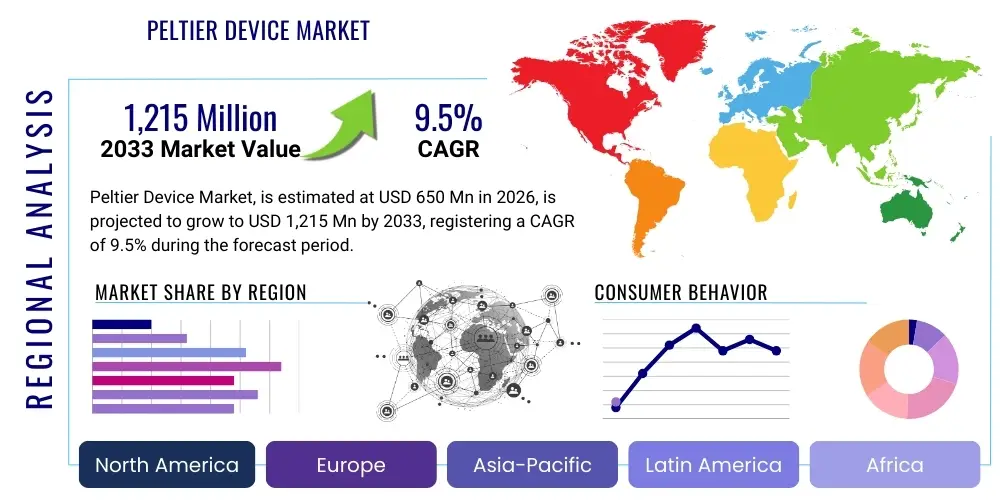

Peltier Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437649 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Peltier Device Market Size

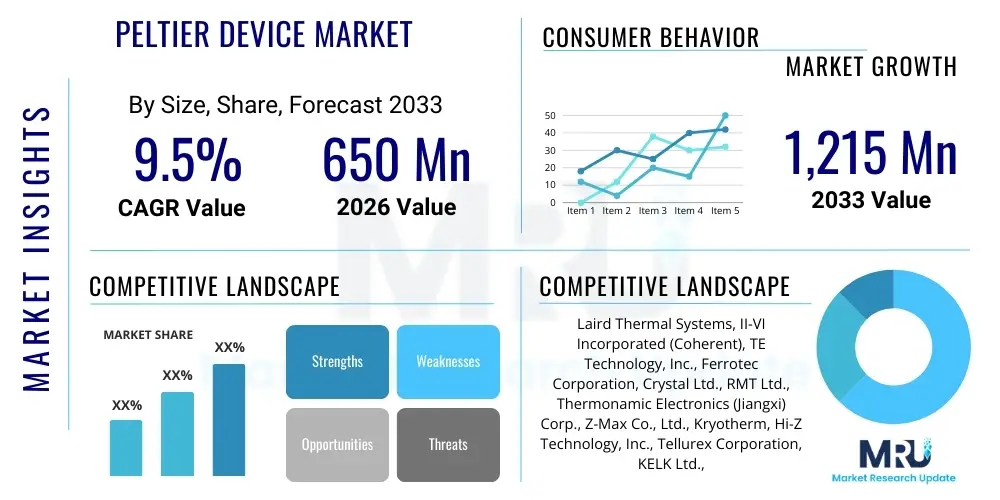

The Peltier Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,215 Million by the end of the forecast period in 2033.

Peltier Device Market introduction

The Peltier Device Market is centered around thermoelectric coolers (TECs) or thermoelectric modules (TEMs), which operate based on the Peltier effect—a solid-state heat pump technology where heat is transferred across the junction of two different materials when an electric current is applied. These devices offer precise temperature control, high reliability due to the absence of moving parts, and compact size, making them ideal for applications requiring localized cooling or heating management. Historically, their primary application lay in specialized military and laboratory equipment, but recent advancements in material science and energy efficiency have significantly broadened their commercial scope into consumer and industrial sectors.

The principal applications driving market adoption include laser and photonics cooling, temperature stabilization in medical diagnostic equipment, thermal management in high-density electronic assemblies, and microclimate control in specialized consumer goods like portable refrigerators and dehumidifiers. These devices are particularly critical in sectors demanding silent operation and stringent temperature stability, such as telecommunications infrastructure (e.g., cooling fiber optic components and 5G base stations) and advanced automotive electronics, including battery thermal management and sensor cooling for autonomous driving systems. The inherent benefits, such as solid-state reliability and form factor flexibility, position Peltier devices as indispensable components in the growing trend toward miniaturization and integration of complex electronic systems.

Key driving factors accelerating the market include the explosive growth of data centers and edge computing, where localized hot spot cooling is paramount for maintaining system performance and longevity. Furthermore, increasing demand for sophisticated temperature control in the healthcare sector, specifically for polymerase chain reaction (PCR) machines and portable blood analyzers, contributes substantially to market expansion. While constraints such as lower coefficient of performance (COP) compared to traditional vapor compression systems pose energy efficiency challenges, continuous research into next-generation thermoelectric materials, such as Bismuth Telluride alloys and nanostructured compounds, promises improved performance, thereby solidifying the Peltier device’s role as a vital thermal management solution across diverse industrial landscapes.

Peltier Device Market Executive Summary

The Peltier Device Market is currently undergoing a transformative period marked by sustained investment in semiconductor technology and miniaturized thermal management solutions. Business trends indicate a strong shift from general industrial cooling towards high-precision, niche applications in photonics, 5G networking, and advanced sensor technology. Key market participants are focusing on vertical integration, controlling the supply chain from raw material synthesis (Bismuth Telluride compounds) to integrated module assembly, aiming to reduce manufacturing costs and enhance device efficiency. Furthermore, strategic alliances between module manufacturers and specialized cooling solution integrators are becoming common to deliver comprehensive thermal management systems tailored to specific OEM requirements, particularly in the competitive consumer electronics and automotive segments.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in electronics manufacturing, telecommunications infrastructure expansion (especially 5G rollout), and burgeoning adoption of electric vehicles (EVs) requiring precise battery cooling. North America and Europe continue to maintain strong market share, predominantly in high-value, specialized sectors like aerospace, defense, and advanced medical diagnostics, where the reliability and stability offered by solid-state cooling justify the higher unit cost. Regulatory environments focusing on energy efficiency and electronic waste reduction also implicitly favor compact, long-lifecycle components like Peltier devices, influencing market dynamics in developed economies.

Segment trends highlight the dominance of the Bismuth Telluride (Bi2Te3) material segment due to its established efficiency and operational temperature range suitable for most commercial applications. However, the multi-stage module segment is experiencing the fastest growth, driven by the need for achieving greater temperature differentials (\(\Delta\)T) required for cooling highly sensitive components such as infrared detectors and high-power lasers. The consumer electronics and telecommunications application segments are expected to be the most lucrative over the forecast period, reflecting the widespread global deployment of smaller, more powerful, and thermally demanding portable devices and network equipment, requiring robust and silent cooling solutions.

AI Impact Analysis on Peltier Device Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Peltier Device Market predominantly center on whether the intensive computational demands of AI, particularly in data centers and edge computing, necessitate a fundamental shift in thermal management strategies. Users frequently ask about the role of Peltier devices in managing extreme localized heat generation (hot spots) inherent to high-performance GPUs and ASICs utilized for AI processing, and how these devices contribute to overall data center energy efficiency. The key themes revolve around the expectation that AI acceleration will mandate ultra-precise, localized cooling solutions that traditional HVAC or liquid immersion systems cannot efficiently provide alone. Users are also concerned about the scalability and cost-effectiveness of deploying Peltier devices at the rack or chip level to sustain continuous AI operations and manage the corresponding power density increase without incurring exorbitant operational costs or complex maintenance requirements.

- AI computation significantly increases power density in chips (GPUs, ASICs), necessitating highly localized and precise thermal management.

- Peltier devices are crucial for active cooling of AI hot spots at the micro-level, improving component longevity and computational stability.

- The rise of edge AI and autonomous systems demands compact, silent, and reliable cooling, perfectly aligning with the form factor and operational profile of TECs.

- AI-driven optimization algorithms can be applied to control Peltier device performance, dynamically adjusting current input for maximum energy efficiency (Coefficient of Performance).

- Increased investment in AI infrastructure, particularly hyperscale and regional data centers, directly translates into higher demand for specialized thermoelectric cooling modules.

DRO & Impact Forces Of Peltier Device Market

The dynamics of the Peltier Device Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive demand for miniaturization across high-tech sectors, particularly in sensor technology, medical devices, and high-speed telecommunications. As electronic components shrink and become denser, heat dissipation becomes a major hurdle; Peltier devices offer the compact, solid-state solution required for precise thermal control without the spatial limitations or maintenance issues associated with fluid-based cooling. This inherent advantage ensures sustained demand, particularly in applications where low noise and high reliability are non-negotiable requirements, thereby continuously expanding the addressable market.

However, the market faces significant restraints, most notably the comparatively lower energy efficiency (Coefficient of Performance or COP) of standard Peltier modules when pitted against conventional vapor compression refrigeration systems. This lower efficiency translates to higher energy consumption and heat rejection requirements, which can be prohibitive in large-scale cooling operations like major HVAC systems or large chillers. Furthermore, the reliance on high-cost materials, primarily Bismuth Telluride compounds, and the complexities associated with scaling manufacturing processes contribute to a higher unit cost per cooling watt, challenging broader adoption in highly cost-sensitive commercial applications where energy expenditure is a critical metric for Return on Investment (ROI).

Opportunities for market growth lie in continuous material science innovations aimed at boosting the ZT figure of merit—the key metric for thermoelectric efficiency. The development and commercialization of advanced materials, such as skutterudites, quantum dot superlattices, and other nanostructured thermoelectric elements, promise substantial improvements in COP, effectively mitigating the primary restraint. Additionally, the emerging potential of integrating flexible Peltier devices into wearable technology, optimizing thermal comfort, and utilizing waste heat recovery from industrial processes via the Seebeck effect, presents lucrative new market segments. These technological advancements, coupled with the increasing adoption of solid-state components in electric vehicles for cabin and battery thermal management, define the powerful impact forces steering the market toward rapid future expansion.

Segmentation Analysis

The Peltier Device Market segmentation provides a clear perspective on which product types, materials, and end-use sectors are exhibiting the highest growth trajectories and market dominance. Segmentation by type differentiates between single-stage modules, which offer moderate temperature differentials (\(\Delta\)T), and multi-stage modules, which are critical for achieving significantly lower temperatures necessary for highly sensitive components like infrared sensors and specialized medical equipment. Segmentation by material is foundational, with Bismuth Telluride (Bi2Te3) alloys retaining the largest share due to their proven performance at near-ambient temperatures, though new materials like Lead Telluride (PbTe) and Silicon Germanium (SiGe) are gaining traction for high-temperature or extreme environment applications. The application landscape is highly diversified, ranging from high-volume consumer electronics to demanding industrial and defense applications, reflecting the versatile utility of solid-state cooling technology across the modern industrial spectrum.

- By Type:

- Single Stage Modules

- Multi-Stage Modules

- By Material:

- Bismuth Telluride (Bi2Te3)

- Lead Telluride (PbTe)

- Silicon Germanium (SiGe)

- Other Advanced Materials (e.g., Skutterudites, Mg2Si)

- By End-Use Application:

- Consumer Electronics (e.g., Portable Coolers, Cameras)

- Automotive (e.g., Climate Control, Battery Thermal Management, Sensor Cooling)

- Healthcare and Medical (e.g., PCR Machines, Blood Analyzers, Cold Storage)

- Telecommunications (e.g., 5G Base Stations, Fiber Optic Components)

- Industrial and Manufacturing (e.g., Laser Cooling, Instrumentation)

- Aerospace and Defense (e.g., Infrared Detectors, Specialized Climate Control)

- Data Centers and Computing (Hot Spot Cooling)

Value Chain Analysis For Peltier Device Market

The value chain for the Peltier Device Market begins with the upstream segment, dominated by the sourcing and refining of specialized semiconductor materials, primarily high-purity Bismuth and Tellurium. This stage is highly complex, requiring meticulous synthesis of Bismuth Telluride alloys to ensure optimal stoichiometry and crystal structure, which directly impacts the thermoelectric efficiency (ZT figure of merit) of the final device. Material suppliers play a critical role, as the purity and quality of the ingots and wafers dictate the performance limits of the Peltier module. Following material production, the fabrication stage involves sophisticated processes such as cutting, dicing, and assembling the p-type and n-type semiconductor pellets, often using thin-film deposition techniques and high-precision ceramic substrates to form the completed thermoelectric module.

Midstream activities focus on the assembly, quality control, and testing of the finished Peltier modules. Manufacturers integrate the semiconductor couples between high thermal conductivity ceramic plates, ensuring robust mechanical integrity and electrical isolation. These modules are then often combined with heat sinks, thermal interface materials (TIMs), and control circuitry to form integrated cooling sub-systems. The distribution channel is multifaceted, relying heavily on both direct and indirect sales strategies. Direct sales are preferred for large Original Equipment Manufacturers (OEMs) in specialized fields like aerospace, defense, and high-power laser manufacturing, where customization and technical consultation are essential parts of the procurement process, facilitating complex integration challenges.

The downstream segment encompasses the broad spectrum of end-use application integrators, including automotive Tier 1 suppliers, medical device manufacturers, and telecommunications equipment providers. Indirect distribution channels, utilizing specialized electronic component distributors, serve smaller volume buyers and the mass-market consumer electronics sector. Effective management of this downstream flow requires distributors with deep technical expertise in thermal management to assist customers in selecting and integrating the appropriate Peltier solution for their specific thermal load and environmental constraints. The profitability across the chain is concentrated in the specialized material synthesis and the high-precision module manufacturing stages, reflecting the intellectual property and technical barriers to entry in these areas.

Peltier Device Market Potential Customers

Potential customers for Peltier devices are defined by entities requiring precise, reliable, and compact thermal control, often in applications where conventional refrigeration is impractical due to space constraints, noise limitations, or the necessity for rapid temperature cycling. The largest segment of end-users includes major Original Equipment Manufacturers (OEMs) in the high-technology sectors. For instance, manufacturers of advanced medical devices, such as laboratory instruments, DNA thermal cyclers (PCR machines), and portable diagnostic kits, rely on the accuracy and stability of TECs to ensure precise temperature protocols critical for assay performance. Similarly, telecommunications infrastructure providers, especially those deploying 5G base stations and remote fiber optic repeaters, are high-volume buyers seeking compact modules to stabilize sensitive optical and radio frequency components against environmental temperature fluctuations.

Another rapidly expanding customer base is found within the automotive industry, particularly among electric vehicle (EV) manufacturers and autonomous driving technology developers. These customers utilize Peltier modules for managing the temperature of critical sensors, such as LiDAR and camera systems, to maintain optimal performance in diverse climates. Furthermore, specialized TECs are integrated into localized thermal management systems within EV battery packs and cabin cooling systems. The industrial sector, including manufacturers of high-power lasers used in cutting, welding, and medical procedures, also represents a core customer segment, as these lasers require extremely stable operating temperatures to ensure beam quality and longevity.

Finally, the consumer electronics market represents a significant volume opportunity, though often focused on lower-cost, standard modules. This segment includes manufacturers of portable coolers, mini-refrigerators, dehumidifiers, and high-end consumer cameras and camcorders that require specialized sensor cooling. The decision factors for these end-users revolve around the trade-off between power consumption, temperature differential capability, and the unit cost, driving manufacturers toward standardized, efficient, and mass-producible module designs to meet the cost structure demands of the consumer market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,215 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Laird Thermal Systems, II-VI Incorporated (Coherent), TE Technology, Inc., Ferrotec Corporation, Crystal Ltd., RMT Ltd., Thermonamic Electronics (Jiangxi) Corp., Z-Max Co., Ltd., Kryotherm, Hi-Z Technology, Inc., Tellurex Corporation, KELK Ltd., Micropelt GmbH, Sheetak Inc., Custom Thermoelectric, Thermoelectric Cooling America Corp., Xiamen Hicool Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peltier Device Market Key Technology Landscape

The core technology landscape of the Peltier Device Market is fundamentally rooted in semiconductor physics and advanced materials engineering, specifically focusing on enhancing the thermoelectric figure of merit (ZT). Current technological efforts are centered on optimizing Bismuth Telluride (Bi2Te3) alloys, which remain the industry standard for near-ambient cooling applications, through techniques like doping and crystal structure engineering to maximize power factor while minimizing thermal conductivity. Advancements in thin-film deposition and micro-manufacturing processes are allowing for the creation of micro-Peltier devices, which are essential for cooling microprocessors and highly integrated circuits (ICs) where traditional bulk modules are too large, pushing the boundaries of miniaturized thermal solutions suitable for high-density computing and photonics.

A significant technological focus involves exploring and commercializing new high-performance thermoelectric materials beyond traditional Bi2Te3. Research into Skutterudites, Half-Heusler alloys, and complex Oxide Thermoelectrics is gaining momentum, particularly for high-temperature applications (T > 200°C) or in environments where Lead Telluride or Silicon Germanium are not optimal due to toxicity or performance limitations. Furthermore, nanotechnology plays a crucial role; the use of quantum dots and nanostructuring techniques—such as creating superlattice structures—is instrumental in intentionally scattering phonons (heat carriers) within the material, thereby dramatically lowering thermal conductivity without significantly impeding electrical conductivity, resulting in a substantial increase in the ZT value and overall device efficiency.

Manufacturing process innovations are equally vital, focusing on scalability and cost reduction. Improvements in module assembly include enhanced ceramic substrates (e.g., highly pure Alumina or Aluminium Nitride) for better thermal interfacing and mechanical stability, alongside advanced soldering and bonding techniques to reduce contact resistance between the semiconductor pellets and the metallized ceramic plates. The integration of highly sophisticated Temperature Controller Units (TCUs) and specialized feedback loops constitutes a major technological trend, enabling precise, dynamic modulation of the Peltier device current to achieve extremely stable temperature set points (sub-0.1°C accuracy), which is paramount for sensitive industrial and medical instruments and aligns the technology with high-precision demanding applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven primarily by the colossal manufacturing base for consumer electronics, massive investments in 5G network infrastructure deployment (especially in China, South Korea, and Japan), and the escalating production and adoption of Electric Vehicles (EVs). Countries like China and India are experiencing immense growth in data center construction and industrial automation, leading to high demand for reliable, localized thermal management solutions. Government initiatives supporting semiconductor manufacturing and high-tech product development further solidify the region's dominance, making it the epicenter for both demand and supply of basic and advanced Peltier modules.

- North America: North America holds a substantial market share, characterized by high-value, specialized demand from the aerospace, defense, and advanced medical sectors. The region is a global leader in high-performance computing (HPC) and data center technology, where Peltier devices are utilized for intricate hot spot cooling in proprietary hardware. Significant research and development activity, particularly concerning advanced thermoelectric materials and high-efficiency modules, originates here, supporting high-margin applications that prioritize performance and reliability over initial cost.

- Europe: Europe is a key market, driven by stringent regulatory standards concerning energy efficiency and the strength of its automotive sector, particularly in the premium and luxury EV segment. The region exhibits high demand for thermoelectric modules used in analytical instrumentation, laboratory equipment, and industrial automation control systems. Focus areas include sustainable solutions, integrating Peltier devices for localized cooling while potentially using the Seebeck effect for minor waste heat recovery contributions within complex systems.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in consumer electronics and small-scale commercial refrigeration applications. Market expansion is moderate, tied closely to economic stability and the adoption rate of modern telecommunications infrastructure. The primary driver is the need for compact cooling solutions in remote locations or where robust, low-maintenance thermal systems are preferred over complex mechanical units.

- Middle East and Africa (MEA): The MEA region is expected to demonstrate gradual growth, particularly due to investments in modernizing telecommunications and healthcare infrastructure. The demand is often centered around specialized cooling for critical outdoor electronic equipment and medical cold chain logistics, which benefit significantly from the portable, robust, and solid-state nature of Peltier technology in high ambient temperature environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peltier Device Market.- Laird Thermal Systems

- II-VI Incorporated (Coherent)

- Ferrotec Corporation

- TE Technology, Inc.

- Crystal Ltd.

- RMT Ltd.

- Thermonamic Electronics (Jiangxi) Corp.

- Z-Max Co., Ltd.

- Kryotherm

- Hi-Z Technology, Inc.

- Tellurex Corporation

- KELK Ltd.

- Micropelt GmbH

- Sheetak Inc.

- Custom Thermoelectric

- Advanced Thermoelectric Solutions

- Thermoelectric Cooling America Corp.

- Xiamen Hicool Electronics Co., Ltd.

- CUI Devices

- Hangzhou Fantai Thermal Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Peltier Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Peltier device and how does it function?

A Peltier device, or thermoelectric cooler (TEC), is a solid-state heat pump that uses the Peltier effect to move heat from one side (cold side) to the other (hot side) when direct electric current is applied. It consists of alternating p-type and n-type semiconductor pellets, typically Bismuth Telluride, connected electrically in series and sandwiched between two ceramic substrates. It offers precise, silent cooling without moving parts.

What are the primary disadvantages of using Peltier devices compared to traditional cooling methods?

The main disadvantage is the lower Coefficient of Performance (COP), meaning Peltier devices convert electricity to cooling less efficiently than conventional vapor compression systems, often requiring more power input relative to the heat removed. They also generate a significant amount of heat on the hot side that must be efficiently dissipated, otherwise, the net cooling effect diminishes rapidly.

Which material dominates the Peltier device market and why is it preferred?

Bismuth Telluride (Bi2Te3) alloys dominate the market. This material offers the highest thermoelectric figure of merit (ZT value) at room temperature, making it the most efficient and suitable compound for cooling applications operating around ambient temperatures (0°C to 100°C), which covers the vast majority of commercial, medical, and consumer electronic applications.

In which emerging applications is the demand for multi-stage Peltier modules increasing rapidly?

Demand for multi-stage modules is surging in high-precision, low-temperature applications that require a large temperature differential (\(\Delta\)T), such as the cooling of sensitive infrared (IR) detectors, high-resolution scientific cameras, and advanced medical diagnostic instruments like benchtop PCR machines, where achieving temperatures significantly below ambient is necessary for operation.

How does the growth of 5G infrastructure directly impact the Peltier Device Market?

The deployment of 5G base stations and associated network equipment requires the thermal stabilization of sensitive optical transceivers and radio frequency (RF) components. Peltier devices are preferred in 5G infrastructure because they provide compact, highly reliable, and passive (non-vibrating) cooling solutions critical for maintaining signal integrity and ensuring the long-term operational stability of remotely deployed high-power telecommunications modules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager