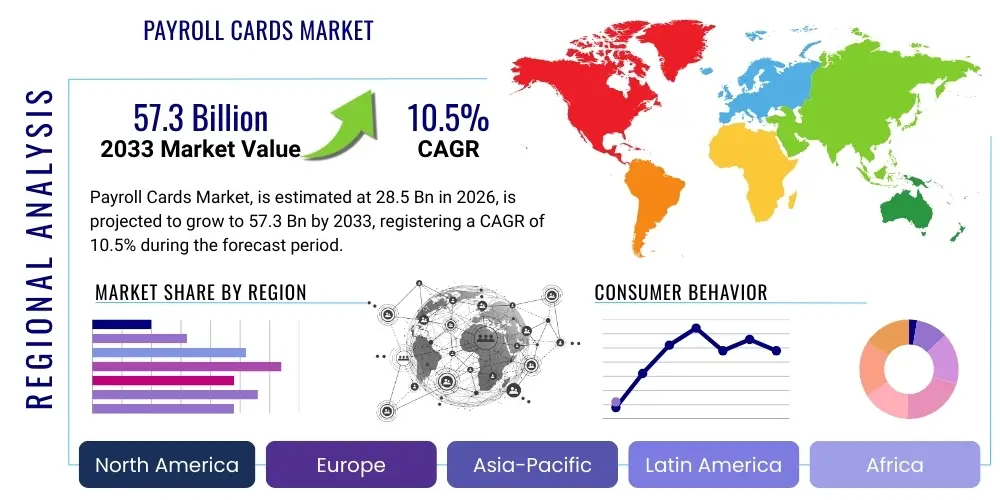

Payroll Cards Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440363 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Payroll Cards Market Size

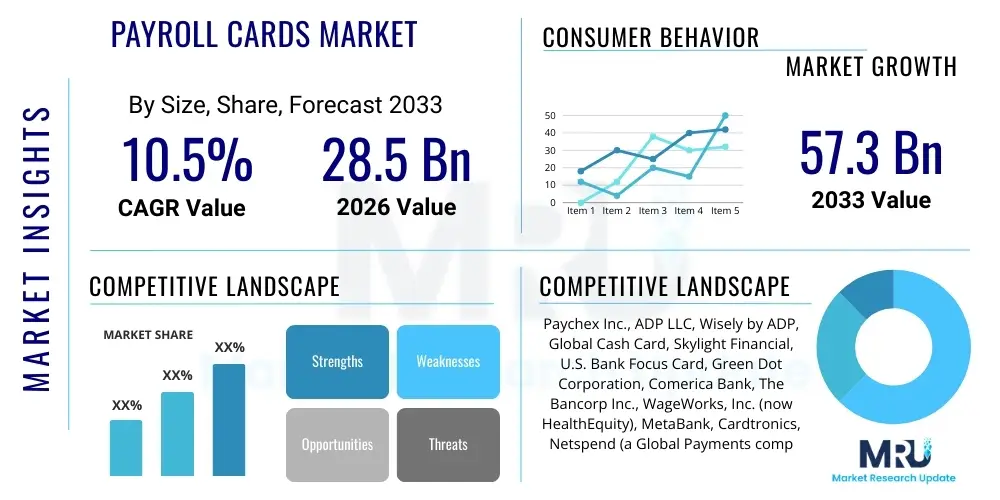

The Payroll Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 57.3 Billion by the end of the forecast period in 2033.

Payroll Cards Market introduction

The payroll cards market represents a transformative segment within financial services, offering an advanced, electronic method for employers to disburse wages directly to their employees. These reloadable prepaid cards serve as a direct deposit alternative, granting workers immediate access to their earnings without requiring a traditional bank account. This innovation significantly addresses the needs of the unbanked and underbanked populations globally, providing them with a secure and convenient platform for managing their finances, conducting transactions, and participating in the digital economy. The cards often come equipped with features such as online account management, bill payment capabilities, and ATM access, thereby expanding financial literacy and inclusion.

Major applications for payroll cards span a diverse range of industries, including retail, hospitality, manufacturing, construction, healthcare, and logistics, particularly in sectors characterized by high employee turnover, remote workforces, or a significant proportion of hourly workers. Employers in these fields increasingly adopt payroll card programs to streamline their payroll processes, reduce the administrative burdens and costs associated with printing and distributing paper checks, and mitigate fraud risks. The efficiency gains extend to reduced bank reconciliation efforts and simplified record-keeping, allowing businesses to reallocate resources to core operational activities rather than manual payroll management.

The benefits of payroll cards are multifaceted, creating a win-win scenario for both employers and employees. For businesses, the primary advantages include substantial cost savings on check printing, postage, and escheatment processes, improved operational efficiency through automated disbursement, and enhanced security by minimizing cash handling. For employees, payroll cards offer unparalleled convenience, immediate access to funds on payday, and the ability to make purchases and pay bills without incurring check-cashing fees. Driving factors propelling market growth include the global push for financial inclusion initiatives, rapid advancements in payment processing technologies, the escalating preference for cashless transactions among consumers, and the expansion of the gig economy and contingent workforce requiring flexible payment solutions. The robust regulatory frameworks supporting electronic payments further contribute to their widespread acceptance and adoption across various geographic regions.

Payroll Cards Market Executive Summary

The payroll cards market is currently experiencing robust expansion, driven by converging business trends, regional economic shifts, and evolving segment demands. Key business trends include the increasing digitalization of financial services, a persistent focus on cost optimization among enterprises, and the growing corporate emphasis on employee welfare and financial inclusion. Companies are recognizing payroll cards not just as a cost-saving measure but also as a vital tool for improving employee satisfaction and engagement, particularly within non-traditional employment models and among populations historically underserved by conventional banking systems. The shift towards cloud-based payroll solutions further integrates payroll card functionalities, enhancing accessibility and data analytics capabilities for employers.

Regional trends significantly influence the market's trajectory, with North America and Europe leading in terms of adoption due to established regulatory frameworks, advanced payment infrastructure, and a high degree of technological readiness. However, emerging economies in Asia Pacific, Latin America, and the Middle East & Africa are demonstrating the fastest growth rates. This acceleration is primarily fueled by large unbanked populations, rapid urbanization, increasing smartphone penetration facilitating mobile banking integration, and government initiatives promoting cashless transactions and digital payments. Regulatory bodies in these regions are also actively developing policies to support and regulate electronic payment systems, thereby fostering a conducive environment for payroll card proliferation.

Segmentation trends highlight distinct growth patterns across different card types, end-user industries, and regional demographics. Prepaid payroll cards, offering immediate fund access and basic transactional capabilities, remain dominant, but hybrid solutions integrating more advanced financial features are gaining traction. The retail and hospitality sectors continue to be major adopters due to their large hourly workforces and logistical complexities in traditional payroll distribution. However, the manufacturing and healthcare industries are increasingly recognizing the benefits of streamlined, secure payroll processing provided by these cards. Furthermore, the rising demand for enhanced security features, real-time transaction alerts, and personalized financial management tools is influencing product development, pushing providers to innovate and offer more comprehensive financial wellness solutions tailored to specific employee needs.

AI Impact Analysis on Payroll Cards Market

User inquiries regarding AI's impact on the payroll cards market frequently center on themes of enhanced security, personalized financial management, operational efficiency, and the future of fraud detection. Users are keen to understand how AI can move beyond basic automation to offer predictive analytics for spending habits, identify suspicious transaction patterns in real-time, and tailor financial advice to cardholders. There is a strong expectation that AI will significantly bolster the security infrastructure of payroll card systems, making them more resilient to cyber threats and data breaches. Furthermore, users anticipate that AI will facilitate seamless integration with other financial wellness platforms, driving a more holistic approach to employee financial health while simultaneously streamlining employer-side payroll administration and compliance processes.

- AI-powered fraud detection systems significantly enhance the security of payroll card transactions by analyzing vast datasets for anomalous patterns and flagging suspicious activities in real-time, far surpassing traditional rule-based methods. This leads to a substantial reduction in fraudulent losses and builds greater trust among users and employers.

- Predictive analytics driven by AI enables payroll card providers to offer personalized financial insights and budgeting tools to cardholders, based on their spending behavior, income patterns, and financial goals. This empowers employees to manage their money more effectively and improves their overall financial wellness.

- AI automates and optimizes various administrative tasks within payroll card management, such as reconciliation, compliance reporting, and customer service inquiries. This automation reduces operational costs for employers and card issuers, allowing human resources to focus on more strategic initiatives.

- Through machine learning algorithms, AI can identify and understand customer service queries more efficiently, directing users to the right resources or providing instant, accurate responses. This improves the overall customer experience for payroll cardholders, making their interactions more seamless and satisfactory.

- AI facilitates the seamless integration of payroll card platforms with other HR and financial management systems, creating a unified ecosystem for employee data and financial services. This interoperability enhances data accuracy, streamlines workflows, and provides a comprehensive view of employee financial health.

- By analyzing market trends and user behavior, AI assists in the development of new, innovative features and customized product offerings for payroll cards, ensuring they remain competitive and relevant in an evolving financial landscape. This proactive approach supports continuous improvement and market responsiveness.

- AI helps in maintaining regulatory compliance by constantly monitoring changes in labor laws and financial regulations, automatically updating system rules, and generating audit-ready reports. This significantly reduces the risk of non-compliance and associated penalties for employers and card providers.

DRO & Impact Forces Of Payroll Cards Market

The payroll cards market is propelled by a dynamic interplay of drivers, restraints, and opportunities, all shaped by various impact forces that influence its growth trajectory. Key drivers include the escalating global demand for financial inclusion, particularly for the vast population of unbanked and underbanked individuals who lack access to traditional banking services. Payroll cards provide a vital entry point into the formal financial system, enabling access to electronic payments, online banking features, and greater control over wages. Furthermore, the continuous drive by employers to reduce administrative costs associated with paper checks and streamline payroll processes acts as a significant catalyst. The convenience, security, and immediate fund access offered to employees also greatly contribute to their widespread adoption, making them an attractive alternative to conventional payment methods.

Despite the strong growth drivers, the market faces several notable restraints. Regulatory complexities and varying compliance requirements across different jurisdictions pose significant challenges for payroll card providers, necessitating continuous adaptation and legal adherence which can be costly and time-consuming. Resistance from employees accustomed to traditional banking or cash payments, coupled with a lack of awareness regarding the benefits of payroll cards, can hinder adoption rates. Moreover, concerns related to hidden fees, security vulnerabilities, and the potential for misuse of funds by cardholders or third parties also contribute to market friction. The competitive landscape, with the continuous evolution of digital payment alternatives like instant payment apps, further exerts pressure on the market.

Opportunities for growth in the payroll cards market are abundant and promising. The expansion of the gig economy and the rise of the contingent workforce worldwide present a vast untapped demographic for flexible, immediate payment solutions. Technological advancements, including the integration of artificial intelligence (AI) for enhanced fraud detection and personalized financial management, offer significant avenues for innovation and differentiation. Strategic partnerships between payroll card providers, financial technology companies, and payroll software vendors can expand market reach and create comprehensive ecosystem solutions. Furthermore, increasing employer emphasis on financial wellness programs for employees creates demand for payroll cards with integrated budgeting tools, savings features, and financial education resources, positioning them as an integral part of broader employee benefit packages. Addressing these opportunities through innovation and strategic market penetration will be crucial for sustained growth.

Segmentation Analysis

The payroll cards market is intricately segmented to reflect the diverse needs of both employers and employees across various demographics and industry verticals. This comprehensive segmentation allows for a granular understanding of market dynamics, enabling stakeholders to identify specific growth areas, tailor product offerings, and develop targeted marketing strategies. The primary segmentation criteria typically include card type, end-user industry, and geographical region, each revealing distinct adoption patterns and growth potentials. Analyzing these segments provides crucial insights into market penetration rates, competitive landscapes, and the evolving preferences of the market participants, highlighting the most promising avenues for investment and expansion. Further sub-segmentation within these categories unveils even more nuanced insights into consumer behavior and market demands, crucial for product differentiation and strategic positioning.

- By Card Type

- Prepaid Payroll Cards: These are the most common type, loaded with wages and used for purchases, ATM withdrawals, and bill payments. They primarily target unbanked and underbanked populations, offering a basic yet effective financial tool.

- Hybrid Payroll Cards: These cards combine features of prepaid cards with limited banking functionalities, such as direct deposit into a linked savings account or advanced online banking services. They appeal to employees seeking more comprehensive financial management tools.

- Virtual Payroll Cards: Increasingly popular for online transactions, these cards exist purely digitally and are accessed via mobile apps or web platforms. They offer enhanced security for online spending and reduce physical card management.

- By End-User Industry

- Retail and Hospitality: Characterized by large numbers of hourly, part-time, and seasonal employees, this segment is a major adopter due to the efficiency and cost-saving benefits of payroll cards over traditional paper checks.

- Manufacturing and Logistics: Companies in these sectors utilize payroll cards to streamline wage distribution for diverse workforces, including those in remote locations or with varying work schedules, enhancing operational efficiency.

- Healthcare: Payroll cards facilitate timely and secure payments for healthcare professionals, especially in large hospital systems or home healthcare services where traditional check distribution can be cumbersome.

- Construction: The construction industry, often with transient workforces and project-based employment, benefits from the flexibility and immediate access to funds that payroll cards provide, improving payment reliability.

- Government and Public Sector: Government agencies are increasingly using payroll cards to disburse payments to temporary workers, aid recipients, or public service employees, aligning with digital transformation initiatives.

- Others (e.g., IT & Telecom, Business Services): These sectors leverage payroll cards for contractors, freelancers, and project-based workers, supporting the growing gig economy and flexible employment models.

- By Region

- North America: Dominant market share due to advanced infrastructure, high adoption rates of electronic payments, and supportive regulatory environments, particularly in the United States.

- Europe: Significant growth driven by financial inclusion initiatives, robust digital payment ecosystems, and stringent data protection regulations fostering trust in electronic payment methods.

- Asia Pacific: Fastest-growing region, propelled by large unbanked populations, rapid economic development, increasing smartphone penetration, and government support for cashless economies in countries like India and China.

- Latin America: Emerging market with substantial growth potential due to ongoing efforts to formalize economies, reduce cash dependency, and extend financial services to underserved populations.

- Middle East and Africa (MEA): Growing adoption driven by government-led digitalization efforts, infrastructure development, and the expansion of the workforce in diverse sectors, seeking efficient payroll solutions.

- By Enterprise Size

- Small and Medium-sized Enterprises (SMEs): SMEs adopt payroll cards to reduce administrative overheads, manage payroll efficiently without dedicated HR staff, and offer competitive employee benefits.

- Large Enterprises: Large corporations use payroll cards to manage complex payrolls for thousands of employees across multiple locations, ensuring consistent and compliant wage disbursement on a massive scale.

- By Technology

- Magnetic Stripe Cards: Traditional and widely accepted, though increasingly being phased out due to security concerns compared to newer technologies.

- EMV Chip Cards: Offer enhanced security against fraud due to embedded microchips, becoming the industry standard globally.

- NFC-enabled Cards: Support contactless payments, offering speed and convenience at points of sale, aligning with modern transaction preferences.

- By Distribution Channel

- Direct Issuance by Employers: Employers directly manage and distribute payroll cards to their employees, often integrating with existing HR systems.

- Bank/Financial Institution Partnerships: Employers partner with banks or financial institutions that issue and manage the payroll card programs, leveraging their expertise and infrastructure.

- Third-party Payroll Service Providers: Specialized payroll companies offer payroll card solutions as part of a broader suite of payroll and HR services, providing comprehensive outsourced management.

Value Chain Analysis For Payroll Cards Market

The value chain for the payroll cards market is a multi-faceted ecosystem involving several key players and processes, starting from the issuance of cards to the final transaction by the employee. At the upstream stage, the value chain begins with technology providers and card manufacturers responsible for developing the payment infrastructure, producing the physical cards, and ensuring the security and functionality of the underlying payment networks. This includes companies that supply EMV chip technology, secure magnetic stripe encoding, and robust transaction processing platforms. These foundational elements are critical for the reliability, interoperability, and security of the entire payroll card system, establishing the groundwork for subsequent services and applications. Strong partnerships between these technology enablers and card issuers are essential for innovation and scalability within the market.

Moving downstream, the value chain encompasses various service providers that facilitate the deployment and management of payroll card programs. This primarily involves financial institutions, such as banks and specialized payment processors, which act as card issuers and program managers, handling compliance, customer support, and transaction settlement. Payroll service providers and HR software companies also play a crucial role by integrating payroll card solutions directly into their existing platforms, offering employers a seamless and comprehensive payroll management system. These entities are responsible for account setup, funds loading, transaction monitoring, and ensuring adherence to regulatory requirements. The efficiency and security of these downstream operations directly impact employer satisfaction and employee adoption rates, making their robust performance vital.

The distribution channels for payroll cards are primarily direct and indirect. Direct distribution involves employers managing the entire payroll card program in-house, from card ordering and distribution to initial setup and employee support. This approach offers employers greater control but requires significant internal resources. Indirect distribution, which is more common, involves partnerships with banks, financial technology companies, or third-party payroll service providers. These partners handle the card issuance, program management, and often provide dedicated support services for both employers and employees. The choice of distribution channel often depends on the employer's size, internal capabilities, and desired level of outsourcing. Both channels rely heavily on robust customer service and effective communication to ensure smooth onboarding and ongoing support for cardholders, which is crucial for the successful adoption and sustained usage of payroll card programs.

Payroll Cards Market Potential Customers

The payroll cards market targets a diverse and expansive customer base, primarily comprising employers across various industries and their respective workforces. The most significant segment of potential customers includes businesses that employ a large number of hourly workers, temporary staff, seasonal employees, or individuals who are unbanked or underbanked. These industries typically include retail, hospitality, manufacturing, construction, and logistics, where high employee turnover, remote workforces, or a preference for non-traditional banking solutions make payroll cards a highly attractive and practical wage disbursement method. Employers in these sectors are constantly seeking efficient ways to reduce administrative costs associated with paper checks, enhance operational efficiency, and ensure timely and secure payments to all employees, irrespective of their banking status.

Beyond these traditional segments, the burgeoning gig economy and the rise of the contingent workforce represent a rapidly expanding customer demographic for payroll cards. Freelancers, contractors, and on-demand workers often require flexible and immediate payment solutions that traditional banking systems may not adequately provide. Payroll cards offer these individuals a convenient way to receive their earnings, manage funds, and conduct transactions without the complexities of setting up direct deposit with multiple employers or managing frequent cash payments. Furthermore, government agencies and public sector entities also emerge as significant potential customers, utilizing payroll cards for disbursing payments to temporary workers, social beneficiaries, or disaster relief recipients, aligning with broader digital payment initiatives and financial inclusion goals.

Ultimately, the end-users or buyers of the product are the employees themselves, whose needs and preferences heavily influence the market's direction. Employees who are unbanked gain access to a secure and regulated financial tool, enabling them to make purchases, pay bills, and access cash without incurring costly check-cashing fees. Those who are underbanked benefit from the added convenience and budgeting tools often integrated with payroll card programs, promoting better financial management. For all employees, the immediate access to funds on payday, enhanced security over carrying cash, and the ability to manage finances digitally are compelling advantages. Therefore, providers must continuously innovate to offer user-friendly interfaces, robust security features, transparent fee structures, and value-added services like financial literacy resources to attract and retain this critical segment of the customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 57.3 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Paychex Inc., ADP LLC, Wisely by ADP, Global Cash Card, Skylight Financial, U.S. Bank Focus Card, Green Dot Corporation, Comerica Bank, The Bancorp Inc., WageWorks, Inc. (now HealthEquity), MetaBank, Cardtronics, Netspend (a Global Payments company), Conduent, Wex Inc., Ceridian HCM, Deluxe Corporation, Money Network, Fintrax (now Planet), Fiserv Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Payroll Cards Market Key Technology Landscape

The payroll cards market is underpinned by a sophisticated array of technologies designed to ensure secure, efficient, and user-friendly wage disbursement. At its core, the technology landscape includes robust payment processing platforms that facilitate real-time transactions, account management, and funds loading. These platforms leverage secure network infrastructures, such as those provided by Visa, Mastercard, and other regional payment networks, to ensure global acceptance and interoperability. Central to card security are EMV (Europay, Mastercard, and Visa) chip technology, which encrypts transaction data and significantly reduces card-present fraud, and tokenization, which replaces sensitive card details with unique, random tokens during transactions, further safeguarding cardholder information against breaches. These foundational technologies are continuously evolving to meet escalating security standards and combat emerging cyber threats.

Beyond core transaction processing and security, the payroll cards market heavily relies on digital and mobile technologies to enhance user experience and administrative efficiency. Mobile applications provide cardholders with instant access to their account balances, transaction history, and budgeting tools, often incorporating features like biometric authentication for enhanced security and convenience. Furthermore, NFC (Near Field Communication) technology is increasingly integrated into payroll cards, enabling contactless payments at points of sale, thereby accelerating transaction times and aligning with consumer preferences for quick and secure payment methods. Cloud-based payroll software solutions also play a pivotal role, integrating payroll card management directly into human resource and accounting systems, offering seamless data synchronization and automated reporting capabilities for employers.

The future of payroll card technology is increasingly influenced by advanced analytics and artificial intelligence (AI). AI-powered algorithms are being deployed for sophisticated fraud detection, identifying anomalous spending patterns and flagging suspicious transactions in real-time, thereby providing a proactive layer of security. Machine learning also enables personalized financial management tools, offering employees tailored insights into their spending habits, savings goals, and budgeting strategies. Additionally, blockchain technology is being explored for its potential to enhance transparency, security, and efficiency in cross-border payroll transactions, though its widespread adoption is still in nascent stages. The convergence of these technologies aims to create a more secure, personalized, and efficient payroll ecosystem, benefiting both employers through streamlined operations and employees through greater financial control and inclusion.

Regional Highlights

- North America: This region holds a dominant share in the payroll cards market, primarily driven by the United States, where robust regulatory frameworks, a high penetration of electronic payments, and a significant unbanked population have fostered widespread adoption. The demand for cost-efficient payroll solutions among large enterprises and a growing contingent workforce further fuel market expansion.

- Europe: Characterized by strong regulatory support for digital payments and financial inclusion initiatives, Europe is witnessing steady growth. Countries like the UK and Germany are leading the charge, emphasizing secure transaction technologies and integrated financial wellness programs, while the gig economy's expansion contributes significantly to demand.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from its vast unbanked population, rapid economic development, increasing smartphone penetration, and government-led drives towards cashless economies. Emerging markets such as India, China, and Southeast Asian nations are key growth engines, driven by both large-scale industrial workforces and burgeoning digital payment infrastructures.

- Latin America: This region presents substantial untapped potential, with a strong imperative to formalize economies and reduce reliance on cash. Governments and financial institutions are actively promoting digital payment solutions, including payroll cards, to enhance financial inclusion and streamline wage disbursements, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region is experiencing increasing adoption due to significant government investments in digital infrastructure, diversification of economies away from oil, and a growing expatriate and migrant worker population. The need for secure and efficient wage payment solutions for unbanked workers in the construction and service sectors is a key driver.

- United States: As the largest market within North America, the US demonstrates high maturity and continued innovation. Stringent state-specific regulations for payroll card usage, coupled with a highly competitive landscape among providers, drive continuous product enhancement and robust employer adoption.

- India: A rapidly expanding market in APAC, India's growth is propelled by the "Digital India" initiative, a large unbanked population, and the proliferation of mobile payment technologies. Payroll cards are instrumental in formalizing wages for migrant workers and increasing financial literacy across diverse economic strata.

- Brazil: Within Latin America, Brazil is a significant market for payroll cards due to its efforts in financial inclusion and the reduction of cash dependency. The country's dynamic labor market and the presence of numerous small and medium-sized enterprises (SMEs) contribute to a growing demand for streamlined payroll solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Payroll Cards Market.- Paychex Inc.

- ADP LLC

- Wisely by ADP

- Global Cash Card

- Skylight Financial (a Netspend solution)

- U.S. Bank Focus Card

- Green Dot Corporation

- Comerica Bank

- The Bancorp Inc.

- WageWorks, Inc. (now HealthEquity)

- MetaBank

- Cardtronics (now NCR Voyix)

- Netspend (a Global Payments company)

- Conduent

- Wex Inc.

- Ceridian HCM

- Deluxe Corporation

- Money Network (a First Data/Fiserv company)

- Fintrax (now Planet)

- Fiserv Inc.

Frequently Asked Questions

Analyze common user questions about the Payroll Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are payroll cards and how do they benefit employees?

Payroll cards are reloadable prepaid cards issued by employers to disburse wages electronically, serving as an alternative to traditional paper checks or direct bank deposits. Employees benefit from immediate access to their funds on payday, enhanced security compared to carrying cash, and the ability to make purchases, pay bills, and withdraw cash without needing a traditional bank account, fostering financial inclusion.

How do payroll cards help employers reduce costs and improve efficiency?

Employers can significantly reduce administrative costs associated with printing, distributing, and reconciling paper checks. Payroll cards eliminate postage fees, check stock expenses, and reduce escheatment processing. They also streamline payroll operations, minimize fraud risks, and free up HR resources, leading to overall improved operational efficiency and compliance.

Are payroll cards secure, and what features protect cardholders?

Yes, payroll cards are designed with robust security features similar to debit cards. They are typically protected by EMV chip technology for encrypted transactions, PIN protection for ATM withdrawals and purchases, and fraud monitoring systems. Many cards also offer FDIC insurance, transaction alerts, and dispute resolution services, safeguarding cardholders against unauthorized use.

Who are the primary target users for payroll cards?

The primary target users include employees who are unbanked or underbanked, lacking access to traditional banking services. Additionally, they are ideal for hourly workers, temporary staff, seasonal employees, and gig economy participants who need immediate and flexible access to their earnings without the complexities of traditional direct deposit setups. Businesses across retail, hospitality, manufacturing, and construction sectors are also key users.

What is the future outlook for the payroll cards market, considering technological advancements?

The payroll cards market is poised for continued growth, driven by increasing financial inclusion efforts, the expansion of the gig economy, and technological innovations. Future developments will include enhanced AI-powered fraud detection, more personalized financial management tools for cardholders, and seamless integration with broader digital payment ecosystems. Mobile accessibility and NFC-enabled contactless payments will also become more prevalent, further increasing convenience and security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager