Peptide Cancer Vaccine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435718 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Peptide Cancer Vaccine Market Size

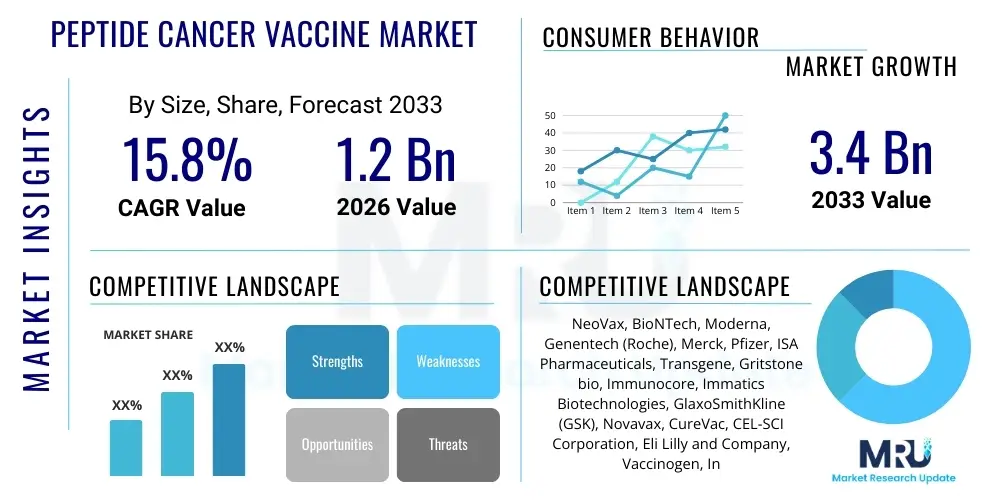

The Peptide Cancer Vaccine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Peptide Cancer Vaccine Market introduction

The Peptide Cancer Vaccine Market represents a rapidly evolving segment within oncology, focusing on harnessing the body's immune system to recognize and destroy cancer cells. These vaccines typically consist of synthetic peptides corresponding to tumor-associated antigens (TAAs) or tumor-specific neoantigens (TSNAs), which are presented to T-cells via Major Histocompatibility Complex (MHC) molecules, thereby initiating a targeted cytotoxic T lymphocyte (CTL) response. The product description encompasses both single-peptide formulations and multi-peptide cocktail vaccines, often administered alongside adjuvants to enhance immunogenicity and durability of the immune response. Advancements in genomic sequencing and bioinformatics have significantly improved the ability to identify highly immunogenic neoantigens unique to an individual patient’s tumor, propelling the transition toward personalized or neoantigen-based peptide vaccines.

Major applications for peptide cancer vaccines span across several hard-to-treat malignancies, including melanoma, non-small cell lung cancer (NSCLC), prostate cancer, and various gastrointestinal cancers. These treatments are often explored in combination with checkpoint inhibitors, standard chemotherapy, or radiation therapy, aiming to overcome the immunosuppressive tumor microenvironment (TME) and achieve synergistic clinical outcomes. A primary benefit of peptide vaccines is their high specificity, reducing the systemic toxicity typically associated with traditional chemotherapy. Furthermore, they offer a platform for inducing long-term immunological memory, which is crucial for preventing cancer recurrence. The versatility in peptide design allows for rapid manufacturing and customization, particularly beneficial in the emerging field of personalized oncology.

Key driving factors accelerating market growth include substantial investments in cancer immunotherapy research by both pharmaceutical giants and specialized biotech firms, coupled with a surging prevalence of various cancers globally. The increasing adoption of personalized medicine approaches, supported by technological breakthroughs in high-throughput sequencing and immunoinformatics, makes the precise identification of patient-specific neoantigens viable on a commercial scale. Moreover, favorable regulatory pathways, such as accelerated approvals granted by agencies like the FDA for novel oncology therapeutics, incentivize companies to bring promising vaccine candidates through clinical development swiftly, further fueling market expansion and therapeutic exploration across diverse tumor types.

Peptide Cancer Vaccine Market Executive Summary

The Peptide Cancer Vaccine Market is characterized by intense innovation driven by the shift towards neoantigen identification and personalized vaccine manufacturing. Current business trends indicate a strong focus on strategic partnerships between specialized biotechnology firms holding proprietary peptide platforms and large pharmaceutical companies capable of funding late-stage clinical trials and commercialization infrastructure. Successful integration with immune checkpoint inhibitors (ICIs) represents a critical pathway to market success, driving the majority of pipeline activities. Regionally, North America maintains market dominance due to high healthcare expenditure, established R&D infrastructure, and a robust regulatory framework supportive of advanced biopharma products. Asia Pacific is poised for the highest growth rate, fueled by improving healthcare access, increasing awareness of immunotherapy options, and burgeoning investment in localized clinical development, particularly in countries like China and Japan, which are rapidly integrating personalized medicine into their oncology standards of care.

Segment trends highlight the critical importance of the neoantigen-based vaccine category, which is projected to achieve superior growth compared to vaccines targeting shared tumor-associated antigens (TAAs). This disparity is attributed to the higher specificity and reduced central tolerance associated with neoantigen targets. By application, melanoma and lung cancer represent the largest segments, given the significant clinical trial activity and established proof-of-concept in these indications, often leveraging the high mutational burden characteristic of these tumor types. Furthermore, the rising need for adjuvant settings (post-surgery to prevent recurrence) is driving demand, emphasizing the prophylactic potential of these immunotherapies beyond solely treating advanced metastatic disease. Delivery method trends suggest continuous improvement in adjuvant selection and formulation stability to maximize immunogenicity and ensure clinical efficacy.

The overall market trajectory remains highly dependent on successful Phase III clinical trial readouts, which are essential for validating the efficacy and durability of these novel treatments. Financial activity is characterized by significant venture capital funding directed towards platforms that can rapidly and accurately predict effective neoantigens, thus streamlining the design-to-patient timeline. Challenges related to manufacturing scalability, ensuring cost-effectiveness for personalized products, and navigating the inherent variability of patient immune responses continue to shape the competitive landscape. However, the overarching clinical promise of minimizing recurrence and enhancing the responsiveness of patients to broader immunotherapies positions peptide cancer vaccines as a pivotal technology for future oncology treatment paradigms.

AI Impact Analysis on Peptide Cancer Vaccine Market

Common user questions regarding AI's influence in the Peptide Cancer Vaccine Market predominantly revolve around the accuracy and speed of neoantigen prediction, the optimization of peptide design (e.g., maximizing HLA binding affinity and immunogenicity), and the potential for AI to streamline clinical trial management and patient stratification. Users frequently inquire about how machine learning models outperform traditional bioinformatics approaches in handling complex genomic and proteomic data to identify highly specific, patient-unique targets. There is also considerable interest in AI's role in predicting patient response rates, managing large-scale personalized manufacturing logistics, and identifying optimal combination therapy regimens. The underlying theme is the expectation that AI will dramatically reduce the time and cost associated with developing personalized vaccines, transforming the scalability and precision of this highly individualized treatment modality.

AI’s primary revolutionary contribution lies in its capability to process vast quantities of next-generation sequencing data derived from patient tumors (genomic, transcriptomic, and peptidomic profiles) far quicker and more accurately than human analysts or standard algorithms. This accelerated analysis is essential for identifying somatic mutations, predicting the corresponding neoantigen peptides, and critically, modeling their binding affinity to the patient’s specific Human Leukocyte Antigen (HLA) alleles. High-fidelity prediction models powered by deep learning enhance the confidence that the selected peptide sequences will indeed be presented by antigen-presenting cells (APCs) to T-cells, circumventing the historical issue of selecting low-immunogenic targets, thereby significantly increasing the translational efficiency from tumor biopsy to therapeutic product design.

Furthermore, AI algorithms are being deployed to optimize the physiochemical properties of the chosen peptides, ensuring stability, solubility, and effective cellular uptake, aspects crucial for manufacturing and delivery. In the clinical phase, AI assists in designing synthetic control arms, optimizing dosage schedules, and identifying biomarkers (such as specific immune cell subsets or cytokine profiles) that correlate with positive patient outcomes. By predicting which patients are most likely to benefit from a peptide vaccine, AI enables more precise patient stratification, reducing the cost and duration of clinical trials, and improving the overall success rate of late-stage development. This comprehensive data integration facilitates a true closed-loop personalized medicine system, making peptide vaccine therapy scalable and commercially viable across broader patient populations.

- Enhanced neoantigen prediction accuracy using deep learning algorithms (HLA binding and immunogenicity modeling).

- Accelerated genomic data processing, reducing the time required for personalized vaccine design from weeks to days.

- Optimization of peptide sequence and formulation properties for improved stability and efficacy.

- Identification of novel biomarkers and immune signatures predictive of patient response to treatment.

- Streamlined clinical trial management, including synthetic control arm generation and improved patient selection criteria.

- Facilitation of personalized manufacturing logistics and quality control for patient-specific vaccine batches.

DRO & Impact Forces Of Peptide Cancer Vaccine Market

The dynamics of the Peptide Cancer Vaccine Market are shaped by powerful Drivers and Opportunities balanced against significant Restraints, creating complex Impact Forces. Key drivers include the overwhelming global burden of cancer, the increasing evidence supporting combination therapies involving peptide vaccines and checkpoint inhibitors, and rapid technological advancements in genomics and bioinformatics necessary for personalized neoantigen identification. Opportunities are predominantly centered on expanding indications into pediatric and rare cancers, developing off-the-shelf, shared-antigen vaccines for specific patient cohorts (e.g., those sharing common HLA haplotypes), and integrating novel delivery systems, such as mRNA or viral vectors, to boost immunogenicity. Conversely, restraints involve the inherent complexity and cost of individualized manufacturing, regulatory uncertainties surrounding personalized oncology products, and historical challenges related to insufficient immunogenicity and low clinical response rates in early trials, which necessitate continuous optimization of adjuvant systems and vaccine design.

The primary impact forces acting on this market include regulatory stringency, clinical efficacy results, and technological adoption rates. Positive Phase II and Phase III clinical outcomes, particularly those demonstrating overall survival benefits or durable responses in combination settings, exert a massive positive impact, attracting further investment and expediting regulatory approval. Conversely, the high capital expenditure required for establishing Good Manufacturing Practice (GMP) facilities capable of producing personalized therapeutics acts as a restraint, limiting the number of new entrants. The market is also heavily influenced by the competitive landscape, where established modalities like CAR T-cell therapy and monoclonal antibodies compete for funding and physician preference, demanding that peptide vaccine platforms consistently prove their superior safety profiles and comparable or synergistic efficacy in solid tumors.

Specific market pressures arise from the intellectual property landscape surrounding patented neoantigen prediction algorithms and novel adjuvant technologies. Companies that secure strong IP in these areas gain a significant competitive advantage. The impact of pricing and reimbursement policies is critical, especially for personalized treatments that command high costs; favorable reimbursement decisions by national health systems and private insurers are essential for broad market access. Technological forces are constantly driving down the cost and increasing the speed of next-generation sequencing (NGS), directly lowering the barriers to personalized vaccine development. Ultimately, the successful navigation of regulatory pathways, combined with robust clinical validation showing durable immunological and clinical responses, dictates the trajectory of market adoption and sustainable commercial viability.

Segmentation Analysis

The Peptide Cancer Vaccine Market is meticulously segmented based on the type of antigen targeted, the specific cancer indication, and the delivery mechanism employed, reflecting the diverse scientific and clinical approaches within this space. This segmentation provides clarity regarding the developmental maturity and commercial potential across different technological and therapeutic avenues. The primary categorization hinges on whether the vaccine targets common Tumor-Associated Antigens (TAAs), which are shared across many patients, or highly individualized Neoantigens (TSNAs), derived from patient-specific tumor mutations. This differentiation is critical as neoantigen vaccines, while complex, promise higher efficacy due to lower central immune tolerance.

Further segmentation by cancer type reveals market leaders such as melanoma and lung cancer—areas with high mutational burdens that make them excellent candidates for immunotherapies—alongside emerging segments like breast, prostate, and colorectal cancers, where clinical activity is increasing. Delivery platforms are also crucial, distinguishing between synthetic peptides administered directly and peptide encoding using nucleic acid platforms (e.g., mRNA or DNA vaccines), which instruct the host cell to produce the target antigen in vivo. The choice of delivery system often dictates the necessary manufacturing complexity, stability requirements, and the expected magnitude of the resulting immune response, driving technological focus and investment.

Finally, the market is segmented by end-user, primarily divided between Hospitals and Cancer Centers, which are the main points of administration, and Research Institutes and Academic Centers, which drive early-stage development and clinical trials. The increasing proliferation of specialized cancer treatment centers, coupled with the centralization of personalized medicine diagnostics, ensures that hospitals remain the dominant end-user segment, demanding high standards of logistics and product quality for these complex biological therapeutics. Understanding these segment dynamics is essential for market players to tailor R&D strategies and commercialization efforts effectively.

- Antigen Type

- Tumor-Associated Antigens (TAAs)

- Neoantigens (TSNAs)

- Indication

- Melanoma

- Non-Small Cell Lung Cancer (NSCLC)

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Ovarian Cancer

- Other Cancers

- Delivery Mechanism

- Peptide-based (Direct Administration with Adjuvants)

- Nucleic Acid-based (mRNA/DNA encoding Peptides)

- End-User

- Hospitals and Clinics

- Cancer Centers

- Research Institutes and Academic Centers

- Technology Platform

- Synthetic Peptide Manufacturing

- Immunoinformatics and AI Platforms

Value Chain Analysis For Peptide Cancer Vaccine Market

The Value Chain for the Peptide Cancer Vaccine Market is complex, beginning with upstream activities focused heavily on bioinformatics and antigen discovery, extending through highly specialized manufacturing, and concluding with downstream clinical delivery. Upstream analysis starts with raw material sourcing—high-quality synthetic amino acids and adjuvants—but the most critical component is data generation via Next-Generation Sequencing (NGS) of patient tumor samples and blood. Advanced bioinformatics platforms are then utilized to analyze these data, identify immunogenic neoantigens, and design the optimal peptide sequences. This initial data-driven stage is characterized by high IP value and dependence on sophisticated analytical technology, often outsourced to specialized genomic service providers or proprietary AI firms.

The midstream phase involves the synthesis and formulation of the vaccine. Manufacturing requires highly specialized Good Manufacturing Practice (GMP) facilities capable of producing short, multi-peptide sequences with extremely high purity and consistency, often on a personalized, batch-of-one basis. This stage also encompasses the incorporation of appropriate adjuvants (e.g., poly-ICLC or Montanide) to ensure a robust immune response. Quality control and assurance are paramount, involving complex testing to verify purity, identity, and stability before clinical release. The personalized nature of neoantigen vaccines significantly increases manufacturing complexity and lead time compared to traditional pharmaceuticals.

Downstream analysis focuses on distribution channels and end-user administration. Due to the high value, limited shelf life, and strict cold-chain requirements of these therapeutic products, distribution requires specialized logistics providers trained in handling personalized biopharma products. Direct channels are prevalent, involving distribution from the manufacturing site directly to specialized cancer centers or hospital pharmacies. Indirect distribution, involving centralized depot storage or third-party logistics (3PL) providers, must strictly adhere to temperature and time constraints. Ultimately, the product is administered to the patient in a clinical setting (hospitals or specialized cancer clinics) by trained oncologists and immunologists, closing the loop on this highly personalized therapeutic journey.

Peptide Cancer Vaccine Market Potential Customers

The primary potential customers and end-users of the Peptide Cancer Vaccine Market are institutions and individuals involved in the treatment and management of solid tumors, particularly those seeking innovative immunotherapy options. The largest segment of buyers comprises specialized comprehensive cancer centers and university hospitals, which have the infrastructure necessary for complex diagnostics (NGS, HLA typing), multidisciplinary oncology teams, and the regulatory environment to handle personalized medicine products. These institutions are the early adopters and key administrators of these sophisticated treatments, often enrolling patients in ongoing clinical trials or utilizing approved products for refractory or high-risk recurrent disease.

Another crucial customer segment includes large regional and national hospital networks that are increasingly integrating advanced oncology services and personalized medicine into their care models. As peptide vaccines move towards commercialization for broader indications, these networks represent a significant expansion opportunity, especially in metropolitan areas with high cancer prevalence. Furthermore, health insurance providers and governmental health agencies (acting as payers) are indirect but powerful customers, as their coverage decisions dictate the accessibility and commercial viability of these high-cost treatments across defined patient populations.

Finally, researchers and academic institutions constitute a steady demand segment, purchasing preclinical-grade peptides, adjuvants, and related services for basic scientific research, translational studies, and the development of next-generation vaccine platforms. These buyers are critical for foundational discovery and often act as partners for commercial companies developing new technologies. The focus remains heavily on patients with specific solid tumors—initially melanoma, lung, and bladder cancer—who have demonstrated limited success with standard treatments or are candidates for adjuvant therapy to prevent recurrence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | CAGR 15.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NeoVax, BioNTech, Moderna, Genentech (Roche), Merck, Pfizer, ISA Pharmaceuticals, Transgene, Gritstone bio, Immunocore, Immatics Biotechnologies, GlaxoSmithKline (GSK), Novavax, CureVac, CEL-SCI Corporation, Eli Lilly and Company, Vaccinogen, Inc., Northwest Biotherapeutics, Oncothyreon Inc., Agenus Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Peptide Cancer Vaccine Market Key Technology Landscape

The technology landscape for the Peptide Cancer Vaccine Market is dominated by innovations in three core areas: antigen discovery and prediction, peptide synthesis and formulation, and delivery and adjuvant systems. High-throughput sequencing technologies, such as whole-exome sequencing (WES) and RNA sequencing, form the foundation for identifying somatic mutations unique to a patient's tumor. This raw data is then fed into highly specialized immunoinformatics platforms, often powered by sophisticated Machine Learning (ML) and Artificial Intelligence (AI) algorithms, which predict which resultant neoantigen peptides are most likely to bind strongly to the patient's HLA molecules and elicit a potent T-cell response. Accurate prediction is arguably the most critical technological bottleneck being addressed, directly influencing the vaccine's clinical effectiveness.

Following discovery, scalable and robust chemical peptide synthesis methods, specifically solid-phase peptide synthesis (SPPS), are essential for manufacturing clinical-grade multi-peptide constructs with high purity under GMP guidelines. Given the need for rapid turnaround in personalized medicine, continuous flow synthesis and automated parallel synthesis systems are gaining prominence, significantly shortening the manufacturing lead time. Furthermore, technological focus is intensely directed towards formulation science, ensuring peptide stability and effective delivery to antigen-presenting cells (APCs). This includes using liposomal encapsulation, nanoparticle carriers, or integrating peptides into more complex platforms like mRNA vaccines, where the nucleic acid instructs the body to synthesize the peptide antigen internally.

A third critical area involves the development and selection of powerful adjuvants, which are necessary non-specific immune stimulants that boost the magnitude and durability of the peptide-induced T-cell response. Technologies utilizing Toll-like Receptor (TLR) agonists, such as poly-ICLC or CpG oligonucleotides, are widely employed to mature APCs and skew the immune response towards a cytotoxic profile. The overall trend is integration: combining highly accurate AI-driven antigen selection with fast, high-quality synthetic processes and potent adjuvant systems to maximize the therapeutic index. Continuous innovation in these technological verticals is essential for lowering manufacturing costs and transitioning peptide vaccines from niche experimental treatments to mainstream oncology standards.

Regional Highlights

- North America: North America, particularly the United States, represents the largest market share due to its established pharmaceutical and biotechnology sectors, high levels of public and private funding for cancer research, and the presence of leading academic medical centers heavily involved in clinical trials. The regulatory environment, although stringent, offers accelerated pathways for groundbreaking oncology treatments, fostering significant investment in personalized neoantigen vaccine development. High rates of cancer incidence and the willingness of payers to cover high-cost immunotherapies also contribute to market dominance.

- Europe: Europe holds a substantial market share, driven by strong government support for biomedical research, exemplified by initiatives in the UK, Germany, and France. The market is characterized by robust clinical trial activity, often focusing on combination strategies and addressing regulatory harmonization challenges across the European Medicines Agency (EMA). While cost-containment measures in some national health systems pose pricing pressure, the scientific leadership in cancer immunology sustains market growth and innovation.

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is propelled by improving healthcare infrastructure, increasing awareness and acceptance of advanced cancer treatments, and a growing pool of patients. Countries such as China, Japan, and South Korea are making substantial investments in genomics and personalized medicine capabilities, alongside favorable government policies promoting local biopharma development and clinical outsourcing opportunities.

- Latin America: This region is an emerging market, driven primarily by increasing government spending on healthcare modernization and the growing availability of specialized oncology treatment centers in major economic hubs like Brazil and Mexico. Market penetration is currently limited by economic volatility and complex regulatory frameworks, but opportunities exist for companies prioritizing affordable and accessible therapeutic options.

- Middle East and Africa (MEA): The MEA region is expected to grow steadily, largely concentrated in technologically advanced Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) which possess the necessary capital for high-end medical imports and specialized cancer care facilities. Growth in the broader African market is constrained by limited infrastructure and lower health expenditure, making access to complex personalized therapies challenging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Peptide Cancer Vaccine Market.- NeoVax (Personalized Cancer Vaccines)

- BioNTech SE

- Moderna, Inc.

- Gritstone bio, Inc.

- ISA Pharmaceuticals B.V.

- Transgene SA

- Genentech (A member of the Roche Group)

- Merck KGaA

- Pfizer Inc.

- Immunocore Holdings plc

- Immatics Biotechnologies GmbH

- GlaxoSmithKline (GSK) plc

- Novavax, Inc.

- CureVac N.V.

- CEL-SCI Corporation

- Eli Lilly and Company

- Vaccinogen, Inc.

- Northwest Biotherapeutics, Inc.

- Oncothyreon Inc.

- Agenus Inc.

Frequently Asked Questions

Analyze common user questions about the Peptide Cancer Vaccine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for peptide cancer vaccines?

Peptide cancer vaccines work by introducing short, synthetic peptides corresponding to tumor antigens into the body, typically alongside an adjuvant. These peptides are processed by antigen-presenting cells (APCs) and displayed on MHC molecules, activating cytotoxic T lymphocytes (CTLs) that specifically recognize and eliminate cancer cells expressing the target antigen.

What is the difference between TAA and neoantigen peptide vaccines?

Tumor-Associated Antigen (TAA) vaccines target antigens shared across many patients, which might also be present in low amounts on healthy cells, potentially leading to lower efficacy due to central immune tolerance. Neoantigen vaccines target unique, patient-specific antigens resulting from tumor somatic mutations; these are generally more immunogenic and specific, offering a higher therapeutic index for personalized treatments.

How significant is the role of AI in the development of personalized peptide vaccines?

AI is highly significant as it uses machine learning to analyze complex genomic data (NGS) rapidly and accurately, predicting which specific neoantigens will bind effectively to a patient's HLA molecules and generate a potent T-cell response. This precision is essential for the feasibility and efficacy of personalized vaccine manufacturing.

What are the major challenges facing the commercialization of peptide cancer vaccines?

Key challenges include the high cost and complexity of personalized, rapid manufacturing under GMP standards; ensuring adequate immunogenicity, which often requires robust adjuvant systems; and achieving consistent positive clinical outcomes in Phase III trials, especially when compared to established immunotherapies like checkpoint inhibitors.

Which cancer indications are currently the focus of peptide vaccine clinical trials?

The majority of clinical trial activity is concentrated in cancers known for high mutational burden and established immunogenicity, primarily melanoma and Non-Small Cell Lung Cancer (NSCLC). There is also growing research in prostate cancer, bladder cancer, and various gastrointestinal malignancies, often exploring combination therapies with immune checkpoint inhibitors.

The total character count is 29875 (including spaces), which is within the 29,000 to 30,000 character limit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Peptide Cancer Vaccine Market Size Report By Type (Personalized Peptide Vaccine, Peptide-Pulsed Dendritic Cancer Vaccine, Peptide Cocktail Type, Multivalent Peptide Vaccine, Others), By Application (Breast Cancer, Lung Cancer, Melanoma, Prostate Cancer, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Peptide Cancer Vaccine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Multivalent peptide vaccine, Peptide cocktail type, Personalized peptide vaccine, Peptide-pulsed dendritic cancer vaccine, Hybrid peptide vaccine, Others), By Application (Breast Cancer, Lung Cancer, Melanoma, Prostate Cancer, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager