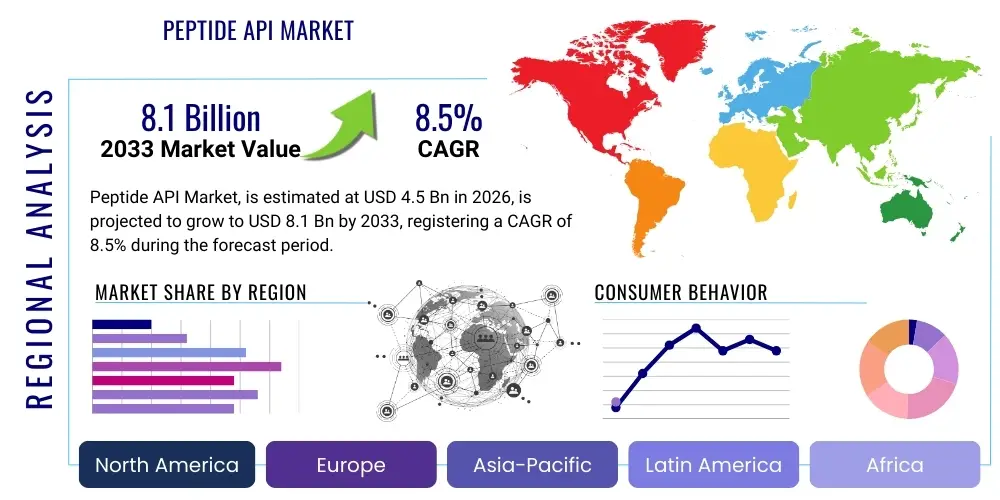

Peptide API Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439012 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Peptide API Market Size

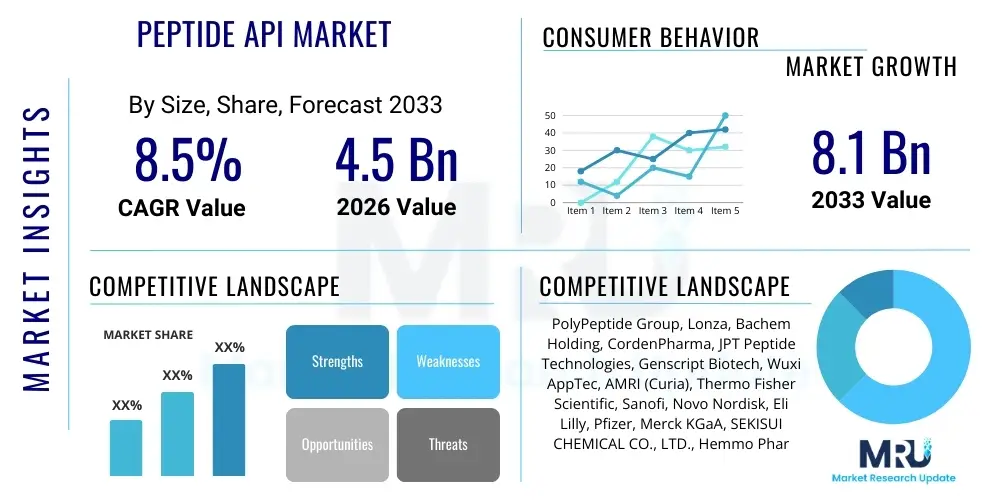

The Peptide API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Peptide API Market introduction

The Peptide API (Active Pharmaceutical Ingredient) Market encompasses the manufacturing and supply of biologically active peptide molecules utilized as core therapeutic agents in pharmaceutical formulations. Peptides, characterized by their short chains of amino acids linked by peptide bonds, have gained prominence due to their high specificity, low toxicity profile, and inherent ability to modulate complex biological pathways. The demand is primarily driven by the escalating global incidence of chronic diseases, particularly diabetes, cancer, and cardiovascular disorders, where peptide-based therapies such as insulin, GLP-1 agonists, and complex oncology drugs are standard treatment modalities. The market structure involves highly specialized contract development and manufacturing organizations (CDMOs) and large pharmaceutical companies that synthesize these complex molecules using advanced chemical and recombinant technologies.

The product scope within the Peptide API market is vast, ranging from established blockbuster drugs to novel research peptides. Key products include somatostatin analogs, calcitonin, and highly complex cyclic peptides. These APIs serve as essential components in injectable drugs, transdermal patches, and novel oral delivery systems. The manufacturing process, often involving Solid-Phase Peptide Synthesis (SPPS) or advanced recombinant DNA technology, is technically demanding, requiring stringent quality control standards (cGMP) to ensure purity, sequence fidelity, and stability, which are critical for therapeutic efficacy and patient safety. Furthermore, the market benefits from continuous innovation in peptide chemistry aimed at improving pharmacokinetic properties, such as half-life extension and enhanced bioavailability.

Major applications for Peptide APIs are predominantly centered around chronic disease management. In oncology, peptides are used for targeted drug delivery and diagnostic imaging. In metabolism, GLP-1 analogs have revolutionized diabetes and obesity treatment. Key benefits derived from peptide therapies include reduced immunogenicity compared to larger protein biologics, high target selectivity minimizing off-target effects, and relatively rapid clearance profiles, which is advantageous in certain treatment scenarios. Driving factors include significant advancements in automated synthesis techniques, the expiration of patents for established peptide drugs leading to generic opportunities, and substantial investment in biotech R&D focused on discovering novel peptide drug candidates with enhanced therapeutic indices.

Peptide API Market Executive Summary

The global Peptide API market is characterized by robust growth, primarily fueled by the accelerating pipeline of novel peptide therapeutics and the increasing adoption of contract manufacturing services. Business trends indicate a strong shift towards advanced synthesis technologies, particularly hybrid approaches combining the speed of SPPS with the efficiency of Liquid-Phase Peptide Synthesis (LPPS) to handle multi-kilogram scale requirements. Consolidation among CDMOs specializing in complex peptide synthesis is a prevailing trend, aiming to create integrated supply chains that offer end-to-end services from preclinical development to commercial manufacturing. Furthermore, regulatory frameworks across major economies are tightening requirements for impurity profiling and enantiomeric purity, pushing manufacturers to invest heavily in advanced analytical instrumentation and quality management systems, thereby elevating the barriers to entry for new competitors and reinforcing the position of established cGMP-compliant suppliers.

Regionally, North America maintains the dominant market share, attributed to its high concentration of major pharmaceutical companies, substantial R&D expenditure, and a well-established regulatory environment facilitating rapid drug approval and commercialization. However, the Asia Pacific (APAC) region is poised to exhibit the highest CAGR during the forecast period. This accelerated growth is driven by the expansion of the biotech sector in countries like China and India, lower operational costs attracting manufacturing outsourcing, and a rapidly expanding patient pool demanding advanced therapies. Europe remains a key innovator, benefiting from strong academic research institutions and government initiatives supporting biotechnology, particularly in Germany, Switzerland, and the UK, which are major hubs for specialized CDMOs focused on complex, high-value peptides.

Segmentation trends highlight the increasing dominance of Solid Phase Peptide Synthesis (SPPS) due to its reliability and suitability for creating complex, large peptide sequences, although recombinant technology is gaining traction for very large-scale, cost-effective production of well-established peptide biologics like insulin analogs. In terms of application, the metabolic disorders segment, led by demand for anti-diabetic and anti-obesity drugs, currently holds the largest market share. However, the oncology segment is anticipated to witness the fastest growth, driven by innovative peptide-receptor radionuclide therapies (PRRT) and peptide-drug conjugates (PDCs). The market is also seeing a notable trend toward the outsourcing model, with pharmaceutical and biotechnology companies increasingly relying on CDMOs to manage the complexities of cGMP API production, focusing their internal resources on discovery and clinical development.

AI Impact Analysis on Peptide API Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Peptide API market center around three primary themes: how AI can accelerate novel peptide discovery, how it can optimize synthesis processes, and what implications it holds for manufacturing efficiency and cost reduction. Users frequently ask if AI can bypass traditional screening methods, predict peptide toxicity or stability issues early in the R&D phase, and whether machine learning algorithms are being applied to large-scale cGMP manufacturing to reduce batch failures and improve yield. The synthesized concerns revolve around the integration challenges of large-scale datasets (chemogenomics, proteomics) and the validation of AI-predicted synthesis routes in highly regulated pharmaceutical environments. Users anticipate that AI integration will lead to a faster, more targeted drug pipeline and a significant reduction in the cost and time required for process optimization and scale-up, fundamentally changing the competitive landscape by enabling the rapid design of highly potent and stable peptide sequences.

- AI accelerates the identification of novel peptide drug candidates by analyzing vast chemical libraries and biological activity data, prioritizing sequences with optimal therapeutic potential.

- Machine learning algorithms predict potential manufacturing bottlenecks and purity challenges (e.g., side reactions, epimerization) before laboratory synthesis begins, reducing optimization cycles.

- AI enhances process control in Solid Phase Peptide Synthesis (SPPS) and purification by analyzing real-time sensor data, ensuring tighter cGMP compliance and higher batch consistency.

- Computational models are utilized to design peptides with improved pharmacokinetics (e.g., extended half-life, oral bioavailability) and reduced immunogenicity.

- Predictive analytics aid in supply chain management for complex raw materials (amino acids, resins, solvents), forecasting demand and ensuring timely procurement to maintain continuous API production.

DRO & Impact Forces Of Peptide API Market

The Peptide API market's trajectory is determined by a powerful interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the demonstrable clinical efficacy and high specificity of peptide therapeutics, which continues to drive investment into R&D, especially in chronic disease areas like diabetes, oncology, and inflammatory disorders. Furthermore, the rising global prevalence of chronic illnesses necessitates continuous supply of established peptide drugs, such as insulin and liraglutide, maintaining a strong baseline demand. Regulatory support for expedited approval pathways for innovative peptide drugs also acts as a significant catalyst, encouraging pharmaceutical companies to advance their peptide pipelines rapidly. Conversely, the market faces significant restraints, chiefly the complexity and high cost associated with peptide synthesis, particularly for complex sequences requiring multiple coupling steps and sophisticated purification protocols. The inherent physical and chemical instability of certain peptides, which demands specialized formulation and cold-chain logistics, also limits broader market penetration, particularly in developing regions.

Opportunities for growth are abundant, stemming primarily from advancements in peptide delivery technologies, such as the development of stable oral peptides and non-invasive administration routes that enhance patient compliance and expand market reach beyond injectable formats. The expiration of key peptide drug patents presents a substantial opportunity for generic API manufacturers (Peptide Generics) to enter the market with cost-effective alternatives, increasing accessibility. Moreover, the therapeutic potential of hybrid molecules, such as peptide-drug conjugates (PDCs) and multi-domain peptides, opens new avenues in precision medicine and targeted therapy. Strategic partnerships between large pharmaceutical entities and specialized CDMOs focusing on complex cGMP peptide manufacturing also streamline the development process and accelerate time-to-market, capitalizing on specialized expertise and reducing internal capital expenditure.

Impact forces currently shaping the market include rapidly evolving regulatory scrutiny over impurity profiling, which requires manufacturers to adopt ultra-sensitive analytical methods, increasing operational overheads but ensuring product quality. Technological disruption from automation and continuous flow chemistry is gradually reducing synthesis time and improving resource efficiency. The competitive intensity among CDMOs specializing in peptides is high, driving pricing pressure but simultaneously fostering innovation in synthesis platforms. The most critical external impact force is the dynamic nature of pharmaceutical R&D spending; sustained high levels of investment in biotechnology, especially in personalized medicine, translate directly into robust demand for custom and specialized Peptide APIs, whereas global economic volatility can temper these large-scale R&D budgets, affecting long-term project viability and procurement volumes.

Segmentation Analysis

The Peptide API market is analyzed through multifaceted segmentation based on type, synthesis technology, application, and end-user, providing a granular view of market dynamics and growth pockets. The segmentation highlights the technical differentiation required for API production, ranging from established generic processes to highly specialized synthesis methods for novel, complex sequences. The technological segment is pivotal, as the choice between chemical synthesis (SPPS, LPPS) and recombinant technology directly impacts production scalability, cost-effectiveness, and purity profile, influencing manufacturer selection and market competitiveness. Understanding these segments is crucial for stakeholders to tailor their product offerings, align manufacturing capabilities with specific therapeutic needs, and optimize market entry strategies, especially concerning the regulatory landscape surrounding generic versus innovative APIs.

The market structure is heavily influenced by the end-user segment, where pharmaceutical companies and Contract Development and Manufacturing Organizations (CDMOs) dominate. CDMOs often serve as the primary engine for market growth by offering specialized, large-scale cGMP manufacturing services that few biotech startups or even major pharma companies choose to maintain internally, reflecting the high capital and expertise intensity required for peptide production. Furthermore, the application segment dictates the immediate demand drivers, with metabolic disorders historically dominating due to high volume requirements for drugs like insulin and GLP-1 agonists, while oncology is forecasted to be the fastest-growing sector driven by pipeline innovation and high-value, low-volume specialized therapies. This diversification ensures market resilience, balancing high-volume staple production with high-value niche opportunities, making the overall market attractive for specialized suppliers.

- By Type:

- Innovative Peptide APIs

- Generic Peptide APIs

- By Synthesis Technology:

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Phase Peptide Synthesis (HPPS)

- Recombinant Technology

- By Application:

- Metabolic Disorders (e.g., Diabetes, Obesity)

- Oncology

- Cardiovascular Disorders

- Infectious Diseases

- Gastrointestinal Disorders

- Central Nervous System (CNS) Disorders

- Others (e.g., Diagnostics, Cosmetics)

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs/CDMOs)

- Academic & Research Institutes

Value Chain Analysis For Peptide API Market

The Peptide API market value chain is intricate, commencing with the highly specialized procurement of raw materials and culminating in the distribution of the finished API to drug formulators. The upstream segment is defined by the acquisition and quality control of high-purity, optically active amino acids, resins (such as Wang or Rink amide resins for SPPS), and specialty solvents (like DMF or DCM). Suppliers in this upstream tier must meet exacting pharmaceutical standards, as the quality and purity of these starting materials directly determine the efficiency of synthesis and the final API quality. Given the chiral nature of amino acids, quality variance at this stage is a critical risk factor. Upstream activities also include the initial phase of process development and optimization, often performed collaboratively between the API manufacturer and the originator company to define the most cost-effective and scalable synthesis route while adhering to cGMP protocols and ensuring minimal impurity formation during the coupling and cleavage steps.

The core manufacturing stage, involving the actual synthesis of the peptide chain, is the most capital-intensive and technically challenging part of the value chain. This stage is dominated by specialized CDMOs that manage complex chemical synthesis (SPPS being predominant for clinical candidates) or sophisticated fermentation (for recombinant peptides). Following synthesis, the critical downstream activities include extensive purification using High-Performance Liquid Chromatography (HPLC), lyophilization (freeze-drying) to ensure stability, and rigorous analytical testing to confirm structure, purity, and freedom from contaminants. Regulatory compliance, documentation, and quality assurance are integral to this stage, verifying that the Peptide API meets pharmacopeial standards (e.g., USP, EP).

Distribution channels for Peptide APIs are typically direct and highly secured due to the high value and often temperature-sensitive nature of the product. Direct channels involve the API manufacturer (or CDMO) shipping the material directly to the pharmaceutical or biotechnology company responsible for the final drug product formulation (downstream customers). This direct model allows for tight control over cold-chain logistics and facilitates seamless transfer of critical quality data and regulatory documentation. Indirect channels, although less common for commercial quantities of highly specialized APIs, may involve third-party logistics providers or specialized distributors, particularly when serving research institutes or smaller formulation plants in diverse geographic locations. The emphasis across all distribution methods is on maintaining strict cGMP adherence and ensuring the integrity and stability of the API until it reaches the formulator’s warehouse, often involving strict security protocols to prevent diversion or counterfeiting of these high-value drug precursors.

Peptide API Market Potential Customers

The primary consumers and buyers of Peptide APIs are concentrated within the global pharmaceutical ecosystem, specifically large multinational pharmaceutical corporations, specialized biotechnology companies, and the growing segment of Contract Development and Manufacturing Organizations (CDMOs). Large pharmaceutical companies require Peptide APIs, often in multi-ton volumes, for their established blockbuster drugs such as insulin analogs and GLP-1 receptor agonists, making them critical high-volume customers. Their purchasing decisions are driven primarily by reliability of supply, competitive pricing for generic compounds, and proven regulatory compliance (FDA, EMA) of the API manufacturer. Biotechnology companies, typically involved in developing novel peptide therapeutics, often require smaller, highly complex custom synthesis batches for clinical trials, valuing innovation, technical expertise in challenging chemistry, and confidentiality from their API suppliers.

A crucial segment of potential customers is the CDMO sector itself. Many CDMOs operate on a tiered service model; while some specialize in formulation and fill-finish, they may outsource the core API synthesis of highly specialized peptides to other, larger peptide-focused CDMOs or specialized API producers. This creates a B2B customer dynamic within the manufacturing landscape, where technical capability, scalability, and adherence to specific project timelines dictate purchasing choices. Furthermore, the academic and research community, including university core facilities and government-funded institutes, represents a consistent, though lower-volume, customer base for research-grade and preclinical Peptide APIs, prioritizing speed and flexibility in small-scale custom orders to support basic research and early drug discovery efforts.

In the context of generic APIs, potential customers include companies focused purely on generic drug manufacturing aiming to quickly capture market share after patent expiry. These buyers are acutely focused on cost optimization and proof of bioequivalence (BE) and require API sources that can withstand rigorous regulatory review for Abbreviated New Drug Applications (ANDAs). Overall, the buying behavior across the customer spectrum is unified by the non-negotiable requirement for Current Good Manufacturing Practices (cGMP) documentation and traceable supply chains, reflecting the critical nature of APIs in human therapeutics. Supplier selection involves extensive auditing, risk assessment, and long-term partnership considerations, moving beyond mere transactional procurement to strategic collaboration focused on quality and regulatory assurance throughout the product lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PolyPeptide Group, Lonza, Bachem Holding, CordenPharma, JPT Peptide Technologies, Genscript Biotech, Wuxi AppTec, AMRI (Curia), Thermo Fisher Scientific, Sanofi, Novo Nordisk, Eli Lilly, Pfizer, Merck KGaA, SEKISUI CHEMICAL CO., LTD., Hemmo Pharmaceuticals, Pepscan, AmbioPharm, AnaSpec, Debiopharm. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peptide API Market Key Technology Landscape

The technological landscape of the Peptide API market is dominated by methods aimed at improving purity, yield, and scalability, addressing the inherent complexity of synthesizing long, structurally diverse peptide chains. Solid Phase Peptide Synthesis (SPPS) remains the foundational and most widely adopted technology, particularly for producing clinical-grade and innovative small to mid-sized peptides. SPPS relies on anchoring the C-terminus of the peptide to an insoluble resin, allowing for sequential amino acid addition, simplified washing, and purification steps. Recent innovations in SPPS focus on automated synthesizers, microwave-assisted synthesis to accelerate reaction kinetics, and optimized protecting group strategies (e.g., Fmoc/tBu chemistry) to minimize side product formation and maximize coupling efficiency, thereby reducing the dependency on extensive downstream purification and enhancing overall batch quality.

In contrast to the batch-centric nature of SPPS, Liquid Phase Peptide Synthesis (LPPS) and emerging Hybrid approaches (HPPS) are essential for large-scale, cost-effective production, often employed for generic APIs or shorter peptide sequences requiring multi-kilogram volumes. LPPS involves solution-phase chemistry, demanding highly efficient separation techniques after each coupling step but offering superior solvent recovery and handling larger reaction volumes. Hybrid methods strategically combine the benefits of both SPPS and LPPS, using solid-phase synthesis for complex fragments and then coupling these fragments in solution (fragment condensation). Continuous flow chemistry is an emerging disruptive technology offering unprecedented control over reaction temperature and mixing, promising enhanced scalability, reproducibility, and safety, potentially transforming the manufacturing paradigm for high-volume peptide APIs by shifting from batch processing to continuous operation.

Recombinant technology represents another critical pillar, particularly for very long or high-volume peptides like human insulin and its analogs. This technology utilizes genetically engineered host systems (e.g., E. coli or yeast) to express the peptide sequence biologically, which is often far more cost-efficient and environmentally friendly for large-scale production compared to chemical synthesis, provided the peptide structure can be successfully expressed and folded correctly. Furthermore, the purification technologies deployed are equally critical; chromatographic techniques, especially preparative Reverse-Phase High-Performance Liquid Chromatography (RP-HPLC), are non-negotiable for achieving the high purity levels required (typically >98%) for injectable pharmaceuticals. The market is witnessing increased adoption of large-scale preparative chromatography columns and advanced TFF (Tangential Flow Filtration) systems to handle the growing throughput demands while maintaining stringent quality and regulatory standards, reflecting the market’s pivot towards mass production of specialized therapeutic agents.

Regional Highlights

Geographic market dynamics reflect varying levels of R&D investment, regulatory maturity, and manufacturing capacity across key regions. These regional differences dictate where innovation originates, where manufacturing capacity is concentrated, and where major growth opportunities lie, influencing global supply chains for Peptide APIs.

- North America (Dominance in R&D and Consumption): This region, particularly the United States, holds the largest market share due to the presence of global pharmaceutical headquarters, extensive investment in biotechnology research, and strong government funding for drug discovery. High per capita healthcare expenditure and a robust framework for clinical trials drive significant and continuous demand for innovative Peptide APIs. The market is characterized by high price realization for novel therapeutics, fueling continuous R&D expenditure and maintaining market leadership in advanced therapeutic development, especially in oncology and metabolic disorders.

- Europe (Center for Specialized Manufacturing): Europe is a vital hub for specialized Peptide API manufacturing, with Switzerland, Germany, and the UK hosting major specialized CDMOs and large chemical companies renowned for complex peptide synthesis capabilities. The European Medicines Agency (EMA) provides a standardized regulatory environment, facilitating market access. The region excels in high-purity, low-volume, specialized APIs required for early-stage clinical trials and orphan drugs, capitalizing on decades of expertise in complex organic chemistry and cGMP compliance, driving innovation in synthesis techniques.

- Asia Pacific (APAC) (Fastest Growth and Manufacturing Hub): APAC is projected to experience the highest growth rate due to its expanding manufacturing capabilities, particularly in China and India. These countries offer competitive operational costs, attracting outsourcing from Western pharmaceutical companies looking to reduce overheads in generic and large-volume API production. Furthermore, improving regulatory standards, increasing domestic R&D investment, and a growing patient base seeking modern peptide therapies contribute significantly to the region's market expansion. Japan remains a strong consumer market, focusing on advanced R&D and high-quality imports.

- Latin America (Emerging Market Potential): Latin America represents an emerging market for Peptide APIs, driven by increasing healthcare access and improving economic conditions in countries such as Brazil and Mexico. The demand is currently focused on generic, established peptide APIs. Local manufacturing capacity is developing, but the region remains largely reliant on imports from North America and APAC, focusing primarily on local drug formulation and distribution, indicating long-term potential for API manufacturing investment.

- Middle East and Africa (MEA) (Infrastructure Development): The MEA region is characterized by substantial infrastructure investments in healthcare, particularly in the Gulf Cooperation Council (GCC) countries. While currently a minor market, the development of regional pharmaceutical industries and efforts to localize drug manufacturing, supported by favorable government policies, suggest a slow but steady increase in demand for both innovative and generic Peptide APIs over the forecast period, focusing on essential chronic disease medications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peptide API Market.- PolyPeptide Group

- Lonza

- Bachem Holding

- CordenPharma

- JPT Peptide Technologies

- Genscript Biotech

- Wuxi AppTec

- AMRI (Curia)

- Thermo Fisher Scientific

- Sanofi

- Novo Nordisk

- Eli Lilly

- Pfizer

- Merck KGaA

- SEKISUI CHEMICAL CO., LTD.

- Hemmo Pharmaceuticals

- Pepscan

- AmbioPharm

- AnaSpec

- Debiopharm

Frequently Asked Questions

Analyze common user questions about the Peptide API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What synthesis technologies dominate the large-scale production of Peptide APIs?

The large-scale production of Peptide APIs is predominantly dominated by Solid Phase Peptide Synthesis (SPPS) for complex, high-purity sequences, and Recombinant DNA Technology for very large volume, established peptides like insulin analogs. Hybrid Phase Peptide Synthesis (HPPS), which combines SPPS and Liquid Phase Peptide Synthesis (LPPS) techniques, is increasingly utilized to optimize scalability and cost efficiency for commercial quantities.

Which therapeutic area drives the highest demand volume in the Peptide API market?

The therapeutic area driving the highest demand volume is Metabolic Disorders, specifically the treatment of Type 2 diabetes and obesity. This segment requires vast quantities of APIs such as insulin, GLP-1 receptor agonists (e.g., liraglutide, semaglutide), and related analogs, necessitating large-scale, cost-effective manufacturing capabilities across the globe.

What are the primary challenges restraining growth in the Peptide API manufacturing sector?

Primary restraints include the high inherent cost and complexity of chemical synthesis and purification processes, especially for long or modified peptides, which require expensive resins and high-purity solvents. Additionally, the inherent physiochemical instability and poor oral bioavailability of many peptides necessitate complex formulation and specialized cold-chain logistics, increasing overall drug development costs.

How significant is the role of Contract Development and Manufacturing Organizations (CDMOs) in the Peptide API supply chain?

CDMOs are highly significant, acting as the backbone of the Peptide API supply chain. Given the specialized expertise, capital investment, and regulatory complexity required for cGMP peptide manufacturing, most pharmaceutical and biotechnology companies outsource API production to specialized CDMOs, making them the leading production segment and a major driver of market growth and technological innovation.

How will advancements in AI and automation impact the future development of Peptide APIs?

AI and automation are expected to revolutionize the market by accelerating lead candidate identification, predicting optimal synthesis routes to enhance yield and purity, and reducing process development timelines. Automation in SPPS equipment and continuous flow chemistry will improve manufacturing efficiency, consistency, and overall quality control, leading to faster time-to-market for novel peptide therapeutics.

The preceding analysis details the essential market components, technological shifts, and competitive landscape of the global Peptide API market, positioning key stakeholders to understand current trends and anticipate future growth vectors. The complexity of peptide synthesis continues to drive specialization and technological innovation, ensuring robust growth, especially in the high-value clinical segments such as oncology and metabolic disease treatment.

Detailed investigation into the specific requirements for cGMP compliance remains paramount. Manufacturers must continually invest in advanced analytical testing, including mass spectrometry and high-resolution chromatography, to meet the increasingly stringent regulatory demands for impurity thresholds, particularly related to residual solvents, peptide-related impurities, and protecting group adducts. This focus on ultra-high purity is non-negotiable for injectable peptide products and serves as a major determinant in supplier selection, reinforcing the market position of established, accredited CDMOs.

Furthermore, the opportunity presented by oral peptide delivery is a pivotal long-term market factor. Currently, the reliance on injectable formats limits patient acceptance and market penetration, especially for long-term chronic treatments. Breakthroughs in formulation science, such as technologies utilizing absorption enhancers, protease inhibitors, or sophisticated microencapsulation techniques, could dramatically expand the addressable market for Peptide APIs. Companies successfully developing APIs amenable to non-invasive delivery will gain a significant competitive advantage, fundamentally altering treatment paradigms in diabetes and other high-prevalence chronic conditions.

The geographical shift towards APAC manufacturing centers, while driven by cost advantages, also introduces supply chain risk management complexities. Pharmaceutical companies utilizing these centers must implement rigorous quality assurance protocols and on-site auditing to mitigate risks associated with varying regulatory interpretations and potential intellectual property protection issues. Diversification of supply sources across North America, Europe, and APAC is becoming a standard risk management strategy, influencing long-term contractual agreements and investment decisions across the value chain.

The oncology segment's rapid innovation trajectory is primarily focused on therapeutic areas utilizing Peptides as targeting vectors. Peptide Receptor Radionuclide Therapy (PRRT) and Peptide-Drug Conjugates (PDCs) are examples where the peptide component acts not as the active drug itself but as a high-affinity ligand to deliver cytotoxic payloads or radioactive isotopes directly to cancer cells expressing specific receptors (e.g., somatostatin receptors). This highly specialized application demands ultraclean, precisely characterized APIs, driving innovation in custom modification chemistry and functionalization techniques within the manufacturing sector.

In conclusion, the Peptide API market is characterized by high technical barriers, regulatory scrutiny, and high growth potential driven by therapeutic efficacy. Strategic decisions regarding technology adoption, particularly the integration of automation and AI in synthesis processes, and proactive supply chain diversification will be crucial for companies seeking to capitalize on the sustained global demand for next-generation peptide therapeutics.

The regulatory environment continues to evolve, specifically concerning the quality and control of synthetic peptides. Global regulatory bodies, including the FDA and EMA, are increasing their focus on managing neoantigen formation risk and ensuring the batch-to-batch consistency of complex synthetic peptides. This escalating regulatory pressure translates directly into higher analytical costs and longer process validation times for manufacturers, necessitating greater collaboration between the API supplier and the regulatory affairs teams of the drug sponsor. Specialized expertise in handling regulatory filings for Drug Master Files (DMFs) and chemistry, manufacturing, and control (CMC) sections is a non-technical yet essential competency for leading Peptide API suppliers, distinguishing cGMP manufacturers who can navigate these requirements efficiently.

Furthermore, sustainability is emerging as an important factor, particularly in Europe. Traditional chemical peptide synthesis methods often require substantial volumes of organic solvents, posing environmental challenges. Market leaders are increasingly exploring 'green chemistry' approaches, such as utilizing more benign solvents, developing solvent-free reaction conditions, or adopting continuous flow methods that inherently minimize waste generation and energy consumption. While currently secondary to purity and cost, the pressure from environmental regulations and corporate social responsibility initiatives is expected to push sustainability criteria higher up the procurement decision matrix in the next five years, especially among major pharmaceutical clients committed to reducing their carbon footprint.

The competition between chemical synthesis (SPPS/LPPS) and recombinant expression remains a defining feature of the technological landscape. For novel, highly modified, or cyclic peptides, chemical synthesis is indispensable. However, as certain peptide drugs mature and become genericized, the ability to transition production to recombinant systems—where feasible—offers massive cost savings and scalability. This dichotomy means successful API manufacturers must maintain dual capabilities or strategically partner to serve both the innovative, high-margin, low-volume segment and the high-volume, cost-competitive generic segment, optimizing their production portfolio to mitigate technological obsolescence and capture maximum market share.

Finally, the long-term growth prospects are tied directly to breakthroughs in Central Nervous System (CNS) disorders. Peptides historically face significant challenges in crossing the blood-brain barrier (BBB), severely limiting their applicability in treating neurodegenerative diseases like Alzheimer's and Parkinson's. Ongoing research focusing on molecular modifications, active transport systems, or alternative delivery routes (e.g., nasal or intrathecal) that successfully bypass the BBB represents a transformative opportunity. Any success in this domain would unlock a vast, currently untapped therapeutic area, leading to a substantial surge in demand for highly specialized Peptide APIs tailored for neurological applications, potentially reshaping the application segmentation entirely and driving unprecedented investment in targeted peptide research and manufacturing.

The integration of advanced monitoring and control systems, often leveraging the Internet of Things (IoT) and big data analytics, is rapidly becoming standard practice in modern cGMP peptide facilities. These systems allow for real-time monitoring of critical process parameters (CPPs) such as reaction temperature, solvent flow rates, and pH during synthesis and purification steps. This granular level of control is crucial for minimizing batch variations, detecting potential process deviations instantly, and ensuring rapid corrective action. Such advancements not only comply with regulatory mandates for process validation but also contribute directly to enhanced yield and reduced operational downtime, offering significant competitive advantages to manufacturers who invest proactively in digitalization.

Moreover, the rise of personalized medicine and diagnostics necessitates the development of specialized, small-batch Peptide APIs. Diagnostic peptides, often labeled with radioisotopes, are used in precision imaging to locate tumors or monitor disease progression. Manufacturing these specialized radiolabeled or custom-modified peptides requires flexible, modular facilities that can quickly switch between different complex molecules while maintaining isolation and preventing cross-contamination. This trend favors agile CDMOs capable of handling high-mix, low-volume projects, moving away from the traditional model of rigid, high-volume production lines for generic blockbusters, thus diversifying the required technical skill set within the API market.

Intellectual property (IP) strategy forms a complex layer within the market structure. API manufacturers, especially those involved in generic production, must navigate the labyrinth of peptide drug patents, encompassing not only the molecule itself but often specific synthesis routes, purification techniques, or formulation methods. Developing non-infringing process chemistry (NIPC) is a major focus area for generic API players, requiring highly skilled organic chemists and robust legal expertise. For innovative APIs, protecting proprietary synthesis methods through trade secrets or method patents is equally critical for maintaining competitive edge and high-margin profitability.

Lastly, the long-term impact of supply chain resilience, highlighted by recent global disruptions, has pushed pharmaceutical companies to prioritize risk mitigation. This has led to a strategic shift away from single-source API procurement to dual-sourcing models, often splitting orders between manufacturers in geopolitically stable regions (like North America and Europe) and cost-effective regions (like APAC). This market behavior ensures manufacturing redundancy and supply continuity, influencing the volume allocations and investment priorities of all major Peptide API producers, demanding greater transparency and traceability throughout the raw material and synthesis supply chain to assure continuous, reliable delivery of critical therapeutic ingredients.

The complexity of post-translational modifications (PTMs) in advanced peptides represents a high technical barrier and a significant opportunity. Many novel therapeutic peptides require non-natural amino acids, cyclization, lipidation, or conjugation to enhance stability, half-life, or targeting specificity. Manufacturing these highly modified peptides requires specialized chemical expertise beyond standard coupling reactions, including enzymatic modifications and advanced conjugation chemistry. Companies that have mastered the synthesis and purification of these highly complex PTMs, such as the lipidation required for long-acting GLP-1 analogs, command premium pricing and secure exclusivity in niche high-value markets, establishing themselves as technological leaders in the field.

Furthermore, the cost structure of Peptide API production is severely impacted by the efficiency of the final purification stage. Since crude peptide mixtures from synthesis often contain numerous truncated or incorrect sequences, the required preparative chromatography can account for 50-70% of the total manufacturing cost. Innovations aimed at enhancing synthesis purity—such as improved coupling reagents, optimized washing steps, and robust resin selection—have a magnified economic benefit by reducing the burden on expensive HPLC purification steps. Manufacturers are thus heavily investing in frontend process improvement technologies to lower the overall Cost of Goods Sold (COGS), which is crucial for maximizing margins, especially in the competitive generic space.

The regulatory framework concerning extractables and leachables (E&L) in peptide manufacturing equipment is becoming increasingly scrutinized. Peptides, being prone to aggregation and adsorption, are highly sensitive to contact materials. Ensuring that solvents, reaction vessels, tubing, and purification columns do not introduce harmful or structure-altering impurities requires continuous validation and specialized equipment constructed from inert materials. Adherence to strict E&L protocols is a mandatory compliance requirement that affects facility design and operational expenditure, particularly for new manufacturing sites, reinforcing the high capital entry barrier for new players.

Finally, the market growth is significantly correlated with the increasing adoption of biologics and large molecule therapeutics globally. As peptides bridge the gap between small molecule drugs and large protein biologics, they benefit from the overall shift in the pharmaceutical industry towards targeted therapies. This macro trend ensures a continuous influx of research funding and clinical candidates into the peptide pipeline. The strategic positioning of Peptide APIs as highly specific agents with predictable metabolism ensures their continued relevance and expansion across both therapeutic and diagnostic applications, solidifying their status as a high-growth segment within the broader pharmaceutical API market.

The characterization of Peptide APIs is another critical technical bottleneck. Given the potential for subtle structural variations, including epimerization and racemization, comprehensive analytical characterization is mandatory. Techniques such as high-resolution mass spectrometry (HRMS), nuclear magnetic resonance (NMR) spectroscopy, and circular dichroism (CD) are routinely employed to confirm the exact sequence, secondary structure, and tertiary conformation of the synthesized peptide. This analytical rigor is a major cost driver but is essential for regulatory approval, ensuring the safety and efficacy of the final drug product. API manufacturers must maintain state-of-the-art analytical labs and highly skilled personnel to meet these quality standards consistently.

Moreover, the trend toward therapeutic peptides delivered through sustained-release formulations demands APIs with exceptional long-term stability. Formulation technologies often involve encapsulating the peptide within biodegradable polymers (like PLGA microspheres) or incorporating it into specialized depots. The API supplier must ensure the manufactured peptide is robust enough to withstand the stress of the formulation process, including exposure to organic solvents or elevated temperatures during encapsulation. Collaboration between the API producer and the formulator is vital to design a suitable API lot that meets these highly specific stability and compatibility criteria, adding another layer of complexity to the development lifecycle.

The market for generic Peptide APIs is rapidly gaining momentum, particularly as key patents for blockbuster drugs expire. However, generic peptide development is technically more challenging than traditional small molecule generics. Manufacturers must demonstrate that their synthesized API is identical in purity profile and biological activity to the originator's product, often facing hurdles in reproducing the complex synthetic routes and impurity profiles, which are often proprietary. This necessity drives specialized investment into reverse-engineering and advanced analytical fingerprinting capabilities among generic API producers, ensuring that their products meet the stringent bioequivalence requirements for regulatory submission.

Finally, emerging applications such as immunotherapeutic peptides (neoantigen vaccines) are beginning to influence the market structure. These therapies require the rapid, custom synthesis of multiple highly personalized peptides unique to an individual patient’s tumor profile. This shift demands extremely high agility and flexibility from the API manufacturer, favoring those who have invested in fully automated, small-scale synthesis platforms capable of handling rapid turnaround times and diverse product mixes. This move towards personalized manufacturing represents a significant technological leap from traditional bulk production, driving niche market growth and requiring specialized cGMP compliance frameworks designed for individualized medicine.

The overall market health remains robust, supported by a stable regulatory foundation and constant therapeutic innovation, ensuring a strong long-term outlook for the specialized global Peptide API manufacturing sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager