Password Policy Enforcement Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438896 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Password Policy Enforcement Software Market Size

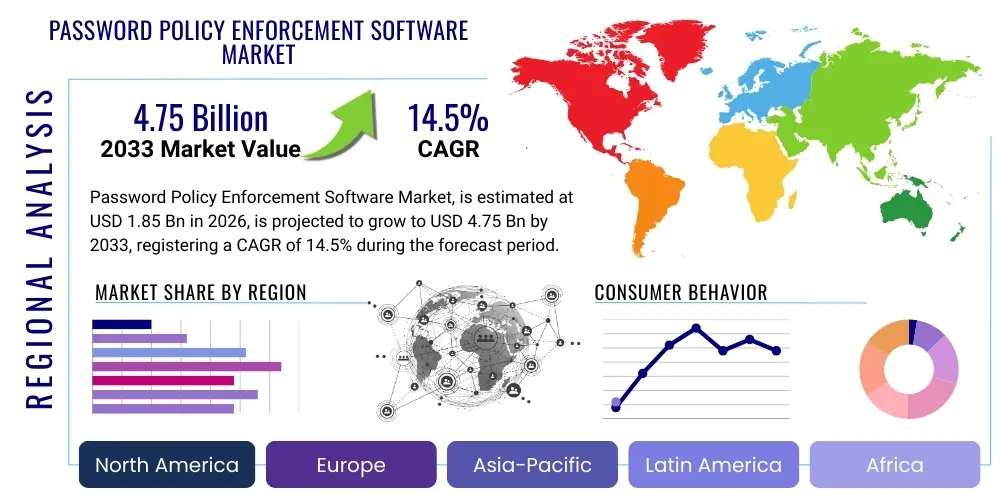

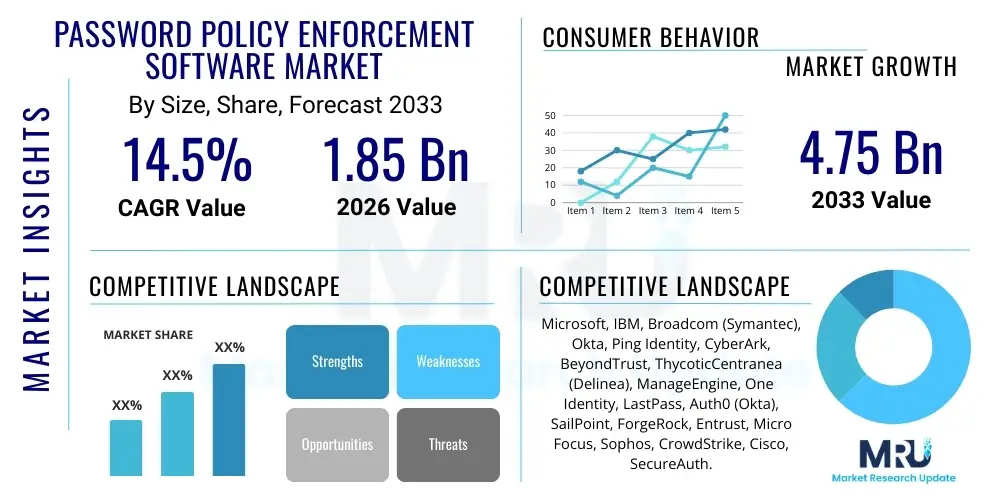

The Password Policy Enforcement Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 4.75 Billion by the end of the forecast period in 2033.

Password Policy Enforcement Software Market introduction

The Password Policy Enforcement Software Market encompasses solutions designed to automate, standardize, and enforce stringent rules regarding the creation, complexity, lifespan, and rotation of user passwords across an organization's digital ecosystem. These sophisticated tools move beyond simple operating system limitations by integrating features like contextual awareness, dictionary checks, blacklisting compromised credentials, and adaptive policy application based on user behavior and risk scores. The core objective is to minimize the attack surface created by weak or reused passwords, which remain one of the primary vectors for initial penetration in cyberattacks. Adoption is driven by increasingly stringent regulatory mandates, such as GDPR, HIPAA, and CCPA, which require demonstrable control over access security, forcing organizations to deploy centralized and robust enforcement mechanisms.

The market product portfolio typically includes modules for advanced complexity requirements, continuous monitoring for password policy violations, and sophisticated synchronization capabilities across heterogeneous IT environments, including cloud services and legacy systems. Major applications span across critical infrastructure protection, ensuring compliance audits are successful, and strengthening zero-trust architectures where every access request, regardless of origin, must be rigorously validated. These applications are particularly vital in sectors dealing with sensitive data, such as Banking, Financial Services, and Insurance (BFSI), Healthcare, and Government agencies, where data breaches carry massive financial and reputational consequences. The technology's ability to seamlessly integrate with existing identity and access management (IAM) frameworks, including Active Directory (AD) and LDAP, ensures ease of deployment and maximizes organizational security posture.

Key benefits derived from implementing these solutions include significantly reducing helpdesk costs associated with password resets, enhancing overall security hygiene by eliminating common credential vulnerabilities, and providing comprehensive audit trails necessary for regulatory adherence. The driving factors behind current market acceleration involve the proliferation of remote work models, which expand the perimeter of corporate networks and introduce more unsecured endpoints, thus amplifying the need for strong endpoint policy enforcement. Furthermore, the rising frequency and sophistication of brute-force and credential stuffing attacks necessitate proactive tools that can prevent, rather than just detect, the use of compromised credentials before they result in a security incident. The evolution toward passwordless authentication is not hindering this market; rather, it is compelling existing solutions to integrate seamlessly with multi-factor authentication (MFA) and biometric strategies, ensuring policy enforcement remains the foundational layer of access security during this transition.

Password Policy Enforcement Software Market Executive Summary

The Password Policy Enforcement Software market is experiencing robust expansion, fundamentally driven by the global escalation in cyber threats, particularly those targeting compromised user credentials, and the corresponding shift towards regulatory environments demanding stronger data protection protocols. Business trends highlight a significant migration towards cloud-based and hybrid deployment models, offering scalability and reduced operational overhead, which makes these sophisticated solutions accessible to Small and Medium-sized Enterprises (SMEs) previously constrained by capital expenditure requirements. Furthermore, the integration of advanced features such as behavioral analytics, which allows policies to dynamically adapt based on observed user risk, represents a crucial technological shift, moving enforcement from static rule sets to adaptive, risk-aware security mechanisms. This focus on adaptive enforcement is transforming how enterprises manage privileged access and standard user accounts, making real-time remediation of policy violations a standard requirement for vendors.

Regionally, North America maintains market dominance, primarily fueled by the presence of major technology vendors, early and widespread adoption of advanced cybersecurity solutions across large enterprises, and stringent federal regulatory frameworks like NIST guidelines and various sector-specific compliance mandates. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by rapid digital transformation initiatives, increasing awareness of data sovereignty and privacy laws (e.g., China's CSL, India's DPDP), and substantial investment in IT infrastructure modernization across emerging economies like India and Southeast Asian nations. European growth is steady, underpinned by the ongoing enforcement of GDPR, which places direct accountability on organizations for protecting user data, thus necessitating mandatory deployment of best-practice password security tools to demonstrate due diligence and avoid punitive fines. The Middle East and Africa (MEA) and Latin America are growing moderately, primarily targeting the BFSI and government sectors as they prioritize digital security maturation.

Segment trends reveal that the BFSI vertical remains the largest consumer due to high transaction volumes and critical regulatory requirements (e.g., PCI DSS), necessitating ironclad credential security. In terms of components, the Services segment, including professional consulting, implementation, and managed security services, is projected to witness faster growth than the software segment itself, as organizations require highly specialized expertise to integrate complex policy engines into multi-cloud and decentralized IT environments. Large Enterprises currently account for the majority of the market share, yet the SME segment is rapidly accelerating its adoption rate, driven by affordable cloud-delivered policy enforcement solutions that provide enterprise-grade security without the need for extensive in-house security teams. This segmentation analysis confirms a market transition from simple installation to complex, integrated security architecture management, emphasizing managed services and sophisticated integration capabilities.

AI Impact Analysis on Password Policy Enforcement Software Market

Common user questions regarding AI's impact on Password Policy Enforcement Software frequently center on how machine learning can transform static enforcement rules into dynamic, risk-adaptive mechanisms, whether AI will ultimately eliminate the need for passwords entirely, and the role of AI in detecting and preventing sophisticated credential-based attacks, such as deepfake authentication attempts or large-scale credential stuffing. Users are also highly concerned about the potential for bias or false positives introduced by AI-driven behavioral analysis, which could impede legitimate user access while failing to identify novel threats. The key themes summarized from these inquiries underscore a strong expectation for AI to enhance preventative capabilities, improve user experience by relaxing policies when risk is low, and provide granular, context-aware policy adjustments far beyond what traditional rules-based engines can achieve.

The immediate impact of Artificial Intelligence and Machine Learning (AI/ML) integration is the evolution of policy enforcement into a risk-based adaptive process. Traditional policy engines enforce binary rules (e.g., minimum length, required characters) but fail to account for contextual risk factors such as location, device health, time of day, or anomalous behavioral patterns. AI/ML algorithms analyze massive datasets of user behavior, network metadata, and historical breach information to assign a real-time risk score to each attempted login or password change operation. If the risk score is high—even if the password technically adheres to the static policy—the system can dynamically trigger secondary checks, enforce immediate password rotation, or demand stronger MFA, thereby making the enforcement process significantly more intelligent and targeted. This shift minimizes friction for low-risk users while immediately escalating security measures for suspicious activity.

Furthermore, AI plays a pivotal role in the continuous auditing and optimization of password policies themselves. By analyzing the common failure points, the types of breached credentials encountered, and the overall security posture, AI can recommend policy adjustments that maximize security efficacy while minimizing user frustration. For instance, AI can identify patterns where complex, frequently rotated passwords lead to users writing them down or reusing them across non-critical systems, suggesting a shift towards longer passphrases, or context-aware policies tied to MFA. This predictive modeling capability ensures that policy enforcement software remains relevant and effective against zero-day credential attacks and evolving adversary techniques, cementing AI's role as a transformative agent that moves the market toward proactive defense rather than reactive compliance checks.

- AI-driven behavioral biometrics enhance policy compliance checks.

- Machine learning models detect credential anomalies and reuse across known breach lists in real-time.

- Adaptive policy enforcement dynamically adjusts complexity requirements based on current user risk scores.

- AI optimizes password expiration intervals, moving away from mandatory frequent resets.

- Automated analysis identifies and blocks dictionary attacks and sophisticated credential stuffing attempts immediately.

- AI assists in recommending optimal policy settings to balance security and usability.

DRO & Impact Forces Of Password Policy Enforcement Software Market

The market dynamics for Password Policy Enforcement Software are shaped by powerful Drivers and significant Restraints, balanced by emerging Opportunities, all synthesized through high-impact forces that dictate investment decisions and technological focus. The primary drivers are the exponential growth in identity-related cyber incidents, including phishing and ransomware attacks heavily reliant on compromised credentials, coupled with the increasing complexity of regulatory compliance across global jurisdictions. Organizations face massive financial penalties and irreversible reputational damage if they fail to demonstrate robust control over user access, making these enforcement solutions mandatory tools. Conversely, key restraints include the substantial resistance from end-users regarding overly complex or frequently changing password requirements, which often leads to "security fatigue" and shadow IT practices, undermining the technology's effectiveness. Additionally, the challenge of achieving seamless integration with diverse, often legacy, IT infrastructure poses a technical barrier, particularly for large multinational corporations with decentralized systems.

Opportunities for market expansion are centered on the rapid uptake of hybrid and multi-cloud environments, necessitating unified policy enforcement that spans on-premise Active Directory and various SaaS applications, creating demand for sophisticated cross-platform solutions. The shift toward Zero Trust Architecture (ZTA) presents a major growth vector, as ZTA mandates the verification of every access attempt, inherently requiring robust, centrally managed credential policies even as organizations explore passwordless alternatives. Furthermore, the burgeoning demand for specialized Privileged Access Management (PAM) policy enforcement, focusing on high-risk administrative accounts, provides premium revenue streams. These policy enforcement tools are evolving to become foundational components of larger IAM ecosystems, ensuring consistency across all identity lifecycles and offering integration points for advanced context-aware security tools, thereby expanding their total addressable market and strategic relevance within enterprise security frameworks.

The overarching impact forces driving the market trajectory include the constant evolution of adversarial techniques, requiring vendors to rapidly incorporate threat intelligence and adaptive behavioral analysis into their offerings. The regulatory environment acts as a persistent, high-intensity force, turning optional security measures into mandatory requirements. Economic forces, particularly the increasing cost of data breaches, heavily incentivize investment in preventative security like policy enforcement over reactive mitigation strategies. Consequently, vendors are competing heavily on ease of deployment, integration capability with existing security stacks (E.g., SIEM, SOAR), and the ability to minimize friction for end-users through intelligent policy relaxation, positioning user experience as a critical competitive differentiator alongside core security efficacy. This competitive landscape ensures continuous innovation focused on adaptive, low-friction policy management.

Segmentation Analysis

The Password Policy Enforcement Software market is highly segmented based on deployment model, organizational size, component type, and the vertical industries served, reflecting the diverse security needs across the global economy. Understanding these segments is crucial for vendors optimizing their product offerings and market strategies, as requirements differ significantly between a highly regulated financial institution needing on-premise control and a growing SaaS startup favoring highly scalable cloud-native solutions. The segmentation highlights the underlying trend toward modularity and customized service offerings, ensuring that solutions can address the specific operational complexity and compliance burden unique to each user category.

- By Deployment Type:

- Cloud-based

- On-premise

- By Component:

- Software

- Services (Consulting, Implementation, Training, Managed Services)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare

- Government and Defense

- Retail and E-commerce

- Energy and Utilities

- Others (Education, Manufacturing)

Value Chain Analysis For Password Policy Enforcement Software Market

The Value Chain for Password Policy Enforcement Software begins with the upstream activities centered on software development and intellectual property creation. This initial stage involves intense research and development (R&D) focused on creating robust policy engines, integrating advanced cryptographic libraries, developing AI/ML algorithms for behavioral analysis, and ensuring compatibility with diverse identity platforms (e.g., Active Directory, various LDAP directories, and modern cloud identity providers). Key suppliers in this upstream segment include developers providing specialized security libraries, cloud infrastructure providers (like AWS, Azure, GCP) hosting SaaS models, and specialized cybersecurity consultants providing threat intelligence crucial for policy optimization. Competitive advantage at this stage is derived from patentable policy enforcement logic and superior interoperability.

The midstream phase focuses on solution manufacturing, packaging, and integration. This involves configuring the core software platform, integrating it into broader IAM suites, and ensuring seamless API connectivity for third-party tools (such as SIEM systems and ticketing software). Distribution channels are highly critical, differentiating between direct sales models, which are often used for large enterprise contracts requiring extensive customization and consulting, and indirect channels relying on Managed Security Service Providers (MSSPs) and value-added resellers (VARs). MSSPs, in particular, play a vital role by bundling policy enforcement software into comprehensive managed security offerings, particularly targeting the SME segment that lacks dedicated security personnel. These channel partners ensure broader geographic reach and localized implementation expertise.

The downstream segment encompasses the implementation, post-sales support, and continuous service delivery. Implementation requires specialized professional services to integrate the policy engine correctly into the client's network architecture and to define the initial complex policy sets specific to regulatory requirements. Continuous support, including software updates, vulnerability patching, and policy review services, ensures the long-term effectiveness of the solution. The end-users or potential customers—large enterprises, governments, and regulated entities—represent the final consumption point. The value chain is constantly optimized for efficiency by moving deployment and policy management to the cloud (SaaS model), reducing the physical distribution burden and allowing for instantaneous updates and centralized management, thus maximizing operational value for the end-user.

Password Policy Enforcement Software Market Potential Customers

Potential customers for Password Policy Enforcement Software are highly concentrated in sectors that manage vast quantities of sensitive personally identifiable information (PII), intellectual property, or critical national infrastructure, and those subject to stringent auditing requirements. These end-users, or buyers, span all organization sizes, though the security requirements and purchasing power differ significantly between Large Enterprises and SMEs. The primary goal of these buyers is not merely compliance, but minimizing the financial and operational risk associated with credential compromise, which forms the basis for prioritizing investment in robust enforcement solutions that exceed minimum policy thresholds. Key decision-makers often include Chief Information Security Officers (CISOs), compliance officers, and IAM architects, who evaluate solutions based on scalability, integration ease, and demonstrated effectiveness against real-world threats.

Within the industry vertical breakdown, the BFSI sector remains the most robust customer base, driven by compliance requirements such as PCI DSS, SWIFT mandates, and internal risk management frameworks demanding granular control over privileged and standard user credentials due to the direct handling of monetary assets. Government agencies, including defense and civil administration, are critical customers, especially given the necessity of meeting stringent federal security mandates like FedRAMP and various defense guidelines that explicitly require strong, centrally enforced authentication policies to protect classified data. The healthcare sector, driven by HIPAA and similar patient data protection laws, represents a rapidly expanding segment seeking solutions that can manage complex access rules across decentralized hospital networks and electronic health record (EHR) systems, where compliance failure results in severe legal ramifications.

Furthermore, technology-intensive sectors like IT and Telecom, which often serve as custodians for client data and manage highly complex infrastructures, are continuous adopters, utilizing enforcement software as a core element of their internal Zero Trust strategies. Even the Retail and E-commerce sectors, traditionally slower adopters, are accelerating their procurement, prompted by the massive volumes of customer transaction data they handle and the increasing threat of account takeover (ATO) fraud. Ultimately, any organization that views digital identity as a critical security perimeter and whose operational continuity depends on preventing unauthorized access to its data and systems is a prime potential customer, valuing the software's ability to automate security policy maintenance and reduce human error.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.75 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft, IBM, Broadcom (Symantec), Okta, Ping Identity, CyberArk, BeyondTrust, ThycoticCentranea (Delinea), ManageEngine, One Identity, LastPass, Auth0 (Okta), SailPoint, ForgeRock, Entrust, Micro Focus, Sophos, CrowdStrike, Cisco, SecureAuth. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Password Policy Enforcement Software Market Key Technology Landscape

The technological landscape of the Password Policy Enforcement Software market is rapidly evolving from simple static rule engines to sophisticated, identity-centric defense mechanisms. The current generation of solutions relies heavily on centralized identity store integration, primarily connecting with Microsoft Active Directory and Azure Active Directory (Azure AD), ensuring uniform policy application across hybrid environments. A crucial technology is the incorporation of advanced hashing and salting techniques for secure storage of credentials, alongside real-time credential blacklisting services that continuously check user-chosen passwords against massive databases of known compromised credentials. This proactive scanning capability prevents users from setting passwords that have already been exposed in third-party data breaches, significantly reducing organizational risk. Furthermore, API-first design approaches are standard, allowing seamless integration with broader security orchestration, automation, and response (SOAR) platforms, enabling automated policy adjustments triggered by external threat intelligence feeds.

The market is increasingly dominated by solutions featuring behavioral analytics and machine learning (ML). These ML models monitor baseline user behavior—such as typical access patterns, resource utilization, and geographical login locations—to establish a normal operating profile. Any deviation from this profile triggers an immediate policy enforcement action, such as demanding multi-factor authentication or forcing a password reset, even if the user correctly enters their credential. This dynamic risk scoring represents a fundamental shift in enforcement philosophy, moving away from rigid, user-unfriendly rules toward contextual security. Additionally, the move toward policy-as-code and containerization technologies is improving scalability and deployment flexibility, particularly for multi-cloud deployments where policies must be instantly provisioned and de-provisioned across varied infrastructure stacks without manual intervention, supporting DevOps security pipelines effectively.

The long-term technology trajectory is focused on bridging the gap between traditional password enforcement and emerging passwordless authentication methods. Modern enforcement software is integrating capabilities to manage transition policies, ensuring that users moving to FIDO2 keys or biometric authentication still adhere to underlying governance rules before being granted access. This involves robust auditing mechanisms and the secure management of recovery passwords or master keys required for system access during service disruption. Advanced technology is also deployed in granular policy application based on resource sensitivity (e.g., highly stringent policies for accessing production databases versus standard policies for accessing internal communication tools). This resource-centric policy definition ensures that enforcement efforts are strategically aligned with the organization's highest risk assets, maximizing the return on security investment.

Regional Highlights

- North America: This region holds the largest market share due to its mature cybersecurity infrastructure, high concentration of major technology vendors, and substantial regulatory pressure (e.g., NIST, HIPAA, SOX). Large enterprises in the US and Canada are early adopters of advanced adaptive policy enforcement tools, driven by high investment in IAM and the necessity to combat frequent, sophisticated attacks targeting privileged accounts. The market is characterized by rapid technological refresh cycles and a strong demand for cloud-native solutions integrated into comprehensive security suites.

- Europe: The European market is heavily influenced by the General Data Protection Regulation (GDPR), which mandates strict technical and organizational measures to protect personal data, making strong password policy enforcement a non-negotiable compliance requirement. Growth is steady, focusing on hybrid deployment models to cater to traditional industries, with strong adoption in the BFSI and Public sectors. Countries like Germany, the UK, and France are leading investment in localized, multi-language solutions.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate, fueled by accelerated digital transformation, increasing internet penetration, and the introduction of new data privacy laws (e.g., in Singapore, Australia, and India). Rapid industrialization and the expansion of the IT and Telecom sectors, particularly in emerging economies, are creating massive demand for scalable, cloud-based policy enforcement software. The market is characterized by a strong focus on managed security services due to limited in-house expertise.

- Latin America (LATAM): This region shows moderate growth, primarily concentrated in financial services and government segments seeking to modernize their security defenses against rising cybercrime. Adoption is often driven by international regulatory standards and local efforts to standardize digital security practices, particularly in economies like Brazil and Mexico. Investment is generally cautious, favoring cost-effective, easily deployable solutions.

- Middle East and Africa (MEA): Growth in MEA is sector-specific, with substantial investments driven by governmental digital initiatives and the booming oil and gas and financial services industries, particularly in the UAE and Saudi Arabia. Security spending is high in these critical infrastructure sectors, focusing on enterprise-grade, on-premise or sovereign cloud solutions to meet stringent national security and data residency requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Password Policy Enforcement Software Market.- Microsoft

- IBM

- Broadcom (Symantec)

- Okta

- Ping Identity

- CyberArk

- BeyondTrust

- ThycoticCentrify (Delinea)

- ManageEngine

- One Identity

- LastPass

- Auth0 (Okta)

- SailPoint

- ForgeRock

- Entrust

- Micro Focus

- Sophos

- CrowdStrike

- Cisco

- SecureAuth

Frequently Asked Questions

Analyze common user questions about the Password Policy Enforcement Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Password Policy Enforcement Software in modern cybersecurity?

The primary function is to centrally automate and standardize stringent rules governing password complexity, rotation, and lifecycle management across all enterprise systems, minimizing the risk posed by weak, reused, or compromised credentials. It acts as a mandatory security gate for identity governance.

How does AI technology enhance the effectiveness of password policies?

AI enhances effectiveness by shifting policies from static rules to adaptive, risk-based enforcement. Machine Learning analyzes user behavior and contextual factors to assign a real-time risk score, dynamically adjusting policy requirements (e.g., enforcing MFA or immediate resets) only when suspicious activity is detected.

Is the market for Password Policy Enforcement Software threatened by the rise of passwordless authentication?

No, the market is adapting. While passwordless solutions (like FIDO2) reduce reliance on passwords, enforcement software remains critical for managing recovery mechanisms, privileged accounts, and hybrid environments, integrating with passwordless strategies to ensure underlying security governance is maintained.

Which industry vertical is the largest consumer of this software?

The Banking, Financial Services, and Insurance (BFSI) industry is the largest consumer. This dominance is due to stringent regulatory mandates (e.g., PCI DSS), high volumes of sensitive transaction data, and the critical need for robust defense against financial cybercrime, necessitating ironclad credential security.

What are the key differences between on-premise and cloud-based deployment models?

On-premise deployment offers greater control, customization, and meets data residency requirements, typically favored by large, highly regulated enterprises. Cloud-based (SaaS) deployment offers greater scalability, lower upfront costs, and faster implementation, making it attractive for SMEs and organizations prioritizing hybrid IT agility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager