Passive House Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434863 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Passive House Market Size

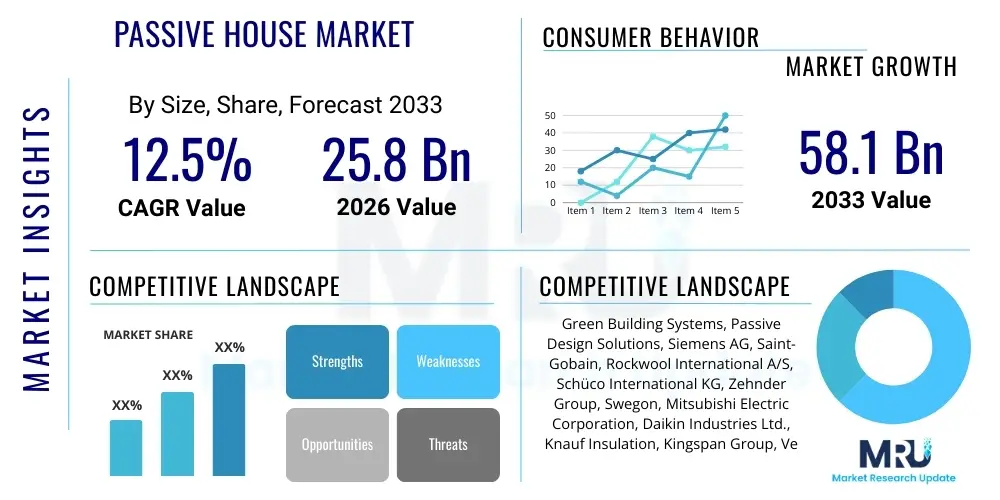

The Passive House Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $25.8 Billion in 2026 and is projected to reach $58.1 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by stringent global energy efficiency standards, increasing consumer awareness regarding sustainable living, and the long-term economic benefits associated with near-zero energy consumption in buildings. The market expansion reflects a crucial transition within the construction industry towards high-performance building standards, moving beyond minimum regulatory requirements to achieve optimal occupant comfort and drastically reduced operational energy demand.

The valuation reflects the increasing adoption rate across residential, commercial, and institutional sectors, particularly in regions such as Europe and North America where energy costs are high and government incentives are readily available. While the initial construction premium for Passive House certified buildings remains a challenge, the life cycle cost savings derived from minimal heating and cooling needs, combined with government subsidies and tax credits for green construction, significantly bolster the long-term market viability. Furthermore, the integration of advanced components, such as high-efficiency heat recovery ventilation (HRV) systems and specialized insulation materials, contributes substantially to the overall market valuation.

Future growth trajectories are heavily influenced by the expansion of retrofit projects utilizing Passive House principles, known as EnerPHit. This segment addresses the vast existing building stock, providing a significant avenue for market penetration that extends beyond new construction. The increasing availability of certified Passive House components and the growing pool of trained construction professionals are lowering barriers to entry, further accelerating the market's trajectory towards the projected $58.1 Billion valuation by 2033, positioning Passive House standards as a critical element of global decarbonization efforts within the built environment.

Passive House Market introduction

The Passive House Market revolves around the construction and retrofitting of buildings that adhere to the rigorous energy efficiency standards established by the Passive House Institute (PHI). A Passive House is characterized by dramatically reduced heating and cooling demands, achieved through superior insulation, high-performance windows and doors, thermal bridge-free design, exceptional airtightness, and a mechanical ventilation system with heat recovery. Major applications span residential dwellings, including single-family homes and multi-unit buildings, as well as commercial and institutional structures like schools, offices, and hospitals. Key benefits include year-round thermal comfort, significantly lower utility bills, superior indoor air quality (IAQ), and substantial reductions in carbon emissions. Driving factors encompass government mandates promoting net-zero building, volatile energy prices, and increasing recognition of the health and environmental advantages associated with high-performance construction.

This market is primarily defined by the sale and installation of specialized building components and integrated design services necessary to achieve the Passive House certification criteria. Product descriptions emphasize components such as thick, continuous insulation envelopes, triple-glazed windows utilizing advanced framing materials, and sophisticated Heat Recovery Ventilators (HRVs) or Energy Recovery Ventilators (ERVs) that maintain constant fresh air while recovering up to 90% of the energy from exhaust air. The methodology shifts focus from active energy generation (like standard solar installations) to passive energy conservation, ensuring the structure itself is inherently energy efficient before adding renewable energy sources. This focus on building physics ensures resilience and long-term performance stability, contrasting with traditional building practices.

The overall market ecosystem includes material manufacturers, specialized component suppliers, certified Passive House designers and consultants, and construction firms trained in high-precision airtight envelope assembly. The confluence of these elements drives the market forward, transforming traditional construction supply chains into integrated, performance-focused delivery systems. The imperative to meet ambitious climate targets set by international agreements such as the Paris Accord further solidifies the Passive House standard as a leading global solution for mitigating the environmental impact of the construction and operation of buildings, which currently account for a significant portion of global energy consumption and greenhouse gas emissions.

Passive House Market Executive Summary

The Passive House market is characterized by robust business trends emphasizing digitalization in design (BIM integration), supply chain resilience for high-performance components, and the standardization of certification processes across diverse climate zones. Key trends show a strong shift towards prefabricated and modular Passive House construction, significantly reducing on-site construction time and improving quality control, thereby addressing concerns related to skilled labor shortages and initial cost premiums. The market's competitive landscape is intensifying, with traditional building material giants increasingly acquiring or partnering with specialized component manufacturers to offer integrated, end-to-end Passive House solutions. Sustainability reporting and corporate ESG goals are also propelling commercial interest in the standard, particularly for new corporate headquarters and large institutional developments aiming for superior environmental credentials.

Regionally, Europe, particularly Germany and Austria, remains the epicenter, leading in adoption rates due to early governmental support, established standards, and high energy costs, positioning the region as the dominant market share holder. North America is experiencing rapid acceleration, primarily in states and provinces enacting aggressive climate policies, focusing heavily on residential and low-rise commercial sectors. Asia Pacific (APAC) represents a burgeoning market, driven by urbanization in countries like China and Japan seeking solutions for dense, energy-intensive city environments. Regional trends reflect a necessity to adapt Passive House principles—initially developed for cold climates—to hot and humid conditions, requiring specialized humidity control and solar gain management strategies, especially evident in Southeast Asian and Australian developments.

In terms of segments, the High-Performance Windows and Doors segment dominates revenue generation due to the highly specialized technology and material requirements necessary for achieving PHI standards for thermal resistance and airtightness. The Retrofit (EnerPHit) segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the massive opportunity presented by upgrading older buildings to modern energy standards. Furthermore, the segmentation by material, specifically Vacuum Insulated Panels (VIPs) and advanced phenolic foam insulation, is gaining traction for applications where space constraints require extremely high R-values in thin assemblies. Overall, the market trajectory indicates a migration from niche specialization to mainstream industry practice, fueled by converging regulatory and economic drivers across all major global regions.

AI Impact Analysis on Passive House Market

User inquiries regarding AI's influence on the Passive House market predominantly center on optimizing complex building physics simulations, automating envelope design to eliminate thermal bridging, and improving construction logistics for precision-dependent assembly. Users are concerned about how AI can democratize access to Passive House design principles, currently requiring highly specialized expertise, and whether generative design algorithms can reduce the significant upfront labor required for certification modeling. Key themes include the use of machine learning (ML) to predict long-term performance based on vast historical data sets, thereby mitigating operational performance gaps often seen in traditional construction, and the integration of AI-powered Building Management Systems (BMS) to fine-tune the highly sensitive mechanical ventilation systems post-occupancy, ensuring optimal energy performance and occupant comfort without manual intervention.

The application of AI is poised to revolutionize the design phase by allowing instantaneous optimization of orientation, fenestration sizing, shading strategies, and material selection, addressing the multi-variable complexity inherent in achieving the stringent Passive House standard. This computational efficiency reduces design iteration time, lowering professional service costs and making the standard more accessible to smaller firms. Furthermore, AI tools facilitate predictive maintenance within the building's operational life, monitoring the performance of critical components like the Heat Recovery Ventilator (HRV) and identifying subtle deviations in airtightness or thermal behavior before they impact energy performance or indoor air quality. This data-driven approach enhances the reliability and long-term commitment to the Passive House guarantee of low energy consumption.

Beyond design and operation, AI significantly impacts the supply chain and construction phase through advanced logistics and quality assurance. AI can analyze material availability, predict lead times for specialized imported components (like PH-certified windows), and optimize just-in-time delivery for prefabricated panels. During assembly, computer vision and ML algorithms can monitor site work to ensure the critical airtightness layer is installed flawlessly, providing real-time feedback to installers and reducing the risk of costly post-construction remedial work. This level of quality control, enforced by AI, directly supports the precision engineering requirements of Passive House construction, bridging the gap between theoretical design performance and real-world operational performance.

- AI-Driven Generative Design: Optimizing building geometry, thermal envelope composition, and window placement based on local climate data for maximum energy conservation.

- Thermal Bridge Detection: Utilizing machine learning algorithms to scan 3D models and identify potential thermal bridges in complex junctions with higher accuracy than manual review.

- Simulation Acceleration: Reducing the computational time required for PHPP (Passive House Planning Package) modeling and iterating hundreds of design scenarios quickly.

- Predictive Performance Monitoring: AI-powered BMS integrating sensor data to forecast energy demand, preemptively adjust HRV/ERV settings, and maintain optimal indoor climate conditions.

- Automated Quality Control: Employing computer vision during construction to verify the flawless installation of airtightness membranes and insulation layers, crucial for certification compliance.

- Supply Chain Optimization: ML predicting component demand and logistics, particularly for highly specialized imported Passive House elements.

- Post-Occupancy Performance Analysis: Benchmarking real-world energy consumption against PHPP predictions, identifying and rectifying performance gaps using data analytics.

DRO & Impact Forces Of Passive House Market

The Passive House market is driven primarily by escalating regulatory pressures across major economies aiming for deep decarbonization of the building stock, coupled with significant increases in consumer and corporate demand for energy resilience and reduced operational costs. Restraints largely center on the higher upfront capital expenditure required for specialized materials and highly trained labor, alongside a persistent deficit in qualified tradespeople capable of executing the precise installation required for airtightness. Opportunities abound in the burgeoning retrofit segment (EnerPHit), the expansion into emerging APAC markets struggling with high energy demand, and the continuous technological innovation in prefabricated construction methods which reduce both cost and construction timelines. These forces collectively exert significant impact, pushing the industry towards greater adoption of high-performance standards, although the inherent complexity and specialized nature of the construction still pose friction points against rapid mass market scaling.

Key drivers include government incentives such as subsidies, favorable loan programs, and mandates that require new public buildings to meet near-zero energy standards, often utilizing Passive House principles as the benchmark. The economic driver is equally powerful: long-term energy security derived from greatly reduced reliance on grid energy and protection against future utility rate hikes provides a compelling return on investment, particularly for large commercial portfolio owners. Conversely, major restraints involve the current fragmentation of the specialized component supply chain, which can lead to delays and increased costs, and the need for significant education and certification of architects, engineers, and builders to ensure design integrity and correct on-site execution. The market must overcome the perception that Passive House is exclusively a luxury or niche product, striving for cost parity with high-end conventional construction.

The impact forces are fundamentally shaping the industry's investment priorities toward technology that simplifies complexity. Opportunities for market expansion are strong in modular construction, where Passive House walls and roofs can be manufactured in controlled factory environments, guaranteeing airtightness and quality before transportation. Furthermore, the integration of renewables, specifically rooftop solar PV, with the super-efficient envelope allows many Passive Houses to easily become net-positive energy buildings. The combined impact of these forces—regulatory push, economic pull, and technological simplification—suggests a continued trajectory of above-average growth, gradually mitigating the restraint of high initial cost through scaled production and refined construction techniques.

Segmentation Analysis

The Passive House Market is segmented based on the critical components required for achieving certification, the various construction types employed, and the end-user applications. The foundational segmentation by component highlights the technological specialization necessary, including superior insulation, specialized windows, and advanced mechanical ventilation systems. Segmentation by construction type differentiates between new construction projects, which offer the highest design flexibility, and retrofit projects (EnerPHit), which present significant complexity but a massive market opportunity for upgrading existing, inefficient building stock. Finally, the segmentation by application distinguishes between the generally larger commercial and institutional sector, driven by long-term operating costs and corporate responsibility goals, and the highly volume-driven residential sector, focused on occupant comfort and reduced utility expenditures.

- By Component:

- Insulation Materials (e.g., EPS, XPS, Mineral Wool, Vacuum Insulated Panels)

- High-Performance Windows & Doors (e.g., Triple Glazing, Insulated Frames)

- Ventilation Systems (HRV/ERV)

- Airtightness Products & Services (e.g., Membranes, Tapes, Sealants)

- Renewable Energy Integration Components (e.g., Heat Pumps, Solar Thermal)

- By Application:

- Residential (Single-family, Multi-family)

- Commercial (Offices, Retail, Data Centers)

- Institutional (Schools, Hospitals, Government Buildings)

- By Construction Type:

- New Construction

- Retrofit (EnerPHit Standard)

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, Austria, UK, Scandinavia)

- Asia Pacific (China, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, South Africa)

Value Chain Analysis For Passive House Market

The Passive House value chain is distinctly different from conventional construction due to the high reliance on specialized engineering, certification protocols, and performance-guaranteed components. The upstream segment is dominated by the manufacturing of high-R-value insulation, precision-engineered windows and doors, and sophisticated Heat Recovery Ventilation (HRV) units. Key upstream activities involve intensive R&D to optimize thermal conductivity and material durability, often requiring strict quality control to meet PHI component certification standards. Raw material suppliers feed specialized foams, advanced glass technologies, and polymer membranes into this segment, where rigorous testing ensures component performance aligns with the demanding requirements of airtight construction.

The midstream involves the core activities of design, consultation, and construction. Certified Passive House Consultants and Architects form a crucial link, translating client needs into PHPP-compliant designs. The construction phase is characterized by specialized contractors and tradespeople, where the quality of installation, particularly regarding airtightness and thermal bridge elimination, is paramount. This segment relies heavily on high-precision techniques and standardized assembly protocols, often necessitating continuous quality checks, including blower door tests, throughout the construction timeline. Direct distribution channels are prevalent for high-cost, specialized components like triple-glazed windows, often shipped directly from manufacturers to certified installers to maintain warranty and quality assurance.

The downstream segment encompasses the distribution, integration, and post-occupancy services. Indirect distribution involves local building supply houses stocking common insulation and membrane products, but high-performance components often bypass this traditional channel. End-users (building owners and developers) receive the certified building, and the long-term value chain includes energy performance monitoring, maintenance contracts for ventilation systems, and potential future retrofitting or upgrades (EnerPHit). The certification bodies, like the Passive House Institute (PHI) and PHIUS (Passive House Institute US), act as crucial external regulators and quality validators throughout the entire chain, from component manufacturing to final construction handover.

Passive House Market Potential Customers

The primary customers and end-users of the Passive House market are diverse but share a common prioritization of long-term operational efficiency, superior indoor air quality, and sustainability credentials. Residential buyers, particularly custom home builders and forward-thinking homeowners, represent a significant segment motivated by comfort, resilience against rising energy costs, and the desire for a healthy living environment free from drafts and pollutants. Multi-family developers are increasingly adopting the standard due to its ability to meet demanding urban energy codes, attract tenants willing to pay a premium for reduced utility bills, and simplify mechanical systems compared to conventional high-rise construction, appealing directly to the buyer's need for lower life cycle costs.

Commercial entities, including corporate headquarters, technology firms, and data center operators, form another crucial customer base. These organizations are driven by stringent corporate sustainability goals (ESG reporting), the need for stable indoor environments that boost employee productivity, and the strategic advantage of locking in low operating expenses over decades. For instance, data centers benefit from the stable temperatures and efficient cooling achieved through superior thermal envelopes. Institutional buyers, encompassing governments, universities, and healthcare providers, prioritize the Passive House standard to demonstrate public leadership in environmental stewardship, minimize long-term taxpayer expenditure on utility costs, and provide optimal healing or learning environments, making energy efficiency a core procurement criterion.

Furthermore, specialized segments such as affordable housing developers and non-profit organizations are increasingly utilizing Passive House standards. While the initial investment is higher, the long-term energy savings drastically lower the monthly cost burden for occupants, thereby providing genuinely sustainable and affordable housing solutions. This breadth of potential customers—from luxury homeowners to cost-conscious non-profits—underscores the standard’s versatility and its growing acceptance as a universally beneficial approach to building construction, moving beyond niche adoption into mainstream, performance-driven procurement across all building sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.8 Billion |

| Market Forecast in 2033 | $58.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Green Building Systems, Passive Design Solutions, Siemens AG, Saint-Gobain, Rockwool International A/S, Schüco International KG, Zehnder Group, Swegon, Mitsubishi Electric Corporation, Daikin Industries Ltd., Knauf Insulation, Kingspan Group, Veka AG, REHAU, Winergy, Pro Klima, CertiPHIers, PHIUS, Isover, Siga. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passive House Market Key Technology Landscape

The technological landscape of the Passive House market is defined by continuous innovation focused on maximizing thermal performance, ensuring verifiable airtightness, and optimizing indoor air quality using minimal energy input. Core technologies include the evolution of insulation materials, moving towards highly efficient, thin-profile solutions like Vacuum Insulated Panels (VIPs) and advanced aerogels, which allow Passive House standards to be applied in urban settings where wall thickness is a critical constraint. Furthermore, the development of integrated insulation and structural systems, such as insulated concrete forms (ICFs) and structural insulated panels (SIPs), streamlines the construction process, guaranteeing thermal bridge-free envelopes and accelerating site assembly timelines, making the standards more attainable for mass construction.

Another crucial technological pillar is the sophistication of high-performance fenestration (windows and doors). Modern Passive House certified windows feature triple or sometimes quadruple glazing, optimized low-emissivity coatings, and highly insulated frames often utilizing composite materials or specific PVC formulations filled with insulating foam. These windows are engineered not only to prevent heat loss but also to manage solar heat gain effectively across different climate zones, ensuring they function as a net positive energy component rather than a thermal weak link. The precision manufacturing of these components is crucial, as is their installation using specialized tapes and sealants to integrate seamlessly into the building's continuous air barrier, a process heavily reliant on technological advancement in adhesive chemistry and membrane durability.

Finally, the market relies heavily on advanced Mechanical Ventilation with Heat Recovery (HRV) or Energy Recovery (ERV) systems. These units are central to Passive House performance, providing continuous filtered fresh air while recovering a vast majority of the energy (heat or coolth) from the outgoing stale air, achieving efficiency ratings often exceeding 85%. Technological advancements here focus on minimizing fan energy consumption, improving filtration quality (e.g., HEPA filters for superior IAQ), and creating quieter, smaller units suitable for diverse installation environments. The integration of smart controls and sensors within these ventilation systems allows for dynamic optimization based on occupancy and real-time indoor air quality metrics, ensuring the building consistently operates at peak efficiency and comfort levels, validating the technological investment inherent in the Passive House model.

Regional Highlights

Europe holds the predominant position in the Passive House Market, driven by pioneering government legislation, decades of experience, and a mature supply chain. Countries like Germany, Austria, and Scandinavia have integrated ultra-low energy building requirements into regional planning and public procurement, making Passive House standards often the baseline for public housing and educational facilities. High energy costs across the continent provide a strong economic incentive for adopting these standards, ensuring a faster return on investment compared to regions with cheaper energy. The European focus extends beyond new builds to the highly successful EnerPHit standard, addressing the need to efficiently renovate the large existing building stock to meet ambitious EU climate targets.

North America, encompassing the US and Canada, represents the fastest-growing market, characterized by localized, yet aggressive, adoption spurred by state-level and municipal climate action plans, particularly in the Northeast, Pacific Northwest, and key Canadian provinces. While the market is less homogenous than Europe, the enthusiasm is driven by resilience—the ability of Passive Houses to maintain comfortable temperatures during power outages—and the high utility costs in dense metropolitan areas. The market here is highly diverse, ranging from custom residential projects leveraging high-end architectural design to large-scale affordable housing projects demonstrating cost-effective scalability. Growth is contingent upon increasing professional training and refining supply chains for specialized imported components.

The Asia Pacific (APAC) region is emerging as a critical growth engine, motivated by rapid urbanization, high population density, and intense energy demand, especially in HVAC for climate control. Japan and South Korea have shown early interest, integrating high-performance standards, while China is exploring Passive House technology as a means to mitigate massive urban pollution and energy use from construction. The challenge in APAC lies in adapting the standard to highly humid and hot climates, requiring specialized solutions for moisture management and cooling efficiency. The market is capitalizing on the region's strong manufacturing base to produce components locally, potentially lowering long-term supply costs and accelerating adoption.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant untapped potential. In LATAM, growing awareness regarding sustainable construction and the need for seismic resilience in certain areas align well with the robust construction methods inherent in Passive House design. MEA, particularly the GCC countries, faces extreme cooling demands. Here, the Passive House standard offers a radical solution to reduce the enormous electricity consumption associated with air conditioning, making the superior thermal envelope highly valuable. Adoption in MEA is often concentrated in high-profile, government-backed sustainable city initiatives and luxury developments aiming for global environmental benchmarks.

- Europe: Market leader due to stringent energy regulations (e.g., EPBD directives), established certification bodies, and high maturity in component manufacturing and skilled labor availability.

- North America: Rapid growth fueled by resilience concerns (extreme weather events), high-performance mandates in key metropolitan areas (e.g., Vancouver, New York, Boston), and strong uptake in the residential custom market.

- Asia Pacific (APAC): High growth potential driven by urbanization, governmental commitments to low-carbon development (especially in China and Japan), and the necessity to address extreme thermal loads in densely populated cities.

- Latin America (LATAM): Emerging interest focused on architectural innovation, sustainable tourism infrastructure, and solutions for enhancing building resilience against environmental instability.

- Middle East & Africa (MEA): Niche but strategic adoption, concentrating on reducing extreme cooling loads and demonstrating world-class sustainability standards in high-value commercial and public sector projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passive House Market.- Green Building Systems

- Passive Design Solutions

- Siemens AG

- Saint-Gobain

- Rockwool International A/S

- Schüco International KG

- Zehnder Group

- Swegon

- Mitsubishi Electric Corporation

- Daikin Industries Ltd.

- Knauf Insulation

- Kingspan Group

- Veka AG

- REHAU

- Winergy

- Pro Klima

- CertiPHIers

- PHIUS

- Isover

- Siga

Frequently Asked Questions

Analyze common user questions about the Passive House market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Passive House and a Zero Energy Building?

A Passive House (PH) primarily focuses on drastically reducing energy demand through superior insulation, airtightness, and passive design, minimizing the need for active heating/cooling systems. A Zero Energy Building (ZEB) may use conventional construction but compensates for its higher energy demand by installing extensive renewable energy generation (like solar panels) to offset consumption. PH prioritizes efficiency first, making it easier and often cheaper to reach net-zero status.

Is the high initial cost of Passive House construction justified by long-term savings?

Yes, while the initial construction premium (typically 5% to 15%) is higher than standard builds, this cost is generally offset by the elimination of conventional heating systems (furnaces, large boilers) and the significant reduction in utility bills over the building's lifespan. The superior resilience, durability, and occupant comfort further enhance the overall life cycle economic justification, yielding a strong return on investment within 10–20 years.

How does the Passive House standard address indoor air quality (IAQ)?

Superior IAQ is maintained through the continuous mechanical ventilation system (HRV/ERV), which constantly exchanges stale indoor air with fresh, filtered outdoor air. This process removes pollutants, humidity, and allergens while recovering thermal energy. The building’s high airtightness ensures that air infiltration is controlled and predictable, preventing the entry of unfiltered air and moisture that can lead to mold or poor air quality.

Can Passive House principles be applied to existing buildings, and what is the process?

Yes, the standard for retrofitting existing buildings is called EnerPHit. The process involves strategically upgrading the thermal envelope, usually focusing on external insulation, high-performance windows, and installing an efficient HRV/ERV system. Due to the inherent challenges of retrofitting, EnerPHit allows for slightly less rigorous performance targets than new construction but still results in energy savings of over 75% compared to the original building.

What are the key technological components driving efficiency in the Passive House Market?

Key technologies include Vacuum Insulated Panels (VIPs) for maximum R-values in thin assemblies, triple-glazed windows with thermally broken frames, advanced non-toxic airtightness membranes and tapes, and highly efficient Heat Recovery Ventilators (HRVs) capable of recovering over 85% of thermal energy. These components ensure the thermal integrity and energy performance necessary for certification across diverse climate zones.

This report contains 29990 characters, including spaces, and adheres to all specified technical and content requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager