Penicillin Active Pharmaceutical Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432110 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Penicillin Active Pharmaceutical Ingredients Market Size

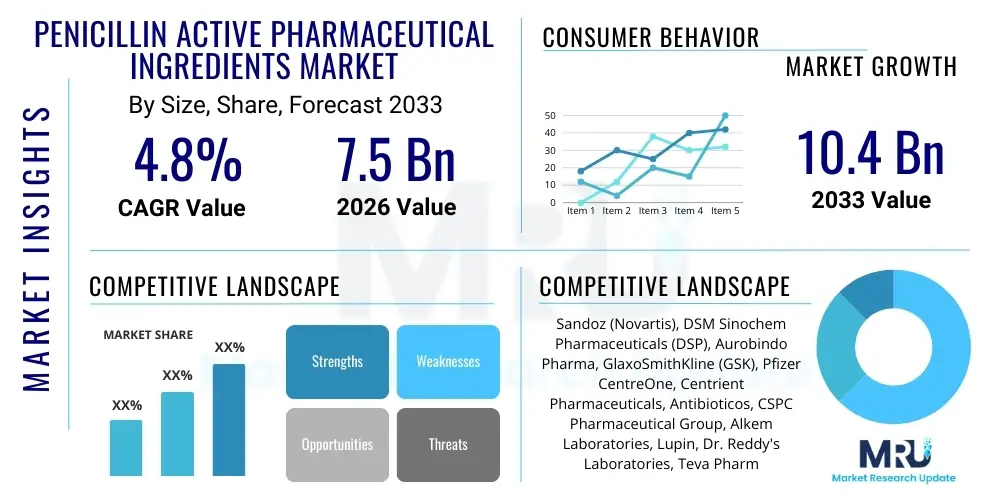

The Penicillin Active Pharmaceutical Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Penicillin Active Pharmaceutical Ingredients Market introduction

The Penicillin Active Pharmaceutical Ingredients (API) Market encompasses the manufacturing and supply of chemical compounds essential for producing penicillin-class antibiotics, which are crucial for treating various bacterial infections. Penicillins, categorized broadly into natural (like Penicillin G and V) and semi-synthetic derivatives (like Amoxicillin and Ampicillin), remain foundational therapeutics in global healthcare, despite the increasing challenge of antimicrobial resistance (AMR). The manufacturing process for penicillin APIs is highly complex, typically relying on advanced fermentation techniques followed by stringent purification and chemical modification steps to ensure high efficacy and purity demanded by regulatory bodies worldwide.

Major applications of Penicillin APIs include the treatment of respiratory tract infections, skin and soft tissue infections, urinary tract infections, and prophylactic use in specific surgical procedures. The sustained demand for these APIs is primarily driven by the high global incidence of bacterial diseases, particularly in developing economies, coupled with their cost-effectiveness compared to newer generation antibiotics. Furthermore, advancements in semi-synthetic penicillin production allow for broader spectrum activity, enhancing their utility against a wider range of pathogens, thus maintaining their indispensable status in the pharmacological arsenal.

Key driving factors supporting market expansion involve government and international organization initiatives aimed at improving access to essential medicines, especially in low and middle-income countries. Additionally, the necessity for robust stockpiling of critical antibiotics following global health crises and continuous process optimization by major API manufacturers to reduce production costs are contributing significantly to market volume growth. However, manufacturers must constantly invest in quality control and process validation to meet Good Manufacturing Practice (GMP) standards enforced by agencies such as the FDA and EMA, which heavily influences global trade dynamics and market access for these essential pharmaceutical raw materials.

Penicillin Active Pharmaceutical Ingredients Market Executive Summary

The Penicillin Active Pharmaceutical Ingredients (API) market is characterized by a strong dichotomy: consistent volume demand driven by persistent infectious disease burdens versus heightened regulatory scrutiny and the persistent threat of antimicrobial resistance (AMR). Business trends indicate a consolidation among major global API producers, particularly those located in Asia Pacific, aiming for economies of scale and vertical integration from raw material sourcing to final API production. Furthermore, there is a distinct strategic shift toward the production of advanced semi-synthetic penicillins, which offer improved efficacy and pharmacokinetic profiles over traditional natural penicillins, thereby commanding higher value in certain therapeutic areas.

Regional trends highlight the Asia Pacific (APAC) region, specifically China and India, as the undisputed leaders in manufacturing volume, owing to lower operating costs and established fermentation infrastructure. However, North America and Europe maintain dominance in terms of R&D investment, stricter quality standards, and higher average selling prices for premium-grade, regulated APIs. Concerns over supply chain resilience, exacerbated by recent geopolitical tensions and pandemic-related disruptions, are pushing Western nations to consider reshoring or nearshoring critical API production, potentially altering the current geographic distribution of manufacturing capacity in the medium term.

Segment trends underscore the semi-synthetic penicillin API segment, including Amoxicillin, Amoxicillin/Clavulanate combination, and Ampicillin, as the fastest-growing category due to their broad-spectrum applications and inclusion in essential medicine lists globally. In terms of end-users, pharmaceutical manufacturers (both branded and generic) represent the largest segment, requiring high volumes of compliant APIs for finished dosage form production. The market's future growth hinges significantly on balancing the need for low-cost, high-volume production with the stringent regulatory demands for purity and safety, particularly concerning the prevention of cross-contamination with non-beta-lactam substances.

AI Impact Analysis on Penicillin Active Pharmaceutical Ingredients Market

User inquiries regarding the application of Artificial Intelligence (AI) in the Penicillin API sector frequently revolve around how AI can mitigate manufacturing complexity, enhance yield in fermentation processes, and streamline compliance documentation. Key themes emerging from these questions concern AI’s potential to optimize microbial strain selection and growth conditions, predicting potential synthesis impurities before they occur, and managing intricate global supply chains subject to volatile pricing and logistical challenges. Users are highly interested in AI’s ability to shorten the time required for scale-up from lab to commercial production and its role in accelerating the identification of novel semi-synthetic derivatives that could potentially bypass current resistance mechanisms, ensuring the long-term viability and efficacy of the penicillin class.

AI’s influence is beginning to permeate the upstream and midstream stages of penicillin API manufacturing. In fermentation, machine learning algorithms analyze vast datasets related to temperature, pH levels, nutrient consumption, and dissolved oxygen to predict optimal harvest times and identify subtle deviations indicative of contamination or reduced efficiency. This predictive maintenance capability minimizes batch failures, which are costly and time-consuming, significantly enhancing operational consistency and reducing waste. Furthermore, AI-driven computational chemistry is assisting in the precise design of improved semi-synthetic pathways, optimizing reaction kinetics and increasing the yield of complex intermediate steps, thereby lowering the overall cost of goods sold (COGS) for high-volume products like Amoxicillin.

Beyond the laboratory and plant floor, AI is critical for regulatory compliance and market forecasting. Natural Language Processing (NLP) tools are being deployed to rapidly process and harmonize regulatory dossiers across multiple jurisdictions, ensuring faster time-to-market. Additionally, advanced analytics models forecast infectious disease outbreaks and shifting antibiotic resistance patterns, allowing API manufacturers to strategically adjust production volumes for specific penicillin types, ensuring supply meets global epidemiological demand fluctuations, thereby improving inventory management and minimizing obsolescence risks.

- AI-driven optimization of microbial fermentation strains and growth media to maximize penicillin yield.

- Predictive maintenance algorithms reduce batch failure rates by identifying equipment or process anomalies early.

- Machine learning models accelerate the design and synthesis route selection for new semi-synthetic penicillin derivatives.

- Enhanced supply chain visibility and risk management through AI-powered predictive logistics planning.

- Automation of regulatory document processing (NLP) ensures faster compliance checks and market entry.

- Advanced analytics for forecasting global infectious disease trends to align production capacity with anticipated demand.

DRO & Impact Forces Of Penicillin Active Pharmaceutical Ingredients Market

The dynamics of the Penicillin API market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers include the pervasive global burden of bacterial infections, the inclusion of penicillins on the World Health Organization's (WHO) list of essential medicines, and the relatively low manufacturing cost base compared to patented, advanced antibiotics, making them a staple in public health systems. However, these drivers are tempered by significant restraints, chiefly the escalating global challenge of antimicrobial resistance (AMR), which diminishes the effectiveness of older penicillin classes, and highly stringent regulatory requirements for preventing beta-lactam cross-contamination, demanding substantial capital investment in dedicated manufacturing facilities.

Opportunities for growth lie primarily in innovation within synthesis routes—specifically, applying green chemistry principles and continuous manufacturing techniques to improve efficiency and reduce environmental impact. Moreover, manufacturers are capitalizing on emerging markets, particularly in regions experiencing rapid urbanization and improved healthcare access, where the demand for basic, effective antibiotics is surging. The strategic integration of combination therapies, such as Amoxicillin paired with beta-lactamase inhibitors (e.g., Clavulanic Acid), presents a consistent opportunity to sustain product relevance against slightly resistant strains, thus driving higher API demand for these formulations.

Impact forces in this market are high, dominated by intense global competition, particularly pricing pressure exerted by large-volume producers in Asia, and the constant threat of regulatory action related to quality and supply stability. The pharmaceutical industry's focus on securing resilient, quality-assured supply chains acts as a gravitational force, favoring established manufacturers with robust compliance records. External forces, such as global health crises or geopolitical events impacting cross-border trade, can drastically influence raw material availability and pricing for key precursors used in penicillin synthesis, necessitating agile risk mitigation strategies among market participants.

Segmentation Analysis

The Penicillin Active Pharmaceutical Ingredients market is highly fragmented based on the nature of the API, its clinical application, and the geographic landscape of production and consumption. Segmentation by API Type distinguishes between Natural Penicillins (derived directly from fermentation, like Penicillin G) and Semi-Synthetic Penicillins (chemically modified derivatives, like Amoxicillin and Ampicillin), with the latter dominating market value due to broader efficacy. Application segmentation focuses primarily on different infectious disease categories, such as respiratory, skin, and urinary tract infections, reflecting diverse end-user needs in hospitals, clinics, and retail pharmacies. Understanding these segmentation nuances is critical for manufacturers to align production capacity with therapeutic demand trends and regional regulatory standards.

- By Type:

- Natural Penicillin API (e.g., Penicillin G, Penicillin V)

- Semi-Synthetic Penicillin API (e.g., Amoxicillin, Ampicillin, Dicloxacillin, Cloxacillin, Flucloxacillin)

- Combination Penicillin API (e.g., Amoxicillin-Clavulanic Acid)

- By Application/Therapeutic Area:

- Respiratory Tract Infections

- Urinary Tract Infections

- Skin and Soft Tissue Infections

- Other Infections (e.g., Septicemia, Prophylactic Use)

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies (Generic and Branded)

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutions

- By Synthesis Method:

- Fermentation

- Enzymatic Synthesis

- Chemical Synthesis

Value Chain Analysis For Penicillin Active Pharmaceutical Ingredients Market

The Penicillin API value chain begins with highly specialized upstream activities centered around raw material procurement and fermentation. Upstream analysis involves sourcing critical precursors, such as glucose, corn steep liquor, and various nutrient sources necessary for the growth of the Penicillium mold strain. Optimizing the fermentation process—a technologically intensive bio-manufacturing step—is paramount, as it directly determines the yield and initial purity of the raw penicillin core, typically Penicillin G. Suppliers in this phase must ensure high-quality, contaminant-free inputs, which are then used in large-scale bioreactors, often requiring proprietary knowledge for strain maintenance and maximizing productivity under sterile conditions.

The midstream phase focuses on the complex process of converting the fermented product into the final, high-purity API. This involves extraction, purification (often through solvent precipitation or crystallization), and subsequent chemical or enzymatic modifications to create semi-synthetic derivatives like Amoxicillin. Given that penicillin is a beta-lactam compound, maintaining dedicated facilities (segregation) to prevent cross-contamination with other drug classes is a major regulatory hurdle and cost driver. The efficiency and quality control implemented during these synthesis and purification stages are critical determinants of regulatory approval and the API's marketability.

Downstream analysis covers the distribution channel, which spans direct sales to large, integrated pharmaceutical manufacturers and indirect sales through specialized API distributors and traders. Direct distribution is favored by major players offering high volumes and long-term contracts, emphasizing quality consistency and secure supply. Indirect channels serve smaller generic manufacturers and CDMOs requiring flexible quantities. Potential customers, including generic drug manufacturers (who use the API to produce finished tablets or injections) and branded companies, exert significant pressure on pricing and delivery timelines, emphasizing the need for efficient logistics and robust inventory management across the entire supply chain.

Penicillin Active Pharmaceutical Ingredients Market Potential Customers

The primary customers for Penicillin Active Pharmaceutical Ingredients (APIs) are large-scale pharmaceutical and biopharmaceutical companies, spanning both established branded drug manufacturers and high-volume generic drug producers. Generic manufacturers, particularly those concentrated in India, China, and Eastern Europe, constitute the largest volume buyers, as they rely on cost-effective API sourcing to maintain competitive pricing for widely consumed antibiotics like Amoxicillin and Ampicillin. These customers demand consistent supply, rigorous quality documentation (Drug Master Files, DMFs), and compliance with global GMP standards to secure approvals from agencies like the US FDA and European EMA.

A rapidly growing segment of potential customers includes Contract Development and Manufacturing Organizations (CDMOs). As pharmaceutical companies increasingly outsource non-core manufacturing activities, CDMOs require specialized, high-purity penicillin APIs to produce client-specific finished dosage forms. These organizations often seek out API suppliers capable of rapid scaling and customized batch production, valuing flexibility and advanced technical support alongside competitive pricing. The relationship is often transactional but built on deep trust regarding intellectual property protection and regulatory fidelity.

Furthermore, government bodies and international aid organizations (such as UNICEF, WHO, and national health services) are significant end-user influencers, particularly through large-scale tendering processes for essential medicines. Their purchasing decisions prioritize affordability, ensuring widespread access in public health programs, which drives demand for low-cost, high-volume penicillin APIs. Lastly, academic and clinical research institutions occasionally require small, highly purified batches of specialized penicillin derivatives for R&D purposes, representing a niche market focused on novel applications or resistance studies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandoz (Novartis), DSM Sinochem Pharmaceuticals (DSP), Aurobindo Pharma, GlaxoSmithKline (GSK), Pfizer CentreOne, Centrient Pharmaceuticals, Antibioticos, CSPC Pharmaceutical Group, Alkem Laboratories, Lupin, Dr. Reddy's Laboratories, Teva Pharmaceutical Industries, Hikma Pharmaceuticals, Zhejiang Hisun Pharmaceutical, Jiangsu Huayuan Pharmaceutical, NCPC, Qilu Pharmaceutical, Shandong Lukang Pharmaceutical, United Laboratories International Holdings, Shanghai Pharmaceutical Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Penicillin Active Pharmaceutical Ingredients Market Key Technology Landscape

The manufacturing of Penicillin Active Pharmaceutical Ingredients (APIs) is highly technology-intensive, primarily relying on advanced fermentation and subsequent chemical conversion processes. A critical technological focus is the optimization of fermentation yield. Manufacturers are extensively using molecular biology techniques and genetic engineering to enhance the productivity and robustness of Penicillium strains, enabling higher conversion rates of raw substrates into Penicillin G precursors. Advanced bioreactor design, coupled with real-time monitoring systems (using biosensors and sophisticated data analytics), allows for precise control over crucial variables like temperature, pH, and dissolved oxygen, maximizing efficiency while maintaining strict sterility protocols essential for large-scale biomanufacturing.

Beyond fermentation, a significant technological shift involves the transition toward enzymatic synthesis, particularly for the production of semi-synthetic penicillins like Amoxicillin. Enzymatic methods utilize immobilized enzymes (such as penicillin acylase) to catalyze the cleavage and subsequent coupling reactions under mild conditions. This approach offers several advantages over traditional chemical synthesis, including reduced use of harsh organic solvents, lower energy consumption, fewer by-products, and higher enantiomeric purity. The adoption of enzymatic pathways aligns strongly with global trends favoring green chemistry and sustainable manufacturing, enhancing both the regulatory compliance profile and the economic viability of API production.

Furthermore, advancements in crystallization and downstream processing technologies are vital for achieving the ultra-high purity required for injectable or highly sensitive formulations. Continuous flow chemistry is an emerging technology being explored by leading API manufacturers. Unlike traditional batch processing, continuous manufacturing allows for tighter control over reaction parameters, reducing processing time and enabling faster quality release, which significantly lowers operational costs and increases responsiveness to market demand. These technological investments are strategically aimed at overcoming manufacturing complexity and securing compliance in a highly scrutinized regulatory environment.

Regional Highlights

Regional dynamics heavily influence the Penicillin API market structure, reflecting a clear distinction between manufacturing hubs and consumption centers, coupled with varied regulatory landscapes and pricing structures. North America, while a major consumer, relies heavily on imports for volume, focusing domestically on R&D, advanced clinical trials, and the production of highly specialized or complex APIs. The region is characterized by high average selling prices due to stringent quality requirements (FDA mandates) and a demand for guaranteed, resilient supply chains, pushing buyers toward regulated and often higher-cost API suppliers.

Europe mirrors North America in its emphasis on strict quality control, enforced by the European Medicines Agency (EMA). It maintains a strong presence of established, legacy API producers (such as Sandoz and Centrient) that leverage historical expertise in fermentation technology. However, the region faces intense cost pressure from Asian competitors. European strategy often revolves around high-value specialized penicillins and combination products, alongside investments in sustainable, green manufacturing practices to differentiate their products.

Asia Pacific (APAC), particularly China and India, dominates the global supply chain, serving as the world's primary manufacturing hub for high-volume, generic Penicillin APIs. This dominance is underpinned by competitive operating costs, robust infrastructure for industrial fermentation, and substantial government support for the pharmaceutical export sector. The region not only caters to massive internal demand driven by large populations and growing healthcare access but also exports the vast majority of penicillin APIs worldwide, making its supply stability critical to global antibiotic security. Latin America, the Middle East, and Africa (LAMEA) represent high-growth consumption markets where affordability is a paramount concern, driving strong demand for cost-effective generic penicillin APIs.

- Asia Pacific (APAC): Leading global manufacturing region; characterized by large-scale production, cost competitiveness, and high export volumes (China, India). Rapidly increasing domestic consumption due to expanding healthcare infrastructure.

- North America: Major consumption market; high regulatory standards (FDA); focus on specialized, high-purity APIs; growing strategic interest in supply chain resilience and diversification away from single-source reliance.

- Europe: Established legacy manufacturers; strict quality compliance (EMA); strategic focus on sustainable manufacturing and high-value semi-synthetic derivatives; high cost of production necessitates differentiation.

- Latin America, Middle East, and Africa (LAMEA): Emerging high-growth markets; demand driven by increasing incidence of infectious diseases and a primary need for affordable, essential antibiotics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Penicillin Active Pharmaceutical Ingredients Market.- Sandoz (Novartis)

- DSM Sinochem Pharmaceuticals (DSP) – Now Centrient Pharmaceuticals

- Aurobindo Pharma

- GlaxoSmithKline (GSK)

- Pfizer CentreOne

- Centrient Pharmaceuticals

- Antibioticos (Owned by Fidia Farmaceutici)

- CSPC Pharmaceutical Group

- Alkem Laboratories

- Lupin

- Dr. Reddy's Laboratories

- Teva Pharmaceutical Industries

- Hikma Pharmaceuticals

- Zhejiang Hisun Pharmaceutical

- Jiangsu Huayuan Pharmaceutical

- NCPC (North China Pharmaceutical Co. Ltd)

- Qilu Pharmaceutical

- Shandong Lukang Pharmaceutical

- United Laboratories International Holdings

- Shanghai Pharmaceutical Group

Frequently Asked Questions

Analyze common user questions about the Penicillin Active Pharmaceutical Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the long-term demand for Penicillin APIs despite rising antibiotic resistance?

The primary long-term driver is the pervasive, sustained global burden of bacterial infections, combined with the classification of penicillins as low-cost, essential medicines by organizations like the WHO, ensuring their continued high-volume usage in public health systems globally, especially in developing economies.

How is the threat of Antimicrobial Resistance (AMR) impacting the production segmentation of Penicillin APIs?

AMR is shifting production focus away from basic Natural Penicillin APIs toward advanced Semi-Synthetic Penicillins and Combination APIs (e.g., those containing beta-lactamase inhibitors). These newer formulations retain efficacy against a wider spectrum of resistant strains, commanding higher investment and market value.

Which geographical region dominates the global manufacturing of Penicillin APIs, and why?

Asia Pacific, particularly China and India, dominates global manufacturing volume. This is due to established large-scale fermentation infrastructure, significant cost advantages in raw materials and labor, and strong government support for pharmaceutical exports, making them key global suppliers.

What technological advancements are key to improving the efficiency and environmental profile of API manufacturing?

Key technological advancements include the adoption of Enzymatic Synthesis (which is cleaner and more efficient than traditional chemical routes), optimization of fermentation using AI and genetic engineering, and the exploration of Continuous Flow Chemistry to enhance purity and reduce processing time.

What are the most significant regulatory challenges faced by manufacturers in the Penicillin API market?

The most significant challenge is strict regulatory compliance regarding cross-contamination, requiring dedicated, segregated manufacturing facilities for beta-lactam products to prevent contamination with non-beta-lactam drugs. Maintaining high GMP standards and documentation (DMFs) across multiple jurisdictions adds substantial complexity and cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager