PEM Fuel Cell Catalysts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435045 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

PEM Fuel Cell Catalysts Market Size

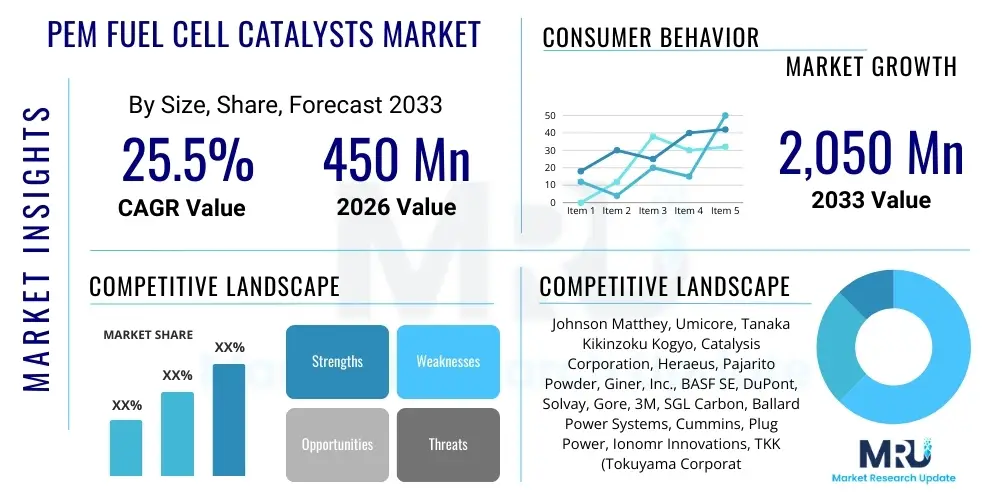

The PEM Fuel Cell Catalysts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 2,050 Million by the end of the forecast period in 2033.

PEM Fuel Cell Catalysts Market introduction

The Proton Exchange Membrane (PEM) Fuel Cell Catalysts Market is foundational to the rapid commercialization and deployment of hydrogen fuel cell technology globally. These catalysts, primarily based on Platinum Group Metals (PGMs), are critical components situated at the anode and cathode of the membrane electrode assembly (MEA). Their core function is facilitating the electrochemical reactions necessary for converting hydrogen and oxygen into electricity and water, achieving high efficiency while ensuring system performance and durability. The ongoing global push toward decarbonization and the stringent environmental mandates placed on the automotive and power generation sectors are directly fueling the demand for highly efficient and sustainable energy solutions like PEM fuel cells.

A key area of focus within this market is the development of advanced catalyst materials that address the persistent challenges of cost and durability. While platinum remains the benchmark material due to its exceptional activity, its high cost and scarcity necessitate intensive research into Platinum Group Metal (PGM) reduction strategies, including the use of core-shell nanoparticles, layered structures, and highly dispersed catalysts. Furthermore, product descriptions often emphasize tailored catalytic inks and powders optimized for integration into gas diffusion layers (GDLs) and membranes, ensuring optimal mass transport and maximizing active surface area under operational conditions.

Major applications of PEM fuel cell catalysts span across the transportation sector, particularly in heavy-duty vehicles, buses, and passenger cars (Fuel Cell Electric Vehicles or FCEVs), as well as in stationary power generation (backup power and distributed generation) and portable electronics. The primary driving factors include significant government investment in hydrogen infrastructure, advancements in catalyst synthesis minimizing PGM loading, and the inherent benefits of PEM fuel cells, such as zero tailpipe emissions, high power density, and rapid refueling capabilities, positioning them as essential enablers of the hydrogen economy.

PEM Fuel Cell Catalysts Market Executive Summary

The PEM Fuel Cell Catalysts Market is characterized by intense technological innovation focused squarely on achieving cost parity and extended operational lifespans compared to conventional power sources. Business trends indicate a pronounced shift toward strategic partnerships between catalyst manufacturers, automotive OEMs, and national research labs, aimed at accelerating the transition from laboratory-scale innovations to mass-producible catalyst coated membranes (CCMs). The industry is witnessing considerable investment in scaling up manufacturing capabilities for PGM-reduced catalysts and exploring viable non-PGM alternatives, such as iron-nitrogen-carbon (Fe-N-C) structures, to mitigate supply chain risks associated with platinum price volatility. The convergence of material science breakthroughs and manufacturing optimization is a defining characteristic of the current market landscape.

Regional trends highlight Asia Pacific (APAC) as the leading growth engine, driven predominantly by massive governmental support for hydrogen mobility in countries like China, Japan, and South Korea, coupled with established industrial ecosystems capable of rapid fuel cell system deployment. North America and Europe, leveraging strong research infrastructure and ambitious climate goals, are focusing heavily on developing heavy-duty FCEVs and establishing continental hydrogen corridors, thereby sustaining high demand for advanced, high-performance catalysts suitable for demanding commercial operations. The Middle East and Africa (MEA) are emerging as significant potential markets, linked to large-scale green hydrogen production initiatives that require reliable stationary power solutions.

Segment trends underscore the dominance of the Platinum segment, particularly advanced Pt alloys used in cathode catalysts to enhance oxygen reduction reaction (ORR) kinetics and durability. However, the rapidly expanding research and development pipeline dedicated to non-PGM catalysts signifies a growing segment poised for substantial long-term disruption, driven by the imperative to reduce overall fuel cell stack costs. Furthermore, the transportation application segment maintains the largest market share, though stationary power applications are anticipated to exhibit the fastest growth rate as utilities seek cleaner and more resilient grid stabilization and backup solutions utilizing hydrogen technology.

AI Impact Analysis on PEM Fuel Cell Catalysts Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the PEM Fuel Cell Catalysts Market revolve around how machine learning can accelerate the discovery of novel, high-performance catalyst materials, optimize synthesis parameters, and predict long-term degradation mechanisms under real-world operating conditions. Users are keenly interested in whether AI can overcome the long lead times associated with traditional trial-and-error material screening, specifically targeting complex multi-component catalyst systems like core-shell nanostructures and ordered intermetallic compounds. Concerns also focus on utilizing AI for digital twin creation of MEAs to simulate catalyst layer thinning, carbon support corrosion, and Pt dissolution, thereby dramatically improving durability predictions and extending fuel cell lifecycle without physical testing.

- AI-driven high-throughput material screening accelerates the identification of highly active PGM-reduced catalyst formulations.

- Machine learning algorithms optimize catalyst synthesis parameters, improving nanoparticle dispersion, uniformity, and active site density.

- Predictive modeling using AI estimates catalyst degradation rates (Pt dissolution, carbon corrosion) under various temperature and humidity cycling profiles, enhancing durability.

- AI facilitates the autonomous optimization of catalyst loading and structure within the MEA design phase, maximizing power density and efficiency.

- Computational chemistry and AI enable the design of novel non-PGM catalyst structures by analyzing quantum mechanical simulations and vast material databases.

- Real-time AI monitoring of operating fuel cells diagnoses catalyst performance issues, recommending immediate operational adjustments for efficiency maintenance.

DRO & Impact Forces Of PEM Fuel Cell Catalysts Market

The market dynamics of PEM Fuel Cell Catalysts are powerfully shaped by the synergy of political willpower, technological advancements, and economic feasibility. The primary market driver is the intensified global commitment to achieving net-zero emissions, manifesting in extensive government subsidies and regulatory support for hydrogen mobility and infrastructure development, which directly increases the production scale of fuel cell vehicles and stationary power units. This regulatory push creates a stable demand floor for catalysts. However, the market faces a significant restraint in the inherent reliance on platinum, whose price volatility and geopolitical supply concentration pose a persistent threat to the economic viability of fuel cell stacks. Furthermore, ensuring long-term catalyst durability, particularly the mitigation of carbon support corrosion during frequent start-stop cycles in automotive applications, remains a technical hurdle requiring sophisticated material engineering solutions.

The key opportunity lies in the rapid progress toward commercializing highly active PGM-free catalysts, which promises to fundamentally lower stack manufacturing costs, unlocking massive potential in cost-sensitive segments like mass-market passenger vehicles. Another critical opportunity is the optimization of catalyst-coated membrane (CCM) manufacturing processes, particularly through high-speed, roll-to-roll coating technologies, which can drive down unit costs and facilitate the necessary scalability required by the booming automotive sector. The market's impact forces are high: the increasing acceptance of hydrogen as a viable energy carrier globally provides a substantial demand pull, while stringent performance requirements set by automotive manufacturers continually pressure the industry to innovate in terms of activity, stability, and longevity. The combination of environmental urgency (Impact) and cost reduction targets (Restraint/Opportunity) dictates the pace of technological adoption and market expansion.

Segmentation Analysis

The PEM Fuel Cell Catalysts Market is structurally segmented based on crucial attributes including the type of catalytic material, the application sector in which the fuel cell is deployed, and the specific component of the fuel cell where the catalyst is utilized. This segmentation provides a granular view of market activity, revealing where research investment is concentrated and which end-user sectors are driving commercial volume. Material segmentation is fundamental, distinguishing between catalysts containing Platinum Group Metals (PGM) and those that are PGM-free. Application segmentation highlights the critical difference in performance requirements between high-power density needs in transportation and long-duration stability needs in stationary power. Component segmentation differentiates between anode and cathode catalysts, recognizing the differing electrochemical environments and reaction mechanisms.

The PGM segment, dominated by pure platinum and platinum alloys (such as Pt-Co, Pt-Ni), holds the majority market share due to its proven efficiency and stability in commercial systems, particularly for the crucial oxygen reduction reaction (ORR) at the cathode. However, the PGM-free segment is experiencing the fastest growth, propelled by sustained global efforts to develop inexpensive, durable alternatives like transition metal macrocycle catalysts (e.g., Fe-N-C) suitable for large-scale production, addressing the core market constraint of platinum cost. Simultaneously, the transportation sector (FCEVs, buses, forklifts) dictates the pace of technological development, demanding robust catalysts capable of enduring thermal and humidity cycling inherent to mobile operations, while the stationary power sector requires materials optimized for continuous, multi-year operation with minimal degradation.

Further analysis of the cathode catalyst market reveals it commands a significantly larger share than the anode market, primarily because the cathode reaction (ORR) is substantially slower and requires higher catalyst loading and more sophisticated material structures (e.g., core-shell architectures) to overcome kinetic limitations and enhance efficiency. Conversely, the anode catalyst, dealing with the relatively facile hydrogen oxidation reaction (HOR), typically utilizes lower PGM loading but must be highly tolerant of trace contaminants such as carbon monoxide, particularly if the hydrogen source is derived from reforming processes. Understanding these distinct requirements is essential for manufacturers tailoring their product offerings to specific operational environments and optimizing overall MEA performance.

- By Type:

- Platinum Group Metal (PGM) Catalysts

- Pure Platinum

- Platinum Alloys (PtCo, PtNi, etc.)

- PGM-Reduced Catalysts

- Non-Platinum Group Metal (Non-PGM) Catalysts

- Transition Metal Macrocycles (Fe-N-C)

- Other Metal Oxides and Carbides

- By Application:

- Transportation (Automotive, Buses, Heavy-duty Trucks)

- Stationary Power (Backup Power, Distributed Generation)

- Portable Power (Drones, Auxiliary Power Units)

- By Component:

- Cathode Catalysts (Oxygen Reduction Reaction - ORR)

- Anode Catalysts (Hydrogen Oxidation Reaction - HOR)

Value Chain Analysis For PEM Fuel Cell Catalysts Market

The value chain for PEM Fuel Cell Catalysts is complex and highly specialized, beginning with the upstream supply of critical raw materials, primarily Platinum Group Metals (PGMs) and carbon black supports. The upstream segment is characterized by geological extraction and refinement, dominated by a few key regions globally (e.g., South Africa, Russia). The stability and pricing of this initial supply chain are significant factors affecting the final product cost. Manufacturers rely on sophisticated chemical suppliers for precursors (like platinum salts) and specialized high-surface-area carbon supports (such as graphitized carbon nanotubes or ordered mesoporous carbon) necessary for maximizing catalyst activity and minimizing degradation. This upstream interaction necessitates robust long-term sourcing strategies and often involves recycling initiatives to manage precious metal supply volatility.

The core manufacturing stage involves the highly technical process of synthesizing the catalyst materials. This includes methods like impregnation, reduction, and controlled precipitation to form nanoparticles with desired size, morphology, and dispersion onto the carbon support. Catalyst manufacturers then process these powders into specialized catalyst inks—a crucial intermediate product formulated with solvents, ionomers (like Nafion), and water. These inks are subsequently applied to the PEM or the gas diffusion layer (GDL) to create the Catalyst Coated Membrane (CCM) or Membrane Electrode Assembly (MEA). The efficiency of ink formulation and coating technology (e.g., slot-die coating, spraying) directly impacts the final fuel cell performance, representing the primary value-add step in the midstream.

The downstream distribution channel involves direct sales from MEA manufacturers to system integrators and Original Equipment Manufacturers (OEMs), particularly those in the automotive and heavy-duty transport sectors. Due to the highly customized nature of MEAs tailored for specific power systems, indirect distribution through generalized distributors is minimal. Direct engagement facilitates quality control, technical support, and rapid feedback loops necessary for continuous product improvement. End-users, such as major vehicle manufacturers (e.g., Hyundai, Toyota) and stationary power providers, procure these assemblies for integration into their final fuel cell stacks and systems. The proximity of catalyst developers to OEM requirements is critical, ensuring the final product meets stringent specifications regarding power density, operational life, and cost efficiency, solidifying a direct channel model.

PEM Fuel Cell Catalysts Market Potential Customers

The primary customers and end-users of PEM Fuel Cell Catalysts are sophisticated entities engaged in the manufacturing, integration, and deployment of fuel cell systems across various high-value sectors. The largest customer base resides within the global automotive and heavy-duty transportation industries, which require high-performance, robust catalysts for Fuel Cell Electric Vehicles (FCEVs), hydrogen buses, commercial trucks, and specialized material handling equipment like forklifts. These buyers demand catalysts that offer exceptional power density, rapid start-up capability, and, critically, long-term durability (often exceeding 5,000 to 10,000 operating hours) to meet commercial lifecycle expectations and warranties.

Another significant segment comprises manufacturers focused on stationary power systems. These customers include utility companies, telecommunications providers, and large industrial facilities seeking reliable, zero-emission backup power and combined heat and power (CHP) solutions. Their focus is less on transient performance and more on continuous operational stability, minimal degradation rates over extremely long periods, and system resiliency. The demand here is often driven by regulatory requirements for grid stability and the need for localized, resilient power generation, making catalyst longevity and resistance to steady-state operational stress paramount purchasing criteria.

Furthermore, specialized end-users in the portable power and emerging aerospace sectors also represent growing potential customers. This includes manufacturers of portable military equipment, high-end recreational vehicles, and drone systems, where the core requirement is exceptional power-to-weight ratio. These applications utilize smaller, lighter fuel cell stacks, driving demand for ultra-low PGM loading catalysts applied to extremely thin membranes. Research and development institutions and national laboratories also act as significant buyers, procuring advanced catalyst materials for testing, benchmarking, and developing next-generation fuel cell prototypes, influencing the future trajectory of material science innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 2,050 Million |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, Umicore, Tanaka Kikinzoku Kogyo, Catalysis Corporation, Heraeus, Pajarito Powder, Giner, Inc., BASF SE, DuPont, Solvay, Gore, 3M, SGL Carbon, Ballard Power Systems, Cummins, Plug Power, Ionomr Innovations, TKK (Tokuyama Corporation), NECCES, and H2scan. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PEM Fuel Cell Catalysts Market Key Technology Landscape

The core technological advancement driving the PEM Fuel Cell Catalysts market centers around strategies for Platinum Group Metal (PGM) minimization and enhancement of catalyst stability, crucial for realizing cost-competitive fuel cells. The current landscape is heavily invested in designing engineered nanomaterials, moving beyond simple supported platinum nanoparticles to structured materials like core-shell catalysts (e.g., Pt-shell on a less expensive transition metal core like Ni or Co). This technology leverages the geometric and electronic effects between the shell and core to boost the oxygen reduction reaction (ORR) kinetics while reducing the total precious metal content per unit of power output. Furthermore, the stabilization of the carbon support against electrochemical oxidation, often through graphitization or the use of novel non-carbon supports, is a critical technology aiming to extend the catalyst lifetime, especially in high-voltage cathode environments.

Another major technological pathway involves the rapid progress in Non-PGM catalysts, primarily focusing on materials derived from transition metal macrocycles, such as iron-nitrogen-carbon (Fe-N-C) materials. These catalysts are synthesized using pyrolysis techniques to create highly dispersed metal active sites within a carbon matrix. While PGM-free catalysts currently exhibit lower activity and stability than platinum in acid environments, significant breakthroughs in optimizing the active site structure and mitigating dissolution mechanisms are rapidly closing the performance gap, presenting a transformative long-term technological opportunity. The ability to manufacture these materials using abundant and inexpensive elements fundamentally changes the cost structure of the fuel cell stack, making them particularly attractive for stationary power and potentially mass-market transportation.

Beyond material composition, manufacturing technology for integrating the catalyst into the Membrane Electrode Assembly (MEA) is equally critical. Advanced coating techniques, particularly precision methods like slot-die coating and decal transfer processes, are replacing traditional spray methods to achieve highly uniform, thin catalyst layers and sharp interfaces. These technologies are vital for scalability, allowing for high-speed, roll-to-roll production necessary for meeting automotive volume demands while ensuring optimal ionomer dispersion throughout the catalyst layer for efficient proton transport. The convergence of computational materials science (AI-driven design) with these advanced manufacturing techniques defines the cutting edge of the market, promising faster material discovery and scalable, cost-effective production of durable, low-PGM MEAs.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global PEM Fuel Cell Catalysts market, driven primarily by government policy and massive industrial investment in hydrogen mobility, particularly in China, Japan, and South Korea. Japan pioneered FCEV commercialization, maintaining high demand for high-performance automotive catalysts. South Korea has set aggressive targets for fuel cell vehicle deployment and established comprehensive hydrogen ecosystems, fueling domestic catalyst innovation. China, with its vast manufacturing capacity and strong push for hydrogen-powered heavy-duty vehicles and public transport, represents the largest volume growth potential, necessitating scaled production of robust catalysts for large vehicle fleets. The region’s focus is on cost reduction through mass production and deploying medium-to-high PGM loading catalysts tailored for commercial operations.

- North America: North America represents a substantial market, characterized by strong governmental support via the US Department of Energy and private investment focused on long-haul trucking and regional hub development for green hydrogen production. The market demands catalysts optimized for high power output and extended durability required by heavy-duty Class 8 trucks, which operate under demanding duty cycles. Furthermore, the region has a robust research and development ecosystem, with leading companies and national labs concentrating efforts on non-PGM catalyst discovery and optimizing MEA assembly processes to meet ambitious cost targets set by federal programs, driving innovation in both material science and manufacturing engineering.

- Europe: The European market is expanding rapidly, fueled by the European Union's Hydrogen Strategy and significant funding directed toward creating hydrogen valleys and cross-border corridors. Germany, France, and the UK are key markets, prioritizing the deployment of hydrogen trains, buses, and stationary power generation for industrial decarbonization. European demand is highly focused on sustainability and efficiency, translating into a strong preference for PGM-reduced and recyclable catalyst solutions. Regulatory pressures, such as stringent emission standards and carbon pricing mechanisms, accelerate the adoption of PEM technologies in high-value industrial and mobility segments, ensuring sustained, quality-driven demand for advanced catalysts.

- Latin America (LATAM): LATAM is an emerging market, currently characterized by smaller pilot projects focused mainly on exploiting the region's abundant renewable energy resources for green hydrogen production. Brazil and Chile are leading efforts, with initial demand concentrating on stationary power solutions for remote operations and limited pilot fleets of public transport. Market growth is contingent upon developing localized hydrogen infrastructure and clear regulatory frameworks, which will eventually translate into consistent demand for standardized, reliable catalyst materials suitable for small-to-medium scale applications.

- Middle East and Africa (MEA): The MEA region is positioned as a future giant in hydrogen production, utilizing vast solar and wind resources for electrolysis. The current demand for PEM fuel cell catalysts is modest but is expected to surge, driven by large-scale power-to-X projects and the need for resilient stationary power solutions in remote areas. Key regional players are focused on exporting blue and green hydrogen, which will eventually create domestic demand for fuel cell systems, particularly in the industrial and maritime sectors, necessitating catalysts optimized for high efficiency and consistent performance over extended periods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PEM Fuel Cell Catalysts Market.- Johnson Matthey

- Umicore

- Tanaka Kikinzoku Kogyo

- Heraeus

- BASF SE

- Pajarito Powder

- Giner, Inc.

- Catalysis Corporation

- Tokuyama Corporation (TKK)

- DuPont

- Solvay

- 3M

- Ballard Power Systems (MEA/Stack Manufacturer)

- Cummins (System Integrator)

- Plug Power (System Integrator)

- Ionomr Innovations (Ionomer Supplier)

- SGL Carbon (GDL/Support Supplier)

- NECCES

- FuelCell Energy

- W. L. Gore & Associates

Frequently Asked Questions

Analyze common user questions about the PEM Fuel Cell Catalysts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor limiting the widespread commercial adoption of PEM fuel cell catalysts?

The primary limiting factor is the high cost and reliance on Platinum Group Metals (PGMs). Platinum scarcity and price volatility significantly increase the overall manufacturing cost of the fuel cell stack, hindering cost competitiveness against established battery electric vehicles (BEVs) and internal combustion engines, particularly in the mass-market automotive sector.

How are manufacturers addressing the durability challenges faced by PEM fuel cell catalysts?

Manufacturers are addressing durability through several engineering strategies, including developing enhanced carbon supports (highly graphitized, non-carbonaceous) that resist corrosion during start-stop cycling, and optimizing catalyst structures (e.g., core-shell architectures) to stabilize the platinum surface and mitigate electrochemical dissolution (Pt leaching) under high potential operation.

What role do Non-PGM catalysts play in the future growth of the market?

Non-PGM catalysts, such as Fe-N-C materials, are crucial for future growth as they offer the potential for dramatically reduced stack costs by replacing expensive platinum with abundant transition metals. Although currently less active, ongoing research aims to improve their performance and long-term stability, making them viable for large-scale, cost-sensitive applications like stationary power and consumer mobility.

Which application segment currently holds the largest market share for PEM fuel cell catalysts?

The transportation segment, encompassing Fuel Cell Electric Vehicles (FCEVs), hydrogen buses, and heavy-duty trucks, holds the largest market share. This dominance is driven by high power requirements and increasing regulatory mandates for zero-emission commercial vehicles globally, requiring high volumes of performance-optimized catalysts.

What is the technological focus for cathode catalysts compared to anode catalysts?

The technological focus for cathode catalysts is enhancing the kinetics of the slow oxygen reduction reaction (ORR) and improving durability against high-voltage cycling, often requiring high PGM loading and complex alloying (e.g., Pt-Co alloys). Anode catalysts, facilitating the fast hydrogen oxidation reaction (HOR), focus primarily on minimizing PGM loading while ensuring high tolerance to trace contaminants like carbon monoxide (CO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager