Peelable Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432430 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Peelable Coating Market Size

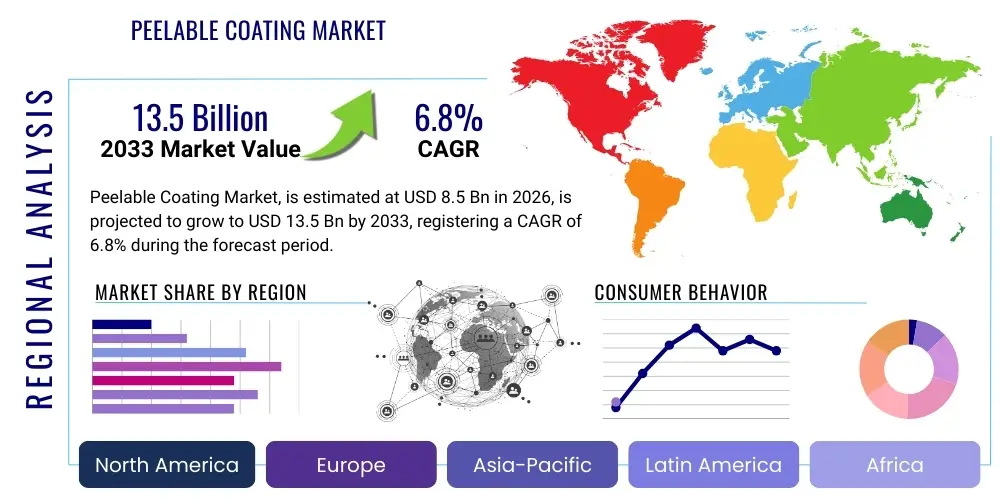

The Peelable Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Peelable Coating Market introduction

Peelable coatings are specialized polymeric formulations designed to provide temporary protection to sensitive surfaces during manufacturing, storage, transportation, or maintenance operations. These coatings, often applied as liquids, dry to form a protective film that can be easily removed or "peeled off" by hand without leaving behind sticky residues or damaging the underlying substrate. The primary product goal is surface integrity protection against scratches, abrasions, chemical spills, and dust, particularly critical in high-value industries like automotive, electronics, and precision manufacturing. The versatility of application methods, including spraying, dipping, or brushing, allows for broad industrial adoption.

Major applications of peelable coatings span temporary masking in painting operations, protecting consumer electronics screens during assembly, and safeguarding large architectural glass panels on construction sites. These coatings offer significant operational benefits, primarily residue-free removal, which minimizes post-application cleaning time and reduces labor costs associated with traditional protective films or tapes. Furthermore, modern peelable coatings are increasingly formulated to be environmentally compliant, utilizing water-based or low-Volatile Organic Compound (VOC) chemistries, aligning with stringent global environmental regulations, thereby enhancing their attractiveness across regulated markets.

The market is predominantly driven by the surging demand for temporary protective solutions in the automotive aftermarket and original equipment manufacturing (OEM) sectors, where maintaining the pristine condition of finished components is paramount. Increasing complexity in electronic device manufacturing, requiring precision masking during chemical etching or soldering processes, further propels adoption. The easy disposability and non-toxic nature of advanced peelable formulations are key factors influencing their preference over conventional protective materials, positioning peelable coatings as an indispensable tool for quality assurance and damage prevention across diverse industrial landscapes.

Peelable Coating Market Executive Summary

The Peelable Coating Market is characterized by robust growth, primarily fueled by rapid industrialization in Asia Pacific (APAC) and the escalating need for temporary surface protection in high-stakes manufacturing environments globally. Key business trends revolve around innovation in water-based and bio-based formulations, driven by global sustainability mandates and end-user demand for safer, less hazardous material alternatives. Manufacturers are focusing on developing specialized coatings that offer UV resistance and high-temperature tolerance, expanding the application scope into aerospace, marine, and advanced construction sectors, necessitating higher performance characteristics than standard protective films. Competitive strategy focuses on supply chain optimization and expanding regional manufacturing hubs to serve geographically diverse industrial clusters efficiently.

Regional trends indicate that APAC maintains market dominance, attributed to burgeoning automotive production in China and India, coupled with massive investments in infrastructure and electronics manufacturing across Southeast Asia. North America and Europe, while mature, exhibit strong growth driven by stringent quality control standards in aerospace and medical device manufacturing, alongside high demand for specialized maintenance coatings used for temporary corrosion or biological contamination prevention during plant shutdowns. The European Union’s REACH regulations are specifically steering regional innovation towards sustainable, low-VOC solutions, forcing market players to quickly adopt green chemistry principles to retain market share and ensure regulatory compliance.

Segment trends highlight the water-based segment as the fastest-growing formulation type, reflecting the industry-wide shift away from solvent-based systems. Acrylic-based polymers remain the material of choice due to their excellent adhesion, flexibility, and easy peelability. By end-user, the automotive segment dominates, utilizing peelable coatings for protecting components during transport and as temporary masking agents during painting. However, the electronics and healthcare sectors are emerging as high-growth areas, driven by miniaturization and the need for sterile, residue-free surface protection in cleanroom environments, demanding specialized, ultra-clean peelable coating solutions.

AI Impact Analysis on Peelable Coating Market

Common user questions regarding AI's impact on the Peelable Coating Market center on how artificial intelligence can optimize formulation development, improve application consistency, and predict the lifespan and peelability performance of coatings under various environmental conditions. Users are particularly interested in AI's role in synthesizing data from large batches of experimental formulations to accelerate the development of sustainable, high-performance water-based coatings, thereby reducing reliance on time-consuming trial-and-error processes. A significant concern revolves around integrating AI-driven sensor technologies into coating lines for real-time quality control—specifically, achieving uniform film thickness and curing consistency, which are critical for optimal protective function and subsequent residue-free peeling.

The analysis indicates that key themes include efficiency gains and predictive maintenance. AI is expected to revolutionize material science within this sector by utilizing machine learning algorithms to predict the interaction between polymer matrices, additives, and different substrate types, leading to highly customized, substrate-specific peelable coatings. This predictive modeling capability directly addresses user expectations for coatings that maintain protection integrity for extended durations but remain effortlessly peelable when required. Furthermore, AI-powered image recognition systems deployed on manufacturing lines will significantly enhance quality assurance by instantly detecting microscopic defects or inconsistencies in the applied film, ensuring zero-defect output before shipment.

In summary, user interest confirms that AI is not merely an optional tool but a transformative technology expected to drive formulation speed, quality assurance, and operational efficiency in the Peelable Coating Market. AI systems will process Big Data related to environmental conditions, curing profiles, and removal forces to provide actionable insights, enabling manufacturers to offer 'smart' coatings with predictable performance characteristics, thereby solving current pain points related to inconsistent peel strength and unpredictable residue formation.

- AI-driven Predictive Formulation: Accelerating the discovery of novel, high-performance, low-VOC peelable polymers.

- Real-time Quality Control (QC): Utilizing computer vision and machine learning for instantaneous detection of film thickness variations and surface defects during application.

- Optimization of Curing Processes: AI algorithms analyzing energy consumption and material characteristics to fine-tune UV or thermal curing cycles for enhanced durability and guaranteed peelability.

- Supply Chain Forecasting: Machine learning models predicting fluctuations in raw material costs (e.g., acrylic monomers) and optimizing inventory management.

- Smart Application Robotics: Integrating AI to control robotic sprayers, ensuring highly uniform application on complex geometries, minimizing waste, and maximizing transfer efficiency.

DRO & Impact Forces Of Peelable Coating Market

The Peelable Coating Market is strongly influenced by key drivers, primarily the burgeoning need for efficient and temporary surface protection across expanding industrial applications, particularly in Asia Pacific’s robust manufacturing sectors. Restraints include the relatively high cost associated with advanced, specialized formulations (especially UV-cured and bio-based systems) compared to conventional protective films, alongside challenges related to durability limitations in harsh, long-term outdoor environments. Opportunities abound in developing specialized functional coatings, such as anti-microbial peelable coatings for the healthcare industry and smart coatings that change color upon reaching the end of their protective life. These elements interact dynamically, shaping investment strategies and R&D focus within the global market.

Key drivers center around regulatory compliance and operational efficiency. The push towards eliminating residue-causing protective materials, coupled with increasing environmental mandates favoring low-VOC and water-based coatings, forces industries to adopt modern peelable systems. Furthermore, the automotive sector's stringent quality standards require zero-defect protection for painted surfaces and electronic components during long-distance transportation, making reliable, easy-to-remove coatings essential. The labor savings associated with quick removal is a substantial economic driver, offsetting the higher material cost of specialized coatings and thus creating a strong commercial justification for adoption.

Conversely, significant market restraints include performance trade-offs, particularly the balance between sufficient adhesion (to prevent premature peeling) and guaranteed residue-free removal. Developing a coating that maintains performance integrity against UV exposure and mechanical stress for prolonged periods remains a technical hurdle, limiting adoption in certain infrastructure and long-term storage applications. The market is also subject to fluctuations in the prices of petrochemical derivatives, which form the base for many polymeric formulations. However, these restraints catalyze innovation, pushing manufacturers towards sustainable and technologically robust solutions that overcome traditional limitations through advanced polymer chemistry and smart material design.

- Drivers (D):

- Increasing demand for temporary surface protection in electronics and automotive manufacturing.

- Stringent environmental regulations promoting the adoption of low-VOC, water-based, and biodegradable formulations.

- Operational cost savings realized through simplified, residue-free removal and reduced labor requirements.

- Expansion of aerospace and construction activities requiring sophisticated masking solutions.

- Restraints (R):

- Higher cost compared to conventional masking tapes and films, particularly for premium formulations.

- Technical challenges in maintaining adequate durability and peelability over extended exposure to extreme weather or chemical agents.

- Variability in peel strength performance across different substrate materials and surface preparations.

- Opportunities (O):

- Development of functional peelable coatings (e.g., anti-microbial, anti-corrosion, or conductive properties).

- Growth in the maintenance, repair, and overhaul (MRO) sector, utilizing coatings for temporary containment and decontamination.

- Focus on bio-based and sustainable raw materials to achieve full biodegradability and meet circular economy targets.

- Impact Forces:

- Bargaining power of buyers is high due to the availability of substitutes (films, tapes), pushing for cost-effective, high-performance solutions.

- Threat of substitution remains moderate, as alternative permanent protective coatings or traditional masking methods are still viable in less critical applications.

- Technological advancements (e.g., UV curing) raise the entry barrier for new competitors but offer significant competitive advantages to established players.

Segmentation Analysis

The Peelable Coating Market segmentation provides a granular view of consumer preferences, technological adoption rates, and targeted industry applications, essential for market forecasting and strategic planning. The market is primarily segmented based on material type, technology/formulation, substrate, and end-user industry. Material type segmentation reveals a clear preference for acrylic and polyurethanes due to their excellent film-forming properties and tunable peel strength, while new materials like specialty rubbers and hybrid polymers are gaining traction for niche, high-temperature applications. Understanding the growth dynamics across these segments is critical, as shifting regulatory landscapes globally heavily influence the adoption of specific coating technologies.

From a technological standpoint, the market is rapidly moving toward water-based and UV-cured systems. Water-based coatings dominate volume due to their environmental safety and ease of application, making them the default choice in general industrial and construction sectors. Conversely, UV-cured coatings, while requiring specialized equipment, command a premium due to their rapid processing time and superior durability, making them essential in high-speed manufacturing lines, particularly in electronics and automotive component production. The substrate segmentation highlights that metal and plastic protection remain the largest application bases, but significant growth is anticipated in glass and composite protection, driven by architectural design trends and lightweighting in transportation.

The End-User segmentation confirms the automotive sector as the backbone of the market, utilizing peelable coatings for factory-to-dealer transit protection and internal production masking. However, significant structural changes are emerging, with the electronics industry showing exponential demand for protective masking in complex semiconductor fabrication and assembly processes. Furthermore, the increasing complexity of machinery maintenance and facility shutdowns drives the demand from the industrial maintenance and MRO sector, where coatings are used for environmental isolation and temporary surface preparation against contaminants.

- By Material Type:

- Acrylic

- Polyurethane

- Rubber Latex

- Vinyl (PVC, PVB)

- Others (Hybrid Polymers, Bioplastics)

- By Technology/Formulation:

- Water-based

- Solvent-based

- UV-cured

- Hot Melt

- By Substrate:

- Metal

- Plastic

- Glass

- Wood & Concrete

- Composites

- By End-User Industry:

- Automotive & Transportation (OEM and Aftermarket)

- Electronics & Electrical Devices (Semiconductors, Display screens)

- Building & Construction (Architectural glass, fixtures)

- Industrial Maintenance & MRO

- Aerospace & Defense

- Healthcare & Pharmaceuticals

Value Chain Analysis For Peelable Coating Market

The value chain for the Peelable Coating Market begins with the upstream sourcing of specialized raw materials, primarily petrochemical derivatives such as acrylic monomers, polyurethane resins, and various solvents and additives (e.g., plasticizers, stabilizers, rheology modifiers). The profitability and stability of the downstream coating manufacturers are critically dependent on the volatility and supply certainty of these chemical feedstocks. Key upstream activities involve intensive R&D by specialty chemical suppliers to develop bio-based or recycled content monomers that meet the performance criteria of peelable films, ensuring compliance with future sustainability metrics.

The core manufacturing stage involves the formulation and compounding of the coating solutions, where technology differentiation occurs through proprietary polymer blends and process optimization (e.g., dispersion techniques for water-based systems, or optimizing UV sensitivity). Manufacturers invest heavily in application testing and quality assurance to guarantee the dual requirement of robust temporary protection and reliable, residue-free peeling. Downstream analysis focuses on the distribution channels, which are bifurcated between direct sales to large volume Original Equipment Manufacturers (OEMs)—such as major automotive plants—and indirect sales through specialized industrial distributors serving smaller MRO operations, construction sites, and the aftermarket sector.

Direct distribution is favored for customized, high-volume orders requiring technical support and specific application compatibility consultation, particularly in highly controlled environments like semiconductor fabrication. Conversely, indirect channels leverage distributor expertise in regional logistics and local market penetration, offering off-the-shelf products and application equipment. The efficiency of this downstream network, combined with the technical support provided, ultimately determines the end-user adoption rate and satisfaction, especially regarding the crucial parameters of film durability and peel consistency.

Peelable Coating Market Potential Customers

Potential customers for peelable coatings represent diverse industrial segments that share the common need for temporary, high-integrity surface protection against physical, chemical, or environmental damage. The automotive OEM sector forms the core customer base, utilizing vast quantities of these coatings to protect high-gloss paint finishes, interior components, and specialized sensors during assembly, transportation, and pre-delivery inspection. The increasing global vehicle production and the consumer demand for flawless vehicle finishes directly correlate with the volume requirements of this segment, making automotive manufacturers primary, large-scale buyers.

Another major customer group is the electronics manufacturing sector, which requires specialized, precision peelable coatings for masking sensitive areas during complex chemical etching, soldering, and plating processes involved in semiconductor, PCB, and display screen fabrication. These applications demand ultra-clean, low-extractable coatings that can withstand high temperatures or aggressive solvents without compromising the underlying electronic circuitry. The rapid pace of innovation and miniaturization in consumer electronics necessitates a steady supply of advanced, chemically resistant peelable masking agents, driving high-value demand.

Furthermore, the building and construction industry, encompassing architectural glass fabricators and general contractors, constitutes a growing customer segment. They rely on peelable coatings to protect glass windows, metal frames, and specialized architectural elements from mortar, paint splatter, and abrasion during construction activities. For these customers, the ease of application over large areas and guaranteed clean removal upon project completion are crucial purchasing criteria. The industrial maintenance and MRO segment also represents critical customers, utilizing specialized formulations for temporary corrosion protection during equipment shutdowns or for isolating surfaces during cleaning and decontamination procedures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avery Dennison, PPG Industries, AkzoNobel N.V., The Dow Chemical Company, BASF SE, Spraylat International Ltd., Chemence Ltd., RBL Products Inc., Protective Coatings, S&K Kaltwachs, Mitsubishi Chemical Corporation, Axalta Coating Systems, 3M Company, HMG Paints Ltd., Crystal Coatings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peelable Coating Market Key Technology Landscape

The technology landscape in the Peelable Coating Market is rapidly evolving, driven primarily by the need for faster processing times, enhanced environmental compliance, and superior performance characteristics, particularly concerning peel consistency and residue elimination. A key technological advancement involves the dominance of water-based polymer dispersions, replacing traditional solvent-based systems. These modern aqueous formulations utilize advanced surfactants and rheology modifiers to achieve excellent flow and leveling properties, crucial for forming a uniform, protective film. Continuous research focuses on increasing the solids content and film strength of these water-based coatings without compromising their non-toxic profile, allowing for wider adoption in indoor and controlled environments where solvent exposure is strictly regulated.

Another transformative technology is the proliferation of UV-cured peelable coatings, which offer instantaneous drying upon exposure to ultraviolet light. This technology is highly valued in automated, high-throughput manufacturing settings, such as electronics assembly and automotive trim production, where curing speed is a bottleneck. UV-cured systems provide superior hardness, chemical resistance, and precise thickness control compared to air-dried or thermally cured alternatives. Innovation within this segment includes the development of cationic and free-radical photoinitiators tailored for optimized curing profiles on heat-sensitive substrates, ensuring minimal energy consumption and maintaining material integrity.

Furthermore, smart coating technology is emerging, though still nascent, where specialty additives allow the peelable film to signal its degradation or readiness for removal. This includes photochromic or thermochromic additives that change color based on UV exposure or temperature, indicating the coating's functional lifespan. Advanced polymer science is also focused on developing biodegradable and compostable peelable coatings using bio-derived feedstocks (e.g., starches, cellulose derivatives). While these bio-based coatings currently face performance limitations regarding durability compared to petroleum-based acrylics, they represent the future direction for meeting ambitious global circular economy targets and appealing to environmentally conscious end-users, requiring significant material science breakthroughs.

Regional Highlights

The global Peelable Coating Market exhibits distinct regional performance patterns, with Asia Pacific (APAC) serving as the undisputed engine of growth, followed by established, yet highly innovative, markets in North America and Europe. The regional dynamics are shaped by varying regulatory frameworks, industrial concentration, and the rate of adoption of advanced manufacturing technologies, influencing the type and volume of coatings consumed.

Asia Pacific is projected to command the largest market share and the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This dominance is intrinsically linked to the immense scale of manufacturing activities, particularly in China, South Korea, Japan, and India. The region is home to massive automotive production bases, rapidly expanding consumer electronics assembly hubs, and aggressive infrastructure development, all of which rely heavily on temporary surface protection. Governmental support for local manufacturing and less stringent historical environmental regulations (though rapidly changing) have historically favored high-volume production of diverse coating types, although the recent shift towards green chemistry is accelerating the adoption of water-based systems across major industrial centers like China's Yangtze River Delta.

North America and Europe represent mature markets characterized by high per-unit value consumption, driven by demanding aerospace, medical device, and high-precision machinery sectors. These regions impose highly strict environmental standards (such as REACH in Europe and various state-level VOC limits in North America), necessitating a strong focus on premium, non-hazardous, and high-performance UV-cured and water-based formulations. The emphasis here is less on volume and more on specialized applications, such as temporary protective masking for composite materials in aircraft manufacturing or sterile surface covers in cleanroom environments, driving innovation in advanced polymer chemistry and residue-free removal guarantees.

Latin America and the Middle East & Africa (MEA) are emerging regions experiencing moderate to high growth, primarily influenced by foreign direct investment in automotive assembly plants (e.g., Mexico, Brazil) and large-scale infrastructure and oil and gas projects (e.g., Saudi Arabia, UAE). In MEA, peelable coatings are critical for protecting expensive equipment and architectural materials from harsh desert climates, requiring formulations with exceptional UV stability and thermal resistance. While these regions have a smaller market share currently, they offer significant untapped potential as industrial diversification and sophisticated manufacturing capabilities continue to expand, increasing the demand for reliable surface protection solutions.

- Asia Pacific (APAC): Market leader due to high concentration of automotive and electronics manufacturing; high CAGR expected, particularly in China and India, driven by mass production and infrastructure growth.

- North America: Strong market for high-performance, specialized coatings in aerospace, defense, and high-tech electronics; focus on low-VOC, compliance-driven innovation and premium products.

- Europe: Growth influenced by strict regulatory adherence (REACH); high adoption of water-based and bio-based formulations; strong demand from automotive, construction, and high-value machinery protection (Germany, UK).

- Latin America: Moderate growth driven by regional automotive assembly and expanding industrial maintenance sectors (Brazil, Mexico).

- Middle East & Africa (MEA): Emerging market primarily linked to major construction projects and oil & gas infrastructure maintenance, requiring durable, heat-resistant protective coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peelable Coating Market.- PPG Industries

- AkzoNobel N.V.

- BASF SE

- The Dow Chemical Company

- Avery Dennison Corporation

- 3M Company

- Chemence Ltd.

- RBL Products Inc.

- Spraylat International Ltd.

- Mitsubishi Chemical Corporation

- Axalta Coating Systems

- HMG Paints Ltd.

- DuPont de Nemours, Inc.

- S&K Kaltwachs GmbH

- Wacker Chemie AG

- Henkel AG & Co. KGaA

- Tikkurila Oyj (now part of PPG)

- ITW Performance Polymers

- Huntsman Corporation

- Crystal Coatings

Frequently Asked Questions

Analyze common user questions about the Peelable Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of UV-cured peelable coatings over traditional solvent-based formulations?

The primary advantage of UV-cured peelable coatings is their instantaneous, energy-efficient curing process, which significantly reduces manufacturing cycle times and eliminates the release of hazardous Volatile Organic Compounds (VOCs). This rapid curing provides superior hardness and chemical resistance almost immediately after application, ensuring high throughput and robust protection, particularly critical in high-speed electronics and automotive production lines.

How do environmental regulations, such as REACH, impact the development of new peelable coatings?

Environmental regulations significantly restrict the use of high-VOC solvents and certain hazardous additives, forcing manufacturers to prioritize research and development into sustainable alternatives. This regulatory pressure accelerates the commercialization of water-based, low-VOC, and bio-based polymeric systems, driving innovation towards formulations that offer performance parity with conventional coatings while ensuring full compliance and reduced environmental footprint.

Which end-user industry accounts for the largest demand in the Peelable Coating Market and why?

The Automotive and Transportation industry accounts for the largest demand. Peelable coatings are essential for protecting critical surfaces—such as painted body panels, chrome trim, and interior components—from scratches, chemical damage, and abrasion during complex assembly processes, component storage, and long-distance shipping from the factory to the dealership, guaranteeing showroom quality upon delivery.

What factors determine the peel strength of a temporary protective coating?

Peel strength is determined by three main factors: the formulation's polymer chemistry (controlling cohesion and adhesion properties), the surface energy of the specific substrate material (e.g., metal versus plastic), and the film thickness and curing profile (how the coating binds and cross-links). Manufacturers must carefully balance these factors to ensure the coating adheres sufficiently for protection but removes cleanly without excessive force or tearing.

What role does the Asia Pacific region play in the overall market growth forecast?

The Asia Pacific region is the key growth engine, projected to exhibit the highest CAGR due to massive expansion in manufacturing industries, particularly automotive, electronics, and construction. Favorable governmental policies supporting industrialization, combined with vast production capacities in countries like China and India, underpin the strong demand for peelable coatings as essential quality assurance tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager