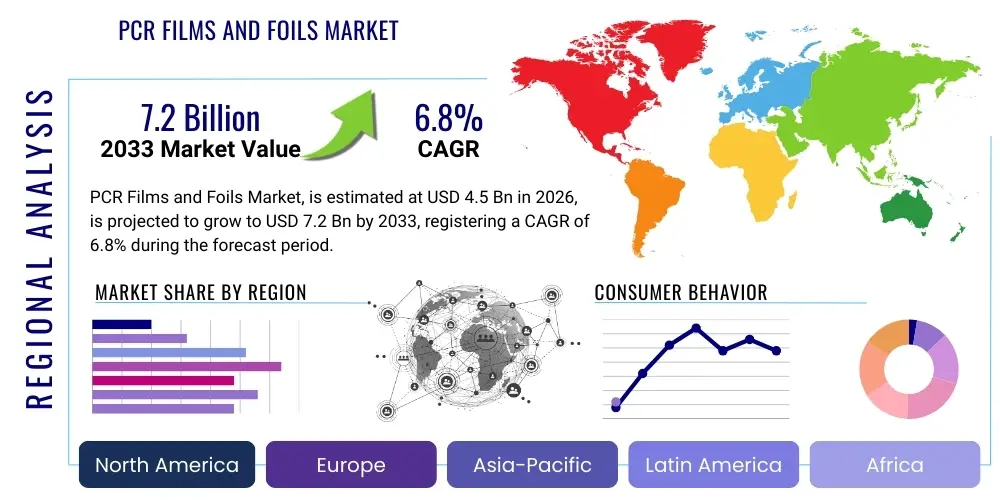

PCR Films and Foils Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438413 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

PCR Films and Foils Market Size

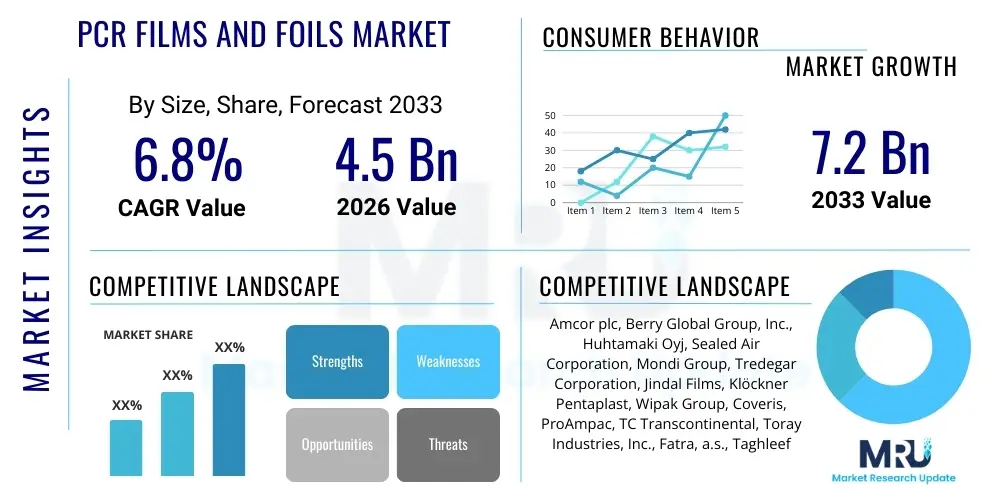

The PCR Films and Foils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

The substantial growth trajectory is underpinned by increasing global legislative pressure, particularly in Europe and North America, mandating the inclusion of Post-Consumer Recycled (PCR) content in packaging materials. This regulatory environment, combined with aggressive corporate sustainability commitments from major brand owners, is forcing a rapid transition away from virgin plastics. The quantifiable market expansion reflects the necessary capital investments in advanced recycling infrastructure, including enhanced sorting and chemical depolymerization capabilities, crucial for producing high-quality films and foils suitable for sensitive applications like food contact.

Furthermore, technological advancements are mitigating historical challenges associated with PCR materials, such as reduced mechanical performance and inconsistent color or clarity. Innovations in multi-layer co-extrusion and barrier technologies now allow PCR films to meet demanding performance specifications required in high-speed automated packaging processes. This functional parity, coupled with the significant environmental benefit, positions PCR films and foils as the preferred sustainable packaging solution across key end-use industries, including Fast-Moving Consumer Goods (FMCG), pharmaceuticals, and e-commerce logistics.

PCR Films and Foils Market introduction

The PCR Films and Foils Market involves the production and distribution of thin polymer sheets derived from plastic waste collected after consumer use. These materials are instrumental in achieving circular economy goals by substituting virgin polymers with recycled content, drastically lowering the carbon footprint associated with packaging manufacturing. Products range from high-performance flexible films used in pouches and sachets to rigid foils utilized in blister packs and trays, primarily serving the packaging sector. Major applications include barrier packaging for food and beverages, protective layers for personal care products, and industrial wraps, driven by enhanced public awareness regarding plastic pollution and global initiatives to reduce dependency on fossil-fuel-derived plastics.

The primary benefits of adopting PCR films and foils extend beyond environmental compliance, offering brands a competitive edge through improved corporate reputation and alignment with consumer values. Driving factors for market acceleration include European Union directives setting mandatory targets for recycled content, especially in beverage bottles and general packaging, alongside significant R&D investments aimed at scaling up chemical recycling, which allows for the production of food-grade quality PCR polymers. The market is characterized by high demand concentration among large global packaging converters and CPG companies seeking reliable, high-volume supply chains for verified recycled materials.

This market segment is increasingly complex due to evolving material certification requirements (e.g., ISCC PLUS) and the need for robust traceability throughout the supply chain. While PET and PE remain the dominant polymer types due to established recycling streams, innovation in PP and PS recycling is expanding the application scope of PCR foils. The integration of advanced sorting techniques utilizing AI and machine vision further enhances the purity and consistency of feedstock, directly impacting the quality and viability of the resulting films and foils, thereby supporting high-end packaging applications previously inaccessible to recycled materials.

PCR Films and Foils Market Executive Summary

The PCR Films and Foils Market is undergoing a rapid transition driven by profound shifts in regulatory mandates and corporate environmental stewardship. Business trends highlight a strong movement towards vertical integration among recycling firms, polymer producers, and converters to secure reliable access to high-quality feedstock, mitigating volatility in recycled plastic pricing. Mergers and acquisitions focusing on bolstering chemical recycling capabilities are prevalent, signifying the industry’s commitment to achieving closed-loop material cycles for difficult-to-recycle flexible packaging. Furthermore, brand owners are entering long-term supply agreements, fostering market stability and providing the necessary confidence for infrastructure investments.

Regionally, Europe maintains market dominance due to early and stringent implementation of the Circular Economy Action Plan, particularly the Plastic Packaging Tax and mandated recycled content targets, driving innovation in film-to-film recycling. Asia Pacific is emerging as the fastest-growing region, powered by large-scale governmental investment in waste management infrastructure, particularly in countries like China, India, and Japan, responding to increased domestic consumption and export demands for sustainable packaging. North America exhibits strong growth, largely catalyzed by voluntary commitments from major FMCG companies and regulatory initiatives at the state level, particularly in California and Washington, focusing on minimum post-consumer content requirements.

Segmentation trends indicate flexible films hold the largest market share, driven by their pervasive use in lightweight packaging, though rigid foils are experiencing accelerated demand in healthcare and durable goods sectors where aesthetic and barrier properties are crucial. By material, PCR PET dominates due to its mature collection infrastructure, but PCR PE and PP segments are projected to see the highest growth rates, spurred by improved pyrolysis and advanced sorting technologies making these historically challenging polyolefins viable for high-value applications. The food packaging application remains the largest and most scrutinized segment, requiring substantial investment in decontamination processes to ensure food safety compliance.

AI Impact Analysis on PCR Films and Foils Market

User queries regarding the impact of Artificial Intelligence (AI) on the PCR Films and Foils Market primarily center on optimizing the feedstock supply chain, enhancing material quality verification, and predicting market price volatility. Users are concerned with how AI can revolutionize the efficiency of waste sorting—the bottleneck of the recycling value chain—and whether AI-driven analytics can guarantee the purity and traceability of PCR resins to meet stringent food-grade standards. Expectations involve AI systems minimizing contamination rates, which directly impact the usability of recycled plastic for high-performance films, and providing real-time data to support compliance reporting and sustainable sourcing strategies.

AI is transforming the pre-processing phase of the PCR lifecycle by integrating sophisticated machine vision and deep learning algorithms into material recovery facilities (MRFs). These systems significantly improve the speed and accuracy of identifying and separating various polymer types, colors, and even multi-layer compositions that were previously difficult to distinguish through traditional methods. By ensuring cleaner feedstock, AI directly enhances the mechanical recycling output, leading to higher yields of film-grade PCR pellets. This optimization is crucial for reducing the operational costs associated with manual sorting and contamination rejection, thereby making PCR materials more economically competitive against virgin resins.

Furthermore, AI is increasingly utilized in predictive maintenance and quality control within film extrusion and conversion processes. AI algorithms analyze spectral data and sensor feedback during production to continuously monitor film thickness, barrier consistency, and potential defects, enabling real-time adjustments. In the strategic realm, AI supports demand forecasting for sustainable packaging mandates, helping producers align production capacity with anticipated regulatory milestones and brand commitments, thereby streamlining inventory management and preventing supply chain bottlenecks in the rapidly expanding PCR films market.

- AI-enhanced optical sorting maximizes feedstock purity, increasing the yield of high-grade PCR polymers.

- Predictive analytics optimize recycling plant throughput and minimize downtime by identifying potential equipment failures.

- Machine learning models improve quality control by verifying compliance with food-grade purity standards through real-time material analysis.

- AI facilitates supply chain traceability, using blockchain integration to track the origin and processing history of PCR content for compliance reporting.

- Demand forecasting using AI helps converters strategically procure PCR resin volumes and manage inventory against fluctuating regulatory demand.

DRO & Impact Forces Of PCR Films and Foils Market

The PCR Films and Foils Market is fundamentally shaped by powerful drivers, strict regulatory constraints, and compelling opportunities that determine its long-term viability. The most potent driver is the global commitment to environmental sustainability, enforced by government mandates requiring specific percentages of recycled content in new packaging, making the adoption of PCR materials a necessity rather than an option. Restraints primarily involve the volatile pricing of PCR resins compared to virgin plastics, largely due to collection infrastructure limitations and the high cost of advanced recycling technologies required for food-contact materials. The crucial opportunity lies in scaling chemical recycling processes, which promise to unlock high-quality PCR supply from currently non-recyclable plastic waste streams, satisfying the growing demand for premium applications.

Drivers include strong consumer preference for eco-friendly packaging and the ambitious Corporate Sustainability Goals (CSGs) set by major global brands, which necessitates an immediate pivot towards verifiable recycled content. However, the existing infrastructure for collecting and sorting flexible film waste remains underdeveloped in many regions, posing a significant hurdle to feedstock consistency and supply reliability. This supply constraint elevates raw material costs and limits rapid market expansion, particularly for high-barrier films where material integrity is paramount. Addressing these issues requires substantial cross-industry collaboration and public-private partnerships focused on standardizing waste collection protocols.

Impact forces are heavily weighted toward regulatory shifts and technological breakthroughs. The potential for extended producer responsibility (EPR) schemes globally is a major force, shifting the financial burden of recycling onto producers and incentivizing the design of truly circular products, favoring PCR films. The increasing sophistication of multilayer film separation and purification technologies represents a positive impact force, transforming previously unrecyclable packaging into valuable feedstocks. Conversely, potential regulatory divergence across different markets regarding acceptable PCR purity levels for sensitive applications could act as a restrictive force, necessitating customized production lines and potentially fragmenting the global supply chain.

Segmentation Analysis

The PCR Films and Foils Market is analyzed based on type, material, application, and end-use industry, reflecting the diverse requirements and technological capabilities across the packaging sector. Flexible films dominate the segmentation by type, leveraging their lightweight nature and versatility for primary and secondary packaging, while rigid foils are critical in demanding applications such as pharmaceutical blister packs. Material segmentation highlights the current dominance of PCR PET, owing to established bottle-to-film recycling processes, with rapid expansion anticipated in the polyolefin categories (PE and PP) as chemical recycling becomes more industrialized. The food packaging application remains the largest consumer, necessitating stringent adherence to regulatory standards regarding migration and contamination control, making high-purity PCR supply essential across all segments.

- By Type:

- Rigid Films

- Flexible Films

- By Material:

- PCR Polyethylene Terephthalate (PET)

- PCR Polyethylene (PE)

- PCR Polypropylene (PP)

- PCR Polystyrene (PS)

- Other Polymers (PVC, PLA)

- By Application:

- Food & Beverage Packaging

- Personal Care and Cosmetics Packaging

- Pharmaceutical and Healthcare Packaging

- Industrial Packaging

- Consumer Goods Packaging

- By End-Use Industry:

- FMCG (Fast Moving Consumer Goods)

- Healthcare and Pharmaceuticals

- Retail and E-commerce

- Automotive and Industrial

Value Chain Analysis For PCR Films and Foils Market

The value chain for PCR Films and Foils begins upstream with the collection and aggregation of post-consumer plastic waste, a process often managed by municipal systems and private waste management organizations. The purity and separation efficiency at this initial stage are critical, determining the quality of the subsequent recycled resin. Upstream activities then transition to Material Recovery Facilities (MRFs) and specialized recycling plants, where mechanical processes (washing, grinding, pelletizing) or chemical processes (depolymerization, pyrolysis) convert the waste into standardized PCR pellets or flake. The cost structure and operational viability of the entire chain are heavily influenced by the volume and quality of feedstock secured at the upstream end.

Midstream activities involve resin production and film extrusion. Polymer manufacturers convert the PCR feedstock into certified resins, which are then supplied to film and foil converters. These converters utilize sophisticated technologies, such as co-extrusion and lamination, to produce multi-layer films that often incorporate a PCR core layer and virgin barrier layers to maintain performance specifications (e.g., oxygen and moisture barriers). Maintaining consistency in thickness, strength, and regulatory compliance is paramount in this stage, often requiring advanced blending and quality control systems to handle the inherent variability of recycled content.

Downstream distribution channels are crucial for market access, dominated by direct sales to large Fast-Moving Consumer Goods (FMCG) brand owners and major packaging manufacturers. Indirect distribution involves large regional distributors or brokers who specialize in sustainable packaging solutions, particularly serving small to medium-sized enterprises (SMEs). The rapid growth of e-commerce also necessitates specialized PCR mailing bags and protective films, adding another important channel. The final stage involves brand adoption, where successful integration depends on the film meeting the high-speed requirements of automated packaging lines, ultimately reaching the consumer who increasingly seeks visible evidence of sustainable packaging choices.

PCR Films and Foils Market Potential Customers

The primary customer base for PCR Films and Foils consists of major global brand owners within the consumer goods sector who are actively seeking solutions to meet stringent public commitments regarding plastic sustainability and circular packaging. Large multinational corporations, particularly those in the food and beverage industry, are massive consumers, driven by the need to secure food-grade PCR materials for items like snack packaging, confectionery wraps, and beverage labels. Their purchasing power and scale stabilize demand and fund innovation throughout the recycling supply chain, demanding verifiable certification (such as ISCC PLUS) to ensure compliance and authenticity in their marketing claims.

The healthcare and pharmaceutical sectors represent a high-value, though highly regulated, customer segment for PCR foils, especially in applications requiring high barrier protection, such as blister packaging and sterile wraps. While the regulatory hurdles for recycled content in direct pharmaceutical contact are higher, there is growing acceptance for PCR use in secondary and tertiary packaging (e.g., medical device wraps and unit dose packaging). These customers prioritize material safety, traceability, and consistency, requiring PCR products that demonstrate minimal variability and proven decontamination protocols.

Retail and e-commerce companies are also rapidly emerging as significant customers, driven by the logistics of last-mile delivery and the need for high-volume, cost-effective sustainable mailing and protective packaging (e.g., bubble wraps, mailer bags). Companies like Amazon and major retail chains are pushing their suppliers to incorporate maximum recycled content into their transit packaging to reduce waste and improve their overall environmental footprint. This demand is particularly focused on PCR PE films for robust and flexible transport applications, often prioritizing high inclusion rates even if slightly compromising on pristine optical clarity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Berry Global Group, Inc., Huhtamaki Oyj, Sealed Air Corporation, Mondi Group, Tredegar Corporation, Jindal Films, Klöckner Pentaplast, Wipak Group, Coveris, ProAmpac, TC Transcontinental, Toray Industries, Inc., Fatra, a.s., Taghleef Industries, UPM Raflatac, WestRock Company, Polyplex Corporation Limited, CCL Industries Inc., Constantia Flexibles |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCR Films and Foils Market Key Technology Landscape

The technological landscape of the PCR Films and Foils Market is primarily defined by advancements in recycling processes designed to overcome the structural limitations of using post-consumer waste in high-specification packaging. Mechanical recycling, which involves physical sorting, washing, drying, and remelting, remains the dominant technology, especially for PCR PET and PE. However, its efficacy is highly dependent on clean input streams. Key technological innovations in mechanical recycling include enhanced washing systems to eliminate odors and volatile organic compounds (VOCs), and solid-state polymerization (SSP) processes which increase the intrinsic viscosity of recycled PET, making it suitable for high-strength applications previously reserved for virgin resins.

Chemical recycling technologies are emerging as critical game-changers, particularly for mixed plastic waste and traditionally difficult-to-recycle films (such as multilayer structures or heavily contaminated polyolefins). Pyrolysis and depolymerization techniques break down the complex polymers into their monomer building blocks or oils, which can then be repolymerized into plastics indistinguishable from virgin material, crucially enabling food-grade compliance. This technological advancement addresses the long-standing challenge of circularity for flexible packaging, allowing brand owners to achieve high-inclusion targets without sacrificing safety or performance.

Furthermore, film conversion technologies are rapidly adapting to accommodate PCR variability. The use of advanced co-extrusion and barrier coating techniques allows manufacturers to encapsulate the PCR content within the film structure, shielding it from external contact while maintaining high-performance barrier properties (e.g., EVOH or specialized coatings). This allows for maximum use of recycled content while adhering to rigorous standards for shelf life and product protection. The integration of advanced sensor technology and spectroscopy in sorting and processing lines, often driven by AI, is paramount for ensuring batch consistency and certifying the PCR content level, thereby securing premium pricing and market trust.

Regional Highlights

- Europe: Europe is the leading region in the PCR Films and Foils Market, characterized by the most aggressive regulatory environment globally. The EU’s Plastic Packaging Tax and the mandated inclusion of recycled content in packaging have created a high and stable demand floor. The region boasts the most mature recycling infrastructure for PET and is rapidly investing in chemical recycling facilities, particularly in Germany, Spain, and the Netherlands, focusing on achieving circularity for flexible PE and PP films. This regulatory pressure and advanced infrastructure provide European converters with a competitive advantage in supplying high-specification PCR materials.

- North America: North America demonstrates strong market growth, driven primarily by large corporate commitments and growing state-level legislation, particularly on the West Coast, which mandates minimum recycled content in beverage containers and certain plastic products. The market relies heavily on PCR PET supply, though significant investments are being made to scale up polyolefin recycling, often through joint ventures between petrochemical companies and recycling innovators. The US market emphasizes material transparency and verifiable claims, accelerating the adoption of certified PCR content across major retail packaging platforms.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid industrialization, expanding consumer base, and evolving waste management policies in economic giants like China, India, and Southeast Asia. While the region faces challenges regarding standardized collection and sorting, government initiatives focused on reducing plastic waste and improving urban waste systems are catalyzing investment in modern recycling plants. Japan and South Korea lead in adopting advanced recycling technologies and high-quality PCR films, often driven by export requirements and domestic sustainability goals.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. Growth is concentrated in countries with developed consumer markets and higher environmental awareness (e.g., Brazil, UAE, South Africa). The market is heavily dependent on imports of high-quality PCR resins but is starting to see domestic investment in basic mechanical recycling infrastructure, often targeting lower-specification applications like non-food packaging and industrial wraps. Future growth is strongly linked to the implementation of effective Extended Producer Responsibility (EPR) schemes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCR Films and Foils Market.- Amcor plc

- Berry Global Group, Inc.

- Huhtamaki Oyj

- Sealed Air Corporation

- Mondi Group

- Tredegar Corporation

- Jindal Films

- Klöckner Pentaplast

- Wipak Group

- Coveris

- ProAmpac

- TC Transcontinental

- Toray Industries, Inc.

- Fatra, a.s.

- Taghleef Industries

- UPM Raflatac

- WestRock Company

- Polyplex Corporation Limited

- CCL Industries Inc.

- Constantia Flexibles

Frequently Asked Questions

Analyze common user questions about the PCR Films and Foils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the PCR Films and Foils Market?

The primary factor is mandatory government legislation, particularly in Europe and North America, requiring minimum recycled content percentages in packaging materials. This legislative pressure forces brand owners to adopt PCR films to ensure compliance and avoid financial penalties.

Are PCR films suitable for food contact applications?

Yes, but only if they are produced using approved advanced recycling technologies, such as chemical recycling or specialized super-cleaning mechanical recycling (e.g., SSP for PET), that ensure the removal of contaminants and meet stringent regulatory requirements set by agencies like the FDA and EFSA.

Which polymer material dominates the PCR Films and Foils market?

PCR Polyethylene Terephthalate (PET) currently dominates the market due to its highly mature collection infrastructure, derived mainly from established bottle-to-bottle recycling streams, which provides a consistent source of high-quality feedstock suitable for film conversion.

What is the biggest challenge facing the expansion of PCR flexible films?

The biggest challenge is securing a consistent and high-purity supply of post-consumer flexible film waste, as current waste management systems struggle with the efficient collection and sorting of lightweight, multi-layer film packaging, leading to feedstock scarcity and price volatility.

How does AI technology impact the PCR Films supply chain?

AI significantly impacts the supply chain by enhancing the efficiency and accuracy of feedstock sorting at Material Recovery Facilities (MRFs) using machine vision. This technology minimizes contamination, improves the quality of PCR resin, and provides better traceability data for compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager