Pedestal Table Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431479 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pedestal Table Market Size

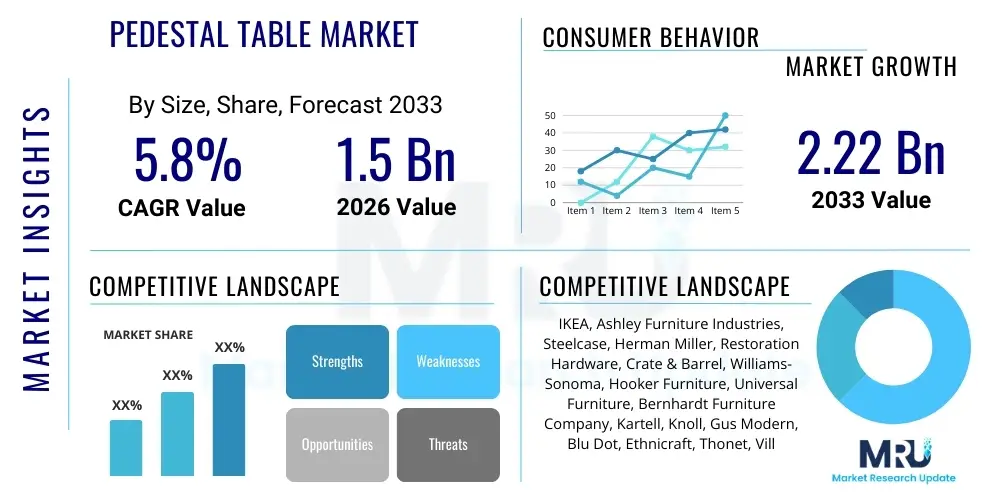

The Pedestal Table Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Pedestal Table Market introduction

The Pedestal Table Market encompasses the global sales and distribution of tables supported by a central column or base rather than four traditional legs. This design characteristic offers enhanced versatility, stability, and aesthetic appeal, particularly favored in residential, commercial, and hospitality settings where maximizing floor space and seating flexibility is critical. The market includes diverse product offerings categorized by material (wood, metal, glass), size, shape (round, square, oval), and application (dining, accent, coffee, conference). Key benefits driving market adoption include superior legroom, modern minimalist design integration, and ease of assembly and maintenance compared to conventional table designs.

Major applications of pedestal tables are widespread across various end-user sectors. In the residential segment, they are highly utilized as dining tables in compact apartments and kitchen nooks, optimizing spatial efficiency. Furthermore, smaller pedestal tables serve as stylish accent pieces or side tables in living rooms and bedrooms. The commercial sector, including cafes, restaurants, and corporate breakout areas, relies heavily on pedestal tables due to their robust design and ease of arrangement, which allows for quick reconfiguration of seating layouts to accommodate different group sizes and social distancing requirements. This functional adaptability positions pedestal tables as a mainstay in modern interior design.

Driving factors propelling market growth include the global trend toward urbanization, leading to smaller living spaces where space-saving furniture is essential. Additionally, the flourishing hospitality industry, particularly the expansion of boutique hotels and contemporary cafes, consistently demands versatile and aesthetically pleasing furniture solutions. Technological advancements in material science, such as the development of durable composite materials and high-strength metal alloys, enable manufacturers to produce lighter, yet more stable and long-lasting pedestal table designs, further contributing to their overall market appeal and consumer acceptance across different price points.

Pedestal Table Market Executive Summary

The Pedestal Table Market is characterized by robust growth, primarily influenced by shifting interior design preferences toward minimalist aesthetics and the increasing global demand for functional furniture tailored for compact spaces. Business trends indicate a strong focus on sustainable sourcing, with a rising number of manufacturers integrating recycled or responsibly harvested materials, responding directly to growing consumer environmental consciousness. Furthermore, the convergence of customization and digital retailing is accelerating, allowing consumers to design personalized tables online, thereby streamlining the purchasing process and expanding market reach globally. This trend is compelling traditional furniture retailers to enhance their e-commerce capabilities and digital showroom experiences.

Regionally, North America and Europe maintain dominance, driven by high consumer spending on home décor and established commercial infrastructure demanding premium office and hospitality furniture. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by rapid urbanization, expanding middle-class disposable incomes, and the swift development of commercial real estate and hotel chains in countries like China and India. The regional dynamics are also shaped by manufacturing hubs in APAC, which provide cost-effective production, facilitating both local consumption and global exports. Manufacturers are increasingly prioritizing supply chain resilience and diversification in response to geopolitical and logistical disruptions observed in recent years.

Segment trends reveal that the Residential Application segment holds the largest market share, though the Commercial segment exhibits a higher growth rate, reflecting substantial investments in corporate facilities and the refurbishment of hospitality venues post-pandemic. In terms of material, wood continues to be the preferred choice for high-end residential applications due to its aesthetic warmth, while metal and composite materials dominate the commercial and outdoor segments due to their durability and ease of maintenance. The distribution landscape is witnessing a strong transition, with Online Retail Channels achieving superior growth rates compared to traditional brick-and-mortar stores, driven by convenience and broader product selections.

AI Impact Analysis on Pedestal Table Market

User queries regarding AI's influence in the Pedestal Table Market often revolve around design optimization, supply chain efficiency, and personalized consumer experiences. Key themes center on how AI can generate novel, ergonomic table designs, predict material procurement needs to stabilize production costs, and enhance customer interaction through virtual reality (VR) furniture placement tools. Users are also concerned about the integration of smart features into furniture, such as adjustable heights or integrated charging pads, and how AI can manage the complex logistics of delivering customized, bulky items efficiently. The primary expectation is that AI will reduce waste, accelerate design cycles, and provide highly tailored product recommendations based on individual home dimensions and style preferences, thereby disrupting traditional retail models.

The integration of Artificial Intelligence tools significantly impacts the initial design and prototyping stages. Generative design algorithms, powered by AI, can analyze thousands of material properties, structural constraints, and aesthetic parameters to rapidly create optimal pedestal base geometries that minimize material usage while maximizing stability and load-bearing capacity. This capability allows manufacturers to significantly reduce the time spent in R&D and physical prototyping, leading to faster product launches and reduced associated costs. Furthermore, AI systems are crucial in predicting potential structural weaknesses under specific use conditions, ensuring a higher standard of product safety and longevity, a critical factor for both residential and commercial purchasers.

Within the manufacturing and distribution segments, AI contributes substantially to operational efficiencies. AI-driven predictive maintenance schedules for machinery minimize downtime in production facilities, ensuring continuous flow. In logistics, AI optimizes shipping routes and warehouse management for bulky furniture items, reducing transport costs and improving delivery times, which directly enhances customer satisfaction. Moreover, AI-powered demand forecasting analyzes historical sales data, seasonal variations, and external macroeconomic indicators to accurately predict future order volumes, allowing manufacturers to manage raw material inventory precisely, thus mitigating risks related to stockouts or excess inventory, particularly important given the volatile prices of wood and metal components.

- AI optimizes structural design using generative algorithms for material efficiency and stability.

- Predictive analytics enhance supply chain management by accurately forecasting raw material demand.

- AI-driven personalized recommendations improve consumer engagement in e-commerce platforms.

- Automated quality control systems utilize machine learning to detect aesthetic and structural defects during production.

- AI assists in optimizing logistics and final mile delivery scheduling for bulky furniture products.

DRO & Impact Forces Of Pedestal Table Market

The Pedestal Table Market is primarily driven by the growing consumer preference for space-saving, aesthetically pleasing furniture solutions suitable for modern urban living, alongside significant expansion in the global commercial and hospitality sectors requiring flexible seating arrangements. However, the market faces notable restraints, chiefly the volatility in the prices of key raw materials like hardwood lumber, steel, and glass, which directly impact manufacturing costs and final product pricing, occasionally leading to reduced profit margins. Opportunities are present in the integration of smart furniture technology and the strong consumer shift towards customizable and sustainably produced tables. These factors converge under the influence of strong e-commerce penetration and evolving architectural design standards emphasizing open-plan layouts.

One major driver is the architectural trend favoring minimalist and open-concept interior designs, where the clean lines and base-centric structure of a pedestal table complement the desired aesthetic far better than traditional four-legged designs, which can appear cluttered. This is compounded by demographic shifts, especially among younger populations in metropolitan areas who often inhabit smaller apartments or co-living spaces, for whom maximized legroom and minimal visual footprint are high priorities. The convenience afforded by the single central base, which simplifies cleaning and allows for effortless seating adjustments without interference from table legs, further enhances its utility and market appeal across all residential price points.

Conversely, a critical restraint involves the engineering challenge of ensuring robust stability, particularly for large dining or conference tables designed on a central base. Achieving the required stability necessitates higher density and often more expensive base materials or complex internal weight distribution mechanisms, which can escalate production costs compared to conventional leg systems. Furthermore, market expansion is occasionally hampered by cheap, mass-produced tables that fail stability tests, leading to consumer distrust and highlighting the need for stricter industry-wide safety and quality standards, particularly in emerging markets where counterfeit products are prevalent.

Significant opportunities exist in the development of modular and multifunctional pedestal table designs. For example, tables with adjustable height mechanisms, often incorporating simple pneumatic or motorized controls, cater to the rising demand for flexible home office setups, easily transitioning from dining height to standing desk height. The growing consumer commitment to sustainability provides a strong avenue for differentiation, encouraging manufacturers to invest in circular economy principles, utilizing reclaimed wood, recycled metals, or bio-based composite materials. The effective navigation of these drivers and opportunities, while mitigating restraints through material innovation, determines competitive advantage in the foreseeable future.

Segmentation Analysis

The Pedestal Table Market is comprehensively segmented based on material type, application, shape, and distribution channel, providing a granular view of market dynamics and consumer preferences across different usage environments. The segmentation highlights the diversity within the market, reflecting the varying requirements of residential consumers versus commercial businesses. While wood materials continue to hold a significant value share due to their traditional appeal and durability, the fastest growth is observed in the metal and composite segments, driven by their suitability for modern, commercial, and outdoor applications requiring weather resistance and high stability. Understanding these segments is crucial for manufacturers developing targeted marketing strategies and optimizing their product portfolios to meet specialized needs.

The Application segmentation—Residential and Commercial—is pivotal, as the functional and aesthetic demands differ greatly. Residential sales are often driven by design trends and individual household space constraints, favoring smaller, accent, and kitchen tables. In contrast, the Commercial segment, encompassing hotels, corporate offices, and quick-service restaurants (QSRs), prioritizes robustness, ease of cleaning, fire resistance, and standardization for high-traffic environments, favoring materials like high-pressure laminate (HPL) tops on heavy steel or cast iron bases. This divergence dictates different supply chain strategies, with residential sales leaning towards personalized retail, while commercial sales depend heavily on large-scale contract furniture providers and interior design firms.

Segmentation by Distribution Channel—Offline (Brick-and-Mortar) and Online Retail—demonstrates the digital transformation affecting furniture purchases. Although large furniture items traditionally required physical viewing, the Online segment is rapidly gaining ground due to improved virtual reality visualization tools, robust return policies, and convenience. This trend mandates significant investment in digital infrastructure and logistics capable of handling large, delicate shipments safely and efficiently. The Shape segment (Round, Square, Rectangular) also influences utility, with round tables dominating residential and cafe settings for their social and space-efficient qualities, while rectangular and square tables are preferred in formal dining and conference room settings.

- By Material:

- Wood (Solid Wood, Engineered Wood, Veneer)

- Metal (Stainless Steel, Aluminum, Cast Iron)

- Glass (Tempered Glass, Frosted Glass)

- Plastic and Composites (Fiberglass, Laminate, Resin)

- By Application:

- Residential (Dining Table, Coffee Table, Accent/Side Table)

- Commercial (Restaurants/Cafes, Offices/Conference, Hospitality)

- By Shape:

- Round/Oval

- Square/Rectangular

- By Distribution Channel:

- Offline (Specialty Stores, Furniture Chains, Contract Dealers)

- Online Retail (E-commerce Websites, Company-owned Portals)

Value Chain Analysis For Pedestal Table Market

The value chain for the Pedestal Table Market is extensive, starting with raw material sourcing (upstream analysis) and extending through manufacturing, distribution, and reaching the final consumer (downstream analysis). Upstream activities are dominated by the procurement of primary materials—timber (hardwoods and softwoods), metals (steel and aluminum), and specialized components like glues, finishes, and hardware mechanisms necessary for stability and assembly. Efficiency at this stage is highly dependent on managing global commodity price fluctuations and ensuring sustainable logging practices or ethical metal sourcing. Strong supplier relationships and long-term contracts are critical for cost control and quality assurance, particularly when sourcing specialized solid wood or high-grade steel bases required for commercial use.

Midstream processes involve rigorous manufacturing, assembly, and quality control. This stage integrates processes such as material cutting, shaping the pedestal base (often involving complex molding or welding for metal structures), surface finishing (lacquering, powder coating, veneering), and final assembly packaging. Advanced automation and precision engineering are increasingly employed here to ensure the structural integrity of the single-base design, which is more complex to stabilize than traditional four-legged designs. High efficiency in manufacturing is achieved through lean principles to minimize waste and optimize throughput, which is essential for maintaining competitive pricing in a largely consolidated but competitive global market.

Downstream analysis focuses on the distribution channels, which include both direct and indirect models. Direct sales involve manufacturers selling through their own branded stores or dedicated e-commerce portals, offering greater margin control and direct customer feedback. Indirect channels encompass wholesale distributors, specialized furniture retailers, large contract dealers serving the commercial sector, and major third-party e-commerce platforms. The trend is shifting towards enhanced digital distribution, requiring manufacturers to invest heavily in robust logistics networks capable of handling large freight, coupled with sophisticated inventory management systems to track and fulfill diverse global orders efficiently and promptly.

Pedestal Table Market Potential Customers

The primary customers for the Pedestal Table Market are segmented into two major categories: Residential Consumers and Commercial Entities, each possessing distinct purchasing drivers and volume requirements. Residential consumers, ranging from first-time homeowners to those downsizing or furnishing secondary properties, prioritize aesthetic design, material quality, and space optimization. These buyers typically acquire single units for dining areas, kitchens, or as accent pieces, often influenced by interior design trends seen on social media or in specialized magazines, and they rely heavily on ease of online visualization and customer reviews before purchase.

Commercial entities represent the bulk purchasers, seeking durability, high functionality, and compliance with institutional safety standards. This category includes the Hospitality Sector (hotels, resorts, cafes, fine dining establishments), Corporate Offices (conference rooms, collaborative zones, break rooms), and Institutional Settings (schools, libraries). These customers require batch orders, often customized to specific dimensions, colors, or logo integration, and their purchasing decisions are heavily influenced by contract furniture dealers and interior architects who specify robust, easy-to-maintain materials like steel, laminates, and tempered glass to withstand heavy, constant use and frequent cleaning.

A rapidly expanding segment of potential customers includes specialized interior designers and architects who specify pedestal tables for client projects across both residential and high-end commercial applications. These professionals often seek premium, custom-designed, or architecturally significant pieces that offer unique aesthetic solutions, focusing on brand heritage, sustainable sourcing certifications, and bespoke material combinations. Servicing this customer group requires manufacturers to maintain strong B2B relationships, provide extensive customization capabilities, and ensure reliable, global logistical support for timely project completion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Ashley Furniture Industries, Steelcase, Herman Miller, Restoration Hardware, Crate & Barrel, Williams-Sonoma, Hooker Furniture, Universal Furniture, Bernhardt Furniture Company, Kartell, Knoll, Gus Modern, Blu Dot, Ethnicraft, Thonet, Villeroy & Boch, Roche Bobois, Fritz Hansen, Muuto |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pedestal Table Market Key Technology Landscape

The technology landscape in the Pedestal Table Market is primarily centered on advanced manufacturing techniques, material science innovation, and digitalization of the consumer experience. In manufacturing, Computer Numerical Control (CNC) machining is standard practice, enabling precise cuts and complex shaping of wood and metal components, which is essential for ensuring the flawless fit and finish demanded by premium designs. Crucially, sophisticated welding and casting technologies are employed for metal bases to achieve high load-bearing capacity and robust stability, circumventing the inherent structural limitations of relying on a single central support column, thereby pushing the boundaries of possible sizes and weight distribution.

Material science is driving innovation through the development and utilization of advanced composites and smart materials. Manufacturers are increasingly integrating lightweight yet high-strength carbon fiber composites or recycled aluminum alloys in the pedestal base construction to reduce the overall product weight for easier mobility and shipping, without compromising on stability. Surface finishing technologies, such as electrostatic powder coating for metal bases, offer superior durability, scratch resistance, and a wider range of aesthetic finishes compared to traditional liquid paints, extending the product lifespan and appealing to the commercial sector's requirement for hard-wearing surfaces.

In the consumer-facing domain, technology adoption focuses heavily on enhancing the buying journey. Augmented Reality (AR) and Virtual Reality (VR) tools allow prospective customers to visualize pedestal tables within their actual living spaces, overcoming the hurdle of purchasing large furniture online without physical inspection. Furthermore, the incorporation of "smart furniture" technologies, such as integrated wireless charging pads, hidden connectivity ports, and motorized adjustable height mechanisms (often driven by embedded microcontrollers and sensors), transforms the basic functionality of the table, catering to the growing demand for tech-integrated home and office environments.

Regional Highlights

- North America: This region holds a significant market share, characterized by high disposable incomes and a strong consumer focus on contemporary, design-forward furniture. Demand is robust across both residential (driven by high-end design trends) and commercial sectors (sustained renovation of corporate campuses and hospitality venues). Key markets, particularly the U.S. and Canada, show a high adoption rate of large, stable pedestal dining and conference tables, often incorporating premium materials like solid marble and high-grade stainless steel. E-commerce platforms are extremely influential in purchasing decisions.

- Europe: Europe is a mature market known for emphasizing heritage design, sustainability, and quality craftsmanship. Countries like Germany, Italy, and Scandinavia lead in both production and consumption, focusing on environmentally certified materials (e.g., FSC-certified wood) and minimalist designs (e.g., Danish Modern and Bauhaus influences). The market is driven by strong regulatory frameworks promoting sustainable sourcing and a well-established contract furniture market supporting corporate and public sector procurement.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by rapid urbanization, significant infrastructure development, and the expansion of the middle class in emerging economies such as China, India, and Southeast Asian countries. The demand is fueled by new residential construction requiring compact furniture solutions and a booming hospitality industry. While mass-produced, cost-effective tables are dominant, there is a burgeoning segment demanding high-quality, imported, or locally produced luxury designs, signaling diversification in consumer tastes and purchasing power.

- Latin America (LATAM): The LATAM market is in a developing phase, where growth is closely tied to economic stability and construction activities. Brazil and Mexico are primary consumers, with demand focused heavily on functional and durable tables, often prioritizing value and locally sourced materials. The penetration of modern retail chains and e-commerce is steadily increasing, but traditional furniture stores and local craftsmanship still play a significant role.

- Middle East and Africa (MEA): This region is characterized by contrasting demand profiles. The GCC nations (UAE, Saudi Arabia) exhibit high demand for ultra-luxury, custom-made pedestal tables, often specified for opulent villas and high-end hotel projects, driven by significant capital expenditure in real estate. The African market, conversely, is highly price-sensitive, with demand concentrated in urban centers for functional and resilient commercial tables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pedestal Table Market.- IKEA

- Ashley Furniture Industries

- Steelcase

- Herman Miller

- Restoration Hardware

- Crate & Barrel

- Williams-Sonoma

- Hooker Furniture

- Universal Furniture

- Bernhardt Furniture Company

- Kartell

- Knoll

- Gus Modern

- Blu Dot

- Ethnicraft

- Thonet

- Villeroy & Boch

- Roche Bobois

- Fritz Hansen

- Muuto

Frequently Asked Questions

Analyze common user questions about the Pedestal Table market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most recommended for commercial pedestal tables?

Commercial pedestal tables highly prioritize durability and stability. Recommended materials include high-pressure laminate (HPL) or solid surfacing for tabletops and heavy-gauge steel or cast iron for the base structure, often finished with electrostatic powder coating to ensure resistance against heavy use, moisture, and frequent cleaning cycles common in hospitality settings.

How does the pedestal design specifically benefit small dining spaces?

The pedestal design significantly benefits small dining spaces by eliminating the need for four corner legs, which maximizes legroom and allows for flexible seating arrangements. Users can easily push chairs closer to the table and accommodate an extra person without obstruction, optimizing the functional floor area, making it ideal for compact apartments and kitchen nooks.

Are height-adjustable pedestal tables a growing trend?

Yes, height-adjustable pedestal tables are a rapidly growing trend, particularly within the Residential and Commercial office segments. These multifunctional tables, often featuring pneumatic or motorized bases, easily transition between coffee, dining, and standing desk heights, catering to the increased need for versatile, ergonomic furniture in dynamic work-from-home and collaborative office environments.

What are the primary stability concerns for large pedestal dining tables?

The primary stability concerns for large pedestal dining tables relate to tipping and wobble, especially near the edges. Manufacturers address this by using disproportionately heavy base plates, complex internal weight distribution mechanisms, and wide base footprints relative to the table diameter, often utilizing dense materials like cast iron or weighted concrete cores to ensure robust performance and safety.

How does e-commerce influence the purchase of pedestal tables?

E-commerce profoundly influences pedestal table purchases by offering extensive product catalogs, competitive pricing, and user convenience. The integration of Augmented Reality (AR) tools allows consumers to digitally preview tables in their homes, mitigating the risk associated with purchasing large furniture sight unseen, thereby accelerating the market shift away from traditional brick-and-mortar sales channels.

The Pedestal Table Market is characterized by intense competition driven by innovation in design and material science. Manufacturers are increasingly focused on customizing products, integrating sustainability into their sourcing and production cycles, and leveraging digital distribution channels to reach a broader global consumer base. The long-term growth trajectory is securely tied to continued urbanization, the evolution of contemporary commercial architecture, and the sustained consumer demand for furniture that balances aesthetic appeal with exceptional functional efficiency in increasingly smaller living and working environments. The challenge for market players remains balancing the cost pressures associated with volatile raw material pricing against the consumer expectation for premium quality and enduring structural integrity, especially regarding the critical stability of the centralized base mechanism. Successful market navigation requires continuous investment in generative design and streamlined logistics, ensuring a robust and responsive supply chain capable of delivering customized, high-quality products efficiently across diverse geographic regions.

Further market maturation is anticipated through technological convergence, specifically the wider integration of smart home features into furniture. Pedestal tables featuring seamlessly embedded charging capabilities, air quality sensors, or modular components will command higher price points and establish new premium segments. The adoption of 3D printing technologies for prototyping and small-batch production of unique base designs also promises to revolutionize customization speed and reduce waste. Furthermore, as global environmental standards become stricter, certification for responsible material sourcing, such as Forest Stewardship Council (FSC) certifications for wood products, will move from being a competitive advantage to a mandatory entry requirement, particularly in highly regulated markets in North America and Europe. This shift underscores the industry's need for transparent sourcing and efficient resource management.

The future landscape of the Pedestal Table Market will see a strategic pivot toward experiential retail, even within the digital domain. While online sales thrive, manufacturers will utilize flagship stores and virtual showrooms as brand experience centers, focusing less on stock turnover and more on allowing consumers to interact with premium and custom designs. The Commercial segment will likely remain highly lucrative, driven by large-scale contract opportunities in expanding international hotel chains and the ongoing trend of redesigning corporate spaces to encourage collaboration and employee comfort, where pedestal tables serve as versatile anchors for small team meetings and informal gatherings. The ability of key players to forecast micro-design trends and quickly adapt manufacturing lines to handle complex, personalized orders will define leadership positions in the forecast period.

The strategic deployment of data analytics across the sales process is also becoming a non-negotiable component of success. Analyzing customer purchase patterns, tracking popular design configurations, and understanding regional material preferences enable targeted marketing campaigns and optimized inventory management. This data-centric approach helps mitigate risks associated with overstocking unpopular designs and ensures that production capacity is aligned with real-time demand fluctuations. Moreover, manufacturers utilizing advanced Enterprise Resource Planning (ERP) systems linked with supply chain management platforms are better equipped to handle the logistical complexities inherent in international furniture shipping, which involves managing fragile components and oversized packaging across multiple customs jurisdictions, ultimately reducing lead times and enhancing overall customer satisfaction metrics.

In summary, the Pedestal Table Market is poised for stable expansion, underpinned by urbanization and evolving aesthetic preferences. Success depends heavily on embracing innovation in stability engineering, committing to sustainable material utilization, and mastering the complex logistics of global, high-volume, and customized furniture distribution. The integration of advanced digital tools for design and customer interaction will continue to narrow the gap between customer expectation and product delivery, securing the market's trajectory towards the projected 2033 valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager