Patent Foramen Ovale Closure Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431717 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Patent Foramen Ovale Closure Device Market Size

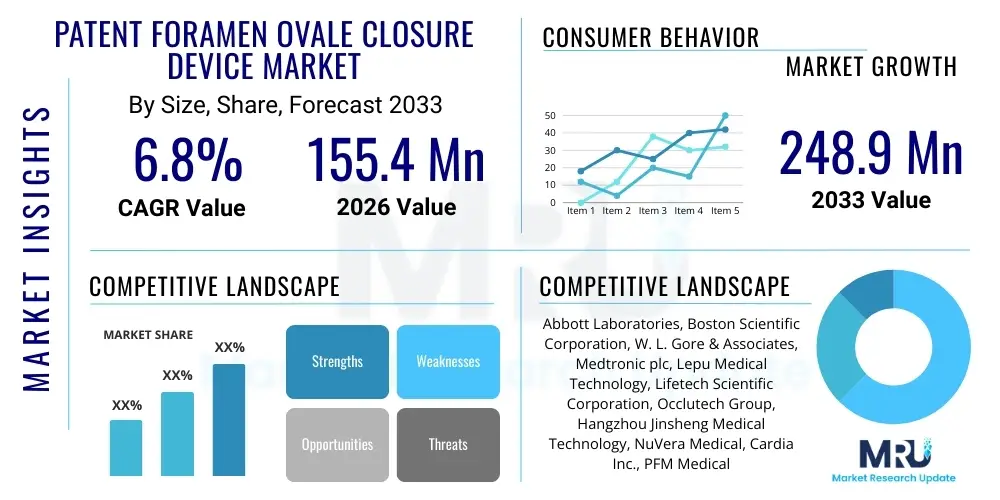

The Patent Foramen Ovale Closure Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 155.4 million in 2026 and is projected to reach USD 248.9 million by the end of the forecast period in 2033.

Patent Foramen Ovale Closure Device Market introduction

The Patent Foramen Ovale (PFO) Closure Device Market encompasses specialized implantable cardiac devices utilized in minimally invasive procedures to seal the persistent opening between the upper chambers of the heart (the atria) that failed to close naturally after birth. PFO closure devices, typically delivered via catheterization, are designed to prevent paradoxical embolization—the passage of blood clots from the venous circulation into the systemic circulation—which is implicated in cryptogenic stroke (CS), transient ischemic attacks (TIA), and specific types of migraine with aura. The primary devices in this category include double-disc occluders and bioabsorbable plugs, engineered for high compatibility and long-term safety within the cardiovascular system. The efficacy of these devices hinges on securely sealing the PFO while minimizing complications such as erosion or device embolization.

The therapeutic rationale for PFO closure has dramatically shifted following landmark clinical trials such as RESPECT, CLOSURE I, and REDUCE, which provided robust evidence supporting device closure over antiplatelet therapy alone for secondary stroke prevention in highly selected patient populations. This definitive shift in clinical guidelines, particularly for patients under 60 years old suffering from CS, serves as a cornerstone driving market expansion. Furthermore, continuous product refinement focuses on reducing the metal mass of the implant, improving deployment mechanisms for procedural ease, and minimizing post-procedure atrial fibrillation risk, thereby expanding the applicability and acceptance of these devices globally among interventional cardiologists.

Major applications of PFO closure devices predominantly revolve around the prevention of recurrent embolic events, though emerging applications include treating specific cases of platypnea-orthodeoxia syndrome and decompression illness in professional divers. Key benefits include the reduction of long-term stroke risk, enhanced quality of life by mitigating debilitating stroke recurrence fears, and the relatively rapid recovery associated with catheter-based intervention compared to open-heart surgery. Driving factors include the increasing prevalence of diagnostic imaging techniques (Transesophageal Echocardiography - TEE), rising awareness among clinicians regarding the PFO-stroke link, and the expanding geriatric population, which is more susceptible to cardiovascular co-morbidities requiring thorough evaluation and preventative intervention.

Patent Foramen Ovale Closure Device Market Executive Summary

The Patent Foramen Ovale Closure Device Market is experiencing robust expansion driven primarily by favorable updates in international clinical guidelines and sustained technological advancements focused on biocompatibility and procedural efficiency. Business trends indicate a movement towards mergers and acquisitions among large medical device manufacturers aiming to consolidate their structural heart portfolio and gain access to differentiated device technologies, particularly those offering lower profile delivery systems or bioresorbable features. Regulatory approvals, especially the pivotal FDA approval of devices specifically indicated for secondary stroke prevention, have de-risked the investment landscape and accelerated market uptake in key geographies. The competitive landscape is characterized by a balance between established device leaders and niche innovators specializing in complex PFO morphology solutions, pushing continuous iteration in material science and deployment ergonomics.

Regionally, North America maintains the highest market share due to highly sophisticated healthcare infrastructure, high reimbursement rates, and aggressive adoption of evidence-based intervention following positive trial data. However, the Asia Pacific region is forecast to exhibit the fastest growth rate, fueled by improving healthcare access, increasing awareness of cardiovascular risk factors, and significant investments in catheterization lab facilities across emerging economies like China and India. European markets demonstrate steady growth, constrained slightly by varied national reimbursement policies and rigorous comparative effectiveness assessments necessary for widespread clinical adoption.

Segment trends highlight the dominance of the device type segment focused on disc-occluder systems, given their long history of clinical use and proven efficacy. Nonetheless, the bioresorbable or bioabsorbable PFO closure segment is poised for significant disruptive growth, offering the long-term benefit of leaving no permanent foreign material structure in the heart once the closure is achieved. Furthermore, the End-User segmentation reinforces the critical role of hospital cardiac centers and specialized cath labs, which serve as the primary purchasing and utilization points for these high-value interventional devices, demanding integrated training and support programs from device manufacturers.

AI Impact Analysis on Patent Foramen Ovale Closure Device Market

User queries regarding the impact of Artificial Intelligence (AI) on the PFO Closure Device Market predominantly focus on three key themes: improving diagnostic accuracy, optimizing procedural planning and execution, and accelerating post-market surveillance. Users are keenly interested in how machine learning algorithms can analyze complex imaging data (such as TEE, CT, and cardiac MRI) to precisely identify PFO morphology, determine optimal device size, and predict procedural difficulty or potential complications like residual shunt. Concerns often center around the reliability of AI in low-volume centers and the regulatory pathway for integrating AI diagnostics into clinical decision support systems, particularly concerning the ethical implications of autonomous decision-making in device selection.

AI is beginning to revolutionize the preclinical and procedural phases of PFO closure. In diagnostics, deep learning models can rapidly analyze thousands of echocardiographic images to detect subtle PFO characteristics—including tunnel length, septal mobility (like atrial septal aneurysm), and associated shunt size—with greater consistency than human operators, thereby significantly reducing misdiagnosis rates and ensuring appropriate patient selection for device implantation. During the procedure, real-time AI image guidance systems overlaying fluoroscopy or echocardiography can assist interventionalists in navigation, precise device positioning, and optimal deployment, ultimately aiming to minimize procedural time and reduce radiation exposure for both the patient and the clinical team.

Looking ahead, the integration of AI platforms into large patient registries is expected to enhance post-market surveillance by identifying device performance anomalies or long-term complication trends much faster than traditional manual analysis. This rapid feedback loop allows manufacturers to iterate on device design and provides regulators with robust data regarding real-world effectiveness. The expectation among clinicians and market observers is that AI integration will standardize PFO closure protocols, improve success rates by personalizing device choice based on sophisticated morphological analysis, and potentially decrease training time required for new interventionalists.

- AI enhances TEE image analysis for precise PFO identification and morphology characterization, reducing diagnostic variability.

- Machine learning models predict optimal device sizing and type selection, minimizing residual shunts and long-term complication risks.

- Real-time AI guidance systems optimize catheter navigation and device deployment during minimally invasive procedures, improving procedural efficiency.

- Predictive analytics identify patients most likely to benefit from PFO closure versus medical management, optimizing resource allocation.

- Accelerated analysis of post-market surveillance data ensures rapid detection of device-related issues or unusual complication patterns.

DRO & Impact Forces Of Patent Foramen Ovale Closure Device Market

The Patent Foramen Ovale Closure Device Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and competitive environment. The primary driving forces stem from compelling clinical evidence establishing PFO closure as superior to medical therapy for secondary stroke prevention in specific demographics, alongside the continuous advancement in material science yielding safer, lower-profile, and bioabsorbable devices. Restraints largely involve the variability in clinical opinion regarding patient selection—especially outside of cryptogenic stroke indications—and the high cost and complexity associated with catheter-based interventions, which limits adoption in developing regions lacking advanced interventional infrastructure. Opportunities are vast, primarily residing in leveraging advanced imaging modalities (like 4D echocardiography) to improve patient screening, exploring new indications (e.g., refractory migraines), and expanding into underserved geographies with rapidly growing healthcare investment.

Impact forces within this market are significant. Clinical trials serve as the paramount impact force; positive results, such as those from the recent long-term follow-up of major PFO trials, directly translate into guideline updates that mandate intervention, thereby opening substantial patient pools. Conversely, negative results or high complication rates from niche products can severely restrict market entry or cause immediate withdrawal. Regulatory forces exert intense pressure, demanding high standards of pre-market testing and extensive post-market monitoring due to the criticality of the cardiovascular application. Economic factors, notably health technology assessment (HTA) bodies and payer coverage decisions, dictate the feasibility of widespread adoption, especially concerning the cost-effectiveness argument relative to lifelong antiplatelet therapy.

Furthermore, technological innovation acts as a continuous impact force. The shift toward single-use, fully disposable delivery systems and the incorporation of remote monitoring capabilities are forces compelling competitors to adapt their portfolios. The competitive rivalry is high, forcing companies to differentiate not only on device characteristics (e.g., size, implant material) but also on comprehensive physician training programs and clinical support services, which are critical for successful procedural outcomes and widespread hospital adoption. These drivers and impact forces collectively emphasize a market environment that prioritizes evidence-based practice, procedural safety, and long-term device performance.

Segmentation Analysis

The Patent Foramen Ovale Closure Device Market is comprehensively segmented based on three primary categories: Device Type, Indication, and End-User. Analyzing these segments provides a nuanced understanding of market dynamics, revealing where investment is concentrating and which clinical applications are experiencing the most rapid growth. The segmentation by Device Type primarily distinguishes between the established double-disk occluder systems, which account for the largest revenue share, and emerging bioresorbable devices, which promise future dominance due to their patient-friendly long-term profile. Indication segmentation clearly separates secondary stroke prevention, which is the dominant application driven by robust clinical trial data and regulatory approvals, from other niche applications such as decompression sickness management or migraine prophylaxis trials.

The structure of the market emphasizes the critical role of specialized cardiology units. End-User segmentation highlights that hospital cardiac centers—particularly those with high-volume structural heart programs—are the foundational customers, given the procedural complexity requiring specialized catheterization lab facilities and highly trained interventional teams. Ambulatory Surgical Centers (ASCs) represent a growing, though currently smaller, segment that offers cost-effective procedural environments, particularly in developed markets where the move toward outpatient procedures for structural heart interventions is accelerating. Understanding these segments is vital for manufacturers developing targeted marketing strategies and optimizing their distribution channels to reach key decision-makers, including interventional cardiologists, neurologists, and hospital administrators focused on structural heart program growth and cost management.

- Device Type:

- Double-Disc Occluders (Amplatzer, Gore Cardioform)

- Bioabsorbable Devices

- Other Mechanical Plugs

- Indication:

- Secondary Stroke Prevention (Cryptogenic Stroke)

- Decompression Sickness (DCS)

- Other Applications (e.g., Migraine Prophylaxis, Platypnea-Orthodeoxia Syndrome)

- End-User:

- Hospital Cardiac Centers

- Ambulatory Surgical Centers (ASCs)

- Specialized Cardiac Clinics

Value Chain Analysis For Patent Foramen Ovale Closure Device Market

The value chain for PFO closure devices begins with highly specialized upstream activities involving research and development (R&D) focused on biomaterials science, device design optimization (e.g., low-profile delivery), and extensive pre-clinical testing to ensure long-term biocompatibility and structural integrity. Key suppliers in the upstream segment include specialized material providers for Nitinol wire, polymer coatings, and biocompatible fabrics necessary for constructing the occluder mechanism. Manufacturing is a high-cost, high-precision activity, often requiring certified cleanroom environments and stringent quality controls (ISO 13485 compliance) due to the nature of the implantable cardiac device.

Midstream activities primarily encompass the distribution channel, which is highly critical given the necessity for controlled inventory, sterile storage, and just-in-time delivery to hospitals. Distribution is typically direct in major markets through dedicated sales teams, or through specialized, highly regulated third-party distributors in smaller international regions. Direct distribution allows manufacturers to maintain tight control over inventory and provide necessary clinical support during the procedure. Downstream activities involve the crucial steps of market access, including obtaining regulatory approval (FDA, CE Mark, NMPA), managing complex reimbursement negotiations with private and public payers, and providing extensive clinical education and procedural support to interventional cardiologists.

The direct pathway often involves manufacturer representatives consulting directly with the hospital's catheterization lab and structural heart team, influencing product preference based on clinical data and training support. Indirect distribution utilizes local medical device wholesalers who possess established logistical networks, but this approach requires manufacturers to ensure adherence to strict temperature and handling requirements. The ultimate downstream delivery to the end-user (the patient undergoing the procedure) is heavily influenced by the referring neurologist's diagnosis, the interventional cardiologist's preference, and the hospital's formulary approval for specific device brands, highlighting the crucial importance of clinical advocacy and comprehensive professional training throughout the value chain.

Patent Foramen Ovale Closure Device Market Potential Customers

The primary customers and end-users of Patent Foramen Ovale closure devices are specialized medical institutions capable of performing complex, catheter-based structural heart interventions. These institutions primarily include large teaching hospitals, academic medical centers, and specialized cardiovascular institutes that possess state-of-the-art catheterization laboratories, advanced imaging capabilities (TEE, Intracardiac Echocardiography - ICE), and multidisciplinary teams including interventional cardiologists, cardiac surgeons, and neurologists. These high-volume centers prioritize devices supported by robust, long-term clinical trial data, demanding devices that demonstrate superior efficacy in reducing recurrent cryptogenic stroke while maintaining an excellent safety profile, particularly concerning device embolization or post-procedure atrial fibrillation.

A secondary, yet rapidly expanding, customer base comprises specialized Ambulatory Surgical Centers (ASCs) and private cardiac clinics, particularly in geographies like the United States where shifts toward cost-effective, outpatient structural heart procedures are gaining traction. These customers value devices that offer ease of use, rapid deployment, and minimal complication rates, enabling shorter hospital stays and streamlined procedural logistics. The purchasing decision within both major hospital systems and ASCs is highly complex, typically involving input from the Head of Cardiology/Structural Heart Program, the purchasing/procurement department (focusing on cost-per-procedure), and the clinical utilization committee (focused on evidence and safety).

Furthermore, referring neurologists, while not direct purchasers, act as crucial influencers in driving the volume of procedures, as they are responsible for identifying patients with cryptogenic stroke who meet the criteria for PFO closure intervention. Therefore, manufacturers must target both the interventionalist performing the closure and the neurologist making the initial referral. The key criterion for all end-users is the availability of comprehensive clinical support and procedural training provided by the device vendor, ensuring successful patient outcomes and institutional confidence in the adopted technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.4 million |

| Market Forecast in 2033 | USD 248.9 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Boston Scientific Corporation, W. L. Gore & Associates, Medtronic plc, Lepu Medical Technology, Lifetech Scientific Corporation, Occlutech Group, Hangzhou Jinsheng Medical Technology, NuVera Medical, Cardia Inc., PFM Medical, BioStar Medical, Shape Memory Medical, Advanced Cardiac Technologies, Coherex Medical Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Patent Foramen Ovale Closure Device Market Key Technology Landscape

The technology landscape of the PFO Closure Device Market is defined by continuous innovation focused on improving implant material science, minimizing procedural invasiveness, and enhancing long-term device safety. Current foundational technology relies heavily on Nitinol (nickel-titanium alloy) wire frames, known for their superelasticity and shape-memory characteristics, which allow the device to be compressed into a catheter for delivery and regain its pre-determined shape upon deployment in the heart. These Nitinol frames are typically covered with specialized polyester or PTFE (polytetrafluoroethylene) patches to facilitate tissue ingrowth and functional closure. Recent technological advancements emphasize reducing the metallic footprint and optimizing device geometry to decrease the risk of long-term complications, particularly erosion and device-related atrial fibrillation, which remains a key concern for structural heart interventionalists.

A major disruptive technology emerging in this space is the development of fully bioabsorbable or bioresorbable PFO closure devices. These next-generation implants are constructed from materials like polylactide or proprietary polymers that dissolve completely over a period of 12 to 24 months after the PFO has been sealed by the body's natural tissue healing process. The primary benefit is the elimination of foreign body presence, which mitigates long-term risks associated with permanent implants, potentially improving patient compliance and easing future cardiovascular imaging needs. Although currently limited by the mechanical strength and deployment profile challenges of absorbable polymers, this technology is gaining significant R&D investment and is expected to rapidly gain market share once extensive long-term safety data is established.

Furthermore, technology related to procedural guidance is advancing significantly. The adoption of Intracardiac Echocardiography (ICE) over traditional Transesophageal Echocardiography (TEE) for intraprocedural imaging is growing, as ICE eliminates the need for general anesthesia and provides superior anatomical visualization from within the heart, thus enhancing precision and efficiency. Alongside enhanced imaging, device delivery systems are becoming lower-profile and more flexible, allowing interventionalists to navigate challenging cardiac anatomies with greater ease. These technological developments collectively aim to move PFO closure toward being a standardized, safer, and potentially outpatient procedure, lowering barriers to access and expanding the eligible patient population globally.

Regional Highlights

The regional dynamics of the Patent Foramen Ovale Closure Device Market are characterized by significant disparity in adoption rates, reimbursement policies, and clinical practice standards, primarily segmented across North America, Europe, and Asia Pacific.

North America, particularly the United States, commands the largest market share and revenue contribution. This dominance is attributable to the early adoption of definitive clinical evidence, especially following the regulatory approval of PFO closure devices specifically indicated for secondary stroke prevention by the FDA. The region benefits from high healthcare expenditure, sophisticated interventional cardiology infrastructure, and robust private insurance and Medicare reimbursement mechanisms. The strong clinical network ensures rapid diffusion of new technologies and surgical techniques, placing the US at the forefront of procedural volume and technological penetration. Key regional trends include the growing push toward same-day or next-day discharge procedures and intense focus on reducing complication rates to meet quality metrics imposed by payers.

Europe represents the second-largest market, exhibiting moderate and stable growth. Adoption rates vary significantly among the major economies (Germany, UK, France), largely dependent on country-specific Health Technology Assessments (HTAs) and national reimbursement decisions. Germany and the UK, with established structural heart centers, are key drivers, showing strong acceptance of evidence-based intervention. However, the regulatory pathway through the CE Mark, while comprehensive, leads to varied market access timelines across the continent. European clinicians often participate heavily in global clinical trials, ensuring high familiarity with new devices, but cost-consciousness in public healthcare systems remains a factor restraining exponential growth compared to the US.

The Asia Pacific (APAC) region is projected to be the fastest-growing market throughout the forecast period. This rapid growth is propelled by improving economic conditions, increased awareness of cardiovascular disease risks, and substantial government investments in upgrading healthcare infrastructure, particularly in countries like China, Japan, and South Korea. While historically reliant on conventional cardiac surgery or medical management, the increasing availability of advanced catheterization labs and training programs is accelerating the adoption of PFO closure devices. Japan and South Korea lead the region due to advanced medical technology adoption, while the vast patient base and expanding middle class in China and India present massive untapped potential, despite challenges related to varied regulatory approval times and the necessity for lower-cost device alternatives. The Middle East and Africa (MEA) and Latin America (LATAM) markets remain nascent, characterized by limited procedural volumes concentrated in specialized urban medical centers, with growth heavily reliant on medical tourism and public health policy reforms.

- North America (US and Canada): Market leader driven by FDA approvals for cryptogenic stroke, high reimbursement, and mature structural heart programs. Focus on technology adoption and reduction of hospital length of stay.

- Europe (Germany, UK, France): Stable growth dictated by national HTA processes and varied public healthcare budgets. Strong clinical expertise but constrained by cost-effectiveness scrutiny.

- Asia Pacific (China, Japan, India): Fastest-growing region due to expanding healthcare infrastructure, rising prevalence of stroke diagnosis, and increasing access to interventional cardiology procedures. Focus on localized manufacturing and lower-cost solutions.

- Latin America (Brazil, Mexico): Emerging markets with growth potential concentrated in private medical centers; hindered by inconsistent reimbursement and fragmented healthcare systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Patent Foramen Ovale Closure Device Market.- Abbott Laboratories

- Boston Scientific Corporation

- W. L. Gore & Associates

- Medtronic plc

- Lepu Medical Technology

- Lifetech Scientific Corporation

- Occlutech Group

- Hangzhou Jinsheng Medical Technology

- NuVera Medical

- Cardia Inc.

- PFM Medical

- BioStar Medical

- Shape Memory Medical

- Advanced Cardiac Technologies

- Coherex Medical Inc.

- Cejia Medical Co., Ltd.

- MicroPort Scientific Corporation

- Meril Life Sciences Pvt. Ltd.

- InspireMD, Inc.

- Claret Medical (part of Boston Scientific)

Frequently Asked Questions

Analyze common user questions about the Patent Foramen Ovale Closure Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the PFO Closure Device Market?

The primary driver is the conclusive evidence derived from long-term clinical trials (like RESPECT and REDUCE) demonstrating that PFO closure significantly reduces the risk of recurrent cryptogenic stroke compared to medical therapy alone, leading to updated international clinical guidelines recommending intervention.

How do bioabsorbable PFO closure devices differ from traditional metal occluders?

Bioabsorbable devices are designed to fully dissolve within the body over a specified period (typically 1–2 years) after the PFO is functionally sealed, eliminating the need for a permanent foreign body implant, thus potentially reducing long-term risks such as device erosion or atrial fibrillation associated with permanent metal frames.

Which geographical region holds the largest market share for PFO closure devices?

North America, particularly the United States, holds the largest market share due to favorable reimbursement policies, high rates of advanced structural heart procedures, and regulatory approval of devices specifically indicated for secondary stroke prevention.

What is the expected Compound Annual Growth Rate (CAGR) for the PFO Closure Device Market?

The Patent Foramen Ovale Closure Device Market is projected to grow at a CAGR of 6.8% between 2026 and 2033, driven by increasing patient identification, technological refinement, and expansion in Asian markets.

What role does Artificial Intelligence (AI) play in the PFO closure procedure?

AI is increasingly used to analyze complex cardiac imaging (TEE/ICE) to accurately size the PFO, select the optimal device type, and provide real-time guidance during catheterization, aiming to improve procedural success rates and standardize clinical outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager