PE Micronized Wax Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432702 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

PE Micronized Wax Market Size

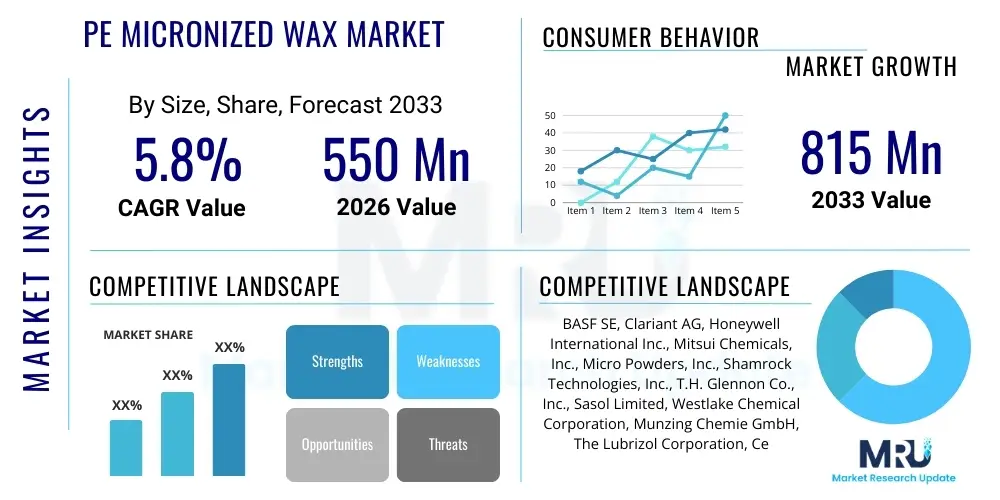

The PE Micronized Wax Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating demand for high-performance additives in industrial coatings, printing inks, and specialized plastic formulations where enhanced surface properties are non-negotiable for product longevity and aesthetic quality. Micronized polyethylene waxes, characterized by their extremely fine particle size, offer superior dispersion and integration into complex matrixes, driving their adoption across diverse sectors.

Market expansion is also supported by infrastructural development and industrialization, particularly in emerging economies across the Asia Pacific region. The construction boom necessitates advanced protective coatings that utilize PE micronized waxes for improved scratch resistance, anti-blocking characteristics, and matte finishes. Furthermore, regulatory shifts favoring low-VOC and sustainable coating solutions are indirectly boosting the demand for high-solid systems and powder coatings, where micronized waxes serve as essential processing aids and performance modifiers. The shift from solvent-based to water-based formulations requires waxes that can maintain stability and effectiveness in aqueous environments, a segment where specialized micronized PE waxes excel.

While the overall market exhibits robust expansion, pricing volatility of raw materials, primarily polyethylene polymers, presents a persistent constraint on profitability margins. Manufacturers are increasingly focusing on vertical integration and optimization of micronization processes to mitigate cost pressures and maintain competitive pricing. The future growth hinges heavily on continuous product innovation, particularly the development of functionalized micronized waxes designed for specific end-use requirements, such as enhanced lubricity in automotive plastics or improved thermal stability in packaging applications, ensuring sustained value proposition against alternative surface modifiers.

PE Micronized Wax Market introduction

The PE Micronized Wax Market encompasses the production and distribution of ultrafine powdered polyethylene waxes utilized as crucial additives to modify and enhance the physical and chemical properties of various end-user products. These waxes, derived primarily from low-density polyethylene (LDPE) or high-density polyethylene (HDPE) feedstock and processed through advanced micronization techniques like jet milling, possess particle sizes typically ranging from 1 to 20 micrometers. This fine particle geometry ensures superior uniform dispersion within host matrices such as printing inks, protective coatings, adhesives, and polymer compounds, optimizing performance characteristics that bulk waxes cannot achieve.

Key applications leveraging PE micronized wax include the formulation of high-quality industrial and architectural coatings, where they impart superior slip, scratch resistance, and abrasion protection without negatively impacting gloss levels or transparency. In the printing industry, they are indispensable for improving rub resistance in offset and gravure inks, enhancing print durability and handling ease. Furthermore, these specialty waxes act as lubricants and mold release agents in plastic processing, facilitating manufacturing efficiency and improving the final product's surface finish. The primary benefits driving market demand include improved wear resistance, controlled coefficient of friction (COF), matting effects, and anti-blocking properties.

Market growth is principally driven by the continuous technological advancement in coating and ink industries, demanding higher performance additives to meet stringent quality standards and functional requirements. Specific driving factors include the rising consumption of powder coatings in the automotive and general industrial sectors, the expansion of flexible packaging requiring durable printing inks, and the general trend toward miniaturization and high-precision manufacturing, necessitating finer and more specialized material inputs. These factors collectively establish PE micronized wax as a cornerstone component in modern high-performance materials science.

PE Micronized Wax Market Executive Summary

The PE Micronized Wax Market is positioned for stable, moderate growth, propelled by robust demand from the coatings and inks industries across major industrial regions. Current business trends indicate a strong move toward product specialization, where manufacturers are offering tailored micronized waxes, including oxidized or modified variants, to address specific functional needs such as enhanced dispersibility in waterborne systems and improved compatibility with UV-curing formulations. The market is also witnessing consolidation among key players aiming to secure raw material supply chains and optimize high-cost micronization technologies, leading to enhanced operational efficiencies and competitive differentiation through product purity and consistency.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market segment, primarily fueled by massive infrastructure projects, burgeoning manufacturing sectors in China and India, and the rapid expansion of the consumer electronics industry demanding advanced surface protection. North America and Europe, while mature, maintain strong market shares driven by strict regulatory standards favoring high-quality, non-hazardous additives and continuous innovation in automotive and aerospace coatings. Segmentation trends reveal that the use of PE micronized wax in powder coatings and specialized adhesives is experiencing above-average growth, reflecting the industry's continuous evolution towards higher performance, solid-content systems.

In summary, the PE Micronized Wax Market landscape is characterized by technological refinement, aggressive regional expansion focused on APAC, and strategic emphasis on sustainability, particularly through the development of waxes derived from recycled or bio-based sources to appeal to environmentally conscious end-users. While potential restraints include volatile crude oil prices impacting PE feedstock costs, the expansive application scope across durable goods, printing, and construction sectors ensures sustained demand and resilience against economic fluctuations, guaranteeing steady CAGR throughout the forecast period.

AI Impact Analysis on PE Micronized Wax Market

Common user inquiries regarding AI in the PE Micronized Wax Market typically center on how artificial intelligence can optimize the high-energy consuming micronization process, predict raw material price volatility, and accelerate the development of new wax formulations with specific particle size distributions. Users are concerned about implementing complex AI models for real-time process control to ensure batch-to-batch consistency, which is critical for high-quality micronized products. The key themes revolve around achieving manufacturing efficiency, enhancing product quality through precise particle engineering, and leveraging predictive analytics for demand forecasting in niche application areas like advanced electronics coatings. Expectations are high that AI will transform research and development (R&D) by simulating molecular interactions, drastically reducing the time needed to bring specialized wax grades to market.

- AI-driven optimization of jet milling processes to minimize energy consumption and maximize yield.

- Predictive maintenance analytics for micronization equipment, reducing unscheduled downtime and operational costs.

- Enhanced quality control using machine vision systems to analyze particle morphology and distribution in real-time.

- Supply chain modeling via AI to forecast polyethylene feedstock price fluctuations and optimize inventory management.

- Accelerated R&D through machine learning algorithms that predict the performance of new wax formulations in specific coating systems.

- Automated formulation assistance for end-users, recommending optimal wax grades based on desired application properties (e.g., slip, matte level).

DRO & Impact Forces Of PE Micronized Wax Market

The PE Micronized Wax Market is primarily driven by the increasing need for surface durability and aesthetic improvements across industrial applications, particularly the rapid expansion of the powder coatings segment which relies heavily on these additives for flow control and degassing. Opportunities stem from continuous innovation in functionalized waxes, including those with enhanced chemical resistance or biodegradability, catering to highly specialized and regulated industries such as aerospace and medical device manufacturing. However, the market faces significant restraints, notably the regulatory scrutiny on polymer additives and the high capital expenditure required for sophisticated micronization facilities, which acts as a major barrier to entry for smaller manufacturers.

The fundamental market driver is the inherent advantage of micronized waxes over standard polyethylene waxes, primarily their superior dispersion capability and minimal impact on gloss, making them ideal for premium formulations. The strong growth in the packaging sector, particularly flexible packaging requiring high rub-resistance inks, further accelerates demand. Opportunities also emerge from regions undergoing rapid industrialization (APAC, MEA), where demand for basic and advanced coatings is multiplying annually. Furthermore, the push towards sustainability creates specific opportunities for specialty waxes derived from sustainable processes or recycled PE, aligning with global corporate environmental mandates.

Impact forces in the market are strongly influenced by the bargaining power of raw material suppliers, as polyethylene sourcing is consolidated and tied to volatile petrochemical markets. The threat of substitutes, particularly alternative micronized polymers like PTFE or natural waxes, remains moderate but necessitates continuous performance improvement and cost management by PE wax producers. Competitive rivalry is high, driven by the presence of large multinational chemical companies capable of large-scale production and sophisticated distribution networks, placing continuous pressure on pricing and efficiency across the value chain. These forces dictate that profitability relies heavily on product differentiation and process efficiency.

Segmentation Analysis

The PE Micronized Wax Market is extensively segmented based on the specific type of wax modification, the manufacturing process used, and its final application, ensuring that specialized grades meet precise performance requirements across diverse industrial uses. Segmentation by type often distinguishes between pure PE micronized wax, oxidized PE micronized wax (offering better polarity and compatibility), and functionalized variants tailored for specific chemical environments. The application segmentation demonstrates the widespread utility of these additives, ranging from high-volume uses in architectural coatings to highly specialized roles in hot melt adhesives and masterbatch production, reflecting the complex and varied performance demands of the global industrial economy.

- By Type:

- Pure PE Micronized Wax

- Oxidized PE Micronized Wax

- Modified/Functionalized PE Wax

- By Manufacturing Process:

- Air Classification Milling (Jet Milling)

- Spray Micronization

- Emulsion/Suspension Process

- By Application:

- Printing Inks (Offset, Gravure, Flexo)

- Paints and Coatings (Powder Coatings, Industrial, Architectural)

- Adhesives and Sealants (Hot Melt Adhesives)

- Plastics and Masterbatches

- Textile and Leather Treatment

- Polishes and Waxes

- By End-Use Industry:

- Automotive

- Construction

- Packaging

- Electronics

- Consumer Goods

Value Chain Analysis For PE Micronized Wax Market

The value chain for PE Micronized Wax begins with the upstream segment, dominated by major petrochemical companies supplying the core feedstock, primarily high-density (HDPE) or low-density polyethylene (LDPE) resins, which are heavily influenced by global crude oil and natural gas prices. The subsequent midstream process involves the complex manufacturing of crude PE waxes, followed by the crucial step of micronization, which requires specialized, high-precision equipment and significant expertise to achieve the desired particle size distribution and morphology. Efficiency in this stage—optimizing energy consumption and minimizing material waste—is key to profitability. This middle segment is where most specialized manufacturers create value through chemical modification (oxidation) and advanced particle engineering.

Distribution channels form the link between manufacturers and diverse end-users. Direct sales are common for large volume industrial buyers (e.g., major coating manufacturers), allowing for tailored technical support and just-in-time inventory management. Indirect sales rely on a vast network of chemical distributors and specialty additive resellers who provide inventory warehousing, localized service, and technical consultation to smaller and geographically dispersed customers, especially in emerging markets. The effective management of these channels ensures widespread market penetration and efficient technical service required for incorporating specialized additives like micronized waxes into complex formulations.

The downstream segment consists of numerous end-user industries, including paint and coating formulators, printing ink producers, and plastic compounders. Their feedback is crucial as they demand specific technical specifications—such as precise melt points, COF control, and compatibility with waterborne or solvent-based systems—which drive innovation upstream. Profit margins are optimized throughout the chain by reducing lead times, ensuring product quality consistency, and providing continuous technical application support, confirming that value creation moves from petrochemical refinement to specialized particle engineering and, finally, effective integration into high-performance consumer and industrial products.

PE Micronized Wax Market Potential Customers

The primary customers for PE Micronized Wax are entities within the chemical formulating and manufacturing sectors that require advanced surface modification and processing aids for their end products. These include global leaders and niche players in the paint and coatings industry, spanning sectors from automotive refinishing and marine coatings to protective industrial finishes and decorative architectural paints. The demand is centered around the need for additives that confer superior scratch, mar, and abrasion resistance, properties essential for product longevity and consumer satisfaction, particularly in high-wear applications like floor coatings and heavy machinery finishes.

Another significant customer segment is the printing ink industry, which utilizes these micronized waxes extensively in offset, gravure, and flexographic ink formulations. Printing companies, particularly those involved in high-speed, high-volume operations like packaging and publication printing, require PE waxes to minimize blocking (sheets sticking together) and significantly improve the ink’s rub and scuff resistance. The quality of the micronized wax directly impacts the final print durability and processing speed, making ink manufacturers highly discerning buyers focused on particle consistency and purity.

Furthermore, the plastics processing industry, including masterbatch producers and compounders, represents a growing customer base. Here, PE micronized waxes function as external lubricants, enhancing melt flow, reducing friction during extrusion or injection molding, and improving mold release characteristics. End-users in this segment, such as automotive component manufacturers and pipe producers, leverage these waxes to improve production efficiency, reduce energy consumption, and ensure a flawless surface finish on highly aesthetic plastic parts, thereby maximizing throughput and product quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, Honeywell International Inc., Mitsui Chemicals, Inc., Micro Powders, Inc., Shamrock Technologies, Inc., T.H. Glennon Co., Inc., Sasol Limited, Westlake Chemical Corporation, Munzing Chemie GmbH, The Lubrizol Corporation, Ceronas GmbH & Co. KG, Lion ChemTech Co., Ltd., Deurex AG, Koster Keunen, Inc., Marcus Oil & Chemical Corporation, BYK-Chemie GmbH, SCG Chemicals, Custom Synthesis, Inc., Michelman, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PE Micronized Wax Market Key Technology Landscape

The core technology driving the PE Micronized Wax Market is mechanical micronization, predominantly achieved through air classification milling (jet milling). This process involves highly sophisticated equipment that subjects the coarse wax particles to high-velocity collisions, resulting in extremely fine powders with precise particle size control, often in the 1 to 10 micrometer range. Jet milling offers the highest purity and allows for the narrow particle size distribution essential for high-end applications like clear coats and thin-film printing inks, where uniformity and absence of oversized particles are critical to avoid defects. Continuous advancements in jet milling focus on reducing energy consumption and increasing throughput while maintaining stringent quality control over particle morphology, which impacts the final product’s performance characteristics such as matting efficiency and slip.

Beyond mechanical methods, the technology landscape includes spray micronization and chemical modification techniques. Spray micronization, or atomization, involves melting the wax and spraying it into a controlled environment where it rapidly cools into fine particles. This method is often utilized for producing coarser micronized grades or waxes with specialized chemical modifications. Chemical modification, such as oxidation, is essential for imparting polar functional groups onto the PE wax backbone, significantly enhancing its compatibility and dispersibility in polar systems, especially waterborne coatings and emulsions, which represent a major technological shift mandated by environmental regulations.

Furthermore, technology innovation is heavily invested in developing functionalized PE waxes. This includes grafting specific polymers or using coupling agents to tailor the wax's surface chemistry for specific interactions, such as increased affinity for pigments or enhanced solubility in specific solvents. The integration of continuous monitoring systems and advanced analytics into the manufacturing process ensures superior batch-to-batch consistency and facilitates the rapid development of custom wax solutions for niche applications, solidifying the market's trajectory towards highly specialized, performance-driven products engineered at the micro-level.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by rapid industrialization, massive construction activities, and the booming manufacturing base in China, India, and Southeast Asian countries. The region’s escalating demand for protective and decorative coatings in automotive, infrastructure, and consumer goods manufacturing is the primary catalyst for the high consumption of PE micronized waxes, particularly in powder coating applications and durable printing inks.

- North America: This region maintains a strong market presence characterized by a mature industrial base and a focus on high-performance, specialized coatings (aerospace, automotive OEM). Strict environmental regulations mandate a shift towards low-VOC, high-solids, and waterborne formulations, driving demand for premium, highly dispersible, and functionally modified PE micronized waxes. R&D innovation and the adoption of advanced material science are key regional strengths.

- Europe: The European market is characterized by stringent chemical safety standards (REACH) and a pronounced commitment to sustainability. Demand is high for oxidized and specialized PE waxes that comply with eco-labeling schemes. Key markets include Germany (automotive, engineering plastics) and Italy (coatings, textiles). Market growth is steady, driven by the replacement of older coating technologies with high-end, functionalized systems.

- Latin America (LATAM): LATAM presents moderate growth potential, influenced by infrastructural investment in countries like Brazil and Mexico. The market is developing, with increased adoption of modern coating and printing technologies, though growth can be sensitive to macroeconomic stability and currency fluctuations. The construction and packaging sectors are primary demand drivers.

- Middle East and Africa (MEA): This region is an emerging market with significant growth expected in the Gulf Cooperation Council (GCC) states due to large-scale construction projects and diversification of manufacturing sectors. Demand focuses on industrial coatings requiring high durability and protection against harsh climatic conditions. The market relies heavily on imports and developing local distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PE Micronized Wax Market.- BASF SE

- Clariant AG

- Honeywell International Inc.

- Mitsui Chemicals, Inc.

- Micro Powders, Inc.

- Shamrock Technologies, Inc.

- T.H. Glennon Co., Inc.

- Sasol Limited

- Westlake Chemical Corporation

- Munzing Chemie GmbH

- The Lubrizol Corporation

- Ceronas GmbH & Co. KG

- Lion ChemTech Co., Ltd.

- Deurex AG

- Koster Keunen, Inc.

- Marcus Oil & Chemical Corporation

- BYK-Chemie GmbH

- SCG Chemicals

- Custom Synthesis, Inc.

- Michelman, Inc.

Frequently Asked Questions

Analyze common user questions about the PE Micronized Wax market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of using PE micronized wax in coatings?

PE micronized wax provides superior scratch and abrasion resistance, anti-blocking characteristics, and excellent slip properties in coatings and inks. Due to its fine particle size (typically 1–20 microns), it disperses uniformly and rises to the surface, creating a protective layer that minimizes the coefficient of friction without negatively impacting gloss or film clarity, which is crucial for high-quality finishes.

How does the micronization process influence the quality of polyethylene wax?

Micronization, typically performed via jet milling, significantly reduces the particle size of PE wax, ensuring uniform dispersion and eliminating agglomeration. This process is essential because smaller, consistently sized particles integrate more effectively into liquid and powder systems, optimizing performance features like matting efficiency, texture, and rub resistance in the final product formulation.

Which application segment holds the largest market share for PE Micronized Wax?

The Paints and Coatings segment holds the largest market share, driven primarily by the high consumption of PE micronized waxes in powder coatings and industrial protective finishes. These waxes are essential additives that enhance the flow properties during application and provide the necessary durability and surface protection required for automotive and architectural applications.

What impact do environmental regulations have on the PE Micronized Wax Market?

Environmental regulations, particularly those promoting reduced Volatile Organic Compounds (VOCs), are favorably impacting the market by driving the adoption of waterborne and powder coating systems. These modern systems require specialized, highly compatible oxidized or functionalized PE micronized waxes to maintain performance standards while adhering to stringent global environmental compliance mandates.

Which region is anticipated to demonstrate the fastest growth in the PE Micronized Wax Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by accelerated industrial growth, extensive infrastructure development, and the rapid expansion of the manufacturing sectors in key economies like China and India. This regional expansion translates into significant, escalating demand for high-performance specialty chemical additives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager