PBT Neat Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436926 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

PBT Neat Resin Market Size

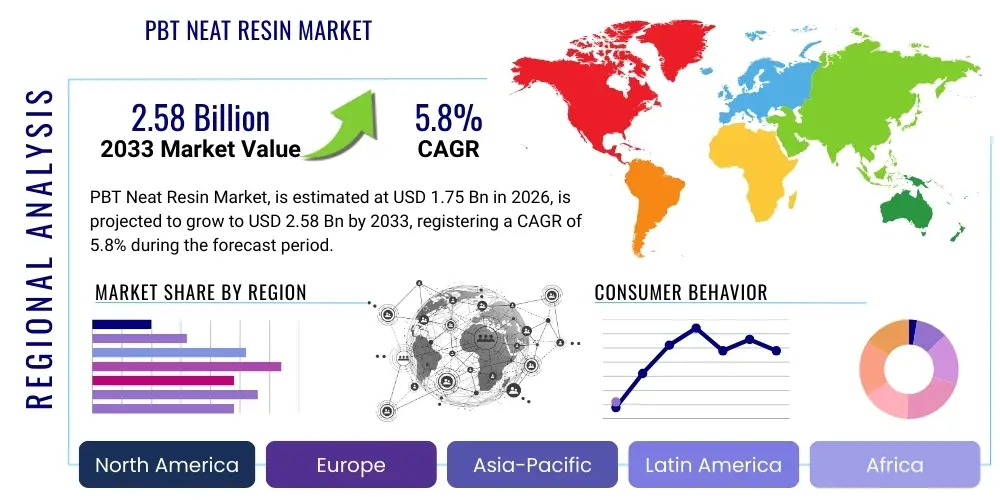

The PBT Neat Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

PBT Neat Resin Market introduction

PBT Neat Resin, or Polybutylene Terephthalate in its unmodified, pure form, is a high-performance, semi-crystalline engineering thermoplastic known for its excellent electrical insulation properties, high stiffness, dimensional stability, and resistance to chemicals and heat. It is synthesized through the polycondensation reaction of 1,4-butanediol (BDO) and either terephthalic acid (TPA) or dimethyl terephthalate (DMT). Unlike commodity plastics, PBT Neat Resin serves critical functional roles in demanding environments, making it indispensable in modern manufacturing. Its inherently rapid crystallization rate allows for faster cycle times during injection molding, a significant competitive advantage in high-volume production sectors.

The primary applications of PBT Neat Resin span the Automotive, Electrical and Electronics (E&E), and Consumer Goods sectors. In automotive manufacturing, it is heavily utilized for connectors, fuse boxes, sensor housings, and under-the-hood components requiring thermal stability and fluid resistance. Within the E&E sector, its excellent dielectric strength makes it ideal for switches, relay components, coil bobbins, and LED lighting housings, supporting the ongoing miniaturization trend. The inherent performance profile of the neat resin provides a superior base material for compounding, where additives further enhance properties like flame retardancy or impact strength, although the neat form itself is increasingly specified for applications requiring maximum purity and specific electrical performance.

Major driving factors influencing the market expansion include the global shift towards electric and hybrid vehicles (EVs), which necessitates higher thermal management and voltage-resistant materials for battery components and charging infrastructure. Furthermore, the rapid expansion of 5G telecommunication infrastructure demands high-quality, reliable thermoplastic components for connectors and housings. The benefits of PBT—low moisture absorption, rigidity, and easy processability—position it favorably against competing engineering plastics like Nylon (Polyamide) and Polycarbonate, ensuring sustained demand across advanced manufacturing ecosystems worldwide.

PBT Neat Resin Market Executive Summary

The PBT Neat Resin market is characterized by robust growth driven fundamentally by persistent demand from high-growth industries, particularly e-mobility and advanced electronics. Business trends indicate a strong focus on capacity expansion, especially in Asia Pacific, to meet burgeoning domestic industrial requirements, alongside strategic mergers and acquisitions aimed at securing BDO feedstock supply chains and integrating advanced compounding capabilities. Key industry players are increasingly investing in proprietary polymerization technologies to enhance resin purity and molecular weight consistency, thereby improving processing efficiency and final product performance for critical applications. Furthermore, the trend toward sustainable production is pushing innovation into bio-based PBT alternatives and enhanced chemical recycling methods, influencing long-term investment strategies.

Regionally, Asia Pacific (APAC) continues to assert dominance, accounting for the largest market share due to its established global hub for automotive manufacturing and E&E production, particularly in China, South Korea, and Japan. Robust industrialization and massive infrastructure investments in emerging economies within APAC ensure this region will exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. North America and Europe, while growing at a slower pace, represent mature markets focused on high-specification, premium-grade PBT for specialized sectors like aerospace, medical devices, and high-voltage automotive systems, emphasizing compliance with stringent regulatory standards (e.g., REACH and RoHS).

In terms of segmentation trends, the Injection Molding Grade PBT Neat Resin segment maintains the largest market share due to its versatility and widespread use in high-volume applications like automotive connectors and consumer appliance components. However, the Extrusion Grade segment is projected to show accelerated growth, primarily fueled by demand for high-performance films, sheets, and monofilaments utilized in specialized industrial textile applications and protective coverings. Application-wise, the Automotive segment remains the largest consumer, but the Electrical & Electronics segment is expected to experience slightly faster volume growth, capitalizing on the deployment of new electronic components and the miniaturization trend.

AI Impact Analysis on PBT Neat Resin Market

Common user questions regarding AI's impact on the PBT Neat Resin market frequently center on how these advanced technologies can address volatility in raw material costs, optimize complex polymerization processes, and enhance quality control consistency in high-specification resin manufacturing. Users often inquire about AI's role in predictive maintenance for continuous reactors and its ability to forecast demand accurately across fragmented end-user markets like E&E and automotive. Concerns also revolve around the required investment in data infrastructure and the necessary upskilling of chemical engineering staff to leverage machine learning models effectively for process optimization and new material formulation.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally shifting operational efficiencies within the PBT manufacturing landscape, moving production facilities toward 'smart manufacturing' environments. AI algorithms are proving invaluable in predictive feedstock procurement, analyzing global oil prices, BDO market dynamics, and PTA availability to minimize input cost risks. Moreover, sophisticated ML models are being deployed to dynamically adjust parameters within polycondensation reactors—such as temperature, catalyst concentration, and residence time—to achieve maximum yield, control molecular weight distribution (MWD), and ensure lot-to-lot consistency, which is critical for customers in safety-critical applications.

Beyond the manufacturing floor, AI is revolutionizing research and development (R&D) efforts for PBT-based materials. Generative AI models are accelerating the discovery and formulation of new PBT compounds, particularly those with enhanced flame retardancy, superior thermal stability, or specific bio-degradable properties. By simulating thousands of formulation permutations virtually, AI significantly reduces the time and cost associated with traditional physical experimentation, leading to faster market entry for innovative PBT solutions required for next-generation technologies like advanced driver-assistance systems (ADAS) and high-voltage electronics.

- AI-driven predictive maintenance reduces unplanned reactor downtime, increasing asset utilization.

- Machine learning optimizes polymerization reaction conditions (temperature, pressure) for enhanced yield and molecular weight consistency.

- Predictive analytics for BDO and PTA feedstock pricing minimizes raw material cost exposure.

- Automated visual inspection systems utilizing AI improve quality control, detecting subtle resin defects faster than human operators.

- Generative AI accelerates the formulation of customized PBT compounds with specific thermal or mechanical properties.

- Optimized inventory management through demand forecasting reduces warehousing costs and minimizes material obsolescence.

DRO & Impact Forces Of PBT Neat Resin Market

The PBT Neat Resin market trajectory is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers include the accelerated global production of Electric Vehicles (EVs), requiring lightweight and heat-resistant insulation and housing materials, coupled with continuous innovation and miniaturization within the Electrical and Electronics sector, particularly concerning 5G infrastructure and data center components. Restraints predominantly revolve around the significant price volatility of 1,4-Butanediol (BDO), the key raw material, which is often tied to petrochemical market fluctuations, posing margin pressure on manufacturers. Furthermore, PBT faces persistent competitive threats from alternative engineering plastics, such as specific grades of Nylon (PA) and high-performance PET, particularly where cost-sensitive substitution is viable.

Opportunities for growth are strong, centered on the emerging trend of sustainability and the development of bio-based PBT (Bio-PBT) derived from renewable sources, which addresses growing environmental consciousness among consumers and regulatory bodies. Expansion into niche, high-value applications such as specialized medical devices (e.g., surgical equipment handles) and aerospace interiors also offers superior revenue potential. These impact forces—technological advancements, regulatory mandates (like requirements for halogen-free flame retardants), and macroeconomic trends (global automotive production recovery)—collectively dictate market structure, pricing power, and investment decisions across the value chain, ensuring that manufacturers must maintain operational flexibility and technological superiority to capture market share.

The inherent performance characteristics of PBT Neat Resin, such as its excellent mechanical strength, low water absorption, and resistance to harsh environments (including fuels and hydraulic fluids), provide a resilient base of impact force sustaining its demand. However, the energy intensity of the polymerization process and the subsequent pressure to reduce carbon footprint serve as continuous restraining forces compelling innovation in process efficiency. Ultimately, successful market players will be those who master supply chain resilience against BDO volatility while aggressively pursuing sustainable and high-specification grades demanded by the EV and advanced medical device sectors.

Segmentation Analysis

The PBT Neat Resin market is systematically segmented based on Grade, Application, and Geography, reflecting the diverse requirements of end-user industries. The segmentation by Grade primarily differentiates between Injection Molding, Extrusion, and Film/Fiber grades, each tailored for specific processing techniques and final product characteristics. Injection Molding Grade PBT, being the most common, dominates the market due to its excellent flow characteristics and high throughput capability, making it ideal for geometrically complex parts like connectors and housings. Application segmentation reveals the heavy reliance of the Automotive and Electrical & Electronics industries, where PBT's insulating and thermal stability properties are crucial. Continuous analysis of these segments helps stakeholders understand shifting demand dynamics, such as the increasing need for high-flow PBT grades driven by smaller, more intricate electronic components.

Detailed analysis of the Application segment confirms that the Automotive sector utilizes PBT for crucial safety and functional components, including relays, ignition systems, and exterior trim, capitalizing on its aesthetic appeal and durability against road salts and oils. The E&E sector, however, is the engine of technological adoption, demanding higher purity and specific fire-retardant characteristics, often driving the need for customized neat resin formulations prior to compounding. Geographically, segmentation highlights the dominance of the Asia Pacific region, which dictates global supply and price trends due to its massive production capacity and consumption footprint, followed by the technological leadership and high-value consumption patterns observed in North America and Europe.

- By Grade

- Injection Molding Grade

- Extrusion Grade

- Film and Fiber Grade

- By Application

- Automotive (Connectors, Fuse Boxes, Sensor Housings, Interior/Exterior Components)

- Electrical & Electronics (Switches, Relays, Coil Bobbins, LED Housing)

- Consumer Appliances (Handles, Housings, Internal Components)

- Industrial (Pump Housings, Bearing Cages)

- Others (Medical Devices, Fiber Optics)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For PBT Neat Resin Market

The PBT Neat Resin value chain commences with the upstream supply of fundamental petrochemical building blocks: 1,4-Butanediol (BDO) and Dimethyl Terephthalate (DMT) or Purified Terephthalic Acid (PTA). BDO production, often derived from crude oil, natural gas, or increasingly through bio-fermentation processes, is the single most critical and price-volatile component of the upstream segment. Major chemical producers control the synthesis of these monomers, impacting the cost structure of PBT manufacturers. The polymerization stage follows, where chemical companies convert these monomers into PBT Neat Resin through advanced continuous or batch processes, focusing on optimizing molecular weight and inherent viscosity (IV) to meet specific end-use requirements for flow and strength.

Midstream activities involve the resin producers selling the base neat resin either directly to large-scale compounders or sometimes straight to very large end-users like Tier 1 automotive suppliers. Compounders play a critical intermediary role (downstream), modifying the neat resin with reinforcements (like glass fiber), flame retardants, and processing aids to create application-specific compounds (e.g., highly flame-retardant PBT for EV battery modules). The distribution channel relies heavily on specialized chemical distributors for small to medium-sized customers, offering localized inventory and technical support, whereas direct sales are common for large volume, long-term contracts with global OEMs.

The final downstream segment involves the processors (injection molders, extruders) who convert the resin/compounds into finished parts for end-users, including automotive OEMs (Ford, Toyota, VW), major electronics manufacturers (Samsung, LG), and consumer goods companies. The efficiency and quality control throughout this chain are crucial, as failure in a single component, such as an EV battery connector made from PBT, can have severe operational consequences, emphasizing the importance of supply chain transparency and collaboration from feedstock to final product.

PBT Neat Resin Market Potential Customers

Potential customers for PBT Neat Resin are primarily large-scale industrial consumers requiring high-specification engineering thermoplastics for mass production and functional integrity. The most significant buyers are Tier 1 and Tier 2 suppliers within the global Automotive industry, such as Continental, Bosch, and Delphi, who purchase vast quantities of PBT resin for molding critical components including complex electrical connectors, sensor housings, and body panel retainers where thermal and chemical resistance is mandatory. These customers prioritize long-term supply contracts, stringent quality certifications (like IATF 16949), and reliable technical support from resin manufacturers to ensure material compatibility across various vehicle platforms.

The second major cohort of potential customers resides within the Electrical and Electronics (E&E) manufacturing sector. This includes Original Equipment Manufacturers (OEMs) specializing in computing hardware (servers, networking gear), domestic appliances (washing machines, vacuum cleaners), and advanced lighting systems (LED modules). Companies like Schneider Electric, ABB, and various Asian electronics giants demand PBT for coil bobbins, switches, and miniaturized components requiring excellent flame retardancy (often mandated by UL 94 V-0 ratings) and superior dielectric properties. Their purchasing decisions are heavily influenced by the resin's ability to facilitate miniaturization and achieve rapid processing cycle times.

Additional significant potential customers include specialized industrial manufacturers focusing on fluid handling systems, industrial machinery components (e.g., bearings, gears), and emerging medical device manufacturers. These customers often require customized, high-purity, and sometimes FDA-compliant grades of PBT. Furthermore, the construction and infrastructure sector increasingly utilizes PBT-based compounds for external fittings and specialized cable jacketing, driven by the resin's resilience to weathering and UV exposure, broadening the customer base beyond traditional automotive and E&E heavyweights.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Celanese Corporation, Mitsubishi Engineering-Plastics Corporation (MEP), DuPont de Nemours, Inc., Lanxess AG, Ticona (A Subsidiary of Celanese), Sabic (Saudi Basic Industries Corporation), Polyplastics Co., Ltd., Changchun Group, Jiangsu Sanfangxiang Group Co., Ltd., Nan Ya Plastics Corporation, Kingfa Sci.& Tech. Co., Ltd., Kolon Plastics, Sipchem (Saudi International Petrochemical Company), Ravago Manufacturing, DSM Engineering Materials (now part of Lanxess), Toray Industries, Inc., Daicel Corporation, Zhejiang Hecheng Chemical Co., Ltd., Blue Star New Chemical Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PBT Neat Resin Market Key Technology Landscape

The technological landscape of the PBT Neat Resin market is primarily defined by advanced polymerization techniques aimed at controlling molecular structure and viscosity, and downstream compounding technologies that enhance performance characteristics. The two main polymerization methods are transesterification (DMT route) and direct esterification (PTA route), with the latter gaining prominence due to environmental advantages and cost efficiency. Crucially, Solid State Polymerization (SSP) technology is widely employed post-polymerization to increase the intrinsic viscosity (IV) of the neat resin. Higher IV PBT is essential for demanding applications like film and fiber extrusion, where improved melt strength and mechanical performance are non-negotiable, ensuring dimensional stability and higher heat resistance in the final product.

In the realm of processing, advancements in reactor design, particularly continuous polymerization (CP) units, are focusing on energy optimization and continuous product quality monitoring. These CP technologies enable manufacturers to achieve exceptional homogeneity and minimize batch variation, catering to stringent automotive and medical standards that demand consistent material properties across massive production runs. Furthermore, computational fluid dynamics (CFD) modeling is being integrated into reactor engineering to predict and optimize mixing efficiency and heat transfer, directly impacting the final resin characteristics and reducing operational bottlenecks.

A significant technological shift is occurring in sustainability-driven innovation, specifically regarding PBT recycling. While mechanical recycling remains common, the focus is rapidly moving toward chemical recycling technologies, such as glycolysis or methanolysis (depolymerization), which break the PBT down into its original monomers (BDO and DMT/PTA). This closed-loop approach allows for the creation of "virgin-quality" recycled PBT, addressing the circular economy mandates imposed by regulators and major end-users. The success of these depolymerization techniques will be vital for the future competitiveness and environmental standing of PBT against other engineering plastics.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for PBT Neat Resin, largely dominated by China, which acts as the global manufacturing hub for electronics and vehicles. Rapid urbanization, massive infrastructure spending, and the exponential growth of local EV manufacturing capabilities fuel demand for high-performance resins. Countries like South Korea and Japan maintain technological leadership, producing high-end, specialized PBT grades for premium electronics and high-precision applications.

- North America: The North American market is mature and characterized by high-value consumption, particularly within the specialized automotive and aerospace sectors. Demand is driven by strict quality requirements and the adoption of cutting-edge technologies, such as Advanced Driver-Assistance Systems (ADAS), which necessitate highly reliable PBT compounds for sensor and camera housings. The region focuses heavily on regulatory compliance and sustainable material sourcing.

- Europe: Europe is a key market defined by rigorous environmental regulations (REACH) and strong emphasis on e-mobility and circular economy principles. Major European automotive manufacturers and Tier 1 suppliers drive demand for bio-based PBT alternatives and chemically recycled resins. Germany, as the automotive powerhouse, and Central Europe, with its expanding manufacturing base, are critical consumption centers emphasizing material fire safety and thermal performance.

- Latin America (LATAM): This region represents an emerging market, primarily driven by automotive assembly and construction activities in Brazil and Mexico. While smaller in volume compared to APAC, the PBT market in LATAM is gradually expanding as local industries upgrade manufacturing standards, shifting away from commodity plastics towards engineering-grade materials.

- Middle East & Africa (MEA): The MEA region's market growth is tied to local petrochemical capacity expansion and infrastructural development, particularly in the GCC countries. As local processing capabilities mature and regional automotive assembly plants increase production, the demand for locally sourced PBT Neat Resin for electrical and industrial applications is expected to rise steadily.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PBT Neat Resin Market.- BASF SE

- Celanese Corporation

- Mitsubishi Engineering-Plastics Corporation (MEP)

- DuPont de Nemours, Inc.

- Lanxess AG

- Polyplastics Co., Ltd.

- Sabic (Saudi Basic Industries Corporation)

- Ticona (A Subsidiary of Celanese)

- Kingfa Sci.& Tech. Co., Ltd.

- Nan Ya Plastics Corporation

- Changchun Group

- Kolon Plastics

- Sipchem (Saudi International Petrochemical Company)

- Toray Industries, Inc.

- Daicel Corporation

- Ravago Manufacturing

- Zhejiang Hecheng Chemical Co., Ltd.

- Jiangsu Sanfangxiang Group Co., Ltd.

- Shenma Industrial Co., Ltd.

- Blue Star New Chemical Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PBT Neat Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for PBT Neat Resin in the automotive sector?

The primary driver is the global proliferation of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). PBT is essential for high-voltage connectors, battery module housings, and internal circuitry due to its high dielectric strength, excellent thermal resistance, and inherent flame retardancy, which ensures safety and long-term performance under demanding thermal loads.

How does PBT Neat Resin compare to PET (Polyethylene Terephthalate) in terms of application?

While both are polyesters, PBT exhibits better impact strength, lower moisture absorption, and superior dimensional stability, particularly under heat, making it preferable for engineering applications like electrical components and automotive parts. PET is generally used where high stiffness and clarity are required, such as in fibers or bottles.

What are the main feedstock challenges facing PBT manufacturers?

The main challenge is the high price volatility and supply chain instability of 1,4-Butanediol (BDO), the key precursor. BDO pricing is often linked to fluctuating crude oil and natural gas markets, leading to significant cost unpredictability and margin pressure across the PBT value chain.

Which geographical region holds the largest market share for PBT Neat Resin?

Asia Pacific (APAC) holds the largest market share. This dominance is attributed to the presence of large-scale manufacturing bases for electronics and automotive components, particularly in China, South Korea, and Japan, which consume vast quantities of PBT for global export and domestic use.

Are there sustainable alternatives available in the PBT market?

Yes, sustainability efforts are centered on the development of Bio-based PBT (Bio-PBT), which utilizes bio-derived BDO from renewable sources like sugar feedstock. Furthermore, chemical recycling technologies (depolymerization) are emerging to convert post-consumer PBT waste back into high-purity monomers for closed-loop production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager