Passenger Vehicle Airbag Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437729 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Passenger Vehicle Airbag Fabric Market Size

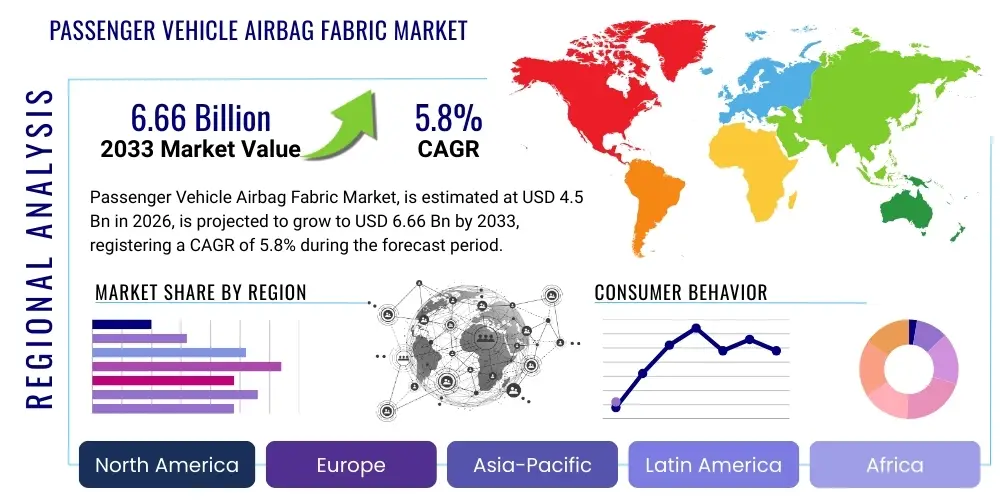

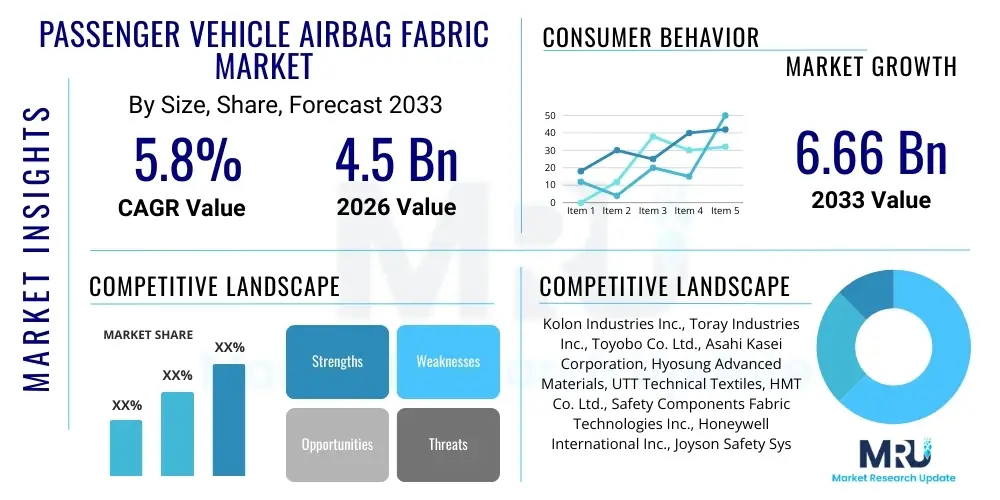

The Passenger Vehicle Airbag Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.66 Billion by the end of the forecast period in 2033.

Passenger Vehicle Airbag Fabric Market introduction

The Passenger Vehicle Airbag Fabric Market encompasses the manufacturing, supply, and distribution of specialized technical textiles used in automotive safety restraint systems, specifically airbags deployed within passenger vehicles. These fabrics are critical safety components designed to rapidly inflate upon collision, providing cushioning and preventing severe occupant injury. The fabric must meet stringent criteria for tear strength, heat resistance, porosity, and deployability under extreme conditions. The primary materials utilized are high-tenacity nylon 6,6 and, to a lesser extent, polyester, processed through highly specialized weaving and finishing techniques to ensure optimal performance during deployment sequences measured in milliseconds.

Product descriptions within this market focus heavily on technical specifications, including thread count, coating type (often silicone or neoprene), and weight per square meter, as these factors directly influence the gas permeability and shelf life of the airbag module. The major applications span all types of passenger vehicle airbags, including frontal airbags (driver and passenger side), side curtain airbags, knee airbags, and newly emerging exterior airbags and seatbelt airbags. The increasing complexity of safety architecture in modern vehicles necessitates a diverse range of fabric specifications tailored to specific deployment volumes and timings.

The core benefits driving this market are undeniable improvements in automotive safety standards globally, mandated by organizations like the National Highway Traffic Safety Administration (NHTSA) and the European New Car Assessment Programme (Euro NCAP). Key driving factors include rigorous regulatory mandates in developing economies, the rising consumer demand for higher safety ratings, and continuous technological advancements aimed at producing lighter, thinner, and more efficient fabrics that contribute to overall vehicle weight reduction and improved packaging within confined spaces in the vehicle interior. The integration of advanced sensor technology also places higher demands on fabric reliability and consistent manufacturing quality.

- Product Description: Specialized technical textiles, primarily nylon 6,6 or polyester, designed for high-speed inflation, low porosity, and excellent heat resistance, forming the containment structure of automotive airbags.

- Major Applications: Frontal impact airbags (driver/passenger), side curtain airbags, knee bolster airbags, and seatbelt integrated airbags in all classes of passenger vehicles.

- Benefits: Enhanced occupant safety, compliance with global automotive safety regulations, minimized injury severity during collisions, and extended product durability.

- Driving Factors: Mandatory installation regulations (e.g., India, China), rising consumer safety awareness, high vehicle production volumes, and advancements in deployment system technology.

Passenger Vehicle Airbag Fabric Market Executive Summary

The global Passenger Vehicle Airbag Fabric Market is characterized by robust growth, primarily fueled by strict government safety legislation in emerging markets coupled with high vehicle penetration rates. Business trends indicate a strong focus on lightweighting and material innovation, particularly the shift towards un-coated fabrics (or lighter coatings) to reduce module size and weight, enhancing fuel efficiency without compromising safety performance. Suppliers are heavily investing in vertical integration, controlling weaving, coating, and cutting processes to maintain rigorous quality standards and respond swiftly to Original Equipment Manufacturer (OEM) demands for customized solutions. Sustainability is also emerging as a pivotal business trend, prompting research into bio-based or recycled high-performance polymers for airbag applications, although adoption remains preliminary due to stringent safety requirements.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both production and consumption, driven by massive vehicle manufacturing hubs in China, Japan, and India, and the implementation of compulsory airbag mandates across new vehicle models. North America and Europe, while mature, exhibit high demand for advanced curtain and specialized knee airbags, focusing on premium vehicle segments and continuous updates to mandatory vehicle crash tests requiring enhanced protection coverage. Conversely, Latin America and the Middle East and Africa (MEA) represent significant future growth pockets, contingent upon the consistent enforcement of regional safety standards and economic stability enabling higher vehicle sales.

Segmentation trends reveal that Nylon 6,6 remains the dominant material due to its superior strength-to-weight ratio and inherent thermal stability. However, polyester fabrics are gaining traction in certain side-impact applications where higher stiffness and specific cost profiles are required. In terms of product type, side and curtain airbags are experiencing the fastest growth rate, largely because modern crash safety protocols emphasize lateral protection alongside frontal impact mitigation. The long-term trajectory of the market is closely tied to automotive production cycles and the ongoing shift toward electric vehicles (EVs), which often incorporate new interior design concepts necessitating redesigned airbag deployment systems and fabric specifications.

- Business Trends: Focus on lightweight, high-performance fabrics; vertical integration among key suppliers; high capital expenditure in advanced weaving and finishing technologies; increasing emphasis on supply chain resilience and material provenance.

- Regional Trends: APAC dominating growth due to regulatory drivers and manufacturing scale; Europe and North America maintaining high demand for sophisticated, multi-chamber airbag systems.

- Segment Trends: Nylon 6,6 fabric maintaining dominance; side/curtain airbags exhibiting superior volume growth relative to standard frontal airbags; increasing demand for thinly coated or non-coated fabric varieties.

AI Impact Analysis on Passenger Vehicle Airbag Fabric Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the Passenger Vehicle Airbag Fabric Market frequently revolve around three main themes: optimizing manufacturing processes, enhancing quality control and traceability, and predicting material failures or deployment anomalies. Users are particularly keen to understand how AI-driven predictive maintenance can reduce defects in highly sensitive weaving and coating operations, which require extreme precision to ensure consistent porosity. Concerns also center on the use of Machine Learning (ML) algorithms to analyze massive amounts of crash data, potentially influencing future fabric design specifications, such as optimizing thread density or coating thickness based on real-world accident scenarios and vehicle kinematics. Expectations are high that AI will streamline the certification process and significantly improve product consistency, a critical factor given the life-saving nature of the component.

- AI impacts in concise points:

- Predictive maintenance optimization in weaving and coating machinery, minimizing downtime and defects related to fabric consistency.

- Enhanced quality control through real-time image recognition and ML algorithms to detect micro-flaws or inconsistent coating levels on the fabric roll.

- Supply chain optimization using AI to forecast material demand, manage raw material inventory (Nylon 6,6 resins), and improve logistics efficiency.

- Simulation and modeling advancements, utilizing AI to predict fabric behavior during high-speed deployment and interaction with advanced restraint systems (pre-tensioners).

- Data-driven design adjustments based on analysis of crash test sensor data, allowing fabric parameters (porosity, stiffness) to be dynamically optimized for specific vehicle platforms.

- Automation of inspection procedures, replacing manual checks with high-speed automated systems for consistency in cut, shape, and module assembly.

DRO & Impact Forces Of Passenger Vehicle Airbag Fabric Market

The dynamics of the Passenger Vehicle Airbag Fabric Market are predominantly shaped by strict regulatory environments and evolving safety consumer expectations. The primary Driver is the mandatory inclusion of multiple airbags (typically 6 to 8) in new vehicles across major global markets, especially in high-growth regions like India (mandating six airbags) and China, where safety standards are rapidly converging with Western norms. This structural demand, coupled with consistently high global vehicle production rates (post-pandemic recovery), ensures a stable and growing requirement for high-quality airbag fabrics. Moreover, ongoing efforts by global NCAP programs to increase test rigor and penalize poor safety performance push OEMs to adopt superior fabric technologies, including advanced hybrid systems requiring specialized materials.

Major Restraints in the market include the high initial investment required for establishing weaving and coating facilities that meet the necessary precision and cleanliness standards for technical textiles. The supply chain dependency on high-grade nylon 6,6 polymer resin, which is susceptible to volatile petrochemical pricing, also poses a significant constraint. Furthermore, the market faces stiff regulatory scrutiny and extremely long product lifecycle validation times; any changes in material or process require extensive, costly re-certification, limiting the speed of innovation adoption. The maturity of some Western markets also limits explosive volume growth, requiring manufacturers to focus on value-added features rather than pure unit expansion.

Key Opportunities lie in the burgeoning electric vehicle (EV) segment, where new cabin designs and autonomous driving features necessitate unique airbag architectures, such as far-side airbags (to prevent occupant collision) and external pedestrian airbags, creating new avenues for fabric application. The drive towards lightweighting offers opportunities for manufacturers proficient in developing un-coated, highly technical woven fabrics that pass demanding permeability tests while reducing material use. Lastly, the expansion into specialized functional fabrics, such as those integrated with sensors or possessing anti-microbial properties (relevant for vehicle interiors), represents a niche growth area. The Impact Forces of these factors are substantial, leading to consolidation among suppliers who can afford the required R&D and quality infrastructure, thereby raising the barrier to entry for new competitors.

- Drivers: Stricter global safety regulations (e.g., Euro NCAP, NHTSA, BIS mandates); increasing penetration of side and curtain airbags; high global passenger vehicle production volumes; consumer preference for 5-star safety rated vehicles.

- Restraints: High capital expenditure and complex regulatory certification hurdles; volatility in raw material prices (Nylon 6,6); intense competition leading to pressure on profit margins; extended product development and validation cycles.

- Opportunities: New applications in Electric Vehicles (EVs) and autonomous vehicles (e.g., far-side and external airbags); development of advanced un-coated or lightweight coated fabrics; expansion into emerging automotive manufacturing hubs in Southeast Asia and Latin America.

- Impact Forces: High entry barriers maintained by stringent quality standards; continuous pressure for lightweighting innovations; increased emphasis on supply chain transparency and regional manufacturing footprint.

Segmentation Analysis

The Passenger Vehicle Airbag Fabric Market is segmented primarily based on Material Type, Coating Type, and Airbag Position (Product Type). Understanding these segments is crucial for strategic planning, as different applications demand distinct fabric properties. Material type segmentation reveals the technological preference for high-strength polymers, with Nylon 6,6 dominating due to its superior performance attributes in high-stress, high-temperature deployment environments. Coating type segmentation reflects the trade-off between maximizing tear strength and minimizing gas permeability (requiring coated fabric) versus achieving module lightweighting and smaller packaging size (favoring non-coated or lighter coated fabrics). Product type segmentation is directly linked to vehicle safety architecture evolution, showcasing high growth in fabrics designed for lateral protection.

- By Material Type:

- Nylon 6,6

- Polyester

- Others (Hybrid Materials, Specialized Composites)

- By Coating Type:

- Coated (Neoprene, Silicone, Polyurethane)

- Non-Coated/Un-Coated

- By Product Type (Airbag Position):

- Frontal Airbags (Driver/Passenger)

- Side Airbags (Seat/Door mounted)

- Curtain Airbags (Head protection)

- Knee Airbags

- Other Specialized Airbags (e.g., Pedestrian, Far-Side, Seatbelt)

Value Chain Analysis For Passenger Vehicle Airbag Fabric Market

The value chain for passenger vehicle airbag fabric is highly integrated and specialized, beginning with the upstream supply of raw materials. This stage is dominated by large chemical companies producing high-tenacity polymer resins, primarily Nylon 6,6 (polyamide). The quality and consistency of these resins are paramount, as they directly dictate the performance characteristics of the final woven fabric. Fluctuations in petrochemical prices and the oligopolistic structure of the polymer resin market heavily influence the cost structure for subsequent players in the chain. Consistent quality control at this initial stage is non-negotiable, requiring strong, long-term relationships between resin suppliers and fabric manufacturers to ensure material traceability and purity.

The midstream process involves highly technical operations: yarn spinning, weaving, and coating. Technical textile manufacturers specialize in weaving high-density, low-porosity fabrics using highly advanced looms. This is followed by the critical coating process, where silicone or neoprene is applied thinly to further control gas permeability and provide heat resistance, although the trend towards un-coated fabrics is challenging this step. Many leading players are vertically integrated, controlling both weaving and coating to ensure consistent fabric parameters. Quality assurance at this stage includes rigorous testing for tensile strength, tear propagation, and air permeability, often using automated non-destructive testing (NDT) techniques.

The downstream segment involves the cutting, sewing, and assembly of the fabric into the final airbag cushion and module, followed by distribution to Original Equipment Manufacturers (OEMs). Airbag cushion manufacturers (Tier 2/3 suppliers) receive the fabric rolls, precision-cut them using laser or ultrasonic cutting technologies, and stitch them using specialized threads to form the three-dimensional bag shape. These cushions are then delivered to Tier 1 suppliers (e.g., Autoliv, ZF, Joyson Safety Systems), which integrate the cushion with the inflator and housing to form the complete airbag module. Distribution channels are predominantly direct, high-security supply lines from Tier 1 suppliers to global OEM assembly lines, emphasizing just-in-time delivery and zero-defect tolerance. Indirect distribution via third-party aftermarket suppliers exists but is minor compared to the OEM segment.

- Upstream Analysis: Focused on key raw materials (Nylon 6,6 and Polyester polymer resins); dominated by global chemical conglomerates; high dependence on petrochemical feedstock stability.

- Midstream Analysis: Includes specialized processes of yarn texturizing, precision weaving of technical textiles, and application of high-performance coatings (silicone/neoprene); high capital and R&D investment required.

- Downstream Analysis: Involves cutting, sewing, and assembly of the fabric cushion (Tier 2/3); integration with inflators and housing to form the complete module (Tier 1); characterized by extremely high quality assurance protocols and traceability requirements.

- Distribution Channel: Predominantly direct delivery from Tier 1 safety system suppliers to OEM vehicle assembly plants globally, utilizing highly secured and efficient logistics networks.

Passenger Vehicle Airbag Fabric Market Potential Customers

The primary and largest group of customers for passenger vehicle airbag fabric are the major Tier 1 automotive safety systems manufacturers. These global suppliers specialize in integrating the fabric cushion with the inflator and electronic control unit (ECU) to create the complete airbag module. Companies like Autoliv, ZF, Joyson Safety Systems, and Robert Bosch are the direct buyers of finished airbag fabric rolls. Their purchasing decisions are driven by factors such as material performance certification, volume capacity, global supply chain reliability, and the ability of the fabric supplier to meet stringent technical specifications unique to each vehicle platform and OEM contract. The relationship between fabric suppliers and these Tier 1 integrators is strategic and long-term, focused on co-development and rigorous quality agreements.

A secondary, yet crucial, group of customers includes the large automotive Original Equipment Manufacturers (OEMs) themselves, who exert significant influence over material specifications, even if they do not purchase the fabric directly. OEMs, such as Toyota, Volkswagen Group, General Motors, and Tesla, define the precise safety standards, system architecture, and weight targets for their vehicles. Tier 1 suppliers must comply with these OEM specifications, meaning that fabric manufacturers must indirectly tailor their products to the demands of the ultimate end-user—the vehicle manufacturer. This necessitates early involvement in the design phase and substantial testing validation aligned with the OEM's crash test requirements.

A third segment consists of specialized Tier 2 manufacturers focusing specifically on the cutting and sewing of the fabric cushion, often working directly under contract for the major Tier 1 safety companies. While their procurement volume is smaller than the Tier 1 giants, they represent a market for specialized fabric batches and smaller, highly customized fabric cuts. Furthermore, the specialized aftermarket and replacement parts industry, although minor in volume compared to the OEM sector, requires fabric suppliers to maintain certification for discontinued or legacy vehicle models, catering to repair shops and specialized refurbishment entities globally.

- End-User/Buyers of the product:

- Tier 1 Automotive Safety Systems Suppliers: (e.g., Autoliv, ZF/TRW, Joyson Safety Systems, Daicel Corporation) – The largest direct purchasers and integrators of fabric into full airbag modules.

- Automotive Original Equipment Manufacturers (OEMs): (e.g., Toyota, VW, GM, Ford, Hyundai) – Indirect customers who dictate design, safety standards, and material specifications.

- Specialized Airbag Cushion Cutters and Sewers (Tier 2): Companies focusing solely on processing the raw fabric rolls into the final cushion shapes.

- Automotive Aftermarket and Repair Chains: Buyers requiring certified replacement fabrics and modules, though representing a small fraction of the total volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.66 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kolon Industries Inc., Toray Industries Inc., Toyobo Co. Ltd., Asahi Kasei Corporation, Hyosung Advanced Materials, UTT Technical Textiles, HMT Co. Ltd., Safety Components Fabric Technologies Inc., Honeywell International Inc., Joyson Safety Systems, Autoliv Inc., ZF Friedrichshafen AG, Porcher Industries, SRF Limited, Global Safety Textiles (GST), TenCate Protective Fabrics, Indorama Ventures, JPS Composite Materials, Milliken & Company, Seiren Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passenger Vehicle Airbag Fabric Market Key Technology Landscape

The technological landscape of the Passenger Vehicle Airbag Fabric Market is defined by precision engineering across textile manufacturing and material science. A primary focus is on advanced weaving technologies, particularly high-speed, controlled-tension looms (often air-jet or water-jet looms) capable of producing extremely dense fabrics with minimal defects and consistent, low permeability. Manufacturers employ specialized "one-piece woven" (OPW) techniques, where the final airbag shape and integral vent structures are woven directly into a single piece of fabric, reducing cutting and stitching requirements. This OPW technology significantly enhances the integrity and efficiency of curtain and side airbags by reducing critical failure points associated with traditional sewing and maximizing deployment predictability. Continuous investment in these specialized looms is essential to maintain competitiveness and meet stringent global quality mandates.

Another crucial technological development revolves around coating and finishing. While silicone and neoprene coatings have historically been used to manage gas permeability, the industry is seeing a shift towards highly optimized, lightweight coating materials or even sophisticated un-coated fabrics. The development of advanced un-coated Nylon 6,6 fabrics relies on highly refined yarn quality and extremely tight weaving patterns to naturally control porosity. When coatings are used, the technology focuses on ultra-thin, environmentally friendly application methods that minimize weight gain while maintaining high thermal stability during deployment. These technological advancements are critical drivers in the overall trend toward reducing the weight and packaging volume of the complete airbag module, aligning with the weight reduction goals of modern EVs and conventional vehicles alike.

Furthermore, technology related to testing and validation has become paramount. Non-destructive testing methods, including advanced sensor integration and AI-driven vision systems, are used throughout the manufacturing process to ensure zero defects in porosity, tension, and coating application. The incorporation of digital twin technology allows engineers to precisely simulate the rapid deployment (pyrotechnic inflation) and interaction of the fabric with crash dynamics, optimizing parameters such as vent size and seam strength before physical prototypes are manufactured. Material research also continues into alternative high-performance fibers and specialized threads (e.g., Kevlar or high-strength aramids for specific load-bearing seams) to handle the immense forces exerted during a collision, ensuring the long-term reliability and consistency required for a safety-critical component.

- Key Technology Focus Areas:

- One-Piece Woven (OPW) Technology: Enables integral airbag structures to be woven directly, increasing structural integrity and reducing assembly complexity, especially for curtain airbags.

- Advanced Weaving Machinery: Utilization of high-speed air-jet and rapier looms for precise, defect-free weaving of ultra-fine denier yarns to achieve consistent porosity.

- Lightweight Coating Systems: Development of ultra-thin silicone or polyurethane coatings, alongside optimization of un-coated fabric structures, focusing on weight reduction.

- Plasma Treatment and Surface Finishing: Specialized surface treatments used to enhance fabric performance, particularly related to tear resistance and adhesion properties.

- Automated Quality Inspection: Implementation of AI-powered vision systems and high-resolution scanning to identify minute material defects and inconsistent weaving patterns in real-time.

Regional Highlights

The global distribution of the Passenger Vehicle Airbag Fabric Market is heavily skewed towards regions with dominant automotive manufacturing bases and aggressive safety regulations. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to the vast scale of vehicle production in China, which also benefits from stringent domestic safety mandates and rising consumer awareness. India's recent regulatory push, mandating up to six airbags in new vehicles, provides a massive long-term growth trajectory for both local and international fabric suppliers. Japan and South Korea, mature automotive hubs, maintain significant market shares, specializing in advanced, high-specification technical fabrics and supplying globally.

Europe represents a highly mature and technologically advanced market. While unit growth is slower compared to APAC, the region drives demand for complex and specialized airbags, such as far-side and advanced pedestrian protection systems. European regulatory bodies like Euro NCAP continuously raise safety standards, compelling vehicle manufacturers to incorporate multi-stage and highly sophisticated airbag systems, requiring high-value, premium technical textiles. Germany, France, and Italy are key consumption centers, intrinsically linked to their dominant domestic automotive OEM presence and stringent material compliance regulations.

North America is characterized by high adoption rates of advanced safety features and a stable demand driven by the large fleet size and the influence of NHTSA and the Insurance Institute for Highway Safety (IIHS). The market here is robust, focusing heavily on curtain and side-impact protection due to specific crash test requirements. Latin America and the Middle East and Africa (MEA) currently hold smaller market shares but are projected to exhibit significant growth as regional governments mandate basic airbag installations, transitioning from zero or two airbags to the global standard of six. This regulatory transition represents a pivotal opportunity for global fabric manufacturers to establish local supply chain partnerships.

- Asia Pacific (APAC): Dominant market share and highest growth rate; fueled by massive manufacturing volumes in China and India; strong regulatory intervention mandating increased airbag count.

- Europe: Mature market characterized by demand for highly complex, multi-stage, and specialized airbag applications (e.g., far-side, pedestrian); driven by strict Euro NCAP standards.

- North America: Stable, high-value market driven by established safety mandates and continuous integration of advanced side and curtain airbag technology; focus on vehicle safety ratings (NHTSA, IIHS).

- Latin America (LATAM): Emerging high-growth potential driven by increasing implementation of basic frontal and lateral airbag mandates across major countries like Brazil and Mexico.

- Middle East and Africa (MEA): Smallest current share but expected expansion tied to rising safety standards, economic stability, and imported vehicle regulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passenger Vehicle Airbag Fabric Market.- Kolon Industries Inc.

- Toray Industries Inc.

- Toyobo Co. Ltd.

- Asahi Kasei Corporation

- Hyosung Advanced Materials

- UTT Technical Textiles

- HMT Co. Ltd.

- Safety Components Fabric Technologies Inc.

- Honeywell International Inc.

- Joyson Safety Systems (GST/KSS)

- Autoliv Inc.

- ZF Friedrichshafen AG (TRW Automotive)

- Porcher Industries

- SRF Limited

- Global Safety Textiles (GST)

- TenCate Protective Fabrics

- Indorama Ventures

- JPS Composite Materials

- Milliken & Company

- Seiren Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Passenger Vehicle Airbag Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used in the manufacturing of passenger vehicle airbag fabrics?

The primary material used is high-tenacity Nylon 6,6 (polyamide), which is favored for its excellent strength-to-weight ratio, superior thermal stability, and ability to handle the extreme stress and heat generated during rapid deployment. Polyester is also utilized, mainly for certain side and curtain airbag applications where specific stiffness or cost profiles are required.

How do safety regulations drive growth in the Passenger Vehicle Airbag Fabric Market?

Safety regulations are the most critical market driver. Mandates in high-volume markets like India and China, requiring minimum numbers of airbags (e.g., six standard airbags), directly increase demand volume. Additionally, rigorous crash test protocols set by agencies like Euro NCAP and NHTSA compel manufacturers to adopt more advanced, complex airbag systems (such as far-side or knee airbags), pushing demand for high-specification technical fabrics.

What is the key technological trend concerning airbag fabric coatings?

The key technological trend is the shift towards lightweighting, specifically through the development of highly optimized, extremely thin coatings or completely un-coated fabrics. While silicone and neoprene coatings historically controlled gas permeability, the latest trend uses advanced weaving techniques (high-density weaving) combined with specialized yarns to achieve the required permeability control and thermal stability without adding significant weight or bulk from a coating layer.

Why is Asia Pacific (APAC) the largest market for airbag fabrics?

APAC dominates the market due to the colossal scale of passenger vehicle manufacturing, particularly in China and India. Furthermore, recent regulatory actions across major APAC economies to enforce mandatory multi-airbag installations in new vehicles have rapidly accelerated the consumption rate of airbag fabrics in the region, far surpassing growth in mature markets like North America and Europe.

What role does the 'One-Piece Woven' (OPW) technology play in this industry?

One-Piece Woven (OPW) technology is crucial for improving airbag integrity and reliability. OPW allows the entire structure of the airbag cushion, including specialized deployment vents and integral seams, to be woven from a single piece of fabric. This reduces the number of cut and sewn seams, minimizing potential failure points and enabling better performance consistency, particularly critical for large curtain and side airbags.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager