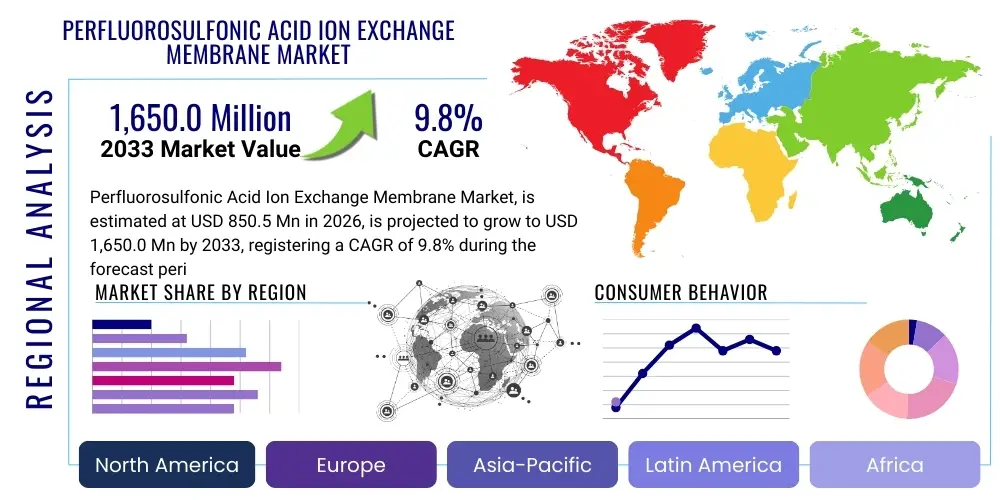

Perfluorosulfonic Acid Ion Exchange Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438544 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Perfluorosulfonic Acid Ion Exchange Membrane Market Size

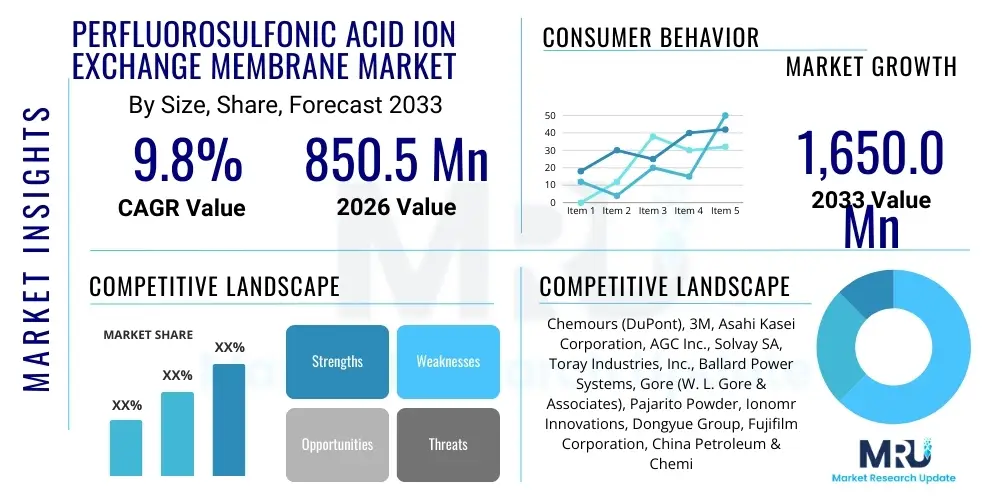

The Perfluorosulfonic Acid Ion Exchange Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,650.0 Million by the end of the forecast period in 2033.

Perfluorosulfonic Acid Ion Exchange Membrane Market introduction

The Perfluorosulfonic Acid (PFSA) Ion Exchange Membrane market encompasses advanced polymeric materials crucial for electrochemical applications, primarily due to their exceptional proton conductivity, high chemical stability, and robust thermal resilience. These membranes, typified by products like Nafion, are essential components in various energy conversion and storage devices, acting as solid electrolytes that selectively transport cations while blocking electrons and other reactants. The core product description revolves around a perfluorinated backbone chain linked to sulfonic acid groups, which are responsible for the high ion exchange capacity and hydrophilicity necessary for efficient operation in harsh electrochemical environments. This unique structural composition allows PFSA membranes to maintain structural integrity and performance even under high temperatures, corrosive conditions, and varying humidity levels, making them irreplaceable in demanding industrial settings.

Major applications driving the demand for PFSA membranes include Proton Exchange Membrane Fuel Cells (PEMFCs), where they are vital for generating clean electricity in automotive and stationary power sectors. Additionally, they are extensively used in chlor-alkali production for efficient brine electrolysis, redox flow batteries (RFBs) for grid-scale energy storage, and various water treatment processes such as electrodialysis and reverse osmosis. The increasing global focus on sustainable energy solutions and the rapid expansion of the hydrogen economy directly correlate with the rising need for high-performance PFSA membranes. These materials facilitate high current densities and minimal energy loss, significantly enhancing the efficiency and longevity of electrochemical systems. Their reliability under prolonged operation is a critical benefit, leading to reduced maintenance costs and improved overall system performance across diverse sectors.

Key driving factors propelling market expansion include stringent global emissions regulations pushing for the adoption of fuel cell vehicles, governmental investments in renewable energy infrastructure, and technological advancements focusing on reducing membrane thickness while maintaining mechanical strength and conductivity. The sustained demand from the chlor-alkali industry, seeking more environmentally friendly and energy-efficient separation technologies compared to older asbestos-based processes, further supports market growth. Furthermore, ongoing research into polymer chemistry aims to develop cost-effective alternatives and modifications to enhance conductivity at lower hydration levels, broadening the applicability of PFSA membranes in emerging markets like portable electronics and medical devices. The intersection of superior material properties and expanding environmental mandates positions the PFSA market for substantial and sustained growth throughout the forecast period.

Perfluorosulfonic Acid Ion Exchange Membrane Market Executive Summary

The Perfluorosulfonic Acid Ion Exchange Membrane market is characterized by robust business trends driven primarily by the transition towards a hydrogen-based energy infrastructure and the burgeoning demand for efficient grid-scale storage solutions. Strategic collaborations between material manufacturers and major automotive original equipment manufacturers (OEMs) are accelerating the commercialization timeline for PEMFC technology, focusing on reducing manufacturing costs and improving durability for mass-market adoption. Business operations are increasingly centered on vertical integration, with key players seeking to control the entire value chain from fluoropolymer synthesis to final membrane fabrication, ensuring supply chain stability and quality control. Furthermore, patent landscapes indicate intense competition in developing next-generation membranes that offer improved tolerance to contaminants and operate effectively at higher temperatures, crucial for automotive applications where waste heat management is challenging.

Regional trends demonstrate that Asia Pacific (APAC), specifically China, Japan, and South Korea, maintains dominance, largely due to aggressive governmental mandates supporting fuel cell vehicle production and massive investments in hydrogen refueling infrastructure. North America and Europe are also experiencing significant growth, fueled by strong policy support for decarbonization, particularly through the European Green Deal and U.S. infrastructure investments targeting green hydrogen production and utilization. The regional market dynamics reflect a split: APAC focuses heavily on scale and high-volume production for both stationary and mobile applications, while North America and Europe prioritize innovation in high-performance materials suitable for heavy-duty transportation and sophisticated industrial processes. Intellectual property protection and technology transfer between regions remain central aspects of the market's global expansion strategy.

Segment trends reveal that the application of PFSA membranes in Proton Exchange Membrane Fuel Cells (PEMFCs) constitutes the largest and fastest-growing segment, propelled by the increasing penetration of electric vehicles and stationary power backup systems. Within the material type segment, the focus is shifting towards reinforced membranes (e.g., those using PTFE or porous substrates) to improve mechanical strength and reduce dimensional changes under cyclic operation, addressing a key durability concern in automotive applications. While the chlor-alkali segment remains a steady revenue generator, the future trajectory of market growth is intrinsically linked to advancements in energy storage and conversion technologies, emphasizing the segment's evolution from traditional chemical processing materials toward high-tech energy components. Pricing strategies across segments are dynamic, reflecting the balance between the high cost of fluorochemical precursors and the economies of scale achieved through increased manufacturing capacity.

AI Impact Analysis on Perfluorosulfonic Acid Ion Exchange Membrane Market

User queries regarding the intersection of Artificial Intelligence and the PFSA Ion Exchange Membrane Market primarily revolve around optimizing material discovery, predicting membrane performance degradation, and enhancing manufacturing efficiency. Key themes frequently encountered include the use of machine learning (ML) algorithms to screen thousands of potential polymer structures for desired properties (like conductivity and stability) much faster than traditional laboratory synthesis and testing. Users also express concerns about the reliability of membranes under real-world, dynamic operating conditions, leading to expectations that AI models can provide predictive maintenance schedules and flag potential failures in fuel cells and electrolyzers by analyzing sensor data streams. There is significant interest in how AI can minimize defects during the complex membrane casting and assembly processes, thereby reducing waste and lowering the overall cost of fuel cell stacks. The general expectation is that AI will act as a major accelerator for material innovation, overcoming the current bottleneck associated with empirical testing of novel PFSA structures and ensuring optimal deployment reliability.

- AI-driven optimization of polymer synthesis and formulation to discover PFSA materials with enhanced proton conductivity and mechanical durability.

- Machine learning algorithms utilized for predictive modeling of membrane degradation and lifetime estimation in operational fuel cells and batteries.

- Integration of AI in manufacturing processes for real-time quality control, defect detection, and precise thickness uniformity during membrane casting.

- Data analytics and AI employed to optimize the operational parameters (temperature, humidity, pressure) of PEMFC stacks using PFSA membranes, maximizing efficiency.

- Development of digital twins for electrochemical devices incorporating PFSA membranes, facilitating accelerated design cycles and scenario testing without physical prototyping.

DRO & Impact Forces Of Perfluorosulfonic Acid Ion Exchange Membrane Market

The Perfluorosulfonic Acid Ion Exchange Membrane market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological trajectory. The primary Driver is the urgent global shift towards decarbonization and the subsequent widespread adoption of hydrogen fuel cells across transportation, stationary power, and portable electronics sectors. Concurrently, significant Restraints include the extremely high cost associated with fluoropolymer precursors and the complex manufacturing processes, which act as a major barrier to mass market penetration, particularly for automotive applications requiring cost parity with internal combustion engines. Opportunities abound in the development of next-generation, low-cost PFSA alternatives or composites, and the expansion into emerging applications such as hydrogen compression and advanced water purification technologies. These forces are further amplified by the inherent impact forces of material innovation, regulatory pressure, and energy security concerns, necessitating continuous advancements in material science to meet escalating performance demands.

The impact forces currently exerting the greatest pressure on the market involve environmental and regulatory constraints, specifically concerns regarding Per- and Polyfluoroalkyl Substances (PFAS). Although PFSA membranes are essential for critical green technologies, the broader regulatory environment concerning PFAS could potentially impose restrictions on manufacturing or disposal, driving manufacturers to invest heavily in sustainable production and recycling methods. Furthermore, the inherent stability of PFSA materials, while a benefit, also contributes to their persistent nature in the environment, leading to ongoing research into end-of-life management solutions. The technological impact force is equally compelling; the market constantly requires membranes capable of operating at higher temperatures (above 100°C) with low relative humidity, which is necessary for simplifying fuel cell cooling systems and improving system efficiency, a challenge that standard PFSA membranes currently struggle to meet without modification.

Strategic responses to these DROs involve vertical integration by key players to mitigate supply chain risks and volatile raw material pricing, alongside aggressive research and development focused on durability improvements. The high capital expenditure required for establishing PFSA production facilities, coupled with the specialized expertise needed for synthesis, restricts the entry of new players, consolidating market power among established chemical companies. The long-term opportunities are intrinsically tied to global energy policy; any accelerated governmental commitment to establishing hydrogen hubs or implementing carbon taxation schemes will rapidly amplify demand, forcing a greater investment in scaling up PFSA membrane production capacities globally. The ultimate success of the market hinges on overcoming the cost barrier while simultaneously navigating increasingly strict environmental regulations regarding fluorine chemistry.

- Drivers: Global push for clean energy and hydrogen infrastructure, rapid growth of the PEM fuel cell automotive sector, rising demand from the high-efficiency chlor-alkali industry.

- Restraints: High production cost of fluorinated precursors and membranes, limited long-term durability under harsh thermal cycling conditions, potential regulatory risks associated with PFAS compounds.

- Opportunities: Development of composite/reinforced membranes for high-temperature operations, expansion into grid-scale redox flow batteries, advancements in hydrogen production (electrolyzers).

- Impact Forces: Intense technological competition in material science, fluctuating prices of fluorochemical raw materials, stringent governmental regulations on energy efficiency and emissions.

Segmentation Analysis

The Perfluorosulfonic Acid Ion Exchange Membrane market is broadly segmented based on Material Type, Application, and End-User. This segmentation provides a granular view of market dynamics, revealing where investment is most concentrated and where technological bottlenecks persist. Material segmentation distinguishes between reinforced membranes, which incorporate a structural support layer (e.g., PTFE mesh) to enhance mechanical integrity, and unreinforced membranes. Reinforced types are increasingly favored in demanding applications like automotive PEMFCs, where mechanical stress and dimensional changes are significant concerns. The Application segment is critical, as the performance requirements for a membrane used in a chlor-alkali cell are vastly different from those needed in a redox flow battery or a portable fuel cell, demanding specific customization in terms of thickness, conductivity, and chemical resistance. Understanding these segment dynamics is paramount for manufacturers tailoring their production lines and R&D efforts to meet precise industrial specifications.

The Application segment dominates market revenue, with Proton Exchange Membrane Fuel Cells (PEMFCs) forming the cornerstone of future market growth. The increasing adoption of PEMFCs in light-duty and heavy-duty vehicles, alongside the rise of stationary power applications, ensures that this segment maintains its leading position. The second major application, the chlor-alkali process, represents a mature but stable segment, where PFSA membranes offer significant energy savings and operational safety improvements over mercury or asbestos cell technologies. Furthermore, the burgeoning demand for high-efficiency water treatment, particularly electrodialysis in resource-scarce regions, provides a niche but rapidly expanding market opportunity for specific PFSA membrane grades designed for ion separation and purification.

From an End-User perspective, the Automotive and Transportation sector is the most dynamic segment, heavily reliant on government incentives and technological breakthroughs in fuel cell durability. This segment demands the highest quality, thinnest membranes for maximum power density and minimal stack volume. The Chemical Processing industry, primarily defined by chlor-alkali and other electrochemical synthesis processes, constitutes a stable industrial user requiring thick, robust membranes capable of long-term resistance to strong caustic solutions. Meanwhile, the Energy Storage and Generation segment, encompassing electrolyzers for hydrogen production and various types of flow batteries, is projected to exhibit the highest CAGR due to global grid modernization efforts and the integration of intermittent renewable energy sources, driving sustained growth for specialized PFSA materials.

- By Material Type:

- Unreinforced PFSA Membranes

- Reinforced PFSA Membranes (e.g., PTFE-reinforced)

- By Application:

- Proton Exchange Membrane Fuel Cells (PEMFCs)

- Chlor-Alkali Production

- Redox Flow Batteries (RFBs)

- Electrodialysis and Water Treatment

- Hydrogen Production (Electrolyzers)

- By End-User:

- Automotive and Transportation

- Chemical Processing

- Energy Storage and Generation

- Industrial and Stationary Power

- Portable Devices

Value Chain Analysis For Perfluorosulfonic Acid Ion Exchange Membrane Market

The value chain for the Perfluorosulfonic Acid Ion Exchange Membrane market is highly specialized and capital-intensive, starting with the upstream sourcing of crucial raw materials. The upstream segment is dominated by the synthesis of fluorinated monomers, specifically perfluorovinyl ethers, which are then copolymerized with tetrafluoroethylene (TFE) to create the PFSA precursor polymer. This stage is highly proprietary and controlled by a limited number of specialized chemical companies due to the stringent requirements for purity and the complex, high-pressure synthesis processes involved. High raw material costs and dependency on stable fluorine chemical supplies represent major vulnerabilities in the upstream sector. Ensuring sustainable and cost-effective precursor synthesis is paramount for stabilizing the final cost of the membrane, a critical challenge for mass production.

The core manufacturing stage involves converting the precursor polymer into the functional membrane through techniques such as extrusion, casting, or rolling, followed by chemical treatments (acidification) to activate the sulfonic acid groups. Quality control and technological expertise are vital in this stage to ensure uniformity in thickness, high ion exchange capacity, and mechanical stability. Manufacturers often employ advanced reinforcement techniques during the casting process to enhance membrane resilience, especially for demanding automotive applications. Following fabrication, membranes are then integrated into final electrochemical products, such as Membrane Electrode Assemblies (MEAs) for fuel cells or cell stacks for chlor-alkali processes, typically performed by specialized component manufacturers or the end-user themselves.

The distribution channel involves a mix of direct sales and specialized distributors. Direct sales are prevalent for large-volume, strategic end-users like major automotive OEMs, fuel cell stack integrators, and large chemical plants, allowing for direct technical support and customized product specifications. Indirect channels utilize specialized distributors who possess expertise in electrochemical materials, catering to smaller R&D institutions, portable electronics manufacturers, and regional flow battery producers. Due to the high-value and technical nature of PFSA membranes, technical support and comprehensive after-sales service are critical components of the distribution strategy. Effective management of the distribution logistics, ensuring membranes are stored and shipped under precise environmental conditions, is crucial to maintain product integrity before integration.

Perfluorosulfonic Acid Ion Exchange Membrane Market Potential Customers

Potential customers for Perfluorosulfonic Acid Ion Exchange Membranes are defined by their reliance on advanced electrochemical processes for energy conversion, chemical production, or sophisticated separation. The primary segment of end-users consists of automotive manufacturers and Tier 1 suppliers engaged in the development and production of Fuel Cell Electric Vehicles (FCEVs). These customers require durable, high-power-density membranes for integration into hydrogen fuel cell stacks, driving demand for materials with superior resistance to radical attack and minimal gas crossover. The criteria for these buyers are extremely stringent, prioritizing longevity, performance consistency under variable load, and cost-effectiveness at high volumes, necessitating close collaboration with membrane suppliers.

A second significant customer base is the global chemical industry, particularly companies specializing in chlor-alkali production (caustic soda and chlorine). These industrial buyers value operational efficiency and safety, seeking PFSA membranes that offer long service life and high current efficiency to minimize energy consumption in electrolysis plants. Unlike automotive buyers who focus on power density, chemical processing customers prioritize chemical resistance to highly corrosive brine and caustic environments. The long-term savings derived from reduced energy costs and maintenance cycles justify the premium price of high-quality PFSA membranes in this sector.

Furthermore, technology integrators in the renewable energy sector, including manufacturers of large-scale electrolyzers (for green hydrogen production) and grid-level redox flow batteries (RFBs), represent a rapidly growing customer segment. RFB manufacturers need PFSA membranes that offer excellent selectivity to prevent cross-mixing of electrolytes while maintaining low resistance, critical for maximizing energy efficiency and reducing self-discharge. As governments worldwide commit to stabilizing power grids with renewable energy storage solutions, these integrators will become increasingly important buyers, seeking membranes optimized for durability and chemical compatibility within non-fluorinated electrolytes like vanadium solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,650.0 Million |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemours (DuPont), 3M, Asahi Kasei Corporation, AGC Inc., Solvay SA, Toray Industries, Inc., Ballard Power Systems, Gore (W. L. Gore & Associates), Pajarito Powder, Ionomr Innovations, Dongyue Group, Fujifilm Corporation, China Petroleum & Chemical Corporation (Sinopec), FuelCell Energy, Inc., Giner Inc., Covestro AG, BASF SE, Plug Power Inc., HyPlat, and Qingdao Tianneng. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfluorosulfonic Acid Ion Exchange Membrane Market Key Technology Landscape

The technology landscape for the Perfluorosulfonic Acid Ion Exchange Membrane market is focused heavily on optimization and cost reduction, moving beyond basic Nafion-type structures to advanced composite materials. A crucial technological area involves thin film fabrication techniques, such as highly controlled solution casting and novel extrusion methods, designed to produce ultra-thin membranes (less than 20 micrometers) while preserving mechanical strength. Thin membranes are necessary to minimize ohmic resistance and maximize power density in fuel cell stacks. Furthermore, researchers are focusing on reinforcing the PFSA matrix, typically using expanded polytetrafluoroethylene (ePTFE) or other non-conductive porous substrates, to mitigate issues related to membrane swelling, shrinkage, and puncture failure during repeated wet-dry and thermal cycling, which is a key technical challenge in commercial FCEV deployment.

Another significant technological advancement is the development of next-generation PFSA structures tailored for high-temperature and low-humidity operation. Traditional PFSA membranes require high hydration to maintain proton conductivity, limiting the fuel cell operating temperature to below 80°C. Current R&D explores incorporating hygroscopic inorganic fillers (e.g., metal oxides or heteropoly acids) into the PFSA matrix to retain water even at elevated temperatures, or modifying the polymer backbone to introduce new functional groups that enable alternative proton conduction mechanisms (like vehicular transport) independent of high water content. Success in this area would dramatically simplify fuel cell system architecture by reducing the complexity of humidification and cooling systems, opening doors for broader industrial application.

Furthermore, the manufacturing technology is evolving towards greater sustainability and efficiency. Solvent recovery and recycling during the membrane casting process are critical due to the use of expensive and specialized solvents required to dissolve PFSA polymers. Technological innovation also extends to the development of robust quality control systems, often incorporating non-destructive testing techniques (like optical inspection and impedance spectroscopy), to ensure membrane quality and uniformity at scale. The overall landscape is defined by the tension between achieving ultra-high performance necessary for electrification targets and the imperative to drastically reduce the per-unit cost of the membrane to enable mass market accessibility, necessitating innovation across materials, processing, and system integration.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market, driven by favorable government policies in China, Japan, and South Korea, aiming for global leadership in hydrogen technology and FCEV production. China’s extensive state planning and investment in hydrogen infrastructure, coupled with Japan's long-standing leadership in fuel cell research (epitomized by companies like Toyota and Honda), ensure massive industrial scale-up. The region is characterized by high-volume manufacturing capacities for both chlor-alkali and PEMFC components, making it the primary consumer and producer of PFSA membranes.

- North America: North America, led by the United States and Canada, represents a high-growth region spurred by significant federal investments (e.g., U.S. infrastructure acts) targeting green hydrogen production via electrolyzers and long-haul heavy-duty FCEV deployment. The market focuses intensely on R&D for next-generation, durable membranes for demanding applications like heavy trucking and grid storage (Redox Flow Batteries). The presence of key material science companies like Chemours and 3M contributes to the technological innovation in this region.

- Europe: Europe exhibits strong growth, supported by the ambitious decarbonization targets of the European Green Deal and the subsequent Hydrogen Strategy. Germany, France, and the UK are key markets, prioritizing the integration of PFSA membranes into power-to-gas solutions (electrolyzers) and stationary combined heat and power (CHP) units. Regulatory clarity and substantial public funding for pilot projects focusing on heavy-duty transport and maritime fuel cell applications are major drivers.

- Latin America, Middle East, and Africa (LAMEA): This region is an emerging market, primarily driven by resource-rich countries (like those in the Middle East) leveraging cheap renewable energy to produce green hydrogen for export, necessitating investment in large-scale electrolyzer membrane capacity. Latin American markets show early interest in integrating fuel cell technology into niche transportation sectors and remote power generation, although market penetration remains relatively lower compared to the Triad regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfluorosulfonic Acid Ion Exchange Membrane Market.- Chemours (DuPont)

- 3M Company

- Asahi Kasei Corporation

- AGC Inc.

- Solvay SA

- Toray Industries, Inc.

- Ballard Power Systems

- Gore (W. L. Gore & Associates)

- Pajarito Powder

- Ionomr Innovations

- Dongyue Group

- Fujifilm Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- FuelCell Energy, Inc.

- Giner Inc.

- Covestro AG

- BASF SE

- Plug Power Inc.

- HyPlat

- Qingdao Tianneng

Frequently Asked Questions

Analyze common user questions about the Perfluorosulfonic Acid Ion Exchange Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Perfluorosulfonic Acid membranes in fuel cells?

PFSA membranes, such as Nafion, function as solid polymer electrolytes in Proton Exchange Membrane Fuel Cells (PEMFCs). Their primary role is to selectively transport protons (H+) generated at the anode to the cathode, completing the electrical circuit, while simultaneously acting as an impermeable barrier to block electron flow and gas crossover (hydrogen and oxygen), ensuring highly efficient energy conversion.

What are the main alternatives to traditional PFSA membranes in electrochemical applications?

The primary alternatives include hydrocarbon-based membranes, often favored for lower cost, and high-temperature polymers like polybenzimidazole (PBI) doped with phosphoric acid, which operate effectively above 100°C without requiring humidification. Additionally, anion exchange membranes (AEMs) are emerging alternatives, particularly in alkaline fuel cells and electrolyzers, offering the potential to utilize non-precious metal catalysts and reduce system cost.

How does the high cost of PFSA membranes impact market adoption?

The high cost, largely driven by expensive fluorochemical precursors and complex, high-purity manufacturing processes, is a significant restraint to the mass market adoption of fuel cells, particularly in the automotive sector. This barrier necessitates ongoing R&D into thinner, reinforced, or partially fluorinated composite PFSA membranes to reduce the material loading per unit of energy output and achieve better cost parity with conventional power sources.

In which regional market is the demand for PFSA membranes highest?

The demand for PFSA membranes is currently highest in the Asia Pacific (APAC) region, specifically in countries like China, Japan, and South Korea. This dominance is due to aggressive governmental initiatives supporting the rapid deployment of Fuel Cell Electric Vehicles (FCEVs) and substantial capacity expansion in the hydrogen production and stationary power generation sectors across the region.

What technological advancements are critical for improving PFSA membrane durability?

Critical technological advancements focus on developing reinforced composite membranes, often utilizing PTFE support structures, to enhance mechanical stability and dimensional integrity during thermal and hydration cycling. Furthermore, incorporating radical scavengers and optimizing the polymer side chain structure is essential to resist chemical degradation (pinhole formation) caused by highly reactive chemical species generated within the fuel cell environment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager