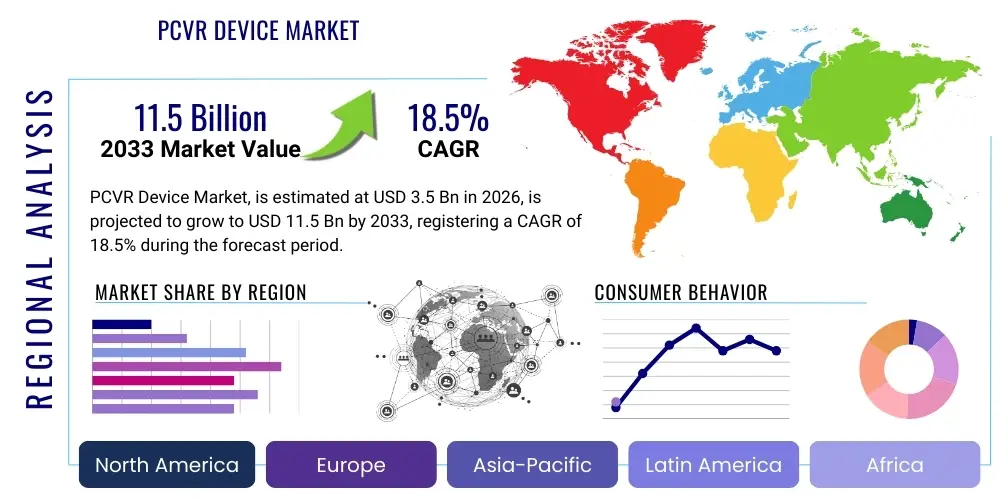

PCVR Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438157 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

PCVR Device Market Size

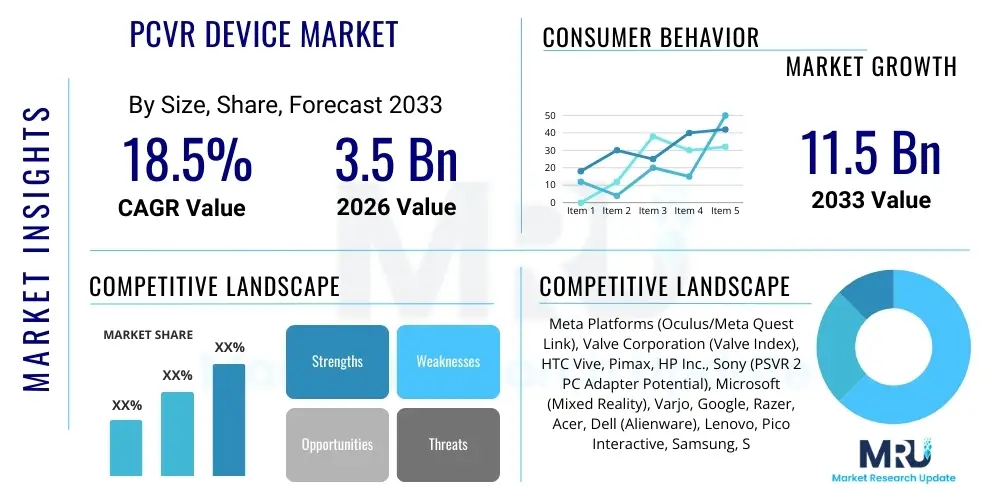

The PCVR Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033.

PCVR Device Market introduction

The PCVR (Personal Computer Virtual Reality) Device Market encompasses specialized head-mounted displays (HMDs) and associated peripheral hardware that require a high-performance computer graphics card and processing unit to deliver immersive, high-fidelity virtual reality experiences. These devices, known for offering superior graphical quality, lower latency, and wider fields of view compared to standalone VR systems, are primarily utilized in demanding applications such as AAA gaming, professional simulation, detailed architectural visualization, and specialized medical training. The core product offering includes tethered headsets and increasingly sophisticated wireless adapters, coupled with precise tracking systems that map the user's movements within a defined physical space into the virtual environment, ensuring a deeply engaging and realistic interaction.

Major applications of PCVR devices span entertainment, education, and enterprise sectors. In the entertainment sphere, high-resolution and complex rendering capabilities enable photorealistic virtual worlds and highly interactive gaming experiences that define the premium segment of the VR market. For professional use, the fidelity offered by PCVR systems is critical for applications like engineering prototyping, complex data visualization, and military simulation where accuracy and detail are paramount. Key benefits driving adoption include unmatched visual clarity, robust performance capabilities that handle complex physics and graphical rendering seamlessly, and the flexibility to leverage continuous PC hardware upgrades, thus extending the lifespan and performance potential of the VR setup itself.

Driving factors for the growth of this market include the continuous decline in the average selling price of high-end graphics processing units (GPUs), which lowers the barrier to entry for consumers requiring a powerful VR-ready PC. Furthermore, the increasing availability of sophisticated VR content, supported by major software developers investing heavily in PCVR titles and enterprise solutions, fuels demand. Technological advancements in display panels, optical efficiency, and precision tracking algorithms—such as inside-out tracking combined with external base stations for enhanced accuracy—are continually improving the user experience, solidifying PCVR’s position as the leading platform for premium, high-fidelity virtual immersion.

PCVR Device Market Executive Summary

The PCVR Device Market is characterized by strong growth fueled by the convergence of falling hardware costs and surging consumer interest in high-fidelity virtual experiences, alongside significant enterprise investment in specialized training and remote collaboration tools. Current business trends indicate a strategic shift towards hybrid PCVR solutions, utilizing advanced compression and streaming technologies to offer near-tethered performance without physical constraints, appealing to users seeking both graphical quality and freedom of movement. Regional trends highlight North America and Europe as dominant markets due to high disposable income, strong gaming culture, and early adoption of enterprise VR solutions, while the Asia Pacific region is demonstrating the fastest growth trajectory, driven by increasing PC penetration and rapid technological infrastructure development, particularly in nations like South Korea and China where competitive gaming and technology manufacturing are prominent.

Analysis of market segments reveals that the Gaming application segment maintains the largest market share, acting as the primary revenue generator; however, the Enterprise segment, including sectors like healthcare simulation and engineering design, is experiencing accelerated compound annual growth, reflecting the tangible return on investment realized through VR training and visualization. Hardware component trends show a focus on integrating lightweight materials and enhancing display technologies, specifically micro-OLED and high-PPD (Pixels Per Degree) lenses, to improve comfort and visual immersion, directly addressing previous ergonomic restraints. Furthermore, the segmentation by device type indicates that while traditional tethered headsets still command the premium performance niche, wireless solutions leveraging dedicated Wi-Fi 6E connectivity are rapidly capturing mid-to-high-end consumer preference due to improved performance-to-convenience ratios.

Competitive landscape analysis underscores the dominance of established tech giants who possess robust ecosystems that seamlessly integrate PC hardware, operating systems, and dedicated VR storefronts. Strategic moves include heavy R&D investment into advanced optics, foveated rendering technologies enabled by eye-tracking, and robust software development kits (SDKs) to attract third-party developers, ensuring a continuous supply of high-quality content that utilizes the full potential of PC processing power. Future market projections suggest that the integration of artificial intelligence for dynamic content scaling, real-time avatar generation, and sophisticated physics simulation will further cement PCVR as the pinnacle of virtual reality experience, driving widespread adoption across both consumer and professional demographics throughout the forecast period.

AI Impact Analysis on PCVR Device Market

User questions concerning the influence of AI on the PCVR Device Market primarily revolve around performance optimization, content scalability, and the creation of dynamic, believable virtual environments. Common inquiries address how AI-powered foveated rendering will reduce the GPU load required for high-resolution experiences, thereby making PCVR accessible to a wider range of hardware users. Users also express high expectations regarding AI's ability to drive complex non-player character (NPC) behavior and generative content creation, transforming static virtual worlds into constantly evolving and highly personalized experiences. A key theme of concern is the expectation for AI to solve persistent issues like realistic physics interactions and avatar realism (the 'uncanny valley'), while maintaining low latency crucial for PCVR. Overall, users anticipate that AI will be the pivotal enabling technology that lowers cost barriers, enhances graphical fidelity, and dramatically increases the depth and realism of interactions possible within the PCVR ecosystem, accelerating its maturity from a niche gaming product to a mainstream computing platform.

- AI-Accelerated Foveated Rendering: Utilizing eye-tracking data processed by AI algorithms to dynamically render only the area the user is directly looking at in high resolution, significantly reducing computational load on the PC graphics card while maintaining perceived visual fidelity.

- Generative Content Creation (GCC): Employing AI models to rapidly generate textures, 3D assets, environmental details, and even entire virtual levels based on simple prompts or parameters, dramatically lowering development costs and speeding up content deployment for PCVR platforms.

- Intelligent NPC Behavior: Implementing deep learning models to govern the actions, dialogue, and decision-making processes of non-player characters, leading to highly realistic, adaptive, and immersive interactions within PCVR games and simulation environments.

- Real-Time Physics Simulation: Using AI to optimize and accelerate complex physics calculations, allowing for more realistic and granular interactions between virtual objects without overloading the PC's CPU.

- Latency Reduction via Predictive Algorithms: Deploying machine learning to predict user movement and head orientation moments before they occur, allowing the system to pre-render frames and minimize motion-to-photon latency, crucial for maintaining comfort in high-speed PCVR applications.

- Personalized Calibration and Comfort: AI-driven systems automatically adjust lens settings, interpupillary distance (IPD), and even sound profiles based on individual user biometric data and comfort feedback, optimizing the ergonomic experience across diverse user groups.

- Enhanced Data Compression and Streaming: AI models optimize video compression and transmission algorithms for wireless PCVR solutions, ensuring high-bandwidth data transfer with minimal latency and compression artifacts over local networks.

- Sophisticated Avatar Realism: Using deep neural networks to generate highly realistic, expressive, and dynamically animated user avatars based on facial scans or webcam inputs, improving social presence in collaborative PCVR environments.

DRO & Impact Forces Of PCVR Device Market

The PCVR Device Market is fundamentally shaped by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities (DRO). Key Drivers include the exponential growth in demand for high-fidelity interactive entertainment, supported by the maturation of AAA VR game development and continuous innovations in GPU architecture that make complex rendering achievable. Additionally, the increasing recognition of VR's efficacy in professional sectors—such as high-risk industrial training, remote surgical guidance, and complex architectural visualization—serves as a robust demand accelerator. These drivers are intrinsically linked to the market's impact forces, particularly technological innovation and content availability, which collectively push performance envelopes and broaden the addressable market base beyond early adopters.

However, significant Restraints challenge rapid market expansion. The primary constraint remains the high total cost of ownership (TCO), which necessitates not only the expensive VR headset but also a high-specification gaming PC, limiting adoption primarily to affluent or dedicated enthusiasts. Furthermore, physical requirements such as dedicated play space and the persistent issue of setup complexity, particularly involving external tracking sensors, present ergonomic and logistical hurdles. The market is also hindered by the current fragmentation of software ecosystems and proprietary standards, which can complicate cross-platform content development and restrict user choice, applying downward pressure on market growth by increasing user friction and uncertainty.

Opportunities for profound market growth exist primarily in the strategic development of wireless streaming solutions that achieve near-tethered performance, effectively mitigating the physical cable restraint. The expanding corporate embrace of the Metaverse concept provides a vast greenfield for enterprise applications, driving demand for high-accuracy PCVR for virtual meetings, prototyping, and employee onboarding. Furthermore, breakthroughs in compact, high-resolution display technology (like micro-OLED) and refined optical designs (pancake lenses) promise lighter, more comfortable headsets, directly addressing ergonomic restraints and broadening mass-market appeal. Leveraging these opportunities while systematically addressing restraints—such as standardized SDKs and reducing TCO through hardware efficiency—will determine the long-term trajectory and sustained profitability of the PCVR Device Market, making impact forces related to integration and standardization critical.

Segmentation Analysis

The PCVR Device Market segmentation provides a granular view of diverse product offerings, application requirements, and geographical consumption patterns. This analysis primarily dissects the market based on Device Type (Tethered, Wireless Adapter), Application (Gaming, Enterprise, Healthcare, Education), Component (Headsets, Controllers, Tracking Systems), and geographical location. Understanding these segments is crucial for manufacturers to tailor product development, pricing strategies, and distribution channels, ensuring alignment with specific end-user demands, ranging from the demanding visual requirements of professional flight simulators to the budget constraints of educational VR labs. The dominant revenue stream currently flows from high-end tethered devices aimed at dedicated enthusiasts and professional users requiring absolute minimal latency and maximum graphical throughput.

The application segmentation highlights the shift in market gravity; while Gaming remains the volume leader, the most significant growth rate is observed in Enterprise and Healthcare applications. Enterprise adoption focuses on areas like virtual training simulations for complex machinery or collaborative design reviews, where the superior clarity and stability of PCVR are necessary prerequisites. Healthcare utilizes PCVR for pain management, rehabilitation therapy, and complex surgical planning visualization. Component segmentation focuses on technological advancements in optical systems (lenses and displays) and input mechanisms (haptic feedback controllers and precision hand tracking modules), revealing substantial investment in optimizing the user interface and physical immersion necessary to differentiate PCVR from lower-fidelity, standalone VR alternatives.

- By Device Type:

- Tethered Headsets (requiring direct physical cable connection to PC)

- Wireless Adapted Headsets (utilizing dedicated wireless transmission technology like WiGig or Wi-Fi 6E)

- By Application:

- Gaming & Entertainment (AAA titles, competitive eSports, social VR)

- Enterprise & Industrial (Design, Prototyping, Maintenance, Virtual Meetings)

- Healthcare & Medical (Surgical Training, Therapy, Pain Management)

- Education & Training (Virtual Field Trips, Complex Simulation, Skill Development)

- By Component:

- Head-Mounted Displays (HMDs)

- Controllers & Input Devices (Handheld, Haptic Feedback, Data Gloves)

- Tracking Systems (External Base Stations, Inside-Out Cameras, Eye Trackers)

- Software & Platforms (Operating Systems, SDKs, Content Distribution Platforms)

- By End-User:

- Individual Consumers

- Corporations/Businesses

- Educational Institutions

- Government/Military Organizations

Value Chain Analysis For PCVR Device Market

The PCVR device value chain initiates with sophisticated upstream activities focused heavily on the sourcing and manufacturing of high-precision components, including micro-display panels (often OLED or LCD with specialized fast-switching capabilities), custom-designed high-resolution optics (pancake or Fresnel lenses), and precision sensors such as IMUs (Inertial Measurement Units) and advanced tracking cameras. Upstream specialization requires deep expertise in miniaturization, thermal management, and rapid refresh rate electronics, establishing high barriers to entry for new component suppliers. Key partnerships are often formed between PCVR manufacturers and leading semiconductor firms (for specialized chips) and display panel makers to ensure stable supply and technological differentiation, with R&D being the critical value-adding activity in this initial stage.

The midstream phase involves the complex assembly, software integration, and system calibration of the finished PCVR HMDs and peripherals. Manufacturers focus intensely on quality control, ensuring perfect lens alignment (critical for user comfort) and robust synchronization between the HMD, controllers, and the PC host system. This stage also includes proprietary software development, specifically the creation of efficient drivers and SDKs that enable seamless interaction between the physical hardware and PC operating systems, allowing third-party developers to easily create optimized content. Efficient logistics and assembly are crucial here to manage costs, which are naturally high due to the complexity and low production yields often associated with cutting-edge optical and display technologies.

Downstream activities center on distribution channels and end-user engagement. Distribution is multifaceted, involving both direct-to-consumer (D2C) online sales for enthusiasts and high-volume indirect channels through specialized electronics retailers, dedicated gaming stores, and PC component vendors. Crucially, the Enterprise segment relies heavily on indirect sales via System Integrators (SIs) and Value-Added Resellers (VARs) who provide complex installation, calibration, and customized software bundles for industrial applications. Post-sale support, content platform management (like proprietary VR stores or open access platforms), and community building are vital downstream activities, directly influencing brand loyalty and sustained product adoption within this ecosystem-driven market segment.

PCVR Device Market Potential Customers

The primary cohort of potential customers for PCVR devices are high-end gaming enthusiasts and competitive eSports players who demand the utmost visual fidelity, lowest possible latency, and complex physical simulation capabilities that only PC hardware can currently provide. These consumers often possess existing high-performance PCs and are willing to invest premium prices for an uncompromised virtual experience, making them the largest and most immediate revenue generators in the consumer segment. Their demand is driven by the complexity and graphical requirements of flagship VR titles, which are often exclusive to or optimized for PCVR platforms, positioning them as early adopters of new display and tracking technologies.

Beyond consumers, the fastest-growing potential customer segment resides within specialized Enterprise domains. This includes manufacturing and engineering firms that use VR for detailed product prototyping, simulation, and remote maintenance training, benefiting from PCVR’s high precision for spatial accuracy and detailed graphical rendering. Healthcare institutions represent another critical customer base, utilizing PCVR for complex surgical rehearsal, medical visualization of patient scans, and highly specific therapeutic rehabilitation programs where graphical fidelity and low motion-to-photon latency are clinical requirements. These institutional buyers value the robust performance, consistent calibration, and long-term upgradeability afforded by tethered PCVR systems.

Furthermore, educational and research institutions constitute a growing segment of potential buyers, particularly in higher education for scientific visualization, remote laboratory work, and architectural design studies. Military and government organizations are also significant potential customers, especially for high-stakes operational simulation and advanced pilot or vehicle training where absolute realism is non-negotiable. These diverse groups of end-users are characterized by their need for professional-grade performance, high data security features, and integration capabilities with existing non-VR computing infrastructure, driving the demand for specialized hardware features and robust enterprise-level support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meta Platforms (Oculus/Meta Quest Link), Valve Corporation (Valve Index), HTC Vive, Pimax, HP Inc., Sony (PSVR 2 PC Adapter Potential), Microsoft (Mixed Reality), Varjo, Google, Razer, Acer, Dell (Alienware), Lenovo, Pico Interactive, Samsung, StarVR, Reverb G2, 3Glasses, Fove, DPVR |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCVR Device Market Key Technology Landscape

The technological landscape of the PCVR Device Market is defined by a relentless pursuit of visual clarity, reduced latency, and enhanced ergonomic comfort, primarily achieved through advancements in optical and display technologies. Critical to current generation devices are high-resolution micro-displays, often utilizing OLED or Micro-LED technology, offering fast refresh rates (up to 144 Hz or higher) and increased pixel density (PPD) to minimize the screen door effect (SDE) and maximize immersion. Coupled with these displays are next-generation optical systems, notably pancake lenses, which utilize reflection to fold light, allowing for significantly thinner, lighter, and more compact headset designs compared to traditional bulky Fresnel lenses, directly addressing major ergonomic restraints and improving user experience over long sessions.

A second pivotal area of technological innovation is precision tracking and input mechanisms. Modern PCVR systems rely heavily on robust inside-out tracking, where cameras integrated into the headset map the environment, often supplemented by external base stations (Lighthouse tracking) for sub-millimeter accuracy required by professional simulation and high-stakes gaming. Eye-tracking technology is rapidly becoming standard, enabling crucial functionalities such as foveated rendering, which dynamically allocates GPU resources to the user’s point of focus, and automatic interpupillary distance (IPD) adjustment, optimizing visual comfort and performance simultaneously. Furthermore, advanced haptic feedback controllers and specialized data gloves are enhancing the realism of virtual interaction, moving beyond simple vibrations to simulate complex tactile sensations like texture, weight, and temperature, crucial for enterprise training applications.

Finally, the evolution of connectivity and processing power is fundamental to PCVR’s future. The shift towards wireless PCVR streaming is being facilitated by high-bandwidth standards like Wi-Fi 6E (802.11ax) and 60 GHz WiGig, requiring sophisticated compression algorithms and edge computing capabilities within the headset to minimize latency and ensure stable data throughput. On the PC side, advancements in real-time ray tracing and complex geometry processing, driven by new generations of GPUs, continuously elevate the graphical ceiling for PCVR content, maintaining its competitive edge over standalone devices. The development of standardized, open-source SDKs and platform-agnostic middleware is simplifying content porting and development, fostering a more interconnected and robust content ecosystem that leverages these technological hardware improvements effectively.

Regional Highlights

Regional dynamics play a crucial role in shaping the PCVR device market, reflecting variations in technological infrastructure, consumer readiness, and enterprise investment priorities. North America maintains market leadership, largely driven by the presence of major technological innovation hubs, high consumer adoption rates of premium gaming hardware, and significant investment in virtual training solutions by defense and large corporations. The region benefits from a robust ecosystem of content developers and a highly competitive hardware market that pushes innovation and performance boundaries, ensuring continued demand for high-end PCVR systems for both consumer and professional use.

Europe represents another mature PCVR market, characterized by strong demand for simulation and training in industrial sectors, particularly in Germany and the UK, and a burgeoning consumer base interested in educational and cultural VR experiences. Regulatory environments, particularly those encouraging digital transformation in manufacturing (Industry 4.0 initiatives), are accelerating enterprise adoption. Key markets within Europe, such as France and Scandinavia, show high uptake due to strong broadband infrastructure and consumer affinity for advanced digital entertainment, demanding devices that leverage powerful local PC processing capabilities.

The Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid urbanization, expanding middle-class populations with increased disposable income, and massive investment in 5G and fiber network infrastructure. Countries like China, Japan, and South Korea are not only manufacturing centers for VR components but also massive consumer markets driven by dense populations, competitive gaming culture, and government support for technological self-sufficiency. The APAC market shows a particular preference for internet café and arcade VR models, driving demand for robust, high-throughput PCVR setups designed for intensive, shared use. This region is critical for future market expansion, especially as local manufacturers introduce more cost-competitive, high-specification devices designed specifically for the rapidly evolving technological landscape.

- North America: Market leader due to large enterprise adoption (aerospace, defense, engineering), high penetration of high-end gaming PCs, and the presence of core industry innovators (Meta, Valve, HP). Focus on premium consumer experiences and professional simulation.

- Europe: Strong demand in industrial simulation and design (Industry 4.0), high average income leading to steady consumer uptake, and early adoption of VR in medical training. Emphasizes ergonomic design and precise tracking for professional applications.

- Asia Pacific (APAC): Fastest-growing region driven by massive youth population, burgeoning eSports culture, expanding broadband infrastructure, and strong domestic manufacturing capabilities in countries like China and Taiwan. High growth expected in VR arcade and B2B training sectors.

- Latin America (LATAM): Emerging market with potential primarily concentrated in Brazil and Mexico, focusing initially on academic research, niche architectural visualization, and low-cost consumer gaming solutions leveraging refurbished PC hardware. Growth is constrained by import tariffs and lower average PC specification penetration.

- Middle East and Africa (MEA): Growth concentrated in oil & gas and government sectors for specialized industrial training and high-tech defense simulations (e.g., Saudi Arabia, UAE). Consumer market remains nascent but shows high growth potential linked to smart city initiatives and technological investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCVR Device Market.- Meta Platforms (Oculus/Meta Quest Link Ecosystem)

- Valve Corporation (Valve Index)

- HTC Vive

- Pimax

- HP Inc. (Reverb G2)

- Sony (PSVR 2 PC Adapter Potential)

- Microsoft (Windows Mixed Reality Ecosystem)

- Varjo

- Google (Software/Content Focus)

- Razer (Peripherals and Accessories)

- Acer

- Dell (Alienware)

- Lenovo

- Pico Interactive (Focusing on Enterprise PCVR)

- Samsung

- StarVR (High FoV Professional Solutions)

- 3Glasses

- Fove

- DPVR

- Zotac (Mini-PC Solutions for VR)

Frequently Asked Questions

Analyze common user questions about the PCVR Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of PCVR devices over standalone VR headsets?

The primary advantage of PCVR devices lies in their ability to leverage the immense processing power and high-end dedicated Graphics Processing Units (GPUs) of a connected personal computer. This enables superior graphical fidelity, higher resolution rendering, lower motion-to-photon latency, complex physics simulation, and access to the most graphically demanding AAA VR content that standalone devices cannot support.

How is AI impacting the performance and required hardware specification for PCVR?

AI is critically impacting PCVR performance through techniques like foveated rendering, which uses eye-tracking to intelligently reduce the rendering load on the GPU by focusing high resolution only where the user is looking. This optimization is expected to lower the minimum required PC hardware specifications for running high-fidelity VR experiences comfortably, making PCVR more accessible.

Are tethered PCVR headsets becoming obsolete due to advanced wireless adapters?

No, tethered PCVR headsets are not obsolete. While advanced wireless solutions (Wi-Fi 6E/WiGig) significantly improve convenience, dedicated tethered connections still offer guaranteed bandwidth, absolute minimal latency, and consistent power delivery, which are non-negotiable requirements for professional simulation, competitive eSports, and applications demanding the highest current visual fidelity without compression artifacts.

Which application segment shows the highest growth rate in the PCVR Device Market?

While Gaming maintains the largest market share in terms of volume, the Enterprise and Industrial application segment, encompassing sectors like corporate training, engineering visualization, and healthcare simulation, exhibits the highest Compound Annual Growth Rate (CAGR). This growth is driven by clear returns on investment realized through highly realistic and complex virtual training environments.

What are the main financial and physical barriers to PCVR mass adoption?

The main barriers are the high total cost of ownership (TCO), which includes both the premium headset price and the prerequisite expense of a high-performance PC, and the physical requirement for dedicated, unobstructed play space. Complexity of setup and cable management (for tethered systems) also pose significant hurdles for mainstream consumer adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager