Peanut Flour Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431710 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Peanut Flour Market Size

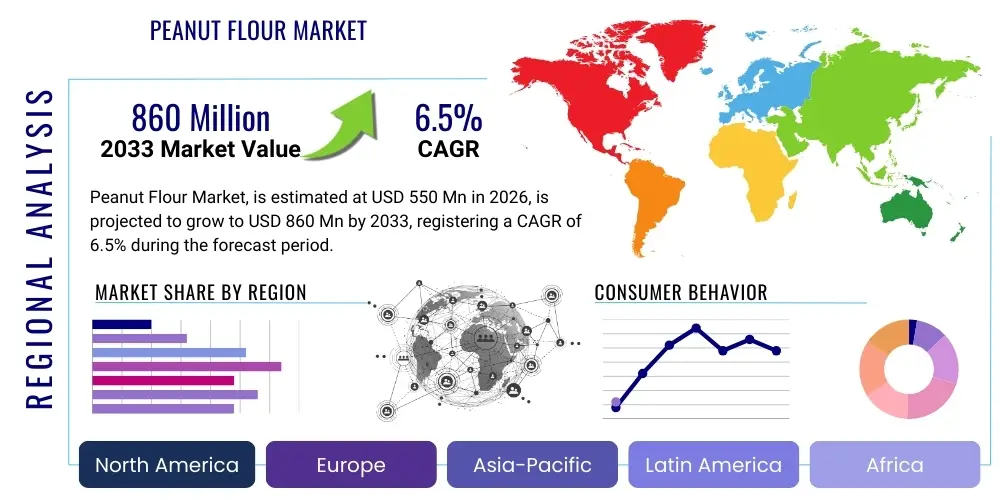

The Peanut Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 860 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating consumer demand for high-protein, gluten-free, and allergen-friendly ingredients across the food and beverage industry, particularly in North America and Europe. The versatility of peanut flour, ranging from its use in bakery and confectionery to nutritional supplements and savory products, positions it as a key functional ingredient replacing traditional wheat and other nut flours.

Market expansion is further supported by innovations in processing technologies that allow for varying fat content levels—from high-fat to defatted versions—thereby broadening its application spectrum. Defatted peanut flour, in particular, has gained traction due to its significantly higher protein content and prolonged shelf life, making it highly valuable in the sports nutrition and weight management sectors. Furthermore, the rising awareness among health-conscious consumers regarding the nutritional benefits associated with peanut derivatives, including fiber, vitamins, and minerals, contributes significantly to sustained market momentum.

The market valuation reflects a robust outlook, supported by strategic investments in production capacity expansion and supply chain optimization, particularly in major peanut-producing regions. While price volatility in raw peanuts and stringent regulations concerning allergens present notable challenges, the underlying trend towards clean label ingredients and plant-based nutrition ensures that the demand for peanut flour, both roasted and raw, remains strong. The projected market size underscores the ingredient’s transition from a niche product to a mainstream component in modern food formulation, serving both industrial processors and direct consumer applications.

Peanut Flour Market introduction

The Peanut Flour Market encompasses the production, distribution, and consumption of finely milled peanuts, typically available in various fat content levels, ranging from full-fat to defatted (low-fat) and medium-fat varieties. Peanut flour is derived from partially or fully defatted peanuts and is widely recognized for its high protein content (up to 50% in defatted variants), mild flavor, and excellent emulsifying properties. This versatility allows it to function as a thickening agent, a protein supplement, or a flavor enhancer in a vast array of food products, distinguishing it from traditional wheat flour by offering gluten-free and superior nutritional profiles. Its introduction into the market was fueled by the requirement for functional ingredients that could meet rising dietary restrictions and consumer preferences for high-protein foods.

Major applications of peanut flour span across several key industry segments, including bakery and confectionery, where it enhances texture and nutritional value in breads, cookies, and pastries. It is extensively utilized in savory food applications such as sauces, soups, and coatings, providing thickness and a rich, nutty flavor without excessive fat. Furthermore, its crucial role in the booming functional food and beverage sector, specifically in protein bars, meal replacement powders, and nutritional supplements, highlights its status as a primary source of plant-based protein. The inherent benefits, such as being naturally gluten-free, non-GMO variants availability, and providing essential amino acids, make it an indispensable ingredient for manufacturers aiming for clean label certifications and enhanced nutritional density.

The primary driving factors propelling this market include the global surge in demand for plant-based protein alternatives as consumers reduce meat consumption and adopt vegetarian or flexitarian diets. The continuous expansion of the gluten-free market further amplifies demand, positioning peanut flour as a superior alternative to traditional grain flours. Moreover, technological advancements in oil extraction and milling processes have improved the quality and shelf stability of defatted peanut flour, minimizing rancidity risks and enhancing its applicability in complex industrial food systems. These factors collectively establish a resilient growth trajectory for the Peanut Flour Market across diverse geographic regions.

Peanut Flour Market Executive Summary

The Peanut Flour Market is characterized by robust growth, primarily influenced by strong business trends centered on nutritional fortification, clean label strategies, and the widespread acceptance of plant-based proteins. Key market players are focusing on product innovation, offering specialized flours based on fat content (defatted, medium-fat) and roasting levels (lightly roasted, dark roasted) to cater to specific functional requirements in various food matrices, such as emulsification in beverages and texturization in baked goods. Strategic collaborations between peanut flour producers and large-scale food manufacturers, particularly those specializing in sports nutrition and healthy snacking, are crucial for expanding market penetration. Furthermore, optimizing sustainable sourcing practices and ensuring stringent allergen control standards remain high-priority business objectives to maintain consumer trust and comply with global food safety regulations.

Regionally, North America holds a dominant market share due to its established functional food industry, high consumer awareness regarding protein intake, and significant demand for gluten-free products. The Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rising disposable incomes, rapid urbanization, and the adoption of Western dietary trends, coupled with large-scale domestic peanut cultivation providing readily available raw materials. European growth is steady, underpinned by strict EU standards favoring natural ingredients and the strong presence of the specialized bakery and confectionery sectors. Manufacturers are adapting their distribution channels to accommodate both large industrial processors and the growing direct-to-consumer (D2C) segment facilitated by e-commerce platforms.

Segment-wise, the defatted peanut flour category maintains the largest market share due to its superior protein concentration and utility in low-fat dietary formulations. Application segmentation shows the food and beverage sector, particularly the snacks and confectionery sub-segment, as the primary consumer, although the nutraceutical and dietary supplement segment is experiencing the highest CAGR. In terms of end-use, industrial processors account for the majority of the volume, leveraging peanut flour for mass production, while the household sector sees increasing demand as consumers seek versatile ingredients for home baking and protein enrichment. The shift towards non-GMO and organic certified peanut flours also represents a notable and premium segment trend influencing pricing and procurement strategies across the supply chain.

AI Impact Analysis on Peanut Flour Market

Common user questions regarding AI's influence in the Peanut Flour Market generally revolve around optimizing supply chain efficiency, enhancing predictive allergen control, improving new product development (NPD) speed, and utilizing AI for yield optimization in peanut farming. Users often inquire how AI algorithms can predict fluctuating raw material prices (peanuts), manage inventory levels to minimize spoilage of fresh ingredients, and ensure traceability from farm to processing plant. A significant concern is the application of machine learning in food safety, specifically for rapid detection of aflatoxins and cross-contamination risks during processing. Key themes emerging from these inquiries highlight expectations that AI will primarily drive operational cost reduction, improve ingredient consistency, and accelerate the commercialization of novel peanut flour-based products tailored to highly specific nutritional requirements or flavor profiles, thereby significantly enhancing market responsiveness.

- AI-driven supply chain optimization reduces waste and minimizes volatility in raw peanut procurement, ensuring consistent ingredient cost management.

- Predictive analytics and machine learning models enhance food safety by rapidly identifying and mitigating risks associated with aflatoxin contamination in raw peanuts.

- AI facilitates accelerated New Product Development (NPD) by simulating formulation changes (protein content, texture, flavor) and predicting consumer acceptance profiles.

- Automated quality control systems using computer vision improve the efficiency and accuracy of sorting and grading peanuts before processing into flour.

- AI-powered market analysis allows companies to identify emerging niche dietary trends (e.g., specific protein blends) to tailor specific peanut flour products (e.g., highly roasted, enzyme-treated).

- Optimization of energy consumption and resource allocation in the milling and oil extraction processes, contributing to lower operational expenditures and sustainability goals.

DRO & Impact Forces Of Peanut Flour Market

The dynamics of the Peanut Flour Market are governed by a distinct set of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. The primary driver is the accelerating shift towards functional and plant-based foods, underpinned by global health trends emphasizing higher protein consumption and the necessity of gluten-free alternatives. This momentum is supported by the versatility of peanut flour as an affordable, nutrient-dense ingredient suitable for both savory and sweet applications. Concurrently, strict allergen labeling requirements act as a major restraint, necessitating substantial investment in dedicated processing facilities and testing protocols to manage cross-contamination risks, which can be particularly burdensome for smaller manufacturers. However, the opportunity lies in exploiting emerging markets in Asia and Latin America and developing specialized, high-margin products like certified organic or non-GMO peanut flours, along with expanding applications beyond traditional baking into pharmaceuticals and cosmetics.

The impact forces operate on multiple levels, influencing both supply and demand. Increased consumer education regarding the protein benefits of defatted peanut flour creates a robust pull effect on the demand side, encouraging large food conglomerates to reformulate existing products. On the supply side, technological advancements in ultra-filtration and oil pressing techniques allow for the production of highly stable, ultra-low-fat flours, minimizing the impact of potential restraints like limited shelf life and high fat content. Furthermore, the economic pressure of rising soybean and whey protein prices inadvertently positions peanut flour as a cost-effective alternative protein source, generating a positive substitution effect, especially in large-volume industrial applications such as animal feed supplements.

Addressing the inherent restraints, particularly the volatility of raw peanut prices due to weather dependency and agricultural yield fluctuations, requires effective supply chain hedging strategies. Successful market navigation hinges on manufacturers' ability to secure long-term contracts and integrate backwardly into the farming process. The critical opportunity remains centered on geographical expansion and targeting innovative applications. As global protein scarcity concerns grow, peanut flour, being a sustainable and efficient protein source, is poised to capture significant market share, provided manufacturers can effectively communicate stringent allergen management protocols to assuage consumer safety concerns and enhance market acceptance.

Segmentation Analysis

The Peanut Flour Market is extensively segmented based on key criteria, including type, application, and fat content, allowing for granular market analysis and targeted strategic planning. Segmentation by type differentiates between raw peanut flour and roasted peanut flour, with the latter offering a richer flavor profile crucial for confectionery and snack applications, while raw variants are often favored in protein supplementation where neutral flavor is prioritized. Segmentation by fat content is perhaps the most critical determinant of application, dividing the market into defatted (or low-fat, typically 1% to 5% fat), medium-fat (6% to 15% fat), and full-fat varieties. The functional properties, protein concentration, and caloric density vary significantly across these segments, influencing their primary utilization in the food industry.

The application segmentation is broad, encompassing bakery and confectionery (cookies, bread, pastries), savory applications (sauces, soups, batters, seasonings), nutritional supplements (protein shakes, energy bars), and non-food uses (cosmetics and pharmaceuticals). The high-growth segment remains nutritional supplements, capitalizing on the demand for clean, plant-based protein boosters. The segmentation structure provides manufacturers with insights into demand hotspots; for instance, defatted peanut flour dominates the nutritional segment due to its high protein-to-calorie ratio, whereas medium-fat flour is often preferred in traditional baking for maintaining moisture and mouthfeel.

Understanding these segments is essential for identifying lucrative market niches and optimizing product offerings. The continuous trend towards personalized nutrition and functional foods means that sub-segments focusing on organic, non-GMO, and finely sifted peanut flours are commanding premium prices and seeing faster adoption among specialty food producers. Geographic segmentation further overlays this analysis, revealing regional preferences for specific fat content levels or roasting intensity, necessitating localized sourcing and formulation strategies to maximize market penetration and ensure cultural relevance.

- By Type:

- Raw Peanut Flour

- Roasted Peanut Flour

- By Fat Content:

- Defatted Peanut Flour (Low-Fat)

- Medium-Fat Peanut Flour

- Full-Fat Peanut Flour

- By Application:

- Bakery and Confectionery

- Savory Foods (Soups, Sauces, Seasonings)

- Nutritional Supplements and Beverages

- Pet Food and Feed

- Others (Cosmetics, Pharmaceuticals)

- By Distribution Channel:

- Direct Sales (Business-to-Business)

- Indirect Sales (Distributors, Online Retail, Supermarkets)

Value Chain Analysis For Peanut Flour Market

The value chain for the Peanut Flour Market begins with the upstream activities of raw material sourcing, predominantly centered around peanut cultivation. This stage involves meticulous farming practices, including seed selection, harvesting, drying, and shelling, which significantly influence the quality and final characteristics of the resultant flour, particularly regarding oil content and potential aflatoxin levels. Key participants at this stage include large agricultural cooperatives and independent farmers in major producing nations like China, India, the United States, and Nigeria. Raw material cost volatility and weather-dependent yields represent the largest upstream risks, requiring processors to establish strong, resilient relationships with suppliers and often engaging in contract farming to ensure consistent supply and quality control necessary for high-grade food applications.

The midstream processing phase is the core of the value chain, involving the transformation of raw peanuts into flour. This includes sophisticated steps such as blanching, roasting (optional, depending on desired flavor profile), oil pressing or extraction (using mechanical pressing or solvent extraction to achieve specific fat percentages), and precise milling into various particle sizes. Specialized manufacturing companies dominate this phase, leveraging proprietary technologies for optimal oil separation and protein preservation, which is critical for producing highly functional defatted flour. The efficiency of the oil extraction process directly impacts the cost structure and the protein concentration of the final product, serving as a significant competitive differentiator in the market.

The downstream activities involve the distribution channel and eventual consumption by end-users, encompassing both direct and indirect sales mechanisms. Direct sales (B2B) involve large volume transactions to industrial food manufacturers (bakeries, supplement producers) who incorporate the flour as an ingredient. Indirect channels utilize distributors, wholesalers, and increasingly, specialized e-commerce platforms and retail outlets to reach smaller processors and household consumers. Effective logistics, cold chain management for certain high-fat varieties, and tailored packaging solutions (bulk bags for industry, retail pouches for consumers) are essential for maintaining product integrity and expanding market reach globally. The final step sees the end-user leveraging the functional and nutritional attributes of the peanut flour in diverse products.

Peanut Flour Market Potential Customers

Potential customers for the Peanut Flour Market are highly diversified, reflecting the ingredient’s versatility and functionality across various industries. The largest segment of end-users consists of industrial food manufacturers, including major bakeries and confectionery producers who utilize peanut flour to enhance the protein content, improve texture, and act as a stabilizing agent in gluten-free products like breads, cookies, and energy bars. These companies prioritize consistent quality, bulk supply capacity, and specific functional attributes like water-holding capacity and emulsification potential. They are typically B2B clients requiring specific fat percentages (often medium-fat for baking) and stringent safety certifications, making supply agreements and long-term contracts crucial components of the customer relationship.

Another rapidly expanding customer base is the functional food, nutraceutical, and sports nutrition industry. These customers, including manufacturers of protein powders, meal replacements, and dietary supplements, are primarily interested in highly defatted peanut flour variants (up to 50% protein) due to its high protein concentration and clean label appeal, contrasting favorably with some animal-based proteins. Their purchasing decisions are heavily influenced by the bioavailability of the protein, non-GMO status, and regulatory compliance regarding labeling. This segment values innovation, often seeking customized blends or specific micronutrient fortifications, pushing manufacturers toward advanced processing techniques and specialized product lines to meet the demanding requirements of health-conscious consumers.

Furthermore, the savory food sector and institutional catering services represent significant potential buyers. Manufacturers of sauces, batters, breading mixtures, and ready-to-eat meals leverage peanut flour for its thickening and emulsifying properties, along with its ability to impart a pleasant, nutty base flavor. Lastly, the emerging markets of specialty pet food formulation and cosmetic industries, where peanut protein is being explored for its moisturizing and conditioning attributes in skincare, form specialized, high-potential customer niches. These diverse customer groups ensure a stable demand ecosystem, requiring suppliers to offer differentiated products and flexible packaging options to satisfy varied industrial and consumer requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 860 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Golden Peanut and Tree Nuts, Premium Peanut, Inc., Severn Peanut Co., Birdsong Peanuts, Archer Daniels Midland Company (ADM), Algood Food Company, Inc., Vinut International, The Tru-Nut Company, Keystone Foods, Olam International, T. Parker Host, Starwest Botanicals, KTC Edibles, SunOpta Inc., Peanut Corporation of America (PCA), JAX Mercantile Co., Hampton Farms, Growers Peanut, National Peanut Board (NPB), Nutrifoods International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peanut Flour Market Key Technology Landscape

The technological landscape of the Peanut Flour Market is primarily centered around optimizing the oil extraction and milling processes to enhance product functionality, consistency, and shelf stability. Mechanical pressing, particularly cold pressing technology, is widely used to physically remove peanut oil, resulting in residual cakes that are subsequently milled into flour. This method is preferred for non-GMO and organic varieties as it avoids chemical solvents. However, solvent extraction, typically using hexane, remains a crucial technology for producing ultra-low-fat (defatted) flour with very high protein percentages, essential for the sports nutrition industry. Innovations focus on developing more efficient and environmentally friendly solvent-free extraction methods, such as supercritical CO2 extraction, though cost remains a barrier to widespread adoption.

Beyond oil extraction, advancements in particle size reduction and sieving technologies are critical for customizing peanut flour based on specific application requirements. Ultra-fine milling technology is employed to produce micro-pulverized flour that integrates seamlessly into liquid formulations, such as sauces and beverages, improving suspension and reducing grittiness. Furthermore, roasting technology, including controlled convection ovens and fluid-bed roasters, allows manufacturers to precisely control the Maillard reaction, yielding consistent flavor and color profiles (from light roast to dark roast) while simultaneously mitigating microbial load, ensuring compliance with rigorous food safety standards globally.

Traceability technology, involving sensor-based systems and blockchain integration, is rapidly becoming integral to the supply chain. These technologies allow for instantaneous monitoring of quality parameters, including moisture content and temperature, throughout the handling and processing stages, and provide end-to-end visibility of the raw peanut source. This enhanced traceability is vital for managing allergen risks and assuring consumers and regulators of product integrity. Overall, the technological focus is shifting towards cleaner processing, functional optimization (e.g., enhanced solubility), and robust safety protocols to solidify peanut flour's position as a premium functional ingredient.

Regional Highlights

Regional dynamics play a significant role in shaping the demand and supply characteristics of the Peanut Flour Market, driven by local dietary habits, regulatory environments, and the concentration of raw material production. North America currently dominates the market share due to its well-established functional food industry, high per capita consumption of protein supplements, and substantial adoption rates of gluten-free and plant-based diets. The US market, in particular, benefits from robust domestic peanut production and technological leadership in processing defatted flour. Regulatory bodies, such as the FDA, enforce strict allergen labeling, compelling manufacturers to invest heavily in specialized production lines, which inadvertently creates high barriers to entry but guarantees high-quality, safe products for consumers.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to countries like China and India, which are major global peanut producers, ensuring readily available and cost-effective raw materials. Furthermore, rapid economic growth, rising urbanization, and the subsequent increase in demand for processed and convenient foods, including nutrient-fortified snacks and beverages, are driving consumption. While traditional consumption patterns often favor whole peanuts or oil, modern food manufacturing is increasingly incorporating peanut flour for its thickening and protein-enhancing qualities, spurred by rising consumer awareness of nutritional labeling and westernized dietary influences.

Europe represents a mature but steadily growing market, where demand is fueled by stringent clean label regulations and a strong consumer preference for natural ingredients in bakery and confectionery sectors, particularly in Western European nations like Germany and the UK. European manufacturers often prioritize certified organic and non-GMO peanut flours, commanding higher price points compared to other regions. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by untapped potential. In Latin America, the growing health and wellness trend, coupled with expanding local food processing capabilities, drives demand. In MEA, geopolitical stability and investment in food processing infrastructure are key prerequisites for substantial market penetration, although local demand for affordable protein sources presents a promising long-term opportunity.

- North America: Dominant market share; driven by high protein supplement demand and mature gluten-free market; strong emphasis on allergen management protocols.

- Europe: Steady growth, influenced by stringent clean label policies and strong uptake in specialty bakery; high demand for organic and non-GMO variants.

- Asia Pacific (APAC): Highest CAGR; benefits from being a major peanut producer (China, India); increasing adoption of westernized and fortified processed foods.

- Latin America: Emerging market; growing middle class leading to increased consumption of packaged and functional foods; regional production supports local supply chains.

- Middle East & Africa (MEA): High growth potential; driven by increasing efforts to address nutritional deficiencies and developing food processing infrastructure; sourcing challenges remain key hurdle.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peanut Flour Market.- Golden Peanut and Tree Nuts

- Premium Peanut, Inc.

- Severn Peanut Co.

- Birdsong Peanuts

- Archer Daniels Midland Company (ADM)

- Algood Food Company, Inc.

- Vinut International

- The Tru-Nut Company

- Keystone Foods

- Olam International

- T. Parker Host

- Starwest Botanicals

- KTC Edibles

- SunOpta Inc.

- Peanut Corporation of America (PCA)

- JAX Mercantile Co.

- Hampton Farms

- Growers Peanut

- National Peanut Board (NPB)

- Nutrifoods International

Frequently Asked Questions

Analyze common user questions about the Peanut Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between defatted and medium-fat peanut flour applications?

Defatted peanut flour (1-5% fat) is predominantly used in high-protein nutritional supplements, protein bars, and beverages due to its high protein concentration and low caloric density. Medium-fat peanut flour (6-15% fat) is favored in bakery and confectionery applications to enhance texture, moisture retention, and provide a richer flavor profile without being excessively oily.

Is peanut flour considered a gluten-free ingredient, and how does it compare nutritionally to wheat flour?

Yes, peanut flour is naturally gluten-free, making it an excellent substitute for wheat flour in gluten-sensitive diets. Nutritionally, peanut flour offers significantly higher protein content (up to 50% vs. 10-15% in wheat flour), a greater fiber content, and essential micronutrients, though it carries potential allergen risk unlike most grain flours.

What is the main driver for the growing adoption of peanut flour in the food industry?

The main driver is the increasing global consumer demand for plant-based, clean label protein sources that are also cost-effective. Peanut flour’s high protein content and functional properties (thickening, emulsifying) make it a versatile and affordable alternative to soy and whey proteins, aligning perfectly with contemporary health and wellness trends.

Which geographical region holds the largest market share for peanut flour, and why?

North America holds the largest market share, driven primarily by its mature health and wellness sector, high consumption rates of dietary supplements, and established infrastructure for processing and distributing specialized, high-grade defatted peanut flours required by major food manufacturers in the US and Canada.

What are the most significant constraints impacting the sustained growth of the Peanut Flour Market?

The most significant constraints are the stringent regulatory requirements concerning peanut allergens, necessitating expensive, specialized, and segregated processing environments. Additionally, the market faces challenges from the price volatility and supply consistency of raw peanuts, which are highly susceptible to adverse climate and agricultural yields.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager