Payroll & HR Solutions and Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433169 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Payroll & HR Solutions and Services Market Size

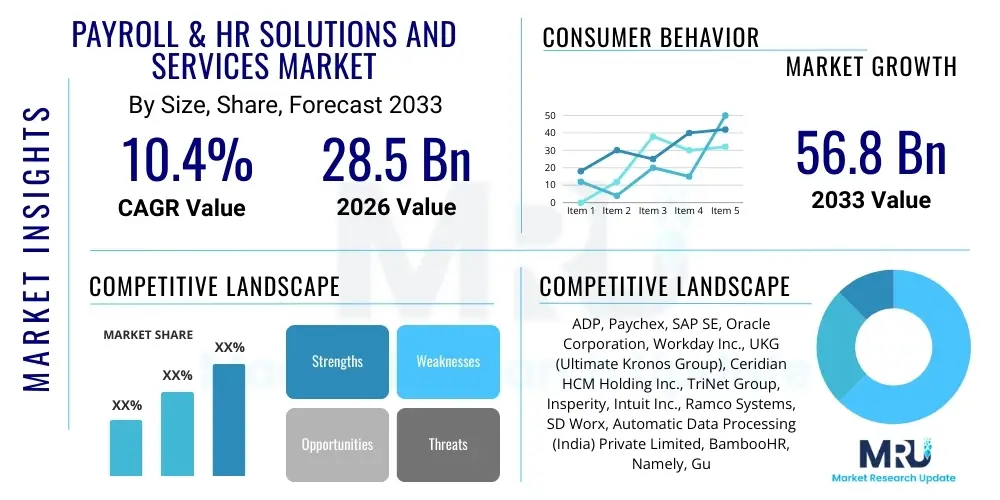

The Payroll & HR Solutions and Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.4% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 56.8 Billion by the end of the forecast period in 2033.

Payroll & HR Solutions and Services Market introduction

The Payroll & HR Solutions and Services Market encompasses integrated software platforms and dedicated professional services designed to manage the human capital lifecycle within organizations, spanning from recruitment and onboarding to compensation, benefits administration, compliance, and separation. These solutions are critical for ensuring operational efficiency, maintaining regulatory adherence, and optimizing employee engagement across all enterprise sizes, particularly as global labor laws become increasingly complex. The primary objective of these market offerings is to automate time-consuming administrative tasks, reduce errors associated with manual processing, and provide actionable analytics regarding workforce performance and costs, thereby shifting HR from a purely administrative function to a strategic business partner.

Product descriptions within this market range from modular, focused applications—such as dedicated time tracking or tax calculation engines—to comprehensive Human Capital Management (HCM) suites that integrate payroll processing, core HR functions, talent acquisition, and learning management into a single unified platform. Major applications span industries globally, including financial services, healthcare, retail, manufacturing, and technology, each demanding tailored solutions to handle industry-specific regulatory requirements, such as specialized shift scheduling in healthcare or high-volume transactional processing in retail. The proliferation of mobile applications and self-service portals has further enhanced the utility of these solutions, improving employee access to personal data and reducing the burden on HR departments.

Key benefits derived from adopting advanced Payroll & HR solutions include enhanced compliance management, significant reduction in processing time and cost, improved data security, and superior workforce planning enabled by robust data analytics. Driving factors fueling market growth include the ongoing digital transformation of businesses worldwide, the critical necessity for organizations to navigate intricate multi-jurisdictional tax and labor laws, and the rising demand for cloud-based, scalable solutions that facilitate remote and hybrid work models. Furthermore, the increasing strategic focus on employee experience (EX) and personalized benefit structures necessitates sophisticated HR technology capable of handling diverse and customized employee profiles.

Payroll & HR Solutions and Services Market Executive Summary

The global Payroll & HR Solutions and Services Market is undergoing rapid transformation, largely driven by the adoption of sophisticated cloud-based HCM platforms and the integration of Artificial Intelligence (AI) for process automation and predictive analytics. Current business trends indicate a strong shift towards unified, all-in-one platforms that consolidate disparate HR functions, eliminating data silos and providing a single source of truth for employee information. This consolidation is particularly appealing to mid-market and large enterprises seeking operational synergy and enhanced reporting capabilities. Furthermore, there is a pronounced focus on solutions that cater specifically to the gig economy and contingent workforce management, requiring flexible payroll structures and compliance monitoring mechanisms distinct from traditional full-time employment models.

Regional trends highlight North America's dominance due to high technological adoption rates and the presence of major solution providers, alongside stringent regulatory environments necessitating advanced compliance tools. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR, fueled by the accelerating digital transformation of SMEs, especially in emerging economies like India and Southeast Asia, coupled with government initiatives promoting digitalization. Europe remains a significant market, characterized by complex labor laws and strong demand for robust, localized payroll systems that adhere to GDPR and national employment regulations. The competitive landscape is intensely focused on strategic acquisitions and partnerships to expand geographical reach and integrate specialized technologies, particularly in the areas of benefits administration and talent management.

Segmentation trends reveal that cloud deployment remains the preferred architecture, offering scalability and reduced infrastructural investment, making it highly attractive to Small and Medium-sized Enterprises (SMEs). Among solution types, HR Analytics and Workforce Management segments are experiencing accelerated growth as businesses prioritize data-driven decision-making and optimization of labor resources. In terms of end-users, the BFSI and IT & Telecom sectors are major adopters, requiring high-security, high-volume processing capabilities, while the healthcare sector shows increasing demand for complex scheduling and compliance-related payroll services. The market's future growth will be fundamentally tied to the effective deployment of AI and machine learning to deliver predictive insights into workforce turnover, skill gaps, and compliance risk.

AI Impact Analysis on Payroll & HR Solutions and Services Market

Common user questions regarding the impact of AI on the Payroll & HR Solutions and Services Market often center on themes of job displacement, data security, efficiency gains, and the accuracy of automated decision-making. Users frequently ask how AI can automate complex compliance checks across multiple jurisdictions, reduce processing time errors, and personalize employee experiences without compromising data privacy. There is significant interest in understanding how AI-driven predictive analytics can forecast employee turnover rates, identify skill shortages, and optimize organizational budgeting through accurate labor cost projections. Concerns primarily revolve around algorithmic bias in talent management modules, the reliability of chatbot interfaces for sensitive queries, and the initial investment required for implementing sophisticated machine learning models within existing legacy systems.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally reshaping the operational landscape of HR and payroll functions, moving them away from repetitive data entry toward strategic analysis. AI algorithms are now capable of automating tedious tasks such as salary benchmarking, expense claim processing, and time-off request approvals, dramatically reducing the administrative load on HR staff. Moreover, sophisticated ML models are being deployed to scrutinize large datasets of employee behavior and performance metrics to generate predictive insights, informing management decisions related to retention strategies, compensation adjustments, and training needs. This analytical depth transforms the role of HR professionals into strategic advisors focused on human capital optimization.

Furthermore, AI significantly enhances compliance and security capabilities within payroll systems. AI-powered tools continuously monitor regulatory changes across various countries and automatically update tax calculations and deduction logic, minimizing the risk of non-compliance penalties. In the services sector, AI-enabled virtual assistants and chatbots provide 24/7 support to employees, addressing common payroll and benefits questions instantly, improving overall employee satisfaction while freeing up HR service representatives for handling more complex, nuanced issues. The integration of Natural Language Processing (NLP) is also improving the accuracy and efficiency of resume screening and sentiment analysis in recruitment and feedback processes.

- Automated compliance monitoring and regulatory updates

- Predictive analytics for employee turnover and budgeting

- Enhanced personalization of benefits and compensation packages

- Reduced payroll processing errors through anomaly detection

- AI-powered virtual assistants for employee self-service queries

- Optimized workforce scheduling and resource allocation

DRO & Impact Forces Of Payroll & HR Solutions and Services Market

The Payroll & HR Solutions and Services Market is propelled by compelling drivers such as the escalating need for regulatory compliance across complex global markets, the pervasive trend of enterprise digital transformation, and the persistent desire among organizations to enhance operational efficiency and reduce labor costs. Restraints primarily involve the high initial implementation costs of integrated HCM suites, persistent data security and privacy concerns related to sensitive employee information (especially under GDPR and CCPA), and the inherent difficulty in migrating legacy HR systems to new cloud architectures. Opportunities abound in addressing the specialized needs of the SME sector with scalable SaaS models, developing niche solutions for managing the gig economy workforce, and integrating advanced analytics and AI for deeper strategic workforce planning. The impact forces acting on this market include intense competition driving innovation in user experience, the rapid obsolescence cycle of non-cloud technology, and regulatory pressures forcing continuous system updates.

Drivers: A paramount driver is the exponential increase in the complexity of multi-country payroll and taxation, which necessitates automated, reliable solutions that guarantee compliance and accuracy. Secondly, the widespread shift towards cloud infrastructure facilitates easier deployment, updates, and scalability, making sophisticated solutions accessible to organizations of all sizes. The demand for actionable HR data to inform strategic business decisions—moving beyond mere record-keeping—further stimulates the uptake of advanced analytical modules. Finally, the post-pandemic acceleration of remote and hybrid work models has amplified the need for centralized, accessible, and secure digital platforms to manage a distributed workforce efficiently.

Restraints: Significant restraints include resistance to change and integration challenges, particularly in large organizations with deeply entrenched legacy systems that are costly and time-consuming to replace. Data privacy and security risks, particularly breaches involving sensitive personal identifiable information (PII) and financial data, pose a critical barrier, mandating continuous and expensive security upgrades. Furthermore, the perceived complexity of configuring sophisticated global payroll systems to local legal and cultural requirements often deters immediate adoption, especially among SMEs that lack dedicated IT resources.

Opportunities: Key opportunities lie in the expansion of niche services addressing specialized compliance needs, such as labor union agreements or industry-specific certifications (e.g., healthcare credentialing). The growing penetration of mobile HR solutions allows providers to tap into the younger workforce's preference for on-the-go access to payroll and benefits information. Emerging markets offer immense untapped potential, as digitalization efforts accelerate and local businesses seek robust, scalable solutions to manage rapidly expanding workforces. Additionally, offering enhanced integrations with financial services and ERP systems creates value-added service layers that increase vendor stickiness and broaden the market scope beyond traditional HR functions.

Segmentation Analysis

The Payroll & HR Solutions and Services Market is fundamentally segmented based on the type of offering (Solutions vs. Services), deployment model, enterprise size, and end-user vertical. Solution segmentation captures the software component, ranging from core payroll processing modules to advanced HCM suites covering talent management and predictive analytics. Service segmentation encompasses outsourcing models, consulting, and managed services where the vendor handles the entire or partial HR administrative workload. Deployment methods distinguish between secure, scalable cloud-based systems and traditional on-premise installations, with cloud gaining dominant market share due to its flexibility and cost-effectiveness. The heterogeneity of organizational needs necessitates tailored approaches based on enterprise size, typically dividing the market into Small and Medium Enterprises (SMEs) and Large Enterprises, each requiring different levels of customization and functional depth.

The end-user vertical segmentation is crucial for understanding specific industry demands. For instance, the Banking, Financial Services, and Insurance (BFSI) sector requires extremely high levels of regulatory compliance and data security, driving demand for specialized compliance solutions. Conversely, the Retail and Manufacturing sectors prioritize robust workforce management solutions focused on scheduling optimization, time tracking, and dealing with high employee turnover. Analyzing these segments reveals shifting investment priorities; currently, large enterprises are focused on integrating AI and advanced analytics into existing platforms, while SMEs prioritize foundational, user-friendly SaaS solutions that minimize administrative overhead.

Geographically, market segmentation reflects differences in regulatory maturity and technological readiness. North America leads in solution expenditure due to technological maturity and complex tax laws, whereas APAC is the fastest-growing service segment as businesses often opt for outsourcing to navigate rapid economic and legal changes without high initial software investment. Strategic planning must acknowledge these segmented dynamics, tailoring pricing, feature sets, and support models to the distinct requirements of each segment to maximize market penetration and ensure competitive differentiation.

- By Offering Type:

- Solutions (Software)

- Services (Managed Services, Consulting, Outsourcing)

- By Solution Type:

- Core Payroll

- Workforce Management (Time & Attendance, Scheduling)

- Benefits Administration

- Talent Management (Recruitment, Learning)

- HR Analytics and Reporting

- By Deployment Model:

- Cloud-based

- On-Premise

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Government and Public Sector

Value Chain Analysis For Payroll & HR Solutions and Services Market

The value chain of the Payroll & HR Solutions and Services Market begins with upstream activities focused on technology development and regulatory expertise acquisition. Upstream actors include core technology providers (e.g., cloud infrastructure services, AI/ML developers, database vendors) and subject matter experts specializing in labor law and taxation across various jurisdictions. The primary value creation at this stage involves rigorous software design, ensuring security protocols, and developing scalable microservices architecture suitable for global deployment. Investment in research and development is critical here to integrate emerging technologies like blockchain for secure data validation and advanced analytics for predictive modeling.

Midstream activities involve the actual processing and delivery of the solutions and services. This includes software licensing, system integration, customization based on client needs, and continuous software maintenance and updates. Distribution channels play a vital role; direct channels involve large vendors selling enterprise suites directly to clients through dedicated sales forces, offering deep customization and consulting. Indirect channels utilize strategic partnerships with regional system integrators, HR consulting firms, and Value-Added Resellers (VARs) who provide localized implementation and ongoing support, particularly important for penetrating fragmented SME markets.

Downstream activities center on customer engagement, support, and continuous improvement. This phase involves managed services, helpdesk support, regulatory compliance checks (e.g., year-end tax reporting), and training services. The success of downstream operations is heavily dependent on maintaining high levels of customer satisfaction and ensuring system uptime and data accuracy. Feedback loops from end-users are utilized to inform upstream product enhancements, creating a continuous cycle of iterative improvement and adaptation to evolving legal and technological landscapes. The efficiency of the distribution channel directly influences market reach and the ability to scale operations efficiently across diverse geographic locations.

Payroll & HR Solutions and Services Market Potential Customers

The core customer base for Payroll & HR Solutions and Services spans across all enterprise sizes and industries, unified by the common need for efficient and compliant workforce management. Potential customers are organizations facing challenges related to complexity in multi-jurisdictional payroll, high administrative overhead associated with manual HR processes, difficulties in attracting and retaining talent, and a lack of real-time insights into labor costs and workforce productivity. Large enterprises are typically motivated by the need for globally unified platforms (HCM suites) that can handle massive data volumes and complex organizational structures, prioritizing features such as advanced talent management and strategic workforce planning modules. Their buying decisions often involve complex RFPs and long implementation cycles, focusing on vendor stability and integration capabilities with existing ERP systems.

Small and Medium-sized Enterprises (SMEs) represent a rapidly expanding segment of potential customers, characterized by their preference for affordable, easy-to-implement, and scalable SaaS solutions. SMEs prioritize core payroll accuracy, simplified benefits administration, and compliance automation, often lacking dedicated in-house HR IT expertise. Their adoption is driven by the desire to streamline operations and comply with local regulations efficiently, enabling them to compete effectively with larger counterparts in talent acquisition. The shift towards self-service capabilities and robust mobile platforms is particularly appealing to this customer segment due to resource constraints.

Furthermore, specialized segments such as organizations heavily reliant on shift work (healthcare, manufacturing) or those with highly regulated workforces (BFSI, government) constitute critical potential customers. The healthcare sector, for instance, requires complex scheduling and credential tracking integrated with payroll. Government and public sectors, while often slower adopters, represent high-value long-term contracts due to the imperative for transparency, auditability, and adherence to specific public sector union rules and compensation standards. All potential customers share a fundamental requirement for solutions that minimize compliance risk and optimize the return on human capital investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 56.8 Billion |

| Growth Rate | 10.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADP, Paychex, SAP SE, Oracle Corporation, Workday Inc., UKG (Ultimate Kronos Group), Ceridian HCM Holding Inc., TriNet Group, Insperity, Intuit Inc., Ramco Systems, SD Worx, Automatic Data Processing (India) Private Limited, BambooHR, Namely, Gusto, TalentSoft, Cornerstone OnDemand, Zenefits, Paycom. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Payroll & HR Solutions and Services Market Key Technology Landscape

The technological landscape of the Payroll & HR Solutions and Services Market is defined by convergence, leveraging advanced computational capabilities to deliver highly automated and insightful platforms. Cloud computing remains the foundational technology, enabling scalable, secure, and globally accessible HCM systems. This architecture facilitates continuous integration and delivery (CI/CD) of updates, ensuring users always comply with the latest regulations without manual intervention. Beyond the core infrastructure, the integration of Application Programming Interfaces (APIs) is critical, allowing seamless interoperability between payroll systems and third-party financial, ERP, and specialized HR applications, fostering an ecosystem approach to human capital management. This shift from monolithic structures to interconnected microservices allows organizations to choose best-of-breed solutions while maintaining unified data streams.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful emerging technologies, transforming both the processing and analytical capabilities of HR systems. AI is utilized for process automation (RPA) in repetitive tasks, improving data accuracy in tasks like time card approval and expense report audits. ML algorithms analyze behavioral and financial data to predict critical outcomes such as employee attrition, inform compensation strategy through predictive modeling, and personalize employee training paths. Furthermore, Natural Language Processing (NLP) powers sophisticated internal chatbots and conversational AI, drastically improving the efficiency and responsiveness of employee support channels, reducing the reliance on human HR representatives for initial queries and information dissemination.

Other essential technologies include robust cybersecurity frameworks utilizing advanced encryption and multi-factor authentication to protect sensitive PII and financial data, reflecting heightened regulatory scrutiny globally. Blockchain technology is emerging as a niche yet powerful tool for secure record-keeping and verification of employee credentials and sensitive payroll data, enhancing trust and immutability. Finally, mobile technology is no longer an ancillary feature but a requirement; robust mobile platforms offering self-service capabilities for pay stubs, benefits enrollment, and time-off requests are essential for engaging modern workforces and optimizing the employee experience (EX) across geographically dispersed teams.

Regional Highlights

The global market exhibits distinct regional characteristics shaped by economic maturity, regulatory environments, and technological adoption rates.

- North America: Dominates the market share due to high technology expenditure, the presence of major industry leaders (e.g., ADP, Workday, Paychex), and a complex, highly regulated tax and compliance environment necessitating advanced, comprehensive HCM solutions. The region is a pioneer in integrating AI and sophisticated analytics into HR processes, driven by a highly competitive labor market and a strong focus on strategic talent management.

- Europe: Represents a mature market characterized by stringent data privacy laws (GDPR) and highly fragmented, localized labor regulations. Demand is strong for solutions offering guaranteed localization and compliance across multiple countries (e.g., Germany, France, UK), driving the success of regional specialists and global vendors with robust multi-country payroll capabilities. Cloud adoption is accelerating, especially among medium-sized businesses seeking harmonization across European subsidiaries.

- Asia Pacific (APAC): Projected to be the fastest-growing region, driven by rapid industrialization, digitalization initiatives by governments (e.g., India, China), and the growing necessity for formalized HR structures in expanding SMEs. The market is highly diverse, demanding flexible solutions that can adapt quickly to evolving statutory requirements and varied technological infrastructures across countries. Outsourcing services are particularly popular due to the complexity of navigating diverse tax structures and languages.

- Latin America (LATAM): Exhibits significant growth potential, motivated by economic stabilization and increasing foreign direct investment, which necessitates modern payroll solutions compliant with varying national labor codes (e.g., Brazil, Mexico). Key focus areas include combating fraud and ensuring compliance in frequently changing regulatory environments, favoring cloud-based solutions accessible despite infrastructure challenges.

- Middle East and Africa (MEA): Emerging market where adoption is accelerating, especially in the GCC countries (Saudi Arabia, UAE) due to large-scale national transformation visions and infrastructure development projects. Demand is centered on unified payroll systems that handle unique local regulations, such as the Wage Protection System (WPS) in the UAE, alongside specialized requirements for expatriate workforce management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Payroll & HR Solutions and Services Market.- ADP

- Paychex

- SAP SE

- Oracle Corporation

- Workday Inc.

- UKG (Ultimate Kronos Group)

- Ceridian HCM Holding Inc.

- TriNet Group

- Insperity

- Intuit Inc.

- Ramco Systems

- SD Worx

- Automatic Data Processing (India) Private Limited

- BambooHR

- Namely

- Gusto

- TalentSoft

- Cornerstone OnDemand

- Zenefits

- Paycom

Frequently Asked Questions

Analyze common user questions about the Payroll & HR Solutions and Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from on-premise to cloud-based HR and Payroll solutions?

The primary drivers are enhanced scalability, lower total cost of ownership (TCO) due to reduced internal IT maintenance, improved data accessibility for distributed workforces, and the ability to receive automatic, real-time regulatory updates essential for compliance management.

How does AI improve payroll accuracy and reduce compliance risk?

AI utilizes machine learning algorithms to automate complex tax calculations, identify anomalies in time and attendance data that could lead to errors, and continuously monitor changes in local and international labor laws, automatically applying updates to payroll logic, significantly minimizing manual errors and compliance penalties.

Which market segment currently exhibits the highest growth potential?

The Small and Medium Enterprises (SME) segment, particularly in the Asia Pacific region, shows the highest growth potential. This growth is fueled by increasing affordability of modular SaaS solutions, accelerated digitalization efforts, and the urgent need for simplified, compliant payroll processing tools.

What are the main security concerns associated with outsourcing payroll functions?

The main concerns revolve around data breaches, unauthorized access to sensitive employee financial data (PII), and vendor compliance with international data protection regulations like GDPR. Customers must ensure providers maintain robust ISO certifications and advanced encryption protocols.

What differentiates HCM suites from traditional HRIS systems?

Human Capital Management (HCM) suites offer integrated, strategic functionalities encompassing talent management, learning, and predictive analytics, moving beyond the administrative record-keeping focus of traditional Human Resource Information Systems (HRIS). HCM platforms aim to optimize the entire employee lifecycle strategically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager