PCB Cutting Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433251 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

PCB Cutting Equipment Market Size

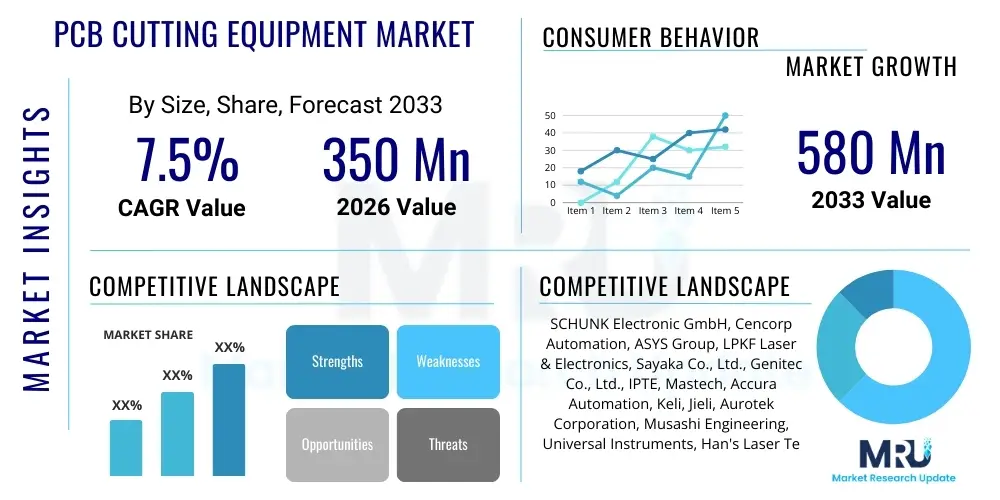

The PCB Cutting Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 580 Million by the end of the forecast period in 2033.

PCB Cutting Equipment Market introduction

The Printed Circuit Board (PCB) Cutting Equipment Market encompasses specialized machinery used to accurately separate individual PCB units or panels from larger manufacturing boards. These processes, critical in electronics manufacturing, require high precision, minimal stress on components, and efficient throughput. The equipment ranges from traditional mechanical routers and scoring machines to advanced laser depaneling systems, each suited for different materials, component densities, and production volumes. The evolution of electronics towards miniaturization, flexibility, and high-density interconnection (HDI) has been the primary catalyst for innovation within this machinery segment, driving demand for non-contact cutting methods like laser technology that minimize debris and mechanical stress.

Major applications of PCB cutting equipment span across critical industries including consumer electronics (smartphones, wearables), automotive electronics (ADAS, infotainment systems), industrial automation, aerospace, and medical devices. The primary benefit derived from these advanced cutting systems is enhanced operational precision, which directly contributes to higher yield rates and reduced waste in sophisticated electronic assembly operations. Furthermore, modern equipment often incorporates automated material handling and vision systems, improving cycle times and reducing the reliance on manual labor, which is essential for maintaining consistency in high-volume production environments. This shift towards automation also addresses the increasing complexity of modern PCBs, which often feature fragile components placed close to the board edges, demanding superior cutting finesse.

Key driving factors accelerating market expansion include the sustained global demand for electronic devices, particularly 5G infrastructure, electric vehicles (EVs), and IoT components, all of which require complex, multi-layered PCBs. Additionally, regulatory demands concerning product reliability and safety, coupled with the competitive pressures on manufacturers to reduce production costs while maximizing quality, necessitate investment in the latest high-speed, high-accuracy cutting solutions. Technological advancements, specifically in femtosecond and picosecond laser cutting systems, offer unparalleled precision for ultra-thin and flexible substrates, cementing their role as crucial tools for next-generation electronics fabrication.

PCB Cutting Equipment Market Executive Summary

The PCB Cutting Equipment Market is poised for robust expansion driven by the exponential growth of end-user industries and a crucial technological shift toward laser-based cutting methods. Business trends highlight increasing mergers and acquisitions focused on integrating complementary technologies, such as advanced vision inspection systems and robotic handling into standard equipment platforms, thereby offering comprehensive, end-to-end depaneling solutions. Original Equipment Manufacturers (OEMs) are increasingly prioritizing modular designs to allow for customization and easier integration into existing Smart Factory (Industry 4.0) setups, enhancing operational flexibility and future-proofing investments for electronics manufacturers globally. Sustainability is emerging as a growing trend, with manufacturers seeking cutting technologies that minimize material loss and energy consumption.

Regionally, the Asia Pacific (APAC) market, particularly China, South Korea, Taiwan, and Japan, maintains overwhelming dominance due to its entrenched position as the global hub for electronics manufacturing and assembly. This region exhibits the highest demand for advanced, automated systems driven by massive production volumes across consumer and telecommunications sectors. North America and Europe, while smaller in volume, represent critical markets for high-precision, low-volume applications, especially in aerospace, defense, and high-end medical devices, favoring sophisticated laser and high-accuracy mechanical routing systems. Developing economies in Southeast Asia are experiencing increased adoption, often starting with high-throughput mechanical systems before transitioning to laser technology as production complexity increases.

Segmentation trends indicate that the Laser Cutting segment is experiencing the fastest growth rate, expected to eclipse mechanical methods in terms of value share by the end of the forecast period, owing to its non-contact nature and suitability for high-density and flexible PCBs. By application, the Consumer Electronics segment remains the largest consumer, but the Automotive Electronics segment, fueled by the transition to electric and autonomous vehicles, is projected to demonstrate the highest CAGR, demanding highly reliable cutting for critical safety components. Furthermore, the Fully Automated equipment segment is rapidly gaining traction over semi-automated systems, reflecting the industry-wide push toward lights-out manufacturing environments to achieve maximum efficiency and traceability.

AI Impact Analysis on PCB Cutting Equipment Market

Common user questions regarding AI’s impact on PCB cutting often revolve around enhancing automation, predictive maintenance capabilities, and optimizing cutting paths for complex board layouts. Users frequently ask if AI can reduce material waste, improve yield rates on highly intricate designs, and automate quality control inspections post-depaneling. Key themes summarized from these inquiries include the expectation that AI will move beyond simple robotics control to provide real-time process optimization, failure prediction based on operational anomalies (vibration, heat), and intelligent decision-making regarding tool wear and calibration. There is significant interest in AI's role in analyzing heterogeneous input data (CAD files, sensor data, production history) to instantaneously adjust cutting parameters, ensuring consistent quality across varied substrate types and high-mix, low-volume production runs.

- AI-powered Vision Systems: Enhancing defect detection post-cut (micro-cracks, burrs) and automating precise alignment correction.

- Predictive Maintenance (PdM): Utilizing machine learning algorithms to analyze sensor data (temperature, motor current, vibration) to forecast potential equipment failure, maximizing uptime.

- Optimal Path Planning: Employing AI to dynamically calculate the most efficient, stress-minimizing cutting routes for complex board geometries, especially crucial for maximizing throughput in laser systems.

- Adaptive Process Control: Real-time adjustment of cutting speeds, laser power, or router feed rates based on material response and immediate quality feedback loop analysis.

- Tool Wear Management: ML models predicting the lifespan of mechanical router bits based on material cut, depth, and duration, optimizing replacement cycles to maintain cut quality.

DRO & Impact Forces Of PCB Cutting Equipment Market

The dynamics of the PCB Cutting Equipment Market are profoundly shaped by a confluence of driving factors, critical restraints, and emerging opportunities, collectively defining the competitive landscape. Primary drivers include the global expansion of 5G networks, demanding high volumes of advanced circuit boards; the automotive industry's electrification trend, requiring robust and specialized cutting for harsh environment PCBs; and continuous miniaturization in consumer electronics, which necessitates the precision offered by non-contact methods. The increased focus on process automation and the adoption of Industry 4.0 standards across manufacturing facilities further amplify the demand for integrated, smart cutting solutions that minimize human intervention and maximize data reporting capabilities. These forces collectively push manufacturers toward technological adoption that prioritizes speed and fidelity.

Conversely, significant restraints hinder growth, notably the high initial capital expenditure associated with advanced cutting systems, particularly high-power laser depaneling equipment, making adoption challenging for smaller manufacturers or those in emerging markets. Technical restraints include the potential for thermal stress or carbonization when using certain laser systems on specific materials, requiring sophisticated cooling and gas extraction infrastructure. Furthermore, the specialized skillset required for operating, maintaining, and programming these complex machines poses a labor constraint globally. The ongoing volatility in raw material prices for machine components and supply chain disruptions affecting lead times for high-precision optics and automation parts also introduce market friction.

Opportunities abound, primarily focused on the untapped potential in flexible PCB (FPCB) and rigid-flex board manufacturing, where mechanical cutting is inadequate, creating a strong niche for laser systems. The development of hybrid cutting equipment that combines mechanical pre-scoring with laser finishing offers versatility and cost-efficiency. Expansion into additive manufacturing support (3D printed electronics) and developing equipment capable of handling novel substrate materials (like ceramic and metal-core PCBs) represents significant avenues for future growth. The intensifying need for traceability and quality assurance also presents an opportunity for integrating advanced metrology and data analytics tools directly into the cutting process, transforming the equipment from a simple cutting tool into an intelligent manufacturing station.

Segmentation Analysis

The PCB Cutting Equipment market segmentation provides a granular view of the diverse technological approaches and application sectors driving market demand. The market is primarily categorized based on the cutting technology employed—distinguishing between mechanical, laser, and other nascent methods—and the degree of automation achieved, reflecting varying production requirements from high-volume standardized output to low-volume, high-mix custom production. Further segmentation by the target application helps identify specific industrial demands, such as the stringent reliability requirements of automotive electronics versus the high-throughput needs of standard consumer devices, offering manufacturers critical insights into product development strategies and market penetration priorities.

The mechanical segment includes traditional routing and V-scoring machines, which are favored for their low operational cost and suitability for standard, rigid PCBs. However, the laser segment, encompassing CO2, UV, and fiber lasers, is rapidly dominating high-precision, complex, and flexible board cutting. Analyzing these segments is crucial as it reveals a clear transition: while mechanical methods maintain a large installed base, future investment and growth are heavily concentrated in non-contact laser technology due to its ability to handle miniaturization and delicate component placement without mechanical stress. The level of automation (manual, semi-automated, fully automated) dictates the investment scale and labor efficiency within a manufacturing facility, with fully automated solutions becoming the benchmark for Tier 1 electronics manufacturers seeking maximum productivity.

- By Cutting Technology:

- Mechanical Router

- V-Scoring Machine

- Laser Depaneling Systems

- CO2 Laser

- UV Laser

- Fiber/Picosecond/Femtosecond Laser

- Punching/Shearing Equipment

- By Automation Level:

- Manual/Benchtop

- Semi-Automated Systems

- Fully Automated (In-Line) Systems

- By Application:

- Consumer Electronics

- Automotive Electronics

- Industrial Control and Automation

- Telecommunication (5G infrastructure)

- Aerospace and Defense

- Medical Devices

- Other Applications (LED lighting, Security)

- By End-Product Type:

- Rigid PCBs

- Flexible PCBs (FPC)

- Rigid-Flex PCBs

- HDI PCBs

Value Chain Analysis For PCB Cutting Equipment Market

The value chain for the PCB Cutting Equipment Market begins with specialized component suppliers, focusing on upstream analysis covering high-precision optics (for laser systems), specialized spindles and cutting tool materials (for mechanical systems), and sophisticated motion control systems (linear motors, robotics). These suppliers provide the foundational technology that determines the speed, accuracy, and reliability of the final equipment. The R&D phase involves continuous innovation in material science and software engineering to handle increasingly complex PCB substrates and component layouts. Key competitive advantages are derived from integrating proprietary control software and vision systems during the manufacturing stage of the equipment, ensuring optimal performance and user interface experience.

The midstream involves the Original Equipment Manufacturers (OEMs) who design, assemble, and test the cutting machinery. OEMs manage the critical supply chain of precision components and are responsible for system integration, compliance with safety standards (e.g., CE marking), and performance validation. Direct distribution channels are crucial for high-end laser systems, where OEMs provide extensive pre-sales consultation, customization, and post-installation training, emphasizing technical partnership with the end-user. Indirect channels, involving regional distributors and system integrators, are often utilized for standardized mechanical and lower-cost semi-automated equipment, leveraging local presence for sales and immediate technical support.

Downstream analysis focuses on the end-users—the PCB fabricators and electronics contract manufacturers (CMs). The operational success of the equipment is highly dependent on maintenance contracts, spare parts availability (especially consumables like router bits or laser optics), and software upgrades to adapt to new PCB technologies. The lifecycle management of the equipment, including decommissioning or trade-ins, concludes the value chain. Effective distribution ensures global reach; however, the complex nature of the machinery means that technical service and support networks often become the most critical element of the downstream value proposition, driving repeat business and maintaining customer loyalty, particularly in regions with high manufacturing density like APAC.

PCB Cutting Equipment Market Potential Customers

The primary end-users or buyers of PCB cutting equipment are high-volume electronics contract manufacturers (CMs/EMS providers) and specialized Printed Circuit Board fabrication houses globally. These entities require robust, high-throughput systems capable of handling a diverse mix of board materials and geometries while adhering to strict quality control standards. Tier 1 contract manufacturers, such as Foxconn and Flextronics, represent the largest customer base, prioritizing fully automated, integrated systems that align with their vast, global production infrastructure and stringent efficiency metrics, often favoring advanced laser depaneling for high-value products.

Beyond the major CMs, the automotive supply chain—including Tier 1 suppliers like Bosch and Continental—is a rapidly expanding customer segment, specifically seeking highly reliable and precise cutting solutions for mission-critical components like engine control units (ECUs), sensor arrays, and battery management systems (BMS). This segment emphasizes traceability and zero-defect tolerance, driving demand for equipment integrated with sophisticated metrology. Furthermore, smaller, specialized manufacturers serving niche sectors like aerospace, defense, and high-end medical imaging equipment are critical customers for ultra-high precision, low-volume machines, where accuracy far outweighs speed as the purchasing determinant.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 580 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHUNK Electronic GmbH, Cencorp Automation, ASYS Group, LPKF Laser & Electronics, Sayaka Co., Ltd., Genitec Co., Ltd., IPTE, Mastech, Accura Automation, Keli, Jieli, Aurotek Corporation, Musashi Engineering, Universal Instruments, Han's Laser Technology Industry Group Co., Ltd., DISCO Corporation, TWS Automation, Hylax Technology, Depanelization Solutions Inc., Pemtron Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCB Cutting Equipment Market Key Technology Landscape

The technology landscape of the PCB Cutting Equipment Market is characterized by a significant bifurcation between traditional mechanical methods, which rely on physical contact, and modern laser-based systems, which offer non-contact precision. Mechanical routing, utilizing high-speed spindles and tungsten carbide router bits, remains prevalent for high-thickness, rigid PCBs requiring robust separation. V-scoring technology, another mechanical approach, uses rotary blades to create pre-scored lines for manual or mechanical snapping, valued for its speed and low operational cost in high-volume, lower-complexity applications. The innovation focus in mechanical systems is primarily on reducing vibration, improving dust extraction, and enhancing automated tool changes to maximize uptime and minimize debris contamination.

However, the industry standard for advanced cutting is rapidly shifting toward laser depaneling systems, necessitated by the proliferation of highly dense boards, flexible substrates, and the need to cut close to sensitive components. UV lasers (355nm wavelength) are dominant in this space, offering high precision with minimal heat-affected zones (HAZ) suitable for cutting organic PCB materials without carbonization. These systems are instrumental in handling flexible PCBs and complex, multi-layered rigid boards where mechanical stress must be avoided entirely. Fiber and emerging picosecond/femtosecond lasers represent the pinnacle of current technology, providing ultra-precise cutting for the thinnest, most delicate materials, including specialized substrates like ceramic and materials used in high-frequency applications, addressing the most demanding requirements of aerospace and 5G component manufacturing.

Integration of advanced machine vision and artificial intelligence (AI) is redefining the functionality of both mechanical and laser equipment. Modern systems incorporate high-resolution cameras for automatic fiducial recognition and highly precise alignment compensation, crucial for maintaining accuracy on large panels subject to thermal expansion. Furthermore, sophisticated control software enables dynamic adjustment of cutting parameters (e.g., speed ramping, power modulation) based on real-time feedback and pre-loaded CAD data, ensuring consistent quality across varied production runs. This move toward smart, connected equipment supports the broader Industry 4.0 goal of fully autonomous and optimized manufacturing lines, enhancing traceability and process control significantly.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for electronics manufacturing, dominating the PCB Cutting Equipment market both in terms of consumption volume and technological adoption speed. Driven by China, South Korea, Taiwan, and Japan, this region benefits from massive production volumes across consumer electronics, telecommunications (including 5G rollout), and high-volume automotive component manufacturing. The demand here is largely centered on high-throughput, fully automated laser depaneling systems and advanced mechanical routers to support massive scale and reduce labor costs. Market growth is sustained by continuous investment in new fabrication facilities and a rapid shift towards highly complex HDI and flexible PCBs.

- North America: This region is characterized by high demand for specialized, high-precision cutting solutions catering primarily to the aerospace, defense, medical device, and high-reliability industrial sectors. While overall volume is lower than APAC, the market value is sustained by premium pricing for technologically advanced systems, particularly picosecond and femtosecond laser cutters. North American manufacturers prioritize quality, traceability, and the integration of highly sophisticated software for compliance and process verification, often favoring localized service and customization over sheer speed.

- Europe: Similar to North America, the European market focuses on high-mix, medium-volume production with strong emphasis on industrial automation, automotive electronics, and specialized high-tech products. Germany and Italy are major hubs for adopting automated equipment. Regulatory compliance, particularly related to environmental impact and worker safety, drives the adoption of advanced laser systems that offer clean cutting processes and superior dust/fume extraction, pushing mechanical methods towards cleaner, enclosed designs. The strong presence of leading industrial automation companies further drives the integration of cutting equipment into seamless production lines.

- Latin America, Middle East, and Africa (LAMEA): These regions represent emerging markets characterized by growing industrialization and increasing domestic electronics assembly activities. Current demand often favors cost-effective mechanical routing and V-scoring machines for basic consumer and industrial products. However, specific countries, notably Mexico (due to its proximity to the North American supply chain) and certain Gulf states (investing in high-tech infrastructure), are beginning to adopt semi-automated and specialized laser cutting solutions, signaling future growth potential as manufacturing complexity increases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCB Cutting Equipment Market.- SCHUNK Electronic GmbH

- LPKF Laser & Electronics

- Cencorp Automation

- ASYS Group

- Sayaka Co., Ltd.

- Genitec Co., Ltd.

- IPTE

- Mastech

- Accura Automation

- Keli

- Jieli

- Aurotek Corporation

- Musashi Engineering

- Universal Instruments

- Han's Laser Technology Industry Group Co., Ltd.

- DISCO Corporation

- TWS Automation

- Hylax Technology

- Depanelization Solutions Inc.

- Pemtron Co., Ltd.

- Bodor Laser

- Precision Tool & Die, Inc.

- Vision Systems International

- Laser Photonics

Frequently Asked Questions

Analyze common user questions about the PCB Cutting Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser depaneling over mechanical routing?

Laser depaneling offers non-contact cutting, eliminating mechanical stress, reducing dust/debris contamination, and providing superior precision for cutting complex shapes and flexible PCBs (FPC). It is essential for components placed close to the board edge and results in a smaller Heat Affected Zone (HAZ) with modern UV or picosecond lasers compared to traditional routing.

Which PCB Cutting Equipment technology is best suited for high-density interconnect (HDI) PCBs?

UV laser depaneling systems are ideally suited for HDI PCBs. Their short wavelength allows for precise material ablation with minimal thermal damage to the multiple thin layers and delicate components characteristic of HDI boards, ensuring structural integrity and high yield rates necessary for these advanced products.

How does the shift to electric vehicles (EVs) impact the demand for PCB cutting equipment?

The EV shift significantly increases demand for highly reliable, large-format PCB cutting for power electronics (inverters, BMS). This necessitates robust, high-accuracy equipment, often favoring automated laser systems or heavy-duty mechanical routers capable of handling thick, multi-layered metal-core PCBs required for battery management and charging infrastructure with stringent safety standards.

What key factors should manufacturers consider when choosing between semi-automated and fully automated cutting systems?

Manufacturers must consider production volume, labor costs, required output consistency, and integration capability (Industry 4.0 compatibility). Fully automated systems are preferred for high-volume, standardized production runs requiring maximum efficiency and minimal human intervention, while semi-automated systems offer flexibility and lower initial capital expenditure for lower-volume or high-mix production environments.

Is the PCB Cutting Equipment Market expected to consolidate due to technological specialization?

Yes, specialization, particularly in high-precision laser technology, is driving market consolidation. Larger players are acquiring smaller, innovative firms specializing in optics or software integration to offer comprehensive, high-end automated solutions, creating fewer, but larger, dominant market participants capable of serving global Tier 1 manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager