PCB Cutting Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435700 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

PCB Cutting Machine Market Size

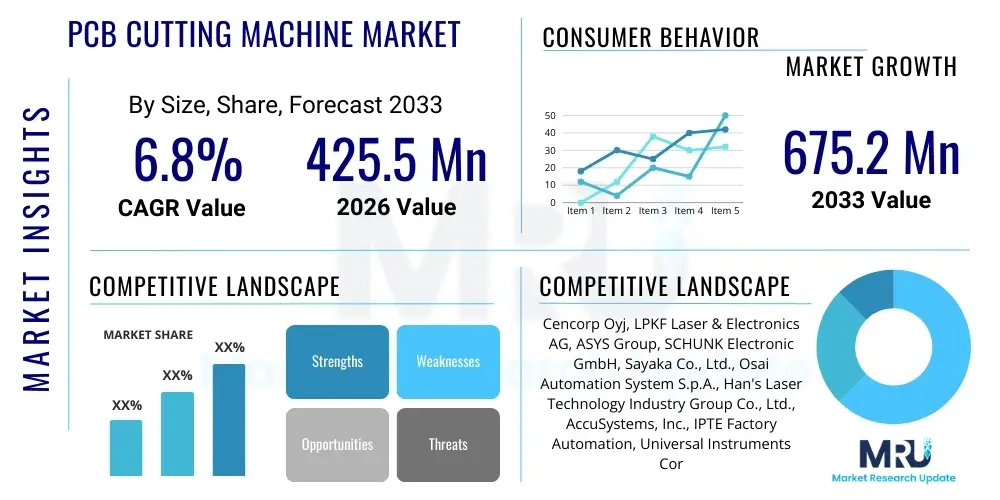

The PCB Cutting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $425.5 Million in 2026 and is projected to reach $675.2 Million by the end of the forecast period in 2033.

PCB Cutting Machine Market introduction

The Printed Circuit Board (PCB) Cutting Machine Market encompasses specialized equipment designed for the precise separation of individual PCB units from a large manufactured panel, a process often referred to as depaneling. This crucial stage in electronics manufacturing requires high accuracy to prevent damage to sensitive components and maintain the structural integrity of the final product. Key technologies employed include mechanical methods (routing, punching, V-cut/V-groove scoring), and advanced non-contact methods, predominantly laser cutting (UV, CO2, fiber lasers). The choice of machine depends heavily on the PCB material, board thickness, component density, required throughput, and the necessary degree of stress avoidance during separation.

These machines are integral to industries demanding highly complex and miniaturized electronic devices, such as consumer electronics (smartphones, wearables), automotive electronics (ADAS, infotainment systems), industrial automation, medical devices, and aerospace and defense. Modern PCB cutting solutions offer significant benefits, including superior positional accuracy, minimized mechanical stress on delicate components like surface-mounted devices (SMDs), reduced dust generation, and high operational speed. Furthermore, the shift towards flexible PCBs (FPC) and high-density interconnect (HDI) boards necessitates the adoption of high-precision laser cutting systems, which are capable of handling intricate outlines and delicate substrates without physical contact, thereby preserving high manufacturing yields.

Driving factors for this market include the global expansion of the 5G infrastructure, leading to increased demand for high-frequency PCBs; the relentless trend toward device miniaturization, which requires ultra-precise cutting tolerances; and the accelerating adoption of IoT and embedded systems across all industrial sectors. Continuous technological advancements, particularly in automated material handling, vision inspection systems, and sophisticated laser source technologies, are further propelling market growth by enhancing efficiency and adaptability to diverse PCB fabrication requirements.

PCB Cutting Machine Market Executive Summary

The PCB Cutting Machine Market is characterized by a significant technological transition, moving away from traditional mechanical methods toward highly precise, automated laser depaneling systems, driven primarily by the rising complexity and density of modern electronic components. Key business trends indicate strong investment in advanced automation features, including integrated robotics for loading/unloading and sophisticated computer vision systems for precise fiducial recognition and defect detection, aiming to minimize human intervention and maximize operational uptime. Furthermore, sustainability initiatives are influencing design, pushing manufacturers towards systems that minimize waste and energy consumption, especially in mechanical routing where dust management and bit wear are critical operational concerns. The competitive landscape is intensely focused on innovation in laser sources, particularly in the realm of picosecond and femtosecond lasers, to achieve cleaner cuts with minimal heat-affected zones (HAZ) on thermally sensitive materials.

Regionally, the Asia Pacific (APAC) continues its dominance, underpinned by its status as the global manufacturing hub for electronics, particularly in countries like China, South Korea, Taiwan, and Japan. The rapid expansion of consumer electronics manufacturing and the burgeoning electric vehicle (EV) sector in APAC are fueling the immediate demand for high-throughput, precision cutting machinery. North America and Europe, while smaller in volume, represent premium markets focused on advanced, high-reliability applications such as aerospace, defense, and sophisticated medical instrumentation, where highly controlled laser depaneling is mandatory. These mature regions emphasize customization, integration capability within smart factories (Industry 4.0), and stringent compliance with quality standards.

Segment trends highlight the mechanical cutting segment maintaining a foundational market share for standard, less complex PCBs, benefiting from lower initial costs. However, the laser cutting segment, particularly Ultraviolet (UV) laser systems, exhibits the highest Compound Annual Growth Rate (CAGR). This acceleration is due to UV lasers' exceptional ability to process a wide array of rigid, flexible, and rigid-flex materials with high precision and low mechanical stress, making them indispensable for HDI and FPC manufacturing. Segment growth is also notable in the automotive sector, driven by the massive integration of electronics required for autonomous driving and safety features, demanding robust and reliable PCB depaneling solutions suitable for high-volume, continuous operation.

AI Impact Analysis on PCB Cutting Machine Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the PCB cutting machine market primarily revolve around optimizing manufacturing efficiency, enhancing quality control, and enabling predictive maintenance. Users frequently ask how AI can refine complex cutting paths to minimize material waste and cutting time, especially for intricate flexible circuits. A major concern is the application of AI in real-time defect detection—identifying micro-cracks or delamination immediately during or after the cutting process, surpassing the speed and accuracy of traditional vision systems. Furthermore, there is significant interest in using ML algorithms to predict tooling or laser source degradation, allowing for scheduled, condition-based maintenance rather than reactive repairs, thus maximizing machine uptime and overall equipment effectiveness (OEE). The overarching theme is leverage AI to transition PCB depaneling from a purely mechanical or laser process into an intelligent, self-optimizing manufacturing stage within the context of Industry 4.0.

- Quality Control and Defect Detection: AI-powered vision systems utilize deep learning to analyze high-resolution images of cut edges, identifying subtle defects (e.g., burrs, chipping, thermal damage) far more accurately than rule-based systems, ensuring compliance with stringent quality standards.

- Predictive Maintenance (PdM): ML models analyze sensor data (vibration, temperature, power consumption, laser intensity) to anticipate component failures, such as router bit wear or laser source instability, scheduling maintenance proactively and reducing unplanned downtime.

- Cutting Path Optimization: AI algorithms dynamically optimize the cutting sequence and path layout based on the specific geometry of the PCB panel, minimizing travel distance, reducing cycle time, and maximizing panel utilization (yield optimization).

- Process Parameter Tuning: AI/ML systems automatically adjust key operational parameters (laser power, speed, focus depth) in real-time based on material variations or environmental changes, ensuring consistent cut quality across entire production batches.

- Automated Material Handling Integration: AI facilitates seamless communication and coordination between the cutting machine and robotic loading/unloading systems, improving throughput and operational autonomy within fully automated assembly lines.

DRO & Impact Forces Of PCB Cutting Machine Market

The dynamics of the PCB Cutting Machine Market are shaped by powerful forces driving adoption alongside significant operational and financial constraints, balanced by emerging opportunities rooted in technological advancements. The primary driving force is the global proliferation of electronic devices demanding high-density and flexible PCBs, necessitating ultra-precise, low-stress cutting technologies like UV lasers. Restraints, however, include the substantial capital investment required for high-end laser systems and the associated technical complexity and maintenance costs, which can be prohibitive for smaller manufacturers. Opportunities are particularly strong in developing automated solutions compatible with Industry 4.0 architectures and leveraging advanced laser technologies, such as picosecond lasers, to process novel, heat-sensitive substrates like Liquid Crystal Polymer (LCP) and specialized composite materials used in 5G applications. The overall impact force matrix suggests a moderately high positive trajectory, where technological drivers and market demand significantly outweigh the capital expenditure restraints.

Drivers: The explosive growth in end-user applications, particularly electric vehicles (EVs), Internet of Things (IoT) devices, and the deployment of 5G networks, is fueling demand for reliable, high-speed PCB production. Miniaturization mandates are forcing manufacturers to adopt laser cutting, as mechanical methods induce excessive stress on densely populated boards. Furthermore, the increasing complexity of flexible and rigid-flex PCBs, which require non-contact separation methods to maintain material integrity, is a critical market accelerant. The continuous need for improved manufacturing yield and reduced operational stress on components is pushing investment toward automated, high-precision depaneling solutions.

Restraints: The high initial procurement cost associated with advanced laser cutting machines, particularly those utilizing high-power UV or ultrashort pulse lasers, acts as a significant barrier to entry, especially for small and medium enterprises (SMEs). Operational challenges such as managing heat-affected zone (HAZ) when using CO2 or fiber lasers on certain polymers, and the complexity involved in programming and maintaining highly automated systems, also constrain widespread adoption. Additionally, mechanical depaneling methods, despite their inherent stress risk, remain cost-effective for legacy and high-volume, low-complexity boards, slowing the full transition to laser technology in all market segments.

Opportunities: Major opportunities exist in the development of hybrid cutting systems that combine laser precision with mechanical speed for specific applications, offering versatility and optimized throughput. The expansion into processing advanced materials like ceramics, specialized high-frequency laminates, and new flexible substrates offers new revenue streams. Furthermore, integrating advanced machine vision and AI for automated quality verification and self-optimization presents a fertile ground for innovation and market differentiation. Growing demand for systems compliant with 'clean room' standards in the medical device and aerospace industries provides specialized, high-margin opportunities.

Impact Forces Summary:

- Driver Impact: High (Driven by 5G, IoT, and Automotive Electronics)

- Restraint Impact: Medium (High Capital Cost and Technical Complexity)

- Opportunity Impact: High (Adoption of Advanced Laser Technology and Industry 4.0 Integration)

- Overall Market Impact: Moderately Positive Growth

Segmentation Analysis

The PCB Cutting Machine Market is primarily segmented based on the type of cutting technology employed, which dictates the precision, speed, and material compatibility of the system, and by the end-use application, which defines the required throughput and quality standards. The segmentation by technology is crucial as it reflects the major evolutionary trend in manufacturing, pivoting towards non-contact methods. Laser cutting, encompassing UV, CO2, and fiber lasers, is the fastest-growing segment due to its unparalleled precision for processing complex, densely populated, and flexible PCBs. Mechanical methods, including routing and V-groove scoring, remain essential for robust, high-volume production of standard boards where component sensitivity is less critical. Analyzing these segments provides deep insight into current industry preferences and future investment trajectories across different manufacturing environments.

- By Type of Technology:

- Laser Cutting Machines (UV Laser, CO2 Laser, Fiber Laser, Picosecond/Femtosecond Laser)

- Mechanical Cutting Machines (Router/Milling, V-Groove Scorer, Punching/Die Cut)

- Waterjet Cutting Machines (Niche applications)

- By Automation Level:

- Manual/Semi-Automatic Machines

- Fully Automatic/In-line Machines

- By End-Use Application:

- Consumer Electronics (Smartphones, Wearables, Laptops)

- Automotive Electronics (ADAS, ECU, Infotainment)

- Industrial Electronics (Automation Control, Power Supplies, Instrumentation)

- Aerospace and Defense

- Medical Devices

- Telecommunications (5G Infrastructure)

Value Chain Analysis For PCB Cutting Machine Market

The value chain of the PCB Cutting Machine Market begins with upstream suppliers providing critical raw materials and specialized components, followed by machine manufacturers who integrate these components into complex systems. The upstream segment is dominated by suppliers of high-precision components such as specialized laser sources (e.g., solid-state UV lasers), advanced motion control systems (linear motors, high-resolution encoders), optical components, and industrial automation software. The quality and reliability of these upstream inputs directly determine the performance and lifespan of the final cutting machine. Effective supplier relationship management, focusing on consistent quality and rapid component innovation, is a key success factor in this market.

Midstream activities involve the Original Equipment Manufacturers (OEMs) who design, assemble, and test the PCB cutting machines. This stage involves complex engineering tasks, including software development for machine control, vision system integration, and ensuring compliance with safety and environmental standards. OEMs differentiate themselves through technological superiority, particularly in laser beam shaping, process control accuracy, and the implementation of user-friendly human-machine interfaces (HMIs). Following manufacturing, the distribution channel handles market penetration. Distribution occurs through both direct sales, particularly for high-value, customized laser systems sold to Tier 1 electronics manufacturers, and indirect sales via regional distributors and system integrators who provide local support, maintenance, and training services. Direct sales allow manufacturers better control over client relationships and technical feedback, while indirect channels provide wider geographical reach.

Downstream consists of the end-users—the PCB fabrication houses and electronics assembly manufacturers across various industry sectors (Consumer Electronics, Automotive, Telecom). The success of the downstream operation hinges on the machine's throughput, precision, and reliability, as depaneling bottlenecks can severely impact the entire assembly line efficiency. Potential customers prioritize machines that offer seamless integration into existing SMT (Surface Mount Technology) lines and demonstrate low Total Cost of Ownership (TCO). Value-added services such as specialized maintenance contracts, application engineering support, and rapid spare parts availability are crucial determinants of purchasing decisions in the downstream market segment.

PCB Cutting Machine Market Potential Customers

The primary consumers and end-users of PCB cutting machines are diverse entities involved in the production and assembly of electronic components, requiring high-precision separation capabilities. These potential customers include dedicated PCB Fabrication Houses (or PCB manufacturers) which handle the raw board production, and Electronics Manufacturing Service (EMS) providers (contract manufacturers) and Original Equipment Manufacturers (OEMs) who integrate these depaneling machines into their sophisticated SMT assembly lines. These organizations seek solutions that can handle increasingly complex board designs, including flexible circuits, high-layer-count boards, and boards densely populated with micro-components, all while ensuring minimal mechanical or thermal stress.

Specific customer segments exhibiting high current and future demand are global Tier 1 electronics companies specializing in high-volume production of smartphones, tablets, and wearables, necessitating extremely high-speed and accurate laser cutting systems. The automotive sector, including specialized Tier 1 automotive component suppliers, forms another critical customer base, driven by the need for highly reliable, traceable cutting processes for safety-critical components like engine control units (ECUs) and Advanced Driver-Assistance Systems (ADAS) sensors. Furthermore, specialized manufacturers in the medical device and aerospace/defense industries represent high-value customers, prioritizing machines offering ultra-high precision, validation capability, and processing techniques suitable for exotic, sensitive materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $425.5 Million |

| Market Forecast in 2033 | $675.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cencorp Oyj, LPKF Laser & Electronics AG, ASYS Group, SCHUNK Electronic GmbH, Sayaka Co., Ltd., Osai Automation System S.p.A., Han's Laser Technology Industry Group Co., Ltd., AccuSystems, Inc., IPTE Factory Automation, Universal Instruments Corporation, TRIUMPH-SMC, Inc., MKS Instruments, Inc. (ESI), Orbotech Ltd. (KLA), V-TEK International, Keliang Electronics Co., Ltd., JFE Engineering Corporation, Wuxi Lead Intelligent Equipment Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, TSM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCB Cutting Machine Market Key Technology Landscape

The technological landscape of the PCB Cutting Machine Market is rapidly evolving, moving decisively toward advanced, high-precision, non-contact methods to meet the strict requirements of modern electronics manufacturing. The dominant trend is the proliferation of laser-based systems, with UV lasers currently holding a pivotal position. UV laser technology (typically 355 nm wavelength) is highly favored because its shorter wavelength provides superior resolution and minimal thermal impact (cold ablation) on the substrate, making it ideal for cutting sensitive organic materials, flexible PCBs (FPCs), and high-density interconnect (HDI) boards without causing significant charring or micro-cracks. This technological shift is directly correlated with the rise of miniaturized electronics and the abandonment of mechanical stress-inducing separation techniques.

Beyond standard UV lasers, the frontier of innovation lies in Ultrashort Pulse (USP) lasers, specifically picosecond and femtosecond lasers. These systems offer unparalleled precision and virtually eliminate the Heat-Affected Zone (HAZ), enabling the clean processing of highly sensitive materials and complex multi-layer substrates, including specialized ceramic and glass-reinforced laminates increasingly used in high-frequency 5G applications. While the initial investment for USP lasers is significantly higher, their capacity for handling complex, high-value PCBs with zero damage justifies the cost for leading manufacturers in the medical, aerospace, and high-end automotive sectors. Simultaneously, the older mechanical cutting technologies, such as V-groove scoring and routing, are undergoing enhancements through improved tooling materials, sophisticated dust extraction systems, and integration with advanced machine vision systems to optimize path planning and component clearance checks, ensuring they remain viable for less complex, high-volume board separation.

Integration of intelligent automation and advanced control software represents another critical technological vector. Modern machines incorporate sophisticated vision systems, often employing high-resolution cameras and AI/ML algorithms, to accurately locate fiducial marks, compensate for material shift, and perform real-time quality inspection of the cut edges. Furthermore, the incorporation of high-speed linear motors for motion control ensures high accuracy and speed necessary for industrial-scale throughput. Connectivity, adhering to Industry 4.0 standards (e.g., SEMI standards, MQTT protocols), allows these cutting machines to communicate seamlessly with upstream and downstream equipment, facilitating remote diagnostics, predictive maintenance scheduling, and comprehensive data analysis to optimize the entire manufacturing process chain, cementing the machine’s role as an intelligent node within the smart factory environment.

- UV Laser Technology: Preferred method for FPC and HDI boards; characterized by cold ablation and high precision, minimizing damage to sensitive components.

- Ultrashort Pulse (USP) Lasers: Includes picosecond and femtosecond lasers; highest precision, zero HAZ, critical for exotic and highly sensitive materials in aerospace and medical devices.

- Advanced Motion Control: Utilization of linear motors and high-resolution optical encoders to achieve rapid movement and sub-micron positioning accuracy, crucial for high throughput.

- Machine Vision and AI: Integrated high-resolution cameras for fiducial recognition, automated alignment correction, and AI-driven quality inspection (defect detection).

- Software and Connectivity (Industry 4.0): Implementation of sophisticated control software for path optimization, remote monitoring, and integration into manufacturing execution systems (MES).

Regional Highlights

The global PCB Cutting Machine Market exhibits pronounced regional variations driven by differing manufacturing capacities, technological maturity, and end-user market saturation. The Asia Pacific (APAC) region stands as the undisputed market leader, accounting for the largest share of revenue and volume. This dominance is attributable to the region’s massive concentration of electronics manufacturing hubs, particularly in China, Taiwan, South Korea, and Japan, which produce the vast majority of consumer electronics, IT hardware, and increasingly, automotive electronics. The ongoing government investments in high-tech manufacturing and the rapid expansion of 5G infrastructure deployment ensure a consistently high demand for high-throughput, precision cutting machines, especially advanced laser systems capable of handling complex multilayer and flexible PCBs. Furthermore, the competitive nature of the regional EMS market drives continuous investment in cutting-edge equipment to enhance efficiency and maintain cost competitiveness.

North America is characterized by high investment in advanced, high-reliability applications, focusing on aerospace, defense, medical devices, and high-performance computing (HPC). While manufacturing volumes are lower than in APAC, the region commands a high average selling price (ASP) for cutting equipment, as manufacturers demand machines capable of processing specialized, high-cost materials with zero defects and high traceability. North American end-users are early adopters of the most sophisticated technologies, such as femtosecond laser systems and comprehensive AI-integrated quality control solutions. The emphasis here is on precision engineering and stringent quality compliance rather than sheer volume throughput.

Europe represents a stable and mature market, driven by automotive manufacturing standards, industrial automation, and high-quality medical device production. European demand is focused on robust, highly automated, and energy-efficient cutting solutions. Countries like Germany and Italy prioritize integrating PCB cutting machines into highly automated, integrated production lines aligned with the principles of Industry 4.0. The market growth in Europe is moderate but consistent, underpinned by strict environmental and operational standards that favor technologically compliant, highly reliable equipment from established vendors. Latin America and the Middle East & Africa (MEA) are emerging markets, showing gradual growth driven by localized electronics assembly and infrastructure projects, relying primarily on imported equipment and offering potential for entry-level and mid-range mechanical cutting systems initially, followed by increasing adoption of laser technology as local manufacturing sophistication rises.

- Asia Pacific (APAC): Dominant market share; driven by high-volume manufacturing of consumer electronics and automotive components; high adoption rate of UV laser technology.

- North America: Focus on high-reliability, low-volume applications (Aerospace, Defense, Medical); high adoption of Ultrashort Pulse laser systems and advanced automation.

- Europe: Stable growth driven by automotive electronics and industrial automation sectors; strong emphasis on Industry 4.0 integration and environmental compliance.

- China: Primary growth engine within APAC due to massive electronics production capacity and state-backed manufacturing expansion initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCB Cutting Machine Market.- LPKF Laser & Electronics AG

- Cencorp Oyj

- Han's Laser Technology Industry Group Co., Ltd.

- MKS Instruments, Inc. (ESI)

- ASYS Group

- SCHUNK Electronic GmbH

- Sayaka Co., Ltd.

- Orbotech Ltd. (KLA Corporation)

- Osai Automation System S.p.A.

- AccuSystems, Inc.

- IPTE Factory Automation

- Universal Instruments Corporation

- TRIUMPH-SMC, Inc.

- Wuxi Lead Intelligent Equipment Co., Ltd.

- Keliang Electronics Co., Ltd.

- JFE Engineering Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Tucal Technology S.L.

- Vision Systems International

Frequently Asked Questions

Analyze common user questions about the PCB Cutting Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from mechanical cutting to laser depaneling technology?

The primary driver is the pervasive trend toward miniaturization and high component density in modern PCBs (HDI, flexible PCBs). Mechanical cutting induces significant stress, risking damage to sensitive, closely placed components. Laser depaneling, particularly using UV lasers, offers non-contact, high-precision separation with minimal mechanical stress and negligible heat-affected zones (HAZ), crucial for maintaining high manufacturing yields.

Which type of laser cutting machine offers the highest precision for specialized and sensitive PCB materials?

Ultrashort Pulse (USP) lasers, including picosecond and femtosecond systems, offer the highest precision. These lasers perform "cold ablation," removing material through non-thermal processes, effectively eliminating the HAZ. This capability is essential for processing specialized, thermally sensitive materials such as polyimides, ceramics, and advanced composites used in aerospace and high-frequency communication electronics.

How is Industry 4.0 affecting the design and operation of new PCB cutting machines?

Industry 4.0 mandates are driving the integration of cutting machines into centralized manufacturing execution systems (MES). This includes incorporating smart sensors, high-speed communication protocols, and AI-driven control software for real-time performance monitoring, predictive maintenance, automated process optimization, and seamless robotic material handling, significantly enhancing overall line efficiency and autonomy.

What are the key application segments contributing most significantly to market revenue growth?

The Consumer Electronics segment (driven by smartphones and wearables) and the Automotive Electronics segment (driven by ADAS and EV components) are the primary revenue drivers. Both segments require high volumes of complex, reliable PCBs that necessitate advanced, high-precision cutting technologies, especially UV and ultrashort pulse laser systems, ensuring consistent quality and high throughput.

What is the main financial barrier to entry for adopting advanced PCB cutting technology?

The high initial capital investment (CapEx) for fully automated, high-precision laser cutting systems is the main financial barrier. These systems require specialized laser sources (e.g., UV or USP lasers) and complex motion control components, resulting in significantly higher procurement costs compared to traditional mechanical routing or scoring machines, limiting adoption among smaller manufacturing operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager