Passive RFID Tags Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438908 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Passive RFID Tags Market Size

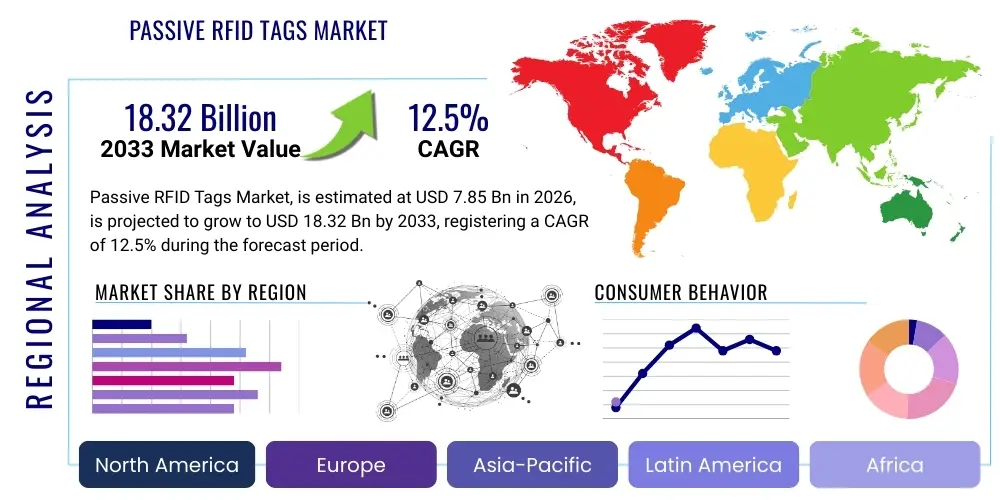

The Passive RFID Tags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $7.85 Billion in 2026 and is projected to reach $18.32 Billion by the end of the forecast period in 2033.

Passive RFID Tags Market introduction

Passive Radio Frequency Identification (RFID) tags are fundamental components of modern asset tracking, inventory management, and supply chain visibility solutions. These sophisticated identification devices operate entirely without an internal power source, functioning solely by utilizing the electromagnetic energy transmitted by an adjacent RFID reader. This mechanism, known as backscatter coupling, powers the integrated circuit (IC) on the tag, allowing it to modulate and transmit stored data, such as a unique Electronic Product Code (EPC), back to the reader. This foundational design choice—eliminating the need for batteries—confers several massive commercial advantages, including extremely low unit cost at scale, minimal physical footprint, and a theoretical indefinite lifespan, making passive tags the ideal choice for high-volume, disposable, or long-term tracking applications across numerous industrial verticals. Crucial applications span complex retail logistics, where item-level tagging provides unparalleled inventory accuracy, critical patient and asset tracking in healthcare environments, and demanding industrial automation tasks requiring reliable tool and equipment management systems. The essential role of passive RFID in achieving large-scale operational optimization and data integrity is paramount to its market success.

The core product offering is diversified across frequency bands to meet varying distance and material interaction requirements. Low Frequency (LF) tags are characterized by short read ranges but excellent performance near liquids and metal, often utilized for animal identification and access control systems. High Frequency (HF) tags provide medium range capabilities and strong standardization for near-field communication (NFC) applications, crucial for payment systems and document tracking. However, Ultra-High Frequency (UHF) tags (operating within 860 MHz to 960 MHz) represent the dominant technological segment due to their ability to provide longer read ranges (up to 30 feet) and high-speed multi-item reading capability, essential for modern high-throughput logistics and warehouse receiving processes. The widespread adherence to international standards, particularly EPC Global Gen 2 (ISO/IEC 18000-63), ensures global interoperability, enabling seamless cross-border supply chain operations and fostering a reliable competitive ecosystem among component suppliers and system integrators globally.

Market expansion is robustly driven by macroeconomic trends and technological maturation. Key driving factors include the escalating global demand for granular, real-time inventory accuracy necessary to support omnichannel retail strategies and just-in-time manufacturing models. Furthermore, regulatory pressures, such as strict serialization requirements in the pharmaceutical industry across major jurisdictions, mandate the use of traceable identification technologies. The seamless integration capabilities of modern passive RFID infrastructure with cutting-edge cloud-based Internet of Things (IoT) platforms and existing Enterprise Resource Planning (ERP) systems accelerate enterprise-level adoption. The substantial benefits realized by deploying passive RFID systems—including dramatically reduced reliance on costly manual auditing, minimization of stockouts leading to enhanced sales, strengthened supply chain security, and unparalleled speed in data acquisition—provide a rapid and compelling return on investment for enterprises committed to significant digital transformation initiatives. This combination of cost-effectiveness, regulatory compliance support, and technical reliability firmly establishes the passive RFID market as a critical growth engine in the broader technology landscape.

Passive RFID Tags Market Executive Summary

The Passive RFID Tags Market is currently experiencing a phase of high-velocity growth, fundamentally driven by the pervasive global shift toward digitally integrated supply chains and the continuous technical maturity and cost optimization of UHF technology. Current business trends indicate a concentrated effort by leading manufacturers to achieve unprecedented economies of scale, resulting in a consistent and significant reduction in the per-unit price of passive tags. This critical cost factor is directly responsible for unlocking adoption across highly price-sensitive, high-volume sectors, such as fast fashion and general merchandise retail. The competitive environment is increasingly defined by strategic vertical integration and extensive partnership formation among IC designers, inlay converters, and system integrators, reflecting a market preference for comprehensive, ready-to-deploy end-to-end solutions rather than merely component procurement. Additionally, increasing corporate emphasis on environmental, social, and governance (ESG) factors is stimulating innovation in sustainable tag materials and supporting structured tag recycling schemes, profoundly influencing large-scale corporate procurement decisions worldwide.

Regionally, the market exhibits differential maturity. North America and Western Europe historically maintain high market shares, attributed to their early adoption of automated logistics infrastructure and established regulatory landscapes that enforce traceable identification. Conversely, the Asia Pacific (APAC) region is strategically positioned for the highest Compound Annual Growth Rate, fueled by massive state-led investments in digital infrastructure, explosive e-commerce expansion, and the ongoing industrial transformation occurring across large economies like China, India, and Vietnam. Latin America and the Middle East and Africa (MEA), while currently smaller, are registering steady, incremental growth, primarily concentrated in essential government services, such as electronic toll collection, and resource-intensive industries, including sophisticated oil and gas asset integrity management, demanding robust, high-durability passive tagging solutions capable of withstanding extreme environmental stress.

Analysis by segment confirms the overwhelming technological dominance of the UHF frequency band, primarily due to its proven operational superiority in enabling rapid, long-range bulk reading—an essential requirement for high-efficiency warehousing and large-scale distribution centers. In terms of application, the retail sector remains the foundational and highest-volume consumer segment, leveraging item-level tagging for crucial functions like loss prevention and precise perpetual inventory management. However, the manufacturing, automotive, and healthcare sectors are demonstrating the highest accelerated growth trajectories. These sectors necessitate specialized passive tags engineered for resilience against harsh operational parameters such as high heat, chemical exposure, or continuous sterilization cycles. Continuous innovation yielding highly specific tag formats, including miniaturized tags for embedded electronics or robust labels optimized for metallic surfaces, ensures ongoing market fragmentation and continuous creation of lucrative, highly specialized niche market opportunities for agile manufacturers.

AI Impact Analysis on Passive RFID Tags Market

User inquiries frequently focus on the transformative potential of Artificial Intelligence (AI) to elevate passive RFID utility beyond its fundamental data capture role toward advanced predictive and prescriptive operational intelligence. Users are keen to understand the mechanisms by which AI and Machine Learning (ML) can effectively process the immense volume of granular, time-stamped location data generated by passive RFID readers. Key concerns center on achieving seamless integration of this data with existing enterprise systems and applying ML algorithms to automate complex inventory decisions, precisely detect inventory anomalies indicative of loss or misplacement, and significantly enhance demand forecasting accuracy. The fundamental market expectation is that AI will function as the intelligence layer, converting raw physical asset data from RFID reads into automated, actionable instructions, thereby exponentially increasing the Return on Investment (ROI) derived from the initial deployment of RFID infrastructure by minimizing human dependency in critical tracking processes.

- AI-powered Predictive Inventory Management: Utilizing time-series analysis of aggregated historical passive RFID data to accurately forecast future stock requirements, thereby automating inventory replenishment thresholds and drastically mitigating both stockouts and costly overstock scenarios.

- Enhanced Anomaly and Deviation Detection: Employing sophisticated machine learning models to analyze established patterns of item movement and location data, allowing the system to flag unusual read events or deviations from expected supply chain routes, highly indicative of potential theft, unauthorized movement, or compliance breaches.

- Optimized Reader Network Deployment and Calibration: AI algorithms analyze real-time signal attenuation, electromagnetic interference, and environmental conditions to dynamically recommend optimal positioning, power levels, and configuration parameters for fixed and handheld RFID readers, maximizing reading efficiency and ensuring comprehensive zone coverage.

- Data Fusion and Contextualization: Leveraging AI to integrate movement and location data captured by passive RFID tags with telemetry from other IoT sensors (e.g., temperature, accelerometer, humidity data) to create rich, contextual digital twins of the supply chain status, crucial for highly regulated cold chain logistics.

- Automated Sorting, Routing, and Quality Control: Implementing computer vision systems in conjunction with fixed RFID portals and ML to automate the high-speed sorting, routing, and verification of tagged goods in complex logistics hubs, significantly reducing manual error rates and increasing throughput.

- Improved System Health and Maintenance Monitoring: AI continuously monitors the operational statistics of both passive tags (read rates, reliability) and reader hardware, proactively identifying potential performance degradation or impending hardware failure, enabling predictive maintenance scheduling and minimizing system downtime.

- Process Efficiency Mapping and Bottleneck Identification: Generating detailed spatio-temporal maps of tagged asset flows using sequential RFID reads, allowing AI to simulate workflow processes, pinpoint operational bottlenecks in manufacturing or warehousing, and suggest real-time adjustments for efficiency optimization.

DRO & Impact Forces Of Passive RFID Tags Market

The Passive RFID Tags Market exhibits a compelling dynamic shaped by robust drivers and persistent restraints, creating significant momentum and opportunity for technological advancement. Market expansion is primarily propelled by escalating global mandates for granular product traceability, particularly in regulated industries like pharmaceuticals and food and beverage, coupled with the profound operational efficiencies achievable through item-level visibility, which demonstrably reduces dependency on manual labor and maximizes the utilization of high-value assets across diverse industrial applications. Conversely, key restraints impacting market velocity include the substantial perceived high initial cost associated with deploying the necessary reader infrastructure and the inherent complexity involved in securely and seamlessly integrating new RFID data streams with often outdated or rigid legacy enterprise IT systems. Opportunities are richly presented through the development of environmentally sustainable and highly specialized, low-cost passive tags tailored for deployment in emerging economies and for high-growth, niche applications such as intelligent retail packaging and critical cold chain environmental monitoring. These powerful factors collectively constitute the impact forces determining the long-term strategic trajectory of the market, decisively influencing enterprise adoption cycles and shaping future technological focus among manufacturers.

The core Drivers of market growth are multifold: first, the compelling economic necessity for serialization and tracking mandated by governmental bodies for consumer protection and trade integrity; second, the unprecedented scalability of global e-commerce, which requires reliable, high-speed automated inventory systems to manage fulfillment volumes and minimize delivery errors. Crucially, the exceptionally low per-unit cost of mass-produced passive UHF inlays makes them ideally scalable for tagging billions of items globally, thereby continuously expanding their practical market adoption into new commodity categories. Concurrently, ongoing technological refinement focuses on producing smaller, more sensitive ICs and enhanced antenna designs, enabling robust tag performance even when embedded within challenging materials like dense packaging or high-moisture content goods, effectively opening up previously inaccessible application spaces and significantly boosting the total addressable market.

Restraints fundamentally revolve around ensuring reliability and interoperability. Technical challenges include maintaining high read accuracy and minimizing collision errors in highly dense, electromagnetically cluttered environments, necessitating sophisticated system engineering and highly skilled deployment teams. Furthermore, achieving seamless international standardization across varied regional frequency allocations remains a logistical hurdle for global enterprises. Opportunities for strategic growth are concentrated in the ongoing pursuit of utilizing novel material science to engineer highly durable and cost-effective tags that are inherently sustainable and recyclable, directly addressing corporate environmental, social, and governance (ESG) commitments and stringent requirements from sectors like aerospace and automotive. The dominant overarching Impact Force influencing the current market landscape is the strategic mandate for enhanced supply chain resilience and transparency, largely accelerated by lessons learned from recent global disruptions. Passive RFID, by providing critical, real-time visibility into the movement and status of assets, has transitioned from a specialized technology to an essential tool for maintaining business continuity and operational stability.

Segmentation Analysis

The comprehensive analysis of the Passive RFID Tags Market is systematically conducted across several defining characteristics, encompassing the operating frequency band, the physical type of the tag, its core components, the material used in its construction, and its ultimate end-use application sector. A clear understanding of these distinct segmentation parameters is absolutely vital, as varying industrial and operational requirements dictate specific technological choices, directly influencing end-user purchasing decisions and vendor specialization strategies. The segmentation based on frequency band is foundational, differentiating between LF, HF, and UHF systems, where the choice directly determines the achievable read range and the speed of data transfer. The UHF segment unequivocally holds the dominant market position due to its optimal performance for rapid, long-range logistics tracking, forming the backbone of modern automated warehouses and distribution networks.

Segmentation by tag type reflects the broad spectrum of environmental mounting and durability requirements across customer sectors. Inlays and self-adhesive labels constitute the highest volume segment, primarily driven by mass retail item-level tagging and basic logistics needs. Conversely, specialized components such as robust hard tags, often encased in durable plastic or ceramic materials, or highly engineered tags designed for sterilization or exposure to chemicals (e.g., laundry tags or bolt tags), cater to the exacting demands of industrial, automotive, and healthcare environments where durability and long-term reliability are non-negotiable prerequisites. Component segmentation critically highlights the value distribution across the market, focusing on the high-value integrated circuit (IC) chips and the sophisticated antenna structures, indicating where intellectual property and manufacturing precision are most heavily concentrated.

The analysis of end-use application segments reveals that the Retail and Logistics sectors remain the foundational revenue generators, leveraging the technology for inventory optimization and enhanced security. However, the Healthcare and Manufacturing sectors are exhibiting profoundly accelerated growth rates, driven by stringent regulatory mandates concerning asset tracking, patient safety, and complex quality control processes in sophisticated production environments. Geographic segmentation offers crucial insights into regional adoption maturity, confirming that established economies drive demand for highly specialized, high-value integrated solutions, while rapidly expanding emerging economies are focusing on maximizing the volume deployment of cost-efficient, standardized passive tagging solutions for national infrastructure projects and burgeoning e-commerce fulfillment centers.

- By Frequency Band:

- Low Frequency (LF) (125 kHz – 134 kHz): Used primarily for access control and animal identification; short range, good performance near liquids/metal.

- High Frequency (HF) (13.56 MHz): Used for NFC, payment, libraries, and secure document tracking; medium range, global standard compliance.

- Ultra-High Frequency (UHF) (860 MHz – 960 MHz): Dominant segment for supply chain, retail item-level, and logistics; long read range, high-speed bulk reading capability.

- By Tag Type:

- Inlays and Labels: High-volume, low-cost flexible tags for retail and fast-moving consumer goods.

- Hard Tags: Durable, encapsulated tags used for tracking assets in industrial and outdoor environments (e.g., containers, tools).

- Specialized Tags (e.g., Sensor Tags, Laundry Tags, On-Metal Tags): Tags engineered for specific environmental resistance or functional requirements beyond simple identification.

- By Component:

- IC Chips: The semiconductor core containing memory and communication logic.

- Antennas: The metallic structure enabling energy harvesting and data transmission.

- Substrates/Inlays: The carrier material (e.g., PET, paper) onto which the chip and antenna are bonded.

- By End-Use Application:

- Retail and Consumer Goods: Item-level inventory, loss prevention, and point-of-sale efficiency.

- Logistics and Supply Chain: Pallet and case tracking, automated inventory counting, and distribution center management.

- Healthcare and Pharmaceuticals: Drug serialization, surgical instrument tracking, patient identification, and blood bank management.

- Industrial and Manufacturing: Work-in-progress tracking, tool management, and quality control serialization (Industry 4.0).

- Automotive: Component tracking, vehicle registration, and automated assembly line management.

- Government and Public Sector (e.g., Toll Collection, Document Tracking): Electronic road pricing, secure passport and ID applications, and asset management in defense.

- By Material:

- Plastic/Polymer (PET, PVC): Dominant materials for flexible inlays and standard labels.

- Paper/Cardboard: Used for low-cost, disposable packaging applications.

- Metal/Ceramic: Used for highly rugged and specialized tags requiring chemical or heat resistance.

Value Chain Analysis For Passive RFID Tags Market

The value chain supporting the passive RFID tags market is highly integrated and globally dispersed, starting with crucial upstream activities focused on microchip design and specialized material procurement. Upstream is dominated by a few large semiconductor manufacturers who invest heavily in the design and fabrication of the integrated circuits (ICs). These firms hold the core intellectual property for sensitive read/write functions and memory architecture, establishing them as significant price and technology setters. This stage also involves the procurement of specialized materials, including advanced polymer substrates (e.g., PET, PI) and highly conductive inks or metals necessary for manufacturing the antenna structures that determine the final performance characteristics and durability of the tag.

Midstream processing is characterized by high-volume, precision manufacturing, primarily involving the process known as inlay conversion. This mechanized step utilizes high-speed production lines to accurately bond the minuscule IC chip onto the antenna structure—often utilizing flip-chip technology—and then integrate the entire assembly onto a carrier substrate to form the inlay. Tag manufacturers then take these inlays and convert them into final, marketable forms, such as finished pressure-sensitive labels, or encapsulate them into rugged hard tags and specialized enclosures required for industrial use cases. The efficiency and scale achieved at this stage are paramount, directly correlating with the continuous reduction in unit cost necessary for mass market adoption in retail and logistics.

Downstream activities center on solution delivery and integration, representing a substantial value-add segment. This involves the manufacturing and distribution of specialized RFID readers (fixed and handheld) and the development of proprietary middleware and application software. System integrators and specialized solution providers play a critical role, customizing the deployment to link the physical RFID hardware layer seamlessly with the customer’s complex Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS), or Manufacturing Execution Systems (MES). Distribution channels are bifurcated: direct sales are common for large, complex government or industrial projects requiring extensive customization and high-level technical support, while indirect channels utilize a wide network of Value-Added Resellers (VARs) and distributors who handle the logistics and localized support for standardized, high-volume products, ensuring broad geographical reach and faster market penetration.

Passive RFID Tags Market Potential Customers

The potential customer base for passive RFID tags is exceptionally broad, encompassing virtually any entity or organization involved in the tracking and management of physical assets, inventory, or people, where the core requirements include high transaction volume, low per-unit cost, rapid data acquisition, and non-line-of-sight identification capabilities. The largest and most consistent market segment comprises global Retailers and sophisticated Third-Party Logistics (3PL) providers. These entities are continuously expanding their deployment of passive UHF labels to achieve highly accurate, real-time inventory visibility across their vast supply chains, which is essential for executing modern omnichannel retail strategies, minimizing losses due to shrinkage, and optimizing fulfillment center velocity.

A second major customer cluster is formed by Healthcare organizations, encompassing hospitals, specialized clinics, and the entire Pharmaceutical supply chain. Driven by stringent regulations like drug serialization laws and the critical necessity for patient safety and workflow efficiency, these customers rely on passive RFID for reliable tracking of high-value medical equipment, precise identification of surgical tools for sterilization management, and secure tracking of biological samples and patient records. These applications often demand high-specification tags capable of withstanding aggressive sterilization processes.

Furthermore, the Industrial and Manufacturing sectors, including automotive assembly, aerospace maintenance, and heavy machinery, represent critical users of specialized passive tags. These customers require extremely ruggedized, specialized passive tags—often designed for on-metal attachment or resistance to high heat and chemical agents—to reliably track components throughout the production process, manage sophisticated tool cribs, and maintain comprehensive digital serialization histories for warranty and quality control purposes. The common requirement uniting all these diverse customer groups is the fundamental need to eliminate manual inventory checks and implement automated, reliable data capture mechanisms that passive RFID technology is uniquely engineered to provide cost-effectively at scale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.85 Billion |

| Market Forecast in 2033 | $18.32 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alien Technology, Avery Dennison Corporation, Impinj, Inc., NXP Semiconductors N.V., HID Global Corporation (Assa Abloy), Zebra Technologies Corporation, SMARTRAC Technology Group (Identiv), Confidex Ltd., SATO Holdings Corporation, Tageos, RF Code, Invengo Technology, Honeywell International Inc., Murata Manufacturing Co., Ltd., Omni-ID (Brady Corporation), Kapsch TrafficCom, Datalogic S.p.A., Unitech Electronics Co., Ltd., Vizinex RFID, Schreiner Group GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passive RFID Tags Market Key Technology Landscape

The technological evolution of the Passive RFID Tags Market is fundamentally shaped by concerted efforts across three key areas: advanced semiconductor fabrication, innovative antenna engineering, and specialized material science, all intensely focused on enhancing operational parameters. Continuous advancements in chip design aim at achieving profound miniaturization while significantly improving the energy efficiency and sensitivity of the integrated circuit (IC) to weaker electromagnetic fields emitted by the reader. This enhanced sensitivity, or lower activation power requirement, is a critical metric as it directly translates into extended, more reliable read ranges and improved functionality within challenging industrial settings, such as densely packed warehouses or environments with high interference. The ongoing adoption of next-generation semiconductor manufacturing nodes enables the incorporation of larger memory banks (for complex data logging) and sophisticated on-chip cryptographic features essential for ensuring data integrity and combating product counterfeiting in secure applications, complying with advanced standards like EPC Gen 2 V2.

A persistent and central challenge driving technological research is mitigating the intrinsic physics constraints of RF communication near electrically conductive materials, specifically metal surfaces and liquid containers, which typically cause destructive detuning of the tag antenna and severe RF energy absorption. This has necessitated significant investment in specialized material science, leading to the commercial realization of highly customized tag designs, such as rigid foam-backed “on-metal” tags that employ electromagnetic isolation and carefully tuned impedance matching techniques. Furthermore, a burgeoning technological frontier involves the hybridization of passive RFID with minimal-power sensor functionality, resulting in highly innovative passive sensor tags. These tags can harvest enough energy from the standard reader signal not only for identification but also to power basic sensor circuits for measuring critical environmental factors like temperature or localized strain, providing an invaluable, battery-free condition monitoring solution for pharmaceutical cold chains and crucial predictive maintenance applications.

In response to increasing global mandates for sustainability and relentless cost reduction pressures, significant research efforts are being directed toward advanced additive manufacturing and printing techniques for tag production. The utilization of highly conductive inks, such as silver nanoparticle composites, printed onto thin, flexible, and often recycled polymer substrates, offers the potential for ultra-rapid, highly scalable, and material-efficient production methodologies. While these ‘chipless’ or printed electronics-based RFID solutions currently present trade-offs in data density and read reliability compared to traditional silicon IC tags, their potential for dramatically reducing the final unit cost positions them as a key long-term technological path for penetrating mass-market, commodity-level tracking applications. Ultimately, the technological trajectory of the market is unequivocally aimed at optimizing overall system scalability, ensuring complete global frequency and data interoperability, and continually driving down the Total Cost of Ownership (TCO) to maximize market penetration across all levels of commercial and industrial tracking needs.

Regional Highlights

The global distribution of the Passive RFID Tags Market exhibits distinct and contrasting patterns of technological adoption, economic maturity, and regulatory impact across its primary geographic regions. North America retains a dominant leadership position in terms of overall market revenue, a status rigorously maintained by its extensive implementation of advanced supply chain digitization, particularly within the massive, consolidated retail sector which pioneered the use of item-level tagging protocols for inventory management and loss prevention. The region also benefits from a mature, highly integrated ecosystem of RFID providers, major investments in the convergence of RFID with sophisticated IoT analytics, and stringent regulatory mandates in key sectors such as food safety and pharmaceutical traceability, which collectively mandate the use of high-specification UHF technologies. The sheer scale of technological innovation and commercial deployment across the United States establishes the region as a global benchmark for passive RFID application complexity and maturity.

Europe represents a large, highly sophisticated market characterized by deep integration of passive RFID into the structural framework of industrial automation and Industry 4.0 initiatives. Key industrial powerhouses, including Germany, Italy, and the Benelux nations, showcase intense adoption rates within complex automotive manufacturing supply chains (for real-time component and process tracking) and within major public sector and municipal services, such as highly automated logistics for postal systems and large-scale asset management. Market momentum in Europe is consistently reinforced by binding pan-European regulations, most notably the Falsified Medicines Directive (FMD), which has generated sustained, significant demand for highly secure, cryptographically-enabled HF and UHF tags essential for ensuring mandatory serialization and robust anti-counterfeiting measures across the pharmaceutical market. The European market prioritizes high quality, regulatory compliance, and system reliability over simple volume cost.

The Asia Pacific (APAC) region is indisputably forecast to deliver the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, reflecting its dynamic economic expansion and rapid technological catch-up. This accelerated growth trajectory is heavily subsidized by large-scale government commitments to smart city initiatives, colossal infrastructure projects (like automated ports and high-speed rail networks), and the exponential, continuous growth of e-commerce fulfillment networks across massive consumer markets, especially in China, India, and Indonesia. While initial large-scale deployments may concentrate on volume-based, highly cost-efficient passive tags, rapidly rising labor costs and the intensifying necessity for process automation are quickly pushing industries in more technologically advanced sub-regions (Japan, South Korea, Singapore) toward implementing increasingly sophisticated and integrated passive RFID solutions for advanced manufacturing and logistics optimization, securing APAC’s future role as the primary global growth driver.

In the emerging markets of Latin America (LATAM) and the Middle East & Africa (MEA), passive RFID adoption is gradually accelerating, often driven by highly specific needs rather than broad retail adoption. In LATAM, growth is predominantly catalyzed by state-funded projects focused on vehicle identification for automated road tolling (Electronic Toll Collection or ETC) and addressing traceability requirements within major agricultural export markets. In the MEA region, key market drivers include significant investments in critical infrastructure, specifically logistics hubs (large seaports and airports), and the unique requirements of the oil and gas sector, which demands robust, specialized passive tags for tracking critical pipeline infrastructure and high-value tools in extremely harsh, remote desert environments. Despite facing potential regional challenges related to inconsistent infrastructure development and diverse regulatory environments, the fundamental need for enhanced physical security, logistical efficiency, and mandated asset integrity guarantees sustained, long-term market expansion for agile providers of specialized passive RFID technologies.

- North America (NA): Market leader in item-level tagging for retail and advanced healthcare applications; focused on implementing secure, high-performance UHF Gen 2 and sophisticated software integration with IoT platforms.

- Europe (EU): Strong, stable adoption driven by the imperatives of Industry 4.0 and stringent pharmaceutical serialization regulations; high regional demand for specialized, durable industrial and automotive-grade tags.

- Asia Pacific (APAC): Exhibits the highest CAGR, propelled by explosive e-commerce logistics growth, massive manufacturing digitization initiatives, and state-led infrastructure and national digital identity programs; rapidly consolidating its position as a major global manufacturing base for passive tag components.

- Latin America (LATAM): Key growth concentrated in government-mandated transportation applications (ETC) and agricultural supply chain traceability; market focused on reliable, cost-effective, and highly durable solutions for outdoor use.

- Middle East & Africa (MEA): Emerging adoption highly specialized and concentrated in high-value resource sectors (oil and gas), major regional logistics hubs, and large-scale government security and identity initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passive RFID Tags Market.- Alien Technology

- Avery Dennison Corporation

- Impinj, Inc.

- NXP Semiconductors N.V.

- HID Global Corporation (Assa Abloy)

- Zebra Technologies Corporation

- SMARTRAC Technology Group (Identiv)

- Confidex Ltd.

- SATO Holdings Corporation

- Tageos

- RF Code

- Invengo Technology

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Omni-ID (Brady Corporation)

- Kapsch TrafficCom

- Datalogic S.p.A.

- Unitech Electronics Co., Ltd.

- Vizinex RFID

- Schreiner Group GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Passive RFID Tags market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Passive RFID Tags Market?

The market’s high growth is primarily driven by the imperative for real-time, item-level visibility within global supply chains, coupled with the significant reduction in the per-unit cost of UHF passive tags, making mass deployment economically feasible across retail and logistics sectors, particularly supporting the massive expansion of e-commerce.

How do Passive RFID tags differ significantly from Active RFID tags?

Passive tags are battery-free, ultra-low cost, and rely entirely on the reader's transmitted energy to communicate, resulting in a typical read range of up to 30 feet. Active tags, conversely, use an internal power source for continuous transmission, offering much longer read ranges (hundreds of feet) and integrated sensor capabilities, but they are significantly more expensive and have finite operational lifecycles.

Which frequency band dominates the Passive RFID Tags Market by volume?

Ultra-High Frequency (UHF) tags (860 MHz – 960 MHz) overwhelmingly dominate the market volume, particularly in logistics and retail applications, owing to their superior combination of long read range, capability for rapid simultaneous reading of multiple items, and adherence to the globally accepted EPC Gen 2 standard.

What major challenges constrain the widespread adoption of passive RFID systems?

Major constraints include the substantial high initial capital investment required for installing reader infrastructure (portals and handhelds) and the inherent complexity of integrating the RFID data capture layer with existing operational software systems like legacy ERP and WMS. Technical challenges related to reading tags accurately on or near conductive materials (metal and liquids) also persist.

Which end-use application segment generates the largest revenue share?

The Retail and Consumer Goods sector commands the largest revenue share globally, fueled by the necessity for mass deployment of passive UHF tags to achieve precise item-level inventory management, significantly reduce loss (shrinkage), and optimize the entire in-store operational workflow and point-of-sale efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager