Pawn Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438796 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pawn Service Market Size

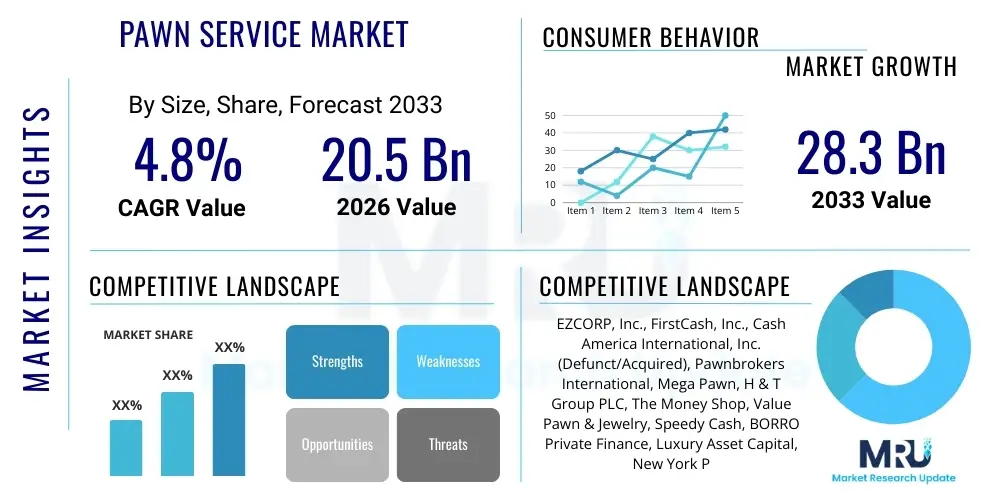

The Pawn Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $28.3 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the persistent demand for immediate, short-term liquidity solutions, particularly among underbanked populations and small businesses facing temporary financial constraints. Economic volatility, characterized by inflation and unpredictable employment rates in several key global regions, further amplifies the reliance on pawn shops as accessible credit providers. The market size expansion is not solely dependent on traditional brick-and-mortar operations; rather, it is increasingly being influenced by the modernization efforts undertaken by major industry players who are integrating digital platforms and advanced appraisal technologies to enhance customer experience and operational efficiency, thereby expanding their reach beyond conventional geographical limitations. Furthermore, regulatory environments, while sometimes restrictive, are stabilizing in specific developed markets, allowing established pawn services to innovate within clear legal boundaries, contributing positively to verifiable market growth metrics.

Pawn Service Market introduction

The Pawn Service Market encompasses financial institutions that offer secured loans to consumers in exchange for tangible personal property, which serves as collateral. The core product, a collateralized loan, allows individuals to quickly obtain cash without undergoing rigorous credit checks typically associated with conventional banking channels. Major applications of pawn services include bridging short-term cash flow gaps, funding unexpected emergencies like medical bills or vehicle repairs, and serving as a crucial funding mechanism for individuals excluded from mainstream financial services. The primary benefit of utilizing pawn services is the speed and convenience of the transaction; loans are processed rapidly, often within minutes, requiring minimal paperwork. Furthermore, the loan is non-recourse, meaning failure to repay results only in the forfeiture of the collateral, with no impact on the borrower's credit score or future financial standing. This unique proposition positions pawn services as a vital component of the alternative financial services ecosystem, particularly attractive during periods of economic uncertainty when traditional lending tightens. The industry is rapidly evolving, moving beyond precious metals and jewelry to accept a wider range of high-value collateral, including electronics, musical instruments, and high-end designer goods, reflecting changing consumer assets and preferences.

Driving factors propelling the expansion of the Pawn Service Market are multifaceted, deeply rooted in socio-economic dynamics. A significant driver is the increasing income disparity and the corresponding growth of the underbanked and unbanked population globally, for whom pawn shops represent the most accessible form of immediate credit. The inherent lack of stringent qualification requirements, coupled with the immediacy of funds disbursement, makes pawn services a preferred choice over complex microloan processes or high-interest payday loans for many consumers. Additionally, the proliferation of high-value consumer goods, driven by technological advancements and disposable income increases in emerging economies, provides a larger pool of acceptable collateral, stimulating transaction volume. Furthermore, the rising integration of specialized management software and online presence by pawn operators enhances service transparency and accessibility, mitigating negative consumer perceptions and broadening the customer base to include more financially literate individuals seeking confidential, rapid funding options. These factors collectively contribute to sustained market buoyancy, reinforcing the role of pawn services as essential emergency financial providers in the modern economic landscape.

Pawn Service Market Executive Summary

The global Pawn Service Market is undergoing significant transformations driven by technological integration and shifting consumer demographics. Current business trends highlight a move toward multi-channel operations, where established brick-and-mortar pawn shops are launching robust digital platforms for online appraisals, loan applications, and collateral management, thereby enhancing market penetration and operational scalability. Major industry consolidation is evident, with larger corporate chains leveraging economies of scale, superior inventory management systems, and centralized risk assessment models to capture greater market share and standardize service quality. Regional trends indicate that North America and Europe, characterized by sophisticated regulatory frameworks, are leading the adoption of digital pawn models and focusing on high-value asset pawning (e.g., luxury watches, fine art). Conversely, Asia Pacific and Latin America exhibit high growth potential driven by large, underserved populations, where traditional gold and jewelry pawning remains dominant but is slowly integrating digital payment mechanisms for improved efficiency. Segment trends show a consistent dominance of jewelry and precious metals as collateral due to their stable intrinsic value and easy liquidity, although the consumer electronics segment is registering the fastest growth rate, aligning with the global proliferation of smartphones and computing devices as valuable assets.

The market’s competitive landscape is defined by continuous innovation focused on optimizing the lending process and minimizing operational risks associated with collateral storage and liquidation. Key market players are investing heavily in advanced security systems and detailed asset verification technologies to combat fraud and ensure accurate appraisal values, which directly impacts profitability and customer trust. Moreover, strategic diversification into retail sales of forfeited collateral, both physical and online, provides a significant secondary revenue stream that stabilizes overall profitability, particularly during economic downturns when pawn loan defaults might increase. Regulatory compliance remains a critical constraint, pushing companies to adopt standardized practices concerning interest rate caps, holding periods, and mandatory customer identification, thereby raising the operational barrier to entry for smaller, independent operators. This convergence of technological enhancement, strategic consolidation, and stringent regulatory adherence is shaping a more professionalized and efficient global pawn market, increasingly viewed by consumers as a viable, albeit non-traditional, source of short-term capital.

AI Impact Analysis on Pawn Service Market

User queries regarding the integration of Artificial Intelligence (AI) into the Pawn Service Market primarily center on three core themes: the accuracy and speed of asset valuation, the potential for personalized customer risk assessment, and the future job displacement of traditional appraisers. Consumers and industry stakeholders frequently ask if AI can reliably appraise complex assets like gemstones or collectibles, and whether automated processes can offer significantly better loan-to-value ratios than human experts. They are concerned about data privacy and the algorithmic fairness of loan terms determined by machine learning models. Analysis shows that the predominant expectation is that AI will dramatically enhance operational efficiency and reduce fraud through sophisticated image recognition and market trend analysis, transitioning the pawn process from subjective assessment to objective, data-driven decision-making. However, concerns persist regarding the initial investment cost, the training data quality necessary for niche collateral types, and maintaining the personalized, trust-based relationship that is often integral to the traditional pawn experience.

AI's influence is expected to be transformative, moving the industry toward rapid, standardized, and transparent transactions. Machine learning algorithms can analyze vast datasets of past sales, current market liquidity, and historical price fluctuations in real-time to provide highly accurate, instantaneous appraisal values for standardized collateral like electronics and common jewelry. This capability drastically reduces the time a customer spends in the shop and minimizes the risk of human error or inconsistency in valuation. Furthermore, AI can be deployed in fraud detection by analyzing patterns in loan applications, collateral characteristics, and customer behavior that might indicate high risk or illegal activity. This predictive analytics capability allows pawn services to optimize their capital allocation and improve overall loan portfolio performance, mitigating losses associated with collateral impairment or theft. The resultant increase in efficiency and reduction in operating costs will allow competitive pawn operators to offer potentially lower interest rates or higher loan amounts, increasing consumer appeal and driving market growth among technologically receptive demographics.

- Instantaneous Collateral Appraisal: AI-driven image recognition and market analysis platforms accelerate the valuation process for common items, ensuring standardized pricing across all branches.

- Enhanced Fraud Detection: Machine learning algorithms analyze transaction history and asset provenance to flag suspicious activities and counterfeit collateral effectively.

- Personalized Loan Pricing: AI optimizes loan-to-value ratios and interest rates based on real-time risk assessment of the borrower and the collateral’s liquidity profile.

- Automated Inventory Management: Robotics and AI systems improve tracking, retrieval, and security of stored collateral, minimizing logistical costs and increasing asset integrity.

- Predictive Market Trend Analysis: AI forecasts optimal liquidation timing and pricing for forfeited collateral, maximizing secondary revenue streams for the pawn operator.

DRO & Impact Forces Of Pawn Service Market

The Pawn Service Market is dynamically shaped by a crucial interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Key Drivers include persistent economic instability worldwide, which increases demand for short-term liquidity, and the sizable, growing demographic of underbanked consumers who lack access to conventional credit. Technological advancements, particularly in automated appraisal and online lending platforms, act as a powerful catalyst, enhancing efficiency and expanding market reach. However, these drivers are tempered by significant Restraints, primarily the strict regulatory landscape in many jurisdictions that caps interest rates and mandates costly compliance procedures, often limiting profitability margins. Furthermore, the persistent negative social stigma associated with pawn shops, though slowly receding, discourages adoption among higher-income segments. These opposing forces create substantial Opportunities, notably the expansion into digital pawning (e-pawning), leveraging blockchain for secure asset tracking, and diversifying collateral acceptance to high-value, non-traditional assets like cryptocurrencies or digital assets, positioning the market for sustained, innovative growth. The overall impact forces suggest a market moving toward greater professionalization and digitization, favoring large, compliant, and technologically advanced players.

Impact Forces are predominantly driven by consumer credit needs and regulatory oversight. Socioeconomic factors like rising consumer debt levels and inadequate emergency savings reinforce the need for quick, accessible funds, acting as a powerful long-term driver. Conversely, the high cost of capital for pawn operators and increasing scrutiny from consumer protection agencies globally exerts significant downward pressure on profitability, necessitating continuous operational optimization. The largest opportunity lies in leveraging technology to minimize physical overheads and extend service accessibility beyond urban centers. The strategic integration of digital interfaces allows pawn brokers to streamline the intake process, offering immediate pre-appraisals online, which significantly improves customer engagement and conversion rates. Furthermore, the market benefits from the cyclical nature of commodity prices, especially gold and precious metals, which bolsters the intrinsic value of common collateral types, stabilizing the loan portfolio’s underlying security. The long-term success of the market depends on balancing the increasing regulatory burden with innovative methods of maintaining high operational efficiency and expanding service value propositions beyond simple lending.

Segmentation Analysis

The Pawn Service Market is segmented based on the type of collateral offered, the type of service provided, and the operational model employed. Segmentation by collateral is crucial as it dictates the required appraisal expertise, risk profile, and subsequent loan amount. The primary collateral categories include jewelry (precious metals and gemstones), electronics (smartphones, computers), and general merchandise (tools, musical instruments). Analyzing these segments reveals shifting consumer asset preferences and their corresponding liquidity needs. Segmentation by service primarily includes pawn loans (secured non-recourse credit) and outright purchasing of goods. The operational model segmentation differentiates between traditional brick-and-mortar stores, which rely on local foot traffic, and rapidly expanding online pawn platforms (e-pawning) which offer nationwide or international services. Detailed segmentation analysis enables market players to tailor their marketing strategies, optimize inventory management systems for specific asset types, and prioritize investment in technologies most relevant to their core customer segments. For instance, companies focused on electronics require sophisticated rapid depreciation modeling, while those focused on jewelry require expert gemological appraisal technology and secure storage solutions, illustrating the necessity of specialized approaches within the segmented market.

Understanding the relative market share and growth rates across these segments provides strategic insights for investment and geographical expansion. While jewelry and precious metals historically command the largest market share due to their high, reliable value and ease of storage, the electronics segment, driven by rapid technology cycles and high consumer replacement rates, exhibits the highest anticipated CAGR. The shift towards online operations is particularly transformative; e-pawning reduces geographic barriers and overhead costs, making short-term secured lending accessible to a broader, tech-savvy demographic. However, online models face challenges related to secure shipping, detailed remote appraisal (often requiring high-resolution video or specialized imagery), and managing the logistics of high-value asset transportation. Consequently, hybrid models combining the trust and physical presence of a store with the convenience of digital application and management are gaining traction, providing a balanced approach to market penetration and risk management across diverse geographical and socio-economic regions. This segmentation framework allows for a granular assessment of competitive positioning and identification of niche, high-growth areas within the alternative financial landscape.

- By Collateral Type:

- Jewelry and Precious Metals (Gold, Silver, Platinum)

- Consumer Electronics (Smartphones, Laptops, Gaming Consoles)

- Automotive (Vehicle Title Pawns)

- General Merchandise (Tools, Firearms, Musical Instruments, Collectibles)

- By Service Type:

- Pawn Loans (Secured Lending)

- Outright Purchase of Goods

- Auxiliary Services (Check Cashing, Money Transfer)

- By Operational Model:

- Brick-and-Mortar Pawn Shops

- Online Pawn Platforms (E-pawning)

- Hybrid Models

Value Chain Analysis For Pawn Service Market

The Value Chain of the Pawn Service Market begins with upstream activities focused on procurement and capital management. Upstream analysis involves securing the necessary capital (either through internal financing, lines of credit, or equity) to fund the loan portfolio. It also includes investing in physical infrastructure such as highly secure storage facilities, advanced surveillance systems, and robust insurance coverage to protect the collateral. Efficient management of capital structure is paramount, as the cost of funds directly impacts the interest rates offered to customers and, consequently, the competitive positioning of the service provider. Furthermore, the selection and training of highly skilled appraisers, especially for specialized items like fine art or luxury watches, forms a crucial upstream bottleneck, requiring significant investment in human resources and continuous professional development to ensure accurate valuation and minimized financial risk. Successful upstream optimization leads to lower operational risk and higher asset integrity, providing the foundation for profitable downstream operations.

Midstream activities primarily revolve around the core transaction: customer acquisition, collateral appraisal, loan negotiation, and documentation. This stage requires seamless integration of compliance processes to adhere to local, state, and federal lending regulations, including verifying ownership and maintaining detailed records. The distribution channel in pawn services is primarily direct, involving the physical interaction between the customer and the pawn broker, even in modern digital operations where the loan application may be online, but the collateral exchange often remains physical (or via secured courier). However, the indirect distribution channel exists through ancillary services, such as partnerships with money transfer agents or check-cashing networks that drive foot traffic. Downstream activities focus on the outcome of the loan: either the repayment and return of the collateral or the forfeiture and subsequent liquidation (retail sale) of the asset. Highly effective downstream performance involves optimizing the retail sales process, utilizing both in-store displays and e-commerce platforms to maximize the recovery value of forfeited collateral, often yielding higher profit margins than the interest earned on the original loan. The synergy between secure storage, accurate appraisal, and efficient retail liquidation defines the overall market profitability.

Pawn Service Market Potential Customers

Potential customers for the Pawn Service Market are fundamentally categorized into two primary segments: the financially underserved population and middle-income individuals seeking rapid, confidential liquidity without impacting their credit rating. The largest segment, the financially underserved, includes individuals who may be unbanked or underbanked, have limited or poor credit history, or lack access to traditional credit sources due to low income or unstable employment. For this group, pawn services offer a necessary financial lifeline for managing unexpected expenses, bridging the gap between paychecks, or covering essential costs when formal channels are inaccessible or overly time-consuming. These customers typically pawn lower-value, easily liquidated items such as simple jewelry, standard electronics, and basic tools, emphasizing the need for immediate, small-denomination loans. This demographic's reliance on pawn services is counter-cyclical, often increasing significantly during periods of high inflation or economic contraction, reinforcing the critical societal function of the industry.

The second key customer base consists of small business owners and financially sophisticated middle-to-high income individuals who utilize pawn services for specific strategic needs. Small entrepreneurs often use high-value collateral, such as business equipment or luxury personal assets, to secure quick, small-scale working capital loans, avoiding the complex application and long approval times associated with bank loans. For wealthier individuals, pawn services offer a confidential and rapid way to monetize high-value assets (like expensive watches, diamonds, or fine wines) without selling them outright, often preferred for tax reasons or to maintain discretion regarding their financial dealings. This group demands highly professional, discrete services and expert appraisal, driving the growth in specialized, high-end pawn operations. Across both segments, the core appeal remains the non-recourse nature of the loan and the immediacy of fund availability, positioning the pawn shop as a flexible alternative financier rather than just a lender of last resort. Targeted marketing efforts must address both the necessity-driven needs of the underbanked and the discretionary, convenience-driven requirements of the high-net-worth individual.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $28.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EZCORP, Inc., FirstCash, Inc., Cash America International, Inc. (Defunct/Acquired), Pawnbrokers International, Mega Pawn, H & T Group PLC, The Money Shop, Value Pawn & Jewelry, Speedy Cash, BORRO Private Finance, Luxury Asset Capital, New York Pawn Shop, Maxferd, G&S Pawn, Gem Pawnbrokers, Cheki Pawn, MoneyMan, Pawn America, Pawn Expo, UltraPawn |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pawn Service Market Key Technology Landscape

The technological landscape of the Pawn Service Market is rapidly modernizing, shifting away from entirely manual processes to sophisticated digital systems that enhance efficiency, security, and customer experience. A core component of this shift involves the widespread adoption of specialized Pawn Management Software (PMS). These systems manage all critical operational functions, including inventory tracking, detailed transaction recording, regulatory compliance reporting (such as reporting to law enforcement databases like LeadsOnline in the US), interest calculation, and customer relationship management (CRM). Modern PMS platforms are cloud-based, offering real-time data synchronization across multiple store locations, crucial for large chains seeking centralized control and standardized operations. Furthermore, the integration of Point-of-Sale (POS) systems within the PMS facilitates the smooth transition of forfeited collateral from asset register to retail sales inventory, maximizing recovery yield and streamlining accounting practices. The efficiency gains derived from these software solutions are fundamental to sustaining profitability in a competitive, regulated environment.

Advanced appraisal technologies represent another significant pillar of market modernization. This includes high-resolution digital imaging equipment used for detailed remote appraisals in e-pawning operations, allowing customers to submit assets virtually for pre-loan evaluation. Crucially, sophisticated assay equipment (like X-ray Fluorescence, or XRF analyzers) is now standard for verifying the purity of precious metals and detecting counterfeits rapidly and non-destructively, minimizing appraisal risk. As the market embraces digitalization, robust cybersecurity infrastructure becomes non-negotiable. Protecting sensitive customer data, especially financial information and records detailing high-value assets, necessitates state-of-the-art encryption and layered security protocols. The nascent integration of blockchain technology is being explored to create immutable, verifiable records of ownership for specific high-value assets (such as luxury watches or diamonds), potentially simplifying due diligence, reducing fraud, and enhancing the confidence of both the broker and the subsequent buyer in the event of liquidation. These technological investments are critical differentiators, separating legacy operations from future market leaders focused on transparency and security.

Digital customer interaction platforms are also transforming how pawn services are delivered. Mobile applications and dedicated customer portals enable clients to manage their loans remotely, including making interest payments, requesting extensions, or tracking the status of their collateral. This digital accessibility not only improves customer satisfaction but also reduces the administrative burden on physical staff, freeing them up to focus on complex appraisal tasks or specialized sales. Furthermore, the use of predictive analytics, often powered by AI algorithms, is increasingly being applied to forecast market demand for various collateral types, allowing companies to strategically adjust their lending terms and inventory stocking levels. The future technological landscape is clearly moving toward fully integrated, automated systems that manage the entire lifecycle of the pawn transaction—from initial customer contact and appraisal, through regulatory reporting and secure storage, to final disposition—ensuring scalability and maintaining high standards of compliance and profitability.

Regional Highlights

North America: Maturity and Digitization Leader

North America, particularly the United States, holds a significant market share, characterized by large corporate chains and a high degree of regulatory maturity. The market here is driven by the necessity for quick credit, especially among lower and middle-income segments facing rising costs of living and wage stagnation. The US market is pioneering the digital transformation, with major players heavily investing in e-pawning platforms and sophisticated AI-driven appraisal systems to handle high volumes of electronics and specialized assets. Regulatory compliance, mandated by state and federal laws (such as the Truth in Lending Act and local reporting requirements), dictates operational standards, favoring larger companies that can absorb the high compliance costs. Growth in this region is primarily focused on increasing operational efficiency and diversifying collateral types beyond traditional jewelry, including high-end designer goods and specialized collectibles, appealing to a broader, more affluent customer base seeking temporary liquidity solutions.

The Canadian market, while smaller, shows similar trends toward professionalization and technological adoption. The key market relevance of North America lies in its established framework for consumer credit and the substantial capital available for market consolidation and technology implementation. The high penetration of smartphones and digital banking services in the region ensures that digital pawn services are readily adopted by the consumer base. The competition is intense, driving innovation in areas like customer data privacy and secure asset logistics. Future expansion in North America will focus less on opening new physical locations and more on optimizing the hybrid model, using physical stores as secure drop-off and retrieval points supported by a highly efficient, data-driven back end. The region sets the global benchmark for professional standards and technological integration within the pawn industry.

- United States: Large market size, high regulatory overhead, leading in e-pawning and AI appraisal technologies, strong corporate chain presence.

- Canada: Stable growth, focus on high-value collateral, early adoption of centralized compliance software.

Europe: Diverse Regulations and Luxury Asset Focus

The European Pawn Service Market is highly fragmented, reflecting the diverse national regulatory frameworks and consumer attitudes across the continent. Western European countries like the UK and Spain have established, mature markets, often specializing in high-end luxury assets, including fine watches, jewelry, and art. The UK, in particular, has seen significant professionalization, with several listed companies dominating the market and emphasizing transparent interest rates and high customer service standards to counteract the historical stigma. In contrast, Eastern and Southern European markets are often characterized by smaller, independent operators and a higher reliance on gold and silver pawning as a hedge against local economic volatility. The introduction of the European Union’s anti-money laundering directives and stricter consumer credit rules significantly impacts the compliance burden across member states, driving smaller players towards consolidation or exit.

A key regional dynamic is the contrast between the high-street, accessible service model prevalent in the UK and the more bank-integrated, specialized model seen in some continental countries. The opportunity in Europe lies in harmonizing digital service delivery across borders, though this is severely complicated by differing legal requirements regarding interest rate caps and collateral holding periods. The strong luxury goods market provides a stable, high-value asset pool, supporting the specialized services targeting affluent clientele. European market growth hinges on efficient cross-border digital operations and adapting to diverse national consumer protection laws while leveraging technology to improve transparency and reduce operational costs across multiple jurisdictions. The demand for flexible financing, especially post-Brexit economic adjustments and during regional energy crises, further underpins steady market activity.

- United Kingdom: Mature, high regulatory standard, dominant corporate players, focus on luxury and high-value collateral pawning.

- Spain/Italy: Fragmented market, increasing modernization, high demand for immediate liquidity driven by regional economic fluctuations.

Asia Pacific (APAC): High Growth and Cultural Significance

The Asia Pacific region represents the fastest-growing market globally, fueled by vast, expanding middle classes and large unbanked populations in economies such as India, China, and Southeast Asian nations. Pawn services (known as 'pawnshops' or 'pajak gadai' in some areas) hold deep cultural significance, particularly for gold and inherited jewelry, which are often viewed both as financial assets and cultural relics. This cultural acceptance, combined with relatively fewer banking options for quick loans in rural or developing areas, makes pawn services highly relevant. The market is currently dominated by traditional, often family-owned shops, but is rapidly seeing the entrance of modernized, corporate entities utilizing technology to scale operations. China and India are major focal points, driven by massive urbanization and rising household income, which increases the accumulation of high-value consumer goods that can serve as collateral.

The primary challenge in APAC is the highly diverse regulatory landscape and the prevalence of informal lending structures that compete with regulated pawn services. Digital transformation is slower than in North America or Europe, focusing more on enabling mobile payments and QR code usage rather than complex AI appraisals, though this is quickly changing in metropolitan centers. The high volatility of specific emerging market economies increases the need for short-term secured loans, thereby boosting transaction volumes. Government initiatives promoting financial inclusion in countries like Indonesia and the Philippines are indirectly supportive of professionalized pawn services that operate legally and transparently. Future growth will be anchored by the integration of robust logistics networks to facilitate e-pawning and the standardization of appraisal processes to handle the high volume and variety of collateral unique to these diverse markets.

- China: Rapid modernization, massive volume of consumer electronics, increasing corporate investment in digital infrastructure.

- India: Strong reliance on gold pawning, high growth potential due to large underbanked rural population, major opportunity for mobile service integration.

- Southeast Asia: Fragmented but culturally accepted, steady growth driven by necessity and financial inclusion efforts.

Latin America: Economic Volatility and Accessibility

Latin America presents a robust market for pawn services due to persistent macroeconomic volatility, high inflation rates, and significant segments of the population excluded from formal banking sectors. Pawn services often serve as a crucial stabilizing mechanism, allowing individuals to quickly secure cash against tangible assets when credit markets are tight or interest rates on unsecured loans are prohibitively high. Mexico, in particular, has a well-developed and heavily utilized pawn industry, with major regional and international players establishing strong presences. The market here is driven largely by essential household needs and emergency financial requirements.

A distinctive feature of the Latin American market is the relatively higher acceptance of automotive title pawns, where the customer keeps the vehicle but offers the title as collateral, although this service is highly regulated due to high default risks. Regulatory oversight varies considerably by country, posing a challenge for multi-country operators who must navigate complex legal requirements regarding maximum loan interest and required holding periods. Digital adoption is accelerating, focused on mobile applications that facilitate payment processing and customer communication, improving convenience and reach across geographically challenging areas. Growth strategies in this region center on building trust and accessibility within local communities and offering competitive, compliant interest rates against the backdrop of fluctuating local currency values, ensuring the pawned assets maintain their relative worth against the local economic environment.

- Mexico: Large, mature market, strong utilization due to economic volatility, relatively high regulatory clarity compared to other LATAM nations.

- Brazil: Emerging corporate structures, focus on jewelry and higher-value goods in urban centers, navigating complex state-level regulations.

Middle East and Africa (MEA): Emerging Market Dynamics and Gold Reliance

The MEA region is highly diverse, presenting contrasting market dynamics. The Middle East, particularly the UAE and Saudi Arabia, exhibits a specialized high-end market driven by wealth accumulation, focusing on luxury watches, rare jewelry, and high-quality gold. Services in this sub-region often cater to expatriates and wealthy individuals seeking confidential, non-credit-based secured loans. Operations are generally modernized, highly secure, and often operate under specific free zone financial regulations that allow for high professional standards but potentially stricter compliance regimes regarding asset origin and anti-money laundering protocols.

In contrast, the African market, especially Sub-Saharan Africa, is characterized by lower service penetration and a reliance on informal lending. Where formal pawn services exist (e.g., in South Africa), they primarily target lower-income demographics using basic electronics and small gold items as collateral. The key drivers are extreme financial exclusion and a high prevalence of informal employment, making traditional bank loans impossible for most citizens. Opportunities abound in mobile technology integration, leveraging high mobile penetration rates to manage loans and payments. However, challenges include lack of formalized property ownership records, inconsistent regulatory enforcement, and difficulties in asset liquidation due to volatile local markets. Future growth in Africa will require substantial investment in trust-building, regulatory lobbying for favorable credit laws, and developing secure logistical solutions for handling collateral across large geographical areas with limited infrastructure.

- Middle East (GCC): Highly specialized, focus on luxury and high-value gold, emphasis on security and discretion.

- Sub-Saharan Africa: Low formal penetration, major opportunity in mobile integration, high demand driven by financial exclusion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pawn Service Market.- EZCORP, Inc.

- FirstCash, Inc.

- H & T Group PLC

- Pawnbrokers International

- The Money Shop

- Value Pawn & Jewelry

- Cash Converters International Limited

- Mega Pawn

- Speedy Cash

- BORRO Private Finance

- Luxury Asset Capital

- New York Pawn Shop

- Maxferd

- G&S Pawn

- Gem Pawnbrokers

- Cheki Pawn

- MoneyMan (Pawn operations)

- Pawn America

- Pawn Expo

- UltraPawn

Frequently Asked Questions

Analyze common user questions about the Pawn Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Pawn Service Market through 2033?

The Pawn Service Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven primarily by increasing financial exclusion globally and widespread adoption of digital lending platforms.

How is technology, specifically AI, changing collateral appraisal methods in pawn services?

AI technology is fundamentally transforming collateral appraisal by offering instant, data-driven valuations based on real-time market data and sophisticated image recognition. This increases accuracy, reduces fraud, and standardizes loan-to-value ratios across different store locations, thereby enhancing operational efficiency and customer trust in fair pricing.

Which geographical region holds the largest market share and why?

North America currently holds a significant market share, primarily due to the high presence of large, well-regulated corporate pawn chains and high consumer awareness of short-term secured lending options. The region also leads in the adoption of digital pawn and hybrid operational models, optimizing market penetration and service delivery.

What are the key differences between traditional pawn loans and modern e-pawning services?

Traditional pawn loans require a physical visit for appraisal and transaction, relying heavily on local foot traffic. E-pawning (online pawning) uses digital platforms for initial application and remote appraisal, requiring secure logistics for asset shipment, offering greater convenience, and significantly expanding the geographical reach of the service providers beyond local constraints.

What types of assets are currently driving the fastest growth within the pawn market?

While traditional collateral like gold and jewelry remain dominant by volume, the fastest growth is currently driven by high-value Consumer Electronics (smartphones, premium laptops, gaming consoles) due to rapid technology cycles, high replacement rates, and their relatively standardized valuation process, making them ideal for quick collateralized loans.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager