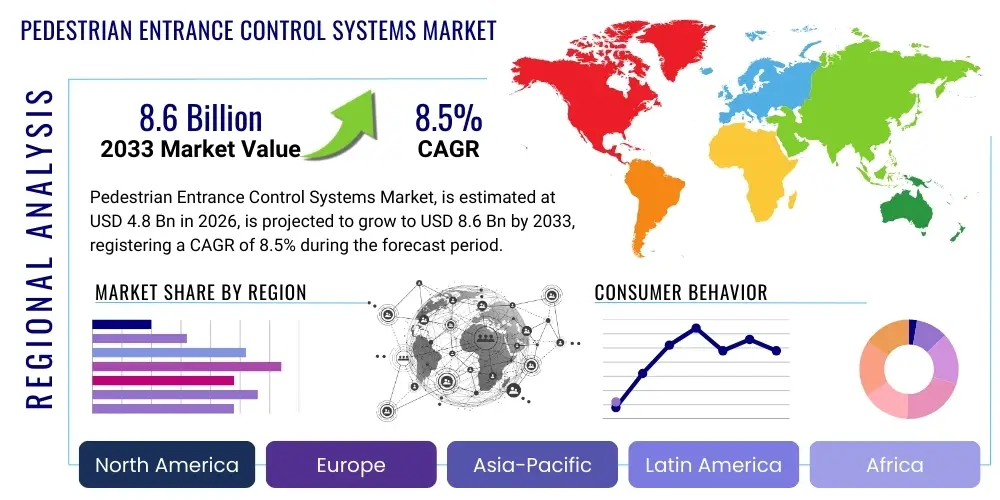

Pedestrian Entrance Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437928 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Pedestrian Entrance Control Systems Market Size

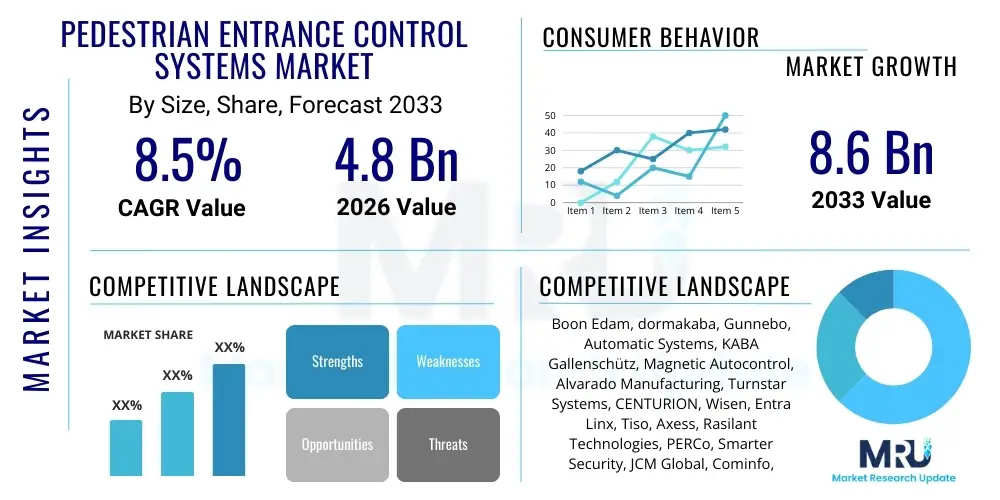

The Pedestrian Entrance Control Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Pedestrian Entrance Control Systems Market introduction

The Pedestrian Entrance Control Systems market encompasses a diverse array of physical security solutions designed to manage and regulate the flow of people through defined access points in public and private facilities. These systems, which include turnstiles, speed gates, revolving doors, and security barriers, serve the fundamental purpose of enhancing security by ensuring that only authorized individuals gain entry, while simultaneously optimizing traffic flow during peak hours. The sophisticated integration of these physical devices with electronic access control systems, such as biometric scanners, RFID readers, and mobile credential technologies, transforms standard entry points into intelligent security checkpoints. The rising prevalence of security threats, coupled with increasing governmental mandates for public safety across critical infrastructure, are primary factors fueling the deployment of these solutions globally. Furthermore, the aesthetic considerations in modern architectural designs have led to the development of sleek, unobtrusive control systems, particularly speed gates, which offer high throughput without compromising on visual appeal or building compliance.

The product scope within this market is extensive, ranging from basic mechanical tripod turnstiles suitable for high-volume, low-security applications like sports stadiums, to highly advanced optical turnstiles and full-height rotor gates utilized in environments demanding maximum security, such as data centers, military installations, and sensitive corporate headquarters. Major applications span across commercial buildings, transportation hubs (airports, metros, train stations), government and institutional facilities, manufacturing plants, and recreational venues. The core benefits derived from implementing these systems include superior physical deterrence against unauthorized intrusion, accurate tracking of personnel for safety compliance, minimizing queue times through fast verification processes, and providing crucial data for facilities management regarding occupancy rates and traffic patterns. This holistic approach to security and operational efficiency drives continuous innovation within the sector, particularly concerning integration with building management systems (BMS) and emergency evacuation protocols.

Key driving factors accelerating market expansion include rapid urbanization leading to increased concentration of people in commercial centers, the global proliferation of smart city initiatives demanding integrated security infrastructure, and the continuous evolution of access control technologies, notably the shift towards frictionless and biometric authentication methods. Moreover, infrastructure investment in developing economies, particularly in the Asia Pacific region, is creating massive demand for reliable pedestrian control solutions for new mass transit projects and large-scale commercial developments. These systems are essential components of modern risk management strategies, providing both a visible deterrent and a critical layer of access segmentation, thereby reducing the vulnerability profile of large organizations and public spaces against both internal and external threats.

Pedestrian Entrance Control Systems Market Executive Summary

The global Pedestrian Entrance Control Systems market is characterized by robust growth, primarily driven by escalating global security concerns and the necessity for efficient traffic management in increasingly dense urban environments. Current business trends indicate a strong shift towards intelligent and aesthetically pleasing solutions, with speed gates and optical turnstiles commanding significant market share due to their high throughput and enhanced security features, especially within corporate and transportation sectors. Technological convergence is a defining feature, where systems are moving beyond simple mechanical barriers to become integrated components of comprehensive security ecosystems, utilizing advanced sensor technology, IoT connectivity, and cloud-based management platforms. Furthermore, the demand for mobile access credentialing, allowing users to pass through entry points using smartphones, is rapidly increasing, forcing manufacturers to prioritize seamless integration with digital identity platforms, streamlining access while maintaining rigorous security standards.

Regionally, the market presents varied adoption landscapes. North America and Europe currently represent the highest revenue share, mainly owing to stringent regulatory frameworks, high security expenditure capabilities, and the early adoption of cutting-edge technologies like biometric access control and AI-driven monitoring. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is directly attributable to massive government investment in new infrastructure projects, including airports, rail networks, and mega commercial complexes, particularly in emerging economies like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa (MEA) are also exhibiting steady growth, fueled by development in tourism infrastructure and the need to secure critical oil and gas facilities, requiring robust and durable exterior control systems.

Segment trends highlight the dominance of the tripod turnstiles and waist-high turnstiles segments in terms of volume, driven by their cost-effectiveness and widespread use in recreational and industrial settings. However, in terms of value growth, speed gates and revolving security doors are leading the way, reflecting the premium customers place on rapid, touchless authentication and high-security containment in sensitive areas. The technology segment is heavily biased towards integration, with systems capable of handling multiple verification methods (biometric, proximity card, mobile QR) gaining preference. This convergence necessitates specialized integration expertise, driving market consolidation as large security companies acquire smaller, innovative technology providers to offer end-to-end solutions that meet the complex demands of modern facilities management.

AI Impact Analysis on Pedestrian Entrance Control Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Pedestrian Entrance Control Systems predominantly revolve around enhancing security screening efficiency, predicting and managing crowd behavior, and minimizing false rejection rates in biometric systems. Users are keenly interested in how AI can move the systems from reactive access logging to proactive threat detection and personalized flow management. Key themes include the implementation of facial recognition systems capable of identifying unauthorized individuals or persons of interest in real-time, the use of machine learning algorithms for predictive maintenance of physical components, and the integration of behavioral analytics to identify tailgating, forced entry attempts, or unusual traffic patterns before a breach occurs. Concerns often center on data privacy, ethical use of biometric data processed by AI, and the necessity for robust cybersecurity measures to protect these intelligent edge devices from network attacks. Expectations are high that AI will lead to truly frictionless access experiences, where security is maintained implicitly without requiring active input from the pedestrian.

- AI-driven real-time anomaly detection, identifying unauthorized entry attempts (e.g., tailgating) with higher accuracy than traditional sensors.

- Enhanced biometric authentication reliability, using deep learning models to improve facial recognition speed and accuracy, even under varying conditions (lighting, partial occlusion).

- Predictive maintenance schedules for turnstile mechanisms based on usage patterns and operational stress analyzed by machine learning, minimizing downtime.

- Optimization of pedestrian flow and throughput rates through dynamic lane adjustments based on AI analysis of current and predicted crowd density.

- Integration with external databases (e.g., watch lists) for instant security alerts upon recognition of flagged individuals at the entry point.

- Behavioral analytics to assess intent, distinguishing legitimate access procedures from potential malicious activities based on movement patterns.

- Reduced administrative burden via automated reporting and data analysis on access logs and security events generated by the intelligent systems.

DRO & Impact Forces Of Pedestrian Entrance Control Systems Market

The Pedestrian Entrance Control Systems market is shaped by a powerful interplay of drivers, restraints, and opportunities, culminating in significant impact forces on market dynamics and strategic positioning. A primary driver is the accelerating global focus on securing critical infrastructure, including government buildings, data centers, and mass transit systems, following heightened geopolitical tensions and terrorist activities, making entrance control indispensable for layered security architectures. This demand is further amplified by continuous technological advancements in biometrics, IoT, and mobile access credentials, which allow for more secure and convenient entry solutions, pushing facility operators to upgrade outdated mechanical systems. Conversely, significant restraints include the considerable initial capital investment required for deploying high-end security turnstiles and speed gates, especially when coupled with necessary complex system integration into existing IT infrastructure. Moreover, growing public and regulatory scrutiny regarding data privacy and the storage of biometric information, particularly under legislation like GDPR, poses a persistent challenge, demanding compliance and robust data protection measures from vendors.

Opportunities for growth are abundant, particularly in the integration of entrance control systems with Smart Building Management Systems (BMS) and Heating, Ventilation, and Air Conditioning (HVAC) systems. This integration allows for optimized energy consumption based on accurate occupancy data derived from the entrance systems, adding significant operational value beyond security. The increasing adoption of mobile-based access control (using smartphones as credentials) presents a major growth avenue, especially as enterprises seek frictionless and hygiene-conscious access solutions in the post-pandemic environment. Furthermore, the untapped potential in developing markets for securing public transportation networks and constructing new commercial real estate offers substantial long-term growth prospects for modular and scalable entrance control solutions, enabling vendors to penetrate new customer segments with competitive pricing models and localized service support.

The overall impact forces are strongly positive, indicating a market moving towards premiumization and intelligence. The critical need for asset protection and compliance with global security standards outweighs the capital expenditure constraints for most high-security end-users. Technological advancements act as a major transformative force, favoring manufacturers who can successfully integrate AI and IoT capabilities into their physical barriers, turning them into intelligent security nodes rather than mere gatekeepers. The long-term trend suggests that systems will become increasingly specialized based on the required security level (low, medium, high), driving segmentation and targeted product development. This pressure compels companies to invest heavily in R&D to maintain competitive advantage, focusing on modularity, aesthetic design, and superior data security features to meet the diverse regulatory and operational requirements of a global clientele.

Segmentation Analysis

The Pedestrian Entrance Control Systems market is comprehensively segmented across several dimensions, including product type, technology deployed, operating mechanism, and end-user application, providing a granular view of market dynamics and adoption patterns. Product type segmentation distinguishes between various physical barriers like turnstiles, speed gates, security revolving doors, and full-height gates, each catering to specific security and throughput needs. Technology segmentation is crucial, differentiating systems based on the access method utilized, such as biometrics (fingerprint, facial recognition), proximity cards (RFID, NFC), and mobile credentials, reflecting the industry's shift towards high-security, touchless verification. The end-user analysis reveals distinct demand drivers, with transportation and corporate sectors being the largest consumers, demanding fast, high-volume access solutions, while government and industrial sectors prioritize maximum security and durability.

Further analysis reveals that speed gates are increasingly dominating the market value segment, particularly in high-rise corporate towers and luxury commercial properties where aesthetics and rapid passage are paramount. These systems rely heavily on advanced optical sensors and often incorporate facial recognition technology for true hands-free access. Conversely, traditional tripod turnstiles continue to hold the largest market volume share due to their widespread, cost-effective deployment in stadiums, universities, and factory entrances, particularly in cost-sensitive markets. The integration complexity varies significantly across segments; high-security solutions require deep integration with video management systems (VMS) and alarm monitoring software, whereas basic turnstiles function effectively as standalone units or through simple electrical integration with card readers.

Understanding these segments allows market participants to tailor their offerings effectively. For instance, manufacturers targeting the banking and finance sector must prioritize compliance with financial security regulations and zero-tolerance tailgating detection, often necessitating the use of security revolving doors or robust full-height turnstiles. Conversely, serving the education sector focuses on durability, vandal resistance, and ease of maintenance. The evolving regulatory environment, particularly concerning data privacy in biometric applications, mandates continuous updating of the technology component, ensuring hardware and software solutions are compliant and ethically sound. This comprehensive segmentation provides a robust framework for strategic planning and resource allocation across different product lines and target industries.

- By Product Type:

- Tripod Turnstiles

- Full-Height Turnstiles

- Waist-High Turnstiles (Half-Height)

- Speed Gates (Optical Turnstiles)

- Security Revolving Doors

- Security Gates and Barriers

- By Technology:

- Biometric Recognition (Facial, Fingerprint, Iris, Palm Vein)

- Card-Based Access (RFID, Proximity, Smart Card)

- Mobile Access Credentials (NFC, QR Codes)

- Other Authentication Methods (Keypad, Barcode)

- By Operating Mechanism:

- Automatic

- Semi-Automatic

- Mechanical/Manual

- By End-User Application:

- Corporate and Enterprises

- Government and Defense

- Transportation (Airports, Metro Stations, Ports)

- Banking, Financial Services, and Insurance (BFSI)

- Education and Academia

- Industrial and Manufacturing

- Healthcare and Pharmaceutical

- Retail and Commercial Centers

- Stadiums and Entertainment Venues

Value Chain Analysis For Pedestrian Entrance Control Systems Market

The value chain for the Pedestrian Entrance Control Systems market is complex, beginning with the sourcing of specialized raw materials and electronic components, extending through sophisticated manufacturing and system integration, and concluding with sales, installation, and long-term maintenance. Upstream activities involve procuring high-grade metals (stainless steel, aluminum) for barrier construction, high-precision motors and gears for mechanical operation, and advanced electronic components like sensors, microprocessors, and sophisticated optical arrays for detection systems. Suppliers of access control peripherals (e.g., biometric modules, card readers) are critical partners in this phase. The quality and reliability of these components significantly dictate the final product's durability and performance, especially in high-traffic or harsh outdoor environments. Major players often maintain tight control over component sourcing to ensure compliance with international quality and sustainability standards.

Midstream activities focus on manufacturing, assembly, and integration. Specialized manufacturers design and assemble the physical housing, fabricate the internal mechanisms, and then integrate the electronic security technology. This stage requires significant precision engineering, particularly for speed gates and revolving doors where tight tolerances are necessary for smooth, quiet, and secure operation. The integration of proprietary software, firmware, and connectivity modules (e.g., IP network interfaces) occurs here, transforming the physical barrier into a smart security asset. Downstream activities involve distribution, sales, installation, and service. Distribution channels are highly fragmented, relying on a combination of direct sales for large, customized infrastructure projects and an extensive network of indirect specialized security system integrators (SSIs) and value-added resellers (VARs) who handle localized sales, customization, and deployment in smaller commercial settings. The reliance on SSIs is crucial, as they provide the essential bridge between the manufacturer’s product and the end-user’s specific environment, handling network configuration, software integration with existing systems, and final commissioning.

The distribution channel preference is largely dependent on the project scale and complexity. Direct channels are preferred for government contracts, major airport upgrades, and large multinational corporate headquarters, allowing manufacturers maximum control over implementation and service quality. Conversely, the indirect channel is essential for market penetration into small and medium enterprises (SMEs) and regional businesses, where localized support and quick installation turnaround are necessary. Post-sales services, including maintenance contracts, software updates, and technical support, represent a vital, high-margin component of the value chain. Long-term relationship management and the ability to offer remote diagnostics and predictive maintenance (often utilizing IoT and AI) are emerging as critical differentiators, ensuring extended product lifecycle and maximizing customer retention.

Pedestrian Entrance Control Systems Market Potential Customers

The customer base for Pedestrian Entrance Control Systems is exceptionally broad, spanning nearly all sectors that require controlled access, asset protection, and managed people flow. The largest and most strategically important customers are high-security facilities and infrastructure operators. This includes large multinational corporate campuses, which deploy advanced speed gates for employee access, data centers demanding full-height turnstiles and mantrap portals for maximum security, and financial institutions (BFSI sector) requiring robust security revolving doors to prevent unauthorized access to sensitive areas and comply with stringent regulatory requirements. These end-users prioritize technology integration, audit trails, and systems capable of zero-tolerance tailgating detection, often justifying premium investments for enhanced security layers.

A second major customer segment is the public infrastructure and transportation sector, encompassing national railway operators, urban metro systems, and international airports. These entities are characterized by extremely high throughput requirements, necessitating durable, vandalism-resistant solutions like heavy-duty tripod turnstiles and specific types of speed gates engineered for fast, efficient ticketing and mass access validation. Security here is critical but must be balanced with rapid evacuation capability and ADA compliance. Governments and defense organizations form another key segment, utilizing the highest security-grade products, including specialized full-height turnstiles and controlled access barriers at military bases, correctional facilities, and sensitive administrative buildings where physical security protocols are paramount and often mandated by federal standards.

Emerging potential customers are increasingly found in the retail, healthcare, and education sectors. Modern large-scale retail centers and hypermarkets utilize entrance control to manage entry/exit points, prevent merchandise theft, and track visitor metrics. Hospitals and pharmaceutical companies use access control systems to segregate public and secure areas, protecting sensitive patient data and high-value drug inventories. Universities and large educational campuses deploy turnstiles at libraries, dormitories, and recreation centers to manage student attendance and secure physical assets. The adoption curve for these customers is accelerating due to the increased perceived value of security management and the availability of systems that integrate seamlessly with existing institutional identity management platforms, making integration and cost-effectiveness key purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boon Edam, dormakaba, Gunnebo, Automatic Systems, KABA Gallenschütz, Magnetic Autocontrol, Alvarado Manufacturing, Turnstar Systems, CENTURION, Wisen, Entra Linx, Tiso, Axess, Rasilant Technologies, PERCo, Smarter Security, JCM Global, Cominfo, IDL Access, FlowTurnstile |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pedestrian Entrance Control Systems Market Key Technology Landscape

The technological landscape of the Pedestrian Entrance Control Systems market is evolving rapidly, driven by the shift towards frictionless, highly secure, and network-enabled access solutions. Biometric authentication remains the cornerstone of advanced entrance control, moving beyond simple fingerprint readers to sophisticated facial recognition and iris scanning technologies that offer speed and superior accuracy, even when subjects are moving or partially obscured. The integration of deep learning algorithms into these biometric systems is crucial for minimizing false acceptance and rejection rates, improving overall user experience, and providing crucial metadata for security personnel. Furthermore, the proliferation of Internet of Things (IoT) sensors within turnstiles and speed gates allows for real-time monitoring of operational status, enabling predictive maintenance that minimizes system downtime and operational costs. These sensors provide vital telemetry data, such as cycle counts and motor performance indicators, which are analyzed remotely via cloud platforms.

A second major technological trend is the pervasive adoption of mobile access credentials. Facilities are increasingly moving away from traditional physical access cards to digital credentials stored securely on smartphones and smartwatches, utilizing Near Field Communication (NFC) or Bluetooth Low Energy (BLE) technologies. This convergence is highly desirable as it reduces the administrative overhead associated with card issuance and replacement, while also aligning with user preference for using personal mobile devices for multiple functions. Integrating mobile access necessitates robust encryption and cybersecurity protocols to protect digital keys from interception or cloning. Cloud-based access control platforms are also becoming standard, offering centralized management of multiple entry points across geographically dispersed locations, providing scalability, flexibility, and simplified software updates, thereby reducing the dependency on local server infrastructure and specialized IT staff.

Beyond access methods, core mechanical and design innovations are critical. Modular design is a key feature, allowing systems to be easily configured and upgraded to meet changing security demands or integrate new biometric readers without complete system replacement. The engineering focus is heavily placed on maximizing throughput without sacrificing security, exemplified by modern speed gates that use sophisticated optical barriers and proximity sensors to detect tailgating within milliseconds. The incorporation of robust anti-vandalism features, weatherproofing (for outdoor installations), and failsafe mechanisms compliant with fire and safety regulations (e.g., automatic barrier retraction upon alarm) are mandatory technological considerations that ensure both safety compliance and long-term durability, especially in harsh operational environments like transportation hubs.

Regional Highlights

- North America: This region holds a significant market share, characterized by high spending on security infrastructure, stringent regulatory compliance, and rapid technological adoption. The corporate sector, particularly in technology, finance, and data centers, drives demand for high-end optical turnstiles and biometric access systems, seeking seamless integration with existing IP-based security networks. The emphasis here is on touchless access, leveraging mobile credentials and facial recognition, ensuring fast throughput in Class A commercial buildings.

- Europe: Europe is a mature market defined by strict security standards and a strong focus on public safety and anti-terrorism measures, particularly in Western European countries. The market sees robust demand from the transportation and government sectors. European manufacturers often lead in aesthetically integrated designs and sustainability. The enforcement of GDPR heavily influences technology choices, pushing vendors toward secure, privacy-by-design biometric solutions, impacting the adoption rate and implementation complexity of facial recognition compared to other regions.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by massive governmental investment in smart city infrastructure, rapid urbanization, and expansion of mass transportation networks (metros and high-speed rail) across China, India, and Southeast Asia. While cost sensitivity remains a factor, driving demand for volume-focused tripod turnstiles in public spaces, the emergence of high-security needs in burgeoning financial centers and technology hubs fuels premium demand for speed gates and advanced biometrics, especially in Australia, Singapore, and Japan.

- Latin America (LATAM): Growth in LATAM is steady, driven primarily by the need to secure critical resources and address rising crime rates in major urban centers. The market typically favors durable, robust solutions like full-height turnstiles for external and industrial security applications, particularly in mining, oil and gas, and manufacturing sectors. Economic volatility often necessitates phased deployment strategies and a greater focus on return on investment and long-term maintenance costs.

- Middle East and Africa (MEA): This region exhibits high growth potential, particularly in the Gulf Cooperation Council (GCC) countries, fueled by ambitious infrastructure projects, tourism expansion (hotels, resorts), and securing critical national assets. High-end, often customized, entrance control systems are deployed in high-visibility locations like airports and government complexes. The African segment is developing, with rising demand focused on securing commercial properties and universities using cost-effective, durable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pedestrian Entrance Control Systems Market.- Boon Edam

- dormakaba

- Gunnebo

- Automatic Systems

- KABA Gallenschütz

- Magnetic Autocontrol

- Alvarado Manufacturing

- Turnstar Systems

- CENTURION

- Wisen

- Entra Linx

- Tiso

- Axess

- Rasilant Technologies

- PERCo

- Smarter Security

- JCM Global

- Cominfo

- IDL Access

- FlowTurnstile

Frequently Asked Questions

Analyze common user questions about the Pedestrian Entrance Control Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Pedestrian Entrance Control Systems market?

The primary factor driving market growth is the escalating need for robust physical security against unauthorized access and terrorism, coupled with the necessity for efficient pedestrian traffic management in rapidly urbanizing environments and major infrastructure projects globally. Technological integration of advanced biometrics and IoT further accelerates this demand.

How are speed gates different from traditional turnstiles, and which segment offers higher revenue growth?

Speed gates (optical turnstiles) are sensor-based, non-contact barriers designed for high throughput and aesthetics, offering rapid access using retracting or swinging glass barriers. Traditional turnstiles are mechanical or semi-automatic barriers. Speed gates offer significantly higher revenue growth due to their premium pricing, technology integration capabilities, and deployment in high-security corporate and commercial environments.

What is the significance of AI and Machine Learning in modern entrance control systems?

AI and Machine Learning are significant for enhancing security and operational efficiency. They are used for ultra-fast and accurate biometric verification (facial recognition), real-time tailgating detection with minimal false alarms, predictive maintenance scheduling based on usage data, and optimizing crowd flow management during peak hours.

Which region currently dominates the market, and which is projected to show the fastest CAGR?

North America and Europe currently dominate the market in terms of overall revenue share due to high security spending and early technology adoption. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to extensive governmental infrastructure development and smart city initiatives across its emerging economies.

What are the key challenges facing the adoption of advanced biometric entrance control systems?

The key challenges include the high initial capital expenditure required for installation and complex integration with existing legacy security systems. Furthermore, significant regulatory and public concerns regarding data privacy and the ethical storage of sensitive biometric data, particularly under regulations like GDPR, pose operational and compliance hurdles for global deployment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager