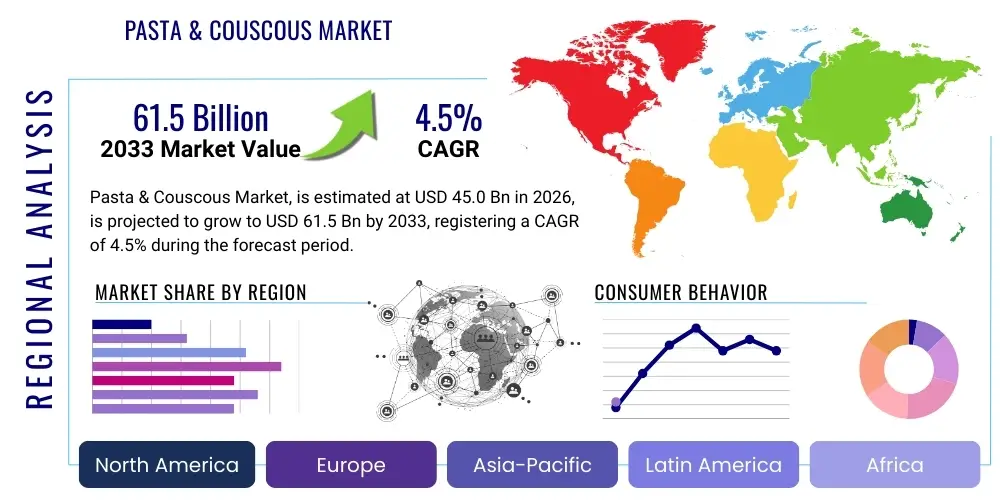

Pasta & Couscous Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438802 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pasta & Couscous Market Size

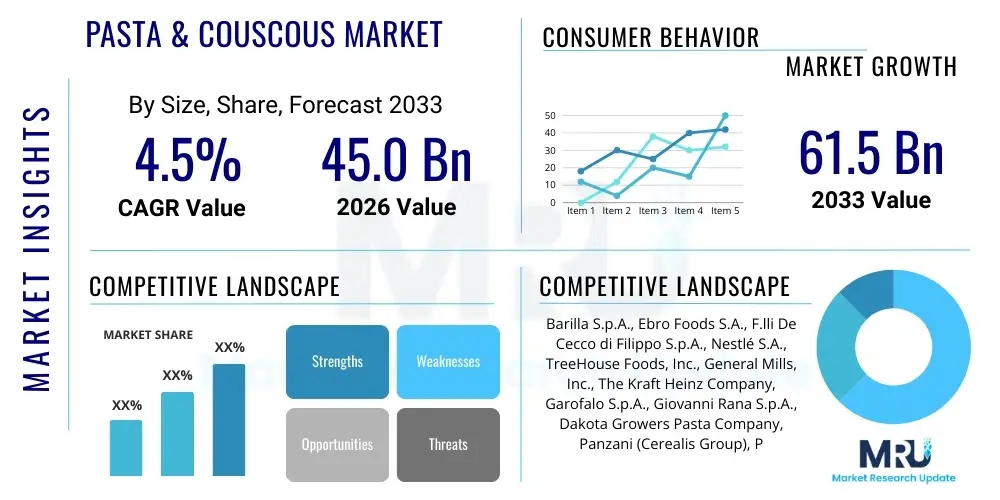

The Pasta & Couscous Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. This robust expansion is fueled by the sustained global popularity of pasta as a convenient, versatile, and economical staple food, coupled with increasing consumer demand for diverse and specialized product formats, including whole grain and gluten-free options. The global shift towards adopting ready-to-eat and quick-preparation meal solutions further solidifies this growth trajectory, particularly in urbanized and time-constrained populations across developed and emerging economies.

The market is estimated at USD 45.0 Billion in 2026 and is projected to reach USD 61.5 Billion by the end of the forecast period in 2033. This valuation reflects not only the volume sales of traditional dried pasta but also the accelerating growth within the value-added segments, such as fresh pasta, premium artisanal varieties, and specialized couscous products catering to specific dietary regimes like the Mediterranean diet. Investment in automated manufacturing processes and advanced packaging technologies is essential for major market players to maintain cost efficiency and extend product shelf life, thereby supporting this revenue expansion.

Regional dynamics play a crucial role in the market size estimation. While Europe, particularly Italy, remains the historical and largest consumer base, the Asia Pacific region and Latin America are anticipated to exhibit the fastest growth rates due to rising disposable incomes, urbanization, and the increasing penetration of Western dietary habits. Strategic market expansion by multinational corporations into these high-potential regions, alongside localization of product offerings, is driving significant gains in both volume and value, underpinning the strong projected CAGR for the forecast period.

Pasta & Couscous Market introduction

The Pasta & Couscous Market encompasses the global production, distribution, and consumption of various dried, fresh, and pre-cooked pasta types made primarily from durum wheat semolina, as well as couscous, a granulated form of semolina traditionally consumed across North Africa and the Middle East. These products serve as fundamental carbohydrate staples globally, valued for their ease of preparation, long shelf stability, affordability, and adaptability across diverse culinary traditions. The primary applications range from household meal preparation and institutional feeding (schools, hospitals) to high-volume use in the Foodservice sector (restaurants, cafes, catering companies).

Key driving factors supporting market growth include the escalating demand for convenient food products that fit modern, fast-paced lifestyles, coupled with sustained health and wellness trends leading to innovation in whole wheat, fortified, and alternative grain (e.g., lentil, chickpea) pasta varieties. The inherent benefits of pasta and couscous, such as being a source of complex carbohydrates and energy, combined with their low cost per serving, make them irreplaceable components of the global food matrix. Furthermore, robust marketing and global supply chains have increased product accessibility, introducing these staples to new consumer bases outside their traditional regions of consumption.

The continuous innovation pipeline includes advancements in extrusion technology for creating unique pasta shapes, development of quick-cook formats, and utilization of sustainable packaging materials. Manufacturers are focusing heavily on enhancing the nutritional profile to appeal to health-conscious consumers, successfully repositioning pasta from a simple carbohydrate source to a foundational component of balanced, diversified meals. This strategic evolution ensures the market remains dynamic and resilient against competitive substitutes, driving consistent global volume and value increases across all segments.

Pasta & Couscous Market Executive Summary

The Pasta & Couscous Market demonstrates stable growth driven by global urbanization and the increasing prevalence of convenience-oriented lifestyles, alongside significant business trends focusing on sustainability and portfolio diversification. Business trends are characterized by major industry players engaging in strategic mergers and acquisitions to consolidate market share and optimize supply chains, particularly targeting specialized segments such as gluten-free and organic pasta. Manufacturing efficiency is being prioritized through investment in high-speed production lines and predictive maintenance using advanced analytics, ensuring cost control despite volatile wheat prices. Innovation in packaging, moving towards biodegradable and recyclable materials, is a critical competitive differentiator responding directly to heightened consumer environmental awareness.

Regionally, Europe maintains the highest per capita consumption and remains the primary revenue generator, anchored by strong demand in Mediterranean countries, though saturation levels are high. The most dynamic growth is observed in the Asia Pacific (APAC) region, where rapid foodservice expansion and the Westernization of diets among middle-class populations are driving exponential volume growth. North America shows stable growth, primarily fueled by premiumization, with consumers increasingly purchasing specialty, artisanal, and healthier pasta alternatives. Emerging markets in Latin America and MEA present substantial long-term opportunities, provided supply chain infrastructures can be reliably scaled to meet growing demand.

Segment trends highlight the shift towards better-for-you products. While traditional durum wheat pasta retains the largest volume share, the Whole Wheat and Specialty Pasta segments (including legumes and vegetable-based variants) are recording significantly higher value growth rates. The distribution landscape is also evolving; although supermarkets and hypermarkets remain dominant, the rapid expansion of e-commerce and direct-to-consumer models is redefining market access, allowing smaller, niche brands to compete effectively globally. Couscous, traditionally segmented, is also witnessing diversification, appearing in pre-flavored and quick-cook pouches, attracting younger demographics seeking easy, nutritious side dishes.

AI Impact Analysis on Pasta & Couscous Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Pasta & Couscous Market frequently center on efficiency gains, predictive capabilities, and enhanced quality control. Key themes include how AI can optimize durum wheat procurement amidst climate volatility, improve product customization and recipe formulation, and revolutionize supply chain resilience, particularly cold chain monitoring for fresh pasta. Consumers and industry stakeholders are highly interested in AI-driven process optimization that can reduce waste, ensure consistent texture and cooking quality (al dente testing), and enable hyper-personalized marketing targeting specific dietary needs (e.g., low-carb, high-protein preferences). The overarching expectation is that AI will minimize operational costs while maximizing product integrity and consumer relevance.

- AI-Powered Supply Chain Optimization: Utilizing machine learning algorithms to forecast demand fluctuations based on seasonality and regional events, optimizing inventory levels of raw materials (semolina), and improving route planning for distribution to reduce logistics costs.

- Predictive Quality Control: Implementing AI vision systems and sensors on production lines to detect minute defects in shape, color, and texture of pasta before packaging, ensuring only premium products reach the market, thereby reducing recalls and enhancing brand reputation.

- Automated Recipe and Formulation Development: Using AI to analyze vast datasets of consumer preferences and nutritional requirements to rapidly develop new pasta variants (e.g., incorporating ancient grains or high-fiber additives) that meet emerging dietary trends.

- Manufacturing Efficiency and Predictive Maintenance: AI monitors sensor data from extruders, dryers, and packaging machines to predict equipment failure before it occurs, minimizing costly downtime and improving overall equipment effectiveness (OEE).

- Personalized Consumer Engagement: Leveraging AI to analyze purchase history and online behavior to offer customized pasta recommendations, meal kits, or subscription services tailored to individual household needs and specific health goals.

- Climate and Sourcing Risk Mitigation: Employing AI models to analyze climate data, monitor global wheat yields, and predict price volatility, enabling procurement managers to secure contracts strategically and mitigate sourcing risks effectively.

- Waste Reduction Systems: AI analyzes material flow and processing outputs to identify areas of significant ingredient waste within the manufacturing process, optimizing mixing and drying parameters to maximize yield.

DRO & Impact Forces Of Pasta & Couscous Market

The dynamics of the Pasta & Couscous market are shaped by powerful Drivers (D) related to convenience and health consciousness, notable Restraints (R) concerning raw material economics and competitive substitutes, and substantial Opportunities (O) arising from geographical expansion and functional food innovation. These elements collectively generate significant Impact Forces that dictate market direction, pricing strategies, and competitive positioning. The primary driving force remains the product's fundamental position as an affordable, shelf-stable, and universally appealing staple that requires minimal preparation time, aligning perfectly with global demographic shifts towards smaller households and busier lifestyles. However, this stability is challenged by inflationary pressures on key inputs and persistent consumer misinformation regarding carbohydrate consumption, demanding continuous innovation in product communication and reformulation to mitigate these restraints.

The impact forces currently exerting the greatest pressure include the sustainability imperative, pushing companies toward eco-friendly sourcing and packaging, and the rise of digital commerce, which mandates integrated omnichannel distribution strategies. Regulatory environments concerning food labeling, particularly for gluten-free and organic claims, also represent a significant force, influencing market entry and product marketing efforts across various geographies. Successfully navigating the market requires manufacturers to invest heavily in supply chain resilience to manage global events (like geopolitical disruptions or climate crises) that directly affect wheat supply and pricing, which are the most critical restraints to profit margins.

Opportunities are largely concentrated in emerging markets where penetration rates are still low but consumption habits are rapidly shifting, presenting scalable white-space expansion. Furthermore, the functional food trend offers a high-value pathway, allowing manufacturers to reposition pasta as a vehicle for protein fortification, fiber enhancement, and vitamin enrichment, moving beyond the traditional commodity status. The interplay between these factors ensures that market growth is not homogenous; rather, it is concentrated within premium, specialty, and convenience segments, demanding strategic adaptation from all industry participants to capitalize on the positive drivers while neutralizing the economic and competitive restraints.

Segmentation Analysis

The Pasta & Couscous Market is systematically segmented based on Type, Form, Distribution Channel, and Raw Material, allowing for a granular analysis of consumer preferences and market dynamics across different demographics and regions. This multi-dimensional segmentation is crucial for understanding the shifting value proposition, where consumers are increasingly moving away from basic dried wheat pasta towards products offering enhanced nutritional value, specific dietary adherence (e.g., gluten-free, vegan), or superior culinary characteristics (e.g., artisanal fresh pasta). Analyzing these segments helps companies tailor their production and marketing strategies, identify high-growth niches, and allocate resources effectively across global operations.

The Form segmentation, distinguishing between Dry, Fresh, and Canned/Instant products, reflects the consumer balance between cost-effectiveness (dry pasta being the most economical) and convenience/premium quality (fresh and instant options commanding higher prices). The fastest-growing segment often includes specialty pasta made from alternative flours like lentil or quinoa, aligning with the macro trend of protein enrichment and reduced carbohydrate intake. Distribution channel analysis confirms the continued dominance of organized retail but also underscores the pivotal role of online channels in delivering niche, premium, and imported products directly to the consumer, especially in densely populated urban centers where convenience is paramount.

- By Type:

- Durum Wheat Pasta (Standard, Semolina)

- Whole Wheat Pasta

- Specialty Pasta (Gluten-Free, Organic, Fortified)

- Alternative Grain Pasta (Lentil, Chickpea, Quinoa)

- Egg Pasta (Noodle, Fresh)

- Couscous (Instant, Medium Grain, Pearl)

- By Form:

- Dry Pasta (Long, Short, Tubular, Shape)

- Fresh Pasta (Refrigerated, Frozen)

- Canned and Instant/Ready-to-Eat Pasta

- By Raw Material:

- Wheat (Durum, Semolina, Whole Grain)

- Corn

- Rice

- Legumes (Pea, Chickpea, Lentil)

- Others (Quinoa, Spelt)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Foodservice (HoReCa)

- Specialty Stores

Value Chain Analysis For Pasta & Couscous Market

The value chain for the Pasta & Couscous market initiates with the Upstream Analysis, which focuses primarily on the sourcing and processing of raw materials, predominantly durum wheat and water. This stage is critical as the quality of the semolina flour directly impacts the end-product quality (texture, cooking time, nutritional content) and is subject to agricultural volatility, commodity price fluctuations, and geopolitical risks. Key upstream activities involve advanced milling techniques to achieve precise granularity and protein content, along with certification and testing to ensure compliance with global food safety and dietary standards, such as organic or gluten-free sourcing.

The middle segment involves the core manufacturing process, where raw materials are mixed, extruded through bronze or Teflon dies (influencing surface texture), and subjected to precise drying processes—a pivotal step for dry pasta shelf stability and quality. Downstream analysis focuses on packaging, distribution, and marketing. Distribution channels are highly diversified, ranging from direct sales to large retailers (Supermarkets/Hypermarkets) who exert significant negotiating power, to specialized logistics networks necessary for managing the strict temperature and shelf-life requirements of fresh and refrigerated pasta. The channel choice profoundly affects profit margins, with Direct-to-Consumer (D2C) and high-volume Foodservice procurement offering different growth potentials.

The distribution network relies heavily on both Direct and Indirect methods. Large multinational brands often use indirect distribution via global distributors and wholesalers to reach diverse international markets quickly. Conversely, smaller, artisanal, or niche fresh pasta producers often favor direct routes or specialty food distributors to maintain brand control and ensure product freshness. Optimization across the entire chain, focusing on reducing energy consumption during the drying process and minimizing food waste during packaging, is a persistent operational goal, driven by both economic necessity and sustainability mandates.

Pasta & Couscous Market Potential Customers

The potential customer base for the Pasta & Couscous market is exceptionally broad, spanning nearly all global demographics due to its status as a versatile and economical staple food. Primary segments include busy families and working professionals seeking convenient, quick-cook meal solutions that are affordable and satisfying. This demographic segment highly values product formats such as instant couscous, quick-cook pasta, and pre-sauced canned options. Furthermore, institutional buyers, including hospitals, schools, military organizations, and corporate cafeterias, represent a massive, stable segment due to the low cost per serving and high scalability of pasta preparation in bulk settings.

A rapidly growing segment of potential customers comprises health-conscious individuals, athletes, and those adhering to specific dietary requirements. These buyers are the key drivers for the premium and specialty segments, including high-protein, gluten-free, whole-grain, and organic pasta. They are typically willing to pay a premium for enhanced nutritional profiles and ingredients perceived as healthier or more sustainable. Manufacturers target this group through clear labeling, certification marks, and ingredient transparency, marketing the product as a functional food rather than merely a standard carbohydrate.

Finally, the foodservice industry (restaurants, cafes, catering) represents a crucial B2B customer segment. These buyers prioritize consistent quality, standardized portion control, and reliable supply chains, often purchasing in large, industrial volumes. Their demand profile dictates the need for specialized packaging and bulk formats. As global tourism and dining out continue to recover, the reliance of global cuisines (especially Italian, Mediterranean, and North African) on pasta and couscous ensures continuous, high-volume demand from this professional consumer base, driving innovation in ingredient stability and cooking performance under commercial conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 Billion |

| Market Forecast in 2033 | USD 61.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barilla S.p.A., Ebro Foods S.A., F.lli De Cecco di Filippo S.p.A., Nestlé S.A., TreeHouse Foods, Inc., General Mills, Inc., The Kraft Heinz Company, Garofalo S.p.A., Giovanni Rana S.p.A., Dakota Growers Pasta Company, Panzani (Cerealis Group), Prince Pasta, Colavita S.p.A., Insieme Pasta, Osem Investments Ltd., Goodman Fielder, AGT Food and Ingredients Inc., Pedon S.p.A., Rustichella d'Abruzzo, 2 Sisters Food Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pasta & Couscous Market Key Technology Landscape

The technological landscape driving the modern Pasta & Couscous market focuses on three primary areas: enhancing production efficiency, improving product quality and nutritional profiles, and ensuring food safety and traceability. High-pressure extrusion technology remains fundamental, but continuous innovation in die materials (e.g., bronze dies for rougher texture, enhancing sauce adhesion) and computer numerical control (CNC) machining allows for complex, unique pasta shapes that appeal to premium consumers. Crucially, the optimization of the drying process—moving towards high-temperature, short-time (HTST) drying—is essential for achieving specific cooking characteristics, maintaining protein integrity, and substantially reducing the risk of microbiological contamination, thus extending shelf life.

In terms of product innovation, manufacturing technology has rapidly advanced to accommodate non-wheat raw materials. Specialized mixing and extrusion equipment is required to process fragile flours derived from legumes (such as chickpea or red lentil), ensuring the structural integrity of gluten-free pasta without compromising the desired al dente texture upon cooking. Furthermore, fortification technology, including micro-encapsulation techniques, is being employed to integrate essential micronutrients (vitamins, iron, calcium) into the pasta matrix without altering sensory attributes, meeting the rising global demand for functional food staples, particularly in regions facing nutritional deficiencies.

Automation and digitalization, central to Industry 4.0, are now standard in large-scale pasta manufacturing. This includes fully automated batching, continuous flow metering, and sophisticated quality assurance systems utilizing infrared spectroscopy and moisture analyzers for real-time process monitoring. These technologies minimize human error, reduce batch-to-batch variation, and significantly enhance operational visibility, allowing manufacturers to react instantly to quality deviations. Traceability systems, leveraging blockchain and digital logging, are increasingly being adopted to track raw materials from the farm to the consumer, providing necessary transparency and ensuring rapid response capability in the event of contamination or recall events.

Regional Highlights

The Pasta & Couscous market exhibits diverse growth rates and consumption patterns across major geographical regions, influenced by cultural traditions, economic development, and dietary trends. Europe, characterized by high maturity and deep-seated culinary traditions, particularly in Italy, France, and Germany, commands the largest market share in terms of value and volume. However, growth is primarily driven by premiumization and diversification into healthier formats (organic, whole grain), as base consumption levels are already high. Investment focuses on efficiency and sustainable sourcing to maintain competitiveness.

North America, led by the US and Canada, shows strong demand for convenience and specialty products. This region is a major hub for gluten-free and alternative pasta innovation, driven by health and wellness movements and high purchasing power. The market structure is highly competitive, with rapid product turnover and significant shelf space dedicated to ethnic and premium brands. E-commerce penetration for fresh and imported pasta is particularly high here, influencing consumer accessibility and price points.

Asia Pacific (APAC) stands out as the highest potential growth region, exhibiting rapid adoption of pasta and couscous, initially driven by foodservice and gradually transitioning into household consumption. Countries like China, India, and Southeast Asian nations are seeing increasing Westernization of diets and rising disposable incomes, resulting in a swift expansion of organized retail channels capable of distributing these products efficiently. Market strategies in APAC heavily involve adapting flavors (e.g., instant noodles incorporating pasta elements) and focusing on convenience packaging to suit urban lifestyles.

Latin America (LATAM) and the Middle East & Africa (MEA) offer varied dynamics. LATAM, with strong wheat production capabilities in countries like Argentina and Brazil, has established domestic pasta industries but is increasingly importing specialty products. MEA is a major consumer of couscous (especially North Africa) and a growing market for pasta in urban centers, fueled by population growth and changing food habits. Geopolitical stability and reliable import infrastructure are critical factors determining market expansion success in these regions.

- Europe: Dominates consumption volume; focus on premiumization, organic and sustainable pasta; Italy, Germany, and France are key markets; high regulatory standards for ingredient quality (durum wheat content).

- North America (US & Canada): High growth in specialty segments (gluten-free, high-protein); driven by consumer health trends and convenience demands; significant leverage of digital and online grocery platforms for niche product distribution.

- Asia Pacific (APAC): Fastest growing region; driven by urbanization, rising middle-class disposable income, and Western dietary adoption; key focus markets include China, India, and Australia; preference for instant and convenience formats.

- Latin America (LATAM): Strong presence of regional producers (Brazil, Argentina); increasing demand for imported European artisanal pasta; market growth influenced by economic stability and currency fluctuations affecting raw material costs.

- Middle East and Africa (MEA): Large traditional couscous market in North Africa; pasta consumption rising in the GCC countries due to expat populations and foodservice expansion; opportunities in fortified pasta products addressing regional nutritional needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pasta & Couscous Market.- Barilla S.p.A.

- Ebro Foods S.A.

- F.lli De Cecco di Filippo S.p.A.

- Nestlé S.A.

- TreeHouse Foods, Inc.

- General Mills, Inc.

- The Kraft Heinz Company

- Garofalo S.p.A.

- Giovanni Rana S.p.A.

- Dakota Growers Pasta Company

- Panzani (Cerealis Group)

- Prince Pasta

- Colavita S.p.A.

- Insieme Pasta

- Osem Investments Ltd.

- Goodman Fielder

- AGT Food and Ingredients Inc.

- Pedon S.p.A.

- Rustichella d'Abruzzo

- 2 Sisters Food Group

Frequently Asked Questions

Analyze common user questions about the Pasta & Couscous market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for specialty and gluten-free pasta variants?

The primary driver is the global increase in celiac disease diagnoses and non-celiac gluten sensitivity, coupled with a broader consumer trend favoring functional foods that offer perceived health benefits, such as higher protein (legume pasta) and lower glycemic indices. Manufacturers are responding with innovations using rice, corn, lentils, and chickpeas.

How significant is the role of raw material price volatility in the market?

Raw material price volatility, particularly for durum wheat semolina, is a highly significant constraint. Global climate changes, agricultural policies, and geopolitical conflicts directly impact wheat yields and futures prices. Manufacturers employ hedging strategies and invest in diverse sourcing to mitigate these cost pressures, which ultimately affect end-user pricing and profit margins.

Which distribution channel is experiencing the fastest growth for fresh pasta products?

Online retail (e-commerce) and specialized convenience stores are experiencing the fastest growth for fresh and premium refrigerated pasta. E-commerce enables efficient cold chain logistics directly to consumers, catering to the growing demand for higher-quality, quick-preparation meals, bypassing traditional large format retail limitations.

What technological advancements are optimizing pasta production efficiency?

Key technological advancements include High-Temperature Short-Time (HTST) drying techniques, which reduce production time and enhance shelf stability, and advanced sensor-driven automation (Industry 4.0 integration) that ensures precise moisture control and shape consistency, minimizing waste and energy consumption across the manufacturing lines.

Is the Asia Pacific region expected to surpass Europe in pasta consumption volume?

While Europe currently maintains the highest per capita consumption, the Asia Pacific region is expected to lead in market growth rate (CAGR) due to massive population size, urbanization, and rapid penetration into new households. APAC is projected to become the dominant volume driver in the long term, though likely not surpassing European aggregate consumption immediately within the current forecast period.

The comprehensive analysis of the Pasta & Couscous market confirms its enduring resilience and capacity for innovation, driven equally by historical consumer staples demand and modern requirements for health, convenience, and sustainability. Strategic planning must prioritize agile supply chain management, investment in functional food technology, and targeted regional expansion, particularly within the dynamic APAC markets. Maintaining competitive pricing while navigating raw material volatility remains a core challenge, demanding robust operational efficiencies and forward-looking risk assessment across all major market participants.

The shift towards plant-based diets and specific nutritional goals continues to reshape product offerings. Brands that successfully integrate clean labels, ethical sourcing, and specialized dietary claims (such as high-fiber or fortified variants) are best positioned for capturing premium market share. Furthermore, leveraging digital channels for consumer engagement and direct distribution offers crucial pathways for niche brands to scale, circumventing the traditional dominance of large supermarket chains. Ultimately, the market trajectory is highly positive, driven by the global appreciation for these versatile and culturally significant staple foods.

Future growth will also be significantly influenced by geopolitical stability concerning major wheat-producing regions. Manufacturers must continuously monitor global trade flows and cultivate diversified sourcing portfolios to ensure supply continuity. Investment in smart factory technologies, including AI-driven predictive analytics for quality control and operational efficiency, will be the determinant factor for competitive differentiation in cost structure and product consistency. This focus on technological adoption ensures that the Pasta & Couscous market remains responsive to both macro-economic pressures and evolving consumer preferences through the end of the forecast period in 2033.

A deeper dive into consumer segmentation reveals distinct needs among different age groups. Younger generations (Millennials and Gen Z) prioritize ready-to-eat formats and eco-friendly packaging, influencing rapid development cycles for instant and canned pasta meals. Conversely, older demographics often seek traditional, familiar formats but show increasing interest in fortified options that support bone health or heart health. Addressing these varied needs requires highly specialized marketing campaigns and distribution strategies tailored to the psychographic profiles of the target consumers within each major geographical market. The global landscape demands localization of marketing content and product flavor profiles while maintaining standardized, high-quality manufacturing processes globally.

The regulatory environment across different regions also dictates operational practices and labeling standards. For instance, European regulations regarding the minimum percentage of durum wheat in dry pasta are stringent, impacting import requirements and ingredient sourcing for international producers. Compliance with these diverse and often complex food safety and nutritional labeling standards represents a non-negotiable cost of doing business, particularly for companies engaged in cross-border trade. Continuous investment in regulatory affairs teams and quality assurance protocols is paramount to avoiding costly market access barriers and potential recalls, which can severely damage brand trust and market positioning.

Furthermore, the competitive landscape is not static; it is characterized by intense rivalry between established multinational corporations and agile local artisanal producers who leverage heritage and premium ingredients as their core selling proposition. Large firms, such as Barilla and Ebro Foods, typically compete on scale, supply chain efficiency, and broad product availability, while smaller players compete on differentiation, specialized raw materials (e.g., ancient grains), and targeted distribution through specialty food stores or high-end e-commerce platforms. Successful companies maintain a balanced portfolio that addresses both commodity volumes and high-margin specialty niches, optimizing their total revenue potential.

The foodservice sector's recovery post-pandemic plays a crucial role in volume recovery, especially for large, bulk pasta formats used in institutional kitchens and chain restaurants. As dining habits normalize globally, the demand for reliably sourced, consistent, and cost-effective pasta inputs for commercial cooking has surged. This sector often requires specific product specifications—such as higher protein content to resist overcooking—prompting manufacturers to develop separate product lines optimized for commercial kitchen environments, further segmenting the market based on end-user application requirements. The ability to secure long-term, high-volume contracts with major global food distributors remains a key competitive advantage in this area.

Finally, the growing environmental scrutiny on food production practices affects the Pasta & Couscous value chain from farm to fork. Consumers and retailers are demanding lower carbon footprints, responsible water usage, and reduced pesticide use in wheat farming. This pressure drives investment in precision agriculture for wheat cultivation and mandates the adoption of energy-efficient manufacturing processes, specifically optimizing the energy-intensive drying phase. Companies demonstrating verifiable commitments to sustainability, often through third-party certifications, are increasingly favored by retailers and environmentally conscious consumers, transforming sustainability from a corporate social responsibility initiative into a core market differentiator.

The expansion into ready-to-eat and ready-to-cook meal kits featuring pasta and couscous is another defining trend. These value-added products capitalize on the convenience factor while offering gourmet or ethnic flavor profiles. This segment requires different packaging technologies (e.g., microwave-safe trays, modified atmosphere packaging) and complex supply chain coordination, especially when incorporating perishable sauces or vegetable components. The success in this niche often relies on strategic partnerships with meal kit providers or dedicated in-house product development focused on maximizing flavor preservation and shelf stability without resorting to excessive preservatives.

In summary, the Pasta & Couscous market is transitioning from a high-volume commodity market to a segmented ecosystem defined by quality, innovation, and adherence to specific dietary and ethical standards. The combined effect of technological advancements (AI, automation), shifts in consumer health priorities, and regional economic dynamics creates a complex yet highly rewarding environment for strategically focused market players over the 2026–2033 forecast period.

The role of emerging economies in driving incremental volume sales cannot be overstated. As middle-class populations grow in regions like Southeast Asia, Africa, and parts of Eastern Europe, the accessibility and affordability of pasta position it as a favorable substitute for more expensive or less convenient local staples. Market penetration in these areas often starts through imports facilitated by organized retail, followed by the establishment of local manufacturing facilities by global players to reduce logistics costs and leverage regional raw material advantages. Successful strategies include localizing packaging sizes and formats to suit varying income levels and consumption habits.

Furthermore, digital marketing and social media are playing an increasingly important role in shaping consumer preferences and driving brand loyalty. Brands are utilizing platforms to showcase product versatility, offering recipes and engaging content that encourages experimental cooking and highlights the nutritional benefits of their specialized pasta lines. This direct interaction helps bridge the knowledge gap regarding new product categories, such as lentil or chickpea pasta, and accelerates consumer trial and adoption rates, particularly among younger, digitally native consumer cohorts who value transparency and engagement with the brands they consume.

Finally, continuous research and development efforts are focused on improving the sensory attributes of non-wheat pasta, which historically struggled with texture and flavor parity compared to traditional semolina pasta. Breakthroughs in blending technologies and extrusion parameters are gradually narrowing this quality gap, making alternative grain options more palatable and widely accepted, thereby ensuring that the health-driven segmentation continues to fuel high-value growth for the overall Pasta & Couscous market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager