomaly detection in car interiors.

- Remote Diagnostics and Troubleshooting: Enables technicians to remotely identify and potentially resolve minor issues, minimizing site visits.

- Component Life Cycle Management: Provides precise estimates of remaining useful life for high-wear parts.

DRO & Impact Forces Of Passenger Elevators Market

The Passenger Elevators Market is driven by global urbanization and infrastructure spending (Drivers), but faces significant headwinds from intense price competition and high capital investment requirements (Restraints). Opportunities emerge primarily through digital transformation, leveraging IoT and AI for enhanced service offerings (Opportunity). These forces collectively create a dynamic market environment where safety regulations and technological innovation act as powerful stabilizing and growth-accelerating impact forces, respectively.

Drivers: Urbanization is the paramount driver, particularly in Asia Pacific, where population density necessitates the construction of taller buildings. Government investment in infrastructure, smart city initiatives, and mandates for accessibility (e.g., ADA compliance) further stimulate demand. The focus on energy efficiency also encourages the adoption of gearless traction and MRL technologies, replacing older, less efficient hydraulic systems, especially in modernization projects across developed nations.

Restraints: The primary restraint is the high initial cost of installation, particularly for high-speed, custom-designed systems required in super-tall buildings. Furthermore, the market faces significant delays due to the complex regulatory approval processes and shortage of highly skilled installation and maintenance technicians globally. Economic downturns leading to stagnant construction activities can immediately and severely impact new installation volumes.

Opportunities: Major opportunities reside in expanding service contracts leveraging advanced digital technologies. The vast installed base offers a continuous stream of revenue through modernization projects focused on energy regeneration, predictive analytics, and safety upgrades. Emerging markets in Africa and Latin America, still in early stages of high-rise development, present untapped potential for new installations in the medium to long term. Development of standardized, modular, and affordable elevator solutions for mid-rise affordable housing also represents a significant growth vector.

Impact Forces: The impact forces are centered around mandatory safety standards (e.g., ASME A17.1, EN 81 series), which necessitate continuous product evolution and upgrades, acting as a crucial non-discretionary spending driver. Technological substitution, specifically the emergence of advanced rope technologies and ultra-lightweight materials, lowers operational weight and enhances performance parameters. Market consolidation through mergers and acquisitions among regional and global players is also a significant force shaping competitive dynamics and pricing strategies.

Segmentation Analysis

The Passenger Elevators Market is highly fragmented yet structured around key technological, operational, and application parameters. Segmentation based on technology helps differentiate efficiency, speed, and suitability for various building heights, with traction and MRL elevators dominating modern installations. Segmentation by service model distinguishes between lucrative long-term maintenance contracts and highly competitive new installation projects. Furthermore, end-user segmentation clearly outlines demand profiles, distinguishing the high-volume residential segment from the high-specification commercial sector. Understanding these segments is crucial for manufacturers to tailor their product lines, service strategies, and regional market entry initiatives effectively.

- By Type/Technology:

- Traction Elevators (Geared and Gearless)

- Hydraulic Elevators

- Machine-Room-Less (MRL) Elevators

- Pneumatic/Vacuum Elevators (Niche)

- By End-User Application:

- Residential (High-rise and Mid-rise housing, Apartments)

- Commercial (Office buildings, Corporate headquarters)

- Industrial/Institutional (Hospitals, Universities, Government buildings)

- Retail and Hospitality (Hotels, Shopping malls, Airports)

- By Service:

- New Installation

- Modernization

- Maintenance and Repair

- By Speed:

- Low Speed (Up to 1.0 m/s)

- Medium Speed (1.0 m/s to 2.5 m/s)

- High Speed (Above 2.5 m/s)

Value Chain Analysis For Passenger Elevators Market

The Passenger Elevators Value Chain begins with the upstream sourcing of critical components, including specialized motors, ropes, control systems (PLCs, VFDs), and cabin materials (steel, glass, decorative finishes). Key upstream activities involve R&D focused on proprietary motor designs and advanced control algorithms, ensuring high efficiency and safety compliance. The industry relies heavily on a specialized supplier base for high-precision safety components and sophisticated sensor technology, making vertical integration in manufacturing advantageous for market leaders.

Midstream activities involve core manufacturing, assembly, and rigorous testing of the units. This stage is capital-intensive, requiring advanced robotic assembly lines and quality assurance protocols. Distribution is handled through a mix of direct sales channels, especially for large institutional projects where direct OEM involvement is mandatory, and indirect channels involving certified distributors and local installation partners for smaller, decentralized projects. The strength of the service network is a critical competitive differentiator in this phase.

Downstream activities are dominated by installation, commissioning, and, most importantly, the long-term maintenance and modernization services. Installation is highly specialized and subject to local building codes, requiring certified, trained personnel. The service segment represents the most significant margin opportunity; direct channels ensure quality control and capture the high-value recurring revenue associated with predictive maintenance contracts, while indirect channels are often used in remote or niche geographic markets to ensure local responsiveness.

Passenger Elevators Market Potential Customers

The primary customers for the Passenger Elevators Market are large real estate developers and construction conglomerates initiating new vertical developments. These buyers prioritize reliability, safety compliance, energy efficiency, and aesthetic customization to meet the demands of future tenants or occupants. Institutional clients, such as governmental bodies developing hospitals, educational campuses, or public housing projects, represent another significant customer segment, typically driven by rigorous tender processes prioritizing lifecycle cost and robust performance metrics.

A rapidly growing customer base comprises property management companies and building owners who drive the modernization segment. These buyers focus less on new construction and more on upgrading existing infrastructure to comply with new safety standards, enhance tenant experience (e.g., through improved speed and smart controls), and reduce operational energy expenditure. This group often seeks comprehensive, long-term maintenance packages bundled with technological upgrades (IoT sensors, remote diagnostics).

The final, specialized customer segment includes niche applications like private high-end residential customers seeking luxury, bespoke elevators, and industrial customers requiring heavy-duty passenger/freight combination lifts. Purchase decisions across all segments are heavily influenced by the OEM's reputation for quality, the availability of localized service support, and adherence to international safety certifications, positioning the market as relationship-driven and expertise-focused.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.4 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Otis Worldwide Corporation, KONE Corporation, Schindler Group, ThyssenKrupp AG, Mitsubishi Electric Corporation, Hitachi Ltd., Fujitec Co., Ltd., Hyundai Elevator Co., Ltd., SJEC Corporation, Canny Elevator Co., Ltd., Toshiba Elevator and Building Systems Corporation, Kleemann Lifts, Wittur Group, Canton Elevator, Electra Varis, Sigma Elevator, Ningbo Xinda Group, Ascen Group, Imperial Elevator Co., GEDA GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passenger Elevators Market Key Technology Landscape

The technology landscape of the Passenger Elevators Market is defined by the integration of mechanical engineering excellence with advanced digital technologies. The dominant technological shift involves the widespread adoption of Gearless Traction and Machine-Room-Less (MRL) systems. Gearless technology improves energy efficiency by eliminating the gearbox, requiring less power and reducing friction losses. MRL systems, which house the mechanical components within the hoistway, allow for greater architectural flexibility and lower construction costs by removing the traditional rooftop machine room, making them highly preferred for mid-rise structures globally.

Beyond core mechanical advancements, the market is undergoing a profound digital transformation fueled by the Internet of Things (IoT) and Artificial Intelligence (AI). Modern elevators are equipped with hundreds of sensors that monitor speed, vibration, temperature, door functionality, and overall system health in real-time. This continuous data feed supports cloud-based platforms that enable predictive maintenance, diagnostics, and remote software updates. Destination Control Systems (DCS) utilizing sophisticated algorithms are becoming standard in high-traffic commercial buildings, optimizing elevator allocation and minimizing passenger congestion.

Furthermore, innovations in materials science are crucial, particularly the development of carbon fiber hoist ropes (e.g., KONE UltraRope) which significantly reduce the weight of the elevator system, allowing for taller travel distances and higher speeds without compromising safety. Safety technologies, including sophisticated door monitoring systems, seismic sensors, and communication systems (e.g., two-way video communication), are continually enhanced to meet increasingly stringent global regulatory requirements, cementing technology as the primary competitive battleground.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by unprecedented rates of urbanization and monumental government investment in housing and infrastructure, particularly in China, India, and Southeast Asian economic hubs. APAC leads in new installation volume, driven by high demand for mid-rise MRL units and high-speed traction systems for new mega-city projects.

- North America: Characterized by high maturity and strong emphasis on the modernization and maintenance segments. Growth is driven by stringent safety code updates (e.g., ASME A17.1), necessitating replacement of hydraulic systems, and a strong preference for smart, connected elevators that integrate seamlessly with smart building management systems (BMS).

- Europe: Exhibits steady, conservative growth, primarily focused on modernization and sustainability initiatives. European markets prioritize energy efficiency (regenerative drives) and low-noise operation. Regulatory compliance with the EN 81 series drives recurring revenue in the maintenance and repair sectors, ensuring a stable market environment.

- Latin America (LATAM): A promising emerging market with growth tied directly to national economic stability and commercial development in Brazil, Mexico, and Chile. Demand is increasing for reliable, cost-effective solutions, often sourced through indirect distribution channels or local assembly partnerships.

- Middle East and Africa (MEA): Growth is highly concentrated in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to ambitious mega-projects and tourism infrastructure development. This region demands ultra-high-speed, specialized elevators for iconic super-tall towers, necessitating bespoke engineering solutions and premium service contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passenger Elevators Market.- Otis Worldwide Corporation

- KONE Corporation

- Schindler Group

- ThyssenKrupp AG (TK Elevator)

- Mitsubishi Electric Corporation

- Hitachi Ltd.

- Fujitec Co., Ltd.

- Hyundai Elevator Co., Ltd.

- SJEC Corporation

- Canny Elevator Co., Ltd.

- Toshiba Elevator and Building Systems Corporation

- Kleemann Lifts

- Wittur Group

- Canton Elevator

- Electra Varis

- Sigma Elevator

- Ningbo Xinda Group

- Ascen Group

- Imperial Elevator Co.

- GEDA GmbH

Frequently Asked Questions

Analyze common user questions about the Passenger Elevators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving efficiency in modern passenger elevators?

The primary technology is the Machine-Room-Less (MRL) system combined with gearless traction drives and regenerative braking. MRL systems save building space, while gearless drives reduce energy consumption by up to 40% compared to traditional geared systems, maximizing operational efficiency.

How significant is the role of AI in elevator maintenance and safety?

AI is highly significant, primarily enabling predictive maintenance. Machine learning algorithms analyze continuous sensor data to forecast component degradation, allowing proactive repairs and drastically reducing unplanned downtime, thereby enhancing both safety and operational reliability.

Which geographic region presents the largest market opportunity for new elevator installations?

Asia Pacific (APAC) presents the largest market opportunity for new installations. This is driven by high population density, rapid urbanization, and massive government-led residential and commercial infrastructure projects across countries like China and India.

What is the difference between modernization and maintenance in the elevator market?

Maintenance involves routine inspections and repairs to ensure current operation and safety. Modernization involves significant upgrades—such as replacing control panels, motors, or cabs—to improve performance, efficiency, and compliance with the latest building codes, extending the elevator’s lifespan.

How do destination control systems improve traffic management in tall buildings?

Destination control systems (DCS) utilize sophisticated software to group passengers based on their destination floor at the lobby interface. This optimization assigns passengers to specific cars efficiently, reducing the number of stops each car makes and significantly decreasing average wait and travel times.

Strategic Outlook and Competitive Landscape

The strategic trajectory of the Passenger Elevators Market is increasingly oriented toward digital services and sustainability. Major OEMs are transitioning from being mere equipment providers to comprehensive service partners, utilizing proprietary IoT platforms to lock in long-term maintenance contracts. This strategic pivot ensures high-margin, recurring revenue streams independent of cyclical construction patterns. Investment in proprietary software and cybersecurity features for connected elevators is now critical, providing a distinct competitive edge against competitors focused solely on mechanical performance. Companies are focusing their research efforts on reducing the carbon footprint of their products, integrating features such as standby power modes, light-emitting diode (LED) lighting, and highly efficient regenerative drives, aligning with corporate sustainability mandates.

The competitive landscape is dominated by a few global giants known as the 'Big Four' (Otis, KONE, Schindler, and TK Elevator), who maintain market share through extensive global distribution networks and technological superiority. However, regional manufacturers, particularly those based in China (e.g., Canny, Hyundai, SJEC), are rapidly gaining ground by offering cost-effective, reliable MRL solutions for the fast-growing mid-rise residential segment in emerging markets. Mergers and acquisitions remain a constant feature, used by market leaders to acquire specialized technology firms (e.g., software or sensor manufacturers) or to expand their service footprint in localized geographies.

Future growth relies heavily on successful innovation adoption. Key players are strategically focused on developing touchless interfaces (e.g., using gesture control or voice commands) in response to heightened hygiene concerns following global health events. Furthermore, the capacity for high-speed connectivity and seamless integration with other building technologies, such as access control and emergency systems, will differentiate leading suppliers. Successful market strategy involves balancing initial product cost with the lifetime value derived from integrated service contracts and modernization revenues.

Market Dynamics By Elevator Technology

The market share distribution among elevator technologies is undergoing a rapid transformation, shifting away from conventional hydraulic and geared systems toward MRL and gearless traction solutions. Hydraulic elevators, while cost-effective for low-rise applications (2–5 floors), face pressure due to their lower energy efficiency and dependence on oil-based components, leading to decreased adoption in new construction where environmental standards are high. They maintain relevance primarily in specific heavy-duty industrial or low-rise retrofit applications where pit depth is a concern.

Gearless traction elevators, conversely, are the technology of choice for high-rise and ultra-high-rise buildings, offering superior speed, high efficiency, and minimal noise. Innovations like lighter suspension media (belts or carbon fiber ropes) are extending their travel capabilities, cementing their dominance in the commercial and institutional high-end segments. The MRL variant of traction technology is arguably the most disruptive, capturing significant market volume in the mid-rise (5–15 floors) category, traditionally served by geared traction. MRL’s compact footprint appeals immensely to architects and developers aiming to maximize rentable space within a building.

Manufacturers are consistently phasing out older geared systems in favor of gearless models across their product portfolios due to regulatory push for energy efficiency. This transition is not only evident in new installations but also forms the core rationale behind most modernization projects. The long-term trend suggests further technological convergence, with all major players investing heavily in standardizing high-efficiency, digitally connected, and space-saving MRL systems for the vast majority of urban construction projects.

- Gearless Traction: Highly favored for speed and efficiency; mandatory for super-tall skyscrapers and high-end commercial projects.

- Machine-Room-Less (MRL): Highest growth segment; ideal for mid-rise residential and commercial buildings due to space optimization and ease of installation.

- Hydraulic: Declining share in new installations; maintains stronghold in low-rise niche markets requiring robust, cost-effective solutions (e.g., specialized lifting, accessibility lifts).

- Advanced Roping Systems: Deployment of lighter, stronger synthetic or carbon fiber ropes enhances efficiency and allows for greater travel height compared to traditional steel ropes.

Service Segment Analysis: Maintenance, Modernization, and New Installation

The service segment, comprising maintenance, modernization, and new installation, is crucial for market stability and long-term profitability. New installation accounts for the largest share in terms of initial project value but is highly volatile, being directly exposed to fluctuations in the global construction economy. Competition in the new installation segment is intense, often leading to compressed margins as OEMs vie for large, anchor projects in high-growth regions like APAC.

In contrast, the maintenance and repair segment provides the most stable and high-margin revenue stream. This segment is characterized by long-term contractual relationships (often spanning 5 to 10 years) and high barriers to entry due to the necessity for proprietary technical expertise and certified parts. The shift towards predictive maintenance, enabled by IoT and AI, is enhancing the profitability of service contracts by reducing emergency callouts and optimizing technician scheduling, transforming service operations into a highly efficient profit center.

Modernization represents the fastest-growing segment in developed markets, acting as a buffer against construction slowdowns. Aging elevator fleets in North America and Europe, often reaching their 20-30 year operational lifespan, require mandatory safety and efficiency upgrades. Modernization projects typically involve replacing control systems, drives, and car interiors, allowing OEMs to re-engage with existing customers, often using the latest MRL or gearless technology to improve energy consumption and prolong the asset life, making it a critical strategic focus area for all major market participants.

- New Installation: Highest volume driver; volatile revenue tied to construction cycles; dominated by APAC growth.

- Maintenance and Repair: Most stable and profitable segment; relies on long-term contracts and digital service platforms (e.g., remote monitoring, predictive analytics).

- Modernization: Fastest growth in mature markets; driven by mandatory safety compliance, energy efficiency upgrades, and improving aesthetics/user experience.

- Service Differentiation: Competitive advantage achieved through quicker response times, proprietary software integration, and certified parts availability.

End-User Application Insights

The Passenger Elevators Market demand profile is heavily segmented by end-user application, with residential and commercial segments representing the largest consumption centers. The residential sector, encompassing high-rise apartment complexes and luxury condominiums, drives high volume for standardized MRL elevators. Demand in this sector is highly sensitive to housing starts and urbanization trends, prioritizing reliability, lower lifetime operational cost, and aesthetic integration.

The commercial sector, which includes corporate offices, financial centers, and high-end retail, demands premium specifications. This sector requires high-speed elevators, sophisticated destination control systems to manage intense peak-hour traffic, and premium interior finishes. Furthermore, commercial buildings often require enhanced security integration and compliance with strict fire and emergency regulations, leading to higher average unit prices and greater complexity in installation and commissioning.

The institutional and public sector (hospitals, universities, government buildings) focuses heavily on specialized requirements such as large-capacity beds lifts, strict accessibility compliance (e.g., wider doors, auditory signaling), and extreme durability to withstand high volumes of traffic and potential misuse. Purchasing decisions in this segment are often driven by long-term operational costs and proven track records of safety and reliability, usually managed through public tender processes prioritizing lifecycle costing over initial purchase price.

- Residential Segment: Highest volume buyer, preference for MRL technology, driving demand for energy efficiency and low noise.

- Commercial Segment: Highest value per unit; demands high-speed, DCS integration, and sophisticated aesthetic customization.

- Institutional Segment (Healthcare/Education): Focus on specialized requirements (capacity, hygiene, accessibility); long-term reliability and heavy-duty usage are critical factors.

- Retail and Hospitality: Emphasizes aesthetics, smooth ride quality, and integration with building flow management systems to enhance guest/shopper experience.

Regulatory Landscape and Safety Standards

The stringent regulatory environment is a primary non-discretionary driver of demand in the Passenger Elevators Market, impacting everything from design and component sourcing to installation and service schedules. Global safety standards, notably the EN 81 series in Europe and ASME A17.1/CSA B44 in North America, mandate specific safety features, testing protocols, and maintenance frequency. These standards ensure passenger safety but also impose considerable costs and technical requirements on manufacturers and building operators, effectively creating high entry barriers for new market entrants.

Regulatory updates often force modernization cycles. For instance, revisions concerning seismic safety, fire resistance, or hoistway access necessitate compulsory upgrades for older elevator systems to remain compliant, providing steady revenue for the modernization segment. Authorities having jurisdiction (AHJs) enforce these codes, requiring periodic inspections and certifications. Manufacturers must maintain rigorous quality control and traceability for all critical components to demonstrate compliance throughout the product lifecycle.

Furthermore, energy efficiency regulations are becoming increasingly important, particularly in Europe and parts of Asia, pushing manufacturers toward adopting ISO 25745 standards for measuring and reducing elevator energy consumption. Compliance with these technical and environmental mandates requires continuous investment in R&D and specialized training for technicians, underscoring the necessity of technical expertise across the value chain to operate successfully in the global passenger elevator industry.

- Key Regulatory Bodies: EN (European Standards), ASME (American Society of Mechanical Engineers), CSA (Canadian Standards Association).

- Mandatory Compliance: Essential for operational legality; drives demand for scheduled modernization and replacement of non-compliant parts.

- Focus Areas: Car door safety, overspeed protection, remote monitoring of safety circuits, and emergency communication systems.

- Environmental Standards: Growing requirement for adherence to ISO 25745 (Energy Performance of Elevators and Escalators) to demonstrate sustainable operation.

Market Challenges and Mitigation Strategies

One of the most pressing challenges facing the Passenger Elevators Market is the global shortage of highly skilled elevator mechanics and installation specialists. Installation and maintenance work requires specialized, often proprietary, training and adherence to rigorous safety standards. This labor shortage drives up operational costs and can cause project delays, particularly in large-scale infrastructure projects. OEMs are mitigating this by investing heavily in specialized apprenticeship programs, utilizing augmented reality (AR) tools for remote guidance and training, and designing modular systems that require less complex on-site assembly.

Another significant challenge is managing raw material volatility, particularly the price fluctuations of steel, copper, and specialized polymers used in control systems. These commodities constitute a substantial portion of manufacturing costs, directly impacting pricing strategies and profit margins, especially in fixed-price installation contracts. Companies are addressing this through improved supply chain risk management, strategic long-term procurement contracts, and exploring alternative lightweight materials like composites and aluminum alloys where appropriate, reducing reliance on single commodity markets.

Furthermore, intense price competition, particularly in the mass-market residential segment where Asian manufacturers offer highly competitive pricing, pressures margins globally. Mitigation strategies include focusing on the high-value service segment, differentiating products through proprietary IoT connectivity and AI services (which cannot be easily replicated by low-cost competitors), and emphasizing superior safety records and lifecycle cost savings rather than just the initial purchase price.

- Skilled Labor Shortage: Addressed via advanced technical training, AR-assisted remote maintenance, and modular design for faster installation.

- Material Price Volatility: Managed through hedging strategies, diversifying the supply chain, and utilizing material substitution (e.g., carbon fiber).

- Price Competition: Mitigated by focusing on service revenue, proprietary digital differentiation, and showcasing superior product lifecycle value and safety certifications.

- Cybersecurity Risks: Protecting connected IoT control systems from unauthorized access is managed through robust encryption protocols and continuous software update cycles.

Key Future Trends in Passenger Elevators

The future of the Passenger Elevators Market is highly synchronized with the broader smart building and connectivity megatrends. The adoption of the elevator as a fully connected device, integrated into the Building Management System (BMS), is inevitable. This integration allows elevators to communicate not only diagnostics but also share user data, energy consumption profiles, and security alerts across the building network, enabling truly holistic facility management and responsiveness.

Another critical trend is the advancement of horizontal/vertical transport systems. While currently niche, multi-directional systems (like ThyssenKrupp's MULTI) that use magnetic levitation technology instead of conventional ropes promise to revolutionize transport in ultra-tall or structurally complex buildings. These systems offer multiple cars operating in a single shaft, significantly reducing the required number of hoistways and enhancing handling capacity, fundamentally changing architectural design possibilities.

Finally, user experience enhancements are driving innovation. Touchless controls—ranging from foot sensors and gesture interfaces to mobile application control—are becoming standard post-pandemic features, prioritizing hygiene and convenience. Furthermore, in-car information and advertising systems that provide personalized content based on passenger profiles or floor destinations are transforming the elevator experience from a transit utility into a dynamic digital touchpoint within the building.

- Seamless BMS Integration: Elevators functioning as key networked components within intelligent building ecosystems.

- Multi-directional Transport: Development and commercialization of rope-less, horizontally and vertically moving systems (e.g., maglev technology).

- Touchless and Hygienic Interfaces: Wide-scale adoption of voice control, mobile apps, and gesture sensors for floor selection.

- Energy Regeneration Standardization: Making regenerative drives standard across all new traction elevator installations to feed energy back into the building grid.

- Augmented Reality Service: Use of AR headsets by technicians for maintenance and complex troubleshooting, improving accuracy and speed.

The commitment to innovation across safety, speed, and intelligence positions the Passenger Elevators Market as a pivotal sector supporting the global transition toward smart, efficient, and vertically integrated urban environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager