Pawn Shop Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432330 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Pawn Shop Market Size

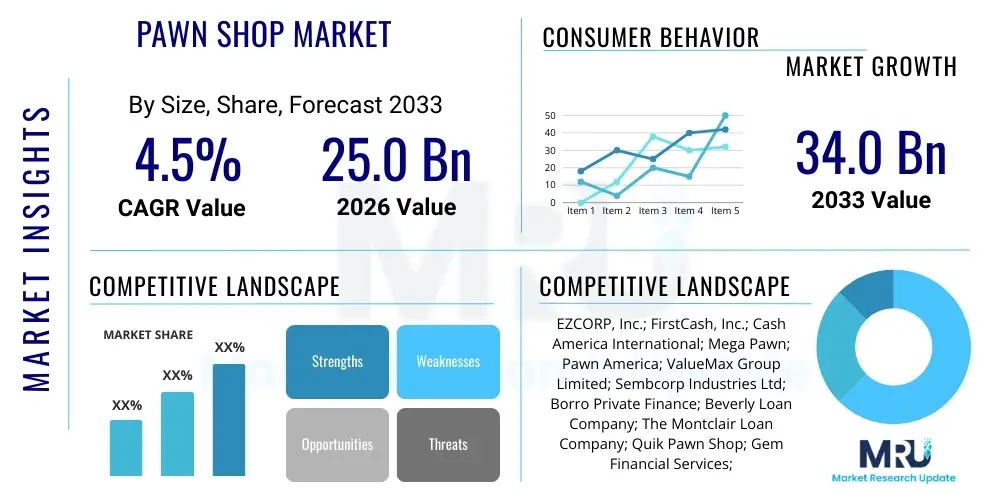

The Pawn Shop Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $25.0 Billion in 2026 and is projected to reach $34.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the persistent global demand for accessible short-term credit, particularly among underbanked populations and small businesses seeking rapid liquidity solutions. Furthermore, the increasing acceptance of online pawn services and digital valuation tools is broadening the market reach beyond traditional brick-and-mortar limitations, contributing significantly to the expanding market size valuation over the projection period.

Pawn Shop Market introduction

The Pawn Shop Market encompasses financial institutions that provide collateralized loans to individuals and businesses in exchange for personal property, commonly known as pawning, or purchasing items outright from customers. The core product offering is the pawn loan, a non-recourse loan secured by an asset of value, such as jewelry, electronics, or tools. Major applications of pawn services include bridging short-term liquidity gaps for personal expenses, financing unexpected emergencies, and providing working capital for micro-enterprises. These services offer significant benefits, primarily speed, simplicity, and accessibility, as the transaction does not require traditional credit checks, making it a crucial alternative financial service for those excluded from conventional banking systems.

Driving factors propelling market expansion include rising economic uncertainty and income inequality globally, which increases the reliance on readily available credit sources like pawnshops. Additionally, the rapid modernization of the industry, involving the implementation of advanced inventory management systems, professional appraisal techniques, and the development of robust omnichannel platforms integrating physical stores with e-commerce capabilities, is attracting a wider demographic of users. Regulatory environments, while varying by region, are gradually stabilizing and legitimizing the sector, encouraging further investment and professionalization. The market dynamics are also increasingly influenced by fluctuations in the value of underlying collateral, such as precious metals and gemstones, impacting the loan-to-value ratios and overall transaction volume.

The transition toward digital engagement remains a powerful force. Many established pawn operations are actively investing in robust online portals, allowing customers to initiate appraisals, manage loan renewals, and even sell items remotely, fundamentally transforming the customer journey. This move not only enhances convenience but also addresses historical perceptions of the industry, positioning pawn services as professional, transparent, and discreet providers of consumer finance. The growth is intrinsically tied to global economic cycles, demonstrating counter-cyclical resilience during recessions when demand for instant cash surges, coupled with pro-cyclical growth during prosperous times when the value of consumer goods increases.

Pawn Shop Market Executive Summary

The global Pawn Shop Market is undergoing a significant transformation driven by digitalization, regulatory harmonization, and evolving consumer behavior, positioning it as a mature yet highly dynamic segment within alternative financial services. Current business trends highlight a strong shift towards omnichannel retailing, where pawnshops leverage both their physical presence for high-touch collateral appraisal and their online platforms for customer acquisition, loan management, and retail sales of unredeemed items. Regional trends show robust growth in emerging economies, particularly in Asia Pacific and Latin America, where a large unbanked population relies heavily on informal or semi-formal credit mechanisms, offering substantial penetration opportunities for organized pawn chains. Meanwhile, established markets like North America and Europe are focusing on technological integration to enhance operational efficiency and regulatory compliance, differentiating themselves through superior customer experience and transparent pricing models.

Segmentation trends reveal that the market is dominated by the Jewelry and Watch segment due to the stable high value and ease of appraisal of these assets, although the Electronics segment is experiencing the fastest growth fueled by rapid technological obsolescence and frequent consumer upgrades. The segment analysis by type of transaction indicates that collateralized lending (pawn loans) remains the primary revenue driver, but outright purchasing and resale margins are becoming increasingly important for profitability. The competitive landscape is consolidating, with larger national and regional chains acquiring smaller independent operators to gain economies of scale, standardize operational protocols, and invest in centralized technology infrastructure, thereby setting higher industry standards for valuation accuracy and fraud prevention.

Key strategic challenges summarized in this report revolve around managing increasing regulatory scrutiny regarding interest rates and consumer protection, coupled with the need for continuous investment in security and advanced inventory systems. Successful market players are those that effectively balance rapid, accessible loan provision with rigorous compliance frameworks, utilizing data analytics to optimize lending decisions and inventory turnover. The overall market trajectory points towards professionalization and integration with broader retail and finance ecosystems, indicating a future where pawn services are recognized as a legitimate, necessary component of the consumer finance landscape, highly resilient to economic fluctuations due to their counter-cyclical demand nature and asset-backed business model.

AI Impact Analysis on Pawn Shop Market

Common user questions regarding AI's impact on the Pawn Shop Market frequently center on whether AI can accurately automate the appraisal process, how machine learning might detect counterfeit goods or fraudulent transactions, and if AI-powered customer service tools could replace personalized interactions. Users are concerned about valuation accuracy for unique or antique items and the ethical implications of using predictive analytics for setting interest rates or loan terms. Analysis suggests key themes are centered around efficiency gains, risk reduction, and the potential for greater standardization across disparate collateral types. Users expect AI to streamline tedious processes, allowing staff to focus on complex appraisal tasks and customer relationship building, thereby increasing throughput and enhancing profitability while maintaining regulatory fairness and operational transparency, crucial factors for maintaining consumer trust in the alternative lending sector.

- AI-Powered Valuation Systems: Utilizing machine learning algorithms trained on vast databases of historical sales data and current market prices to provide rapid, highly accurate initial valuation estimates for common items (electronics, standard jewelry), significantly reducing processing time and mitigating human error in asset appraisal.

- Fraud and Counterfeit Detection: Implementation of AI-driven image recognition and material analysis tools to instantly flag potentially fraudulent items or high-quality counterfeits, enhancing the security of the collateral and minimizing financial risk associated with accepting compromised assets.

- Predictive Inventory Management: Employing AI models to forecast demand for specific categories of goods in the retail sales division, optimizing inventory rotation, discounting strategies, and pricing for quicker turnover of unredeemed items, maximizing retail profitability.

- Customer Relationship Management (CRM) Enhancement: Utilizing natural language processing (NLP) and chatbots for initial customer inquiries, appointment scheduling, and loan status updates, freeing up staff and providing 24/7 basic service accessibility, enhancing overall customer satisfaction.

- Optimized Lending Decisions: AI algorithms analyzing customer history, collateral type, and current market conditions to optimize the loan-to-value ratio and interest rate offerings, ensuring competitive pricing while maintaining favorable risk exposure for the pawn operation.

- Regulatory Compliance Monitoring: Automated systems monitoring transaction patterns and reporting requirements to ensure strict adherence to local, state, and national lending laws (e.g., KYC, AML checks), automatically generating required documentation and audit trails.

DRO & Impact Forces Of Pawn Shop Market

The market is fundamentally propelled by key Drivers such as economic instability and the pervasive presence of underbanked populations globally, which create a structural, sustained demand for instant, asset-backed credit without stringent credit checks. Restraints include complex and often high-interest rate regulations imposed by jurisdictions globally, which cap potential profitability and increase compliance burdens, alongside the persistent, albeit diminishing, negative social perception sometimes associated with alternative financial services. Opportunities abound in the rapid proliferation of online pawn platforms, allowing businesses to expand geographical reach without physical infrastructure, and the growing mainstream acceptance of pawning as a legitimate short-term financing tool among younger, digitally native generations. The primary Impact Forces shaping the market include fluctuating global commodity prices (especially gold and precious metals, which affect collateral value), advancements in digital security and payment infrastructure, and shifts in consumer confidence related to data privacy and asset security within online lending environments.

Segmentation Analysis

The Pawn Shop Market is meticulously segmented based on asset type, operational model, and service offering, reflecting the diverse applications and underlying value propositions within the industry. Understanding these segments is crucial for strategic market positioning and resource allocation, enabling specialized marketing efforts targeted at specific collateral owners or borrowers. The segmentation analysis helps identify high-growth areas, such as high-value luxury goods pawning (which requires specialized appraisal expertise) versus general consumer electronics pawning (which relies more on high volume and rapid turnover). Furthermore, geographic segmentation remains vital, as regulatory frameworks and consumer preferences vary dramatically between North America, Europe, and developing regions, necessitating locally tailored operational strategies and pricing structures that respect cultural and financial norms.

- By Asset Type:

- Jewelry and Watches

- Electronics (Laptops, Smartphones, Gaming Consoles)

- Tools and Equipment (Construction, Industrial)

- Musical Instruments

- Luxury Goods (Handbags, Fine Art, Memorabilia)

- Others (Vehicles, Firearms where permitted)

- By Operational Model:

- Brick-and-Mortar Pawn Shops (Traditional)

- Online Pawn Platforms (Digital/Hybrid)

- Specialized Pawn Brokers (Focusing solely on high-value or niche assets)

- By Service Offering:

- Pawn Loans (Collateralized Lending)

- Outright Purchase and Resale (Retail Trade)

- Ancillary Services (Check Cashing, Money Transfer, Financial Products)

- By Application:

- Short-Term Personal Liquidity

- Small Business Financing

- Consumer Retail Purchase

Value Chain Analysis For Pawn Shop Market

The value chain for the Pawn Shop Market begins with Upstream Analysis focused on sourcing capital and acquiring collateral. Capital sourcing involves traditional commercial bank lending or private equity investment, while collateral acquisition relies on effective marketing and robust security systems to attract customers offering items for pawning or sale. Critical upstream activities also include standardized asset appraisal training and certification programs to ensure accurate loan-to-value determinations, minimizing asset devaluation risk. Downstream Analysis centers on the two primary revenue streams: managing the loan portfolio (tracking redemption rates, collecting interest) and the retail resale of unredeemed collateral. Efficient inventory management systems are vital downstream to accurately track asset location, condition, and eventual pricing strategy for resale, often leveraging integrated e-commerce platforms to maximize the retail market reach.

Distribution Channel dynamics involve a blend of direct and indirect methods. The Direct Channel predominantly involves the in-store transaction at the physical pawn shop location, which remains essential for immediate, accurate, physical appraisal of high-value or fragile items, maintaining customer trust through face-to-face interaction, and adhering to strict regulatory identification requirements. The Indirect Channel is growing rapidly, encompassing online platforms where customers can submit assets for remote appraisal (often requiring secure shipping and detailed image submissions), manage loans digitally, and purchase retail goods. The successful integration of these channels requires a unified, technology-enabled operational back end, ensuring seamless transition between online inquiries and physical service delivery while maintaining data security and regulatory compliance across all touchpoints, which is increasingly complex given varying state and international regulations on online collateral transactions.

Therefore, optimizing the value chain demands significant investment in technology across key nodes, including advanced point-of-sale (POS) systems, integrated regulatory reporting software, and sophisticated e-commerce engines capable of handling diverse product inventories. Furthermore, the selection of secure third-party logistics (3PL) partners for shipping high-value collateral between the customer and the pawn facility is a critical consideration in the digital distribution model. Efficiency gains in the value chain are realized through standardized processing workflows, minimizing the time between collateral intake and loan dispersal, and aggressively managing the inventory turnover rate for retail assets to prevent carrying costs from eroding profit margins. Transparency in pricing and communication throughout the chain is key to fostering long-term customer relationships and reducing litigation risk.

Pawn Shop Market Potential Customers

Potential customers, or End-Users/Buyers, for the Pawn Shop Market are highly diverse but generally fall into two primary categories: individuals seeking immediate, short-term liquidity, and value-conscious consumers looking to purchase pre-owned goods at discounted prices. The primary target demographic for the loan services includes individuals who are underbanked, lacking access to traditional revolving credit or small personal loans, or those who need funds instantly without the delay associated with bank applications and credit checks. This often includes individuals facing unexpected financial emergencies, low-to-moderate income households, and small business owners requiring quick bridge financing, particularly those with valuable assets readily available to serve as collateral. The counter-cyclical nature of demand means that economic downturns often expand this customer base significantly.

The secondary, yet rapidly growing, customer base includes retail buyers who frequent pawnshops to purchase high-quality pre-owned items. These buyers are typically value-driven and seek discounted electronics, branded jewelry, musical instruments, and tools that are often in excellent condition but priced significantly lower than new retail items. The increasing popularity of sustainability and the circular economy further strengthens this segment, appealing to environmentally conscious consumers who prefer second-hand goods. Modern pawn operations, particularly those with robust online retail presences, are effectively tapping into this consumer segment by professionalizing the presentation and authentication of their retail inventory, expanding their reach far beyond the local geographic area of their physical store locations and competing directly with online marketplaces for pre-owned goods.

The market also serves niche segments, such as collectors or hobbyists looking for unique or specialized assets (e.g., rare firearms, vintage watches, specialized tools), who are attracted by the unique and constantly fluctuating inventory available through pawnbroker retail channels. Furthermore, high-net-worth individuals occasionally utilize specialized high-end pawn services for discrete, rapid loans against luxury assets like fine art, high-end vehicles, or complex investment-grade jewelry, preferring the speed and non-disclosure aspects of pawn loans over liquidating assets or engaging in complex wealth management credit facilities. The operational success of a pawn shop increasingly depends on its ability to identify and segment these diverse customer needs, offering tailored service levels and marketing communications appropriate for both the distressed borrower and the opportunistic retail buyer, ensuring robust security and discretion for all transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.0 Billion |

| Market Forecast in 2033 | $34.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EZCORP, Inc.; FirstCash, Inc.; Cash America International; Mega Pawn; Pawn America; ValueMax Group Limited; Sembcorp Industries Ltd; Borro Private Finance; Beverly Loan Company; The Montclair Loan Company; Quik Pawn Shop; Gem Financial Services; London Pawnbrokers; Maxi-Cash Financial Services Corporation Ltd.; Browns Pawnbrokers; Ace Cash Express; Mr. Pawn; MoneyMan Pawn; Pawn Express; Checkmate Payday Loans. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pawn Shop Market Key Technology Landscape

The technological landscape of the Pawn Shop Market is increasingly sophisticated, moving far beyond basic point-of-sale systems to incorporate advanced digital tools critical for efficient operation, regulatory compliance, and enhanced customer experience. A cornerstone technology is specialized Pawn Shop Management Software (PMS), which integrates inventory tracking, loan management, detailed compliance reporting (e.g., daily submission of transaction data to law enforcement databases like LeadsOnline), and customer history analysis into a single, cohesive system. The shift to omnichannel models relies heavily on robust e-commerce platforms and secure digital appraisal tools that utilize high-resolution image analysis and integrated market data feeds to facilitate remote transactions and online retail sales of collateral with verified authenticity.

Furthermore, security technologies are paramount in this asset-heavy sector. This includes advanced biometric security systems for high-value vaults, integrated anti-fraud software utilizing machine learning to detect suspicious transaction patterns, and specialized testing equipment for precious metals and gemstones (e.g., X-ray fluorescence analyzers) that ensure the collateral's true value and integrity. Blockchain technology is emerging as a critical tool, particularly in managing the provenance and ownership chain of high-value luxury goods and certified pre-owned items, providing immutable records that enhance transparency and buyer confidence in the secondary retail market, directly addressing the historical challenge of trust and authentication in the trade of used goods.

Investment in mobile technology is also accelerating, enabling customers to manage their pawn loans—viewing due dates, making interest payments, and initiating renewals—via dedicated mobile applications. This move to mobile self-service significantly reduces operational overhead related to manual customer service and increases loan redemption rates by providing timely reminders and easy payment options. Finally, the effective utilization of Data Analytics tools is transforming business intelligence, allowing chains to analyze regional demand trends, optimize interest rate structures based on local demographics and economic indicators, and strategically deploy marketing resources to segments exhibiting the highest potential for both loan utilization and retail purchase, thereby maximizing both lending profitability and retail margins efficiently across geographically dispersed operations.

Regional Highlights

The Pawn Shop Market exhibits distinct characteristics and growth dynamics across major global regions, influenced by varying financial inclusion rates, economic stability, and regulatory environments.

- North America: Representing a highly mature market, growth is driven primarily by consolidation among large national chains (like EZCORP and FirstCash) and intensive technology adoption. Focus is on digital integration, compliance technology, and enhancing the retail segment through professional online platforms. Demand is structurally high, particularly in the US, due to persistent income inequality and dependence on short-term credit solutions.

- Europe: Characterized by fragmented regulatory environments and differing cultural perceptions of pawning, the market is highly localized. Western European countries (especially the UK and Spain) feature strong, often highly regulated, specialist pawnbrokers focusing on high-end collateral, while Eastern Europe sees faster adoption driven by increasing consumer finance needs and less established traditional banking alternatives.

- Asia Pacific (APAC): Expected to register the fastest growth due to massive, predominantly underbanked populations and rapid urbanization in countries like India, China, and Southeast Asia. Traditional family-run businesses are quickly being challenged and replaced by organized, corporatized pawn chains (e.g., in Singapore and Malaysia), which are leveraging technology to standardize services, attract higher transaction volumes, and penetrate rural areas.

- Latin America: A critical growth region driven by high economic volatility and fluctuating currency values, which drives demand for asset-backed loans as a hedge against inflation and financial instability. Market players focus on physical presence and regulatory compliance amidst variable government oversight, with significant expansion opportunities in Mexico and Brazil.

- Middle East and Africa (MEA): Growth is nascent but promising, especially in countries with large expatriate populations and high domestic wealth disparity. High-value transactions involving gold and luxury items are common in the Middle East, while organized pawn services in South Africa address broad consumer credit gaps, focusing on regulatory frameworks that protect consumers while ensuring business viability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pawn Shop Market.- EZCORP, Inc.

- FirstCash, Inc.

- Cash America International

- Mega Pawn

- Pawn America

- ValueMax Group Limited

- Sembcorp Industries Ltd

- Borro Private Finance

- Beverly Loan Company

- The Montclair Loan Company

- Quik Pawn Shop

- Gem Financial Services

- London Pawnbrokers

- Maxi-Cash Financial Services Corporation Ltd.

- Browns Pawnbrokers

- Ace Cash Express

- Mr. Pawn

- MoneyMan Pawn

- Pawn Express

- Checkmate Payday Loans

Frequently Asked Questions

Analyze common user questions about the Pawn Shop market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Pawn Shop Market?

The primary driver is the increasing demand for accessible, short-term liquidity solutions, particularly among the underbanked or credit-constrained populations globally, coupled with the ongoing professionalization and digitalization of pawn services which enhances consumer trust and operational reach.

How is technology impacting collateral appraisal accuracy?

Technology, specifically AI and machine learning algorithms, is significantly improving appraisal accuracy by utilizing vast datasets of market values and historical sales, providing rapid and standardized initial valuations for common assets like electronics and standard jewelry, mitigating subjective human error.

Which asset type generates the most revenue for pawn shops?

Jewelry and Watches historically generate the most revenue, primarily because precious metals and gemstones hold stable, easily appraisable value, allowing for high loan-to-value ratios and high profitability both in lending and subsequent retail resale.

What are the main regulatory challenges faced by the market?

Key regulatory challenges include managing strict limits on interest rates (APR caps) and complying with stringent local and national consumer protection laws, especially concerning transaction reporting (e.g., stolen goods databases) and disclosure requirements for loan terms.

Are online pawn platforms replacing traditional brick-and-mortar stores?

No, online platforms are not replacing physical stores but rather augmenting them, creating an essential omnichannel strategy. Physical stores remain crucial for secure, in-person appraisal of high-value items and building customer trust, while online platforms handle loan management and broader retail sales efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager