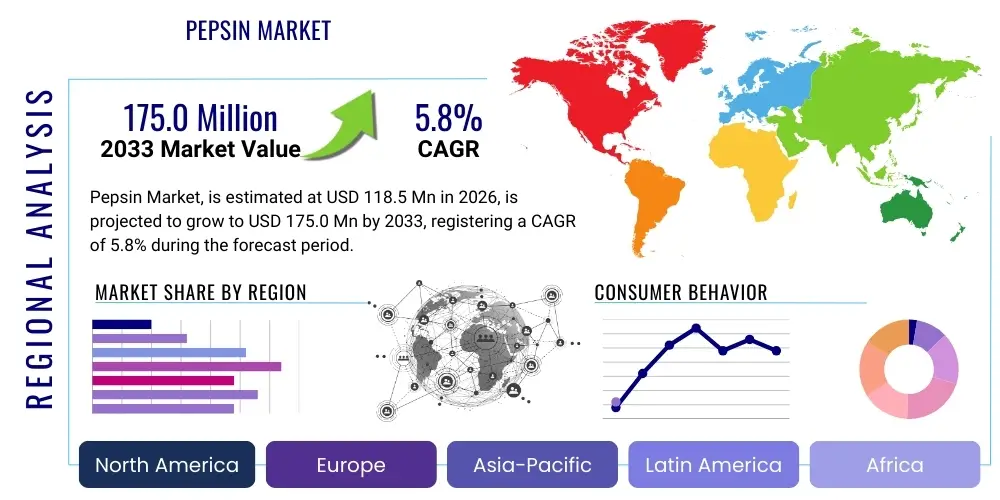

Pepsin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437000 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pepsin Market Size

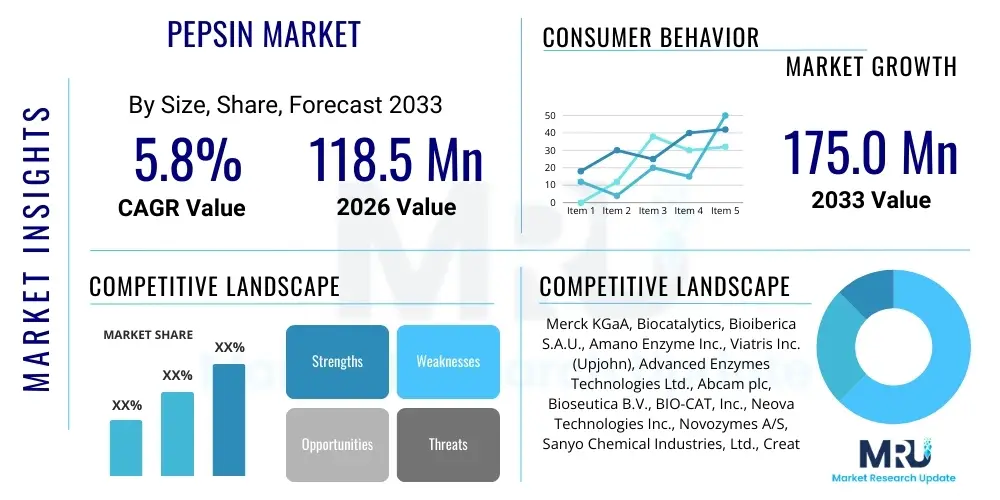

The Pepsin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 118.5 Million in 2026 and is projected to reach USD 175.0 Million by the end of the forecast period in 2033.

Pepsin Market introduction

Pepsin, an endopeptidase found in the gastric juice, plays a crucial role in protein digestion, breaking down proteins into smaller peptides. Industrially, it is primarily derived from the glandular layer of porcine stomachs, although bovine and microbial sources are also utilized. This enzyme exhibits optimal activity in highly acidic environments (pH 1.5 to 2.5) and is essential across several high-value industries. The increasing global focus on digestive health, coupled with advancements in the application of enzymes in food processing and pharmaceuticals, are fundamentally shaping the market trajectory.

The product description spans various grades, including NF (National Formulary) grade for pharmaceutical applications, FCC (Food Chemicals Codex) grade for food processing, and technical grades used in industrial processes such as leather manufacturing and rendering. Major applications of pepsin include its use as an active pharmaceutical ingredient (API) in digestive enzyme supplements, a curdling agent in cheese manufacturing, and a protein hydrolyzing agent in the preparation of specialized food ingredients like protein hydrolysates and peptones for microbial culture media. Its efficiency in hydrolyzing diverse protein sources makes it irreplaceable in specific industrial settings.

Key benefits driving the market include pepsin's high specificity and effectiveness in breaking down complex proteins, offering superior performance in digestive aids compared to general protease blends. Furthermore, the rising incidence of gastrointestinal disorders globally, particularly among aging populations, significantly fuels the demand for enzyme replacement therapy products. Regulatory support for natural and enzymatic ingredients in food processing further strengthens market growth. Driving factors also encompass the expansion of the livestock industry, ensuring a consistent raw material supply, and ongoing research into novel applications of pepsin in biotechnology and diagnostics.

Pepsin Market Executive Summary

The Pepsin Market is characterized by steady growth, primarily underpinned by robust demand from the nutraceutical and pharmaceutical sectors, which prioritize high-purity enzyme preparations for digestive health supplements. Business trends indicate a strong move toward vertical integration among key manufacturers to secure raw material sourcing (porcine and bovine mucosa) and enhance quality control, minimizing supply chain volatility. Innovation is focused on developing highly stable, immobilized pepsin variants suitable for continuous industrial processes, particularly in the production of specialized protein derivatives. Furthermore, strategic mergers and acquisitions targeting smaller, technology-focused enzyme developers are observed as established market players seek to diversify their source portfolio, including emerging microbial pepsin alternatives to address ethical and dietary constraints associated with animal-derived sources.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, driven by massive expansion in the regional livestock industry, facilitating raw material availability, and increasing consumer awareness regarding digestive wellness in economies like China and India. North America and Europe remain the dominant revenue generators, characterized by mature pharmaceutical regulatory landscapes and high per capita expenditure on dietary supplements. Regulatory scrutiny regarding the sourcing and ethical treatment of livestock, however, poses a minor constraint in Western markets, pushing regional trends towards standardized quality certifications and sustainable sourcing practices, thereby increasing operational costs.

Segment trends reveal that the application of pepsin in digestive enzyme supplements holds the largest market share, correlating with the global aging demographic and prevalent lifestyle-induced digestive issues. The porcine source segment continues to dominate due to superior yield and cost-effectiveness, although the bovine segment is gaining traction in regions with high bovine populations or where religious/cultural preferences restrict porcine product consumption. Technology segments show a clear shift towards immobilized enzyme systems, which offer enhanced reusability and operational stability, providing a competitive edge in large-scale food and technical applications, thereby optimizing the total cost of ownership for end-users.

AI Impact Analysis on Pepsin Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pepsin Market frequently revolve around optimizing enzyme production yield, accelerating novel enzyme discovery (specifically microbial sources), and improving supply chain resilience. Key concerns center on whether AI can enhance the extraction efficiency from animal mucosa, thereby reducing waste and costs, and how machine learning algorithms can predict and mitigate supply chain disruptions linked to livestock health and geopolitical trade policies. Users also express strong interest in AI's role in computational enzymology, expecting that AI-driven molecular modeling can quickly identify and optimize pepsin variants with superior thermal stability or altered substrate specificity, expanding their utility beyond current therapeutic and industrial limitations. The consensus expectation is that AI will not replace the core biochemical process but will profoundly enhance the precision, efficiency, and sustainability of the entire value chain, from raw material management to final product quality assessment and formulation optimization.

- AI-driven optimization of fermentation processes for microbial pepsin production, enhancing yield and purity.

- Predictive analytics utilized for raw material sourcing (porcine/bovine mucosa), forecasting supply availability and pricing fluctuations.

- Computational enzymology via machine learning models to design and engineer pepsin variants with improved stability and catalytic efficiency.

- Automated quality control systems using image recognition and data analysis to ensure standardized enzyme activity and contaminant screening.

- Supply chain risk management algorithms predicting logistical bottlenecks related to animal disease outbreaks or processing capacity constraints.

- Personalized medicine applications, where AI guides the optimal dosage and formulation of pepsin supplements based on individual patient digestive profiles.

DRO & Impact Forces Of Pepsin Market

The Pepsin Market is significantly influenced by a confluence of driving factors, regulatory constraints, and emerging strategic opportunities. Primary drivers include the escalating global demand for high-quality digestive aids and nutraceutical products, which is intrinsically linked to rising consumer health awareness and the global prevalence of poor dietary habits contributing to digestive disorders. Simultaneously, the expanding utilization of pepsin in the food and beverage industry for applications such as clarifying beverages, tenderizing meat, and producing specialized protein hydrolysates (peptones) sustains consistent industrial demand. These drivers collectively necessitate increased production efficiency and quality standards, placing pressure on manufacturers to innovate in extraction and purification techniques.

Restraints primarily encompass the reliance on animal sources (porcine and bovine), leading to ethical concerns, risks associated with animal diseases (such as Bovine Spongiform Encephalopathy, BSE), and the inherent supply chain vulnerability tied to livestock farming cycles and regional processing capacities. Furthermore, the stringent regulatory environment governing pharmaceutical and food-grade enzymes, particularly concerning enzyme activity verification and contaminant thresholds, imposes significant investment in quality assurance and certification processes. Price volatility of raw materials, influenced by global commodity markets and trade restrictions, also serves as a critical constraint impacting the profitability margins of smaller manufacturers.

Opportunities for market expansion are substantial, driven by the increasing exploration of microbial pepsin sources (e.g., fungal or bacterial), which offer a sustainable, vegetarian, and potentially more scalable alternative, bypassing the ethical and supply limitations of animal sources. Additionally, the growing application of pepsin in niche fields such as diagnostics, forensics, and laboratory research (e.g., tissue dissociation) represents untapped growth potential. Impact forces, ranging from regulatory shifts favoring natural ingredients to technological advancements in enzyme immobilization, mandate continuous adaptation. The collective effect of these forces shapes competitive strategies, emphasizing quality assurance, backward integration, and diversification of enzyme sources to achieve long-term market resilience and capitalize on digestive health trends globally.

Segmentation Analysis

The Pepsin Market is comprehensively segmented based on its source, primary application, and product grade, reflecting the diverse end-use requirements across various industries. Analysis of these segments is crucial for identifying targeted growth pockets and strategic investment areas. The source segmentation, dividing the market mainly into porcine and bovine origins, highlights cost and yield efficiencies, with porcine dominance due to higher natural concentration and ease of extraction, though bovine sources cater to specific dietary preferences and regional availability. Application segments illustrate the enzyme's versatility, ranging from high-value pharmaceutical use to large-volume food processing applications, each subject to distinct regulatory standards and market dynamics.

The segmentation by application reveals the highest growth potential in the nutraceutical sector, driven by self-care trends and preventative healthcare. Conversely, industrial applications, such as leather processing and animal feed production, represent stable, high-volume segments with lower profit margins but crucial operational stability. Further segmentation by grade (NF, FCC, Technical) dictates the required purity levels, directly influencing production costs and pricing strategies. Pharmaceutical and food grades demand intensive purification steps, adhering to pharmacopeial standards, while technical grades permit less stringent processing, catering to industrial bulk needs.

Understanding these segment dynamics is paramount for stakeholders. For instance, manufacturers focusing on the NF grade must prioritize compliance and rigorous testing, targeting pharmaceutical companies. In contrast, those focusing on the FCC grade must optimize bulk production and cost efficiency for the food and beverage sector. The ongoing efforts to develop robust, cost-effective microbial sources threaten to disrupt the traditional animal-based source segment, demanding strategic hedging and R&D investments from incumbent players to maintain market relevance and address future supply chain ethics.

- By Source:

- Porcine

- Bovine

- Microbial (Emerging)

- By Application:

- Digestive Aids and Nutraceuticals

- Food Processing (Meat Tenderizing, Cheese Manufacturing, Protein Hydrolysates)

- Pharmaceuticals (API and Excipients)

- Research and Diagnostics

- Animal Feed and Pet Food

- Other Industrial Uses (e.g., Leather)

- By Grade:

- National Formulary (NF) Grade

- Food Chemicals Codex (FCC) Grade

- Technical Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Pepsin Market

The Pepsin market value chain begins with the upstream segment, dominated by the raw material supply chain: the harvesting of porcine and bovine gastric mucosa, primarily from slaughterhouses. This stage is highly sensitive to livestock market volatility, disease outbreaks, and regional processing infrastructure. Efficient collection, rapid freezing, and timely transport of mucosa are critical to preserving enzyme integrity before extraction. Key upstream players include specialized meat processors and slaughterhouses that establish reliable partnerships with pepsin manufacturers, emphasizing traceability and hygienic handling standards to minimize contamination risks and ensure compliance with food and pharmaceutical safety regulations.

The midstream segment involves the core manufacturing process, encompassing extraction, purification, and formulation. Manufacturers employ acidic extraction followed by multiple purification steps, such as filtration, precipitation, and chromatography, to achieve the required NF or FCC grade purity. This stage is capital-intensive and requires high technical expertise to optimize yield and maintain consistent enzyme activity. Formulation involves converting the purified powder into standardized concentrations or specific dosage forms (e.g., tablets, capsules). Downstream analysis focuses on packaging, distribution, and sales channels. Distribution channels are varied, including direct sales to large pharmaceutical companies, specialized distributors catering to nutraceutical manufacturers, and bulk commodity traders handling technical-grade pepsin for industrial clients.

The distribution network is segmented into direct and indirect channels. Direct distribution is favored for large pharmaceutical clients demanding stringent quality audits and customized technical support, ensuring traceability from source to final drug product. Indirect distribution, leveraging specialized chemical and enzyme distributors, facilitates market penetration in fragmented industrial and smaller nutraceutical markets globally. Geographical proximity to key end-user markets significantly influences logistics costs. The integrity of the cold chain is paramount for maintaining enzyme stability throughout distribution, underscoring the necessity of reliable refrigerated transport and warehousing, which adds a layer of complexity and cost to the overall value chain management.

Pepsin Market Potential Customers

The core customer base for pepsin spans multiple high-growth and industrial sectors, reflecting the enzyme's proteolytic functionality. The largest group of potential customers comprises pharmaceutical and nutraceutical manufacturers specializing in digestive health products. These companies utilize pepsin as the primary active ingredient in enzyme replacement therapies, targeted at individuals suffering from hypochlorhydria or general protein digestion difficulties. The increasing awareness of gut health and the self-medication trend drive robust demand from this segment, making them the most profitable customer group requiring NF grade products with extensive documentation and regulatory compliance.

Another significant customer segment is the food and beverage processing industry. This includes dairy manufacturers using pepsin as a rennet substitute or supplementary enzyme for cheese production, meat processors utilizing it for tenderization, and specialized ingredient manufacturers producing protein hydrolysates (peptones) derived from soy, casein, or gelatin. These peptones are crucial ingredients in microbial culture media used in diagnostics and biotechnology research. Food-grade customers typically demand FCC grade pepsin, prioritizing cost-effectiveness, consistent performance, and ease of incorporation into high-volume manufacturing processes.

Furthermore, technical-grade pepsin finds steady demand among industrial end-users, notably in the leather industry for dehairing and bating processes, and in the production of specific chemicals and laboratory reagents. Research institutions and diagnostic laboratories also represent a specialized, albeit smaller, customer segment requiring high-purity, often customized, preparations of pepsin for biochemical assays, tissue digestion, and protein analysis. The diversification of potential customers across therapeutic, nutritive, and technical fields ensures market resilience against economic fluctuations in any single industrial segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 118.5 Million |

| Market Forecast in 2033 | USD 175.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Biocatalytics, Bioiberica S.A.U., Amano Enzyme Inc., Viatris Inc. (Upjohn), Advanced Enzymes Technologies Ltd., Abcam plc, Bioseutica B.V., BIO-CAT, Inc., Neova Technologies Inc., Novozymes A/S, Sanyo Chemical Industries, Ltd., Creative Enzymes, Zhongshan Chemical Industries Co., Ltd., BBI Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pepsin Market Key Technology Landscape

The technology landscape for the pepsin market is primarily centered on enhancing extraction efficiency, achieving higher purity levels required by regulatory bodies, and improving the stability and operational reusability of the enzyme. Conventional pepsin production relies on complex acid extraction and salting-out techniques from animal mucosa. However, continuous technological advancements focus on optimizing these downstream processes. Modern purification utilizes advanced chromatography techniques (ion exchange, affinity chromatography) and ultrafiltration systems to remove impurities, pathogens, and unwanted side components, ensuring the final product meets stringent NF and FCC requirements for trace element and microbial contamination.

A significant technological focus involves enzyme immobilization, which is pivotal for increasing the industrial utility of pepsin. Immobilization techniques, such as covalent binding or encapsulation onto inert carriers (e.g., silica, polymer resins), allow the enzyme to be reused in continuous flow reactors, drastically reducing overall operational costs in large-scale applications like peptide production or continuous milk clotting. This technology improves thermal and pH stability, extending the enzyme's effective lifespan outside its natural environment. Research is also heavily invested in optimizing freeze-drying and spray-drying processes to ensure the long-term storage stability and high activity retention of pepsin powder, a crucial factor for global distribution.

The emerging technological front includes the development of recombinant and microbial production systems. Genetic engineering allows for the heterologous expression of pepsin-like proteases in microorganisms (e.g., fungi or bacteria). This approach offers several advantages: eliminating the reliance on animal sourcing, enabling massive scalability, and facilitating enzyme engineering to tailor specific characteristics, such as enhanced acid stability or modified substrate recognition. Although microbial production still faces challenges related to yield optimization and cost parity with traditional animal sources, this technology represents the future direction for sustainable and ethical pepsin supply, potentially driving a paradigm shift in market dynamics over the long term.

Regional Highlights

- North America: This region holds a significant market share, driven by a highly developed nutraceutical industry and substantial consumer spending on dietary supplements. The US dominates the regional market due to advanced healthcare infrastructure, high regulatory compliance standards (FDA), and a large aging population proactively seeking digestive health solutions. The market here prioritizes NF-grade pepsin and innovative formulations, experiencing steady demand despite being a mature market.

- Europe: Characterized by stringent food safety regulations (EFSA) and high quality requirements, Europe is a major consumer, particularly in pharmaceuticals and specialized food ingredients (cheese manufacturing). Germany, France, and the UK are key contributors. The region shows a growing preference for non-animal sourced enzymes, fostering R&D into microbial alternatives to comply with evolving consumer ethics and dietary trends.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market. This growth is fueled by increasing livestock production (especially in China and India, ensuring raw material supply), rapid industrialization of the food processing sector, and rising disposable incomes leading to higher investment in healthcare and supplements. Favorable government policies supporting the pharmaceutical industry further accelerate market penetration, particularly for affordable digestive enzyme products.

- Latin America: This region presents moderate growth, largely driven by the expansion of the animal feed and industrial sectors (e.g., leather). Brazil and Mexico are primary revenue generators. Market growth is often volatile due to economic fluctuations and less stringent, though evolving, regulatory frameworks compared to Western markets, leading to demand predominantly for FCC and Technical grades.

- Middle East & Africa (MEA): MEA is currently the smallest market but shows potential, primarily in the pharmaceutical import sector and domestic animal feed production. Saudi Arabia and South Africa are key hubs. Market expansion is constrained by slower regulatory harmonization and reliance on imports for high-grade enzymes, though increasing health awareness is slowly boosting nutraceutical consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pepsin Market.- Merck KGaA

- Biocatalytics

- Bioiberica S.A.U.

- Amano Enzyme Inc.

- Viatris Inc. (Upjohn)

- Advanced Enzymes Technologies Ltd.

- Abcam plc

- Bioseutica B.V.

- BIO-CAT, Inc.

- Neova Technologies Inc.

- Novozymes A/S

- Sanyo Chemical Industries, Ltd.

- Creative Enzymes

- Zhongshan Chemical Industries Co., Ltd.

- BBI Solutions

- Sigma-Aldrich (Part of Merck KGaA)

- Jiangxi Golden Valley Pharmaceutical Co., Ltd.

- Enzyme Development Corporation (EDC)

- Chr. Hansen Holding A/S

- Rongsheng Biotechnology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Pepsin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary commercial source for industrial pepsin production?

The primary commercial source is porcine gastric mucosa, extracted from the stomach lining of pigs, due to its high concentration and established extraction efficiency. Bovine sources are also utilized to cater to specific religious or dietary constraints.

Which application segment drives the highest demand for high-purity pepsin?

The pharmaceutical and nutraceutical sectors, specifically for digestive enzyme supplements and enzyme replacement therapies, drive the highest demand for National Formulary (NF) grade, high-purity pepsin.

What are the key technological advancements influencing pepsin manufacturing?

Key technological advancements include enzyme immobilization techniques, which enhance pepsin stability and reusability in industrial reactors, and the development of cost-effective microbial (recombinant) sources as sustainable alternatives to animal extraction.

How do ethical concerns regarding animal sourcing affect the Pepsin Market?

Ethical concerns drive market restraint and encourage investment in microbial pepsin alternatives, particularly in Europe and North America, as consumers and manufacturers increasingly seek vegetarian or vegan-friendly enzyme sources.

What is the projected Compound Annual Growth Rate (CAGR) for the Pepsin Market through 2033?

The Pepsin Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven largely by sustained demand from the global digestive health industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pepsin Market Size Report By Type (High Activity (min. 1:10000), Low Activity (below 1:10000)), By Application (Pharmaceuticals, Inspection & Quarantine, Health Supplements, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pepsin Market Statistics 2025 Analysis By Application (Pharmaceuticals, Inspection & Quarantine, Health Supplements), By Type (High Activity (min. 1:10000), Low Activity (below 1:10000)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Pepsin Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pharmaceutical Grade, Food Grade, Industry Grade), By Application (Pharmaceuticals industry, Industry Area, Food and Feed, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager