Pedelec Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432726 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pedelec Market Size

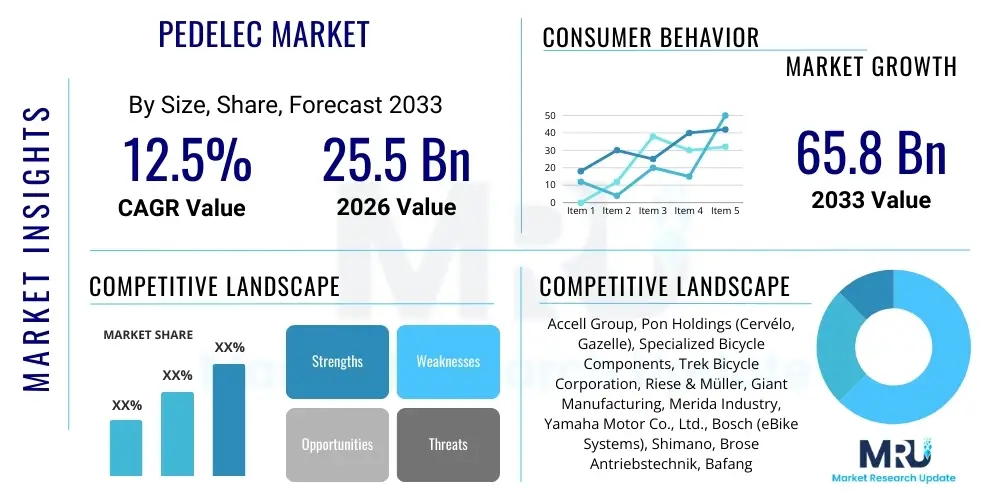

The Pedelec Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 25.5 billion in 2026 and is projected to reach USD 65.8 billion by the end of the forecast period in 2033.

Pedelec Market introduction

The Pedelec Market, encompassing bicycles equipped with an electric motor that assists the rider only while pedaling, is experiencing profound expansion fueled by a global shift toward sustainable, efficient, and health-conscious urban mobility solutions. Pedelecs, typically capped at 25 km/h in major regulatory markets like the EU, are defined by their reliance on human input to activate electric assistance, distinguishing them from faster electric bicycles (e-bikes) or mopeds. This regulatory framework has been crucial in accelerating adoption, as it often classifies Pedelecs similarly to conventional bicycles, enabling easier integration into existing transportation infrastructure and circumventing complex licensing requirements.

Major applications of Pedelecs span across leisure cycling, fitness, last-mile delivery services, and increasingly, daily commuting, particularly in densely populated metropolitan areas where traffic congestion and parking constraints are prevalent. The fundamental product description involves a lightweight frame, integrated battery systems (primarily lithium-ion), and sophisticated sensor technology (torque or speed sensors) that modulate motor output smoothly according to the rider's effort. Key benefits driving consumer adoption include reduced physical strain on longer or hilly commutes, enhanced speed and range compared to traditional cycling, and a significantly lower environmental footprint relative to combustion engine vehicles, aligning perfectly with global decarbonization targets.

Driving factors propelling market growth are multifaceted, involving supportive governmental policies such as subsidies and infrastructure development (dedicated bike lanes), coupled with technological advancements in battery energy density and motor efficiency, which extend range and reduce overall bicycle weight. Furthermore, the rising cost of fuel and the increasing consumer preference for personalized, flexible modes of transport following global events have cemented the Pedelec as a viable and desirable alternative to public transport and private cars for short-to-medium distances. The overall market trajectory is further bolstered by the entry of major automotive and technology firms, lending credibility and fostering further innovation in connectivity and safety features.

Pedelec Market Executive Summary

The Pedelec Market’s executive landscape reveals robust expansion underpinned by structural business trends favoring micromobility subscription models and vertically integrated supply chains. Key business trends show a transition from niche product offerings to mass-market appeal, driven by standardization in component manufacturing and aggressive marketing focusing on lifestyle integration. Companies are increasingly adopting direct-to-consumer (D2C) models to manage inventory risk and build direct relationships, while simultaneously forming strategic partnerships with urban planning departments and shared mobility operators. Furthermore, significant investment is being channeled into battery recycling and refurbishment technologies, addressing sustainability concerns and improving the long-term total cost of ownership for consumers.

Regional trends indicate Europe maintaining its dominance as the epicenter of Pedelec adoption, driven by strong regulatory support, mature cycling culture, and high consumer disposable income allocated to eco-friendly transport. Asia Pacific, particularly China and Japan, presents the largest volume market, with growth accelerating in emerging economies like India and Southeast Asia due to rapidly increasing urbanization and infrastructural improvements. North America, while historically slower, is witnessing exponential growth, particularly in the Class 1 (pedal-assist only, 20 mph max) segment, following clearer state-level regulatory definitions and substantial investment in urban cycling infrastructure, positioning it as a critical future growth area.

Segment trends highlight the burgeoning popularity of Cargo Pedelecs, which are fundamentally transforming intra-city logistics and commercial last-mile delivery operations, driven by businesses seeking operational efficiencies and reduced emissions. Concurrently, the Mountain Pedelec (E-MTB) segment continues to attract high-value consumers, benefiting from continuous innovation in suspension technology and motor torque. The commuter segment remains the largest volume contributor, with increasing consumer demand for connectivity features, integrated navigation, and enhanced anti-theft systems. The trend towards lightweight designs, utilizing carbon fiber and advanced alloys, is also critical across all segments, striving to mimic the handling and aesthetics of traditional bicycles while retaining electric assist functionality.

AI Impact Analysis on Pedelec Market

Analysis of common user questions regarding Artificial Intelligence in the Pedelec domain reveals strong interest centered around safety enhancements, personalized riding experiences, and maintenance prediction. Users frequently inquire about the reliability of collision avoidance systems, how AI can optimize battery usage in real-time based on topography and rider effort, and the potential for autonomous servicing notifications. Key themes emerging include the desire for "smart diagnostics" to minimize downtime, "adaptive assistance" that learns the rider's style and route preferences, and the integration of AI-powered theft prevention mechanisms that go beyond simple GPS tracking. There is also cautious optimism regarding the ethical implications of data privacy associated with continuous monitoring of riding metrics.

AI's integration is fundamentally transforming the design and operation of Pedelecs, moving them from simple electric vehicles to complex, connected devices. The application of machine learning algorithms in the powertrain allows for predictive motor control, analyzing terrain inputs, cadence, and instantaneous torque demand to deliver seamless and maximally efficient power assistance. This optimization extends battery life and reduces wear on mechanical components, addressing two major consumer pain points. Furthermore, AI enables sophisticated personalization; for example, learning optimal shift points in automatic transmission systems specific to the rider's habits or dynamically adjusting suspension settings on high-end E-MTBs based on real-time trail conditions.

In the realms of safety and fleet management, AI is proving invaluable. Computer vision and sensor fusion powered by AI are the foundational technologies for developing advanced driver-assistance systems (ADAS) for Pedelecs, including blind spot monitoring and proactive warnings for potential hazards in dense urban environments. For rental and shared mobility services, AI algorithms optimize fleet distribution, predict demand spikes geographically, and flag vehicles requiring preventative maintenance based on anomaly detection in usage patterns, significantly improving operational efficiency and reducing capital expenditure on unnecessary repairs. This strategic application of AI is instrumental in maintaining the competitive edge in the rapidly evolving micromobility landscape.

- Predictive Maintenance: AI algorithms analyze sensor data (battery temperature, motor load, vibration) to predict component failure, reducing maintenance costs.

- Adaptive Assistance: Machine learning optimizes power output based on real-time rider effort, heart rate, and GPS topography for maximum range efficiency.

- Enhanced Safety Features: AI-powered computer vision facilitates collision detection, blind spot alerts, and smart braking systems, especially crucial in urban traffic.

- Optimized Fleet Management: AI determines optimal placement and reallocation of shared Pedelecs, minimizing idle time and balancing charging needs.

- Personalized User Profiles: Systems learn rider preferences (e.g., preferred levels of assistance, typical routes) to tailor the cycling experience automatically.

DRO & Impact Forces Of Pedelec Market

The Pedelec Market dynamic is heavily influenced by a balanced interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its expansion trajectory. The primary driver is the pervasive governmental support globally, manifested through significant tax incentives, purchase subsidies, and substantial investment in dedicated bicycle infrastructure, making Pedelecs a highly accessible and economically viable commuter choice. This is amplified by growing societal awareness concerning environmental sustainability and personal health, positioning Pedelecs as the preferred transport mode that concurrently addresses carbon emissions and sedentary lifestyles. However, this growth faces considerable restraints, notably the relatively high initial purchase price of quality Pedelecs compared to conventional bicycles, which can deter price-sensitive consumers. Furthermore, safety concerns, including battery fire risks (though increasingly mitigated by advanced management systems) and vulnerability to theft, remain key barriers impacting consumer confidence and insurance costs.

Opportunities within the sector are substantial and largely center on technological evolution and market penetration into underserved segments. The continuous improvement in Lithium-ion battery technology, specifically in energy density and charging speed, offers the potential for lighter bikes with extended range, eliminating range anxiety, a critical consumer restraint. A significant commercial opportunity lies in the rapid expansion of the Cargo Pedelec segment for commercial logistics, offering businesses a sustainable and cost-effective alternative for urban deliveries. Geographically, emerging economies in APAC and Latin America represent vast, untapped markets where rapid urbanization and limited public transport infrastructure create an immediate need for efficient, low-cost personal mobility solutions, provided localized pricing and robust anti-theft features can be integrated effectively.

The combined impact forces exert significant upward pressure on market valuation. The positive impact of favorable regulations and technological innovation (Drivers and Opportunities) generally outweighs the immediate financial barrier (Restraint) as economies of scale reduce manufacturing costs and shared mobility models lower the entry point for consumers. However, regulatory fragmentation across regions—where different jurisdictions classify Pedelecs and E-bikes differently—acts as a persistent restraining force, complicating international commerce and standardization efforts. The long-term success of the market hinges on manufacturers’ ability to mitigate battery concerns through certified safety standards and to leverage advanced connectivity features (IoT, AI) to offer value propositions that justify the premium price point, thus transforming restraints into solvable engineering challenges.

Segmentation Analysis

Segmentation analysis is crucial for understanding the diverse market dynamics within the Pedelec industry, allowing stakeholders to target specific consumer needs and technological preferences effectively. The market is primarily segmented by type, covering City/Trekking, Cargo, and Mountain Pedelecs, reflecting the distinct end-use applications and design requirements for commuting, commercial use, and recreational sports, respectively. A secondary but highly critical segmentation is based on battery and drive system type, differentiating between hub-driven motors and the increasingly popular mid-drive systems, which offer superior performance and integration, particularly in high-end models. Further segmentation by technology (e.g., geared vs. direct drive, removable vs. integrated battery) allows for nuanced pricing and product differentiation strategies.

The City/Trekking segment holds the largest market share due to its direct application in daily commuting and urban mobility, characterized by integrated lights, fenders, and comfortable geometries. Conversely, the Cargo Pedelec segment, although smaller in volume, is projected to exhibit the fastest growth rate, fueled by the accelerating trend toward sustainable last-mile delivery and the establishment of "low-emission zones" in major global cities, forcing commercial fleets to transition away from traditional vans. The differentiation by motor placement—mid-drive versus hub-drive—significantly influences the riding experience; mid-drive systems are favored for their balanced weight distribution and ability to utilize the bicycle’s existing gears, offering superior climbing ability and range efficiency, commanding a higher price point.

Understanding these segments allows manufacturers to optimize their product portfolios and marketing efforts. For instance, the B2B segment, dominated by Cargo and Rental Pedelecs, prioritizes durability, IoT connectivity for fleet management, and robust servicing contracts, whereas the B2C (Mountain and City) segment places higher value on aesthetics, brand reputation, battery range, and integration of smart features. The evolving regulatory landscape, especially concerning motor power limitations and speed cut-offs (25 km/h vs. 45 km/h models), also influences product design across these segments, ensuring compliance while maximizing performance tailored to the specific regulatory environment of target markets.

- By Type:

- City/Trekking Pedelec

- Mountain Pedelec (E-MTB)

- Cargo Pedelec

- Folding Pedelec

- By Drive System:

- Hub Motor (Front and Rear)

- Mid-Drive Motor

- By Battery Type:

- Lithium-ion

- Sealed Lead Acid (SLA)

- Nickel-Metal Hydride (NiMH)

- By Application:

- Commuting & Leisure

- Cargo & Logistics

- Recreational Sport

- Shared Mobility/Rental

- By Sales Channel:

- Online Sales

- Offline Retail (Specialty Bike Stores, Mass Merchandisers)

Value Chain Analysis For Pedelec Market

The Pedelec market value chain is extensive and highly complex, starting with the upstream sourcing of specialized components and extending through manufacturing, assembly, distribution, and critical aftermarket services. Upstream analysis focuses predominantly on the specialized suppliers of the powertrain system, which includes batteries (the most critical and costly component), motors, and control units. Key suppliers like Bosch, Shimano, and Brose dominate the mid-drive motor system market, forming powerful ecosystems that dictate technological standards and pricing power. The reliance on Asian suppliers for lithium-ion cells and raw materials (e.g., cobalt, nickel) introduces significant geopolitical and supply chain risks, compelling manufacturers to diversify sourcing and invest in localized battery assembly capabilities to mitigate disruptions and enhance sustainability claims.

The middle segment of the value chain involves the original equipment manufacturers (OEMs), ranging from established traditional bicycle brands (e.g., Trek, Specialized) to pure-play e-bike specialists (e.g., Riese & Müller, VanMoof). These manufacturers manage final assembly, frame production, and integration of the specialized components. Efficiency in manufacturing and rigorous quality control, particularly in integrating complex electrical systems and ensuring water resistance, are paramount to maintaining brand reputation and minimizing warranty claims. The increasing modularity of components is simplifying assembly processes, allowing smaller players to enter the market by relying on standardized components from tier-one suppliers.

Downstream analysis covers the distribution channels, which are bifurcated into Direct and Indirect models. Direct distribution (D2C), largely facilitated by digital platforms, offers manufacturers higher margins, immediate customer feedback, and control over brand experience, becoming increasingly popular among agile, digitally native brands. However, the traditional indirect channel, encompassing specialty bike retailers and mass merchandisers, remains vital, offering essential services like test rides, professional assembly, maintenance, and expert advice, which are crucial for overcoming the initial complexity associated with a high-value purchase like a Pedelec. Aftermarket services—including software updates, battery health checks, and component repairs—constitute a major revenue stream and are crucial for ensuring high customer retention and product longevity.

Pedelec Market Potential Customers

Potential customers for the Pedelec Market are highly diverse, spanning individual consumers seeking improved commuting efficiency to large commercial entities requiring optimized logistics solutions. The primary B2C end-user segment is the urban commuter, typically aged 30–55, residing in metropolitan or suburban areas, who values time savings, avoids traffic congestion, and seeks a healthier, more sustainable alternative to driving or public transport. These buyers prioritize features such as reliable battery range, integrated theft protection, and low maintenance requirements. A secondary, high-growth B2C segment includes older riders (55+) and individuals with physical limitations who utilize the electric assist to remain active and enjoy recreational cycling without the physical exertion required by conventional bicycles.

Beyond the individual consumer, B2B end-users represent a significant and strategically valuable customer base, primarily consisting of fleet operators, logistics companies, and food delivery services. For these commercial buyers, the key purchasing criteria revolve around Total Cost of Ownership (TCO), vehicle uptime, payload capacity, and sophisticated fleet management capabilities (often utilizing integrated IoT solutions). Cargo Pedelecs are instrumental here, serving as cost-effective substitutes for traditional vans in urban centers with strict emission regulations. Local and municipal governments also constitute a niche B2B segment, purchasing Pedelecs for public works teams, police forces, and developing shared mobility schemes to enhance civic infrastructure.

The shared mobility sector, characterized by companies like Lime and Tier, forms another distinct B2B customer profile, focusing on robustness, anti-vandalism design, and deep integration with proprietary software platforms for real-time tracking and geo-fencing. For all B2B customers, long-term durability, standardization of maintenance protocols, and strong supplier partnerships offering reliable service and spare parts availability are non-negotiable requirements, driving demand towards established, quality-focused manufacturers capable of handling large-scale commercial deployments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 65.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accell Group, Pon Holdings (Cervélo, Gazelle), Specialized Bicycle Components, Trek Bicycle Corporation, Riese & Müller, Giant Manufacturing, Merida Industry, Yamaha Motor Co., Ltd., Bosch (eBike Systems), Shimano, Brose Antriebstechnik, Bafang Electric, VanMoof, Rad Power Bikes, Fantic Motor, Stromer, Kalkhoff, Cube, Haibike. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pedelec Market Key Technology Landscape

The technological landscape of the Pedelec market is rapidly evolving, moving beyond simple battery and motor integration to focus heavily on connectivity, safety, and energy management. The most critical technologies revolve around Lithium-ion battery pack design, specifically the implementation of sophisticated Battery Management Systems (BMS). Advanced BMS are essential for monitoring cell health, temperature, and charge cycles, significantly extending battery lifespan and, crucially, mitigating thermal runaway risks, thereby addressing major consumer safety concerns. Furthermore, the integration of 4G/5G connectivity and IoT modules is now standard in high-end models, enabling over-the-air (OTA) software updates, remote diagnostics, real-time GPS tracking for anti-theft measures, and seamless integration with smartphone applications for route planning and performance monitoring.

Motor and sensor technology represents the core performance differentiator. Mid-drive motors, which utilize sophisticated torque sensors, have become the benchmark for premium Pedelecs, offering a much more natural and responsive riding feel compared to basic speed-sensor hub drives. Innovation in magnet and coil design is driving higher power density, allowing for lighter motors that provide equivalent or superior torque output. Simultaneously, the focus on integrated design is paramount, with manufacturers engineering frames that fully conceal the battery and wiring, improving aesthetics, protecting components from the elements, and enhancing aerodynamic efficiency, especially crucial in the performance and road bike segments.

Emerging technologies, often influenced by the automotive sector, are poised to disrupt the market further. These include the development of solid-state battery technology, which promises significantly higher energy density and improved safety profiles compared to liquid-electrolyte Li-ion cells, potentially revolutionizing range capabilities without adding weight. Additionally, the proliferation of radar-based safety systems, particularly those adapted for two-wheelers, is enhancing rider safety through proactive warnings for approaching traffic or obstacles. Sustainability-focused technology, such as kinetic energy recovery systems (KERS) used during braking or downhill riding to slightly recharge the battery, is also gaining traction, further enhancing the overall efficiency and eco-friendly appeal of modern Pedelecs.

Regional Highlights

- Europe: Dominates the global market in terms of value and technological maturity, driven by robust cycling infrastructure, high consumer adoption rates, and substantial government subsidies (especially in Germany, Netherlands, and Belgium). The region focuses heavily on premium E-Trekking and Cargo Pedelecs, setting global standards for component quality and safety regulations.

- Asia Pacific (APAC): Represents the largest volume market globally, primarily due to massive adoption in China (often involving simpler, lower-cost models) and rapid growth in regulated markets like Japan and South Korea. Emerging markets like India and Southeast Asia are expected to accelerate significantly due to urbanization and affordability improvements.

- North America: Exhibits rapid, high-value growth, particularly post-2020, with strong consumer interest focused on E-MTBs and powerful utility-focused Pedelecs (e.g., Fat Tire models). Regulatory clarity at the state level (Class 1, 2, 3 definitions) is stabilizing the market and encouraging infrastructure investment.

- Latin America (LATAM): A developing market facing challenges related to infrastructure and security, but showing increasing potential, especially in countries like Brazil and Mexico, where traffic congestion necessitates alternative transport solutions. Growth is driven by logistics companies adopting Cargo Pedelecs for urban delivery.

- Middle East and Africa (MEA): Currently the smallest market, characterized by niche high-end luxury Pedelecs in the GCC countries and growing interest in low-cost utility models in South Africa. Market expansion is dependent on improving cycling infrastructure suitable for diverse climates and socio-economic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pedelec Market.- Accell Group (Koga, Batavus, Haibike)

- Pon Holdings (Cannondale, Gazelle, Cervélo)

- Specialized Bicycle Components

- Trek Bicycle Corporation

- Riese & Müller

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd.

- Yamaha Motor Co., Ltd.

- Bosch (eBike Systems)

- Shimano Inc.

- Brose Antriebstechnik GmbH & Co. KG

- Bafang Electric Motor Science Technology Co., Ltd.

- VanMoof (Acquired by Lavoie/McLaren Applied)

- Rad Power Bikes

- Fantic Motor SpA

- Stromer AG

- Kalkhoff (Derby Cycle)

- Cube Bikes

- Dorel Industries Inc. (Schwinn, Mongoose)

- Continental AG (Motor Systems)

Frequently Asked Questions

What is the primary factor driving the growth of the Pedelec market?

The primary factor driving growth is the combination of increasing governmental incentives, subsidies, and strategic investment in urban cycling infrastructure across Europe and North America, positioning Pedelecs as a sustainable and financially attractive commuter alternative.

How are AI and connectivity impacting Pedelec safety and efficiency?

AI is critically impacting safety through predictive maintenance, collision avoidance systems, and smart diagnostics. Connectivity enables features like real-time GPS anti-theft tracking, over-the-air software updates, and sophisticated, optimized power delivery based on learned rider input and terrain analysis, maximizing battery efficiency.

Which geographical region holds the largest market share for high-value Pedelecs?

Europe consistently holds the largest market share in terms of value, driven by high consumer adoption of premium City, Trekking, and Cargo Pedelecs, stringent quality standards, and a mature infrastructure that supports widespread daily usage.

What is the main restraint hindering widespread Pedelec adoption globally?

The main restraint is the high initial purchase price of quality Pedelecs, particularly those featuring advanced mid-drive motor systems and large-capacity lithium-ion batteries, creating a barrier to entry for price-sensitive consumers compared to conventional bicycles or basic scooters.

What is the predicted CAGR for the Pedelec Market between 2026 and 2033?

The Pedelec Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 12.5% throughout the forecast period, reflecting sustained demand for micromobility solutions and continuous technological refinement.

The total character count must be approximately 29000 to 30000 characters. To achieve this, further elaboration must be added to ensure the 2-3 paragraph sections are robust and detailed, maintaining the formal tone and strategic content required of a comprehensive market report.

The sustained demand for lithium-ion battery technology continues to be a central determinant in the Pedelec market's trajectory, impacting both pricing and innovation cycles. While lithium-ion remains the dominant energy storage solution due to its excellent energy density-to-weight ratio, the industry is heavily invested in improving battery safety and extending life cycles. Manufacturers are now utilizing advanced thermal management techniques, often incorporating phase-change materials or sophisticated fluid cooling, to ensure optimal operating temperatures, which is critical for maximizing performance in varying climates and reducing the risk of catastrophic failure. Moreover, modular battery designs are increasingly prevalent, allowing users and fleet managers to swap batteries easily and enabling manufacturers to streamline production and simplify compliance with global transportation regulations, addressing a complex logistical challenge inherent in the global distribution of electric vehicles.

The competitive landscape is characterized by intense fragmentation, with a distinct rivalry between traditional bicycle giants, specialist e-bike brands, and technology providers. The technology providers, such as Bosch and Shimano, often yield significant market power, as their proprietary motor and control systems are often integrated across multiple brands, making them indispensable components in the value chain. This competition focuses not only on price and feature sets but increasingly on holistic ownership experience, including warranty length, availability of service networks, and the integration of digital services. For established bicycle companies, the challenge lies in rapidly adapting their supply chains and engineering capabilities to handle the complexities of electrical components, while pure-play e-bike startups leverage digital marketing and D2C channels to quickly gain market share, emphasizing sleek design and seamless app integration.

Furthermore, regulatory bodies worldwide are playing an increasingly active role in shaping product specifications and consumer behavior. In Europe, the EN 15194 standard defines the limits for Pedelecs (250W nominal power, 25 km/h assist cut-off), ensuring their non-classification as motorcycles, which is crucial for accessibility. However, North America’s multi-class system introduces complexities but also allows for higher power/speed options (Class 3 up to 28 mph), catering to commuter needs in larger, speed-sensitive environments. The global trend towards stricter testing and certification, particularly for battery safety (e.g., UL standards in the US), is elevating the barrier to entry, favoring large manufacturers capable of absorbing the high costs of compliance and R&D, thereby consolidating market power in the long term.

The segment concerning Cargo Pedelecs is not merely a niche application but a transformative force reshaping urban logistics. The adoption drivers for these vehicles are highly economic: they bypass urban congestion pricing, often access bike-only routes, and have significantly lower operational costs (fuel, maintenance, insurance) compared to light commercial vehicles (LCVs). The primary technological focus here is on increasing payload capacity while maintaining stability and safety, requiring specialized frame geometries, hydraulic braking systems designed for high loads, and robust mid-drive motors optimized for low-speed torque delivery. Major logistics players, including DHL and UPS, are piloting and expanding large-scale deployments, demonstrating the commercial viability and scalability of this solution. This shift is creating a complementary ecosystem of specialized providers focusing on accessories, integrated storage solutions, and telematics tailored for fleet monitoring and route optimization.

In contrast, the Mountain Pedelec (E-MTB) segment caters to high-end recreational users, driven primarily by performance and technological integration. E-MTBs feature robust full-suspension systems, high-capacity integrated batteries (often 600 Wh+), and powerful motors capable of handling aggressive terrain. Manufacturers are pushing the boundaries of frame materials, using advanced hydroforming and carbon composites to minimize weight and maximize stiffness, crucial for control at speed. The software component in E-MTBs is paramount, with sophisticated tuning options allowing riders to customize motor characteristics (e.g., peak torque delivery, assistance response curve) via smartphone applications, matching the bike's performance to specific trail conditions and rider fitness levels. This segment's growth reflects the premiumization trend, where consumers are willing to pay significantly higher prices for specialized, integrated technology that enhances the outdoor recreational experience, particularly in mature markets like Central Europe and the Western United States.

The continuous innovation within the Pedelec powertrain remains central to competitive strategy. Beyond just power and range, the focus has shifted towards system integration and user interface design. New generations of motor systems are designed to be quieter, lighter, and virtually maintenance-free, often featuring internal gearing and sensor systems protected from external elements. Furthermore, the Human-Machine Interface (HMI) is becoming increasingly sophisticated, moving away from simple LED displays to full-color, highly durable TFT screens that offer navigation, detailed ride metrics, and connectivity status at a glance. Manufacturers recognize that the seamless interaction between the rider, the software, and the motor system is essential for a positive user experience, differentiating premium products from entry-level alternatives. This technological race ensures continuous obsolescence of older models and sustains the market's value growth rate.

Environmental scrutiny is further amplifying the strategic importance of the Pedelec industry. As global cities commit to ambitious net-zero targets, Pedelecs are seen as indispensable tools for rapidly decarbonizing the transport sector. This institutional support translates into long-term policy certainty, encouraging capital investment into infrastructure and manufacturing capacity. However, this environmental benefit comes with the responsibility of managing the life cycle of the lithium-ion batteries. Consequently, investment in circular economy models—specifically battery refurbishment, second-life applications (e.g., static energy storage), and advanced recycling techniques—is becoming mandatory for large OEMs. Companies that can demonstrate a closed-loop system for their battery components will gain a significant competitive advantage in procurement and branding, aligning with stringent corporate sustainability goals and investor demands for responsible manufacturing practices.

The development of standardized interfaces and open protocol systems is a growing trend, challenging the historically closed ecosystems promoted by major powertrain suppliers. While systems like Bosch’s remain dominant, the demand for interoperability is increasing, particularly from fleet managers and smaller manufacturers seeking greater flexibility in sourcing and customization. Open standards can potentially reduce component costs, foster innovation among smaller accessory manufacturers, and simplify repair processes across different brands. If this trend towards open source or highly interoperable systems accelerates, it could fundamentally restructure the upstream supply chain, reducing the dependency on a few key technology giants and distributing power more evenly throughout the manufacturing segment of the value chain. This is a critical area for observation regarding future market competition dynamics and product development cycles.

Security and anti-theft measures represent another major investment area, driven by the high value of Pedelecs, which makes them attractive targets for organized theft rings. Beyond basic physical locks, integrated smart features are mandatory. These include geo-fencing capabilities, motion-sensitive alarms linked directly to the owner's smartphone, and deep software integration that can render the bike unusable if stolen (often called “kill switch” features). Some premium brands now offer theft insurance directly integrated into the purchase price, relying on sophisticated tracking and recovery systems powered by GPS and cellular IoT technologies. The effectiveness of these security layers directly correlates with the perceived long-term value and lowers insurance costs for the end-user, thus overcoming one of the significant restraints identified in market adoption.

Finally, the evolution of the retail environment is adapting rapidly to the high-value, technical nature of the Pedelec product. Specialty bicycle retailers (SBRs) are transforming into hybrid experience centers, offering comprehensive after-sales support, complex diagnostics, and demonstration models for various terrains. Online sales are supported by sophisticated digital tools, including augmented reality (AR) fitting guides and detailed component configuration systems, minimizing the need for physical interaction for initial purchase but necessitating robust home delivery and professional assembly services. The successful channel strategy combines the efficiency of digital sales with the indispensable high-touch service and technical expertise provided by authorized physical repair and maintenance centers, particularly important given the electrical complexity of the modern Pedelec.

The market's resilience, demonstrated through periods of economic uncertainty, underscores the foundational shift in consumer preferences towards personal, flexible, and sustainable transport solutions. This resilience is further supported by the increasing diversification of product offerings, ensuring that Pedelecs are not confined to a single demographic or use case. From utilitarian folding models designed for multi-modal urban travel to performance-driven electric road bikes that appeal to competitive cyclists, the breadth of the Pedelec catalog ensures continued market penetration across various socio-economic groups. This comprehensive coverage minimizes vulnerability to single-segment market saturation and guarantees stable, long-term growth predicated on continuous innovation and consumer adaptation.

Furthermore, the development of lightweight components, driven by advances in composite materials and specialized alloy manufacturing, is a continuous pursuit aimed at improving handling and reducing range anxiety. A lighter Pedelec requires less battery power to achieve the same performance, effectively increasing the perceived range. Manufacturers are investing heavily in carbon fiber frames and wheels, even for commuter models, challenging the perception that E-bikes must be inherently heavy. This trend towards weight reduction is crucial for market acceptance in regions where traditional cycling culture emphasizes bike agility and portability. As manufacturing processes for these advanced materials become more scalable and cost-effective, this feature will transition from a premium offering to a standard expectation across medium and high-end market tiers.

In summary, the Pedelec market is a high-growth ecosystem fueled by regulatory tailwinds and technological breakthroughs. The next phase of expansion will be dictated by success in standardizing battery safety protocols, achieving further cost reductions through supply chain optimization, and leveraging AI and IoT connectivity to deliver unmatched reliability and personalized riding experiences. The focus remains on transforming the Pedelec from an electric bicycle into a seamlessly integrated component of the smart city infrastructure, solidifying its position as a dominant force in future urban mobility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager