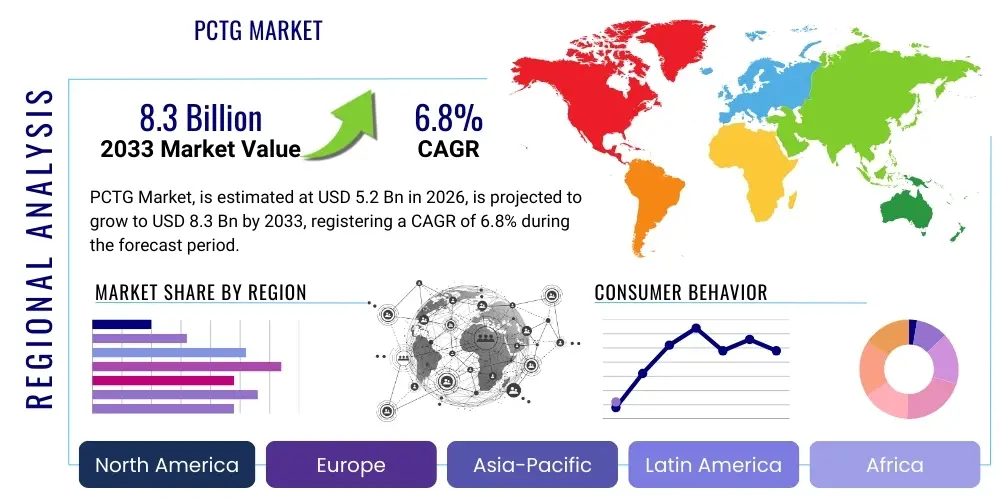

PCTG Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437024 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

PCTG Market Size

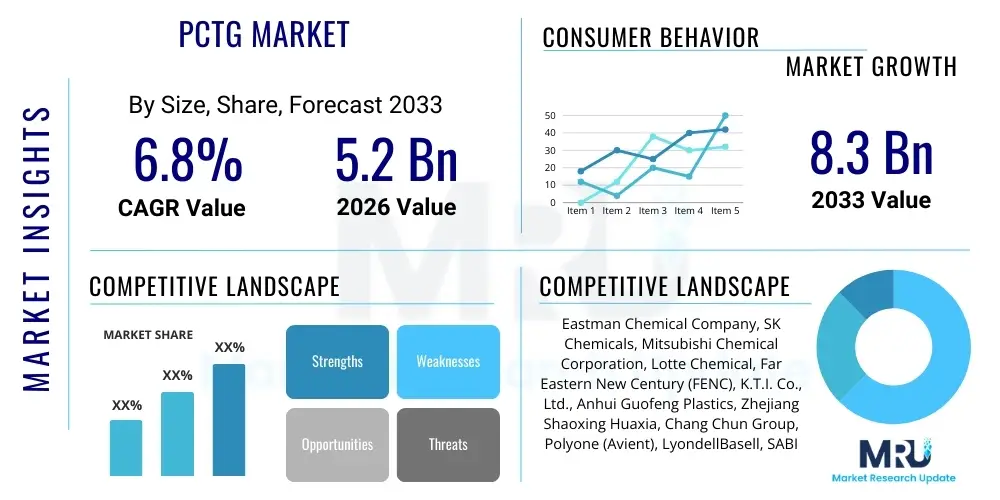

The PCTG Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.3 Billion by the end of the forecast period in 2033.

PCTG Market introduction

The Polycyclohexylenedimethylene Terephthalate Glycol (PCTG) market encompasses the production, distribution, and application of this high-performance thermoplastic polyester. PCTG is a modified variation of PETG, offering superior properties, particularly enhanced toughness, chemical resistance, and exceptional clarity, making it highly desirable for demanding applications. Unlike standard PETG, the inclusion of cyclohexylenedimethanol (CHDM) during polymerization alters the polymer structure, yielding a material that excels in durability and impact strength, particularly important in consumer goods and specialized medical devices. Its amorphous nature also ensures excellent processing characteristics, allowing manufacturers to create complex shapes and detailed designs without compromising structural integrity.

Major applications of PCTG span across several critical industries. In the packaging sector, it is extensively used for high-end cosmetic containers, luxury beverage bottles, and durable food storage due to its glass-like transparency and shatter resistance. The medical industry relies on PCTG for disposable medical devices, drug delivery systems, and sterile packaging where high transparency, sterilization compatibility, and biocompatibility are non-negotiable requirements. Furthermore, its chemical resistance makes it ideal for household appliances and electronic casings that require materials capable of withstanding harsh cleaning agents or repeated handling. The inherent benefits, such as high ductility, low haze, and excellent surface gloss, solidify PCTG’s position as a premium polymer solution.

Key driving factors accelerating market expansion include the increasing global demand for sustainable and recyclable packaging materials, as PCTG is inherently recyclable, aligning with circular economy initiatives. The consumer preference for aesthetic and highly durable products, especially in the cosmetics and personal care sectors, further stimulates adoption. Additionally, the continuous growth and technological advancements in the healthcare sector, particularly in Asia Pacific, necessitate materials that meet stringent regulatory and performance standards, directly benefiting the PCTG market. However, market growth is sometimes constrained by the relatively higher production cost compared to conventional plastics like PET or standard PETG.

PCTG Market Executive Summary

The PCTG market is characterized by robust expansion driven by innovation in end-use applications and a geographical shift in manufacturing capabilities. Current business trends indicate a strong move toward specialization, where PCTG manufacturers are developing customized grades tailored for specific processes, such as thin-wall injection molding for electronic components or specialized grades offering enhanced resistance to high-energy sterilization methods for medical use. Strategic partnerships between raw material suppliers and downstream converters are becoming prevalent to ensure a stable supply of key monomers and to optimize cost structures. Furthermore, sustainability is an overarching theme, compelling leading market players to invest in bio-based PCTG variants to meet evolving consumer expectations and regulatory mandates, positioning the market for long-term resilience.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to rapid industrialization, expanding domestic consumption of packaged goods, and the establishment of large-scale electronics manufacturing hubs in countries like China, South Korea, and India. North America and Europe maintain significant market shares, primarily driven by high adoption rates in specialized, high-value sectors such as sophisticated medical equipment and premium cosmetic packaging, where manufacturers prioritize quality and compliance over cost. Regulatory landscapes, particularly the stringent requirements set by the FDA and European Commission regarding food contact and medical device safety, heavily influence material selection in these mature markets, reinforcing the demand for compliant materials like PCTG.

Segmentation trends indicate that the packaging segment, specifically high-end personal care and cosmetics packaging, remains the largest revenue generator due to PCTG’s aesthetic advantages (superior clarity and gloss). However, the medical segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the increasing complexity of minimally invasive surgical tools and diagnostic devices requiring chemically inert and highly durable plastic components. Segmentation by grade shows that injection molding grades hold the majority share, catering to the diverse needs of consumer goods and electronic casings, while the development of advanced extrusion grades is accelerating for specialized sheet and film applications.

AI Impact Analysis on PCTG Market

Common user inquiries regarding AI's influence on the PCTG market typically revolve around optimizing material composition, predicting supply chain disruptions, and enhancing manufacturing efficiency. Users frequently ask: "How can AI minimize defects in PCTG injection molding?" or "Will machine learning accelerate the development of bio-based PCTG?" The prevailing themes suggest high expectations for AI to drive operational excellence, specifically in reducing polymerization inconsistencies and improving the precision of compounding processes. There is significant interest in leveraging AI algorithms to model structure-property relationships in PCTG copolymers, allowing researchers to predict the optimal ratio of CHDM needed to achieve specific performance benchmarks, such as maximum impact strength or chemical resistance, thereby speeding up R&D cycles and lowering material wastage. Furthermore, supply chain visibility and demand forecasting, crucial for managing volatile monomer prices, are key areas where AI integration is anticipated to deliver substantial cost savings.

- AI-driven Predictive Maintenance: Utilizing sensor data from polymerization reactors and compounding extruders to predict equipment failure, minimizing unplanned downtime and ensuring consistent material quality.

- Optimized Material Formulation: Employing machine learning models to analyze vast datasets of chemical structures and performance tests, rapidly identifying optimal co-monomer ratios for bespoke PCTG grades (e.g., enhanced thermal stability or UV resistance).

- Supply Chain Resilience: Using AI to model global feedstock availability and logistics networks, predicting potential bottlenecks related to terephthalic acid (PTA) or CHDM, and optimizing inventory management.

- Enhanced Quality Control (QC): Implementing computer vision and AI algorithms in inline inspection systems to instantaneously detect microscopic defects or surface imperfections in finished PCTG sheets and molded parts, ensuring stringent adherence to quality standards, particularly in medical applications.

- Simulation and Digital Twin Technology: Creating digital twins of polymerization plants to simulate various operational parameters (temperature, pressure, reaction time), enabling manufacturers to fine-tune production processes for maximum yield and minimum energy consumption without physical experimentation.

DRO & Impact Forces Of PCTG Market

The market dynamics for PCTG are shaped by a complex interplay of driving factors that foster demand, restraints that challenge profitability, and opportunities that pave the way for future growth. PCTG's excellent physical properties—notably its superior toughness, transparency, and chemical resistance—are primary drivers, especially when compared to polyethylene terephthalate (PET) or even standard PETG, positioning it as the material of choice for premium and demanding applications. The increasing regulatory emphasis on Bisphenol A (BPA)-free plastics in food contact and consumer goods applications strongly favors PCTG, which is inherently BPA-free, boosting its adoption across sensitive market segments. The growing affluence in emerging economies translates into higher consumer demand for high-quality, aesthetically pleasing durable goods and packaging, further propelling the market forward. These drivers collectively create a robust, high-value ecosystem for PCTG adoption.

However, the market faces significant restraints, most notably the higher manufacturing cost associated with PCTG, primarily due to the specialized monomers (CHDM) and the proprietary polymerization processes required, making it less competitive price-wise against commodity plastics. This cost disparity limits its widespread use in low-margin, bulk applications. Additionally, the fluctuating prices and availability of petroleum-derived feedstock materials introduce supply chain volatility, directly impacting production costs and profitability margins for PCTG manufacturers. Although PCTG is recyclable, the current lack of widespread, dedicated recycling infrastructure for co-polyesters sometimes poses a challenge for true closed-loop sustainability, limiting the realization of its environmental benefits.

Opportunities for market players are abundant, particularly in developing advanced bio-based or recycled content PCTG variants, catering to the accelerating corporate sustainability goals of major consumer brands. The continuous innovation within the medical device industry, especially concerning drug delivery systems, diagnostics, and sterile packaging, presents significant niche market expansion potential where PCTG’s properties are uniquely valued. Geographically, establishing manufacturing and conversion facilities in high-growth regions like Southeast Asia and Latin America allows companies to mitigate logistical costs and capitalize on emerging local demand. Successful navigation of these drivers, restraints, and opportunities, coupled with strategic investments in process efficiency and sustainable material development, defines the long-term competitive landscape of the PCTG market.

Segmentation Analysis

The PCTG market is extensively segmented based on grade, application, and end-use industry, reflecting the material’s versatility across diverse manufacturing requirements. This granular segmentation allows market participants to tailor their production capabilities and marketing strategies toward specific high-growth niches. Analyzing the market by grade—Injection Molding, Extrusion, and Blow Molding—reveals distinct demand patterns; injection molding dominates due to its applicability in precision parts for electronics and cosmetics, while extrusion grades are critical for durable sheets and films used in construction and specialized packaging. The application segmentation, ranging from high-performance packaging to complex medical components, underscores the premium nature of PCTG, focusing on areas where performance outweighs cost considerations.

The segmentation by end-use industry clearly delineates the major consuming sectors. The Consumer Goods and Cosmetics segment maintains the largest market share, driven by the need for premium aesthetics, shatter resistance, and chemical resistance against various products like perfumes and lotions. Conversely, the Healthcare and Medical Devices segment represents the highest growth potential, spurred by increasing regulatory demands for biocompatible, sterilizable, and high-clarity materials for single-use devices and diagnostic equipment. Understanding these segment dynamics is crucial for strategic investment, especially for companies aiming to diversify away from commodity markets and capture high-margin opportunities within the specialized PCTG ecosystem.

- By Grade:

- Injection Molding Grade

- Extrusion Grade

- Blow Molding Grade

- Thermoforming Grade

- By Application:

- Packaging (Cosmetics, Food & Beverage, Consumer Products)

- Medical Devices and Healthcare (IV components, Housings, Sterile packaging)

- Consumer Goods (Water bottles, Kitchenware, Toys)

- Appliances and Housings (Electronic casings, Small appliance components)

- Sheets and Films (Graphic displays, Industrial sheeting)

- By End-Use Industry:

- Food & Beverage Industry

- Healthcare and Pharmaceutical Industry

- Electronics and Electrical Industry

- Cosmetics and Personal Care Industry

- Automotive Industry (Interior components)

- Construction and Signage Industry

Value Chain Analysis For PCTG Market

The PCTG value chain commences with the upstream procurement of essential raw materials, primarily purified terephthalic acid (PTA), ethylene glycol (EG), and the key co-monomer, cyclohexylenedimethanol (CHDM). The procurement phase is highly sensitive to geopolitical factors and crude oil price volatility, given that these feedstocks are predominantly derived from petrochemical sources. Major chemical producers specializing in polyester precursors are critical nodes at this stage. Effective supply chain management and long-term contracts are essential for PCTG manufacturers to stabilize input costs and ensure consistent supply, underpinning the subsequent polymerization process which is highly capital and energy-intensive.

Midstream activities involve the proprietary polymerization of these monomers to create the PCTG resin. This manufacturing stage demands specialized technology and precise control over reaction conditions to achieve the desired molecular weight, clarity, and physical properties. Once the resin is produced, it often undergoes compounding, where additives (such as colorants, UV stabilizers, or processing aids) are incorporated to customize the final material properties for specific end-use applications. This compounding step adds significant value, transforming base resin into application-ready pellets for converters.

The downstream segment involves the conversion process—including injection molding, extrusion, and blow molding—conducted by specialized fabricators who transform the PCTG pellets into final products like cosmetic jars, medical tubing, or electronic casings. Distribution channels are varied: direct sales are common for high-volume orders to large brand owners (e.g., major cosmetic companies or medical device OEMs), while indirect distribution relies on specialty plastics distributors and compounding houses to serve smaller converters and specialized local markets. Efficiency at the downstream level is crucial, as PCTG is a high-cost material where minimizing scrap rate and optimizing processing parameters directly influence the final product cost and market competitiveness.

PCTG Market Potential Customers

The primary customers and end-users of PCTG are large-scale consumer product manufacturers, specialized medical device producers, and multinational electronics firms who require materials offering superior performance and aesthetics compared to conventional plastics. In the consumer space, potential buyers include leading global cosmetics brands that demand glass-like clarity, high gloss, and chemical resistance for their premium packaging lines, ensuring product integrity against oils, alcohol, and fragrances. These customers prioritize the material’s non-reactivity and luxurious feel to enhance brand perception and product safety.

In the healthcare sector, PCTG is highly sought after by manufacturers of single-use medical devices, diagnostic consumables, and pharmaceutical packaging. Key customers include OEMs specializing in IV components, filter housings, blood collection tubes, and surgical trays. These buyers demand materials that are rigorously tested for biocompatibility, can withstand gamma or electron beam sterilization without degradation, and offer exceptional transparency for fluid monitoring and inspection. The reliability and adherence to strict regulatory standards (such as ISO 10993 and FDA requirements) are the primary purchasing criteria for this customer group.

Furthermore, the electronics and small appliance industries constitute a significant customer base. Manufacturers of smart home devices, high-end blender jars, and display casings utilize PCTG for its robust impact resistance, scratch durability, and excellent transparency, providing protection while maintaining aesthetic appeal. These customers often seek injection molding grades that allow for intricate designs and tight dimensional tolerances. The decision to purchase PCTG is typically driven by the need to differentiate products through material quality and longevity in competitive consumer markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, SK Chemicals, Mitsubishi Chemical Corporation, Lotte Chemical, Far Eastern New Century (FENC), K.T.I. Co., Ltd., Anhui Guofeng Plastics, Zhejiang Shaoxing Huaxia, Chang Chun Group, Polyone (Avient), LyondellBasell, SABIC, Kuraray Co., Ltd., Covestro AG, RTP Company, Teijin Limited, BASF SE, Evonik Industries AG, LG Chem, China Petroleum & Chemical Corporation (Sinopec). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCTG Market Key Technology Landscape

The technology landscape for the PCTG market is centered around optimizing polymerization efficiency and enhancing post-processing capabilities to unlock niche applications. The foundational technology involves polycondensation—specifically esterification and subsequent polytransesterification—where the careful incorporation of cyclohexylenedimethanol (CHDM) alongside ethylene glycol (EG) and purified terephthalic acid (PTA) is crucial. Advanced continuous polymerization systems are employed by leading manufacturers to ensure highly consistent material properties, minimal batch-to-batch variation, and maximized energy efficiency. Key technological innovations in this area focus on catalyst systems that accelerate reaction rates while minimizing color formation, ensuring the resultant PCTG resin maintains its high intrinsic clarity and low yellowness index (YI).

Beyond polymerization, compounding technology represents another critical area of innovation. Modern twin-screw extrusion systems are utilized to uniformly incorporate specialized additives, such as anti-scratch coatings, complex UV absorbers, flame retardants, and functional pigments. Technology is evolving toward reactive extrusion, where minor chemical modifications or grafting can occur during the compounding phase to fine-tune surface energy or improve adhesion characteristics for subsequent coating or printing processes. This precision compounding allows manufacturers to produce highly specialized PCTG grades, for instance, those required for complex co-extrusion packaging films or highly durable graphic display applications, expanding the material's market reach beyond traditional uses.

Further technological advancements focus on manufacturing processes specific to end-product formation. In injection molding, technologies such as sequential valve gating and mold flow analysis software are used extensively to manage the high viscosity and flow behavior of PCTG, thereby minimizing shear stress and preventing degradation while achieving complex, thin-walled geometries, particularly critical for medical components and small electronic casings. For sheet applications, advanced multi-layer extrusion technology allows PCTG to be combined with other barrier layers, enhancing its performance in demanding food and pharmaceutical barrier packaging applications, driving adoption in highly regulated sectors globally.

Regional Highlights

Regional dynamics play a significant role in shaping the PCTG market, driven by varying regulatory environments, levels of industrial maturity, and consumer spending patterns. Asia Pacific (APAC) currently dominates the global market both in terms of consumption volume and production capacity. This supremacy is attributed to the substantial presence of major electronics, consumer goods, and packaging manufacturing hubs, particularly in China, South Korea, and Taiwan. Rapid urbanization, coupled with the rising middle-class population in India and Southeast Asia, fuels massive domestic demand for high-quality packaging and consumer durables, accelerating the deployment of PCTG in premium product lines. Investment in new polymerization facilities within this region continues to drive competitive pricing and localized supply chains.

North America holds a substantial market share, characterized by high adoption rates in the medical and specialized consumer goods sectors. The stringent regulatory environment in the U.S. (FDA requirements) favors materials like PCTG that offer confirmed biocompatibility and chemical resistance for advanced medical devices and pharmaceutical packaging. The region is also a major consumer of high-end cosmetic packaging, where brands leverage PCTG’s superior aesthetic properties. Innovation in North America tends to focus on developing specialized, small-volume, high-margin PCTG applications, including bio-based variants and recycled content integration, often setting the global benchmark for sustainability initiatives.

Europe represents a mature market with steady growth, primarily influenced by strong environmental regulations promoting sustainable and recyclable plastics. The demand for PCTG is robust in the cosmetics, food contact materials, and medical sectors, largely driven by the European Union’s push for BPA-free materials and the circular economy framework. Eastern European countries are emerging as key manufacturing centers for packaging and appliances, contributing to the growing regional consumption. Market players in Europe prioritize compliance with REACH regulations and investment in production methods that minimize environmental footprint, further solidifying PCTG's position as a premium engineered thermoplastic across the continent.

- Asia Pacific (APAC): Dominant region due to rapid industrial growth, massive electronics and packaging production bases, and increasing consumer affluence in China and India. Expected to register the highest CAGR.

- North America: Strong market driven by the advanced medical device industry, high demand for premium cosmetic packaging, and early adoption of sustainable, high-performance materials.

- Europe: Key growth supported by strict environmental regulations (BPA-free mandates) and high demand from the pharmaceutical and personal care sectors. Focus on sustainable and compliant material solutions.

- Latin America (LATAM): Emerging market with growing opportunities in food and beverage packaging and expanding local manufacturing capabilities in Brazil and Mexico.

- Middle East and Africa (MEA): Gradually increasing adoption, primarily concentrated in high-value imports and localized consumer goods manufacturing in GCC countries requiring durable, heat-resistant packaging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCTG Market.- Eastman Chemical Company

- SK Chemicals

- Mitsubishi Chemical Corporation

- Lotte Chemical

- Far Eastern New Century (FENC)

- K.T.I. Co., Ltd.

- Anhui Guofeng Plastics

- Zhejiang Shaoxing Huaxia

- Chang Chun Group

- Polyone (Avient Corporation)

- LyondellBasell Industries Holdings B.V.

- SABIC (Saudi Basic Industries Corporation)

- Kuraray Co., Ltd.

- Covestro AG

- RTP Company

- Teijin Limited

- BASF SE

- Evonik Industries AG

- LG Chem

- China Petroleum & Chemical Corporation (Sinopec)

Frequently Asked Questions

Analyze common user questions about the PCTG market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between PCTG and PETG?

PCTG (Polycyclohexylenedimethylene Terephthalate Glycol) offers superior toughness, impact strength, and chemical resistance compared to standard PETG. This enhancement is due to a higher concentration of the cyclohexylenedimethanol (CHDM) co-monomer in PCTG’s chemical structure, making it the preferred choice for high-durability and specialized applications, such as medical devices and luxury consumer goods.

Is PCTG considered a sustainable or environmentally friendly plastic?

PCTG is considered a more sustainable option than several conventional plastics because it is inherently BPA-free and fully recyclable. Leading market players are also focusing heavily on developing bio-based PCTG variants and those incorporating certified recycled content, aligning with global mandates for a circular economy in packaging and manufacturing.

Which end-use industry drives the highest demand for PCTG globally?

The packaging industry, particularly the high-end cosmetics, personal care, and specialized food packaging sectors, currently drives the highest volume demand for PCTG. This is due to PCTG’s ability to deliver exceptional clarity, chemical resistance against products like essential oils, and shatterproof durability, enhancing product presentation and safety.

What regulatory factors most influence PCTG adoption in North America and Europe?

PCTG adoption in North America and Europe is heavily influenced by mandates requiring Bisphenol A (BPA)-free materials for food contact and sensitive consumer goods. Additionally, stringent biocompatibility requirements (FDA, ISO 10993) accelerate PCTG’s use in the medical device sector, where material safety and sterilizability are paramount concerns for regulatory approval.

What is the main restraint limiting the widespread adoption of PCTG in high-volume applications?

The main restraint is the relatively high production cost of PCTG compared to commodity plastics like PET or even standard PETG. The synthesis requires specialized co-monomers (CHDM) and proprietary polymerization techniques, leading to elevated material pricing, which restricts its use primarily to high-performance, premium, and low-volume specialized applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager