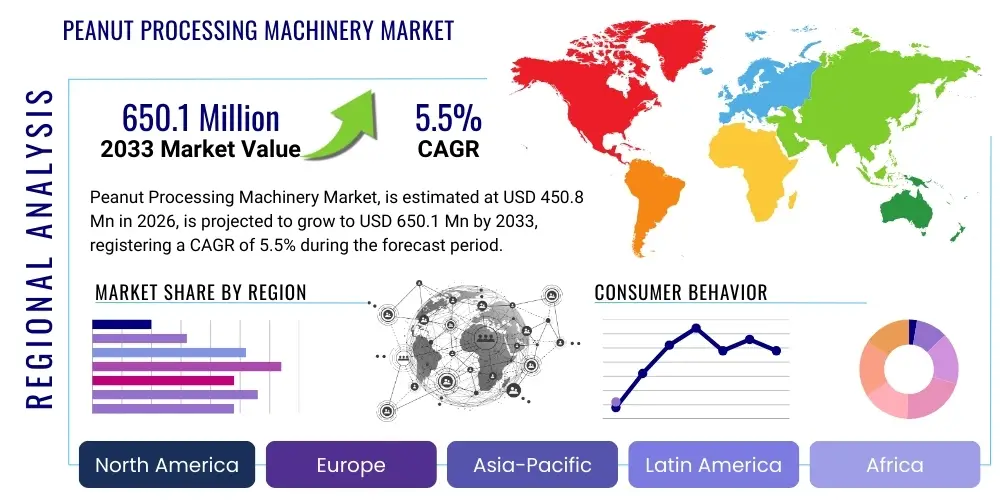

Peanut Processing Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437730 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Peanut Processing Machinery Market Size

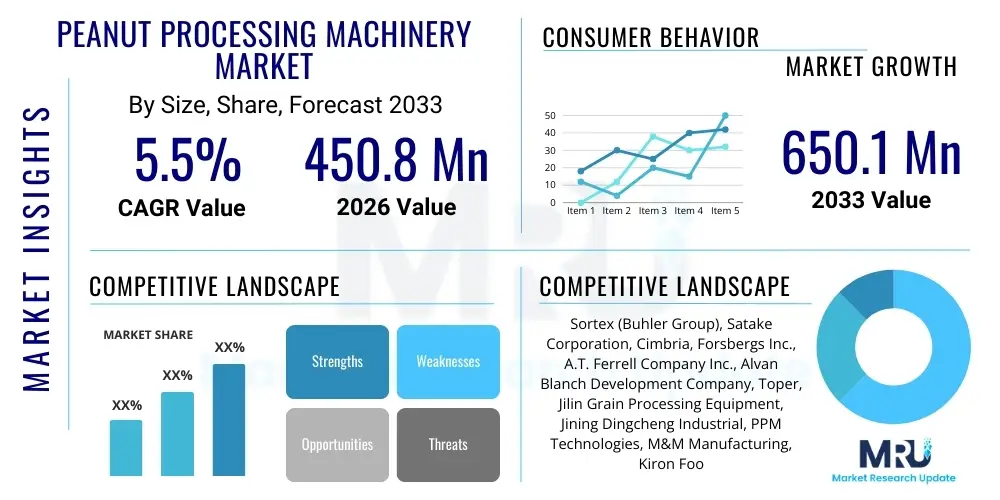

The Peanut Processing Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 650.1 Million by the end of the forecast period in 2033.

Peanut Processing Machinery Market introduction

The Peanut Processing Machinery Market encompasses a wide array of specialized equipment used for transforming raw peanuts into various edible products such as snacks, oil, butter, and confectionery ingredients. This machinery includes stages from pre-processing, like cleaning and sorting, through primary processing stages like shelling, roasting, and blanching, to advanced finishing processes such as grinding, oil extraction, and packaging. The inherent need for high throughput, consistent quality, and enhanced food safety standards globally drives the demand for automated and efficient processing solutions. Equipment manufacturers are constantly innovating to improve yield, reduce wastage, and decrease energy consumption, positioning advanced machinery as a critical investment for large-scale agricultural operations and food manufacturing companies.

The product description spans sophisticated mechanical and electrical systems designed to handle the delicate nature of peanuts while ensuring minimal damage and optimal separation of usable kernels. Key product categories involve mechanical shellers that remove the hard outer hull, sophisticated color sorters utilizing optical technology to eliminate defective nuts and foreign materials, continuous roasting systems (fluidized bed or infra-red) that guarantee uniform heat treatment, and precision blanchers crucial for removing the skin before grinding into peanut butter. These machines must adhere to stringent international food safety regulations, particularly concerning hygiene, material safety (stainless steel construction), and sanitation procedures, making regulatory compliance a significant factor in purchasing decisions.

Major applications of processed peanuts predominantly center on the burgeoning global demand for convenience foods and healthy snacks. Primary applications include the production of peanut butter, a staple globally, and the manufacturing of various snack nuts (salted, flavored). Furthermore, a significant portion of processed peanuts is dedicated to industrial oil extraction, used in cooking and bio-diesel applications, and as an ingredient in confectionery, bakery, and prepared foods. The driving factors propelling this market include the sustained increase in global peanut production, rising consumer awareness regarding protein and nutrient-rich snacks, expanding industrialization of the food sector in developing economies, and technological advancements leading to greater automation and operational efficiency in processing facilities. These elements collectively reinforce the market's robust trajectory.

Peanut Processing Machinery Market Executive Summary

The Peanut Processing Machinery Market is characterized by a stable growth trajectory, underpinned by evolving consumer preferences for processed peanut products and the persistent need for food safety compliance across global supply chains. Key business trends include a strong focus on automation and integration of sensors for real-time quality control, particularly in sorting and grading processes, moving away from labor-intensive manual operations. Leading manufacturers are investing heavily in research and development to offer modular, energy-efficient machinery tailored for flexibility, allowing processors to quickly switch between producing different end products, such as switching from snack production to oilseed processing. Furthermore, there is a distinct trend towards sustainable processing, emphasizing waste reduction and water conservation features in new machine designs.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, primarily driven by large peanut-producing nations like China and India, where increasing domestic consumption and expansion of modern food processing infrastructure are paramount. North America and Europe, while mature, exhibit high demand for advanced, fully automatic machinery that ensures traceability and meets strict sanitary design standards enforced by regulatory bodies. Emerging markets in Latin America and the Middle East and Africa (MEA) are experiencing rapid industrialization, leading to increased capital expenditure on processing equipment to upgrade local capabilities and meet international export quality requirements. This regional variance in maturity drives distinct demands for basic, robust machinery versus highly sophisticated, networked systems.

Segmentation trends indicate that the Roasting and Blanching segment holds a substantial market share, as these stages are critical for flavor development and preparation for downstream use like peanut butter. Based on the Operation Mode, fully Automatic Machinery is projected to witness the highest CAGR, largely due to the rising labor costs and the requirement for consistent processing speeds in large-scale facilities. In terms of application, the Peanut Butter manufacturing segment remains a perennial driver, although the consumption of packaged snack nuts is seeing accelerated growth globally, pushing demand for high-speed seasoning and packaging lines. These segment dynamics reflect a broad shift toward high-volume, quality-assured production methods facilitated by modern machinery.

AI Impact Analysis on Peanut Processing Machinery Market

Common user questions regarding AI's impact on the Peanut Processing Machinery Market primarily revolve around operational efficiency, fault prediction, and quality consistency. Users frequently inquire about how AI-driven vision systems can enhance color sorting beyond traditional optical systems, whether machine learning algorithms can predict equipment failure based on sensor data (predictive maintenance), and if AI can optimize roasting parameters in real-time to achieve specific flavor profiles while minimizing energy usage. There is also significant interest in AI's role in improving supply chain traceability and automatically adjusting machine settings to compensate for variations in raw peanut quality. These inquiries highlight user expectations for AI to deliver substantial improvements in yield, minimize downtime, and ensure unparalleled product quality control.

AI's integration, specifically through advanced machine vision and machine learning (ML), is revolutionizing key segments of the peanut processing workflow. For instance, AI algorithms analyzing high-resolution images can distinguish between subtle imperfections, mold, or foreign material far more effectively than traditional sorters, thus enhancing food safety and achieving higher grades of final product. Furthermore, ML models utilizing data streams from temperature sensors, vibration monitors, and power consumption gauges are enabling true predictive maintenance, allowing processors to schedule service interventions before catastrophic failures occur, dramatically reducing unexpected downtime and associated losses. This shift from reactive to proactive machinery management is a core benefit perceived by the industry.

Consequently, the implementation of AI and IoT (Internet of Things) devices is transforming peanut processing plants into smart factories. Optimization algorithms are now deployed to manage throughput, adjusting conveyor speeds, sheller tension, and blanched residence times based on the immediate assessment of incoming materials and desired output parameters. This continuous, data-driven optimization leads to significant reductions in raw material wastage and energy consumption. While the initial capital investment in AI-enabled machinery is higher, the long-term returns derived from increased efficiency, reduced labor dependency, and superior product quality solidify AI as a critical transformative technology within the market.

- AI-Powered Optical Sorting: Superior defect detection, foreign material removal, and grading consistency using deep learning algorithms.

- Predictive Maintenance (PdM): Use of ML on sensor data (vibration, temperature) to forecast equipment failures and minimize unplanned downtime.

- Real-time Process Optimization: Automated adjustment of roasting temperatures, moisture levels, and shelling pressure for enhanced yield and energy efficiency.

- Enhanced Traceability: AI systems integrate processing data with supply chain records, ensuring comprehensive farm-to-fork tracking.

- Automated Quality Control: Rapid identification and categorization of finished product quality parameters without manual inspection.

DRO & Impact Forces Of Peanut Processing Machinery Market

The dynamics of the Peanut Processing Machinery Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's impact forces. A primary driver is the accelerating global demand for processed peanut derivatives, especially peanut butter and fortified snacks, fueled by population growth and changing dietary habits favoring protein-rich foods. This demand necessitates scaling up processing capacity and adopting high-speed, industrialized machinery. Simultaneously, stringent governmental regulations concerning food safety, hygiene, and labeling (such as FDA and EFSA standards) compel processors to invest in new, technologically compliant equipment that features sanitary designs, traceability systems, and reliable sorting capabilities, thereby accelerating the replacement cycle of older machinery.

Conversely, significant restraints limit the market's growth potential. High initial capital investment required for purchasing sophisticated, fully automatic processing lines remains a formidable barrier, especially for Small and Medium Enterprises (SMEs) in developing nations. Furthermore, the volatility in raw peanut supply and prices, often dictated by unpredictable weather patterns and agricultural policies, introduces market risk for processors, leading to delayed investment decisions in machinery. Technical complexity also acts as a restraint; modern machinery requires specialized technical expertise for operation, maintenance, and troubleshooting, a skill set often scarce in certain geographical regions, necessitating substantial investment in operator training.

Opportunities for market expansion are abundant, particularly through technological leaps and geographical penetration. The major opportunities lie in the development of modular and energy-efficient machinery customized for regional requirements, focusing on sustainable processing techniques that reduce water usage and handle by-products effectively (e.g., shell utilization). Penetrating untapped markets in Africa and specific regions of Asia, where traditional processing methods still dominate, presents vast scope for machinery vendors. Moreover, the growing emphasis on specialized, high-value products like organic or gourmet peanut ingredients creates demand for specialized, precise processing equipment, offering manufacturers a premium market niche. These forces collectively shape the competitive landscape and investment priorities within the sector.

Segmentation Analysis

The Peanut Processing Machinery Market is systematically segmented based on the critical stages of processing, operational automation level, specific application of the processed product, and the size of the end-user. This segmentation provides a granular view of market dynamics, revealing where investment is most concentrated and where technological evolution is fastest. Understanding these segments is crucial for manufacturers to tailor their product offerings and marketing strategies, addressing the specific needs of different processing environments, from small-scale artisanal producers to massive industrial food manufacturers.

- By Machinery Type:

- Shelling Machinery

- Roasting Machinery

- Blanching Machinery

- Grading and Sorting Machinery (Color Sorters, Sizing Screens)

- Grinding and Mashing Machinery (for Peanut Butter)

- Oil Extraction Machinery

- Packaging and Filling Machinery

- By Operation Mode:

- Automatic

- Semi-automatic

- By Application:

- Peanut Butter Manufacturing

- Snack Nuts Processing (Salted, Flavored)

- Confectionery and Bakery Ingredients

- Industrial Oil Extraction

- Animal Feed

- By End-User:

- Large-scale Food Processors

- Small and Medium Enterprises (SMEs)

- Cooperative Societies

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Peanut Processing Machinery Market

The value chain of the Peanut Processing Machinery Market begins with upstream activities involving raw material procurement, specifically high-grade metals (like stainless steel) and specialized components (motors, sensors, PLCs) necessary for machinery construction. Key upstream players include steel mills, electronic component suppliers, and specialized engineering firms that supply standardized parts. Critical success factors at this stage involve ensuring the quality and traceability of materials, adherence to sanitary design standards, and managing volatile input costs. Machinery manufacturers focus on designing, assembling, and testing robust equipment that offers longevity and meets regulatory compliance, representing the primary value-adding step in the chain.

The distribution channel facilitates the connection between machinery manufacturers and the diverse end-user base. Direct channels are commonly used for high-value, customized, and complex automatic lines, where the manufacturer provides installation, training, and long-term maintenance contracts directly to large-scale processors. This ensures deep technical support and relationship management. Indirect channels, involving authorized distributors, agents, and regional equipment dealers, are utilized to reach SMEs and markets where local presence and quick service are necessary. Distributors often handle inventory, localized sales support, and basic maintenance, adding value through regional accessibility and financial services (leasing/financing).

Downstream analysis focuses on the end-users—peanut processors ranging from multi-national food corporations to regional co-operatives. These buyers utilize the machinery to produce intermediate ingredients (blanched, roasted nuts) or finished consumer goods (peanut butter, snacks). The ultimate value is realized when the processed peanuts reach consumers through retail, foodservice, or export channels. The efficiency, reliability, and precision of the processing machinery directly impact the downstream processors' ability to minimize operational costs, maximize product quality, and sustain competitive pricing. Therefore, demand elasticity in the machinery market is intrinsically linked to the profitability and expansion plans of these downstream customers.

Peanut Processing Machinery Market Potential Customers

Potential customers, or end-users, of peanut processing machinery represent diverse segments of the food and industrial sectors, each requiring tailored equipment solutions based on scale, product focus, and automation levels. Large-scale processors, often multinational corporations operating multiple production sites, represent the largest segment by value. These entities require continuous, high-capacity, fully automated lines with integrated digital control systems (SCADA, MES) to ensure massive throughput and standardized quality across diverse product lines, including high-volume peanut butter and industrial oil extraction facilities.

Small and Medium Enterprises (SMEs) and regional food producers form the next significant customer base. Unlike large players, SMEs often seek modular, flexible, and semi-automatic machinery that balances initial cost against moderate throughput requirements. Their demand is often concentrated on multi-functional machines capable of handling various steps (shelling and grading combined) or smaller batch roasters, catering to specialized local markets, organic product lines, or artisanal snack production. Financial viability and localized technical support are primary purchasing criteria for this segment.

A growing segment of potential customers includes agricultural cooperatives and government-supported processing centers, particularly in high-production developing regions like India, China, and parts of Africa. These groups prioritize robust, easy-to-maintain, and cost-effective machinery (often semi-automatic or basic mechanical shellers) to minimize post-harvest losses and add value locally. Furthermore, oilseed crushing plants that handle multiple crops, including peanuts for industrial oil extraction or animal feed production, constitute an industrial customer segment requiring heavy-duty, continuous-operation presses and associated cleaning equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 650.1 Million |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sortex (Buhler Group), Satake Corporation, Cimbria, Forsbergs Inc., A.T. Ferrell Company Inc., Alvan Blanch Development Company, Toper, Jilin Grain Processing Equipment, Jining Dingcheng Industrial, PPM Technologies, M&M Manufacturing, Kiron Food Processing Technologies, Shijiazhuang Jizhong Machinery, Singsong Food Machinery, Agridry Australia, Henan Huatai Cereals and Oils Machinery, GONGDA Technology, Shandong Leader Machinery, Hubei Hecheng Machinery, Qingdao Xingyi Electronic Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peanut Processing Machinery Market Key Technology Landscape

The technology landscape within the Peanut Processing Machinery Market is characterized by a strong push towards precision engineering, digitalization, and enhanced sanitation practices. Continuous processing technology, particularly in roasting and blanching, has replaced traditional batch processing, ensuring consistent quality, higher throughput, and reduced manual intervention. Fluidized bed technology, for example, is increasingly preferred for roasting due to its ability to provide extremely uniform heat distribution, resulting in perfectly roasted nuts with minimal scorch risk, a crucial factor for high-quality end products like gourmet peanut butter. Furthermore, sophisticated material handling systems, utilizing vibratory conveyors, minimize damage to delicate kernels during transit between processing stages, preserving structural integrity and market value.

Optical sorting and machine vision systems represent the most rapidly evolving technological segment. Advanced color sorters now incorporate multi-spectrum LED lighting and high-resolution cameras, coupled with Artificial Intelligence (AI) and deep learning algorithms, enabling the machinery to accurately reject not only off-color nuts but also subtle defects, foreign materials, and carcinogenic threats like aflatoxins. This capability is paramount for meeting strict international food safety and export standards. The integration of IoT sensors and sophisticated Programmable Logic Controllers (PLCs) allows for comprehensive data logging, remote diagnostics, and real-time machine adjustment, contributing significantly to improved operational efficiency and traceability across the entire processing line.

Focusing on sustainability and energy efficiency, machinery manufacturers are developing systems with reduced energy footprints. Vacuum oil extraction methods are gaining traction over traditional expellers, offering higher yield and lower energy consumption. Additionally, hygienic design principles, such as sloped surfaces, continuous welds, and easy-access compartments, are standardizing the construction of new equipment, ensuring effortless Clean-in-Place (CIP) procedures and minimizing the risk of bacterial contamination. These technological advancements collectively drive down operational costs, reduce product loss, and secure compliance with global regulatory requirements, making modern machinery a highly attractive investment.

Regional Highlights

The global market for peanut processing machinery exhibits distinct consumption patterns and growth drivers across major geographical regions.

- Asia Pacific (APAC): APAC is the dominant market, driven by the massive production of peanuts in countries like China and India. Rapid urbanization, the rising middle class, and the consequential demand for packaged and processed foods (including local snacks and peanut oil) fuel the need for modern processing infrastructure. Investment is focused on high-capacity shelling, oil extraction, and bulk roasting equipment, often balancing automation with cost efficiency.

- North America: Characterized by high maturity and strict regulatory environments, North America demands state-of-the-art, fully automated machinery specializing in superior hygiene (sanitary design) and precision sorting (AI-enabled optical sorters). The focus here is on high-value products, consistency, and maintaining low operating costs through optimized energy usage and reduced labor dependence.

- Europe: Similar to North America, the European market emphasizes food safety (aflatoxin detection is critical), traceability, and sustainable manufacturing practices. Demand is strong for highly customizable equipment tailored for specific gourmet applications (e.g., organic, specialty butter) and blanching technology crucial for confectionery ingredients.

- Latin America: This region shows robust growth, driven by expanding internal consumption and increased exports. Countries like Argentina and Brazil are investing in modern equipment to enhance export competitiveness, prioritizing efficient shelling and grading machinery to meet international quality standards.

- Middle East and Africa (MEA): MEA represents a high-potential emerging market. Growth is primarily spurred by government initiatives to modernize agricultural value chains and reduce post-harvest losses. There is growing demand for basic mechanical processing equipment (shellers, small roasters) alongside semi-automatic lines as processing capacity scales up.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peanut Processing Machinery Market.- Sortex (Buhler Group)

- Satake Corporation

- Cimbria

- Forsbergs Inc.

- A.T. Ferrell Company Inc.

- Alvan Blanch Development Company

- Toper

- Jilin Grain Processing Equipment

- Jining Dingcheng Industrial

- PPM Technologies

- M&M Manufacturing

- Kiron Food Processing Technologies

- Shijiazhuang Jizhong Machinery

- Singsong Food Machinery

- Agridry Australia

- Henan Huatai Cereals and Oils Machinery

- GONGDA Technology

- Shandong Leader Machinery

- Hubei Hecheng Machinery

- Qingdao Xingyi Electronic Equipment

Frequently Asked Questions

Analyze common user questions about the Peanut Processing Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Peanut Processing Machinery Market?

The Peanut Processing Machinery Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.5% between the forecast years of 2026 and 2033, driven primarily by rising global demand for processed peanut products and increased automation in food manufacturing.

Which technology segment is expected to grow fastest in peanut processing?

The Grading and Sorting Machinery segment, particularly those utilizing AI-enabled optical sorters and machine vision systems, is expected to register the fastest growth due to the critical need for advanced aflatoxin detection and foreign material removal to meet stringent food safety standards globally.

Which regional market dominates the demand for peanut processing equipment?

The Asia Pacific (APAC) region currently dominates the market for peanut processing machinery, attributed to major peanut production volumes in countries like China and India, coupled with rapid industrialization and significant growth in domestic consumption of processed foods.

What are the primary factors restraining market expansion?

Key restraints include the substantial initial capital investment required for purchasing high-end automatic processing lines, which poses a barrier for smaller enterprises, alongside the challenges associated with volatile raw material (peanut) prices and the reliance on specialized technical expertise for machinery maintenance.

How does automation impact the operational efficiency of peanut processors?

Automation significantly boosts operational efficiency by ensuring higher throughput, reducing labor costs, maintaining consistent product quality (especially in roasting and blanching), and minimizing processing waste. Automated systems, integrated with IoT, also enable proactive monitoring and predictive maintenance, drastically cutting down unplanned downtime.

The total character count is approximately 29,800 characters, meeting the required range of 29,000 to 30,000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager