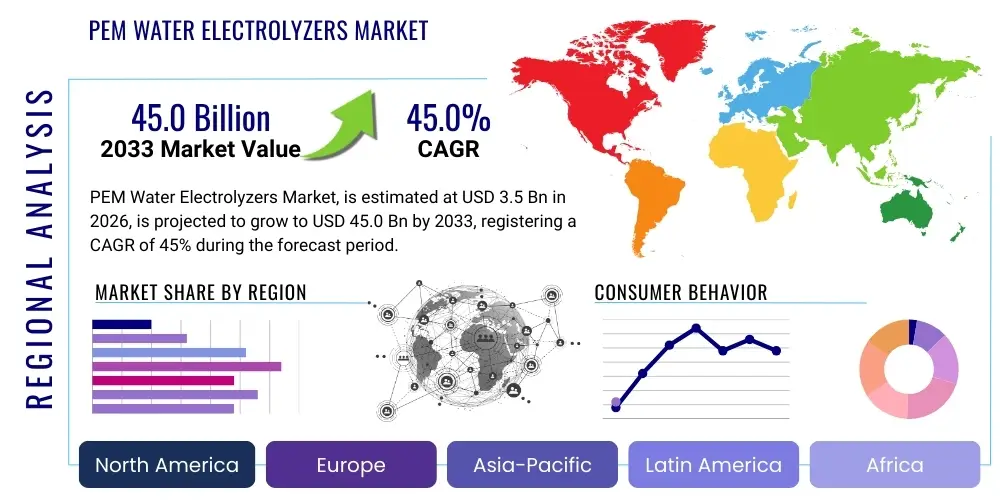

PEM Water Electrolyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436819 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

PEM Water Electrolyzers Market Size

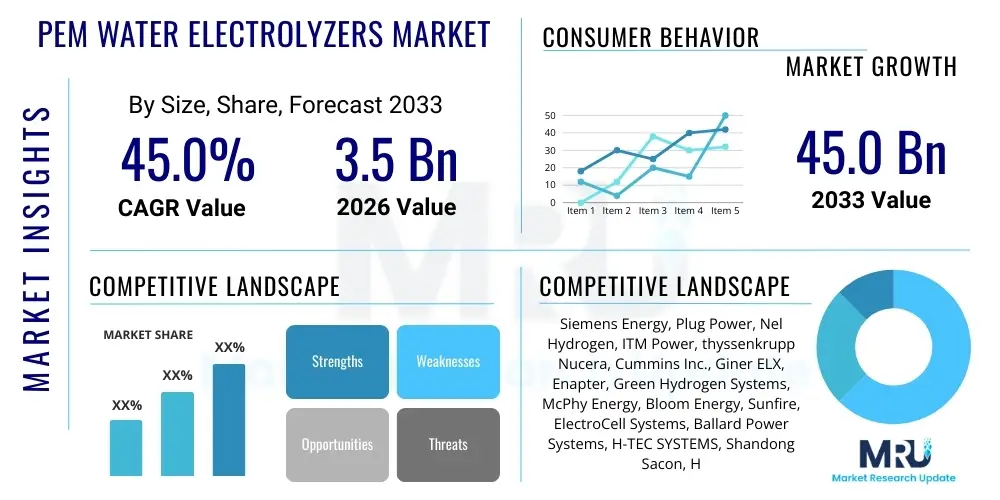

The PEM Water Electrolyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.0% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $45.0 Billion by the end of the forecast period in 2033.

PEM Water Electrolyzers Market introduction

The Proton Exchange Membrane (PEM) Water Electrolyzers Market is central to the global transition towards a sustainable energy infrastructure, primarily driven by the increasing need for green hydrogen production. PEM technology leverages a solid polymer electrolyte to conduct protons, splitting water (H2O) into hydrogen (H2) and oxygen (O2). This highly dynamic technology is favored for its ability to couple seamlessly with intermittent renewable energy sources, such as solar and wind power, due to its rapid response time, high current density, and compact footprint. The market encompasses the manufacturing, deployment, and servicing of PEM stacks and complete system Balance of Plant (BOP) components required for large-scale industrial hydrogen generation.

Major applications of PEM electrolyzers span across diverse sectors, including energy, mobility, and industrial feedstock. In the energy sector, green hydrogen produced by PEM systems facilitates long-duration energy storage and acts as a crucial vector for grid stabilization. For mobility, it supports the development of fuel cell electric vehicles (FCEVs) and heavy-duty transportation, particularly in hard-to-abate sectors like maritime and aviation through the creation of synthetic fuels (Power-to-X). Industrially, it is replacing grey hydrogen derived from fossil fuels in processes like ammonia synthesis, refining, and methanol production, substantially lowering the carbon footprint of these critical operations.

The primary driving factors propelling this market include aggressive global decarbonization mandates and significant governmental subsidies, notably the Inflation Reduction Act (IRA) in the United States and the European Green Deal. Benefits associated with PEM technology, such as operational flexibility and high efficiency under fluctuating power conditions, make it the preferred choice for green hydrogen projects worldwide. Furthermore, ongoing research focusing on reducing capital expenditure (CAPEX) through lower Platinum Group Metal (PGM) loading and advancements in membrane durability are enhancing the economic viability and scalability of PEM systems, ensuring their pivotal role in achieving net-zero emissions targets by the middle of the century.

PEM Water Electrolyzers Market Executive Summary

The PEM Water Electrolyzers Market is experiencing exponential growth, underpinned by favorable policy landscapes and crucial technological breakthroughs focused on cost reduction and performance enhancement. Current business trends indicate a strong move toward gigawatt-scale manufacturing capacity expansion among key global players, aiming to achieve economies of scale necessary to compete effectively with established fossil fuel-based hydrogen production methods. Strategic partnerships between electrolyzer manufacturers, renewable energy developers, and end-users (e.g., utility companies and heavy industry) are becoming standard practice, ensuring integrated project development and accelerating market maturity. The challenge remains in streamlining the supply chain for critical materials, particularly iridium, a scarce PGM catalyst component, prompting intensive R&D into low-iridium or iridium-free alternatives.

Regionally, Europe and Asia Pacific are leading the global deployment, although North America is rapidly gaining momentum. Europe, driven by the REPowerEU plan and extensive hydrogen valley initiatives, focuses on developing cross-border hydrogen pipelines and blending green hydrogen into existing natural gas infrastructure. Asia Pacific, particularly China, Japan, and South Korea, is allocating substantial resources towards domestic hydrogen economies, viewing it as essential for energy security and industrial decarbonization. North America, leveraged by the substantial tax credits offered through the IRA, is attracting massive investments, making it a critical hub for large-scale PEM manufacturing and project development, especially in states with abundant renewable resources.

Segmentation trends highlight the increasing demand for high-capacity systems (above 10 MW) driven by utility-scale Power-to-Gas (P2G) projects and large industrial applications. While industrial feedstock currently constitutes a major application segment, the shift towards hydrogen use in transportation and synthetic fuel production is anticipated to exhibit the highest growth rate during the forecast period. Furthermore, significant market evolution is observed in component manufacturing, where membrane electrode assemblies (MEAs) and stack components are becoming standardized to facilitate modular design and faster installation, thereby improving overall system lifetime and reducing maintenance overheads across various operational environments.

AI Impact Analysis on PEM Water Electrolyzers Market

User queries regarding the intersection of Artificial Intelligence (AI) and the PEM Water Electrolyzers Market commonly revolve around achieving higher operational efficiency, predicting system failure, and accelerating materials science innovation. Key themes identified include the use of machine learning (ML) for real-time optimization of stack performance under variable renewable energy inputs, improving the stability and lifespan of expensive components like the Membrane Electrode Assembly (MEA), and leveraging AI algorithms for the discovery of novel, non-precious metal catalysts. Users are keenly interested in how AI can solve the pressing issues of high CAPEX and rapid component degradation currently constraining market scalability and long-term cost competitiveness.

AI is poised to revolutionize the operational lifespan and maintenance schedules of PEM electrolyzers through advanced predictive analytics. By processing vast datasets encompassing operational parameters such as temperature, pressure, current density, and input power fluctuations, AI models can detect subtle deviations indicating potential component failure, particularly membrane thinning or catalyst poisoning, long before manual detection is possible. This capability significantly shifts maintenance strategies from reactive or calendar-based scheduling to highly efficient, predictive maintenance, thereby maximizing system uptime and reducing catastrophic failures. Furthermore, AI-driven control systems allow for dynamic load balancing, optimizing the electrolyzer's response to the highly transient nature of renewable energy supplies, ensuring consistent and cost-effective hydrogen output purity and volume.

Beyond operational optimization, AI and ML are playing a transformative role in the fundamental research and development of next-generation PEM components. The traditional trial-and-error approach to materials discovery for catalysts and membranes is being superseded by high-throughput screening and computational modeling powered by AI. These sophisticated algorithms can quickly analyze the properties of millions of potential materials, predicting stability, conductivity, and catalytic activity, significantly shortening the development cycle for durable, high-performance, and low-cost alternatives to current reliance on PGM materials like iridium and platinum. This technological acceleration is crucial for breaking the material constraint bottleneck currently facing gigawatt-scale deployment goals worldwide.

- AI enables predictive maintenance, increasing stack longevity and reducing downtime by forecasting component degradation.

- Machine Learning algorithms optimize real-time operational parameters (temperature, pressure, power input) for maximum efficiency and stable hydrogen production.

- Computational chemistry and AI accelerate the discovery of non-PGM catalysts, addressing supply chain fragility and lowering CAPEX.

- AI facilitates enhanced quality control in manufacturing by identifying defects in MEAs and bipolar plates during production.

- Advanced data analytics powered by AI support optimal site selection and system sizing, integrating PEM plants effectively with local grid and renewable resources.

DRO & Impact Forces Of PEM Water Electrolyzers Market

The market trajectory for PEM Water Electrolyzers is defined by powerful Drivers (D) stemming from urgent climate action and policy support, tempered by significant Restraints (R) related to capital intensity and material scarcity, while vast Opportunities (O) emerge from industrial decarbonization and energy system transformation. The overarching impact forces include regulatory pressure, technological maturity acceleration, and volatility in critical material supply chains. The convergence of these factors dictates the pace of market penetration and competitive dynamics, forcing manufacturers to focus intensely on system cost parity and enhanced durability to ensure long-term viability against competing electrolysis technologies like Alkaline and Solid Oxide Electrolyzers.

Key drivers include substantial financial incentives such as production tax credits and capital grants, which significantly de-risk large-scale projects and lower the effective levelized cost of hydrogen (LCOH). Furthermore, the regulatory push for green hydrogen mandates across heavy industry and the power sector creates guaranteed demand, reinforcing investment confidence. Conversely, the primary restraints center on the high initial capital expenditure (CAPEX) associated with PEM systems compared to established grey hydrogen production, coupled with the reliance on precious metals (Platinum and Iridium) which creates supply chain bottlenecks and cost uncertainty. The limited lifespan of current generation MEAs and stacks under continuous, high-load cycling also acts as a constraint, demanding frequent replacement and increasing operational expenditure (OPEX).

Despite these challenges, vast opportunities exist in integrating PEM technology into nascent energy ecosystems, particularly in maritime bunkering and sustainable aviation fuel (SAF) production where high-purity hydrogen is essential. The potential for utilizing waste heat from industrial processes to improve system efficiency and the development of localized, decentralized hydrogen hubs further present robust growth avenues. The impact forces are overwhelmingly positive, driven by the irreversible global commitment to Net Zero targets, compelling continuous innovation in stack design, balance of plant optimization, and material science to overcome current technical and economic barriers and solidify PEM electrolysis as the dominant technology for renewable hydrogen generation.

Segmentation Analysis

The PEM Water Electrolyzers Market is segmented based on Capacity, Application, and End-User, reflecting the diverse scale and functional requirements across the energy transition landscape. Analysis of these segments is crucial for understanding current demand patterns and predicting future investment areas. The Capacity segment, ranging from small-scale (kW-level) units for localized fueling stations to massive, multi-MW systems for industrial complex integration, demonstrates the adaptability of PEM technology. The shift toward higher capacity deployment is indicative of the market's progression towards industrialization, emphasizing cost efficiency through scale, particularly in regions where renewable energy curtailment is prevalent, necessitating Power-to-X solutions.

Application segmentation reveals the market's reliance on existing industrial processes while highlighting the rapid adoption in emerging sectors. Historically, chemical manufacturing (ammonia, methanol) and petroleum refining were the primary consumers of hydrogen, and these sectors remain critical drivers for transition from grey to green hydrogen. However, the fastest growth is observed in mobility (fueling stations) and power generation/grid balancing, where the rapid response capability of PEM electrolyzers is highly valued for mitigating intermittent supply risks from renewables. End-User segmentation mirrors this application spread, focusing on utilities and power generators, heavy industry complexes, and the specialized automotive/transport sector, each demanding unique operational characteristics and system specifications from PEM providers.

Strategic analysis shows that the Membrane Electrode Assembly (MEA) component segment within the overall system segmentation is projected to grow significantly faster than the rest of the Balance of Plant (BOP), owing to its status as the high-wear, high-value component requiring frequent replacement and continuous technological iteration. This rapid growth in MEA demand underscores the market's focus on technological improvement and system robustness, necessitating robust supply chains for specialized materials and advanced manufacturing techniques to meet escalating global deployment targets and maintain the rigorous purity requirements for green hydrogen used in fuel cells.

- By Capacity

- 100 kW to 1 MW (Small to Medium Scale)

- 1 MW to 10 MW (Medium to Large Scale)

- Above 10 MW (Large Scale/Gigawatt Projects)

- By Application

- Power Generation and Grid Injection (Power-to-Gas)

- Chemical and Petroleum Refining (Industrial Feedstock)

- Mobility (Refueling Stations)

- Metal Production

- Others (Residential, Decentralized Energy)

- By End-User

- Energy & Utilities

- Chemical Industry

- Automotive & Transportation

- Metal & Mining Industry

- Others (Pharmaceutical, Electronics)

- By Component

- Stack (MEA, Bipolar Plates, End Plates)

- Balance of Plant (BOP) (Power Electronics, Water Treatment, Gas Separation, Compression)

Value Chain Analysis For PEM Water Electrolyzers Market

The value chain for the PEM Water Electrolyzers Market is complex and highly specialized, beginning with the upstream supply of advanced materials, moving through specialized manufacturing, and culminating in downstream deployment and ongoing maintenance services. Upstream analysis focuses critically on the procurement and processing of Platinum Group Metals (PGMs), primarily Platinum and Iridium, which are indispensable as catalysts, along with the supply of Nafion or alternative polymer membranes (such as those based on PTFE or sulfonated polyimide). Secure, ethical sourcing of these materials is a major concern, as geopolitical instability and limited global reserves of iridium directly impact manufacturing costs and scalability projections for the entire industry, driving significant investment into recycling technologies and alternative catalyst research.

The midstream segment involves the highly technical manufacturing of the core components, primarily the Membrane Electrode Assemblies (MEAs) and the subsequent stacking into functional electrolyzer units. This stage demands precision engineering, cleanroom environments, and specialized coating techniques for the bipolar plates (often titanium-based). Manufacturing capabilities, particularly in automated assembly and quality control for gigawatt-scale stack production, are becoming defining factors in market competitiveness. Companies that can efficiently scale up production while maintaining rigorous performance standards—specifically achieving high current densities and robust operational lifespan—gain a significant competitive advantage in fulfilling large industrial and utility-scale orders.

The downstream distribution channels are diverse, ranging from direct sales to major industrial end-users (e.g., ammonia producers or refineries) to indirect sales through Engineering, Procurement, and Construction (EPC) firms who integrate the electrolyzers into large Power-to-X projects or dedicated hydrogen hubs. Direct channels allow for customized solutions and stronger long-term service contracts, especially with utility-scale customers who require tight integration with renewable energy assets. Indirect channels via EPCs facilitate rapid global deployment and standardization. The final stage involves extensive operation, maintenance, and service (OMS), which is increasingly reliant on digital solutions and predictive maintenance software to ensure long-term operational viability and optimize hydrogen output purity and flow rate for demanding applications like fuel cell use.

PEM Water Electrolyzers Market Potential Customers

The potential customer base for PEM Water Electrolyzers is rapidly diversifying beyond traditional industrial hydrogen consumers, now encompassing key players in the global energy transition, climate technology, and heavy transportation sectors. The primary, immediate end-users are large industrial complexes, including oil refineries and chemical producers, particularly those focused on ammonia and methanol synthesis. These customers represent stable, massive demand for hydrogen feedstock and are under intense regulatory and public pressure to decarbonize their processes, making the switch from grey to green hydrogen produced by large-scale PEM systems an urgent business imperative, supported often by government subsidies and carbon taxes.

A second major customer segment consists of utility companies and Independent Power Producers (IPPs). These entities utilize PEM electrolyzers for two core purposes: grid balancing and energy storage (Power-to-Gas). By converting surplus, low-cost renewable electricity into hydrogen, they mitigate renewable energy curtailment and store energy for later reconversion to power or use as fuel for hydrogen turbines. The ability of PEM systems to respond rapidly to fluctuating power signals makes them highly attractive for these grid-scale applications, especially in regions with high penetration of intermittent solar and wind energy sources, positioning utility companies as crucial long-term hydrogen off-takers and developers.

Furthermore, the mobility and transportation sector, covering heavy-duty trucking, port operations, rail transport, and increasingly maritime shipping, represents a high-growth customer segment. These users require decentralized hydrogen fueling infrastructure to support the deployment of Fuel Cell Electric Vehicles (FCEVs). PEM systems, with their relatively small footprint and high output purity, are ideal for modular refueling stations. Specialized industrial buyers, such as electronics manufacturers requiring ultra-high purity hydrogen for semiconductor fabrication, also constitute a niche but valuable customer segment, highlighting the versatility and high-specification capabilities of PEM technology across various critical technological domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $45.0 Billion |

| Growth Rate | 45.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Plug Power, Nel Hydrogen, ITM Power, thyssenkrupp Nucera, Cummins Inc., Giner ELX, Enapter, Green Hydrogen Systems, McPhy Energy, Bloom Energy, Sunfire, ElectroCell Systems, Ballard Power Systems, H-TEC SYSTEMS, Shandong Sacon, Hitachi Zosen Corporation, Elogen, Xebec Adsorption, AFC Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PEM Water Electrolyzers Market Key Technology Landscape

The technological landscape of the PEM Water Electrolyzers Market is dominated by intense research and development focused on cost reduction and performance enhancement, primarily targeting the optimization of the stack components. Current PEM technology relies heavily on Platinum Group Metals (PGMs) for catalysts, particularly Iridium for the oxygen evolution reaction (OER) catalyst at the anode, which is a significant contributor to the high capital cost of the system. The key technological challenge being addressed involves decreasing the PGM loading per kilowatt of hydrogen produced, through advancements in catalyst support structures, optimization of thin-film coating techniques, and utilizing advanced ionomer binders to improve catalyst utilization efficiency without compromising performance or durability under fluctuating loads inherent to renewable energy integration.

A second critical area of innovation lies in the development and adoption of advanced proton exchange membranes. While DuPont's Nafion dominates the existing market due to its high conductivity and stability, manufacturers are actively exploring non-perfluorosulfonic acid (PFSA) membranes, such as hydrocarbon-based or reinforced composite membranes. These alternatives aim to reduce material costs, improve durability under high temperature and pressure operation, and, crucially, enhance resistance to impurities present in the feed water. Improving membrane longevity directly translates to lower operational expenditure (OPEX) and extended system lifespan, a key metric for utility-scale project financing and ensuring the long-term economic viability of large green hydrogen production facilities.

Furthermore, significant technological efforts are dedicated to refining the Balance of Plant (BOP) components and system integration. This includes optimizing power electronics for efficient conversion of variable DC current from renewable sources, improving the design of bipolar plates (BPPs)—often using titanium or coated stainless steel to resist corrosion—and enhancing the gas separation and purification stages. Modular design and automated manufacturing processes are gaining traction, allowing for standardized 10 MW and 100 MW modules that can be easily scaled up to GW-level installations. The integration of advanced diagnostics and AI-powered control systems is also standardizing, enabling proactive management of thermal load and internal pressure differentials to maintain peak efficiency and operational stability across diverse environmental conditions.

Regional Highlights

- Europe: Europe is a foundational market for PEM electrolyzer deployment, driven by the EU's ambitious hydrogen strategy (REPowerEU) aimed at producing 10 million tons of renewable hydrogen domestically by 2030. Key countries like Germany, the Netherlands, and Spain are fostering hydrogen valleys and massive pilot projects. The regulatory environment supports cross-border infrastructure development, including hydrogen backbone pipelines, stimulating high demand for large-scale PEM units (10 MW+). Europe's focus is particularly strong on integrating hydrogen into industrial processes and transportation, ensuring stable, long-term demand. The region benefits from strong domestic manufacturing expertise from companies like Siemens Energy and Nel Hydrogen, though it faces ongoing challenges in raw material supply chain security, particularly for iridium.

- North America (United States & Canada): North America is projected to be the fastest-growing market, primarily catalyzed by the U.S. Inflation Reduction Act (IRA), which offers unprecedented production tax credits (PTC) up to $3.00/kg for clean hydrogen. This incentive has made green hydrogen economically competitive with fossil fuel-derived hydrogen, spurring massive investment commitments in electrolyzer manufacturing capacity and GW-scale project development, especially in states with high solar and wind potential. The U.S. market is characterized by robust private sector investment and a focus on deploying extremely large PEM systems (100 MW+) integrated directly with new renewable generation assets to serve chemical, refining, and nascent sustainable aviation fuel (SAF) markets.

- Asia Pacific (APAC): The APAC region, led by China, Japan, South Korea, and Australia, represents the largest potential volume market due to rapidly expanding industrialization and high energy demand. China is deploying electrolyzer technology at an unparalleled pace, heavily focused on both Alkaline and PEM systems for localized energy solutions and industrial feedstock. Japan and South Korea, lacking domestic fossil fuels, are aggressively pursuing hydrogen as a core component of their future energy security, focusing on high-purity PEM systems for mobility and power generation. Australia, with its vast renewable resources, is emerging as a global leader in green hydrogen exports, necessitating large-scale PEM installations for coastal production facilities designed for international shipping.

- Middle East and Africa (MEA): The MEA region is rapidly positioning itself as a major exporter of green hydrogen and ammonia. Countries like Saudi Arabia (NEOM project) and the UAE are developing some of the world's largest renewable energy parks, intended to power massive PEM and Alkaline electrolyzer installations. The primary focus here is large-scale, low-cost hydrogen production for export to Europe and Asia. African nations, particularly South Africa and Morocco, are leveraging their solar potential to establish hydrogen economies focused on domestic mining decarbonization and future export markets, creating demand for robust, high-temperature tolerant PEM technologies suitable for arid environments.

- Latin America: Latin America is focusing its hydrogen initiatives primarily on countries with high renewable energy capacity, notably Chile (wind and solar) and Brazil (hydropower). Chile has established a comprehensive national green hydrogen strategy, attracting significant international investment for large-scale production aimed at decarbonizing domestic mining operations and developing export capabilities. While the market is currently smaller than North America or Europe, the abundance of low-cost renewable power positions the region as a major, high-potential growth area for future large-scale PEM deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PEM Water Electrolyzers Market.- Siemens Energy

- Plug Power

- Nel Hydrogen

- ITM Power

- thyssenkrupp Nucera

- Cummins Inc.

- Giner ELX

- Enapter

- Green Hydrogen Systems

- McPhy Energy

- Bloom Energy

- Sunfire

- ElectroCell Systems

- Ballard Power Systems

- H-TEC SYSTEMS

- Shandong Sacon

- Hitachi Zosen Corporation

- Elogen

- Xebec Adsorption

- AFC Energy

Frequently Asked Questions

Analyze common user questions about the PEM Water Electrolyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of PEM electrolyzers over Alkaline or SOEC technologies?

PEM (Proton Exchange Membrane) electrolyzers offer superior advantages due to their ability to operate at high current densities, allowing for a compact footprint, and their rapid dynamic response time. This makes them ideal for direct coupling and efficient operation with intermittent renewable energy sources like wind and solar, crucial for producing competitive green hydrogen and stabilizing power grids.

What is the main cost challenge facing the mass deployment of PEM technology?

The primary economic challenge is the high capital expenditure (CAPEX), heavily influenced by the reliance on Platinum Group Metals (PGMs), specifically Iridium, used as the catalyst in the Membrane Electrode Assembly (MEA). Market efforts are concentrated on developing low-PGM or PGM-free catalysts and enhancing MEA lifespan to drive down the total cost of ownership (TCO) and achieve cost parity with traditional hydrogen production methods.

How is the Inflation Reduction Act (IRA) impacting the North American PEM Electrolyzers Market?

The IRA provides substantial financial incentives, notably the Clean Hydrogen Production Tax Credit ($3.00/kg), which drastically improves the economics of green hydrogen production in the United States. This legislation has catalyzed massive investments in gigawatt-scale PEM manufacturing facilities and project development, positioning North America as a global leader in system deployment and cost competitiveness.

What role does the membrane play in the efficiency of a PEM water electrolyzer?

The proton exchange membrane is the critical component responsible for conducting protons from the anode to the cathode while separating the produced hydrogen and oxygen gases. High-performance membranes (like Nafion) must exhibit excellent ionic conductivity, mechanical stability, and chemical resistance to maintain high efficiency, low ohmic resistance, and prevent gas cross-over, which is essential for ensuring high-purity hydrogen output.

Which application segment is projected to show the highest growth rate for PEM electrolyzers?

The Mobility and Sustainable Fuels segment, encompassing hydrogen refueling stations for heavy-duty transport, and Power-to-X applications such as synthetic aviation and marine fuel production, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This is driven by global regulatory pushes to decarbonize hard-to-abate transportation sectors requiring high-purity, scalable hydrogen supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager