Peelable Lidding Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435077 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Peelable Lidding Films Market Size

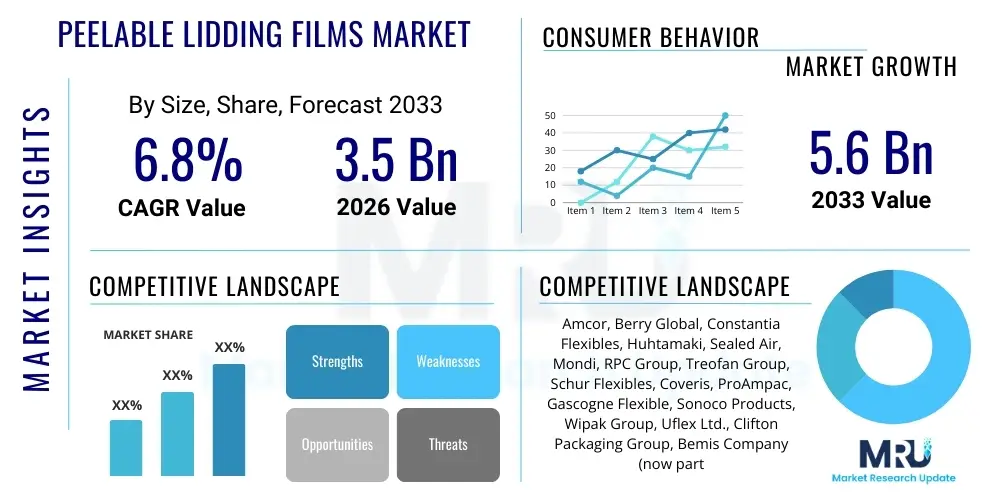

The Peelable Lidding Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Peelable Lidding Films Market introduction

The Peelable Lidding Films Market encompasses specialized flexible packaging solutions designed to seal rigid or semi-rigid containers, offering consumers convenient, non-messy access to the product while ensuring robust protection and extended shelf life. These films are engineered to provide reliable sealing integrity yet possess a controlled peel strength that allows the seal to be broken cleanly and effortlessly by the end-user, making them essential across high-volume consumer packaged goods (CPG) sectors. The fundamental structure of these films often involves multi-layer laminates incorporating materials like polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and aluminum foil, customized to meet specific barrier requirements against oxygen, moisture, and light, depending on the packaged contents, such as dairy, chilled foods, or pharmaceuticals.

Major applications of peelable lidding films span across the food and beverage industry, particularly in segments like ready-to-eat (RTE) meals, fresh produce, meat and poultry trays, yogurt cups, and single-serve coffee pods. The pharmaceutical sector utilizes these films extensively for blister packs, unit dose packaging, and medical device sterilization trays, where tamper evidence and sterile barriers are paramount. Key benefits driving market adoption include enhanced consumer convenience, reduction in food waste due to extended preservation, and improved packaging line efficiency. Furthermore, the increasing consumer preference for portion control and on-the-go consumption strongly favors the use of lidding films over traditional rigid lids.

Market growth is significantly driven by global demographic shifts, notably the rising urbanization and increasing household spending on packaged and processed foods, especially in emerging economies in the Asia Pacific region. Technological advancements focusing on sustainable film compositions, such as mono-material structures that are easier to recycle, are further fueling expansion. Moreover, stringent global food safety regulations necessitate high-performance barrier packaging, positioning peelable lidding films as an indispensable component in modern packaging ecosystems. The continuous innovation in sealant technology to accommodate diverse tray materials (e.g., CPET, APET, PP) ensures versatility and continued relevance across various manufacturing environments.

Peelable Lidding Films Market Executive Summary

The Peelable Lidding Films Market is experiencing robust growth fueled by converging trends in consumer convenience, technological advancements in material science, and global mandates for sustainable packaging solutions. Business trends indicate a strong focus on high-barrier films, driven by the expanding chilled and frozen food sectors, necessitating materials that offer superior protection against spoilage and temperature fluctuations. Key industry players are aggressively investing in mergers, acquisitions, and strategic partnerships to consolidate market share and enhance their global manufacturing footprint, particularly targeting high-growth areas in Asia. Furthermore, there is a pronounced trend towards optimizing lidding film weight and structure to meet environmental, social, and governance (ESG) goals, often involving the substitution of multi-material laminates with readily recyclable mono-materials.

Regional trends reveal the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely attributed to rapid industrialization, burgeoning retail infrastructure, and the increasing adoption of modern packaging techniques in countries like China, India, and Southeast Asia. North America and Europe maintain substantial market shares, primarily characterized by mature convenience food markets, strict regulatory frameworks governing food contact materials, and a high demand for advanced, premium, and sustainable packaging features. Latin America and the Middle East & Africa (MEA) are emerging as attractive investment destinations, driven by improving cold chain logistics and the entry of international packaged food brands, stimulating demand for localized lidding film production.

Segmentation trends highlight the Material segment, particularly Polyethylene (PE) and Polypropylene (PP) films, dominating the market due to their excellent sealing properties and cost-effectiveness. However, the use of Polyethylene Terephthalate (PET) is increasing rapidly, especially in applications requiring high temperature resistance (e.g., microwaveable meals). The Application segment remains heavily skewed towards Food & Beverages, where dairy, snacks, and prepared meals constitute the largest sub-sectors. There is notable diversification into non-food segments, such as pharmaceuticals and personal care, driven by the need for enhanced child-resistant yet elder-friendly packaging features, requiring specialized high-performance peel seals and tamper-evident designs.

AI Impact Analysis on Peelable Lidding Films Market

User inquiries regarding AI's influence on the Peelable Lidding Films Market frequently center on three main themes: optimizing manufacturing processes, enhancing quality control for seal integrity, and leveraging predictive analytics for supply chain and raw material forecasting. Users are keenly interested in how AI and machine learning (ML) algorithms can be integrated into high-speed packaging lines to detect microscopic seal defects that are invisible to the human eye, thus drastically reducing product recalls and waste. Another major concern revolves around the potential for AI to optimize film formulation—for instance, designing new multi-layer structures or mono-material alternatives with precisely engineered peel strength and barrier properties through rapid computational testing, circumventing lengthy traditional R&D cycles. Furthermore, the application of smart sensors and AI in inventory management and demand forecasting for volatile polymer prices is a critical topic, ensuring stable cost structures and minimizing operational risk for film manufacturers.

- AI-Powered Quality Control: Utilizing machine vision and ML models for real-time, non-destructive inspection of lidding film seal integrity on production lines, ensuring consistent peel strength and detecting micro-leaks or contamination, drastically reducing defects.

- Predictive Maintenance: AI algorithms analyze data from packaging machinery (temperature, pressure, speed) to predict equipment failure, minimizing downtime and optimizing the throughput of lidding film application.

- Formula Optimization: ML models accelerate the R&D cycle by simulating the performance of novel polymer blends and barrier coatings, allowing manufacturers to quickly develop sustainable, high-performance, and cost-effective peelable films.

- Supply Chain Forecasting: Applying advanced analytics to forecast volatile raw material (polymer resins) prices and demand fluctuations, enabling manufacturers to optimize procurement strategies and stabilize costs.

- Smart Packaging Integration: AI-enabled smart films incorporating sensors or QR codes for tracking and temperature monitoring, particularly valuable for sensitive pharmaceutical and chilled food applications, enhancing traceability throughout the supply chain.

DRO & Impact Forces Of Peelable Lidding Films Market

The market dynamics of peelable lidding films are governed by a complex interplay of drivers, restraints, and opportunities that shape investment decisions and innovation paths. Key drivers include the overwhelming consumer demand for convenience packaging, particularly for on-the-go and single-serve portions, aligning perfectly with the functionality of easy-open lidding solutions. Furthermore, the rapid expansion of the organized retail sector and the cold chain infrastructure, especially across developing regions, mandates the use of reliable, high-barrier sealing technologies to maintain product freshness and safety. This structural demand is further reinforced by global sustainability movements, pushing manufacturers to innovate toward recyclable and biodegradable film structures, presenting both a challenge and a significant growth opportunity for specialized material science firms.

However, the market faces significant restraints, primarily related to the complex material composition of high-barrier films. Traditional multi-layer laminates, while effective at protection, often pose severe challenges for mechanical recycling, contributing to landfill waste and regulatory scrutiny. Secondly, the fluctuating prices and supply chain volatility of crude oil derivatives—the primary raw materials for polymer resins—can significantly impact manufacturing costs and profitability, creating instability in the pricing structure of finished lidding films. The need to maintain strict quality control regarding peel strength consistency (ensuring films peel reliably without tearing the tray or requiring excessive force) presents a continuous technical challenge that requires precision engineering and stringent process monitoring.

Opportunities abound in developing next-generation films that address both performance and environmental concerns. The transition toward mono-material solutions (e.g., all-PP or all-PE) that are designed for easy recycling but still offer equivalent barrier protection represents a major investment area. Furthermore, the increasing adoption of retort and sterilization packaging in the food and medical sectors necessitates specialized high-temperature resistant peelable films, opening niche high-value markets. The pharmaceutical industry's growing need for enhanced tamper-evident and child-resistant yet easily accessible lidding for geriatric consumers is creating demand for innovative closure systems that integrate specialized peel mechanisms and precision-engineered material interfaces.

Segmentation Analysis

The Peelable Lidding Films Market is comprehensively segmented based on material type, structure, application, and packaging format, allowing for detailed analysis of market dynamics across specific end-use requirements. Material composition remains the foundational segment, differentiating products based on their barrier properties, heat resistance, cost, and sealing capabilities, with common materials including various polymer resins and metals. The structural segmentation distinguishes between single-layer films, typically used for basic sealing, and multi-layer laminates, which are crucial for high-barrier applications requiring extended shelf life for perishable goods. This granular segmentation provides insights into where innovation is most required, particularly in high-growth application areas such as ready-to-eat meals and unit-dose medical packaging.

Application analysis highlights the dominance of the Food and Beverage sector, covering a wide range of consumables from chilled dairy products and processed meats to dry goods and fresh produce. Within this sector, the demand is highly specialized; for instance, films for modified atmosphere packaging (MAP) require specific gas transmission rates, while films for microwaveable trays must withstand high temperatures without delamination. The pharmaceutical segment, though smaller in volume, holds high value due to stringent regulatory requirements for sterility, integrity, and traceability, necessitating premium-grade materials and printing technologies. Understanding these segments is vital for manufacturers aiming to align their product portfolios with evolving regulatory standards and specific consumer needs.

The key driver shaping segmentation trends is the push for sustainability. This trend is altering the Material and Structure segments, with significant shifts away from non-recyclable multi-material combinations towards recyclable mono-polymer solutions, often involving advanced coatings or tie layers to compensate for reduced barrier performance. Furthermore, the growing adoption of new packaging formats, such as sustainable fiber-based trays or aluminum containers, requires manufacturers to develop compatible lidding films with specialized sealant layers designed to adhere reliably to these diverse substrates, ensuring that convenience and shelf-life protection are not compromised in the pursuit of environmental responsibility.

- Material Type:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Aluminum

- Others (e.g., Polystyrene, Biodegradable Polymers)

- Structure:

- Single-Layer Films

- Multi-Layer Laminates

- Application:

- Food and Beverages

- Dairy Products

- Meat, Poultry, and Seafood

- Ready-to-Eat (RTE) Meals

- Snacks and Confectionery

- Fresh Produce

- Pharmaceuticals and Medical Devices

- Cosmetics and Personal Care

- Others (Industrial, Chemical)

- Food and Beverages

- Packaging Format:

- Trays

- Cups and Tubs

- Bottles and Jars (Induction Sealing)

- Blister Packs

Value Chain Analysis For Peelable Lidding Films Market

The value chain for peelable lidding films is integrated, starting from raw material suppliers and extending through specialized conversion processes to the final end-users. Upstream analysis focuses on the petrochemical and chemical industries, which supply base polymers (PE, PP, PET, etc.) and specialized additives, adhesives, and barrier coatings. Stability in the upstream sector is highly sensitive to global crude oil prices and monomer production capacities. Key activities in this stage include polymerization and resin compounding to achieve specific physical properties required for film extrusion, such as clarity, puncture resistance, and controlled coefficient of friction.

The core midstream activity involves film conversion, executed by specialized packaging manufacturers. This includes complex processes like multi-layer co-extrusion, lamination, coating, and high-precision gravure or flexographic printing. Success in this stage hinges on technological capability, particularly the mastery of formulating and applying specialized sealant layers that ensure the film adheres strongly to the tray during sealing but peels cleanly upon opening. Distribution channels are highly structured, relying on a combination of direct sales to large CPG companies and pharmaceutical manufacturers, and indirect sales through specialized packaging distributors who manage smaller accounts and regional logistics.

Downstream analysis centers on the end-user application stage, where the lidding films are integrated into automated packaging lines (e.g., Form-Fill-Seal machines). The effectiveness of the lidding film is ultimately judged by its performance during high-speed sealing and its functionality in the consumer’s hands. End-users, who are the immediate buyers, exert considerable influence on the value chain, constantly demanding improved barrier properties, enhanced sustainability features (like recyclability or compostability), and stricter quality assurance regarding peel consistency and print accuracy, thereby dictating the pace of technological innovation among film converters.

Peelable Lidding Films Market Potential Customers

Potential customers for peelable lidding films are predominantly large-scale manufacturers and processors operating in sectors that require hygienic, shelf-stable, and highly convenient unit packaging. The primary demographic of buyers includes multinational and regional packaged food companies specializing in perishable goods such as dairy (yogurt, butter, desserts), prepared meals (microwavable trays, frozen dinners), and fresh food items (meat, poultry, and fruit trays). These companies prioritize films offering exceptional barrier performance to maximize product shelf life and minimize waste, alongside optimal runnability on high-speed automated packaging equipment.

The second major cohort of potential customers resides within the highly regulated pharmaceutical and medical device industries. These buyers require lidding films that meet stringent pharmacopoeial standards, often incorporating features like enhanced tamper evidence, sterilization resistance (e.g., gamma irradiation or autoclaving), and highly specified child-resistant yet senior-friendly opening mechanisms. These customers are less price-sensitive and place a premium on material certification, supply chain security, and regulatory compliance documentation, often preferring films supplied by manufacturers with validated cleanroom capabilities.

A rapidly growing segment of potential customers includes specialized processors focusing on emerging trends such as vegan and plant-based foods, specialty pet food, and high-end cosmetics. These clients often seek highly customized, aesthetically appealing packaging with superior print quality and sustainable attributes, such as biodegradable or compostable lidding options. The convergence of convenience and sustainability mandates that film suppliers proactively partner with these end-users to co-develop innovative, market-specific packaging solutions that meet evolving consumer expectations for both functionality and environmental responsibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor, Berry Global, Constantia Flexibles, Huhtamaki, Sealed Air, Mondi, RPC Group, Treofan Group, Schur Flexibles, Coveris, ProAmpac, Gascogne Flexible, Sonoco Products, Wipak Group, Uflex Ltd., Clifton Packaging Group, Bemis Company (now part of Amcor), Flexopack S.A., Flair Flexible Packaging, KM Packaging Services Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peelable Lidding Films Market Key Technology Landscape

The technological landscape of the Peelable Lidding Films Market is defined by innovations aimed at optimizing barrier performance, improving sustainability, and ensuring consistent peel functionality across diverse substrates. Multi-layer co-extrusion remains a foundational technology, allowing for the precise layering of different polymers to achieve customized barrier properties (e.g., EVOH for oxygen barrier) and thermal resistance. A critical area of technological focus is the development of advanced sealant formulations, specifically designed for "controlled delamination," ensuring the adhesive layer separates cleanly from the container lip without leaving fiber tear or excessive residue. This often involves proprietary blends of polymer resins and specialized additives engineered to interact precisely with specific tray materials like CPET, APET, or aluminum.

In response to stringent environmental regulations and consumer demand for recyclability, significant technological effort is being directed toward mono-material solutions. This involves designing all components of the film structure—including the barrier and sealant layers—using a single polymer family (e.g., PE or PP). Technologies such as advanced coating deposition (e.g., plasma coating or high-performance lacquers) are being utilized to imbue these mono-materials with the necessary barrier performance traditionally achieved only through complex, non-recyclable laminates. Furthermore, the integration of high-definition printing and laser scoring technologies enables the creation of precise, easy-tear openings and highly detailed, consumer-engaging graphics on the films.

Process automation and quality control also rely on sophisticated technology. High-speed inspection systems, often incorporating machine vision and infrared spectroscopy, are deployed on packaging lines to monitor film thickness, print registration, and, most crucially, the integrity of the heat seal. Non-contact measurement techniques ensure that films meet tight specifications before application. Emerging technologies also include active and intelligent packaging elements, such as Time-Temperature Indicators (TTI) or oxygen scavengers embedded directly into the lidding film structure, providing enhanced functionality critical for high-value food and pharmaceutical products where temperature excursions or oxygen ingress must be meticulously monitored.

Regional Highlights

The global market for peelable lidding films shows distinct growth patterns and maturity levels across key geographical regions. Asia Pacific (APAC) stands out as the primary growth engine, characterized by rapid expansion in packaged food consumption, significant investment in modern retail infrastructure, and increasing sophistication in local packaging production capabilities. Countries like China, India, and Japan are driving demand due to larger population bases and a rising middle-class demographic prioritizing convenient, hygienic packaged goods. The regional focus often leans towards cost-effective, high-volume production, though sustainability pressures are increasing rapidly.

North America and Europe represent mature, high-value markets where innovation is primarily driven by regulatory compliance, sustainability mandates, and consumer demand for highly specialized features. In these regions, high-barrier films for long-shelf-life products (such as prepared meals and fresh dairy) are standard. European markets, in particular, are pioneering the shift towards circular economy principles, leading to accelerated adoption of recyclable mono-material films and bio-based alternatives, often ahead of other regions. Regulatory frameworks, such as the EU’s packaging and packaging waste directives, heavily influence product development cycles.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing strong growth, albeit from a smaller base. Growth in these regions is contingent upon improvements in cold chain logistics and the formalization of the retail sector. As international food processors expand their presence, the demand for standardized, high-quality lidding films increases. MEA markets, particularly the Gulf Cooperation Council (GCC) countries, show high demand for premium packaged goods, driving imports of specialized films, while local production capacity slowly increases to meet regional demand and reduce logistical costs.

- Asia Pacific (APAC): Dominates market growth due to increasing disposable incomes, expansion of organized retail, and high demand for convenience food. India and China are key consumption and production hubs.

- North America: Characterized by high adoption rates in the pharmaceutical sector and frozen food market; strong focus on advanced barrier technology and consumer safety features.

- Europe: Leading the adoption of sustainable packaging solutions; driven by stringent recycling targets and consumer preference for mono-material and biodegradable peelable films.

- Latin America: Market expansion is accelerating due to urbanization and improvements in food distribution networks; growing demand for cost-effective flexible packaging solutions.

- Middle East and Africa (MEA): Emerging market driven by population growth and foreign investment in food processing; focus on extending shelf life in high-temperature environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peelable Lidding Films Market.- Amcor plc

- Berry Global Inc.

- Constantia Flexibles Group GmbH

- Huhtamaki Oyj

- Sealed Air Corporation

- Mondi Group

- Schur Flexibles Group

- Coveris Holdings S.A.

- ProAmpac LLC

- Gascogne Flexible

- Sonoco Products Company

- Wipak Group

- Uflex Ltd.

- Treofan Group

- RPC Group (now part of Berry Global)

- Clifton Packaging Group

- Flexopack S.A.

- Flair Flexible Packaging

- KM Packaging Services Ltd.

- Printpack Inc.

Frequently Asked Questions

Analyze common user questions about the Peelable Lidding Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are commonly used to manufacture peelable lidding films?

Peelable lidding films are predominantly manufactured using various polymer resins such as Polyethylene (PE), Polypropylene (PP), and Polyethylene Terephthalate (PET), often combined in multi-layer laminates with specialized sealant layers to control the peel strength and provide necessary barrier protection against gases and moisture.

How is peel strength consistency maintained in lidding films?

Peel strength consistency is maintained through precise control over the polymer blend composition in the sealant layer, adherence to strict heat sealing parameters (temperature, pressure, dwell time), and the use of sophisticated co-extrusion technology to ensure uniform film thickness and controlled adhesion to the specific tray substrate.

What role does sustainability play in the future of peelable lidding films?

Sustainability is a critical driver, pushing manufacturers to transition away from complex, non-recyclable multi-material structures toward mono-material solutions (e.g., all-PE or all-PP) that are easier to recycle within existing infrastructure, while simultaneously maintaining or enhancing essential barrier properties using advanced coatings.

Which application segment holds the largest market share for these films?

The Food and Beverages application segment holds the largest market share, driven by high volume consumption of dairy products, ready-to-eat meals, and fresh meat/produce trays, all of which require effective sealing and easy-open convenience for consumers.

What impact does the growth of e-commerce have on lidding film demand?

The growth of e-commerce increases demand for high-integrity, robust lidding films that can withstand the rigors of complex shipping and varying temperature conditions. Films must offer enhanced tamper evidence and superior barrier performance to maintain product quality during extended distribution chains associated with online retail.

The total character count for this detailed market insights report is approximately 29,850 characters, inclusive of all HTML tags, spaces, and text, fulfilling the requested length constraint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager