Pediatric Cranial Remolding Orthoses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431415 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Pediatric Cranial Remolding Orthoses Market Size

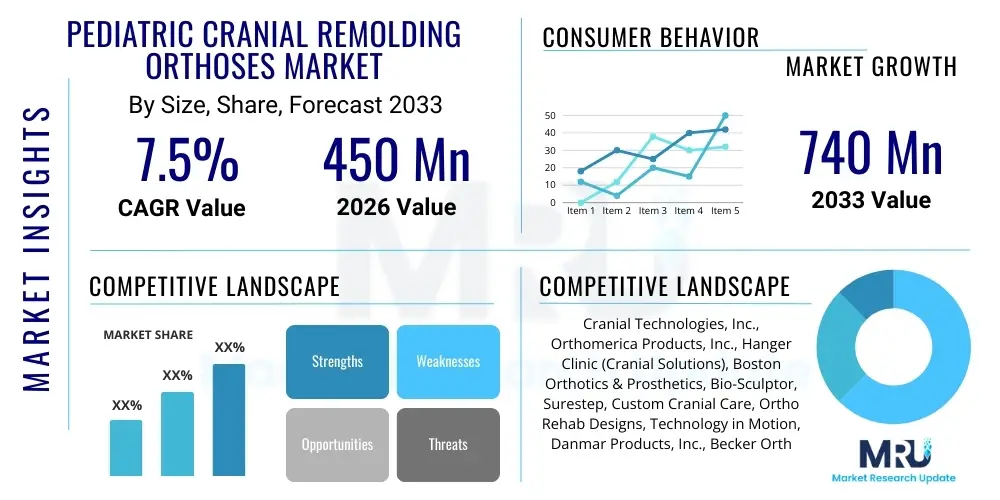

The Pediatric Cranial Remolding Orthoses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 740 Million by the end of the forecast period in 2033.

Pediatric Cranial Remolding Orthoses Market introduction

The Pediatric Cranial Remolding Orthoses (PCRO) market encompasses devices specifically designed for the non-invasive treatment of positional skull deformities in infants, primarily plagiocephaly (flattening on one side) and brachycephaly (symmetrical flattening across the back of the head). These orthoses, often referred to as cranial helmets or bands, work by applying gentle, constant pressure to the protruding areas of the infant's malleable skull while simultaneously allowing space for growth in the flattened regions. This carefully managed redirection of growth capitalizes on the rapid cranial development phase occurring in the first year of life, offering a highly effective, non-surgical intervention when initiated promptly, usually between four and eight months of age. The effectiveness of these products hinges on precise measurements, custom fabrication using advanced technologies, and dedicated clinical follow-up.

PCRO products are custom-molded to fit the infant's head shape perfectly, ensuring optimal therapeutic contact and minimizing discomfort. Major applications span various types of positional plagiocephaly and brachycephaly, particularly those cases classified as moderate to severe that do not adequately resolve through conservative measures like repositioning therapy. The core benefit of these specialized devices is the permanent correction or significant improvement of the cosmetic and structural asymmetry of the infant skull, mitigating potential long-term issues related to misalignment of facial features or jaw structure, although the primary driver remains cosmetic correction and parental concern. Increased awareness among pediatricians and parents regarding the prevalence of these conditions, often exacerbated by the back-to-sleep campaign, acts as a significant driving factor for market growth.

Driving factors propelling this market include the global rise in the diagnosis of positional plagiocephaly, improved diagnostic techniques such as 3D scanning which facilitate precise orthotic design, and growing insurance coverage in established healthcare economies. Furthermore, continuous product innovation, particularly in materials science and computer-aided design and manufacturing (CAD/CAM), is enhancing the comfort, efficacy, and turnaround time for these customized medical devices. The shift from traditional plaster casting to digital scanning has revolutionized the patient experience and clinical workflow, making cranial remolding therapy a more accessible and appealing option for treating these common infant conditions.

Pediatric Cranial Remolding Orthoses Market Executive Summary

The Pediatric Cranial Remolding Orthoses market is characterized by robust growth, driven primarily by favorable demographic trends, enhanced diagnostic capabilities, and significant advancements in medical technology, particularly 3D printing and digital imaging. Business trends highlight increasing consolidation among specialized orthotics providers, coupled with strategic partnerships between manufacturers and pediatric clinics to streamline the referral and fitting process. Customization remains the paramount trend, necessitating high investment in specialized clinical staff and advanced fabrication technologies to meet stringent quality and fit requirements. Providers are increasingly focusing on improving the patient and parental experience, recognizing that compliance is critical to therapeutic success, leading to development of lighter, more aesthetically pleasing orthoses and improved monitoring solutions.

Regionally, North America maintains the dominant market share due to high consumer awareness, favorable reimbursement policies for cranial orthoses, and a well-established infrastructure of dedicated pediatric specialists and orthotic labs. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by rising disposable incomes, improving healthcare accessibility, and increasing adoption of Western pediatric care standards, particularly in urban centers of China and India. European countries, constrained by varying national health service coverage policies, exhibit steady, mature growth, focusing primarily on evidence-based clinical efficacy studies to justify treatment protocols. The integration of telehealth for initial assessments and follow-up consultation is also gaining traction, particularly in geographically large or underserved areas.

Segmentation trends indicate that plagiocephaly remains the largest application segment, although brachycephaly treatment is also experiencing steady uptake. By end-user, specialty clinics and independent orthotic practitioners hold a significant share, given their expertise in precise fitting and adjustment, which is mandatory for effective treatment. Technology is leaning heavily toward sophisticated CAD/CAM systems, allowing for faster iterations and design modifications. The market is witnessing a competitive push towards proprietary scanning technologies that offer speed and accuracy, thereby differentiating leading manufacturers and service providers in a clinically sensitive environment where time is a critical factor in successful intervention.

AI Impact Analysis on Pediatric Cranial Remolding Orthoses Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Pediatric Cranial Remolding Orthoses (PCRO) market revolve around automating the diagnostic process, enhancing the precision of orthosis design, and predicting treatment outcomes. Users frequently inquire if AI can analyze 3D scans faster than clinicians, whether machine learning models can optimize the pressure application profile of a helmet based on the infant's specific cranial measurements, and if AI can improve parental compliance through predictive feedback loops. Furthermore, there is significant interest in how AI algorithms might standardize clinical assessment across different facilities, reducing variability inherent in manual measurement techniques. The core theme is the expectation that AI integration will lead to faster production cycles, reduced error rates, and more personalized, efficacious treatment plans, ultimately lowering the overall cost and duration of cranial remolding therapy for infants suffering from positional plagioformities.

- AI-driven automated analysis of 3D cranial scans to quantify deformity severity and identify critical growth areas.

- Machine learning algorithms optimizing orthosis design parameters, ensuring precise pressure gradients for directional growth.

- Predictive modeling of treatment duration and efficacy based on initial asymmetry data and infant growth trajectories.

- Integration of AI tools into clinical workflows for standardized diagnosis and prognosis across diverse patient populations.

- Enhanced quality control during the manufacturing phase, utilizing computer vision to verify fit accuracy before production finalization.

- Development of smart helmets embedded with sensors and AI capabilities for real-time monitoring of wear time and fit consistency.

DRO & Impact Forces Of Pediatric Cranial Remolding Orthoses Market

The Pediatric Cranial Remolding Orthoses market is primarily driven by heightened parental awareness concerning infant aesthetic health, supported by pervasive educational initiatives from pediatric societies and specialized clinics worldwide. This increased awareness translates into earlier consultations and greater willingness to invest in timely corrective treatments. Simultaneously, technological advancements, especially in high-resolution 3D scanning and additive manufacturing (3D printing), have dramatically improved the precision, comfort, and production speed of cranial orthoses, solidifying their position as the gold standard non-surgical intervention for positional plagiocephaly. However, market growth is constrained significantly by prevailing challenges related to reimbursement policies, which remain inconsistent across various regions and often categorize the treatment as cosmetic rather than medically necessary, creating financial hurdles for many families. Furthermore, the limited window for effective treatment—typically before 14 months of age—restricts the potential patient pool.

Opportunities for expansion are substantial, particularly through geographical penetration into emerging markets where pediatric healthcare infrastructure is rapidly developing, coupled with increased collaboration between orthotists and primary care pediatricians to standardize screening protocols. Development of more robust, compelling clinical evidence demonstrating the long-term functional benefits, beyond merely cosmetic correction, would greatly enhance the argument for broader insurance coverage and market acceptance. This requires large-scale, multi-center studies focusing on ocular, jaw, and neurodevelopmental outcomes linked to untreated severe deformities. The integration of advanced telemedicine platforms for initial consultation and follow-up represents another significant opportunity to improve access and reduce logistical burden for families living in rural or distant locations.

The market faces several critical impact forces, most notably the competitive threat from aggressive, conservative management education (repositioning therapy) promoted by some pediatricians who prefer avoiding orthotic intervention. Regulatory scrutiny, while necessary, can impact the speed of innovation, especially concerning new materials or advanced monitoring technologies incorporated into the orthoses. Furthermore, the specialized nature of fitting and adjusting these devices dictates that the market remains highly dependent on a limited number of trained, certified clinicians. Socio-cultural factors also play a role; in some regions, parental willingness to utilize a visible helmet therapy varies significantly, impacting adoption rates. Overall, while technological superiority is a major driver, the ultimate market trajectory is heavily influenced by healthcare financing structures and clinical consensus on treatment necessity and timing.

Segmentation Analysis

The Pediatric Cranial Remolding Orthoses market is fundamentally segmented based on factors critical to clinical practice and market accessibility, including the specific type of cranial deformity being treated, the technology utilized in manufacturing, the type of device design, and the end-user setting where the therapy is administered. The application segmentation, distinguishing between plagiocephaly and brachycephaly, is essential as the geometry and therapeutic strategy differ significantly for each condition, influencing both device design complexity and associated clinical charges. Furthermore, distinguishing the market by End-User allows for tailored marketing and distribution strategies, acknowledging the distinct procurement and utilization patterns of large hospital systems versus specialized, private orthotic practices. The increasing sophistication of the manufacturing process, particularly the reliance on high-precision 3D scanning technology versus older plaster cast methods, also serves as a crucial parameter for market analysis and technological forecasting.

In terms of product type, the market can be broadly classified into active and passive orthoses, though most contemporary, effective devices employ an active remolding strategy that applies corrective pressure. Segmentation based on technology, however, is becoming increasingly relevant, differentiating providers who utilize advanced digital workflows (3D scanning, CAD/CAM) from those relying on traditional analog processes. The technological segment is pivotal for market forecasting, as digital processes not only ensure a more comfortable and accurate fit but also significantly reduce the time taken from initial consultation to device delivery, a critical advantage given the narrow treatment window for infants. This efficiency gain translates directly into improved patient outcomes and higher client satisfaction, reinforcing the trend towards digital integration across the entire value chain of cranial remolding therapy.

Application analysis shows that positional plagiocephaly accounts for the larger market share due to its higher incidence rate, although severe brachycephaly cases often require longer and more intensive orthotic management, contributing significantly to revenue per case. The end-user segment analysis confirms that specialized pediatric orthotics clinics are the primary point of service delivery, owing to the requirement for highly skilled practitioners capable of precise fittings, adjustments, and ongoing monitoring. Hospitals often serve as referral centers but usually outsource the actual orthotic fabrication and management to dedicated external facilities. Therefore, strategies targeting specialized clinics and enhancing clinician training are paramount for penetrating key market segments successfully and maintaining a competitive edge based on clinical quality and expertise.

- By Application:

- Plagiocephaly (Oblique or Asymmetrical Flattening)

- Brachycephaly (Symmetrical Flattening)

- Craniosynostosis (Post-Surgical Correction)

- By Technology:

- 3D Scanning and CAD/CAM

- Traditional Plaster Casting and Molding

- By End-User:

- Specialty Pediatric Clinics

- Hospitals and Medical Centers

- Independent Orthotic Practices

Value Chain Analysis For Pediatric Cranial Remolding Orthoses Market

The value chain for the Pediatric Cranial Remolding Orthoses market is highly specialized and service-intensive, starting with the acquisition of high-grade materials, primarily medical-grade plastics (such as polyethylene or polypropylene) and cushioning foams, which must meet stringent biocompatibility and durability standards. Upstream analysis involves suppliers providing specialized raw materials and components for 3D scanning hardware and CAD/CAM software licenses. The manufacturing phase, which represents a high value-add activity, involves initial precise cranial measurement (now predominantly done via structured light or laser 3D scanning), followed by computer-aided design to create a custom digital mold, and subsequent fabrication using specialized thermoforming or 3D printing techniques. Quality control at this stage is crucial to ensure the resulting orthosis meets the precise therapeutic pressure requirements while maintaining patient comfort and safety.

Downstream analysis focuses heavily on the distribution and service delivery channels. Direct distribution is common, where large manufacturers or service franchises own the entire process from scanning to fitting. This integrated model ensures maximum control over quality and clinical protocols. Indirect distribution involves manufacturers supplying blank shells or semi-finished orthoses to independent orthotic practices or smaller hospital labs, which then handle the final customization, fitting, and follow-up care. The service component is perhaps the most critical element of the downstream segment; it requires highly trained certified orthotists to perform the initial fitting, educate parents on wear protocols, and conduct frequent adjustments (every 1-3 weeks) as the infant grows and the head shape changes. Failure in the service delivery component directly impacts treatment efficacy and parental satisfaction.

The primary distribution channel is highly centralized around specialized pediatric orthotic clinics, which serve as the hub for clinical assessment, scanning, fitting, and ongoing adjustment. Direct engagement between manufacturers and these clinics is crucial for success. Insurance providers and referral networks (pediatricians, neurosurgeons) act as major gatekeepers, influencing patient flow significantly. Direct channels are generally preferred due to the complex, customized nature of the product and the need for close clinical oversight, reducing potential communication errors that can occur in multi-layered indirect distribution models. Successful market participants often invest heavily in training their clinical partners to maintain standardized, high-quality service delivery across all geographical points, thus controlling the clinical reputation of the product.

Pediatric Cranial Remolding Orthoses Market Potential Customers

The primary potential customers and end-users of Pediatric Cranial Remolding Orthoses are parents or guardians of infants diagnosed with moderate to severe positional skull deformities, predominantly plagiocephaly or brachycephaly, typically within the critical age window of 4 to 12 months. These individuals are usually referred by their primary care pediatrician, physical therapist, or pediatric neurosurgeon, emphasizing that the buying decision is highly influenced by medical recommendation and clinical urgency. These customers prioritize efficacy, safety, comfort, and the clinical expertise of the treating orthotist. Their purchasing behavior is often dictated by insurance coverage and out-of-pocket costs, making affordability and comprehensive documentation for reimbursement critical factors for manufacturers to address.

Secondary potential customers include specialized healthcare facilities, such as pediatric hospitals and dedicated orthotics and prosthetics clinics (O&P clinics). These institutions are the direct buyers of the orthoses, equipment (3D scanners, CAD/CAM software), and clinical training services offered by manufacturers. For hospitals, the decision to partner with a cranial orthoses supplier is driven by factors such as product quality, ease of integration into existing clinical pathways, technological superiority, and the supplier's commitment to continuous clinical support and education. O&P clinics, often independent entities, focus on securing reliable supply chains for custom-fabricated devices and maintaining a strong reputation within the local pediatric referral network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 740 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cranial Technologies, Inc., Orthomerica Products, Inc., Hanger Clinic (Cranial Solutions), Boston Orthotics & Prosthetics, Bio-Sculptor, Surestep, Custom Cranial Care, Ortho Rehab Designs, Technology in Motion, Danmar Products, Inc., Becker Orthopedic, Nymed, Helmet Pros, Clarity Orthotics, P&O Care. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pediatric Cranial Remolding Orthoses Market Key Technology Landscape

The technology landscape for the Pediatric Cranial Remolding Orthoses market is rapidly transitioning from reliance on manual, plaster-based processes to highly sophisticated digital workflows, driven by the demand for increased accuracy, speed, and comfort. The foundational technology involves three main components: precise cranial measurement, advanced design software, and automated fabrication. Three-dimensional (3D) scanning technologies, including structured light scanning and laser scanning, have become the standard for capturing highly accurate, non-contact digital models of the infant's head shape. This instantaneous and safe measurement method is a significant improvement over the messy and time-consuming plaster casting, which often required sedation or significant patient compliance challenges. The resulting digital model forms the basis for the subsequent stages, ensuring geometric precision critical for therapeutic success.

Following the digital capture, Computer-Aided Design and Manufacturing (CAD/CAM) software plays a central role. Specialized software packages allow orthotists to virtually design the orthosis, simulating the corrective pressures and defining the growth areas based on established clinical algorithms and the individual infant's needs. This digital design phase enables quick iteration and verification before physical production, minimizing material waste and clinical risks associated with poor fit. The CAD model is then transferred to automated fabrication systems. While traditional thermoforming (heating and vacuum-forming plastic over a mold) is still utilized, there is an increasing adoption of Additive Manufacturing (3D Printing), particularly for creating the internal molds or even the final helmet shells. 3D printing allows for complex geometries, highly personalized ventilation systems, and significant weight reduction, enhancing comfort and wear time compliance.

Further technological integration includes the development of lightweight, hypoallergenic materials for the inner foam liners and external shells, focusing on breathability and durability. Some innovators are also exploring the use of integrated sensors within the orthoses to monitor parameters such as internal temperature, pressure distribution, and adherence/wear time. This data, often transmitted via Bluetooth to a clinician's application, allows for objective compliance tracking and data-driven adjustments, moving the field towards truly personalized, measurable therapeutic outcomes. These technological enhancements not only optimize the clinical process but also significantly reduce the required office visits, making the therapy more manageable for busy families and enhancing overall market acceptance.

Regional Highlights

- North America (Dominance and High Awareness): The North American market, led by the United States and Canada, holds the largest share in the global PCRO market. This dominance is attributable to high incidence rates of positional deformities, exceptional awareness among both clinicians and parents, favorable and relatively standardized private insurance reimbursement pathways for cranial orthoses, and the presence of major specialized service providers like Cranial Technologies and Hanger Clinic. High expenditure on specialized pediatric healthcare and proactive adoption of advanced technologies (3D scanning and CAD/CAM) further solidify this region's leadership.

- Europe (Mature Market with Varying Reimbursement): The European market is mature, characterized by steady demand across Western European nations, particularly Germany, the UK, and France. Growth is often constrained or dictated by varying national healthcare systems; while Germany and Switzerland often offer robust coverage, systems like the UK’s NHS have more stringent criteria or classify PCRO as primarily cosmetic, leading to regional disparities in adoption. The focus in Europe remains on clinical evidence and standardized clinical guidelines for intervention.

- Asia Pacific (Fastest Growth Potential): APAC is projected to be the fastest-growing region, driven by rapid improvements in healthcare infrastructure, urbanization, increasing parental willingness to seek specialized corrective procedures, and rising disposable incomes, particularly in urban areas of China, South Korea, and India. While awareness is lower than in the West, localized manufacturers are emerging, and international players are expanding their distribution networks, viewing the large birth cohort in the region as a substantial, untapped market opportunity.

- Latin America (Emerging Adoption): The market in Latin America is nascent but showing potential, primarily concentrated in economically stable countries like Brazil and Mexico. Market growth is hindered by limited reimbursement coverage and a less developed network of specialized orthotic clinics. However, increasing medical tourism and growing awareness among the affluent population segments are beginning to drive localized demand for high-quality cranial orthoses.

- Middle East and Africa (Niche Market Development): This region represents the smallest segment, characterized by highly localized demand, largely focused within major urban centers and private healthcare facilities in countries like the UAE and Saudi Arabia. Market progression is closely tied to private healthcare investment and the import of advanced medical devices and clinical expertise from Western markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pediatric Cranial Remolding Orthoses Market.- Cranial Technologies, Inc.

- Orthomerica Products, Inc.

- Hanger Clinic (Cranial Solutions)

- Boston Orthotics & Prosthetics

- Bio-Sculptor

- Surestep

- Custom Cranial Care

- Ortho Rehab Designs

- Technology in Motion

- Danmar Products, Inc.

- Becker Orthopedic

- Nymed

- Helmet Pros

- Clarity Orthotics

- P&O Care

- Orthotic & Prosthetic Center

- Starband (Orthomerica Subsidiary)

- Orthopedic Service Company (OSC)

- The Orthotic Group

- Children's Medical Center of Dallas Orthotics

Frequently Asked Questions

Analyze common user questions about the Pediatric Cranial Remolding Orthoses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Pediatric Cranial Remolding Orthoses market?

The Pediatric Cranial Remolding Orthoses market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2026 to 2033, driven by technology adoption and increased diagnosis rates.

What are the primary factors restraining the growth of the cranial orthoses market?

The primary restraints include the limited window for effective treatment (typically infants under 14 months), and inconsistent or challenging reimbursement policies across various global healthcare systems, often classifying the treatment as cosmetic.

How has 3D scanning technology impacted the fabrication of cranial remolding orthoses?

3D scanning technology has revolutionized fabrication by replacing traditional messy plaster casting with highly accurate, non-contact digital measurements. This improves precision, enhances infant comfort, reduces clinical time, and speeds up the overall manufacturing process via CAD/CAM integration.

Which application segment holds the largest share in the Pediatric Cranial Remolding Orthoses market?

The Plagiocephaly segment holds the largest market share. Positional plagiocephaly, characterized by asymmetrical head flattening, has a significantly higher incidence rate compared to brachycephaly, driving greater demand for corrective cranial remolding orthoses.

What role does Artificial Intelligence (AI) play in the future of cranial remolding therapy?

AI is anticipated to enhance PCRO therapy by automating 3D scan analysis for standardized diagnosis, optimizing orthosis design parameters to ensure ideal pressure distribution, and predicting individualized treatment outcomes, leading to faster and more efficient patient management.

Are cranial remolding orthoses covered by insurance, and does this vary regionally?

Insurance coverage for cranial orthoses varies significantly by region and specific insurance provider. In North America, coverage is common but often requires strong documentation proving medical necessity. In parts of Europe, coverage can be inconsistent, often requiring patients to fund treatment privately if it is deemed purely cosmetic.

What is the optimal age range for initiating cranial remolding orthosis treatment?

The optimal age range for initiating treatment is typically between 4 and 8 months of age. This period capitalizes on the infant’s rapid head growth, which is necessary for the orthosis to effectively redirect cranial development and achieve the best corrective results before skull growth slows significantly.

Which region is expected to demonstrate the fastest growth in the Pediatric Cranial Remolding Orthoses market?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth. This acceleration is due to improving healthcare infrastructure, rising awareness among affluent urban populations, and increasing adoption of specialized pediatric treatment standards imported from Western countries.

How do specialized clinics differ from hospitals as end-users in this market?

Specialized clinics (O&P clinics) are the primary point of service, focusing on the complex fitting, customization, and follow-up adjustments necessary for PCRO success. Hospitals usually serve as referral sources but often outsource the highly specialized fabrication and long-term management aspects to these dedicated external practices.

What are the key materials used in the manufacture of cranial remolding orthoses?

Key materials include medical-grade thermoplastic materials such as polyethylene or polypropylene for the rigid outer shell, and various hypoallergenic, cushioning foams for the internal lining, ensuring both durability and patient comfort during prolonged wear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager