Payday Loans Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433008 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Payday Loans Service Market Size

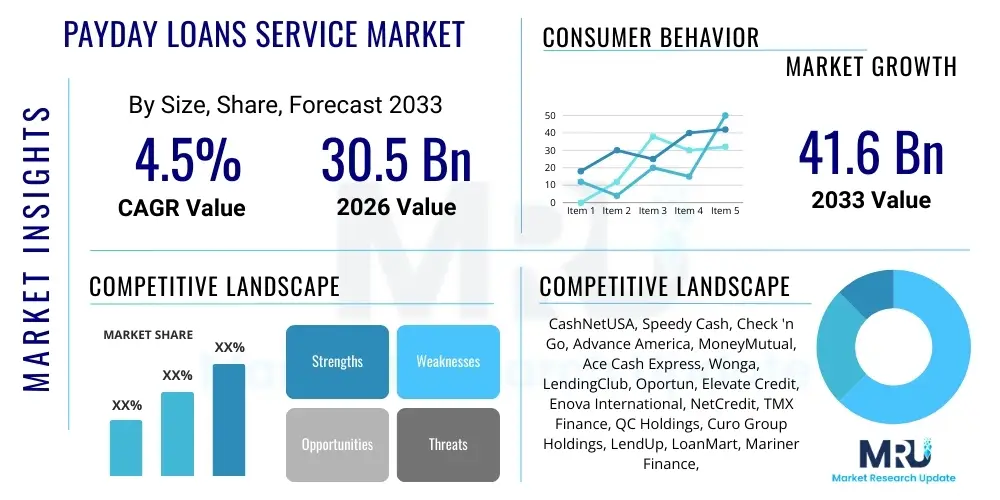

The Payday Loans Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% (CAGR) between 2026 and 2033. The market is estimated at USD 30.5 Billion in 2026 and is projected to reach USD 41.6 Billion by the end of the forecast period in 2033.

Payday Loans Service Market introduction

The Payday Loans Service Market encompasses short-term, high-interest financing solutions designed to bridge financial gaps between paychecks. These products are typically characterized by small principal amounts, short repayment durations, and annualized percentage rates (APRs) significantly higher than conventional credit options. The primary objective of these services is to provide immediate liquidity to consumers facing unexpected expenses or temporary cash flow shortages, particularly those with limited access to mainstream banking or prime credit facilities. The operational model relies heavily on rapid approval processes, often necessitating only proof of income and a checking account, appealing directly to underbanked and credit-constrained populations seeking prompt financial relief.

Major applications of payday loans revolve around immediate financial emergencies, such as unexpected medical bills, urgent car repairs, or avoiding utility disconnection fees. The core benefits driving consumer adoption are the speed of disbursement—often within hours—and the minimal credit scrutiny involved, making them accessible when traditional banks reject applications. However, the market remains highly controversial due to the potential for debt cycles caused by high rollover rates and punitive fees. Consequently, the industry operates within a volatile framework of evolving state and federal regulations aimed at consumer protection, influencing product design, maximum lending limits, and acceptable interest charges.

Key driving factors accelerating the digitalization of the market include increasing income volatility, persistent wage stagnation, and the growing accessibility of mobile financial services. FinTech companies are actively disrupting traditional brick-and-mortar payday loan stores by offering streamlined online platforms, sophisticated risk assessment using alternative data, and often slightly more flexible repayment structures. This shift to digital delivery enhances convenience for borrowers and allows lenders to scale operations more efficiently, although regulatory compliance remains the single most significant determinant of market profitability and geographical viability.

Payday Loans Service Market Executive Summary

The Payday Loans Service Market is undergoing a fundamental transformation characterized by heightened regulatory scrutiny and aggressive technological integration. Business trends indicate a decisive shift from physical storefront operations toward fully online, mobile-first lending models, driven by consumer demand for instantaneous processing and lower operational costs for providers. This digitalization has led to intense competition among online lenders, prompting innovation in underwriting processes, particularly the adoption of AI and machine learning to evaluate creditworthiness without reliance on traditional FICO scores, thereby expanding the addressable market beyond previously defined credit segments. Despite this technological advancement, profitability margins are increasingly constrained by state-level caps on interest rates and the rising compliance burden, forcing consolidation and the pursuit of hybrid installment loan products that offer extended terms while still serving the near-prime and sub-prime segments.

Regional trends reveal significant fragmentation, with North America, particularly the United States, dominating market value but simultaneously presenting the most complex regulatory environment. State-by-state variations in APR limits and loan structures dictate market entry strategies and profitability, leading major players to concentrate efforts in states with favorable legal frameworks or to pivot entirely to installment loans to navigate stricter rules. In contrast, the Asia Pacific (APAC) region is demonstrating the fastest growth, fueled by vast underbanked populations, rapid mobile penetration, and relatively nascent regulatory frameworks in developing economies. Europe, meanwhile, shows mature, yet highly diversified markets, where consumer credit regulations are generally stricter, often pushing short-term lending toward alternative consumer credit facilities rather than traditional payday loan models.

Segmentation trends highlight the dominance of the Online Platform segment, which continues to outpace traditional Storefront Lending due to superior customer experience and operational efficiency. Furthermore, analysis by End-User Age Group indicates a rising proportion of younger millennials and Gen Z utilizing these services, suggesting a broader acceptance of short-term, high-cost credit as a necessity in the modern gig economy. The adoption of advanced analytics within the Decision-Making segment is crucial for minimizing default rates while maximizing approval speed, optimizing the trade-off between risk and volume. Overall, the market's trajectory is defined by a dichotomy: high underlying demand driven by socioeconomic pressures versus severe external pressure exerted by governmental and consumer advocacy groups demanding lower costs and fairer lending practices.

AI Impact Analysis on Payday Loans Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Payday Loans Service Market primarily center on three critical areas: fairness and algorithmic bias, the efficiency gains in instant decisioning, and the future role of AI in credit scoring for the underbanked. Users are keen to understand if AI-driven systems can truly provide access to credit for those historically excluded, or if the algorithms merely perpetuate existing biases, potentially leading to discriminatory pricing or rejection rates based on non-traditional demographic data. A significant theme revolves around consumer protection, specifically how regulatory bodies can audit and control 'black box' AI models to ensure compliance with fair lending laws and prevent predatory algorithmic practices that might encourage excessive borrowing or rollovers, leading to chronic indebtedness.

The core promise of AI in this sector is the ability to instantaneously process thousands of data points—including banking history, mobile data usage, utility payments, and behavioral patterns—to create highly granular risk profiles. This rapid, sophisticated underwriting capability dramatically reduces the approval time, which is a key value proposition of the payday lending model. Users often inquire about the expected reduction in operational costs for lenders due to automation, and whether these savings translate into lower interest rates for borrowers, or are simply absorbed as profit, which remains a key point of public debate. The expectation is that AI will make the market faster and more competitive, but the concern is that it might also make it less transparent and potentially more coercive.

In summary, the key themes indicate high user expectation regarding AI's potential to revolutionize credit scoring and reduce default risk, thereby lowering lender risk exposure. However, this optimism is tempered by profound concerns about ethical AI deployment, the potential for digital exclusion, and the need for robust regulatory oversight to prevent unfair or discriminatory lending outcomes. The successful integration of AI will depend on developing explainable models (XAI) that can withstand regulatory scrutiny and prove they are extending financial inclusion rather than just maximizing short-term profit through exploitative pricing structures. The consensus is that AI is unavoidable, but its ethical implementation is critical to the future viability of the industry.

- Enhanced Credit Scoring: AI enables the use of alternative data (rent payments, mobile behavior) for highly precise risk assessment of unbanked individuals.

- Instant Decisioning: Machine learning models automate the loan approval process, allowing for near-instantaneous funding, crucial for emergency needs.

- Fraud Detection: Sophisticated algorithms improve the accuracy of identity verification and minimize fraudulent applications, reducing lender losses.

- Algorithmic Bias Risk: Concerns exist regarding AI perpetuating existing socioeconomic biases, leading to discriminatory interest rates or exclusion for specific user groups.

- Personalized Repayment Structures: AI can dynamically adjust repayment schedules and amounts based on predicted borrower cash flow volatility, potentially reducing default rates.

DRO & Impact Forces Of Payday Loans Service Market

The dynamics of the Payday Loans Service Market are governed by a complex interplay of internal and external forces summarized by Drivers, Restraints, and Opportunities (DRO). Primary market drivers include persistent income instability among lower and middle-income demographics, the increasing difficulty for individuals with low credit scores to access traditional bank loans, and the efficiency of digital platforms offering immediate cash access. The demand for urgent, small-scale liquidity remains robust across numerous global markets, especially where banking infrastructure is either restrictive or non-existent for the subprime segment. This intrinsic need for short-term financial gap-filling ensures a continuous market base, regardless of external controversy or regulation, as the utility of speed outweighs the cost for users in distress.

Significant restraints severely limit market growth and profitability. Foremost among these are the global trends towards stricter consumer protection laws, particularly the implementation of Annual Percentage Rate (APR) caps by national and state governments (e.g., the 36% military APR cap often used as a benchmark). These caps fundamentally challenge the economic viability of traditional payday lending models, which rely on high fees to compensate for high default risks and low loan principal amounts. Additionally, reputational risk and negative media coverage act as powerful restraints, pressuring financial institutions and digital processors to disassociate from the sector, complicating the flow of capital and payment processing infrastructure for lenders.

Despite these challenges, substantial opportunities exist, primarily through technological innovation and product diversification. Opportunities include the development of alternative, lower-cost short-term credit products like installment loans or credit builder loans, which offer extended repayment periods and lower regulatory hurdles. Furthermore, leveraging big data and AI for refined credit underwriting presents a massive opportunity to lower risk and potentially operate profitably even under tighter interest rate regimes. The impact forces acting on the market are overwhelmingly external and regulatory, with governmental policy shifts in key jurisdictions acting as the ultimate determinant of market structure, often forcing rapid product redesign or regional withdrawal. The competitive impact force from non-traditional FinTech challengers offering Employer-Sponsored Wage Access (ESWA) programs also severely pressures the traditional payday model by providing low- or no-cost alternatives for accessing earned wages early.

Segmentation Analysis

The Payday Loans Service Market is primarily segmented based on the mode of service delivery, the type of loan duration, and the underlying technology utilized for risk assessment and processing. The Service Delivery Channel segmentation—Online vs. Storefront—is crucial for understanding the market's trajectory toward full digitalization and the geographical density of services. Furthermore, segmenting the market by Loan Duration is essential, distinguishing the traditional short-term (14-30 days) payday product from the increasingly popular intermediate-term installment loan structures (60 days to 12 months), which lenders are adopting to circumvent restrictive payday laws. Technological segmentation includes the increasing use of advanced data analytics and AI for underwriting, driving efficiency and expanding the potential customer base.

- Service Delivery Channel:

- Online Platform (Dominant and fastest-growing segment)

- Storefront/Retail Location (Declining segment, high overhead)

- Loan Duration:

- Short-Term Payday Loans (Typically 14 to 30 days)

- Medium-Term Installment Loans (3 months to 12 months)

- End-User Age Group:

- 18-25 Years

- 26-45 Years (Largest borrowing demographic)

- 46-65 Years

- Technology Used for Underwriting:

- Traditional Credit Bureau Checks

- Alternative Data Scoring (Bank statement analysis, utility payments)

- AI/Machine Learning Models

Value Chain Analysis For Payday Loans Service Market

The value chain for the Payday Loans Service Market begins upstream with funding and technological infrastructure providers. Upstream analysis focuses on capital sources, which include private equity, commercial bank lines of credit (though often discreetly due to reputational risk), and increasingly, securitization of loan portfolios for large operators. Technology providers, including specialized FinTech platforms for fraud detection, credit scoring software, and secure mobile application developers, form another critical upstream component. The availability and cost of capital, along with access to sophisticated technological tools, directly impact the lending rates and operational scalability of the service provider, dictating competitive advantage in a high-risk lending environment.

The core value creation stage involves the service providers themselves (the payday lenders), where activities such as marketing, lead generation, underwriting (credit decisioning), disbursement, and collections occur. The efficiency of the underwriting process, particularly the ability to utilize alternative data sources for fast, accurate risk assessment, is where most value is currently extracted. Distribution channels are bifurcated into direct and indirect methods. Direct distribution involves the lender operating its own branded website, mobile application, or physical storefront. Indirect distribution often includes lead generation aggregators or brokers who connect potential borrowers with multiple lenders, earning a commission, although this intermediary model is frequently criticized for potentially increasing the overall cost to the borrower.

The downstream component of the value chain consists of the end-users (borrowers) and the external regulatory and payment ecosystems. Payment processors, credit bureaus, and collections agencies are essential downstream partners. The success of the service is ultimately measured by the repayment rates and the lender's ability to manage defaults while maintaining regulatory compliance. The intense regulatory scrutiny imposed by government agencies (e.g., CFPB in the US) fundamentally shapes the downstream relationship, mandating clear disclosure and fair collection practices, which adds complexity and cost to the final stages of the value delivery process. The entire chain is highly sensitive to external shocks, particularly changes in interest rate regulations which can instantly make entire product lines non-viable.

Payday Loans Service Market Potential Customers

Potential customers for the Payday Loans Service Market are predominantly characterized by a persistent need for immediate, small-scale liquidity coupled with limited or poor access to traditional credit instruments. These end-users, often referred to as the 'underbanked' or 'unbanked,' frequently possess low or subprime credit scores, disqualifying them from personal loans or credit cards offered by mainstream financial institutions. A significant proportion of potential customers experience volatile income streams, such as those working in the gig economy, hourly wage earners, or those facing unexpected fluctuations in essential expenses, making the gap between paychecks financially precarious. The rapid speed and minimal requirements of payday loans appeal directly to this segment during moments of urgent financial crisis, positioning the service as a last-resort or emergency bridge financing mechanism.

Demographically, the market targets individuals across various age groups, though a high concentration is found within the 26-to-45-year-old bracket, often managing young families and facing mid-level financial pressures without substantial savings reserves. Psychographically, these buyers prioritize speed and convenience over cost, demonstrating a high inelasticity of demand when faced with immediate financial threats such as impending eviction or utility cut-off. Furthermore, potential customers include individuals who, despite having moderate incomes, may have recently experienced life events (divorce, medical emergency) that have temporarily depleted their savings and damaged their credit history, forcing them into alternative lending solutions.

The rise of digital delivery has expanded the potential customer base to include tech-savvy individuals who might be geographically distant from traditional storefront lenders but require instant funding. This shift emphasizes mobile access and discreet borrowing processes, attracting younger, digitally native segments who prioritize application seamlessness. Crucially, the fundamental characteristic uniting all potential customers is the lack of a viable, lower-cost alternative source of funding for short-term needs, making them susceptible to the high-cost structure of the payday loan product. Therefore, market analysis must consistently focus on socioeconomic indicators such as financial literacy, credit availability, and income volatility to accurately size the potential customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 30.5 Billion |

| Market Forecast in 2033 | USD 41.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CashNetUSA, Speedy Cash, Check 'n Go, Advance America, MoneyMutual, Ace Cash Express, Wonga, LendingClub, Oportun, Elevate Credit, Enova International, NetCredit, TMX Finance, QC Holdings, Curo Group Holdings, LendUp, LoanMart, Mariner Finance, OppLoans, Spotloan |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Payday Loans Service Market Key Technology Landscape

The technological landscape of the Payday Loans Service Market is rapidly evolving, driven by the need for faster processing, lower default rates, and enhanced regulatory compliance. Central to this evolution is the deployment of proprietary and third-party Application Programming Interfaces (APIs) that facilitate seamless integration with banks, credit bureaus, and alternative data providers (e.g., utility companies, telecommunication services). This API integration allows for real-time data ingestion and verification, significantly shortening the underwriting cycle from days or hours to mere minutes, fulfilling the customer demand for instant access to funds. Furthermore, secure cloud computing environments are foundational, providing the scalability and resilience required to handle high volumes of transactional data and application traffic, particularly during periods of economic stress.

Advanced data analytics and Machine Learning (ML) algorithms form the technological core of modern payday lending operations. These technologies move beyond traditional credit scores, analyzing hundreds of alternative data points—such as checking account cash flow patterns, spending habits, and behavioral biometrics—to create highly predictive risk models. This capability is paramount for profitably serving the subprime segment, as it minimizes adverse selection and identifies high-risk applicants before significant capital outlay. The use of ML also extends into automating compliance checks, ensuring that loan terms and disclosures adhere to the specific, often complex, regulatory requirements of various jurisdictions, thereby mitigating the risk of costly fines and legal action.

Mobile-first platforms represent the critical customer-facing technology. The provision of comprehensive services via dedicated mobile applications—including application submission, document uploading via camera, loan tracking, and repayment management—is now standard practice. This shift optimizes the user experience and reduces friction points, driving higher conversion rates. Additionally, some innovative players are exploring the use of blockchain technology for immutable record-keeping and enhanced security in transaction processing, although widespread adoption remains nascent. Collectively, these technologies are transforming the payday loan from a paper-intensive, retail-centric service into a high-speed, data-driven financial product focused on maximizing efficiency and minimizing human error.

Regional Highlights

The geographic distribution of the Payday Loans Service Market demonstrates significant heterogeneity, largely dictated by the specific regulatory climate of each region. North America, predominantly the United States, holds the largest market share by volume and value, characterized by intense competition between state jurisdictions with vastly differing regulatory stances—some states prohibit high-interest payday loans entirely, while others permit them under strict conditions. This regulatory fragmentation necessitates highly adaptive operational strategies from lenders, often leading to complex interstate models or a strategic pivot to federally regulated tribal lending models, which present their own set of legal and ethical challenges.

Europe presents a mature but highly constrained market environment, especially in the United Kingdom and Spain, where regulatory bodies have imposed strict price caps and mandatory financial health checks to reduce consumer detriment. Consequently, many traditional payday lenders in Europe have either exited the market or transitioned their offerings toward lower-cost installment loans or specialized credit services. Nordic countries, known for their robust consumer protection, maintain low tolerance for high-APR products. The primary driver in Europe is the demand for flexible, smaller loans, forcing innovation in risk assessment rather than price gouging.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This acceleration is underpinned by vast, digitally connected, and largely underbanked populations in economies like India, Indonesia, and the Philippines. In these emerging markets, traditional banking penetration is low, creating a significant vacuum that digital short-term lenders are rapidly filling. While regulatory oversight is increasing, it often lags behind market innovation, providing a more favorable, albeit increasingly scrutinized, environment for rapid expansion and technological experimentation in digital lending compared to the highly saturated and regulated Western markets.

- North America (USA, Canada): Market dominance but extreme regulatory fragmentation (state-level caps). High adoption of online lending and alternative credit products.

- Europe (UK, Spain, Eastern Europe): Highly regulated, characterized by strict price caps and increased consumer scrutiny. Shift towards lower-APR installment loans and greater focus on affordability checks.

- Asia Pacific (India, Southeast Asia): Fastest growing region due to large underbanked populations and rapid mobile/internet penetration. Regulatory frameworks are evolving rapidly in response to market growth.

- Latin America (Brazil, Mexico): Significant potential driven by financial exclusion and socioeconomic inequality. Market growth is cautious, hindered by economic instability and variable consumer protection enforcement.

- Middle East and Africa (MEA): Nascent market with growth focused on urban centers. Regulatory landscape is heavily influenced by religious constraints on interest (Sharia-compliant financing), leading to unique product structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Payday Loans Service Market.- CashNetUSA (Enova International)

- Speedy Cash (CURO Group Holdings)

- Check 'n Go (Axcess Financial)

- Advance America (TMX Finance)

- MoneyMutual

- Ace Cash Express

- Wonga (ceased operations in some regions, influential historical entity and model innovator)

- LendingClub (Hybrid platform offering personal loans)

- Oportun

- Elevate Credit

- NetCredit (Enova International)

- LoanMart

- Mariner Finance

- OppLoans (Opportunity Financial, LLC)

- Spotloan

- EZCorp

- Check Into Cash

- OneMain Financial (Personal Installment Loans)

- World Acceptance Corporation (WAC)

- Think Finance (currently operating under various brands)

Frequently Asked Questions

Analyze common user questions about the Payday Loans Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor limiting the growth of the Payday Loans Service Market?

The main limiting factor is increasing regulatory pressure, specifically the implementation of stringent Annual Percentage Rate (APR) caps by state and national governments. These caps reduce the revenue potential for lenders, forcing them to pivot to alternative, lower-APR installment loan models or exit highly regulated jurisdictions, thereby constraining overall market expansion.

How is AI changing the lending process for payday services?

AI is primarily used for advanced credit underwriting by analyzing alternative data sources (like bank transaction history and utility payments) rather than traditional credit scores. This enables near-instantaneous loan decisions, improves fraud detection, and allows lenders to more accurately price risk for subprime borrowers, boosting operational efficiency.

Which geographic region demonstrates the highest growth potential for short-term lending?

The Asia Pacific (APAC) region, driven by countries like India and Indonesia, exhibits the highest growth potential. This is attributed to the large, digitally connected, and significantly underbanked population, creating massive demand for accessible, short-term digital financial products despite evolving regulatory environments.

Are online payday loan platforms replacing traditional storefront operations?

Yes, online platforms are increasingly dominating the market. They offer superior convenience, significantly faster processing times, and lower operational overhead compared to physical storefronts. This digital shift is driven by strong consumer preference for mobile-first financial services and better scalability for lenders.

What are the typical repayment structures available in the current short-term lending market?

The market primarily offers two structures: traditional short-term payday loans, typically due in a single lump sum on the borrower's next paycheck (14–30 days), and the increasingly prevalent medium-term installment loans, which are repaid over several scheduled payments (3 to 12 months) at lower effective APRs to ensure regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager