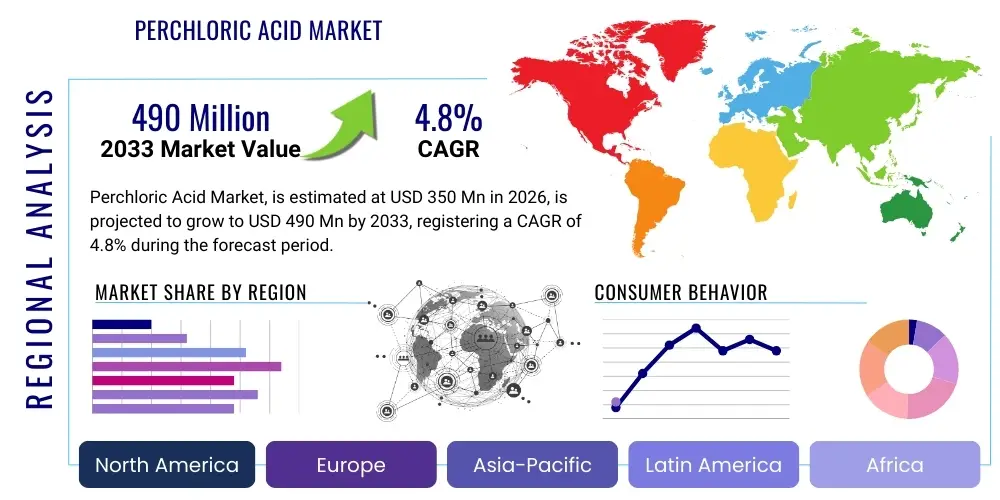

Perchloric Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436750 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Perchloric Acid Market Size

The Perchloric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 490 Million by the end of the forecast period in 2033.

Perchloric Acid Market introduction

Perchloric acid ($\text{HClO}_4$) is categorized as a powerful mineral acid, predominantly supplied as an aqueous solution, and stands out due to its exceptionally strong acidic and oxidizing capabilities. It is synthesized primarily through the anodic oxidation of chlorate solutions, an energy-intensive process requiring specialized, corrosion-resistant equipment. The commercial viability of $\text{HClO}_4$ is rooted in its application flexibility; it serves as a critical precursor in the production of perchlorate salts, most notably ammonium perchlorate ($\text{AP}$), which is the principal oxidizer component in solid rocket propellants utilized by the defense and aerospace industries globally. Given its inherent stability when diluted and its non-complexing nature, $\text{HClO}_4$ is also indispensable in specialized analytical procedures requiring high purity and minimal interference, cementing its role across diverse industrial supply chains.

The market trajectory for perchloric acid is heavily influenced by geopolitical factors, particularly global defense spending trends, and the continuous innovation within high-technology manufacturing. In addition to its high-volume application in propellants, the acid's unique chemical properties have secured its place in niche, high-value sectors. For instance, ultra-high purity grades are essential in the electronics and semiconductor industry, where they are deployed for precision etching and cleaning of silicon wafers and other sensitive electronic components. This demand for specialized, low-metal impurity grades drives significant investment in advanced purification technologies and rigorous quality control protocols by leading manufacturers, differentiating the market for technical grade acid from that of ultra-pure grades.

Furthermore, the expanding use of advanced materials and the increasing regulatory mandate for environmental monitoring significantly contribute to the market's stability. Perchloric acid is the reagent of choice for the demanding task of sample digestion in environmental laboratories, where complete dissolution of complex matrices (like soil, biological tissue, or difficult alloys) is required prior to heavy metal analysis via techniques such as Inductively Coupled Plasma Mass Spectrometry ($\text{ICP-MS}$). Key driving factors sustaining market growth include modernization of military stockpiles, substantial governmental investment in space exploration programs utilizing solid fuel rockets, and the consistent expansion of regulatory bodies requiring sophisticated, reproducible analytical testing, ensuring continuous, baseline demand despite the high operational risks associated with its production and handling.

Perchloric Acid Market Executive Summary

The global Perchloric Acid market exhibits highly concentrated supply dynamics, primarily driven by critical end-use applications in the defense, aerospace, and high-purity electronics sectors. Current business trends emphasize enhanced security of supply, requiring robust risk management strategies due to stringent environmental, health, and safety ($\text{EHS}$) regulations governing hazardous materials. Manufacturers are strategically focusing on improving process efficiency through capital investment in advanced electrochemical cells and developing innovative, safer storage and transport solutions, aiming to mitigate the substantial operational costs associated with explosion risk management and corrosion control. The industry witnesses a strategic push towards vertical integration, securing precursor chemical supplies (like sodium chlorate) to minimize exposure to upstream price volatility and ensure continuity of production, which is paramount for long-term governmental and defense contracts.

Regionally, the market presents distinct growth profiles. Asia Pacific (APAC) currently dominates in terms of growth trajectory, fueled by unprecedented infrastructure development requiring explosives, escalating defense spending, and a rapid, large-scale expansion of the semiconductor fabrication industry, particularly in East and Southeast Asian nations. In contrast, North America and Europe represent mature, high-value segments, characterized by stringent demand for ultra-high purity analytical reagents and specialized chemical synthesis applications. Regulatory environments in these Western regions are exceptionally demanding, often dictating technological choices and favoring suppliers who can demonstrate superior environmental compliance and comprehensive hazard mitigation strategies, placing a premium on certified high-grade products.

Segmentation analysis reveals that the application in Propellants and Explosives remains the largest segment by volume, intrinsically linking market performance to macroeconomic stability and global security concerns. However, the fastest growth is anticipated in the specialized chemicals segment, propelled by the increasing complexity of chemical synthesis and pharmaceutical intermediate production that leverages perchloric acid's strong, non-complexing acidic properties. The market also sees significant traction in the $70\%$ aqueous solution concentration category, which is the industry standard for bulk applications, while the demand for higher concentration or customized purity grades continues to define profitability in the niche, high-tech sectors, reflecting a market that balances high-volume industrial necessity with precision, specialty requirements.

AI Impact Analysis on Perchloric Acid Market

Analysis of user and industry inquiries concerning the application of Artificial Intelligence ($\text{AI}$) in the Perchloric Acid market reveals a strong focus on using smart technologies to counteract the inherent dangers and complexities of handling this highly corrosive and oxidative chemical. Common questions center on how $\text{AI}$ can enhance manufacturing safety, ensure compliance with evolving environmental standards, and optimize the highly sensitive electrochemical production processes. Users anticipate $\text{AI}$-driven solutions primarily in predictive maintenance for specialized, expensive corrosion-resistant infrastructure, real-time risk modeling to prevent thermal excursions or crystallization hazards during concentration, and the application of machine learning ($\text{ML}$) for precision quality control, especially in detecting trace impurities that could compromise ultra-pure grades required by the microelectronics industry. The overarching expectation is that $\text{AI}$ will transform operational security and cost efficiency rather than fundamentally altering the chemical end-uses.

- $\text{AI}$-driven predictive maintenance systems are being implemented to monitor corrosion rates and material degradation in specialized reactors, piping, and storage tanks, extending equipment lifespan and proactively preventing catastrophic containment failures associated with highly corrosive $\text{HClO}_4$.

- Deployment of advanced Machine Learning ($\text{ML}$) algorithms for real-time process control in the electrochemical synthesis stage, optimizing current density, temperature, and electrolyte concentration to maximize yield, minimize energy consumption, and crucially, maintain safety margins during highly exothermic reactions.

- Utilization of Artificial Intelligence and deep learning for sophisticated anomaly detection in quality assurance, particularly in ultra-high purity perchloric acid grades, enabling rapid identification of trace metal or organic contaminants critical for semiconductor etching applications.

- Integration of $\text{AI}$-powered environmental monitoring and simulation tools to forecast and model the transport and fate of perchlorate ions in discharge scenarios, assisting manufacturers in achieving proactive compliance with increasingly stringent zero-discharge environmental regulations.

- Optimization of supply chain and logistics management through $\text{AI}$ modeling, factoring in complex hazardous material shipping regulations, required specialized containment, and optimizing route planning to minimize transit risk and ensure timely delivery to sensitive end-users like defense facilities.

- Development of $\text{AI}$-supported simulation platforms for training operational personnel on emergency response procedures and complex handling protocols for concentrated perchloric acid, significantly enhancing preparedness and minimizing human error in hazardous environments.

- Automated spectroscopic analysis and data interpretation using $\text{AI}$ tools to accelerate the characterization of synthesized batches, providing faster release schedules and ensuring consistent product specification adherence for military and industrial applications.

- Application of computational chemistry powered by $\text{AI}$ to investigate and potentially synthesize novel, less hazardous precursors or alternative oxidation pathways that could reduce the reliance on conventional high-risk production methods.

- $\text{ML}$ models employed in procurement to analyze raw material market volatility (e.g., sodium chlorate and energy prices) and predict optimal timing for large-volume purchasing, ensuring cost efficiency in the energy-intensive production process.

- Implementation of robotic automation in conjunction with $\text{AI}$ vision systems for routine handling and sampling of high-concentration perchloric acid, thereby minimizing direct human exposure and enhancing worker safety compliance.

DRO & Impact Forces Of Perchloric Acid Market

The market for Perchloric Acid is highly sensitive to a confluence of technological necessities, stringent regulations, and macroeconomic policies, creating a unique dynamic of Drivers, Restraints, and Opportunities ($\text{DRO}$). Key drivers sustaining demand include the continuous, non-negotiable requirement of ammonium perchlorate in global solid-fuel rocketry and defense modernization programs, which provides a resilient base load demand impervious to minor economic fluctuations. Furthermore, the burgeoning demand for high-purity chemical reagents driven by the exponential growth of the microelectronics industry, coupled with mandated global expansion of environmental monitoring and regulatory testing, ensures consistent growth in specialty segments. These drivers are closely tied to state-level strategic investments and technological breakthroughs in materials science, ensuring the chemical's irreplaceable status in specific high-performance applications.

Conversely, the market faces significant restraints that severely limit its scalability and accessibility. Foremost among these is the extreme hazard profile associated with concentrated perchloric acid—its potent oxidizing capability and reactivity necessitate costly, specialized production facilities, highly trained personnel, and comprehensive liability insurance, leading to high capital expenditure and operational costs. Regulatory restraints are pervasive, particularly the intensifying global concern and regulation of perchlorate accumulation in drinking water and ecosystems, forcing manufacturers into expensive remediation and waste minimization strategies. These strict environmental controls act as a significant entry barrier for new competitors and increase operational complexity for existing players, constraining supply growth even when demand is robust.

Opportunities for growth are concentrated in technological advancements that address these restraints. The development of safer, encapsulated or neutralized perchlorate compounds that ease transport and storage risks presents a major avenue for market expansion. Furthermore, the relentless pursuit of miniaturization and complexity in semiconductors dictates an ever-increasing need for ultra-high purity grades with negligible trace elements, offering premium pricing potential for technologically advanced manufacturers capable of meeting these specifications. The impact forces determining the long-term market shape are heavily geopolitical—geopolitical tensions directly correlate with defense budgets and subsequent propellant demand—and energy policy, as the electrochemical synthesis process is highly vulnerable to fluctuating electricity prices, which significantly affects the final cost of the product.

Segmentation Analysis

The Perchloric Acid market is functionally segmented based on the product's concentration, its diverse end-use applications, and the target industries that require its unique properties. The segmentation is critical for market assessment as it distinguishes between bulk, technical-grade sales, heavily regulated by defense procurement cycles, and the high-value, niche sales of ultra-high purity reagents governed by stringent electronic industry standards. This differentiation influences everything from manufacturing purity targets and packaging requirements to regional distribution logistics and competitive pricing strategies, reflecting the heterogeneity of demand for this highly specialized chemical agent.

- By Concentration

- $70\%$ Aqueous Solution: The most common industrial concentration; primarily used for producing ammonium perchlorate and general chemical synthesis; requires moderate handling precautions but is relatively stable.

- $60\%$ Aqueous Solution: Often preferred for certain industrial processes where slightly lower reactivity is desired, or as a starting point for specialized dilutions.

- $35\%$ Aqueous Solution: Predominantly used in laboratory settings for standard analytical preparations, sample digestion, and titration due to its manageable reactivity and reduced hazard.

- Ultra-High Concentration Grades ($>72\%$): Used for highly specialized, often anhydrous applications, requiring the highest level of caution and technological control during manufacturing and handling; commands significant price premiums.

- High Purity Electronic Grade: Solutions formulated to contain metal impurities measured in parts per trillion ($\text{PPT}$), essential for sensitive semiconductor etching and cleaning processes.

- Reagent and Technical Grades: Defined by purity standards suitable for industrial bulk use versus laboratory analytical requirements.

- By Application

- Propellants and Explosives Production: The dominant application, serving as the precursor for ammonium perchlorate ($\text{AP}$) used in solid rocket boosters, military ordnance, and commercial blasting agents.

- Analytical Reagents and Laboratory Use: Employed for sample digestion, dissolution of refractory materials, and as a strong acidic catalyst in various complex chemical reactions in research and quality control environments.

- Electronics and Semiconductor Etching: Utilization of ultra-pure grades for anisotropic etching of silicon wafers, cleaning sensitive electronic components, and preparation of specialized electrolyte solutions.

- Specialty Chemical Synthesis: Used as a powerful oxidizing agent or a non-complexing strong acid catalyst in the production of various organic and inorganic chemicals, including specialized dyes and pharmaceuticals.

- Metal Treatment and Electroplating: Employed in specialized metal finishing processes where a highly corrosive and strong acidic environment is necessary for surface preparation.

- By End-Use Industry

- Defense and Aerospace: Major consumer driven by long-term strategic defense programs, military modernization, and civil/commercial space exploration initiatives.

- Electronics and Semiconductor: Rapidly growing segment focused on high-specification, low-volume requirements for microchip manufacturing and component fabrication.

- Chemical and Petrochemical: Utilization in manufacturing processes where high acid strength and specific oxidation properties are mandatory.

- Environmental Testing and Research: Essential sector for compliance and R&D, utilizing the acid for sample preparation across regulatory testing laboratories and academic institutions.

- Pharmaceutical and Biotechnology: Niche applications requiring the acid as a catalyst or specialized reagent in the synthesis of complex drug intermediates and active pharmaceutical ingredients ($\text{APIs}$).

- Mining and Construction: Indirect consumption driven by the use of perchlorate-based explosives in excavation, quarrying, and tunneling operations.

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Perchloric Acid Market

The perchloric acid value chain begins with the highly resource-intensive upstream activities, centered on the production of precursor chemicals, primarily sodium chlorate ($\text{NaClO}_3$), which is generated via the energy-intensive process of chloralkali electrolysis. This stage is highly capital-intensive and profoundly sensitive to global energy market fluctuations, dictating the baseline production cost of perchloric acid. Raw material procurement stability is a key success factor, forcing manufacturers to integrate upstream or secure resilient, long-term supply contracts for electrical power and chlorate salts. Midstream manufacturing involves complex, highly specialized chemical engineering processes, specifically the anodic oxidation of chlorate, demanding infrastructure built from specialized materials (like tantalum or platinum electrodes) and substantial investment in safety redundancy systems to manage the volatility and corrosion risks inherent to the process.

The downstream distribution channels are subject to the strictest global regulatory frameworks for hazardous goods ($\text{e.g., DOT, ADR, IATA, IMDG}$), making logistics a significant operational hurdle and cost driver. Specialized carriers with certified containment systems are mandatory for the safe transport of high-concentration aqueous solutions. Direct distribution is favored for large-volume customers, such as national defense organizations and large chemical processing plants, enabling greater control over handling protocols, security, and purity maintenance. This model reduces intermediate risk but requires substantial internal logistical infrastructure. Indirect distribution, leveraging specialized chemical distributors, is common for serving smaller end-users like university research labs, specialized electronics fabrication houses, and regional analytical testing facilities, where the distributor manages the complex regulatory paperwork and smaller-batch packaging requirements.

Crucially, the value chain emphasizes purity refinement as an added-value activity. Ultra-high purity grades demanded by the semiconductor industry require additional, expensive purification steps (such as sub-boiling distillation) which significantly increase manufacturing costs but yield high-margin products. The final stage involves specialized handling and storage at the end-user site, necessitating ongoing technical support and safety guidance from the manufacturers. The entire value chain is therefore defined not just by chemical transformation but also by rigorous quality assurance, risk mitigation, and compliance management, ensuring that product integrity and safety are maintained from precursor synthesis through final application.

Perchloric Acid Market Potential Customers

The potential customer base for Perchloric Acid is diverse but converges on industries characterized by high technological standards and demanding safety specifications. The most significant customer segment is governmental and private defense contractors who rely on perchloric acid for the mass production of ammonium perchlorate, the oxidizing agent essential for solid rocket boosters used in military missiles, space launch vehicles, and civil aerospace applications; these buyers prioritize volume stability, security of supply, and strict regulatory adherence. Secondly, the electronics and microchip fabrication sector represents a high-growth, high-value customer group. These companies demand ultra-pure, low-metal grades of $\text{HClO}_4$ for critical etching and cleaning steps in semiconductor manufacturing, placing extreme emphasis on trace impurity profiles and certified quality assurance.

Another essential customer cluster involves analytical and environmental testing laboratories, ranging from government regulatory agencies (e.g., EPA-certified labs) to private contract research organizations ($\text{CROs}$). These customers require the acid for the complex and complete digestion of samples (environmental matrices, alloys, biological materials) prior to instrumental analysis, valuing reliable reagent quality and purity consistency for reproducible results. Furthermore, specialty chemical manufacturers and pharmaceutical companies utilize $\text{HClO}_4$ as a powerful catalyst or oxidant in the synthesis of complex organic molecules and drug intermediates, requiring specialty grades often customized to specific reaction conditions. The diversity of applications mandates that manufacturers maintain flexible production capabilities to meet the highly varied volume, purity, and concentration requirements across these distinct end-user categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 490 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GFS Chemicals Inc., Arkema Group, Hebei Wingo Chemical Co., Ltd., Merck KGaA, Avantor Performance Materials, ProChem Inc., Alfa Aesar (Thermo Fisher Scientific), American Elements, Central Glass Co., Ltd., Beihai Group, VWR International, Kanto Chemical Co. Inc., ICL Group Ltd., Tokyo Chemical Industry Co., Ltd. (TCI), Reagent Chemical & Research, Inc., Hawkins, Inc., Solvay S.A., BASF SE, Spectrum Chemical Mfg. Corp., Clearsynth Labs Private Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perchloric Acid Market Key Technology Landscape

The manufacturing of perchloric acid is defined by the electrochemical oxidation method, which remains the cornerstone technology globally, primarily utilizing the anodic oxidation of sodium chlorate solutions. Technological focus in this domain is centered on optimizing the energy efficiency of the electrolysis process, a significant cost component, through the deployment of advanced ion-exchange membrane cell technology. These next-generation cells enhance selectivity and current efficiency, minimizing unwanted side reactions and improving the overall yield of the product while reducing the carbon footprint associated with the highly energy-intensive synthesis. Continuous improvement in electrode material science, often involving noble metals like platinum or proprietary doped materials, is also crucial for maximizing cell lifespan and operational stability under highly corrosive conditions.

A second critical area of technological innovation is dedicated to safety and purity refinement, particularly crucial for meeting the stringent specifications of the semiconductor and defense industries. Technologies such as sub-boiling distillation, ultra-filtration, and specialized ion-exchange techniques are employed to achieve electronic-grade purity, reducing trace metal contaminants to parts per trillion ($\text{PPT}$) levels. Furthermore, the handling and storage technology landscape is evolving rapidly, with increased adoption of inert materials like Polytetrafluoroethylene ($\text{PTFE}$) and specialized glass linings for construction of reaction vessels and transport containers. This material science focus is essential for safely managing the high oxidizing potential of the acid, especially in concentrations above $70\%$, where risks of spontaneous decomposition or explosion are heightened, thereby driving innovation in passive safety systems and inert gas blanketing.

The industry is also witnessing the emergence of advanced analytical technologies integrated into the production line. Real-time monitoring systems, often incorporating spectroscopic techniques and process analytical technology ($\text{PAT}$), are used to continuously track purity and concentration profiles, allowing for immediate process adjustments and superior batch consistency. Furthermore, research into greener synthesis methods that might utilize alternative, less hazardous precursors or catalytic pathways is ongoing, aiming to potentially bypass the environmental and safety challenges inherent in conventional electrochemical processes. However, these novel methods remain largely in the laboratory stage, underscoring the dominance of established electrochemical synthesis, which is constantly refined for better efficiency and improved safety management.

Regional Highlights

- Asia Pacific (APAC): The APAC region is recognized as the fastest-growing market for perchloric acid, underpinned by massive industrial expansion, particularly in China and India. This growth is bifurcated: significant consumption is driven by geopolitical dynamics leading to increased defense spending and modernization (requiring $\text{AP}$), and exponential growth in the semiconductor manufacturing sector, which necessitates vast quantities of ultra-high purity etching agents for microchip production. South Korea, Japan, and Taiwan remain central hubs for high-grade electronic acid consumption.

- North America: Representing a mature yet high-value market, North America maintains strong demand driven by established aerospace programs (NASA, private space ventures) and a highly regulated environmental sector. The U.S. Environmental Protection Agency ($\text{EPA}$) requirements for water and soil analysis mandate the widespread use of perchloric acid for sample digestion, ensuring persistent demand for certified analytical grades. The region is characterized by exceptionally strict regulatory compliance and high safety standards, favoring domestic suppliers with robust $\text{EHS}$ track records.

- Europe: The European market, particularly Germany and France, focuses heavily on advanced chemical research, pharmaceutical synthesis, and specialized materials science. While defense procurement is significant, a large portion of the demand stems from high-tech industrial applications and stringent regulatory testing required by the European Union. Innovation is concentrated on developing high-quality reagents and sustainable manufacturing processes that adhere to REACH regulations and minimize environmental discharge.

- Latin America: Market growth is moderate and cyclical, strongly correlated with the region's mining and construction sectors, which utilize perchlorate-based explosives. Demand is also generated by regional defense forces and agricultural chemistry. Market dynamics are heavily influenced by local economic stability and reliance on imported high-purity grades, as local production capacity is generally limited.

- Middle East and Africa (MEA): This region is an emerging consumer, driven primarily by ongoing military modernization projects in key Gulf nations and nascent industrial chemical production centers. Supply chain development remains a challenge due to logistical complexities and varied regulatory landscapes, requiring specialized import arrangements and adherence to international hazardous material transport codes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perchloric Acid Market.- GFS Chemicals Inc.

- Arkema Group

- Hebei Wingo Chemical Co., Ltd.

- Merck KGaA

- Avantor Performance Materials

- ProChem Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- American Elements

- Central Glass Co., Ltd.

- Beihai Group

- VWR International

- Kanto Chemical Co. Inc.

- ICL Group Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Reagent Chemical & Research, Inc.

- Hawkins, Inc.

- Solvay S.A.

- BASF SE

- Spectrum Chemical Mfg. Corp.

- Clearsynth Labs Private Limited

- Chemtron Science

- Samchully Pharm. Co., Ltd.

- Olin Corporation

- Dow Chemical Company

- Mitsubishi Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Perchloric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the current growth of the Perchloric Acid market?

The primary driver is the sustained global demand from the defense and aerospace sector, where perchloric acid serves as a critical precursor for manufacturing ammonium perchlorate, an essential component in solid rocket propellants and explosives. Secondary growth is fueled by the expansion of analytical chemistry and high-purity requirements in the semiconductor industry, particularly in the Asia Pacific region.

What are the major regulatory challenges facing perchloric acid manufacturers?

Manufacturers face strict and complex global regulations concerning environmental discharge and handling safety, primarily due to the inherent explosion risk of the concentrated acid and intensifying international concerns over perchlorate contamination in vital water sources, necessitating significant investment in zero-discharge technologies and compliance protocols.

Which geographical region holds the largest potential for market expansion?

Asia Pacific ($\text{APAC}$) is projected to hold the largest expansion potential, driven by significant government investment in domestic defense capabilities, rapid urbanization, and accelerated growth in the electronics and semiconductor fabrication sectors across countries like China, India, and South Korea, which demand high-specification reagents.

How is the concentration of perchloric acid correlated with its end-use application?

Highly concentrated (around $70\%$) aqueous solutions are typically used as industrial precursors for producing perchlorate salts for propellants and bulk chemicals due to their high reactivity. In contrast, ultra-high purity, highly diluted solutions are exclusively required for sensitive applications such as semiconductor etching, where minimal trace metal impurities are mandatory.

What are the key technological advancements shaping the production process?

Key advancements focus on improving the safety and energy efficiency of electrochemical synthesis, specifically the adoption of advanced membrane cell technology for better energy utilization, and the development of specialized sub-boiling distillation techniques for producing the ultra-high purity grades required by the microelectronics industry.

Why is Perchloric Acid the preferred reagent for certain analytical applications?

Perchloric acid is highly valued in analytical chemistry because of its extremely strong acidity and its non-complexing nature. This combination makes it highly effective for completely dissolving refractory materials and difficult samples during digestion (e.g., prior to $\text{ICP-MS}$ analysis) without introducing interfering ions, ensuring accurate results.

What role do raw material costs play in the final price of Perchloric Acid?

Raw material and energy costs are primary determinants of the final product price, as the initial step—electrolysis of sodium chlorate—is highly energy-intensive. Fluctuations in electricity prices and the cost of precursor chemicals directly impact manufacturers' operational expenses and, consequently, market pricing stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager