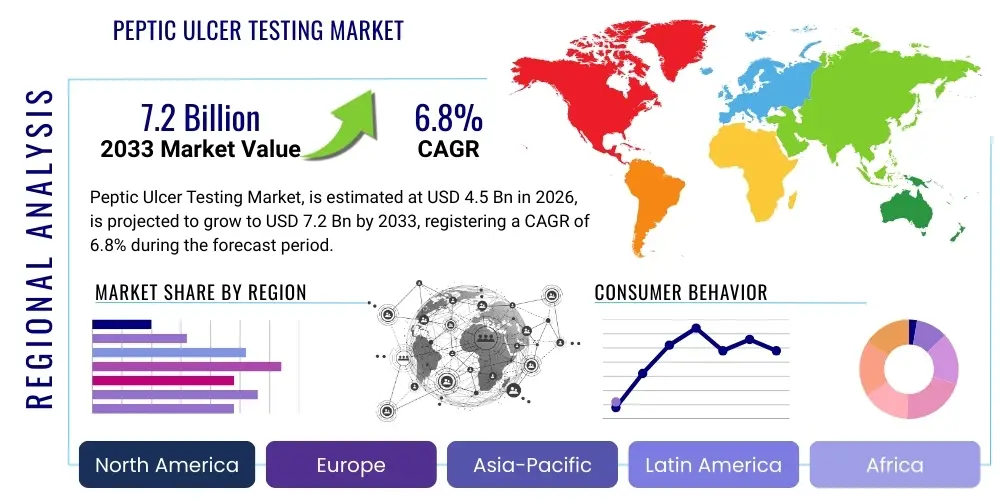

Peptic Ulcer Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437129 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Peptic Ulcer Testing Market Size

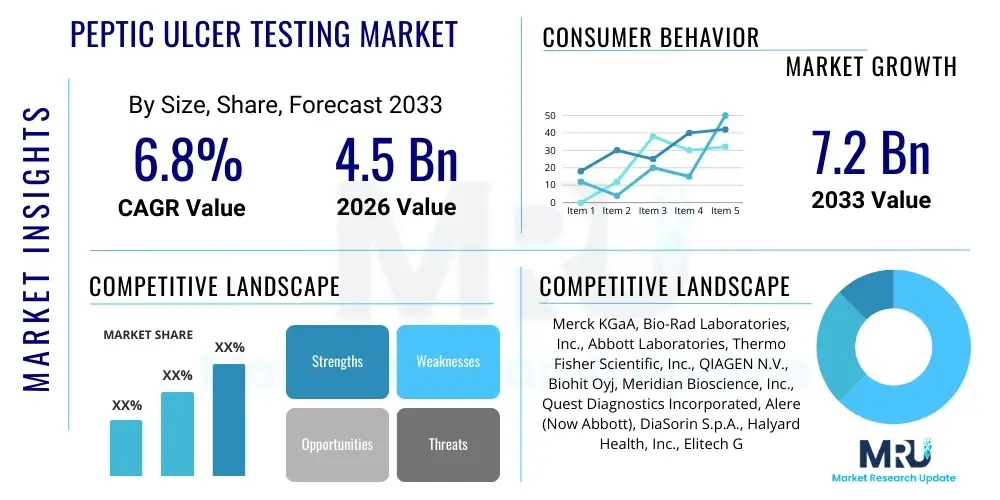

The Peptic Ulcer Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global prevalence of Helicobacter pylori (H. pylori) infection, which remains the primary etiological factor for peptic ulcers. Furthermore, advancements in non-invasive diagnostic methodologies, particularly the widespread adoption of Urea Breath Tests (UBT) and Stool Antigen Tests (SAT), are facilitating earlier diagnosis and treatment, thereby driving market expansion across developed and emerging economies. The shift toward point-of-care (PoC) testing solutions is also contributing significantly to volume growth by improving accessibility in remote or resource-limited settings.

Peptic Ulcer Testing Market introduction

The Peptic Ulcer Testing Market encompasses all diagnostic procedures and associated products utilized for the identification of peptic ulcers and their underlying causes, predominantly the presence of H. pylori bacteria. Peptic ulcers are open sores that develop on the inner lining of the stomach, the upper small intestine, or the esophagus, often leading to significant morbidity if left untreated. Testing methodologies range from invasive procedures like endoscopy with biopsy and subsequent histology or rapid urease tests (RUTs), to highly preferred non-invasive tests such as the Urea Breath Test (UBT), Stool Antigen Test (SAT), and serological antibody testing. The product description segment includes specialized reagents, testing kits, breath test analyzers, endoscopy equipment, and associated consumables used in clinical and laboratory environments.

Major applications of these testing modalities include initial diagnosis of symptomatic patients, screening of high-risk populations, and confirmation of eradication success following antibiotic therapy for H. pylori. The immediate benefits of accurate and timely peptic ulcer testing include reduced risk of severe complications like gastrointestinal bleeding or perforation, improved patient outcomes, and optimized treatment protocols, which collectively lower the overall burden on healthcare systems. Non-invasive methods offer additional benefits such as improved patient comfort and lower procedural costs compared to traditional endoscopy, accelerating their market penetration.

The market is primarily driven by several critical factors, including the global burden of H. pylori infection, increased awareness regarding the links between H. pylori and gastric carcinoma, and favorable clinical guidelines recommending eradication confirmation post-treatment. Technological advancements, specifically the development of highly sensitive and specific molecular diagnostics and integrated lab automation systems, are further propelling market growth. Furthermore, the growing elderly population, which is more susceptible to ulcerogenic factors like long-term non-steroidal anti-inflammatory drug (NSAID) use, contributes significantly to sustained demand for testing solutions.

Peptic Ulcer Testing Market Executive Summary

The Peptic Ulcer Testing Market is characterized by robust business trends focusing heavily on the development and commercialization of rapid, non-invasive, and cost-effective diagnostic tools. Key business strategies observed across major market players include strategic mergers and acquisitions aimed at consolidating technology portfolios, and extensive investment in R&D to enhance the sensitivity and specificity of H. pylori detection methods, especially PoC devices. The primary trend influencing growth is the migration of testing volume from traditional hospital settings to specialized diagnostic laboratories and decentralized care centers, driven by efficiency and reduced turnaround times. Furthermore, regulatory bodies are increasingly streamlining approval processes for advanced molecular testing kits, fostering quicker market entry for novel solutions.

Regional trends indicate that North America currently dominates the market share due to sophisticated healthcare infrastructure, high patient awareness, and favorable reimbursement policies for both invasive and non-invasive testing protocols. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion in APAC is attributable to the large, often densely populated patient pool, increasing healthcare expenditure, improving clinical standards, and substantial unmet medical needs in populous nations like China and India. Europe also holds a significant share, driven by stringent adherence to clinical guidelines emphasizing post-eradication confirmation and high adoption rates of advanced laboratory diagnostic instruments.

Segment trends highlight the dominance of the Non-Invasive Testing segment, specifically the Urea Breath Test (UBT) and Stool Antigen Test (SAT), owing to their ease of use, high accuracy, and lower risk profile compared to endoscopy. Among End Users, Diagnostic Laboratories represent the largest revenue contributor due to their centralized capacity for processing high volumes of tests and utilizing sophisticated automated systems. Conversely, the Point-of-Care/Clinics segment is expected to show the highest CAGR, spurred by the increasing availability of rapid diagnostic tests (RDTs) that enable immediate clinical decision-making. Continuous innovation in molecular diagnostics, particularly PCR-based tests for antibiotic resistance detection, is also shaping segment dynamics, offering precision-based treatment strategies.

AI Impact Analysis on Peptic Ulcer Testing Market

Common user questions regarding AI's influence in the Peptic Ulcer Testing Market center on its potential to revolutionize endoscopic diagnosis, enhance the accuracy of H. pylori detection, and predict treatment failures. Users frequently inquire about AI algorithms for automating the interpretation of complex diagnostic images, asking whether AI can significantly reduce the inter-observer variability inherent in histopathology and endoscopic grading systems. Concerns often revolve around data privacy and the integration complexity of AI models into existing laboratory information systems (LIS). The overarching expectation is that AI will streamline clinical workflows, offering faster, more consistent results, particularly in high-volume settings, and potentially enabling non-invasive diagnostics to achieve accuracy levels comparable to traditional invasive procedures, thereby contributing to precision medicine initiatives.

- AI algorithms enhance the analysis of endoscopic images, identifying subtle mucosal changes indicative of peptic ulcers and early gastric lesions.

- Integration of machine learning (ML) models improves the accuracy and speed of histopathological diagnosis for biopsy samples taken during endoscopy.

- Predictive analytics driven by AI assess patient data (symptoms, history, demographics) to stratify risk and prioritize high-risk patients for immediate testing.

- AI optimizes laboratory workflow management by automating quality control, monitoring reagent integrity, and scheduling high-throughput testing processes.

- Development of AI-powered digital health platforms aids in monitoring patient adherence to antibiotic regimens post-diagnosis, crucial for eradication success.

- AI models assist in analyzing molecular diagnostic data to predict antibiotic resistance patterns in H. pylori strains, guiding personalized treatment selection.

DRO & Impact Forces Of Peptic Ulcer Testing Market

The Peptic Ulcer Testing Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping its competitive landscape. Key drivers include the persistently high global prevalence of H. pylori infection, particularly in developing regions, coupled with strong clinical evidence linking the bacteria to chronic gastritis, peptic ulcer disease, and gastric cancers. Increased global health awareness campaigns promoting early screening, along with regulatory support for non-invasive testing methods, provide sustained momentum for market growth. Furthermore, the rising incidence of non-ulcer dyspepsia, which often mimics ulcer symptoms and necessitates differential diagnosis, also boosts the demand for comprehensive testing panels. These drivers collectively exert a significant positive impact force, ensuring consistent demand across various healthcare settings.

However, the market faces several notable restraints that impede faster adoption. The primary restraint is the relatively high cost associated with advanced diagnostic technologies, such as PCR-based molecular assays and sophisticated breath test analyzers, limiting their accessibility in low- and middle-income countries. Additionally, the prevalence of false negative and false positive results, particularly associated with serological tests that only indicate past exposure rather than active infection, creates diagnostic ambiguity and necessitates confirmatory testing, adding complexity and cost. Regulatory hurdles and time-consuming approval processes for novel diagnostic devices, especially those requiring validation for antibiotic resistance profiling, also slow down product commercialization. These restraints collectively create moderate friction against maximizing market potential.

Significant opportunities are emerging from the shift towards Point-of-Care (PoC) diagnostics, offering rapid results outside traditional laboratory settings, which is particularly beneficial for gastroenterology clinics and primary care physicians. Emerging markets in APAC and Latin America present vast untapped potential due to improving healthcare infrastructure and a massive, susceptible patient base. Moreover, continuous technological innovation focusing on multiplexing capabilities—testing for both H. pylori presence and associated antibiotic resistance mutations simultaneously—is creating new revenue streams and enhancing clinical utility. These opportunities provide a strong impetus for strategic investment and market expansion, potentially offsetting the existing restraints through improved efficiency and cost-effectiveness of next-generation testing platforms.

Segmentation Analysis

The Peptic Ulcer Testing Market is comprehensively segmented based on Test Type, End User, and Region, allowing for granular analysis of market penetration and growth trajectories across various clinical and geographical landscapes. The segmentation by Test Type differentiates between Invasive tests (primarily Endoscopy with Biopsy, Histology, and Rapid Urease Tests) and Non-Invasive tests (including Urea Breath Test, Stool Antigen Test, and Serology/Antibody tests). This differentiation is crucial as market trends show a definitive preference shift toward non-invasive methods due to patient comfort and reduced procedural risks. The End User segment categorizes consumption patterns across major healthcare providers, including Hospitals, Diagnostic Laboratories, Clinics/Gastroenterology Centers, and Ambulatory Surgical Centers (ASCs), reflecting the varied settings where peptic ulcer diagnosis and monitoring occur. Understanding these segments is vital for manufacturers to tailor product development and distribution strategies effectively.

- By Test Type

- Invasive Tests

- Endoscopy with Biopsy

- Rapid Urease Test (RUT)

- Histology

- Culture

- Non-Invasive Tests

- Urea Breath Test (UBT)

- Stool Antigen Test (SAT)

- Serology/Antibody Tests

- Molecular Diagnostics (PCR-based)

- Invasive Tests

- By End User

- Hospitals

- Diagnostic Laboratories

- Gastroenterology Clinics and Specialty Centers

- Ambulatory Surgical Centers (ASCs)

- Point-of-Care (PoC) Settings

- By Region

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (Japan, China, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Peptic Ulcer Testing Market

The value chain for the Peptic Ulcer Testing Market is complex, stretching from the procurement of highly specialized raw materials to the final delivery of diagnostic services to the end-user. The upstream activities involve the sourcing and manufacturing of critical components, such as radioisotopes (for UBT), high-purity chemical reagents (for SAT and RUT), and proprietary antibodies/antigens (for serology and immunoassay kits). Research and Development (R&D) plays a crucial role upstream, focusing on improving assay sensitivity, developing multi-target detection panels, and miniaturizing equipment for PoC applications. Suppliers of highly specialized instruments, such as mass spectrometers for UBT analysis and automated immunoassay platforms for high-throughput laboratory testing, maintain considerable leverage due to the specialized nature of these technologies and strict quality requirements mandated by regulatory bodies like the FDA and EMA. Efficiency in this phase directly impacts the final cost and reliability of the diagnostic solutions offered downstream.

Midstream activities encompass the manufacturing, quality control, and large-scale production of diagnostic kits and analyzers. This stage is dominated by large, established medical device and diagnostics companies that possess the infrastructure and regulatory compliance necessary for global distribution. Optimization of manufacturing processes to ensure scalability while maintaining stringent quality assurance standards is paramount. The distribution channel then bridges the gap between manufacturers and end-users. Distribution can be classified into direct and indirect channels. Direct distribution involves manufacturers selling directly to large hospital networks, reference laboratories, or government health programs, offering greater control over pricing and service provision. Indirect distribution relies on third-party medical distributors, wholesalers, and regional dealers, especially vital in fragmented or geographically challenging markets, providing localized support and faster inventory replenishment.

Downstream activities involve the execution of the test and the delivery of results to patients. End-users, including hospitals, diagnostic labs, and clinics, utilize these products to perform diagnoses. Diagnostic Laboratories represent a key downstream element due to their role in centralized, high-volume testing and their requirement for advanced automation systems. The final step involves the clinical consultation and treatment initiation based on the test results. The profitability across the chain is highly dependent on effective inventory management, minimizing waste of time-sensitive reagents, and optimizing reimbursement structures. The increasing trend towards non-invasive and rapid testing is pushing the value proposition further downstream, emphasizing speed and ease of use at the point of patient interaction.

Peptic Ulcer Testing Market Potential Customers

The primary purchasers and end-users of peptic ulcer testing products and services are diverse, ranging from large institutional buyers to specialized private practices. Hospitals, particularly those with dedicated gastroenterology departments and internal medicine units, represent a crucial segment of potential customers. Hospitals require a broad range of testing solutions, including invasive methods (endoscopy suites, histology labs) for complex cases and high-throughput non-invasive kits for screening and eradication confirmation. They procure large volumes of reagents, breath test consumables, and capital equipment, prioritizing reliability, integration capability with existing LIS, and comprehensive service contracts from suppliers.

Diagnostic Laboratories, including both central reference labs and independent private laboratories, constitute the largest volume consumers. These facilities specialize in processing massive numbers of non-invasive tests (UBT and SAT) referred by primary care physicians and specialists. Their purchasing decisions are driven primarily by factors such as automation capability, cost per test, efficiency, and the ability to integrate advanced molecular diagnostics for antibiotic resistance testing. They often prefer long-term supply agreements with manufacturers that can guarantee consistent supply and high analytical accuracy across different batches.

Gastroenterology Clinics and Specialty Centers are highly focused customers utilizing a mix of rapid urease tests for immediate diagnosis during endoscopy procedures and standardized non-invasive tests for follow-up. These specialized centers seek PoC solutions that deliver quick results, enabling immediate therapeutic decision-making during the patient visit. Finally, Ambulatory Surgical Centers (ASCs) that perform routine endoscopies, and governmental public health programs involved in large-scale screening initiatives in high-prevalence areas, also represent significant, high-volume potential customers for both consumables and specialized diagnostic equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Bio-Rad Laboratories, Inc., Abbott Laboratories, Thermo Fisher Scientific, Inc., QIAGEN N.V., Biohit Oyj, Meridian Bioscience, Inc., Quest Diagnostics Incorporated, Alere (Now Abbott), DiaSorin S.p.A., Halyard Health, Inc., Elitech Group, EKF Diagnostics Holdings plc, Beijing Wantai Biological Pharmacy Enterprise Co., Ltd., Sekisui Diagnostics, Ltd., F. Hoffmann-La Roche Ltd, Trinity Biotech plc, Tecan Group Ltd., Danaher Corporation (Beckman Coulter), Agilent Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peptic Ulcer Testing Market Key Technology Landscape

The technological landscape of the Peptic Ulcer Testing Market is rapidly evolving, moving away from subjective, manual methodologies toward highly automated and precise diagnostic platforms. One of the most significant advancements is the refinement of the Urea Breath Test (UBT), where sophisticated, compact mass spectrometers and infrared spectrophotometers are replacing older, bulky devices. These next-generation UBT analyzers offer enhanced throughput, higher sensitivity, and reduced operational complexity, making the test viable in smaller clinic settings. Furthermore, molecular diagnostics, specifically real-time Polymerase Chain Reaction (RT-PCR) assays, are becoming critical. These assays not only confirm the presence of H. pylori but also simultaneously detect genetic mutations associated with resistance to standard antibiotics like clarithromycin and metronidazole, providing invaluable information for tailoring effective treatment regimens and combating antimicrobial resistance.

Another crucial technological development involves the continuous improvement of enzyme immunoassays (EIAs) and immunochromatographic assays (ICAs) used in Stool Antigen Testing (SAT) and serological screening. Manufacturers are focused on integrating magnetic bead technology and microfluidics into these assay formats to reduce sample volume requirements, decrease preparation time, and increase overall assay precision. The development of lateral flow assays (LFAs) designed for point-of-care use has been instrumental in expanding testing access, particularly in primary care and resource-limited settings, offering results within minutes without requiring specialized laboratory infrastructure. These technological leaps are fundamentally changing clinical practice by enabling rapid, evidence-based diagnostic decisions immediately.

Furthermore, the integration of automation and digital platforms is transforming laboratory workflows. Fully automated immunoassay systems minimize human error and significantly increase the throughput capacity of diagnostic laboratories, essential for managing high-volume testing programs. These systems often include integrated barcoding, automated liquid handling, and seamless connectivity with Laboratory Information Management Systems (LIMS). This digital integration allows for remote monitoring of instrument performance and faster result reporting, accelerating the path from sample collection to clinical intervention. Future technological growth is heavily focused on developing multi-omic approaches that combine bacterial detection with host genetic markers to predict disease severity and response to treatment, pushing the market toward true precision diagnostic solutions.

Regional Highlights

- North America: This region holds the largest market share, driven by advanced healthcare infrastructure, high awareness regarding gastrointestinal health, and early adoption of molecular diagnostics and automated laboratory testing solutions. Favorable reimbursement policies, particularly in the U.S., cover both invasive and non-invasive testing, encouraging clinicians to follow standardized guidelines for H. pylori management and eradication confirmation. Major market players are concentrated here, facilitating continuous technological innovation and product launches tailored to meet stringent regulatory standards.

- Europe: Europe is a mature market characterized by robust clinical guidelines issued by bodies like the European Helicobacter and Microbiota Study Group (EHMSG), which mandates confirmation of eradication post-treatment. Western European countries, such as Germany, France, and the UK, exhibit high adoption rates for UBT and SAT, supported by well-established public health systems. The focus is increasingly shifting towards integrating molecular testing to address rising antibiotic resistance concerns across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily due to the significantly high prevalence of H. pylori infection, vast patient populations, and rapidly improving healthcare access and expenditure, particularly in emerging economies like China and India. The market growth here is fueled by a strong demand for cost-effective, rapid diagnostic tests (RDTs) suitable for widespread screening programs and decentralized testing in rural areas, leading to massive volume growth for non-invasive test kits.

- Latin America (LATAM): The LATAM market is expanding steadily, motivated by increasing healthcare investments and rising awareness of gastric cancer risk associated with H. pylori. Brazil and Mexico are leading the adoption of non-invasive tests, though economic instability and varying regulatory environments pose moderate challenges to rapid adoption of high-cost advanced diagnostics.

- Middle East & Africa (MEA): This region offers nascent opportunities, particularly in the Gulf Cooperation Council (GCC) countries which possess substantial healthcare funding. Market penetration remains low across much of Africa, but concerted efforts by NGOs and public health initiatives to control infectious diseases are slowly increasing the demand for affordable diagnostic solutions, focusing primarily on basic SAT and serological tests.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peptic Ulcer Testing Market.- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Biohit Oyj

- Meridian Bioscience, Inc.

- Quest Diagnostics Incorporated

- DiaSorin S.p.A.

- Halyard Health, Inc.

- Elitech Group

- EKF Diagnostics Holdings plc

- Beijing Wantai Biological Pharmacy Enterprise Co., Ltd.

- Sekisui Diagnostics, Ltd.

- F. Hoffmann-La Roche Ltd

- Trinity Biotech plc

- Tecan Group Ltd.

- Danaher Corporation (Beckman Coulter)

- Agilent Technologies

- Becton, Dickinson and Company (BD)

Frequently Asked Questions

Analyze common user questions about the Peptic Ulcer Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Peptic Ulcer Testing Market?

The primary factor driving market growth is the high global prevalence of Helicobacter pylori infection, which necessitates widespread screening and confirmation of eradication using highly sensitive non-invasive tests like the Urea Breath Test (UBT) and Stool Antigen Test (SAT).

Which non-invasive testing method is projected to hold the largest market share?

The Urea Breath Test (UBT) segment is projected to hold the largest market share among non-invasive methods due to its high accuracy in detecting active H. pylori infection both initially and post-treatment, supported by technological advancements in compact analyzer devices.

How is antibiotic resistance impacting the demand for peptic ulcer diagnostics?

Rising antibiotic resistance in H. pylori strains is significantly increasing the demand for advanced molecular diagnostics (PCR-based tests) that can rapidly identify specific genetic mutations, enabling clinicians to prescribe targeted, effective second-line therapies.

Which geographical region is expected to show the fastest growth rate (CAGR)?

The Asia Pacific (APAC) region is expected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to large susceptible patient populations, improving healthcare infrastructure, and rising public and private expenditure on advanced diagnostic services.

What role does Point-of-Care (PoC) testing play in the market?

PoC testing is crucial for market decentralization, enabling rapid diagnostic results in clinics and specialty centers using tests like rapid urease tests (RUTs) and advanced Stool Antigen Test kits, thus reducing diagnostic turnaround time and facilitating immediate patient management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager