Pavement Defect Detection Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431930 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Pavement Defect Detection Systems Market Size

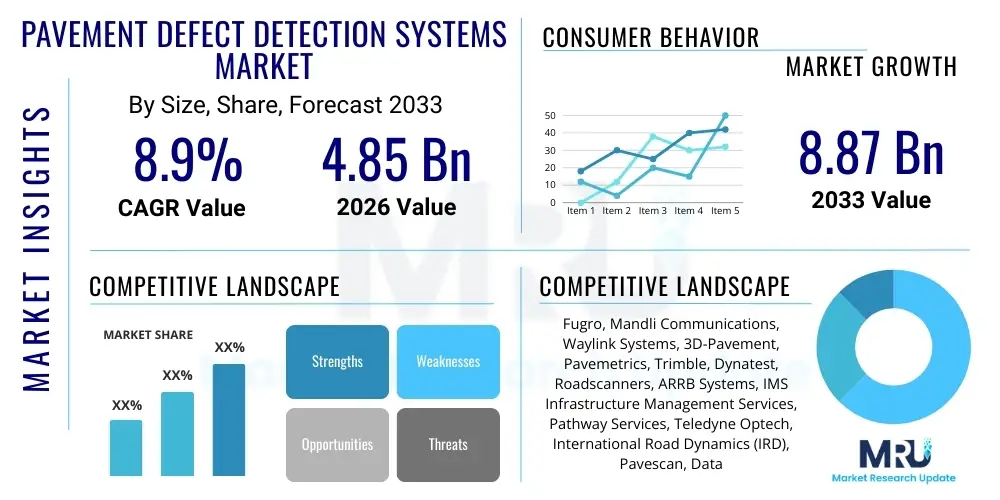

The Pavement Defect Detection Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 8.87 Billion by the end of the forecast period in 2033.

Pavement Defect Detection Systems Market introduction

The Pavement Defect Detection Systems Market encompasses advanced technological solutions designed to automatically inspect, analyze, and report defects—such as cracks, potholes, rutting, and ravelling—on road surfaces and airport runways. These systems utilize a combination of high-resolution cameras, laser scanners (LiDAR), ultrasonic sensors, and sophisticated computer vision algorithms, increasingly powered by Artificial Intelligence (AI) and Machine Learning (ML), to provide rapid, objective, and reproducible condition assessments. The necessity for these systems arises from the aging global infrastructure, coupled with the inherent dangers and inefficiency of traditional manual inspection methods, which often lead to subjective data and delays in essential repair work. The transition toward automated systems is fundamentally driven by the need for enhanced road safety, optimized maintenance planning, and stringent asset management practices by government agencies and private infrastructure operators worldwide.

The product portfolio within this market is diverse, ranging from vehicle-mounted integrated systems capable of high-speed data acquisition to drone-based and handheld devices used for localized or preliminary assessments. Major applications include highway management, urban road network assessments, airport pavement maintenance, and railway track infrastructure monitoring. These tools provide infrastructure owners with crucial, quantitative data used to calculate Pavement Condition Index (PCI) scores, enabling predictive maintenance schedules rather than reactive repairs. This strategic shift towards data-driven maintenance significantly extends the service life of pavements, reduces operational costs, and minimizes traffic disruption associated with prolonged repair cycles.

Key benefits derived from implementing pavement defect detection systems include dramatically increased data collection speed, improved accuracy and consistency of defect identification, and reduced exposure of human workers to high-risk traffic environments. The market is primarily driven by increasing government spending on smart city initiatives, rising awareness of infrastructure asset valuation, and regulatory mandates emphasizing the critical importance of maintaining pavement quality to support economic activity and public safety. Technological advancements, particularly in sensor fusion, 3D imaging, and real-time processing capabilities, are continually refining the precision and reliability of these automated systems, cementing their role as indispensable tools in modern infrastructure management.

Pavement Defect Detection Systems Market Executive Summary

The Pavement Defect Detection Systems Market is experiencing robust expansion, fundamentally underpinned by the global shift towards intelligent transportation systems (ITS) and predictive infrastructure management. Business trends indicate a strong move toward offering Pavement as a Service (PaaS) models, where vendors not only supply hardware and software but also undertake comprehensive data collection, processing, and analytical reporting for clients, thereby lowering the initial capital expenditure barrier for smaller municipalities. Mergers and acquisitions are becoming common, focused on integrating specialized AI companies into traditional equipment manufacturers to enhance automated classification accuracy and depth of analysis. Furthermore, there is significant emphasis on developing multi-sensor platforms that combine visual data with structural integrity metrics, such as ground-penetrating radar (GPR) results, to provide a holistic view of pavement health, addressing both surface and sub-surface issues simultaneously.

Regionally, North America and Europe currently dominate the market due to established infrastructure maintenance standards, mandatory performance-based contracts for road networks, and high adoption rates of sophisticated monitoring technologies. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by massive infrastructure expansion projects in developing economies like China, India, and Southeast Asian nations. These countries are increasingly prioritizing rapid, scalable inspection methods to manage newly built and rapidly deteriorating road networks. Latin America and MEA are lagging but show promising potential, particularly where large-scale resource development and urbanization necessitate reliable transport corridors, prompting pilot projects utilizing drone-based systems for cost-effective coverage.

Segmentation trends highlight the dominance of the hardware segment, although the fastest growth is observed in the software and service components, reflecting the increasing value placed on data analytics and algorithmic precision over raw data collection capacity. In terms of technology, 3D imaging and LiDAR technologies are rapidly replacing traditional 2D camera systems due to their ability to capture detailed longitudinal and transversal profiles necessary for measuring rutting and texture. Furthermore, the segmentation by end-user shows that government agencies, specifically departments of transportation and public works, remain the largest consumers, but private infrastructure investors and airport authorities are increasing their procurement of proprietary systems tailored to specialized asset management needs, emphasizing durability and extreme operational accuracy.

AI Impact Analysis on Pavement Defect Detection Systems Market

Common user questions regarding AI's influence in the Pavement Defect Detection Systems market frequently center on three primary themes: reliability, scalability, and integration complexity. Users, primarily infrastructure managers and engineering consultants, consistently ask about the accuracy of automated crack classification compared to human experts, particularly regarding subtle damage types like fatigue cracking or early-stage deterioration. They are also concerned with the scalability of AI solutions—whether the systems can handle petabytes of visual and sensor data generated by large highway networks in real-time, and how quickly new AI models can be trained to recognize regional-specific pavement degradation patterns. A third major theme revolves around the integration of AI-derived Pavement Condition Index (PCI) data directly into existing infrastructure asset management systems (IAMS) and enterprise resource planning (ERP) software, seeking seamless operability and automated repair recommendation generation.

The implementation of Artificial Intelligence, specifically Deep Learning (DL) models such as Convolutional Neural Networks (CNNs), has been transformative, fundamentally altering the accuracy and speed of defect identification. Before AI, traditional image processing relied on fixed threshold algorithms that struggled with variable lighting, shadows, and road markings, leading to high false positive rates. AI models, conversely, learn complex feature representations from vast datasets, allowing for robust detection and precise classification (e.g., longitudinal, transverse, block cracking, alligator cracking) even under sub-optimal conditions. This cognitive leap reduces manual review time by up to 90%, thereby accelerating the maintenance cycle from assessment to repair allocation, delivering significant operational efficiency and cost savings to governmental bodies managing extensive road networks.

Furthermore, AI is instrumental in moving the market beyond simple detection toward predictive analytics. By analyzing historical performance data alongside current sensor inputs, ML algorithms can forecast the rate of pavement deterioration, identifying 'hot spots' that require immediate attention before critical failures occur. This predictive capability shifts maintenance strategies from reactive to proactive, maximizing the remaining useful life of the pavement structure. The reliance on cloud-based AI processing platforms also enables rapid deployment of updated detection models and facilitates the processing of data generated by multi-sensor fusion platforms (LiDAR, GPR, high-speed cameras), thus overcoming the computational limitations often faced by edge computing devices mounted on inspection vehicles, ultimately enhancing overall system performance and data throughput.

- AI enables highly accurate, objective classification of defect types (e.g., fatigue cracking, spalling, potholes) using CNNs.

- Machine Learning algorithms predict future pavement deterioration rates, supporting proactive, condition-based maintenance strategies.

- Automated feature extraction drastically reduces manual data review time, accelerating the Pavement Condition Index (PCI) calculation process.

- Sensor fusion facilitated by AI integrates data from multiple sources (LiDAR, cameras, GPR) for comprehensive sub-surface and surface analysis.

- Edge computing devices utilize optimized AI models for real-time processing and immediate defect alerts during high-speed data collection.

- AI optimizes resource allocation and budgetary planning by quantifying maintenance needs and prioritizing critical repair sections.

- Natural Language Processing (NLP) is increasingly used in reporting modules to generate concise, standardized defect summaries and actionable recommendations.

DRO & Impact Forces Of Pavement Defect Detection Systems Market

The Pavement Defect Detection Systems Market is shaped by a powerful confluence of drivers pushing rapid adoption and specific restraints that mandate technological refinement, while abundant opportunities define the future trajectory. Key drivers include stringent regulatory requirements imposed by transportation authorities globally to maintain minimum Pavement Condition Index (PCI) standards, often linked to federal or state funding availability. The escalating cost of manual labor, coupled with the need for high-speed, repeatable, and non-invasive data collection methods that minimize traffic disruption, further accelerates the demand for automated solutions. Conversely, major restraints involve the high initial capital investment required for advanced sensor vehicles and processing infrastructure, creating a barrier for smaller municipal governments. Furthermore, the lack of standardized data formats and calibration protocols across different national road agencies complicates cross-platform data compatibility and large-scale deployment efforts, requiring vendors to develop highly customizable, localized solutions.

Opportunities within this market are substantial, particularly in merging automated defect detection with emerging technologies like 5G and IoT infrastructure. The rise of connected vehicles and Vehicle-to-Infrastructure (V2I) communication presents a chance to integrate real-time pavement condition monitoring data directly into navigation and safety systems, providing proactive warnings to drivers. The expansion into developing economies, which often have rapidly built, yet frequently deteriorating, road infrastructure requiring immediate large-scale assessment, represents a massive untapped market. Moreover, the refinement of drone and autonomous mobile robot platforms for inspection of areas inaccessible to traditional vehicles (e.g., tunnels, bridges, constrained urban environments) offers specialized revenue streams. Addressing the current restraint related to data standardization through industry collaborations could unlock significant market efficiency.

Impact forces currently driving market dynamics are heavily weighted toward technological disruption and legislative pressure. The introduction of advanced computer vision and AI has fundamentally lowered the operating cost per kilometer of inspection while drastically increasing accuracy—a powerful force that favors technological leaders. Government expenditure on smart infrastructure, particularly post-pandemic economic stimulus packages focused on renewal, provides substantial financial momentum. However, the force of technological integration complexity acts as a counterweight, as infrastructure owners struggle to integrate massive, continuous data streams from defect detection systems into legacy IAMS platforms, requiring significant upfront investment in middleware and training. The lifecycle cost advantage offered by predictive maintenance over reactive repair, facilitated by these systems, provides a strong, long-term economic impact force favoring market adoption.

Segmentation Analysis

The Pavement Defect Detection Systems Market is broadly segmented based on Component, Technology, Application, and End-User. This market structure reflects the diversity in operational needs, budget constraints, and technical sophistication demanded by various infrastructure managers. The component segmentation clearly distinguishes between the initial high cost associated with hardware (such as specialized vehicles and sensor arrays) and the recurring, high-growth revenue streams derived from software licenses, data processing services, and analytical reports. Analyzing these segments is crucial for understanding investment priorities, as the market rapidly transitions from being hardware-centric to service-centric, driven by the analytical capabilities of cloud platforms.

Technology segmentation is vital for tracking innovation, illustrating the shift from conventional 2D imaging to multi-modal data acquisition using LiDAR, thermal imaging, and GPR for comprehensive structural assessment. This segment analysis helps stakeholders understand which technologies offer the best balance between speed, cost, and depth of inspection detail. For instance, high-speed highway inspections heavily rely on integrated LiDAR and high-resolution line-scan cameras, whereas urban or local road assessments might favor more maneuverable, drone-based photogrammetry solutions combined with basic GPS tracking for precise location mapping. The application segmentation, spanning highways, urban roads, and critical airport runways, defines the necessary precision and certification standards required for system deployment.

Finally, the End-User segmentation provides insight into procurement behaviors. Government agencies (federal, state, and local departments of transportation) constitute the largest segment due to their vast ownership of public road assets and legal responsibility for maintenance. However, specialized sectors like airport authorities and private toll road operators often demand higher performance specifications (e.g., certified accuracy for high-speed runway inspections or continuous monitoring for toll roads) and are willing to invest in proprietary, customized systems. This segmentation highlights the diverse functional requirements across the industry, ranging from routine monitoring to critical, high-precision inspections.

- By Component:

- Hardware (Cameras, Laser Scanners/LiDAR, GPS/IMU, Sensors, Acquisition Systems)

- Software (Processing & Analysis Software, AI/ML Modules, Reporting Tools)

- Services (Data Collection, Consulting, Maintenance, Training)

- By Technology:

- 2D Imaging Systems

- 3D Imaging Systems (Laser Profilers, LiDAR)

- Ground Penetrating Radar (GPR)

- Thermal Imaging

- Multi-Sensor Fusion Systems

- By Application:

- Highway Networks

- Urban and Rural Roads

- Airport Runways and Aprons

- Bridges and Tunnels

- By End-User:

- Government Agencies (Federal & State DOTs)

- Local Road Authorities/Municipalities

- Private Infrastructure Operators (Toll Roads, Concessionaires)

- Airport and Port Authorities

Value Chain Analysis For Pavement Defect Detection Systems Market

The value chain for Pavement Defect Detection Systems begins with upstream activities centered around the sophisticated manufacturing and sourcing of high-precision technological components. This segment includes specialized suppliers of high-speed line-scan cameras, high-power LiDAR sensors, Inertial Measurement Units (IMUs), and computational hardware optimized for mobile data acquisition. Innovation in the upstream phase focuses on enhancing sensor resolution, reducing size, improving environmental ruggedness, and increasing the data collection speed capability (up to highway speeds). Key partnerships are formed between system integrators and these component suppliers to ensure seamless hardware and software compatibility, driving down latency and improving data quality under diverse operational conditions. Manufacturing and assembly of the integrated inspection vehicles or specialized mounting kits follow, prioritizing ergonomic design and modularity to facilitate field maintenance and upgrades.

Midstream activities involve the core system integration and processing, which are the primary value-add components. This stage includes developing proprietary software algorithms, especially those leveraging AI for automated defect classification and segmentation, and ensuring robust calibration and geo-referencing capabilities. The distribution channel is typically direct or semi-direct. Due to the high cost, technical complexity, and need for specialized training, large system manufacturers often deal directly with end-users (government DOTs) through request-for-proposal (RFP) processes and direct consultation. Indirect channels, such as specialized engineering consultancy firms or regional sales partners, are utilized primarily for servicing smaller municipalities or providing auxiliary services like data interpretation and asset management integration.

Downstream activities focus on the provision of services and the utilization of the data generated. This includes the highly lucrative data collection and processing service market, where vendors operate their own equipment fleets to capture pavement data under contract (PaaS). The final link in the chain involves integrating the processed data—such as high-fidelity defect maps and calculated PCI scores—into the client's existing Infrastructure Asset Management Systems (IAMS). This integration enables informed decision-making regarding maintenance prioritization, budget allocation, and long-term capital planning. The value chain is increasingly shifting towards the downstream service segment, as the complexity and sheer volume of data make the analytical service component more valuable than the initial hardware sale.

Pavement Defect Detection Systems Market Potential Customers

The primary customer base for Pavement Defect Detection Systems consists of entities responsible for the design, construction, maintenance, and oversight of public and private transportation infrastructure. Government agencies represent the largest and most consistent buyers, driven by public accountability, safety mandates, and the need to efficiently manage vast public assets funded by taxpayers. These include national Departments of Transportation (DOTs), State Highway Authorities, and local public works departments. Their procurement strategy typically favors robust, high-speed, and standardized systems that can cover large geographical areas rapidly and integrate data seamlessly into national road inventory databases.

A rapidly growing segment of potential customers includes specialized transportation infrastructure managers, such as airport authorities and private infrastructure concessionaires. Airport operators require highly accurate and certified detection systems tailored for concrete and asphalt runways, where minor defects can pose significant safety risks to aircraft. Private toll road operators and infrastructure investment funds utilize these systems to fulfill performance-based contracts (PBCs) and optimize maintenance spending to ensure long-term profitability and asset preservation. These customers often seek continuous monitoring solutions and highly customized, predictive analytics capabilities to minimize unplanned downtime and traffic disruption, prioritizing efficiency and precision over initial acquisition cost.

Furthermore, engineering consulting firms and construction material testing laboratories act as secondary buyers or influential intermediaries. These organizations often purchase detection systems or subcontract data collection services to provide specialized pavement evaluation reports to their own clients (municipalities or construction companies). Emerging customers also include logistics companies interested in road quality data for optimizing fleet routing and minimizing vehicle wear-and-tear. Ultimately, any organization managing extensive paved assets, from large corporate campuses to military bases, represents a potential buyer focused on enhancing safety, prolonging asset life, and achieving verifiable compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 8.87 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fugro, Mandli Communications, Waylink Systems, 3D-Pavement, Pavemetrics, Trimble, Dynatest, Roadscanners, ARRB Systems, IMS Infrastructure Management Services, Pathway Services, Teledyne Optech, International Road Dynamics (IRD), Pavescan, Data Collection Limited (DCL), GSSI, Topcon Corporation, Leica Geosystems (Hexagon), NDE Technologies, Surfacedots. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pavement Defect Detection Systems Market Key Technology Landscape

The core technology landscape of the Pavement Defect Detection Systems market is defined by the integration and fusion of high-fidelity sensory inputs processed by sophisticated computational intelligence. High-speed data acquisition is primarily achieved through vehicle-mounted systems utilizing advanced optical sensors. These typically include high-resolution line-scan cameras capable of capturing visual data at speeds exceeding 100 km/h, providing detailed 2D surface images. Crucially, 3D imaging technologies, dominated by high-accuracy laser profilers (LiDAR and structured light systems), capture the transversal and longitudinal profiles of the road surface. This 3D data is essential for quantitatively measuring pavement distresses such as rutting, faulting, and texture depth (macrotexture/microtexture), which are difficult or impossible to measure accurately using traditional 2D imagery alone. The combination of geo-referencing technology, including highly precise GPS (RTK/PPP) and Inertial Measurement Units (IMUs), ensures that every defect is located with centimeter-level accuracy for efficient maintenance crew dispatch.

Beyond surface analysis, the technological evolution emphasizes subsurface inspection to understand structural integrity and potential causes of surface defects. Ground Penetrating Radar (GPR) systems are widely deployed for this purpose, emitting electromagnetic waves to map the different layers of the pavement structure, detect voids, moisture infiltration, and assess the thickness of asphalt or concrete layers. Modern systems often combine GPR with visual sensors in a single, integrated vehicle platform, allowing for multi-modal data fusion. Furthermore, specialized technologies like thermal imaging are utilized to detect subtle temperature variations indicative of moisture trapped beneath the surface or delamination in concrete pavements, providing early warnings for structural failures that precede visible surface defects. The continuous refinement of sensor sensitivity and acquisition rates remains a core focus area for maximizing data quality and operational efficiency.

The definitive technological advancement driving market growth is the adoption of Artificial Intelligence and Machine Learning frameworks for data interpretation. Raw sensor data, particularly from high-resolution cameras and LiDAR, generates massive datasets (petabytes per year for large networks). AI/ML algorithms, specifically Deep Convolutional Neural Networks (DCNNs), automate the process of sifting through this data, identifying defects, classifying them according to established standards (e.g., AASHTO, ASTM), and quantifying their severity and extent. This automation replaces manual processing and dramatically reduces subjectivity, transforming raw data into actionable Pavement Condition Index (PCI) scores and maintenance recommendations. Future developments are focused on optimizing these AI models for edge computing, enabling real-time decision-making during the data collection process, further enhancing the responsiveness and efficiency of pavement asset management globally.

Regional Highlights

- North America: North America, particularly the United States and Canada, represents the largest and most mature market for Pavement Defect Detection Systems. This dominance is driven by high spending on infrastructure maintenance, stringent safety regulations (federal and state level), and the established adoption of sophisticated asset management practices. State Departments of Transportation (DOTs) are mandated to conduct regular, detailed Pavement Condition Index (PCI) assessments, creating constant, high demand for high-speed LiDAR and AI-powered systems. The region is characterized by early adoption of new technologies like multi-sensor fusion (GPR integration) and a strong focus on data standardization to ensure compatibility across large state-owned networks. Competition is high, fostering rapid innovation in analytical software and data-as-a-service offerings.

- Europe: Europe is a significant market, characterized by advanced infrastructure quality standards and substantial investment from supranational bodies like the European Union in TEN-T networks. Western European nations (Germany, UK, France) prioritize integrating pavement monitoring data into broader Intelligent Transportation Systems (ITS) frameworks. The market growth here is steady, fueled by the demand for preventative maintenance solutions and the need to manage dense urban road networks where traffic interruption must be minimized. There is a notable trend towards adopting portable and autonomous (drone/robot) systems for inspecting localized defects in culturally significant or heavily congested urban areas, complementing the use of high-speed vehicle-mounted systems on major motorways.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest CAGR during the forecast period. This rapid growth is primarily attributable to massive urbanization and government-led infrastructure development programs in countries such as China, India, and Indonesia. These nations possess extensive and rapidly expanding road networks that require scalable, fast, and cost-effective inspection methods. While the market initially favored cost-effective 2D systems, there is a swift transition towards sophisticated AI and 3D LiDAR solutions to manage the deterioration rates of newly constructed roads. Governments in the region are increasingly prioritizing smart city initiatives, creating a fertile ground for market expansion, often driven by international partnerships and technology transfer.

- Latin America (LATAM): The LATAM market is currently characterized by moderate adoption, largely concentrated in major economies like Brazil, Mexico, and Chile. Market growth is heavily influenced by private concessions managing toll roads and critical trade corridors, which implement advanced systems to meet performance metrics defined in their contracts. Public sector adoption is slower, often hampered by budgetary constraints and fragmented infrastructure management across various governmental levels. However, as international financing standards increasingly demand proven asset management protocols, the demand for affordable, yet reliable, detection systems is expected to rise, often favoring integrated service contracts rather than outright hardware purchase.

- Middle East and Africa (MEA): The MEA market shows potential, largely focused on critical infrastructure projects related to oil, gas, and major urban centers (e.g., Saudi Arabia’s Vision 2030, UAE’s expansion). The Middle Eastern segment relies on high-specification equipment due to the extreme environmental conditions (heat, sand) and the strategic importance of highways. Africa, while representing the smallest current share, presents significant long-term opportunities, particularly in rapidly developing economic hubs and in cross-border trade route maintenance, where automated, high-coverage systems are essential for managing vast, often remote, road networks with limited access to skilled manual inspection labor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pavement Defect Detection Systems Market.- Fugro

- Mandli Communications

- Waylink Systems

- 3D-Pavement

- Pavemetrics

- Trimble

- Dynatest

- Roadscanners

- ARRB Systems

- IMS Infrastructure Management Services

- Pathway Services

- Teledyne Optech

- International Road Dynamics (IRD)

- Pavescan

- Data Collection Limited (DCL)

- GSSI (Geophysical Survey Systems Inc.)

- Topcon Corporation

- Leica Geosystems (Hexagon)

- NDE Technologies

- Surfacedots

Frequently Asked Questions

Analyze common user questions about the Pavement Defect Detection Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological components used in modern Pavement Defect Detection Systems?

Modern systems primarily utilize a combination of high-resolution line-scan cameras for 2D visual data, high-accuracy laser profilers (LiDAR) for 3D measurement of rutting and surface texture, Ground Penetrating Radar (GPR) for subsurface structural analysis, and highly precise GPS/IMU systems for geo-referencing. These sensors feed data into specialized onboard computers running AI/ML algorithms for automated classification of defects like cracks, potholes, and deformation, thereby generating objective Pavement Condition Index (PCI) reports automatically.

How does Artificial Intelligence (AI) improve the accuracy and speed of defect detection compared to traditional methods?

AI, specifically Deep Learning models such as CNNs, significantly enhances detection by learning complex defect patterns and filtering out environmental noise (shadows, oil spills, road markings) that typically confuse traditional threshold-based image processing. This allows for rapid, precise classification and quantification of diverse defect types (e.g., classifying longitudinal vs. alligator cracking) at high vehicle speeds, reducing manual review time dramatically and increasing overall consistency and reliability of the pavement assessment process.

What is the Pavement Condition Index (PCI) and why is automated calculation critical for asset managers?

The Pavement Condition Index (PCI) is a numerical rating (0 to 100) used globally to indicate the operational and structural condition of a pavement section based on the type, severity, and extent of observed defects. Automated calculation of PCI using defect detection systems is critical because it provides objective, verifiable, and consistent data necessary for prioritizing maintenance investments, justifying budget allocations, and shifting infrastructure management from reactive repairs to optimized, predictive maintenance strategies, maximizing the useful life of road assets.

What major restraints impede the widespread adoption of advanced Pavement Defect Detection Systems globally?

Major restraints include the substantial initial capital investment required for purchasing and maintaining highly specialized sensor-equipped vehicles and powerful computing infrastructure. Furthermore, challenges related to data integration persist, as high-volume data must be seamlessly incorporated into diverse, often proprietary, legacy Infrastructure Asset Management Systems (IAMS). Finally, a lack of universally accepted data standards and standardized training protocols across different governmental jurisdictions complicates large-scale deployment and data sharing efforts, requiring vendor customization.

Which regional market is anticipated to experience the highest growth rate and what are the driving factors?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by aggressive government spending on large-scale infrastructure expansion projects (highways, expressways), rapid urbanization leading to increased traffic loads, and the urgent necessity for scalable, automated assessment methods to manage newly constructed, yet quickly deteriorating, road assets. The adoption of smart city initiatives further boosts the regional demand for high-speed, data-driven pavement management solutions.

How are Pavement Defect Detection Systems benefiting private sector toll road concessionaires?

Private toll road concessionaires utilize these systems extensively to meet stringent performance metrics stipulated in their contracts with government bodies. These systems ensure continuous monitoring and provide auditable proof of road condition, minimizing penalties for non-compliance. Furthermore, the predictive maintenance capabilities facilitated by the data allow concessionaires to optimize their operational expenditure, target repairs precisely, and reduce traffic downtime, thereby maximizing operational efficiency and long-term asset profitability.

What is sensor fusion in the context of pavement assessment and why is it important?

Sensor fusion involves integrating data streams from multiple distinct sensors—such as high-resolution cameras, LiDAR, GPR, and thermal imagers—into a single, coherent analytical model. This is crucial because surface defects (captured by cameras/LiDAR) often result from subsurface issues (detected by GPR). Fusion provides a holistic assessment, linking surface deterioration to underlying structural problems like voids or moisture, enabling maintenance decisions that address the root cause rather than just the visible symptom, leading to more durable repairs.

Are drone-based Pavement Defect Detection Systems a viable alternative to vehicle-mounted systems?

Drone-based systems are highly viable for specific applications, particularly for inspecting limited-access areas like bridge decks, tunnels, or localized sections of urban roads where vehicle deployment is impractical or disruptive. They offer high-resolution aerial photogrammetry and flexible deployment. However, they generally cannot match the sustained high-speed data acquisition capability, the penetration depth (GPR), or the certified 3D accuracy provided by integrated, vehicle-mounted LiDAR profilers required for large-scale highway network assessments.

What role does the 'Service' component play in the Pavement Defect Detection Systems market value chain?

The 'Service' component, often delivered as Pavement as a Service (PaaS), is increasingly dominant, encompassing data collection contracts, post-processing analytics, customized reporting, and expert consulting. This component lowers the entry barrier for municipalities by eliminating large capital hardware expenditures, shifting the cost to an operational expense (OpEx). The service providers leverage their proprietary AI models and expertise to deliver actionable, interpreted data directly, which is the highest value-add element in the current market.

How do detection systems handle variations in lighting and weather conditions during data collection?

Advanced Pavement Defect Detection Systems utilize controlled, high-intensity artificial lighting (often LED strobes) synchronized with the cameras and lasers to minimize the adverse effects of ambient sunlight, shadows, and varying weather conditions. Furthermore, AI algorithms are trained on diverse datasets that include varying light and moisture conditions, allowing the software to robustly compensate for environmental factors and maintain consistent detection accuracy throughout the inspection campaign, ensuring data quality remains reliable regardless of time of day.

Which standards bodies heavily influence the required data outputs of these detection systems?

Key standards bodies include the American Association of State Highway and Transportation Officials (AASHTO), which provides widely used testing protocols, and ASTM International, which defines standards for measuring various pavement properties. Additionally, specific national road agencies (like FHWA in the US or relevant European transport bodies) mandate specific defect classification codes and severity levels that automated systems must adhere to when calculating and reporting the Pavement Condition Index (PCI) and related metrics.

Why is the integration of GPS and IMU technology essential for defect detection?

The integration of Global Positioning Systems (GPS) and Inertial Measurement Units (IMUs) is essential for geo-referencing, ensuring that every identified defect is precisely mapped to its corresponding physical location on the road network. IMUs track the precise motion and orientation of the sensor vehicle, correcting for tilt and acceleration, which is vital for high-speed data collection accuracy. This location data is critical for maintenance crews to find and repair defects efficiently and for accurately updating the infrastructure asset database.

What are the limitations of older 2D imaging systems in assessing pavement condition?

Older 2D imaging systems primarily capture plan view images, making it difficult to accurately measure three-dimensional distresses such as rutting (longitudinal depressions) and faulting (vertical misalignment between pavement slabs). They also struggle with shadows and lighting variations, leading to high false-positive or false-negative rates. The lack of 3D profile data limits their ability to provide the quantitative metrics required for comprehensive structural evaluation and calculation of macrotexture properties.

How do governments manage data security and privacy concerns related to large-scale data collection on public roads?

Governments address data security by implementing secure, often proprietary or dedicated cloud storage platforms compliant with federal IT security standards. Privacy concerns are minimal compared to other sectors, as the data collected (images of road surfaces and infrastructure geometry) is generally classified as public asset data and does not contain personally identifiable information (PII). Data governance protocols are established to ensure authorized access and prevent manipulation of the official road condition indices used for budgeting and compliance reporting.

What is the concept of 'predictive maintenance' facilitated by these systems?

Predictive maintenance moves beyond scheduled or reactive repairs by using advanced analytics, including AI, to forecast the remaining useful life of a pavement section. By continuously monitoring the rate of deterioration and analyzing historical data, the system identifies sections likely to fail in the near future. This allows infrastructure managers to schedule preventative maintenance interventions (e.g., surface treatments) at the optimal time, maximizing efficiency and preventing costly, large-scale rehabilitation required after catastrophic failure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager