Patent Licensing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434260 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Patent Licensing Market Size

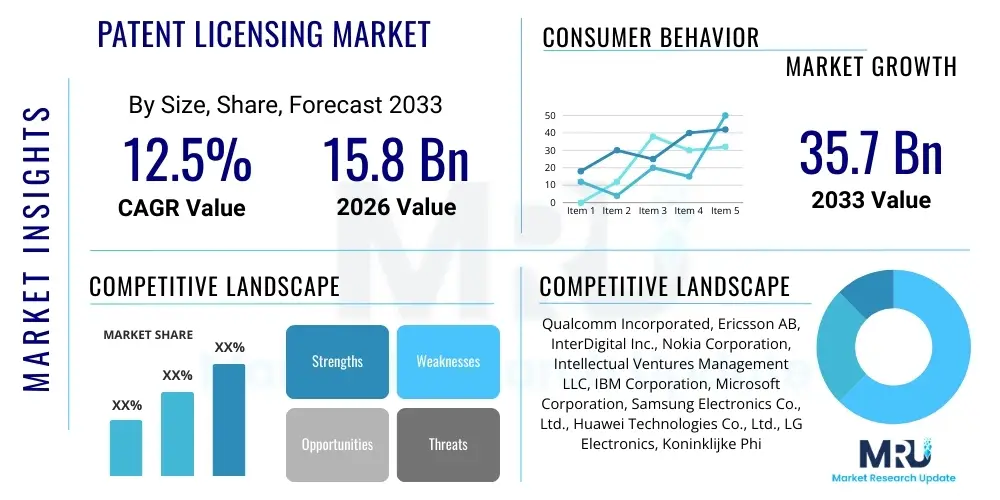

The Patent Licensing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 35.7 Billion by the end of the forecast period in 2033.

Patent Licensing Market introduction

The Patent Licensing Market encompasses the legal grant of rights by a patent holder (licensor) to another party (licensee) to use, manufacture, sell, or import the patented invention for a specified period, typically in exchange for royalty payments or other forms of compensation. This market acts as a crucial facilitator for technology diffusion and commercialization, allowing innovators to monetize their intellectual assets without necessarily engaging in manufacturing or distribution, while simultaneously enabling other entities to adopt proven technologies rapidly, bypassing extensive and costly Research and Development (R&D) cycles. The core product of this market is the licensing agreement itself, which defines the scope of use, territorial restrictions, duration, and financial terms, including lump-sum payments, running royalties, or cross-licensing arrangements. The complexity of these agreements requires specialized legal and technical expertise, underpinning the value proposition of the entire ecosystem.

Major applications of patent licensing span across high-technology sectors, including telecommunications (5G, IoT standards), pharmaceuticals (drug formulations, bio-similar manufacturing), electronics (semiconductors, consumer devices), and automotive industries (electric vehicle technology, autonomous driving systems). Key benefits driving the market include risk mitigation for licensees, rapid market entry, enhanced revenue streams for patent holders, and the promotion of standardized technologies through Standard Essential Patents (SEPs). Licensing agreements are instrumental in facilitating global standardization, ensuring interoperability, and reducing the incidence of protracted patent infringement litigation, although disputes over Fair, Reasonable, and Non-Discriminatory (FRAND) terms remain a significant regulatory and operational challenge in standard-setting organizations (SSOs).

The primary driving factors for the expansion of the Patent Licensing Market are the accelerating pace of technological innovation, particularly in deep tech areas like AI, quantum computing, and biotechnology, leading to a massive surge in patent filings globally. Furthermore, the increasing globalization of manufacturing and supply chains necessitates complex cross-border licensing agreements, especially within fragmented intellectual property regimes. The growing emphasis on Open Innovation models, where companies strategically outsource R&D or seek external technology integration, further fuels the demand for robust licensing frameworks. Additionally, the proliferation of specialized Non-Practicing Entities (NPEs) and patent pools, which streamline the licensing process for complex technology portfolios, contributes significantly to market maturity and overall transaction volume.

Patent Licensing Market Executive Summary

The Patent Licensing Market is experiencing robust expansion, fundamentally driven by shifts toward digital transformation, geopolitical realignments impacting global intellectual property (IP) governance, and the maturation of key technology sectors such as 5G, electric vehicles, and personalized medicine. Business trends highlight a pronounced increase in strategic patent portfolio management, where large technology firms are proactively leveraging their IP assets not just for defense, but as core revenue generators, leading to more frequent and higher-value licensing deals. A notable trend involves the formation of new, large-scale patent pools focusing on cross-industry technologies like IoT and automotive connectivity, aiming to simplify the licensing landscape and reduce transaction costs, thereby accelerating technology deployment across various verticals. Furthermore, the market is characterized by intense litigation surrounding Standard Essential Patents (SEPs), particularly concerning the definition and application of Fair, Reasonable, and Non-Discriminatory (FRAND) terms, influencing valuation methodologies and risk assessment for licensees.

Regionally, North America maintains its dominance due to strong legal frameworks protecting intellectual property and the presence of leading technology innovators and major litigation venues, though Asia Pacific is emerging as the fastest-growing region, fueled by rapidly increasing R&D investments in countries like China, South Korea, and Japan, which are aggressively building domestic patent portfolios, particularly in AI and 5G communications. Europe remains a critical hub, especially with ongoing regulatory developments related to unitary patents and specialized IP courts, aiming to harmonize licensing practices across member states. These regional dynamics create fragmented yet highly lucrative licensing opportunities, often requiring nuanced, jurisdiction-specific legal strategies to navigate differences in enforcement and royalty determination.

Segment trends reveal that technology licensing, particularly in software and digital platforms, commands the largest market share, driven by pervasive digital integration across all industries. Within licensing types, the shift is favoring sophisticated revenue-sharing and royalty-based models over simple lump-sum payments, reflecting the long-term value and sustained use of patented technologies. The growing prominence of NPEs (Non-Practicing Entities), often termed "patent assertion entities," continues to shape the competitive landscape, providing liquidity to the IP market but also sparking debate regarding the balance between incentivizing innovation and minimizing hold-up risks for implementers. Overall, the market remains highly competitive, demanding continuous innovation in licensing strategies, enhanced transparency, and predictive analytics tools to accurately value complex patent portfolios.

AI Impact Analysis on Patent Licensing Market

Common user questions regarding AI's impact on the Patent Licensing Market frequently revolve around whether AI systems can be considered inventors, how AI-generated inventions are owned and protected, and the necessary adjustments to current licensing frameworks to accommodate machine-assisted innovation. Users are particularly concerned about the rapid expansion of AI-related patents (e.g., machine learning algorithms, deep neural networks), which threatens to create dense "patent thickets," potentially increasing litigation risks and negotiation complexities for implementers seeking comprehensive licenses. Furthermore, there is significant interest in how AI tools are being deployed within the IP ecosystem itself—for patent searching, infringement detection, and especially for patent valuation and royalty rate determination, raising expectations for greater efficiency but also demanding new standards for algorithmic fairness and transparency in licensing negotiations.

The integration of Artificial Intelligence (AI) fundamentally alters the landscape of patent generation and utilization, posing existential questions for traditional licensing models. AI-driven R&D accelerates the innovation cycle, generating vast numbers of highly complex and interconnected patents in narrow technical fields, leading to the aforementioned patent thickets that make freedom-to-operate assessments and portfolio licensing increasingly arduous. Licensing professionals are required to develop new methods for valuing these AI-generated patents, moving beyond conventional metrics that focus on human inventive contribution toward models that account for data input, algorithm efficacy, and predictive commercial utility. Moreover, the legal status of AI-invented works remains contentious globally, forcing patent offices and courts to reassess inventorship criteria, which directly impacts who holds the right to license the resulting technology, creating jurisdictional uncertainties in cross-border agreements.

From an operational standpoint, AI tools are rapidly becoming indispensable in the licensing lifecycle. Advanced natural language processing (NLP) and machine learning algorithms are utilized to perform large-scale portfolio mapping, identifying potential infringement targets, and benchmarking comparable licensing deals, thereby providing critical data points for negotiation strategies. This technological enhancement aims to reduce the opacity often associated with patent valuation and improve the efficiency of identifying essential patents within standard pools. However, the adoption of AI-enhanced enforcement and valuation tools also introduces ethical and legal challenges regarding data privacy, algorithmic bias, and the reliance on black-box models to determine multi-million dollar royalty payments, necessitating regulatory guidance and the development of industry best practices for AI-assisted licensing.

- AI accelerates patent generation, creating complex patent thickets requiring specialized licensing strategies.

- AI tools enhance patent valuation and royalty rate setting through automated benchmarking and portfolio mapping.

- The legal status of AI-generated inventions impacts inventorship and ownership, directly affecting licensor eligibility.

- Increased litigation risk surrounding AI-related Standard Essential Patents (SEPs) in telecommunications and automotive sectors.

- AI-driven infringement detection leads to more aggressive enforcement actions by patent holders.

- New licensing models are emerging to address access to proprietary data and AI training models alongside patented algorithms.

- Demand for greater transparency in algorithmic decision-making used for patent validity and essentiality assessments.

DRO & Impact Forces Of Patent Licensing Market

The Patent Licensing Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively determine its growth trajectory and stability. Key drivers include the massive global expenditure on R&D, especially in emerging technologies like biotechnology, 5G, and IoT, which continuously replenish the pool of licensable assets. The increasing regulatory emphasis on global standardization in communication and energy sectors mandates licensing for technology adoption, particularly for SEPs (Standard Essential Patents). However, the market faces significant restraints, primarily stemming from the complexity and cost of global patent litigation, particularly over disputes related to FRAND terms, which introduce uncertainty and risk into licensing negotiations. Furthermore, the rise of protectionist IP policies in certain jurisdictions and the high administrative costs associated with maintaining vast international patent portfolios act as structural barriers to seamless cross-border licensing. These combined forces shape the market equilibrium, balancing the incentive for innovation against the need for broad technology dissemination.

Opportunities for growth are substantial, driven largely by the proliferation of cross-industry applications of established technologies. For instance, telecommunications patents (e.g., 5G) are now critically essential for the automotive, industrial IoT, and healthcare sectors, opening vast new revenue streams for patent holders through diversification of licensing targets. The development of sophisticated patent pools and clearinghouses offers a scalable solution to the complexity of licensing bundled portfolios, attracting smaller entities that lack the resources for individual negotiations. Moreover, the strategic use of Non-Practicing Entities (NPEs) as aggregators and assertion vehicles provides liquidity and a defined market for otherwise underutilized patents. These opportunities encourage strategic monetization and market maturity, facilitating transactions that might otherwise be impeded by high negotiation costs or enforcement barriers.

The impact forces within the market are predominantly characterized by shifting geopolitical power dynamics and evolving judicial interpretations of intellectual property rights. Recent court decisions regarding the jurisdiction for setting global FRAND rates (e.g., in Germany, the UK, and the US) significantly impact the perceived strength and bargaining power of licensors versus implementers. Standardization bodies play a crucial role as impact forces by determining which technologies become essential, thereby generating massive royalty potential for corresponding patent holders. Technological forces, specifically the convergence of hardware and software, necessitate comprehensive licensing packages that cover multiple layers of IP, increasing the average value of licensing agreements but simultaneously demanding greater granularity in defining scope and use, which ultimately dictates market stability and future growth potential.

Segmentation Analysis

The Patent Licensing Market is comprehensively segmented based on the type of intellectual property involved, the nature of the licensing agreement, the specific industry application, and the geographic location. Understanding these segments is crucial for strategic market entry and valuation, as licensing terms, royalty rates, and regulatory compliance requirements vary dramatically across segments. For instance, pharmaceutical patents typically involve long-term, high-value, exclusive licenses tied to complex regulatory approval milestones, while software licensing often involves non-exclusive, mass-market agreements with lower per-unit royalties but high volume potential. The overall segmentation landscape reflects the heterogeneity of intellectual property assets and the diverse commercial objectives of both licensors and licensees, necessitating tailored approaches to negotiation and enforcement.

Key segmentation categories include Type (Technology Licensing, Trademark Licensing, Copyright Licensing), which differentiates the underlying asset being protected and monetized. Furthermore, the segmentation by Licensing Type (Exclusive vs. Non-exclusive, Cross-licensing, Compulsory Licensing) defines the scope and limitations of the rights granted, fundamentally impacting competition and market access. The application segments, spanning high-growth sectors like Biotechnology, Telecommunications, and Electronics, provide insights into the highest concentration of licensing activity and future potential, often correlating directly with global R&D spending and technological disruption cycles. This multi-layered segmentation allows stakeholders to accurately gauge market maturity, identify underserved niches, and forecast revenue generation based on specific IP classes and regional demand dynamics.

The market analysis relies heavily on differentiating between the monetization strategies of Practicing Entities (PEs) and Non-Practicing Entities (NPEs). PEs primarily license patents to secure market access or cross-license defensively, ensuring freedom to operate. Conversely, NPEs focus solely on IP monetization, aggregating and asserting patents, often targeting large implementers. This distinction is vital for competitive analysis, as it dictates the nature of negotiations—PE deals are often collaborative, while NPE assertions typically lead to litigation or settlement pressure. The continuing growth in technology sectors guarantees that segments related to cutting-edge IP, such as Artificial Intelligence and Quantum Computing, will become increasingly dominant in the segmentation analysis during the forecast period.

- By Licensing Type:

- Exclusive Licensing

- Non-exclusive Licensing

- Cross-licensing

- Sub-licensing

- Compulsory Licensing

- By Type of Patent:

- Standard Essential Patents (SEPs)

- Non-Standard Essential Patents (Non-SEPs)

- By Application/Industry:

- Telecommunications (5G, 6G)

- Biotechnology & Pharmaceuticals

- Electronics & Semiconductors

- Automotive (EVs, Autonomous Driving)

- Software & Internet Services

- Industrial Manufacturing & IoT

- By End-User Entity:

- Practicing Entities (PEs)

- Non-Practicing Entities (NPEs)/Patent Assertion Entities (PAEs)

- Academic Institutions & Research Organizations

- Government & Defense Agencies

Value Chain Analysis For Patent Licensing Market

The Patent Licensing Market value chain commences with the upstream activities of Research and Development (R&D) and Intellectual Property (IP) creation, typically conducted by large corporations, startups, universities, and dedicated research institutes. This initial stage involves substantial investment in innovation, culminating in the filing, prosecution, and eventual grant of patents by national and regional patent offices. The quality and strength of the patent portfolio generated upstream directly determine the value extracted further down the chain. Key activities at this stage include identifying patentable inventions, strategic filing across key jurisdictions, and maintaining the portfolio through annuity payments. This foundation-laying phase requires specialized technical expertise combined with patent law knowledge to ensure robust, enforceable IP assets suitable for monetization.

The midstream phase focuses on IP asset management, valuation, and transaction execution. This critical stage involves assessing the commercial viability and essentiality of patents, often requiring sophisticated valuation models, especially for SEPs. Market intermediaries, including specialized IP law firms, patent brokers, and patent pools/clearinghouses, play a vital role here, facilitating the connection between licensors and potential licensees. The distribution channel analysis is complex: direct licensing involves bilateral negotiations between the patent owner and the implementer, often utilized for highly valuable, strategic technologies or complex cross-licensing deals. Indirect licensing channels, conversely, utilize patent pools (e.g., MPEG LA, Avanci) or NPEs, which offer streamlined, bundled access to multiple patents, significantly reducing transaction costs and market fragmentation, particularly in highly standardized sectors like wireless communications.

Downstream, the value chain centers on the licensees (implementers) who utilize the technology to create commercial products or services, and the subsequent monitoring and enforcement activities. Licensees integrate the patented technology into their manufacturing or software offerings, generating revenue upon which royalties are often calculated. The final stage involves rigorous royalty auditing, compliance checks, and, crucially, patent enforcement against unlicensed users or breaches of agreement terms. Strong and efficient enforcement mechanisms, whether through national courts or arbitration, are essential to upholding the integrity and value of the licensing framework, ensuring that the licensor receives fair compensation and maintaining the incentive for upstream R&D investment. The efficiency of both direct and indirect distribution channels largely determines the speed and scale of technology adoption globally.

Patent Licensing Market Potential Customers

The potential customer base for patent licensing is diverse, encompassing any entity that manufactures, uses, or sells products that incorporate patented technologies, extending across virtually all industrial sectors globally. The primary end-users or buyers are often large-scale manufacturing corporations (e.g., Samsung, Toyota, Pfizer), which seek licenses to ensure "freedom to operate" (FTO) and avoid costly infringement litigation, particularly in technology areas where standardized solutions are mandatory, such as 5G base station equipment or automotive connectivity modules. These corporate licensees typically prefer non-exclusive or cross-licensing arrangements to balance risk and maintain competitive flexibility, viewing licensing fees as a necessary operational cost for market access and technological parity. The appetite for licensing is highest in R&D-intensive sectors where the pace of innovation quickly outstrips internal development capabilities.

A second major segment of potential customers includes smaller enterprises, startups, and mid-sized technology firms that require access to foundational IP to enter or scale their operations but lack the resources or time for extensive internal R&D. For these entities, patent licensing provides a rapid and relatively cost-effective path to market viability. They are often served more effectively through patent pools or intermediaries, which bundle necessary IP at predictable, standardized rates. Furthermore, customers include academic institutions and technology transfer offices (TTOs) themselves, acting as both licensors and licensees, often licensing out foundational university-developed technologies while licensing in necessary commercialization tools or complementary IP to complete product development pipelines.

Finally, the growing specialization of the market means that NPEs (Non-Practicing Entities) also serve as significant customers, particularly in their role as buyers and aggregators of patent portfolios from corporations that are divesting non-core assets or winding down operations. While not end-users in the traditional sense, these entities fuel secondary market liquidity by acquiring patents for monetization through assertion, effectively becoming customers of patent holders seeking divestiture. Government and defense agencies also represent significant customers, often requiring specific licenses for mission-critical technologies (e.g., secure communication systems, defense manufacturing processes), usually negotiating terms directly with the patent originator or specialized defense contractors holding the necessary rights.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 35.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Incorporated, Ericsson AB, InterDigital Inc., Nokia Corporation, Intellectual Ventures Management LLC, IBM Corporation, Microsoft Corporation, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., LG Electronics, Koninklijke Philips N.V., Dolby Laboratories, Inc., Technicolor SA, Sisvel International S.A., Via Licensing Corporation, MPEG LA, LLC, Avanci LLC, RPX Corporation, Finjan Holdings, Inc., Acacia Research Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Patent Licensing Market Key Technology Landscape

The technology landscape underpinning the Patent Licensing Market is defined by rapid innovation in disruptive fields, requiring sophisticated frameworks for IP protection and monetization. Currently, the most active area is wireless communication technology, specifically 5G and nascent 6G standards, where the complexity of Standard Essential Patents (SEPs) necessitates widespread licensing, often managed through large patent pools like Avanci and Via Licensing. These technologies dictate the royalty structure for billions of connected devices, ranging from smartphones to industrial sensors. Furthermore, the convergence of hardware and software, particularly within the IoT and automotive sectors, means that licensing agreements must address not only communication protocols but also proprietary algorithms, embedded software, and specific semiconductor designs, increasing the technical depth required for successful portfolio assessment and negotiation.

Beyond connectivity, the biotechnology and pharmaceutical sectors represent a highly valuable, albeit often slower-moving, segment of the technological landscape. Key technologies here include gene editing (CRISPR), personalized medicine platforms, and complex biologic manufacturing processes. Licensing in this sphere often involves lengthy agreements that transfer know-how alongside patent rights, emphasizing R&D collaboration and regulatory milestones. The emergence of digital therapeutics and health tech introduces a hybrid category, blending traditional medical device licensing with software and data rights, complicating traditional valuation methods and requiring specialized legal clauses related to data ownership and artificial intelligence integration in diagnostics.

Finally, technologies supporting the market infrastructure itself—specifically AI and blockchain—are increasingly critical. AI is deployed for predictive analytics in patent litigation, automated portfolio monitoring, and highly accurate infringement detection, fundamentally increasing the efficiency of the assertion phase of licensing. Blockchain technology is being explored as a secure and transparent ledger for recording patent assignments, tracking royalty payments, and establishing indisputable proof of usage, promising to reduce fraud and administrative overhead associated with complex, global licensing regimes. These technical advancements are reshaping how transactions are validated and managed, moving the industry toward greater reliance on automated, verifiable systems for intellectual asset governance.

Regional Highlights

Regional dynamics play a paramount role in the Patent Licensing Market due to the territorial nature of patent rights and significant variations in legal enforcement mechanisms and judicial precedents globally. North America, particularly the United States, remains the largest and most influential market, characterized by highly litigious environments, substantial royalty payments, and the presence of the world's leading technology innovators (e.g., Qualcomm, IBM, Microsoft). The strength of US courts in enforcing IP rights, coupled with high damage awards, incentivizes rigorous patent assertion and attracts global licensors. Licensing activities here are often focused on high-stakes software, biotechnology, and semiconductor patents, and the US serves as a major hub for NPE activity and patent aggregation, driving market liquidity and value.

Europe represents a mature and rapidly evolving licensing landscape. The operationalization of the Unified Patent Court (UPC) and the European Unitary Patent system is projected to significantly streamline patent protection and enforcement across participating member states, offering a centralized mechanism that reduces costs and complexity for licensors. Key markets like Germany and the UK remain central to global SEP litigation, shaping international FRAND standards. Licensing in Europe is heavily concentrated in the automotive, industrial IoT, and telecommunications sectors. The region's regulatory focus on fair competition and antitrust concerns influences the setting of royalty rates and the permissible scope of licensing agreements, particularly concerning dominant market players.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by massive domestic R&D investment and soaring patent filing rates, particularly in China and South Korea. China has rapidly shifted from being primarily an implementer market to a major innovator and licensor, especially in 5G and AI, supported by a specialized IP court system aiming for quicker enforcement. Japanese and South Korean firms hold vast portfolios in electronics and semiconductor manufacturing, making these countries key licensors and licensees. Growth in APAC is fueled by local consumer electronics and automotive sectors, demanding both technology transfer and local licensing expertise to navigate diverse national regulations and differing interpretations of essentiality and use. The region's expansion is crucial for global market growth, creating both competition and co-licensing opportunities.

- North America (NA): Dominant market share; characterized by high-value litigation (US) and significant NPE activity; focus on software, biotech, and semiconductor SEPs.

- Europe: Rapidly evolving due to the implementation of the Unitary Patent and Unified Patent Court (UPC); focus on harmonizing FRAND standards and industrial IoT licensing.

- Asia Pacific (APAC): Fastest-growing region; driven by aggressive R&D in China and South Korea (5G, AI); increasing importance as both a licensor and licensee hub for global electronics manufacturing.

- Latin America (LATAM): Emerging market; growth driven by telecommunications infrastructure upgrades and pharmaceutical generics licensing; characterized by local regulatory hurdles and slower enforcement timelines.

- Middle East and Africa (MEA): Nascent market primarily focused on technology imports and infrastructure development; increasing demand for licenses in energy, telecommunications, and financial technology (FinTech).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Patent Licensing Market.- Qualcomm Incorporated

- Ericsson AB

- InterDigital Inc.

- Nokia Corporation

- Intellectual Ventures Management LLC

- IBM Corporation

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- LG Electronics

- Koninklijke Philips N.V.

- Dolby Laboratories, Inc.

- Technicolor SA

- Sisvel International S.A.

- Via Licensing Corporation

- MPEG LA, LLC

- Avanci LLC

- RPX Corporation

- Finjan Holdings, Inc.

- Acacia Research Corporation

Frequently Asked Questions

Analyze common user questions about the Patent Licensing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Standard Essential Patent (SEP) and how does it affect licensing?

A Standard Essential Patent (SEP) is a patent deemed necessary for implementing a technical standard (e.g., 5G, Wi-Fi). Licensors of SEPs are typically obligated to offer licenses under Fair, Reasonable, and Non-Discriminatory (FRAND) terms. This framework is crucial for interoperability but often leads to disputes over what constitutes a 'fair' royalty rate, heavily influencing the telecommunications and automotive licensing segments.

How is the valuation of a patent portfolio determined for licensing purposes?

Patent portfolio valuation utilizes multiple methods, primarily the comparable license method (benchmarking against similar deals), the income approach (discounted cash flow based on expected future royalties), and the cost approach (R&D replacement cost). AI tools are increasingly used to refine the income approach by predicting product adoption and potential infringement damages, leading to more data-driven royalty negotiations.

What are the primary risks associated with cross-border patent licensing agreements?

The primary risks include jurisdictional variances in patent validity and enforceability, differing legal interpretations of FRAND obligations, exchange rate volatility impacting royalty calculations, and the risk of compulsory licensing being invoked by foreign governments. Navigating these risks requires highly specialized international IP counsel and robust dispute resolution clauses.

What role do Non-Practicing Entities (NPEs) play in the Patent Licensing Market?

NPEs, often termed patent assertion entities, acquire patent portfolios solely for monetization through licensing or litigation, without manufacturing products. They increase market liquidity by providing an exit strategy for patent holders and can streamline enforcement. However, their assertive strategies sometimes lead to 'patent troll' criticisms, although they remain vital facilitators of IP commercialization and valuation.

How does the emergence of the Unified Patent Court (UPC) impact the European licensing market?

The UPC creates a centralized system for litigating and enforcing European patents across participating member states, drastically reducing complexity and cost compared to national litigation. This harmonization aims to make Europe a more attractive market for both licensors and licensees by offering single decisions on validity and infringement, potentially leading to higher-value regional licensing deals and more predictable outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager