PBSA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435508 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

PBSA Market Size

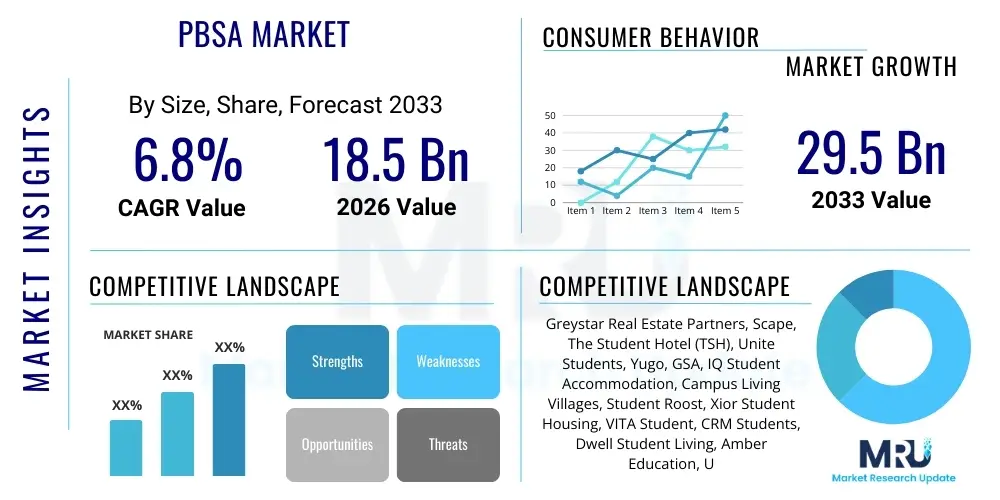

The PBSA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033.

PBSA Market introduction

The Purpose-Built Student Accommodation (PBSA) market encompasses high-quality, professionally managed residential properties specifically designed and tailored for students enrolled in tertiary education. Unlike traditional university halls or privately rented houses, PBSA facilities prioritize safety, modern amenities, academic support spaces, and community features, addressing the evolving expectations of both domestic and international students. This specialized real estate sector has attracted significant institutional investment globally, transforming student housing from a secondary asset class into a core component of real estate portfolios due to its resilient income streams and counter-cyclical nature compared to other commercial property segments.

Key applications of PBSA extend beyond mere shelter; they serve as integrated ecosystems supporting student well-being and academic success. These properties typically offer diverse unit types, ranging from shared cluster flats to self-contained studios, all equipped with high-speed internet, secure access control, and dedicated communal areas such as study rooms, gyms, and social lounges. The primary benefits driving the market include superior yields compared to conventional residential assets, high occupancy rates stabilized by consistent growth in global tertiary enrollment, and enhanced management efficiencies resulting from standardized designs and professional operational platforms. The market scope covers established education hubs in North America and Europe, alongside rapidly emerging markets in Asia Pacific.

Major driving factors fueling this expansion include the persistent global shortage of quality student housing relative to enrollment figures, the increasing mobility of international students seeking education in top-tier universities, and the subsequent need for accommodation that guarantees safety and quality upon arrival. Furthermore, universities are increasingly outsourcing their accommodation needs to third-party PBSA providers, allowing institutions to focus capital expenditure on core academic facilities. Regulatory changes supporting educational infrastructure development in various countries also provide a foundational boost to investment confidence, positioning PBSA as a critical component of modern urban and educational infrastructure.

PBSA Market Executive Summary

The PBSA market is currently characterized by robust institutional investment activity, driven primarily by favorable demographic trends and the defensive characteristics of the asset class during economic uncertainty. Major business trends indicate a shift towards sustainable development practices, with investors increasingly prioritizing Environmental, Social, and Governance (ESG) criteria in their acquisitions and developments, necessitating higher standards for energy efficiency and social impact. Operational excellence, facilitated by Property Technology (PropTech), is becoming crucial for maximizing net operating income, focusing particularly on automated management systems, streamlined leasing processes, and data-driven occupancy optimization. Cross-border capital flows remain strong, confirming PBSA's status as a globally recognized core real estate investment asset.

Regional trends highlight divergence in market maturity and growth potential. North America and Europe represent mature, stable markets characterized by consolidation and sophisticated operational models, with emphasis on optimizing existing portfolios and strategic development in supply-constrained, high-ranking university towns. Conversely, the Asia Pacific region, particularly countries like Australia, China, and emerging South Asian economies, exhibits explosive growth potential, underpinned by rapidly increasing domestic and outbound student populations and a pronounced historical lack of purpose-built supply. This geographical disparity drives differential investment strategies, favoring development and joint ventures in APAC, and value-add strategies in established Western markets.

Segment trends reveal a sustained polarization in student demand. There is increasing demand for premium, self-contained studio units, reflecting a preference among postgraduate and affluent international students for privacy and high-specification amenities. Concurrently, affordability remains a critical concern, driving demand for innovative, high-density cluster flats that balance cost-effectiveness with communal living quality. The specialization of accommodation, focusing on health, wellness, and dedicated professional development facilities within the properties, is emerging as a key differentiator. Furthermore, hybrid models, integrating accommodation with flexible co-working and learning spaces, are being piloted to maximize utilization during non-peak academic periods and cater to modern learning styles.

AI Impact Analysis on PBSA Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the PBSA market predominantly center on operational efficiency, personalized student experiences, and asset security. Key themes analyzed include how AI can automate repetitive management tasks (e.g., maintenance scheduling, leasing inquiries), the utilization of machine learning for dynamic pricing strategies to maximize revenue yield based on real-time demand fluctuations, and the implementation of AI-driven smart building technologies for enhanced energy management and predictive maintenance. Users are also highly concerned with the ethical implications of data privacy and the role of AI in creating genuinely personalized, rather than merely standardized, living environments tailored to diverse international student needs. Expectations are high for AI to reduce operational friction and provide a competitive edge in tenant attraction and retention.

The implementation of AI algorithms is poised to fundamentally redefine the operational backbone of PBSA assets. AI-powered platforms can analyze vast datasets concerning student demographics, local market supply, competitor pricing, and historical leasing velocity to recommend optimal pricing structures several months in advance of the academic year, drastically improving yield management compared to static pricing models. Moreover, AI facilitates hyper-efficient property management by interpreting sensor data from IoT devices to flag potential equipment failures before they occur (predictive maintenance), significantly reducing downtime and maintenance costs, thereby improving the overall financial performance of the asset.

Beyond operational improvements, AI deeply influences the student living experience. Smart concierge systems, powered by natural language processing, can handle the majority of routine student queries instantly, ranging from rent payment status to local area recommendations, enhancing customer service outside of typical business hours. AI-driven security systems, utilizing facial recognition and behavioral analytics (when legally permissible), offer elevated safety standards, which is a paramount concern for both students and parents. Ultimately, AI transforms PBSA from passive residential buildings into proactive, smart environments that respond dynamically to the needs and behaviors of their occupants, boosting desirability and asset valuation.

- AI-driven Dynamic Pricing and Yield Management optimization based on real-time market conditions.

- Predictive Maintenance scheduling using machine learning to preempt equipment failure and reduce operational expenditure.

- Automated Leasing and Inquiry Processing via chatbots and AI-powered workflow systems, enhancing speed and 24/7 availability.

- Smart Energy Management and Utility Optimization through AI analysis of occupancy patterns and environmental controls (HVAC, lighting).

- Enhanced Security and Access Control systems utilizing sophisticated pattern recognition and identity verification technologies.

- Personalized Student Experience platforms offering tailored community events and support services based on resident profiles.

DRO & Impact Forces Of PBSA Market

The PBSA market's trajectory is strongly dictated by a powerful combination of demographic drivers, economic limitations, strategic opportunities, and immediate impact forces. Primary drivers center on the global explosion in tertiary enrollment and the persistent gap between the demand for, and the supply of, quality student accommodation, ensuring high structural occupancy rates. Restraints often manifest as regulatory friction, particularly in restrictive planning environments, coupled with the escalating costs of land acquisition and construction in prime urban locations, squeezing development margins. Opportunities arise from expanding into secondary and tertiary university markets and developing specialized niche accommodations catering to specific demographic segments, such as postgraduate or medical students. These forces combine to create a highly dynamic investment landscape where strategic positioning and development expertise determine competitive advantage.

Drivers: A fundamental driver is the demographic bulge of university-age populations globally, particularly in emerging economies, alongside increasing affluence enabling greater participation in higher education internationally. The professionalization of the market, offering institutional-grade assets with transparent management structures, appeals strongly to global equity funds and pension schemes seeking stable, inflation-hedged returns. Furthermore, the increasing global mobility of students, who prioritize safe, managed, and amenity-rich housing, exerts constant upward pressure on demand for the PBSA product type. Universities, constrained by debt and capital expenditure limitations, are increasingly divesting their accommodation responsibilities or entering into long-term partnerships with established PBSA providers, reinforcing the operational model of the private sector.

Restraints: The market faces significant headwinds from planning and zoning restrictions, particularly in major European and North American cities where local authorities often favor residential housing over purpose-built student schemes, leading to protracted approval processes and development delays. High barriers to entry for new developers are created by the substantial upfront capital expenditure required for land acquisition and construction, particularly when complying with stringent modern building and sustainability standards. Additionally, public perception and NIMBYism (Not In My Backyard) related to the concentration of student populations in specific neighborhoods can introduce political and regulatory risk that complicates large-scale development projects.

Opportunities: Significant future growth opportunities lie in scaling operations within established, yet underserved, secondary university cities that offer attractive land values and stable student populations, reducing competition from major Tier 1 city hubs. Furthermore, the development of sophisticated operating platforms enables providers to explore counter-cyclical utilization strategies, such as offering accommodation for corporate housing or short-term tourist stays during summer months, enhancing revenue diversification and asset yield. The growing focus on wellness and sustainability provides an opportunity for market leaders to differentiate their products through superior ESG credentials, attracting premium-paying, environmentally conscious students and sustainable institutional capital.

Segmentation Analysis

The PBSA market is highly diversified and segmented based on operational characteristics, student demographics, and the physical attributes of the accommodation. Segmentation by type differentiates between traditional cluster flats, which maximize density and affordability through shared communal facilities, and premium studios or one-bedroom apartments, which cater to students seeking privacy and superior amenities, often at a higher price point. Geographical segmentation is critical, separating high-yield, high-cost urban core properties near top-tier institutions from lower-cost, potentially higher-growth suburban or secondary market locations. Further segmentation addresses the level of service and management (e.g., luxury high-end vs. budget-friendly) and the tenure or partnership model (e.g., university-managed vs. fully private operational models).

Analyzing these segments provides clarity for investors regarding risk profiles and target returns. The studio/premium segment typically commands higher rents and attracts stable international or postgraduate tenants, offering lower operational risk per unit, although requiring higher initial development cost. Conversely, the cluster flat segment offers scale and efficiency, maximizing bed count on constrained sites, and often serves the bulk of the domestic undergraduate population. Strategic focus on the intersection of these segments—such as affordable luxury, or high-amenity shared living—is driving innovation in market offerings. Furthermore, the segmentation by contract duration, differentiating between 52-week contracts appealing to international students and 42/44-week terms common among domestic students, influences annual revenue cycling and summer utilization strategies.

- By Type:

- Studio Apartments (Self-contained, premium pricing)

- En-suite Cluster Flats (Shared kitchen/living area, private bedroom/bathroom)

- Non-en-suite Cluster Flats (Traditional shared facilities, budget-friendly)

- By Location:

- Urban Core (High proximity to Tier 1 universities, high rental rates)

- Suburban/Peripheral (Lower cost, potentially larger sites, reliant on transport links)

- By Contract Length:

- Academic Year (Typically 42–44 weeks)

- Full Year (Typically 50–52 weeks, common for international students)

- By Investment Model:

- Direct Lease/Ownership

- University Partnership/Nomination Agreements

- Joint Venture Development Models

Value Chain Analysis For PBSA Market

The PBSA value chain is a complex structure involving distinct phases from capital origination and land acquisition (upstream) through to daily property operations and student experience delivery (downstream). The upstream segment is dominated by land sourcing, securing necessary planning permits, and capital structuring, involving institutional investors, real estate developers, and specialized finance providers. Success at this stage hinges on accurate demographic forecasting, navigating stringent regulatory processes, and securing cost-effective financing. The crucial midstream phase involves the construction and development process, where efficiency, adherence to modern design standards, and sustainable building practices directly impact the asset's lifespan and attractiveness.

The downstream component is focused entirely on operations, management, and occupancy maintenance. This includes direct leasing, student relationship management, facilities maintenance, and community building, often executed through sophisticated digital platforms. Distribution channels play a vital role here, primarily relying on direct booking portals managed by the operators, often supplemented by strong nomination agreements with universities (direct channel) or utilizing specialized international education agents (indirect channel) to secure international student tenants months in advance. The efficacy of the downstream operations, particularly the student experience and retention rates, directly dictates the asset's yield and overall valuation for investors.

Direct channels offer maximum control and profitability, utilizing proprietary websites and dedicated in-house sales teams to handle bookings and manage tenant relationships throughout the entire lifecycle. Indirect channels, primarily involving trusted international student recruitment agencies or third-party booking platforms, are essential for penetrating high-growth overseas source markets where students and parents rely on established intermediaries for secure accommodation placement. Optimizing the flow of information and payments between these channels is critical for maximizing occupancy rates, minimizing marketing spend, and ensuring a seamless transition for incoming students, thereby securing the value generated throughout the upstream and midstream phases.

PBSA Market Potential Customers

The primary customers in the PBSA market are students enrolled in accredited tertiary institutions, categorized chiefly by their geographical origin and educational level. Domestic undergraduates often seek cluster flat options due to affordability and a desire for social interaction during their first years of study. International students, however, represent a highly valuable customer base, typically demanding premium self-contained studio accommodation, full-year contracts, and higher service levels due to their reliance on the accommodation provider for initial orientation and support in a new country. This segment is highly sensitive to safety, location convenience, and overall product quality.

Beyond the direct resident students, universities themselves act as crucial institutional buyers or partners. Many universities enter into long-term nomination agreements, effectively guaranteeing a certain level of occupancy for the PBSA provider in exchange for prioritized placement of their students. This institutional relationship secures the asset's long-term revenue stream. Finally, the ultimate financial buyers are the institutional investors, including pension funds, sovereign wealth funds, and private equity firms, who purchase the assets themselves. These buyers are primarily concerned with stable yields, high occupancy historical data, asset quality, and robust, professional management platforms.

The rise of specialized educational courses, such as intensive post-graduate degrees, medical placements, and specialized vocational training programs, is creating niche customer segments. These students often have higher disposable incomes and specific demands for accommodation features, such as proximity to clinical sites or highly focused study environments. Catering successfully to these specialized end-users allows developers to charge premium rents and mitigate direct competition faced in the general undergraduate market. Understanding the interplay between these diverse customer groups is central to strategic site selection and product design in the PBSA sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Greystar Real Estate Partners, Scape, The Student Hotel (TSH), Unite Students, Yugo, GSA, IQ Student Accommodation, Campus Living Villages, Student Roost, Xior Student Housing, VITA Student, CRM Students, Dwell Student Living, Amber Education, UPP Ltd., Asset Campus Housing, Harrison Street Real Estate Capital, Nuveen Real Estate, Hines, Tishman Speyer |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PBSA Market Key Technology Landscape

The technological landscape within the PBSA market is rapidly evolving, driven by the necessity for operational efficiency, enhanced security, and the delivery of a superior resident experience expected by digitally native students. Core technologies revolve around Property Technology (PropTech) solutions, specifically IoT (Internet of Things) integration and sophisticated cloud-based property management software (PMS). IoT sensors are widely deployed for energy monitoring, allowing operators to track and optimize usage across common areas and individual units, directly contributing to sustainability goals and reduced utility expenses. Integrated smart access systems, utilizing mobile credentials instead of traditional keys, enhance security and convenience, simplifying check-in and managing visitor access efficiently, minimizing logistical friction for both students and staff.

Furthermore, robust digital platforms are essential for managing the end-to-end student journey, from initial virtual tours and online applications to rent payment and maintenance requests. Cloud-based PMS systems provide real-time data on occupancy, financials, and maintenance status across entire portfolios, enabling centralized, data-driven decision-making. These platforms often incorporate AI-driven tools for marketing automation and customer relationship management (CRM), ensuring timely and personalized communication with prospects and current residents. The reliance on high-speed, dedicated fiber broadband infrastructure is non-negotiable, serving as the foundational technology that supports all academic and leisure activities within the property.

Emerging technologies also play a crucial role in maintaining asset relevance. Building Information Modeling (BIM) is increasingly used during the construction phase to improve precision and reduce long-term maintenance costs by providing a detailed digital twin of the asset. Virtual Reality (VR) and Augmented Reality (AR) are transforming the leasing process, allowing international students to experience the property remotely before committing to a lease. The continuous investment in these technologies is not merely an operational cost, but a key competitive necessity, as modern students prioritize living environments that are technologically seamless, secure, and supportive of their academic lives, ultimately driving higher rental yields for tech-enabled operators.

Regional Highlights

The global PBSA market exhibits significant regional heterogeneity, with growth and investment strategies tailored to local educational and regulatory frameworks. North America, particularly the US, remains a dominant market, characterized by large-scale, off-campus housing developments often adjacent to major public universities. Investment here focuses heavily on private student housing assets, leveraging strong demographics and high tuition fees. The market is highly mature, dominated by specialized real estate investment trusts (REITs) and institutional funds focusing on maximizing ancillary income and operational efficiencies through portfolio optimization.

Europe represents a fragmented yet high-growth area. The UK is the most established PBSA market globally, serving as the blueprint for institutional investment due to clear regulatory structures and high international student mobility. Continental Europe, however, presents varying levels of maturity; countries like Germany and Spain are rapidly institutionalizing their fragmented student housing supply, attracting significant cross-border capital, while markets in Eastern Europe are just beginning to see institutional-grade development. Emphasis in Europe is placed on centrally located urban sites and meeting rigorous EU sustainability standards (ESG).

The Asia Pacific (APAC) region is forecasted to be the engine of future growth. Australia leads the APAC market, benefiting from its popularity as a destination for Asian international students, ensuring high demand in major cities like Sydney and Melbourne. Elsewhere in APAC, including China, Japan, and India, the market is characterized by insufficient purpose-built supply relative to the massive domestic tertiary enrollment growth. Investment often takes the form of strategic joint ventures with local developers or educational institutions to overcome regulatory complexities and capitalize on rapid urbanization and increasing parental willingness to pay for quality student accommodation.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging, frontier markets for PBSA. LATAM's market is characterized by localized developers focusing on addressing the housing deficit in major educational cities like Bogotá, Santiago, and Mexico City, often targeting domestic students requiring safe, modernized options near campuses. MEA, particularly the GCC countries and South Africa, shows nascent growth tied to increasing government investment in developing world-class educational hubs and attracting international branch campuses, necessitating supporting modern accommodation infrastructure. These regions offer long-term opportunities but carry higher political and operational risks compared to established Western markets.

- North America (NA): Characterized by high development costs, large-scale assets, mature operational platforms, and robust demand linked to top-tier university rankings.

- Europe: Led by the established UK market; high regulatory hurdles in Continental Europe; strong push for sustainability and central urban locations.

- Asia Pacific (APAC): Highest projected growth rates driven by domestic enrollment and outbound mobility; significant supply gap, particularly in major educational hubs in China and India.

- Latin America (LATAM): Emerging market focused on domestic demand and addressing historical housing shortages in major metropolitan areas.

- Middle East and Africa (MEA): Nascent investment focused around new university precincts and government-backed educational infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PBSA Market.- Greystar Real Estate Partners

- Scape

- The Student Hotel (TSH)

- Unite Students

- Yugo

- GSA

- IQ Student Accommodation

- Campus Living Villages

- Student Roost

- Xior Student Housing

- VITA Student

- CRM Students

- Dwell Student Living

- Amber Education

- UPP Ltd.

- Asset Campus Housing

- Harrison Street Real Estate Capital

- Nuveen Real Estate

- Hines

- Tishman Speyer

Frequently Asked Questions

Analyze common user questions about the PBSA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the current global growth of the PBSA market?

Growth is principally driven by two macro trends: the consistent rise in global tertiary enrollment rates, especially in emerging economies, and the sustained increase in international student mobility. This demographic pressure creates a structural supply-demand imbalance for high-quality, professionally managed housing, attracting institutional investment seeking resilient, counter-cyclical asset returns.

How does institutional investment view PBSA compared to traditional residential real estate?

Institutional investors favor PBSA due to its higher rental yields, superior occupancy stability, and rental payment certainty often secured by annual contracts and nomination agreements with universities. PBSA is generally considered a defensive asset class, offering inflation-hedging qualities and lower volatility compared to general market residential or commercial property sectors.

What role does PropTech and IoT play in modern PBSA operations and competitiveness?

PropTech is critical for maximizing operational efficiency and resident experience. Key applications include utilizing IoT for predictive maintenance and energy optimization, implementing AI for dynamic pricing strategies and automated leasing, and using advanced cloud platforms for centralized portfolio management and seamless student interaction (e.g., smart access, online service requests).

Which geographical regions currently offer the strongest development opportunities for PBSA?

While mature markets like the UK and US offer stability, the highest development opportunities are concentrated in the Asia Pacific (APAC) region, particularly Australia and major educational centers in China and India, where a significant shortfall in quality accommodation meets rapidly expanding student populations. Opportunities also exist in underserved secondary university markets globally.

What are the primary operational challenges facing PBSA providers globally?

Major operational challenges include navigating complex and restrictive local planning regulations for new developments, managing escalating construction and land acquisition costs, and meeting the evolving demands of modern students for high-specification amenities and robust sustainability (ESG) standards, all while maintaining competitive affordability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager